Form 8-K - Current report

February 07 2024 - 5:25PM

Edgar (US Regulatory)

false

0001036262

0001036262

2024-02-05

2024-02-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

February 5, 2024

Date of Report (Date of earliest event reported)

inTEST Corporation

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

(State or Other Jurisdiction of Incorporation)

|

1-36117

(Commission File Number)

|

22-2370659

(I.R.S. Employer Identification No.)

|

|

804 East Gate Drive, Suite 200, Mt. Laurel, New Jersey 08054

(Address of Principal Executive Offices, including zip code)

|

(856) 505 8800

(Registrant's Telephone Number, including area code)

| |

N/A

|

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written Communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of Each Class

|

Trading Symbol

|

Name of Each Exchange on Which Registered

|

|

Common Stock, par value $0.01 per share

|

INTT

|

NYSE American

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

| |

|

Emerging growth company ☐

|

| |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

As previously disclosed, on January 9, 2024, inTEST Corporation (the “Company”) and Scott Nolen mutually agreed that Mr. Nolen’s employment with the Company would end effective immediately. In connection with Mr. Nolen’s departure, on February 5, 2024, Mr. Nolen and the Company entered into a separation agreement (the “Agreement”). Pursuant to the terms of the Agreement, and subject to Mr. Nolen’s compliance with the terms of the Agreement, the Company has agreed that: (i) it will pay to Mr. Nolen an aggregate of $95,266.13, representing three months’ severance, his accrued but unused paid time off, and the cost of COBRA continuation for three months, less applicable deductions and withholdings; (ii) Mr. Nolen’s outstanding performance shares granted under that certain Restricted Stock Award Agreement signed by the Company on March 23, 2021, shall vest with respect to a number of shares as determined based on the Company’s actual 2023 results; and (iii) it will pay Mr. Nolen the 2023 Short Term Incentive Bonus that Mr. Nolen would have otherwise earned had he remained employed as determined based on the Company’s actual 2023 results, less applicable deductions and withholdings.

The foregoing description of the Agreement is not complete and is qualified in its entirety by reference to the full and complete terms of the Agreement, a copy of which is filed as Exhibit 10.1 hereto and is incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

Exhibit No.

|

Description

|

| |

|

|

10.1

|

|

|

104

|

Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

inTEST CORPORATION

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

By:

|

/s/ Duncan Gilmour

|

|

| |

|

Duncan Gilmour

|

|

| |

|

Chief Financial Officer, Treasurer and Secretary

|

|

Date: February 7, 2024

Exhibit 10.1

SEPARATION AGREEMENT

This Separation Agreement (the “Agreement”) is by and between inTEST Corporation (the “Company”) and Scott Nolen (“Executive”).

WHEREAS, Executive has been employed by the Company as the Company’s Division President, Process Technologies;

WHEREAS, Executive’s employment with the Company has at all times been on an “at will” basis, and the Company and Executive are not parties to a written employment agreement or other contractual understanding regarding the payment of severance upon the termination of Executive’s employment with the Company, and;

WHEREAS, the employment of Executive shall end on the Termination Date (defined below); and

WHEREAS, the parties agree to resolve any and all issues or disputes that may presently exist, or that may arise out of the circumstances surrounding Executive’s employment with or separation from the Company.

NOW THEREFORE, in consideration of the mutual promises and commitments made herein, and intending to be legally bound hereby, Executive and the Company agree as follows:

|

1.

|

Termination of Employment and Officer Relationships

|

| |

A.

|

Executive’s employment relationship with the Company, and Executive’s participation as an officer of the Company and its subsidiaries and affiliates, if any, shall terminate effective January 10, 2024, immediately prior to the open of business (“Termination Date”). From and after the Termination Date, Executive shall not hold any office, title or fiduciary role with the Company or its subsidiaries and affiliates.

|

| |

B.

