false0001005210SUBURBAN PROPANE PARTNERS LP00010052102024-02-082024-02-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15 (d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

February 8, 2024

Commission File Number: 1-14222

SUBURBAN PROPANE PARTNERS, L.P.

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

|

22-3410353 |

(State or Other Jurisdiction |

|

(IRS Employer |

of Incorporation) |

|

Identification No.) |

240 Route 10 West

Whippany, New Jersey 07981

(973) 887-5300

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol |

Name of exchange on which registered |

Common Units |

SPH |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION

The following information, including Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

On February 8, 2024, the Partnership issued a press release (the “Press Release”) describing its Fiscal 2024 First Quarter Financial Results. A copy of the Press Release has been furnished as Exhibit 99.1 to this Current Report.

Within the Press Release, we reference net income before deducting interest expense, income taxes, depreciation and amortization (“EBITDA”) which is considered a non-GAAP financial measure. Additionally, we discuss EBITDA excluding the unrealized net gain or loss from mark-to-market activity for derivative instruments and certain other items (“Adjusted EBITDA”). Our calculations of EBITDA and Adjusted EBITDA are presented in the Press Release furnished as Exhibit 99.1 to this Current Report.

We provide these non-GAAP financial measures because we believe that they provide the investment community with supplemental measures of operating performance. In addition, we believe that these non-GAAP financial measures provide useful information to investors and industry analysts to evaluate our operating results.

We also reference gross margins, computed as revenues less cost of products sold as those amounts are reported on the consolidated financial statements. Since cost of products sold does not include depreciation and amortization expense, the gross margin we reference is considered a non-GAAP financial measure. Given the nature of our business, the level of profitability in the retail propane, fuel oil, and natural gas and electricity businesses is largely dependent on the difference between retail sales price and product cost. Therefore, we discuss gross margins in order to provide investors and industry analysts with useful information to facilitate their understanding of the impact of the commodity prices on profitability.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

February 8, 2024 |

|

SUBURBAN PROPANE PARTNERS, L.P. |

|

|

|

|

|

|

|

By: |

|

/s/ MICHAEL A. KUGLIN |

|

|

Name: |

|

Michael A. Kuglin |

|

|

Title: |

|

Chief Financial Officer |

Exhibit 99.1

|

|

|

|

|

|

|

|

News Release Contact: Michael A. Kuglin Chief Financial Officer P.O. Box 206, Whippany, NJ 07981-0206 Phone: 973-503-9252 |

FOR IMMEDIATE RELEASE

Suburban Propane Partners, L.P.

Announces First Quarter Results

Whippany, New Jersey, February 8, 2024 -- Suburban Propane Partners, L.P. (NYSE:SPH), today announced earnings for its first quarter ended December 30, 2023.

Net income for the first quarter of fiscal 2024 was $24.5 million, or $0.38 per Common Unit, compared to net income of $45.4 million, or $0.71 per Common Unit, in the fiscal 2023 first quarter. Adjusted earnings before interest, taxes, depreciation and amortization (Adjusted EBITDA, as defined and reconciled below) for the first quarter of fiscal 2024 was $75.2 million, compared to $90.0 million in the prior year first quarter.

In announcing these results, President and Chief Executive Officer Michael A. Stivala said, “The fiscal 2024 first quarter was dominated by unseasonably warm weather that persisted across the country, especially during the critical last six weeks of the quarter, which negatively impacted customer demand for heating purposes. Propane volumes were down just 2.0% compared to the prior year first quarter, as the impact of warmer weather was favorably offset by solid agricultural demand from an active crop drying season, and positive customer base trends and market expansion efforts over the past couple of years. Our operations personnel are continuing to do an excellent job managing our selling prices and expenses and, as more seasonable weather arrived in the early part of the second quarter, our business is very well positioned to meet increased demand. There is still plenty of heating season ahead of us.”

Mr. Stivala continued, “In our renewable natural gas (“RNG”) operations, we have deployed capital to enhance the efficiency and operating performance of our RNG production facility in Stanfield, Arizona. We continue to execute on our capital improvement plans at the Columbus, Ohio facility, which will include the installation of RNG upgrade equipment, and we are advancing the engineering and construction of our anaerobic digester facility located at Adirondack Farms in upstate New York. In addition, we continue to develop relationships with local feedstock providers to increase tipping fee revenue and production capacity for all of our facilities, as well as developing RNG offtake arrangements for Columbus and New York once those facilities begin producing RNG.”

