false000160767800016076782024-02-072024-02-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 7, 2024

Viking Therapeutics, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

Delaware |

001-37355 |

46-1073877 |

(State or Other Jurisdiction |

(Commission |

(IRS Employer |

of Incorporation) |

File Number) |

Identification No.) |

9920 Pacific Heights Blvd, Suite 350, San Diego, California 92121

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (858) 704-4660

N/A

(Former Name, or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act |

|

|

Title of Each Class |

|

Trading Symbol |

Name of Each Exchange on Which Registered |

Common Stock, par value $0.00001 per share |

|

VKTX |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

In this report, “Viking Therapeutics,” “Viking,” “Company,” “we,” “us” and “our” refer to Viking Therapeutics, Inc.

Item 2.02 Results of Operations and Financial Condition.

On February 7, 2024, we issued a press release reporting our financial results for the fourth quarter and year ended December 31, 2023 and providing a corporate update. The full text of the press release is furnished as exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

In accordance with General Instructions B.2 of Form 8-K, the information in Item 2.02 of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

Viking Therapeutics, Inc. |

|

|

|

Date: February 7, 2024 |

By: |

/s/ Brian Lian, Ph.D. |

|

|

Brian Lian, Ph.D. |

|

|

President and Chief Executive Officer |

|

|

(Principal Executive Officer) |

Exhibit 99.1

Viking Therapeutics Reports Fourth Quarter and Year-End 2023 Financial Results and Provides Corporate Update

Conference call scheduled for 4:30 p.m. ET today

•Results for Phase 2 VENTURE Trial of GLP-1/GIP Agonist VK2735 in Obesity Expected in 1Q24

•Histology Results for Phase 2b VOYAGE Study Evaluating VK2809 for the Treatment of NASH and Fibrosis Expected in 1H24

•Results for Phase 1 Trial of Oral VK2735 Expected in 1Q24

•Strong Year-End Cash Position of $362 Million

SAN DIEGO, February 7, 2024 -- Viking Therapeutics, Inc. ("Viking") (NASDAQ: VKTX), a clinical-stage biopharmaceutical company focused on the development of novel therapies for metabolic and endocrine disorders, today announced its financial results for the fourth quarter and year ended December 31, 2023, and provided an update on its clinical pipeline and other corporate developments.

Highlights from the Quarter Ended December 31, 2023, and Other Recent Events:

“2023 was an event-filled year for Viking, with the company achieving significant progress with each of our four clinical programs,” stated Brian Lian, Ph.D., chief executive officer of Viking. “In the first quarter, we reported results from the first Phase 1 trial of VK2735, our newest clinical program, for the treatment of obesity. This study demonstrated early signals of efficacy, as well as promising safety and tolerability. Last fall, we initiated the VENTURE Phase 2 trial to evaluate VK2735’s longer term clinical benefits, and completed enrollment in an upsized trial more rapidly than expected. In 2023 we also initiated a complementary Phase 1 clinical trial evaluating a novel oral formulation of VK2735, which we believe may expand the market opportunity for this therapeutic. We expect to report topline results from both the VENTURE Phase 2 study and the Phase 1 trial of oral VK2735 in the first quarter of 2024. An additional highlight for 2023 was the announcement of positive topline results from our Phase 2b VOYAGE study of VK2809 in patients with biopsy-confirmed non-alcoholic steatohepatitis with fibrosis. This study affirmed VK2809’s best-in-class profile, demonstrating statistically significant liver-fat reduction, unique lipid-lowering properties, and favorable safety and tolerability profile. We look forward to reporting the 52-week biopsy data from this study in the first half of 2024. Importantly, we completed 2023 with a strong cash position that will support our objectives for 2024 and beyond. We look forward to an exciting year ahead and thank our shareholders and

partners, as well as the investigators and patients participating in our clinical programs, for their continued support.”

Pipeline and Recent Corporate Highlights

•Results for Phase 2 VENTURE Trial of GLP-1/GIP Agonist VK2735 in Obesity Expected in 1Q24. VK2735 is a wholly owned dual agonist of the glucagon like peptide-1, or GLP-1 receptor, and the glucose dependent insulinotropic polypeptide, or GIP receptor, for the potential treatment of various metabolic disorders such as obesity, non-alcoholic steatohepatitis (NASH), and certain rare disorders.