|

Executive no longer will be authorized to transact business or incur any expenses, obligations, and liabilities on behalf of the Company or its subsidiaries and affiliates as of the Termination Date. Executive acknowledges the following: (i) Executive has no unreported reimbursements to report or claim against the Company or its subsidiaries and affiliates; and (ii) Executive has reported to the Company any and all work-related injuries incurred during Executive’s employment.

|

| |

C.

|

Executive shall receive all final employment-related pay and benefits from the Company in accordance with the Company’s regular payroll processes, and Executive’s employment benefits shall end on the Termination Date or January 31, depending on the benefit. Executive’s entitlement to continue insurance coverage under the Company’s benefit plans will be determined in accordance with the provisions of the Consolidated Omnibus Budget and Reconciliation Act of 1985, as amended (“COBRA”). Except as described in Section 2 below, any and all equity compensation awards granted to Executive by the Company or any of its affiliates that remain unvested as of the Termination Date shall be terminated effective as of the Termination Date and be forfeited without consideration.

|

| |

A.

|

In consideration for Executive signing, returning and not revoking this Agreement (which contains a General Release), the Company agrees to pay Executive severance in the amount of Seventy-Two Thousand Five Hundred Dollars ($72,500.00), less applicable deductions and withholdings (“Severance”). The Severance, which is equivalent to three (3) months of the Executive’s base salary, shall be in the form of salary continuation over a period of three (3) months, with the first payment being made on the Company’s first regular pay day following the date this Agreement takes effect.

|

| |

B.

|

In further consideration for Executive signing, returning and not revoking this Agreement (which contains a General Release), the Company agrees to pay Executive a payment in the amount of Twenty-Two Thousand Three Hundred Eight Dollars ($22,308.00), less applicable deductions and withholdings (“PTO Payout”). The PTO Payout, which is equivalent to Executive’s accrued but unused paid time off, shall be paid in a lump sum being made on the Company’s first regular pay day following the date this Agreement takes effect.

|

| |

C.

|

In further consideration for Executive signing, returning and not revoking this Agreement (which contains a General Release), the Company agrees to pay Executive a payment in the amount of Four Thousand Five Hundred Eighty Three Dollars and Thirteen Cents ($4,583.13), less applicable deductions and withholdings (“Insurance Payment”). The Insurance Payment, which is equivalent to the cost of COBRA continuation for three months (but is not required to be used for such purpose), shall be paid in a lump sum being made on the Company’s first regular pay day following the date this Agreement takes effect.

|

| |

D.

|

In further consideration for Executive signing, returning and not revoking this Agreement (which contains a General Release), the Company agrees that Executive’s outstanding performance shares granted under that certain Restricted Stock Award Agreement signed by the Company on March 23, 2021, that the Executive would have otherwise earned had he remained employed shall vest with respect to a number of shares as determined based on the Company’s actual 2023 results. Such vesting shall occur in 2024 at the time provided for in the Restricted Stock Award Agreement. No less than 5,280 shares shall vest in accordance with this subsection (88% of the 6,000-share target).

|

| |

E.

|

In further consideration for Executive signing, returning and not revoking this Agreement (which contains a General Release), the Company agrees that it shall pay Executive the 2023 Short Term Incentive Bonus that Executive would have otherwise earned had he remained employed in accordance with the Company’s actual results, less applicable deductions and withholdings. This payment shall be made during 2024 in a lump sum payment at the time such payments are paid to the Company’s current executives. The payment shall be no less than Sixty-Five Thousand Two Hundred Fifty Dollars ($65,250), less applicable deductions and withholdings.

|

| |

F.

|

Executive agrees that Executive is not entitled to the benefits described in this Section absent this Agreement and that such benefits are conditioned on the accuracy of the representations made by, and the performance of obligations of, the Executive set forth in this Agreement.

|

|

3.

|

Executive Representations. Executive specifically represents, warrants, and confirms that Executive:

|

| |

A.