Retail propane gallons sold in the first quarter of fiscal 2024 of 106.5 million gallons decreased 2.0% compared to the prior year, primarily due to an inconsistent and warmer weather pattern that adversely impacted heat-related demand. Average temperatures (as measured by heating degree days) across all of the Partnership’s service territories during the first quarter were 9% warmer than normal and 6% warmer than the prior year first quarter. Average temperatures for the month of December, which is the most critical month of the first quarter for heat-related demand, were 10% warmer than both normal and December 2022.

Average propane prices (basis Mont Belvieu, Texas) for the first quarter of fiscal 2024 decreased 16.7% compared to the prior year first quarter. Total gross margin of $212.8 million for the fiscal 2024 first quarter decreased $2.0 million, or 0.9%, compared to the prior year first quarter. Gross margin for the first quarter of fiscal 2024 included a $10.8 million unrealized loss attributable to the mark-to-market adjustment for derivative instruments used in risk management activities, compared to a $13.7 million unrealized loss in the prior year first quarter. These non-cash adjustments, which were reported in cost of products sold, were excluded from Adjusted EBITDA for both periods. Excluding the impact of the mark-to-market adjustments, total gross margin decreased $4.9 million, or 2.2%, compared to the prior year first quarter, primarily due to lower propane volumes sold and lower propane unit margins, offset to an extent by margin contribution from the

1

RNG assets acquired at the end of December 2022. Excluding the impact of the unrealized mark-to-market adjustments, propane unit margins for the first quarter of fiscal 2024 decreased $0.05 per gallon, or 2.8%, compared to the prior year first quarter, primarily due to a greater mix from the Partnership’s commercial and industrial customer base that tend to be less weather sensitive than our residential customer base.

Combined operating and general and administrative expenses of $147.6 million for the first quarter of fiscal 2024 increased 6.4% compared to the prior year first quarter, primarily due to higher payroll and benefit-related expenses and operating costs associated with the RNG production facilities. In addition, included within general and administrative expenses in the first quarter of the prior year were fees and expenses of $0.9 million associated with the acquisition of the RNG assets, which were excluded from Adjusted EBITDA for the first quarter of fiscal 2023.

Total debt outstanding as of December 2023 increased $54.8 million compared to September 2023, due to seasonal borrowings under the Partnership’s revolving credit facility to help fund working capital. The Consolidated Leverage Ratio, as defined in the Partnership’s credit agreement, for the twelve-month period ending December 30, 2023 was 4.72x.

As previously announced on January 25, 2024, the Partnership’s Board of Supervisors declared a quarterly distribution of $0.325 per Common Unit for the three months ended December 30, 2023. On an annualized basis, this distribution rate equates to $1.30 per Common Unit. The distribution is payable on February 13, 2024 to Common Unitholders of record as of February 6, 2024.

About Suburban Propane Partners, L.P.

Suburban Propane Partners, L.P. (“Suburban Propane”) is a publicly traded master limited partnership listed on the New York Stock Exchange. Headquartered in Whippany, New Jersey, Suburban Propane has been in the customer service business since 1928 and is a nationwide distributor of propane, renewable propane, renewable natural gas (“RNG”), fuel oil and related products and services, as well as a marketer of natural gas and electricity and producer of and investor in low carbon fuel alternatives, servicing the energy needs of approximately 1 million residential, commercial, governmental, industrial and agricultural customers through approximately 700 locations across 42 states. Suburban Propane is supported by three core pillars: (1) Suburban Commitment – showcasing Suburban Propane’s 95-year legacy, and ongoing commitment to the highest standards for dependability, flexibility, and reliability that underscores Suburban Propane’s commitment to excellence in customer service; (2) SuburbanCares – highlighting continued dedication to giving back to local communities across Suburban Propane’s national footprint; and (3) Go Green with Suburban Propane – promoting the clean burning and versatile nature of propane and renewable propane as a bridge to a green energy future and investing in the next generation of innovative, renewable energy alternatives. For additional information on Suburban Propane, please visit www.suburbanpropane.com.

Forward-Looking Statements

This press release contains certain forward-looking statements relating to future business expectations and financial condition and results of operations of the Partnership, based on management’s current good faith expectations and beliefs concerning future developments. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those discussed or implied in such forward-looking statements, including the following:

•The impact of weather conditions on the demand for propane, renewable propane, fuel oil and other refined fuels, natural gas, renewable natural gas (“RNG”) and electricity;

•The impact of climate change and potential climate change legislation on the Partnership and demand for propane, fuel oil and other refined fuels, natural gas, RNG and electricity;

•Volatility in the unit cost of propane, renewable propane, fuel oil and other refined fuels, natural gas, RNG and electricity, the impact of the Partnership’s hedging and risk management activities, and the adverse impact of price increases on volumes sold as a result of customer conservation;

•The ability of the Partnership to compete with other suppliers of propane, renewable propane, fuel oil, RNG and other energy sources;