During the first quarter of 2023, Viking announced positive results from a Phase 1 single ascending dose (SAD) and multiple ascending dose (MAD) clinical trial of VK2735 following 28 days of weekly dosing in healthy volunteers. In the MAD portion of the study, VK2735 demonstrated encouraging safety and tolerability, and positive signs of clinical activity. All cohorts receiving VK2735 experienced reductions in mean body weight from baseline, ranging up to 7.8%. Cohorts receiving VK2735 also demonstrated reductions in mean body weight relative to placebo, ranging up to 6.0%. Statistically significant differences compared to placebo were maintained or improved at the Day 43 follow-up time point, 21 days after the last dose of VK2735 was administered. VK2735 also demonstrated encouraging safety and tolerability following repeated dosing. The majority of observed adverse events (98%) were reported as mild or moderate, and the majority of gastrointestinal-related adverse events (99%) were also reported as mild or moderate.

This study also demonstrated VK2735’s encouraging impact on liver fat and plasma lipids. Specifically, after four weekly subcutaneous doses of VK2735, subjects in the Phase 1 trial reported liver fat reductions of up to 47% from baseline. Among subjects with non-alcoholic fatty liver disease, placebo-adjusted reductions in liver fat reached approximately 59%. Though the sample size was limited, these results indicate VK2735’s potential benefit in patients with various forms of fatty liver disease. With respect to plasma lipids, treatment with VK2735 produced encouraging reductions from baseline in total cholesterol of up to 21%, and reductions in LDL-cholesterol of up to 23%. In addition, plasma levels of apolipoprotein B were reduced by up to 21%. These findings are particularly interesting in light of the fact that these healthy volunteers began the study with normal baseline lipid levels. The results from this trial were featured in an oral presentation at ObesityWeek® in October 2023.

During the third quarter of 2023, Viking initiated the Phase 2 VENTURE trial, evaluating VK2735 in patients with obesity. The VENTURE trial is a randomized, double-blind, placebo-controlled multicenter study to evaluate the safety, tolerability, pharmacokinetics, and weight loss efficacy of VK2735, administered subcutaneously, once weekly for 13 weeks. The trial was designed to enroll adults who are obese (BMI ≥30 kg/m2) or adults who are overweight (BMI ≥27 kg/m2) with at least one weight-related comorbid condition. Due to heightened clinician and patient interest, the trial size was increased to 176 patients, compared with the original target of 125 patients. The primary endpoint of the study will assess the percent change in body weight from baseline to Week 13 among patients treated with VK2735 as compared with placebo, with secondary and exploratory endpoints evaluating a range of additional safety and efficacy measures. The doses being evaluated range from 2.5 mg to 15 mg, compared to the 10 mg top dose evaluated in the prior Phase 1 MAD study.

The company completed enrollment in VENTURE in 4Q23 and expects to report topline results from this study in 1Q24.

•Results for Phase 1 Trial of Oral VK2735 Expected in 1Q24. Concurrent with the 1Q23 announcement of results from the Phase 1 trial of the injectable formulation of VK2735, Viking announced the initiation of a Phase 1 clinical study to evaluate a novel oral formulation of VK2735. Viking believes the potential to provide both subcutaneous and oral dosage forms may represent an important option for patients, and may significantly expand the market opportunity for VK2735.

This study is an extension of the SAD/MAD Phase 1 trial described above, and is a randomized, double-blind, placebo-controlled trial in healthy adults with a minimum BMI of 30 kg/m2. The primary objective of the study is to evaluate the safety and tolerability of VK2735 administered as an oral tablet once daily for 28 days. The secondary objective is to evaluate the pharmacokinetics of orally administered VK2735 in healthy subjects. Exploratory pharmacodynamic measures include assessments of changes in body weight and other metrics.

The company expects to report the initial data from the oral formulation Phase 1 study in 1Q24.