|

has not filed any claims, complaints, or actions of any kind against the Company with any court of law, or local, state, or federal government or agency;

|

| |

B.

|

has received all salary, wages, bonuses, equity, commissions, incentives and other compensation due to Executive, with the exception of Executive’s final payroll check through and including the Termination Date, which will be paid on the next regularly scheduled payroll date for the pay period including the Termination Date.

|

|

4.

|

General Release. In consideration for the Severance, Executive releases and forever discharges the Company (defined for this General Release to include the Company, its parents, subsidiaries, affiliates, successors and assigns, and all of their respective shareholders, officers, directors, agents, representatives, attorneys and employees and their successors, heirs and assigns) from every claim, demand, right, action or cause of action of whatsoever kind or nature, in law or in equity, direct or indirect, liquidated or unliquidated, known or unknown, that Executive ever had or now has, against the Company (as defined herein) with respect to any and all matters relating to Executive’s employment with the Company and the end of that employment with the Company, and any and all other claims of whatsoever kind or nature which Executive may have against the Company (as defined herein) arising from events occurring on or before Executive’s execution of this Agreement. This General Release of the Company (as defined herein) also specifically includes, but is not limited to, any and all claims for employment discrimination, harassment and/or retaliation; all claims in contract, including but not limited to, claims for breach of contract, claims for promissory estoppel and claims for detrimental reliance; all claims in tort (including, but not limited to, all claims for wrongful discharge, fraud, intentional and/or negligent misrepresentation, intentional and/or negligent infliction of emotional distress, defamation/libel/slander, fraudulent inducement, including fraudulent inducement as to this Agreement); all claims for wages, bonuses, equity, profit sharing, performance awards, incentive compensation, severance pay, vacation pay, health insurance premiums, other insurance premiums, medical expense/costs, retirement contributions or benefits, any other fringe benefit, or any form of income or compensation; and all claims arising under Title VII of the Civil Rights Act of 1964, the Age Discrimination in Employment Act, the Americans with Disabilities Act, the Employee Retirement Income Security Act, the New York State Human Rights Law (NYHRL), the New York State Labor Law (NYLL) except minimum wage and unemployment claims), the New Jersey Law Against Discrimination (NJLAD), the New Jersey Family Leave Act, the New Jersey Conscientious Employee Protection Act (NJCEPA), the New Jersey Wage Payment Law, the New Jersey Wage and Hour Law, retaliation claims under the New York State Workers’ Compensation Law and New Jersey Workers' Compensation Law, the New Jersey Equal Pay Act, and all other federal, state, and local laws that may be legally waived and released, all including any amendments and their respective implementing regulations. This General Release also includes, but is not limited to, any and all claims for any type of damages (e.g., back pay; front pay; compensatory damages for emotional distress/pain and suffering, etc.; punitive damages; liquidated damages; consequential damages for an employment search); for any type of equitable relief (i.e., reinstatement; injunction; etc.); for attorneys’ fees/costs; and for interest.

|

|

5.

|

Exceptions to the General Release. The claims Executive is giving up and releasing do not include Executive’s vested rights, if any, under any qualified retirement plan in which Executive participate and Executive’s COBRA, unemployment insurance, and workers’ compensation rights, if any. In addition, nothing in this Agreement shall be construed to constitute a waiver of: (i) any claims Executive may have against the Company that arise from events that occur after the date that Executive signs this Agreement; (ii) Executive’s rights, protected under law, to file an administrative charge or complaint with, communicate with, provide relevant information to or otherwise cooperate with any federal, state or local governmental authority, including the Securities and Exchange Commission, regarding a possible violation of law or respond to any inquiry from such authority, including an inquiry about the existence of this Agreement or its underlying facts; (iii) Executive’s right to participate in any administrative, regulatory, court or law enforcement investigation, hearing or proceeding; and (iv) any other right that Executive cannot waive as a matter of law. Executive acknowledges and agrees, however, that Executive is giving up and forever releasing any right Executive may have to attorneys’ fees, liquidated damages, civil penalties, compensatory or economic damages, equitable relief, emotional distress awards, punitive damages, costs, interest or any other kind of penalties or damages from any complaint or charge, including any class or collective action, filed against the Company with any federal, state or local agency, board or court, except as prohibited by the Securities and Exchange Commission or by appliable law. This does not affect any right Executive may have to recover any payment from a government agency for any information provided to that agency. In addition, the release of all claims set forth in this Agreement does not affect Executive’s rights as expressly created by this Agreement and does not limit Executive’s ability to enforce this Agreement.