2

•The impact on the price and supply of propane, fuel oil and other refined fuels from the political, military or economic instability of the oil producing nations, including hostilities in the Middle East, Russian military action in Ukraine, global terrorism and other general economic conditions, including the economic instability resulting from natural disasters;

•The ability of the Partnership to acquire and maintain sufficient volumes of, and the costs to the Partnership of acquiring, reliably transporting and storing, propane, renewable propane, fuel oil and other refined fuels;

•The ability of the Partnership to attract and retain employees and key personnel to support the growth of our business;

•The ability of the Partnership to retain customers or acquire new customers;

•The impact of customer conservation, energy efficiency, general economic conditions and technology advances on the demand for propane, fuel oil and other refined fuels, natural gas, RNG and electricity;

•The ability of management to continue to control expenses and manage inflationary increases in fuel, labor and other operating costs;

•Risks related to the Partnership’s renewable fuel projects and investments, including the willingness of customers to purchase fuels generated by the projects, the permitting, financing, construction, development and operation of supporting facilities, the Partnership’s ability to generate a sufficient return on its renewable fuel projects, the Partnership’s dependence on third-party partners to help manage and operate renewable fuel investment projects, and increased regulation and dependence on government funding for commercial viability of renewable fuel investment projects;

•The generation and monetization of environmental attributes produced by the Partnership’s renewable fuel projects, changes to legislation and/or regulations concerning the generation and monetization of environmental attributes and pricing volatility in the open markets where environmental attributes are traded;

•The impact of changes in applicable statutes and government regulations, or their interpretations, including those relating to the environment and climate change, human health and safety laws and regulations, derivative instruments, the sale or marketing of propane and renewable propane, fuel oil and other refined fuels, natural gas, RNG and electricity and other regulatory developments that could impose costs and liabilities on the Partnership’s business;

•The impact of changes in tax laws that could adversely affect the tax treatment of the Partnership for income tax purposes;

•The impact of legal risks and proceedings on the Partnership’s business;

•The impact of operating hazards that could adversely affect the Partnership’s reputation and its operating results to the extent not covered by insurance;

•The Partnership’s ability to make strategic acquisitions, successfully integrate them and realize the expected benefits of those acquisitions;

•The ability of the Partnership and any third-party service providers on which it may rely for support or services to continue to combat cybersecurity threats to their respective and shared networks and information technology;

•Risks related to the Partnership’s plans to diversify its business;

•The impact of current conditions in the global capital, credit and environmental attribute markets, and general economic pressures; and

•Other risks referenced from time to time in filings with the Securities and Exchange Commission (“SEC”) and those factors listed or incorporated by reference into the Partnership’s most recent Annual Report under “Risk Factors.”

Some of these risks and uncertainties are discussed in more detail in the Partnership’s Annual Report on Form 10-K for its fiscal year ended September 30, 2023 and other periodic reports filed with the SEC. Readers are cautioned not to place undue reliance on forward-looking statements, which reflect management’s view only as of the date made. The Partnership undertakes no obligation to update any forward-looking statement, except as otherwise required by law.

3

# # #

(more)

4

Suburban Propane Partners, L.P. and Subsidiaries

Consolidated Statements of Operations

For the Three Months Ended December 30, 2023 and December 24, 2022

(in thousands, except per unit amounts)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