•Histology Results for Phase 2b VOYAGE Study Evaluating VK2809 for the Treatment of NASH and Fibrosis Expected in 1H24. VK2809 is an orally available, small molecule agonist of the thyroid hormone receptor that is selective for liver tissue as well as the beta isoform of the receptor. Viking is currently evaluating VK2809 in the Phase 2b VOYAGE study, in patients with biopsy-confirmed NASH and fibrosis. The VOYAGE study is a randomized, double-blind, placebo-controlled, multicenter, international trial designed to assess the efficacy, safety and tolerability of VK2809 in patients with biopsy-confirmed NASH and fibrosis. Enrollment included patients with at least 8% liver fat content as measured by magnetic resonance imaging, proton density fat fraction (MRI-PDFF), as well as F2 and F3 fibrosis. The study also allowed for up to 25% of enrolled patients to have F1 fibrosis, provided that they possess at least one additional risk factor, such as diabetes, obesity or hypertension. The primary endpoint of the study evaluated the change in liver fat content from baseline to Week 12 in patients treated with VK2809 as compared to patients receiving placebo. Secondary objectives include the evaluation of histologic changes assessed by hepatic biopsy after 52 weeks of treatment.

During the second quarter of 2023, Viking announced positive topline results from the VOYAGE study. The trial successfully achieved its primary endpoint, with patients receiving VK2809 experiencing statistically significant reductions in liver fat content from baseline to Week 12 as compared with placebo. The median relative change from baseline in liver fat as assessed by MRI-PDFF ranged from 38% to 55% for patients receiving VK2809. Importantly, up to 85% of patients receiving VK2809 experienced at least a 30% relative reduction in liver fat content (p<0.0001), a level of reduction that is associated with greater likelihood of histologic improvement in NASH. Additionally, VK2809-treated patients demonstrated statistically significant reductions in LDL-cholesterol, triglycerides, and atherogenic lipoproteins, all of which have been correlated with cardiovascular risk. These results support prior data demonstrating that

VK2809 may offer a cardio-protective benefit through its robust reduction in plasma lipids.

The results for the primary endpoint of the VOYAGE Phase 2b study were highlighted in a November presentation at the annual meeting of the American Association for the Study of Liver Diseases (AASLD). A key takeaway from the presentation was the finding that treatment with VK2809 led to robust and comparable liver fat reductions among patients with or without type 2 diabetes, as well as in patients with either F2 or F3 fibrosis. Specifically, among patients with type 2 diabetes, reductions from baseline in liver fat were reported for all VK2809 cohorts, ranging from 36% to 54% at Week 12. This effect size was comparable to that reported for patients without type 2 diabetes. Among non-diabetics, reductions in liver fat from baseline ranged from 19% to 51%. These data suggest that activation of the thyroid hormone beta receptor remains effective at reducing liver fat in the presence of an important metabolic comorbidity commonly observed in patients with NASH. Consistent efficacy was also observed in patients with F2 or F3 fibrosis. Thus, it appears that neither the presence of type 2 diabetes nor the presence of F2 or F3 fibrosis meaningfully impacts VK2809's efficacy at reducing liver fat. As steatosis and lipotoxicity are believed to be underlying drivers in NASH, these data suggest benefits across important disease subgroups.

The topline VOYAGE data also confirmed previously reported results demonstrating VK2809’s encouraging safety and tolerability profile. After 12 weeks, 94% of treatment related adverse events among patients receiving VK2809 were reported as mild or moderate. In particular, as observed in prior studies, VK2809 demonstrated excellent GI tolerability, with rates of nausea, diarrhea, stool frequency, and vomiting similar among VK2809-treated patients compared to placebo.

The company expects to report data from the secondary and exploratory objectives of the VOYAGE study, including the evaluation of histologic changes assessed by hepatic biopsy after 52 weeks of treatment, in the first half of 2024.

•Results for Phase 1b Study of VK0214 in X-ALD Expected in 1H24. VK0214 is a novel, orally available thyroid hormone receptor beta agonist that is being evaluated as a potential treatment for X-linked adrenoleukodystrophy (X-ALD), a rare neurogenerative disease for which there are currently no pharmacologic treatment options.

Results from a prior Phase 1 study of VK0214 in healthy volunteers successfully achieved its primary and secondary endpoints demonstrating encouraging safety and tolerability, dose-dependent exposures, no evidence of accumulation, and a half-life consistent with once-daily dosing. No serious adverse events were observed and no differences were reported for GI side effects such as nausea or diarrhea among subjects treated with VK0214 compared with placebo.