|

|

6.

|

Non-Disparagement. Executive agrees that Executive will not at any time or in any manner make or cause to be made any written or verbal statements, or take any actions that disparage, are detrimental to or damage the reputation of the Company, its subsidiaries and affiliates, and their former or current officers, directors, employees, agents and/or owners. This Section does not in any way restrict or impede the Executive from exercising protected rights, including rights under the federal securities laws, including the Dodd-Frank Wall Street Reform and Consumer Protection Act, Pub. L. No. 111-203, Section 929-Z, 124 Stat. 1376, 1871 (2010), to the extent that such rights cannot be waived by agreement, or from complying with any applicable law or regulation or a valid order of a court of competent jurisdiction or an authorized government agency, provided that such compliance does not exceed that required by law. Executive shall promptly provide written notice of any such order to the Company’s CEO at inTEST Corporation, 804 East Gate Drive, Suite 200, Mount Laurel, NJ 08054.

|

|

7.

|

Non-Disclosure Agreement; Continuing Obligations. Executive agrees that this Agreement is conditioned upon his continued compliance with the Nondisclosure Agreement that he executed upon his hire and any other post-employment obligations contained in any agreement between Executive and the Company.

|

|

8.

|

Compliance with Securities Laws. Executive acknowledges that he is required to comply with all applicable securities laws, rules, and regulations including those with respect to insider trading as well as Section 16 of the Securities Exchange Act of 1934, as amended.

|

|

9.

|

Company Property. Executive agrees that Executive has returned or will return to the Company, or will arrange for return to the Company within five (5) days following Executive’s Termination Date, any and all of the Company’s, and its subsidiary and affiliates’, property, including Executive’s Company-issued desktop computer, laptop computer, mobile phone, and iPad, and proprietary and/or confidential information, including originals and copies thereof (whether in hard copy or electronic form), which was or may be in Executive’s possession or under Executive’s control. Any such materials and other property of Company that Executive possesses, including that which exists on Executive’s personal computer(s), electronic equipment, storage media and e-mail account(s), shall be returned in the same format that Executive possesses such (i.e., hardcopy paper documents returned in their original format and all electronically stored documents returned via electronic media (e.g., thumb drive or CD Rom)) on or before Executive’s Termination Date. To the extent an electronic copy exists of the returned materials, Executive must permanently delete such electronic copy/copies on or before Executive’s Termination Date (following transmittal to Company of such documents as set forth above), other than materials on Executive’s electronic devices. Executive agrees that he will not download, upload, transfer, erase, or otherwise relocate Company material from Executive’s Company-issued desktop computer, laptop computer, mobile phone, or iPad and will not use any type of wiping or erasing software on those devices or reset them to a factory default setting. Executive understands that if Executive does not return any hardcopy paper documents and/or electronic media within the time period set forth above, Executive is affirming and representing to the best of Executive’s knowledge that Executive has no such materials in Executive's possession.

|

|

10.

|

No Knowledge of Wrongdoing. Executive represents and warrants that Executive (a) has no knowledge that any officer, director, employee, agent, or representative of the Company, its subsidiaries or affiliates, has committed or is suspected of committing any act which is or may be in violation of any federal or state law or regulation or has acted in a manner which requires corrective action of any kind and (b) Executive has not informed the Company of, and Executive is unaware of, any alleged misconduct by the Company, its subsidiaries, or affiliates, that have not been resolved satisfactorily by the Company.

