false

0000891417

0000891417

2024-02-05

2024-02-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 5, 2024

Nano Magic Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-11602 |

|

47-1598792 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(Commission

File No.) |

|

(I.R.S. Employer

Identification No.) |

31601

Research Park Drive, Madison Heights, MI 48071

(Address

of principal executive offices) (Zip Code)

(844)

736-6266

(Registrant’s

telephone number, including area code)

Former

name or former address, if changed since last report:

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of Each Exchange on Which Registered |

| Common

Stock, $0.0001 par value |

|

NMGX |

|

OTC

Markets |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item

1.01 Entry into a Material Definitive Agreement

On

February 5, 202, the Board approved a one-year extension of the employment agreement with our Chief Executive Officer and President,

Tom J. Berman. Under the terms of the extension, effective January 1, 2024, Mr. Berman will earn an annual salary of $225,000 and will

be entitled to a profit bonus tied to 2024 revenue as well as a bonus if the EBITDA of the corporation is 20% or more. The specific bonus

terms, including rights to payment of the profit

bonus if the contract is terminated, are set forth in the extension included as an exhibit to this filing.

Item

9.01. Financial Statements and Exhibits.

d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Nano

Magic Inc. |

| |

|

|

| Date:

February 7, 2024 |

By: |

/s/

Tom J. Berman |

| |

|

President

& CEO |

Exhibit 10.1

EXHIBIT B

THIS EXHIBIT B (the

“Exhibit”), by and between Nano Magic Inc. (the “Company”) and Tom Berman (“Employee”),

supplements and relates to that certain Employment Agreement having an Effective Date of April 3, 2019 previously amended in 2021

(the “Agreement”).

In consideration of the covenants contained in the

Agreement and herein, the parties, intending to be legally bound, hereby agree as follows:

Services. Employee agrees to continue to use his best efforts to

provide and perform the following services:

| |

a. |

Full-time duties related to the title of President and CEO of the Company. |

| |

b. |

All other services as directed by the Company from time to time. |

Compensation.

Salary: Employee will be paid an annual salary of $225,000 (monthly

salary of $18,750) for January, 2024 and each subsequent month of 2024.

Bonuses: In addition, Employee shall be entitled to earn cash bonuses

as follows:

Revenue Bonus:

| Revenue | |

Bonus | |

| $5 million | |

$ | 50,000 | |

| $6 million | |

$ | 25,000 | |

| $7 million | |

$ | 25,000 | |

| $8 million | |

$ | 50,000 | |

| $9 million | |

$ | 50,000 | |

| $10 million+ | |

$ | 50,000 | |

Revenue bonus payments are cumulative and payable in the quarter after

the quarter in which the revenue is reported. For example, if the Company reports revenue of $5 million in the third quarter, a bonus

of $50,000 will be paid in the fourth quarter, and if the reported revenue for the year 2024 is over $7 million (but under $8 million),

an additional bonus of $50,000 will be paid in the first quarter of 2025. So long as his employment was not terminated for “Cause”

(as defined below) Employee will remain eligible to earn the revenue bonus for 2024.

Profit Bonus equal to 5% of EBITDA for 2024. EBITDA means sum of

the Company’s net profit for the prior year plus interest, taxes, depreciation and amortization expense for the prior year, except

that if EBITDA is 20% or more of Revenue for the year, the bonus payable will equal 10% of the prior year’s EBITDA. The Profit Bonus

will be paid in cash, stock options or a combination of cash and options as determined by the Board of Company. Any portion to be paid

in options as determined by the Board will result in vesting of options to purchase that number of shares as determined by the Board from

the EBITDA tranche of an option to be granted to Employee that references this Exhibit B.

“Cause” means a determination by the Board or a committee of

the Board that Employee (i) has engaged in personal dishonesty, willful violation of any law, rule, or regulation (other than minor traffic

violations or similar offenses), or breach of fiduciary duty involving personal profit, (ii) has failed to satisfactorily perform his

or her duties and responsibilities for the Company or any Related Company, (iii) has been convicted of, or plead nolo contendere to, any

felony or a crime involving moral turpitude, (iv) has engaged in gross negligence or willful misconduct in the performance of his or her

duties, including but not limited to willfully refusing without proper legal reason to perform his or her duties and responsibilities,

(v) has materially breached any corporate policy or code of conduct established by the Company or any Related Company as such policies

or codes may be adopted or amended from time to time, (vi) has violated the terms of any confidentiality, nondisclosure, intellectual

property, non-solicitation, noncompetition, proprietary information or inventions agreement, or any other agreement between Employee and

the Company or any Related Company related to his or her service with any of them, or (vii) has engaged in conduct that is likely to have

a deleterious effect on the Company or any Related Company or their legitimate business interests, including but not limited to their

goodwill and public image.

Benefits. Employee may be furnished with a company owned computer

and/or a company credit card or other company property for which Employee shall sign an agreement acknowledging said property of the Company

shall be returned to the Company upon termination of employment or at the request of the Company at any time. In addition, Employee may

be eligible to participate in the Company’s benefit programs of Paid Time Off, and medical insurance. In the event of a conflict,

the terms and conditions of the benefit plan documents and/or separate handout(s) shall control.

Termination. In the event that Employee’s employment with

the Company is terminated, as of the date of termination and thereafter, the Company shall no longer be required to pay and provide to

Employee any salary or other benefits, except for the Revenue Bonus described above.

The parties acknowledge and agree that this Exhibit

along with Exhibit A shall be governed by all terms and conditions of the Agreement and that the Agreement remains in full force an effect

as supplemented hereby.

IN WITNESS WHEREOF, this Exhibit is executed and entered

into by the parties with an effective date of January 1, 2024.

| /s/ Tom J. Berman |

|

NANO MAGIC INC. |

| Tom J. Berman |

|

|

|

| |

|

By: |

/s/ Leandro Vera |

| |

|

|

Leandro Vera, Chief Financial Officer |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

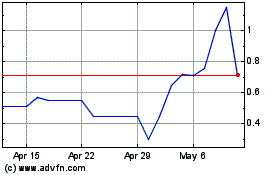

Nano Magic (QB) (USOTC:NMGX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nano Magic (QB) (USOTC:NMGX)

Historical Stock Chart

From Apr 2023 to Apr 2024