December 30, 2023 |

|

|

December 24, 2022 |

|

Revenues |

|

|

|

|

|

|

Propane |

|

$ |

313,358 |

|

|

$ |

342,353 |

|

Fuel oil and refined fuels |

|

|

23,898 |

|

|

|

30,141 |

|

Natural gas and electricity |

|

|

6,493 |

|

|

|

8,690 |

|

All other |

|

|

22,085 |

|

|

|

16,286 |

|

|

|

|

365,834 |

|

|

|

397,470 |

|

|

|

|

|

|

|

|

Costs and expenses |

|

|

|

|

|

|

Cost of products sold |

|

|

153,053 |

|

|

|

182,653 |

|

Operating |

|

|

122,070 |

|

|

|

115,711 |

|

General and administrative |

|

|

25,570 |

|

|

|

23,012 |

|

Depreciation and amortization |

|

|

16,393 |

|

|

|

13,779 |

|

|

|

|

317,086 |

|

|

|

335,155 |

|

|

|

|

|

|

|

|

Operating income |

|

|

48,748 |

|

|

|

62,315 |

|

Interest expense, net |

|

|

18,192 |

|

|

|

15,994 |

|

Other, net |

|

|

5,853 |

|

|

|

975 |

|

|

|

|

|

|

|

|

Income before provision for (benefit from) income taxes |

|

|

24,703 |

|

|

|

45,346 |

|

Provision for (benefit from) income taxes |

|

|

249 |

|

|

|

(48 |

) |

|

|

|

|

|

|

|

Net income |

|

$ |

24,454 |

|

|

$ |

45,394 |

|

|

|

|

|

|

|

|

Net income per Common Unit - basic |

|

$ |

0.38 |

|

|

$ |

0.71 |

|

Weighted average number of Common Units

outstanding - basic |

|

|

64,064 |

|

|

|

63,634 |

|

|

|

|

|

|

|

|

Net income per Common Unit - diluted |

|

$ |

0.38 |

|

|

$ |

0.71 |

|

Weighted average number of Common Units

outstanding - diluted |

|

|

64,381 |

|

|

|

63,933 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Information: |

|

|

|

|

|

|

EBITDA (a) |

|

$ |

59,288 |

|

|

$ |

75,119 |

|

Adjusted EBITDA (a) |

|

$ |

75,232 |

|

|

$ |

90,042 |

|

Retail gallons sold: |

|

|

|

|

|

|

Propane |

|

|

106,545 |

|

|

|

108,764 |

|

Refined fuels |

|

|

5,256 |

|

|

|

5,563 |

|

Capital expenditures: |

|

|

|

|

|

|

Maintenance |

|

$ |

5,091 |

|

|

$ |

5,721 |

|

Growth |

|

$ |

6,059 |

|

|

$ |

5,059 |

|

(more)

(a) EBITDA represents net income before deducting interest expense, income taxes, depreciation and amortization. Adjusted EBITDA represents EBITDA excluding the unrealized net gain or loss on mark-to-market activity for derivative instruments and other items, as applicable, as provided in the table below. Our management uses EBITDA and Adjusted EBITDA as supplemental measures of operating performance and we are including them because we believe that they provide our investors and industry analysts with additional information that we determined is useful to evaluate our operating results.

5

EBITDA and Adjusted EBITDA are not recognized terms under accounting principles generally accepted in the United States of America (“US GAAP”) and should not be considered as an alternative to net income or net cash provided by operating activities determined in accordance with US GAAP. Because EBITDA and Adjusted EBITDA as determined by us excludes some, but not all, items that affect net income, they may not be comparable to EBITDA and Adjusted EBITDA or similarly titled measures used by other companies.

The following table sets forth our calculations of EBITDA and Adjusted EBITDA:

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

December 30, 2023 |

|

|

December 24, 2022 |

|

Net income |

|

$ |

24,454 |

|

|

$ |

45,394 |

|

Add: |

|

|

|

|

|

|

Provision for (benefit from) income taxes |

|

|

249 |

|

|

|

(48 |

) |

Interest expense, net |

|

|

18,192 |

|

|

|

15,994 |

|

Depreciation and amortization |

|

|

16,393 |

|

|

|

13,779 |

|

EBITDA |

|

|

59,288 |

|

|

|

75,119 |

|

Unrealized non-cash losses on changes in fair value of derivatives |

|

|

10,786 |

|

|

|

13,706 |

|

Equity in losses of unconsolidated affiliates |

|

|

5,158 |

|

|

|

282 |

|

Acquisition-related costs |

|

|

— |

|

|

|

935 |

|

Adjusted EBITDA |

|

$ |

75,232 |

|

|

$ |

90,042 |

|

We also reference gross margins, computed as revenues less cost of products sold as those amounts are reported on the consolidated financial statements. Our management uses gross margin as a supplemental measure of operating performance and we are including it as we believe that it provides our investors and industry analysts with additional information that we determined is useful to evaluate our operating results. As cost of products sold does not include depreciation and amortization expense, the gross margin we reference is considered a non-GAAP financial measure.

The unaudited financial information included in this document is intended only as a summary provided for your convenience, and should be read in conjunction with the complete consolidated financial statements of the Partnership (including the Notes thereto, which set forth important information) contained in its Quarterly Report on Form 10-Q to be filed by the Partnership with the SEC. Such report, once filed, will be available on the public EDGAR electronic filing system maintained by the SEC.

6

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

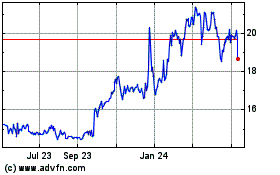

Suburban Propane (NYSE:SPH)

Historical Stock Chart

From Mar 2024 to Apr 2024

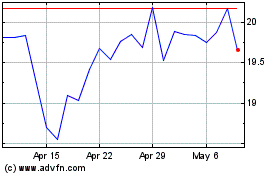

Suburban Propane (NYSE:SPH)

Historical Stock Chart

From Apr 2023 to Apr 2024