|

|

11.

|

No Admission of Wrongdoing. Neither this Agreement nor the furnishing of the consideration for this Agreement shall be deemed or construed at any time for any purpose as an admission or evidence of any liability or unlawful conduct of any kind by the Company.

|

|

12.

|

No Obligation to Employ Executive in the Future. The Company has no obligation, contractual or otherwise, to rehire, employ, or hire Executive at any time in the future. Executive further agrees that if Executive seeks any employment with the Company, a rejection of Executive’s application or inquiry will not constitute a breach of this Agreement or a violation in any manner whatsoever by the Company.

|

|

13.

|

Cooperation; Litigation. Executive agrees to cooperate with the Company and its attorneys with respect to any current or future proceedings arising out of or relating to matters of which Executive was involved prior to the termination of Executive’s employment and, if applicable, shall receive reimbursement for expenses (including attorneys’ fees) in accordance with the Company’s Bylaws and the terms of the Indemnification Agreement entered into between Executive and the Company. A copy of Executive’s Indemnification Agreement has been provided to Executive along with this Agreement.

|

|

14.

|

Advice of Counsel, Consideration and Revocation Periods and Effective Date.

|

| |

A.

|

Executive is advised to consult with an attorney prior to signing this Agreement that includes a General Release. Executive has twenty-one (21) days to consider whether to sign this Agreement (the “Consideration Period”), and is advised that the Agreement may not be signed before the Termination Date. If the Consideration Period ends before Executive’s Termination Date, Executive will be able to sign the Agreement (if Executive so chooses) on Executive’s Termination Date or within five (5) calendar days after Executive’s Termination Date.

|

| |

B.

|

Executive must return this signed Agreement to the Vice President Human Resources of the Company, at inTEST Corporation, 804 East Gate Drive, Suite 200, Mount Laurel, NJ 08054, by first class mail, hand delivery or via email from your personal email address within the Consideration Period. If Executive signs and returns this Agreement before the end of the Consideration Period, it is because Executive freely chose to do so after carefully considering its terms.

|

| |

C.

|

Additionally, Executive shall have seven (7) days from the date of the signing of this Agreement to revoke it by delivering a written notice of revocation within the seven-day revocation period to the Vice President Human Resources of the Company at the above address. If the revocation period expires on a weekend or holiday, Executive will have until the end of the next business day to revoke.

|

| |

D.

|

This Agreement will become effective on the eighth (8th) day after Executive signs this Agreement provided Executive does not revoke this Agreement.

|

| |

E.

|

Executive agrees with the Company that changes to the Agreement, whether material or immaterial, do not restart the running of the Consideration Period. The Company is not required to make any payment described in this Agreement unless the Agreement becomes effective.

|

|

15.

|

Section 409A. This Agreement is intended to be exempt from or comply with Section 409A of the Internal Revenue Code of 1986, as amended (“Section 409A”), including the exceptions thereto, and shall be construed and administered in accordance with such intent. Notwithstanding any other provision of this Agreement, payments provided under this Agreement may only be made upon an event and in a manner that complies with Section 409A or an applicable exemption. Any payments under this Agreement that may be excluded from Section 409A either as separation pay due to an involuntary separation from service, as a short-term deferral, or as a settlement payment pursuant to a bona fide legal dispute shall be excluded from Section 409A to the maximum extent possible. For purposes of Section 409A, any installment payments provided under this Agreement shall each be treated as separate and distinct payments. Notwithstanding the foregoing, the Company makes no representations that the payments and benefits provided under this Agreement comply with Section 409A and in no event shall the Company be liable for all or any portion of any taxes, penalties, interest, or other expenses that may be incurred by Executive on account of non-compliance with Section 409A.

