Evoke Pharma Announces Pricing of Underwritten Public Offering of up to $30 Million

February 09 2024 - 7:30AM

Evoke Pharma, Inc. (NASDAQ: EVOK), a specialty

pharmaceutical company focused primarily on treatments for

gastrointestinal (GI) diseases with an emphasis on

GIMOTI® (metoclopramide) nasal spray, announced today

that it has priced an underwritten public offering led by Nantahala

Capital Management, with participation by other fundamental

investors, for gross proceeds of up to $30 million, that includes

initial upfront funding of approximately $7.5 million, prior to

deducting underwriting discounts and commissions and estimated

offering expenses.

The offering is comprised of (i) 11,029,411

shares of common stock (or pre-funded warrants in lieu thereof),

(ii) 11,029,411 Series A Warrants with an initial exercise price of

$0.68 per share and a term of five years following the issuance

date, (iii) 11,029,411 Series B Warrants with an exercise price of

$0.68 per share and a term of nine months following the issuance

date and (iv) 11,029,411 Series C Warrants with an exercise price

of $0.68 per share and a term of five years following the issuance

date, subject to early expiration as described below. The Series C

Warrants may only be exercised to the extent and in proportion to a

holder of the Series C Warrants exercising its Series B Warrants,

and are subject to an early expiration of nine months, in

proportion and only to the extent any Series C Warrants expire

unexercised.

The combined price per share of common stock,

Series A Warrant, Series B Warrant and Series C Warrant is $0.68,

totaling $7.5 million initial gross proceeds to the Company. If the

Series A Warrants are exercised in full, the Company would receive

an additional $7.5 million in gross proceeds. If the Series B

Warrants are exercised in full, the Company would receive an

additional $7.5 million in gross proceeds. If the Series C Warrants

are exercised in full, the Company would receive an additional $7.5

million in gross proceeds; thus if all warrants are exercised in

full the total gross proceeds to the Company including the initial

upfront funding would be $30 million.

Evoke intends to use the net proceeds from the

public offering for working capital and general corporate purposes.

Evoke may also use a portion of the net proceeds, together with its

existing cash and cash equivalents, to in-license, acquire, or

invest in complementary businesses, technologies, products or

assets; however, Evoke has no current commitments or obligations to

do so. The offering is expected to close on or about February 13,

2024, subject to satisfaction of customary closing conditions.

Craig-Hallum and Laidlaw & Company (UK) Ltd.

are acting as joint book-running managers for the offering.

The securities described above are being offered

by Evoke pursuant to a registration statement on Form S-1 (File No.

333-275443) previously filed and declared effective by the

Securities and Exchange Commission (SEC). This press release shall

not constitute an offer to sell or the solicitation of an offer to

buy, nor shall there be any sale of these securities in any state

or jurisdiction in which such offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such state or jurisdiction. The offering is

being made only by means of a written prospectus and prospectus

supplement that will form a part of the registration statement. A

final prospectus supplement relating to the offering will be filed

with the SEC and will be available on the SEC’s website at

www.sec.gov. Alternatively, when available, copies of the final

prospectus supplement relating to this offering may be obtained

from Craig-Hallum Capital Group LLC, Attention: Equity Capital

Markets, 222 South Ninth Street, Suite 350, Minneapolis, MN 55402,

by telephone at (612) 334-6300 or by email at prospectus@chlm.com;

or from Laidlaw & Company (UK) Ltd., Attention: Syndicate

Department, 521 Fifth Avenue, 12th Floor, New York, NY 10175, or by

email at syndicate@laidlawltd.com.

About Evoke Pharma, Inc.

Evoke is a specialty pharmaceutical company

focused primarily on the development of drugs to treat GI disorders

and diseases. The company developed, commercialized and markets

GIMOTI, a nasal spray formulation of metoclopramide, for the relief

of symptoms associated with acute and recurrent diabetic

gastroparesis in adults. Diabetic gastroparesis is a GI disorder

affecting millions of patients worldwide, in which the stomach

takes too long to empty its contents resulting in serious GI

symptoms as well as other systemic complications. The gastric delay

caused by gastroparesis can compromise absorption of orally

administered medications. Prior to FDA approval to commercially

market GIMOTI, metoclopramide was only available in oral and

injectable formulations and remains the only drug currently

approved in the United States to treat gastroparesis.

Safe Harbor Statement

Evoke cautions you that statements included in

this press release that are not a description of historical facts

are forward-looking statements. In some cases, you can identify

forward-looking statements by terms such as “may,” “will,”

“should,” “expect,” “plan,” “anticipate,” “could,” “intend,”

“target,” “project,” “contemplates,” “believes,” “estimates,”

“predicts,” “potential” or “continue” or the negatives of these

terms or other similar expressions. These statements are based on

Evoke’s current beliefs and expectations. These forward-looking

statements include statements regarding Evoke's expectations on the

completion, timing and size of the offering and the anticipated use

of proceeds therefrom, as well as the potential additional proceeds

to the Company from the exercise of the Series A Warrants, Series B

Warrants and Series C Warrants. The inclusion of forward-looking

statements should not be regarded as a representation by Evoke that

any of its plans will be achieved. Actual results may differ from

those set forth in this press release due to the risks and

uncertainties associated with market conditions and the

satisfaction of customary closing conditions related to the

proposed public offering, investors may choose not to exercise any

of the warrants issued in the offering and other risks and

uncertainties inherent in Evoke’s business, including those

described in Evoke's periodic filings with the SEC and the

prospectus supplement and related prospectus for this offering

filed with the SEC. You are cautioned not to place undue reliance

on these forward-looking statements, which speak only as of the

date hereof, and Evoke undertakes no obligation to revise or update

this press release to reflect events or circumstances after the

date hereof. All forward-looking statements are qualified in their

entirety by this cautionary statement. This caution is made under

the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995.

Investor Contact:Daniel Kontoh-BoatengDKB

PartnersTel: 862-213-1398dboateng@dkbpartners.net

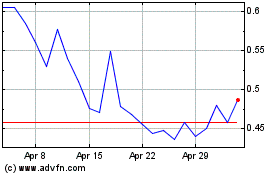

Evoke Pharma (NASDAQ:EVOK)

Historical Stock Chart

From Mar 2024 to Apr 2024

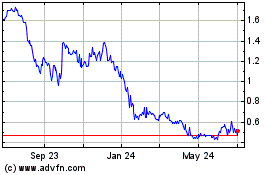

Evoke Pharma (NASDAQ:EVOK)

Historical Stock Chart

From Apr 2023 to Apr 2024