Following completion of the Phase 1 study, Viking initiated a Phase 1b study of VK0214 in patients with the adrenomyeloneuropathy, or AMN, form of X-ALD, which is the most common form of the disorder. The Phase 1b trial is a randomized, double-blind, placebo-controlled multi-center study in adult male patients with AMN. The primary objectives of the study are to evaluate the safety and tolerability of VK0214 administered orally, once daily for 28 days. The study also includes an evaluation of

the pharmacokinetics of VK0214 in AMN patients, as well as an exploratory assessment of changes in plasma levels of very long chain fatty acids.

The company expects to announce results from the Phase 1b study of VK0214 in adrenomyeloneuropathy in 1H24.

•Strong Year-End Cash Position of $362 Million. As of the end of the fourth quarter and year ended December 31, 2023, the company held approximately $362 million in cash, cash equivalents, and marketable securities. These funds will support the ongoing expansion of Viking’s development pipeline, allowing advancement of these programs through important clinical milestones.

•Upcoming Investor Events. Viking management will participate in the following upcoming investor event:

Oppenheimer 34th Annual Healthcare Life Sciences Conference

Virtual

February 13 – 14, 2024

Fourth Quarter and Full-Year 2023 Financial Highlights

Fourth Quarter Ended December 31, 2023 and 2022

Research and development expenses for the three months ended December 31, 2023, were $20.5 million compared to $16.2 million for the same period in 2022. The increase was primarily due to increased expenses related to clinical studies, pre-clinical studies, manufacturing for our drug candidates, stock-based compensation, salaries and benefits and third-party consultants.

General and administrative expenses for the three months ended December 31, 2023, were $8.8 million compared to $4.1 million for the same period in 2022. The increase was primarily due to increased expenses related to legal and patent services, stock-based compensation and third-party consultants, partially offset by decreased expenses related to salaries and benefits.

For the three months ended December 31, 2023, Viking reported a net loss of $24.6 million, or $0.25 per share, compared to a net loss of $19.6 million, or $0.26 per share, in the corresponding period in 2022. The increase in net loss for the three months ended December 31, 2023, was primarily due to the increase in research and development expenses and general and administrative expenses, noted previously, partially offset by increased interest income compared to the same period in 2022.

Year Ended December 31, 2023 and 2022

Research and development expenses for the year ended December 31, 2023, were $63.8 million compared to $54.2 million for the same period in 2022. The increase was primarily due to increased expenses related to pre-clinical studies, stock-based compensation, manufacturing for our drug candidates, salaries and benefits, and services provided by third-party consultants, partially offset by decreased expenses related to clinical studies.

General and administrative expenses for the year ended December 31, 2023, were $37.0 million compared to $16.1 million for the same period in 2022. The increase was primarily due to increased expenses related to legal and patent services, stock-based compensation, third-party consultants and salaries and benefits.

For the year ended December 31, 2023, Viking reported a net loss of $85.9 million, or $0.91 per share, compared to a net loss of $68.9 million, or $0.90 per share, in the corresponding period in 2022. The increase in net loss for the year ended December 31, 2023, was primarily due to the increase in research and development expenses and general and administrative expenses, noted previously, partially offset by increased interest income compared to the same period in 2022.

Balance Sheet as of December 31, 2023

At December 31, 2023, Viking held cash, cash equivalents and short-term investments of $362.1 million, compared to $155.5 million as of December 31, 2022.

Conference Call

Management will host a conference call to discuss Viking’s fourth quarter and full-year 2023 financial results today at 4:30 pm Eastern. To participate in the conference call, please dial (844) 850-0543 from the U.S. or (412) 317-5199 from outside the U.S. In addition, following the completion of the call, a telephone replay will be accessible until February 14, 2024, by dialing (877) 344-7529 from the U.S. or (412) 317-0088 from outside the U.S. and entering conference ID #5763805. Those interested in listening to the conference call live via the internet may do so by visiting the Webcasts page of Viking’s website at http://ir.vikingtherapeutics.com/webcasts. An archive of the webcast will also be available on the Webcasts page of Viking’s website for 30 days.

About Viking Therapeutics, Inc.