|

|

16.

|

Applicable Law and General Provisions. This Agreement shall be interpreted under the laws of the State of New Jersey. This Agreement sets forth the entire agreement between the Parties. Executive is not relying on any other agreements or oral representations not fully addressed in this Agreement. The provisions of this Agreement are severable, and if any part of this Agreement is found by a court of law to be unenforceable, the remainder of this Agreement will continue to be valid and effective. The Company may assign this Agreement to any successor in interest to the business of the Company. Any legal action by either party to enforce any of the terms of this Agreement shall be commenced in the federal or state courts in the State of Delaware.

|

|

17.

|

Paragraph Headings. The paragraph headings in this Agreement are for convenience only; they form no part of this Agreement and shall not affect its interpretation.

|

|

18.

|

Significance of Executive’s Signature. Executive’s signature below indicates that Executive:

|

| |

A.

|

has carefully read and reviewed this Agreement;

|

| |

B.

|

fully understands all of its terms and conditions;

|

| |

C.

|

fully understands that the Agreement is legally binding and that by signing it, Executive is giving up certain rights;

|

| |

D.

|

has not relied on any other representations by the Company, whether written or oral, concerning the terms of the Agreement;

|

| |

E.

|

has been provided at least twenty-one (21) days to consider this Agreement (which includes a General Release) and agrees that changes to this Agreement, whether material or immaterial, do not restart the Consideration Period;

|

| |

F.

|

will have seven (7) days to revoke Executive’s acceptance of this Agreement after signing it;

|

| |

G.

|

has been advised, and has had the opportunity, to consult with an attorney prior to signing the Agreement;

|

| |

H.

|

has signed and delivered this Agreement freely and voluntarily; and

|

| |

I.

|

is duly authorized to sign this Agreement and has not assigned or attempted to assign or give to anyone else any claim Executive has or believes that Executive may have against the Company.

|

|

19.

|

Execution in Counterparts. This Agreement may be executed in any number of counterparts, each of which shall be deemed to be an original against any party whose signature appears thereon, and all of which shall together constitute one and the same instrument. A signature made on a faxed or electronically mailed copy of the Agreement, or a signature transmitted by facsimile or electronic mail, shall have the same effect as the original signature.

|

IN WITNESS WHEREOF, the Parties have executed this Separation Agreement on the date(s) set forth below.

|

|

|

|

EXECUTIVE |

|

| 2/5/2023 |

|

|

/s/ Scott Nolen

|

|

| Date of Signing |

|

|

Scott Nolen |

|

|

|

|

|

|

|

| |

|

|

|

|

| |

|

|

ACCEPTED: |

|

| |

|

|

|

|

| |

|

|

inTEST Corporation |

|

| |

|

|

|

|

| 1/31/24 |

|

By: |

/s/ Richard N. Grant, Jr. |

|

| Date of Signing |

|

|

Richard N. Grant, Jr. |

| |

|

|

President and Chief Executive Officer |

v3.24.0.1

Document And Entity Information

|

Feb. 05, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

inTEST Corporation

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 05, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

1-36117

|

| Entity, Tax Identification Number |

22-2370659

|

| Entity, Address, Address Line One |

804 East Gate Drive, Suite 200

|

| Entity, Address, City or Town |

Mt. Laurel

|

| Entity, Address, State or Province |

NJ

|

| Entity, Address, Postal Zip Code |

08054

|

| City Area Code |

856

|

| Local Phone Number |

505 8800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

INTT

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001036262

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

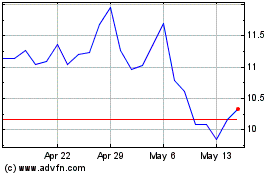

inTest (AMEX:INTT)

Historical Stock Chart

From Mar 2024 to Apr 2024

inTest (AMEX:INTT)

Historical Stock Chart

From Apr 2023 to Apr 2024