Viking Therapeutics is a clinical-stage biopharmaceutical company focused on the development of novel first-in-class or best-in-class therapies for the treatment of metabolic and endocrine disorders, with three compounds currently in clinical trials. Viking's research and development activities leverage its expertise in metabolism to develop innovative therapeutics designed to improve patients' lives. The company's clinical programs include VK2809, a novel, orally available, small molecule selective thyroid hormone receptor beta agonist for the treatment of lipid and metabolic disorders, which is currently being evaluated in a Phase 2b study for the treatment of biopsy-confirmed non-alcoholic steatohepatitis (NASH) and fibrosis. In a Phase 2a trial for the treatment of non-alcoholic fatty liver disease (NAFLD) and elevated LDL-C, patients who received VK2809 demonstrated statistically significant reductions in LDL-C and liver fat content compared with patients who received placebo. The company is also developing VK2735, a novel dual agonist of the glucagon-like peptide 1 (GLP-1) and glucose-dependent insulinotropic polypeptide (GIP) receptors for the potential treatment of various metabolic disorders. Data from a Phase 1 trial evaluating VK2735 (dosed subcutaneously) for metabolic disorders demonstrated an encouraging safety and tolerability profile as well as positive signs of clinical benefit. The company recently initiated a Phase 2 study to evaluate VK2735 in patients with obesity. The company also recently initiated a Phase 1 study to evaluate an oral formulation of VK2735. In the rare disease space, the company is

developing VK0214, a novel, orally available, small molecule selective thyroid hormone receptor beta agonist for the potential treatment of X-linked adrenoleukodystrophy (X-ALD). VK0214 is currently being evaluated in a Phase 1b clinical trial in patients with the adrenomyeloneuropathy (AMN) form of X-ALD. The company holds exclusive worldwide rights to a portfolio of five therapeutic programs, including VK2809 and VK0214, which are based on small molecules licensed from Ligand Pharmaceuticals Incorporated.

For more information about Viking Therapeutics, please visit www.vikingtherapeutics.com.

Forward-Looking Statements

This press release contains forward-looking statements regarding Viking Therapeutics, Inc., under the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, including statements about Viking's expectations regarding its clinical and preclinical development programs, anticipated timing for reporting clinical data and cash resources. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially and adversely and reported results should not be considered as an indication of future performance. These risks and uncertainties include, but are not limited to: risks associated with the success, cost and timing of Viking's product candidate development activities and clinical trials, including those for VK2735, VK0214, VK2809, and the company's other incretin receptor agonists; risks that prior clinical and preclinical results may not be replicated; risks regarding regulatory requirements; and other risks that are described in Viking's most recent periodic reports filed with the Securities and Exchange Commission, including Viking's Annual Report on Form 10-K for the year ended December 31, 2023, and subsequent Quarterly Reports on Form 10-Q, including the risk factors set forth in those filings. These forward-looking statements speak only as of the date hereof. Viking disclaims any obligation to update these forward-looking statements except as required by law.

Viking Therapeutics, Inc.

Consolidated Statements of Operations and Comprehensive Loss

(In thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

Year Ended

December 31, |

|

|

2023 |

|

|

2022 |

|

Revenues |

|

$ |

— |

|

|

$ |

— |

|

Operating expenses: |

|

|

|

|

|

|

Research and development |

|

|

63,806 |

|

|

|

54,234 |

|

General and administrative |

|

|

37,021 |

|

|

|

16,121 |

|

Total operating expenses |

|

|

100,827 |

|

|

|

70,355 |

|

Loss from operations |

|

|

(100,827 |

) |

|

|

(70,355 |

) |

Other income (expense): |

|

|

|

|

|

|

Amortization of financing costs |

|

|

(88 |

) |

|

|

(59 |

) |

Interest income, net |

|

|

15,020 |

|

|

|

1,589 |

|

Realized loss on investments, net |

|

|

— |

|

|

|

(42 |

) |

Foreign exchange gain |

|

|

— |

|

|

|

— |

|

Total other income, net |

|

|

14,932 |

|

|

|

1,488 |

|

Net loss |

|

|

(85,895 |

) |

|

|

(68,867 |

) |

Other comprehensive loss, net of tax: |

|

|

|

|

|

|

Unrealized gain (loss) on securities |

|

|

742 |

|

|

|

(295 |

) |

Foreign currency translation loss |

|

|

(29 |

) |

|

|

(258 |

) |

Comprehensive loss |

|

$ |

(85,182 |

) |

|

$ |

(69,420 |

) |

Basic and diluted net loss per share |

|

$ |

(0.91 |

) |

|

$ |

(0.90 |

) |

Weighted-average shares used to compute basic

and diluted net loss per share |

|

|

94,347 |

|

|

|

76,834 |

|

Viking Therapeutics, Inc.

Consolidated Balance Sheets

(In thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

December 31,

2023 |

|

|

December 31,

2022 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

55,516 |

|

|

$ |

36,632 |

|

Short-term investments – available-for-sale |

|

|

306,563 |

|

|

|

118,853 |

|

Prepaid clinical trial and preclinical study costs |

|

|

2,624 |

|

|

|

8,144 |

|

Prepaid expenses and other current assets |

|

|

2,522 |

|

|

|

3,411 |

|

Total current assets |

|

|

367,225 |

|

|

|

167,040 |

|

Right-of-use assets |

|

|

1,126 |

|

|

|

1,418 |

|

Deferred financing costs |

|

|

106 |

|

|

|

38 |

|

Deposits |

|

|

33 |

|

|

|

33 |

|

Total assets |

|

$ |

368,490 |

|

|

$ |

168,529 |

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

7,512 |

|

|

$ |

8,529 |

|

Other accrued liabilities |

|

|

11,299 |

|

|

|

13,114 |

|

Lease liability, current |

|

|

324 |

|

|

|

304 |

|

Total current liabilities |

|

|

19,135 |

|

|

|

21,947 |

|

Lease liability, net of current portion |

|

|

936 |

|

|

|

1,260 |

|

Total long-term liabilities |

|

|

936 |

|

|

|

1,260 |

|

Total liabilities |

|

|

20,071 |

|

|

|

23,207 |

|

Commitments and contingencies |

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

Preferred stock, $0.00001 par value: 10,000,000 shares authorized at December 31, 2023 and 2022; no shares issued and outstanding at December 31, 2023 and 2022 |

|

|

— |

|

|

|

— |

|

Common stock, $0.00001 par value: 300,000,000 shares authorized at December 31, 2023 and 2022; 100,113,770 shares issued and outstanding at December 31, 2023 and 78,257,258 shares issued and outstanding at December 31, 2022 |

|

|

1 |

|

|

|

1 |

|

Treasury stock at cost, 2,193,251 shares at December 31, 2023 and 2022 |

|

|

(6,795 |

) |

|

|

(6,795 |

) |

Additional paid-in capital |

|

|

733,546 |

|

|

|

445,267 |

|

Accumulated deficit |

|

|

(377,944 |

) |

|

|

(292,049 |

) |

Accumulated other comprehensive loss |

|

|

(389 |

) |

|

|

(1,102 |

) |

Total stockholders’ equity |

|

|

348,419 |

|

|

|

145,322 |

|

Total liabilities and stockholders’ equity |

|

$ |

368,490 |

|

|

$ |

168,529 |

|

Contacts:

Viking Therapeutics

Greg Zante

Chief Financial Officer

858-704-4672

gzante@vikingtherapeutics.com

Vida Strategic Partners

Stephanie Diaz (Investors)

415-675-7401

sdiaz@vidasp.com

Tim Brons (Media)

415-675-7402

tbrons@vidasp.com

v3.24.0.1

Document and Entity Information

|

Feb. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 07, 2024

|

| Entity Registrant Name |

Viking Therapeutics, Inc.

|

| Entity Central Index Key |

0001607678

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-37355

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

46-1073877

|

| Entity Address, Address Line One |

9920 Pacific Heights Blvd

|

| Entity Address, Address Line Two |

Suite 350

|

| Entity Address, City or Town |

San Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92121

|

| City Area Code |

858

|

| Local Phone Number |

704-4660

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.00001 per share

|

| Trading Symbol |

VKTX

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

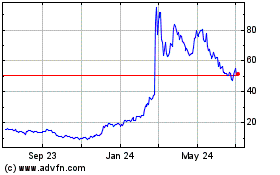

Viking Therapeutics (NASDAQ:VKTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

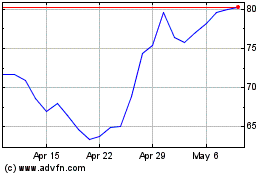

Viking Therapeutics (NASDAQ:VKTX)

Historical Stock Chart

From Apr 2023 to Apr 2024