false

0001563665

0001563665

2024-02-01

2024-02-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

The

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 1, 2024

Harvard

Apparatus Regenerative Technology, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-35853 |

|

45-5210462 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 84

October Hill Road, Suite 11, Holliston, MA |

|

01746 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (774) 233-7300

Biostage,

Inc.

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

HRGN |

|

OTCQB |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement.

On

February 1, 2024, Harvard Apparatus Regenerative Technology, Inc. (the “Company”) entered into a loan arrangement

with Junli He, the Chairman and Chief Executive Officer of the Company (the “Lender”), pursuant to which the Lender

has agreed to loan the Company an aggregate amount of $500,000 as evidenced by a Bridge Note executed by the Company in favor of, and

accepted by, the Lender (the “Bridge Note”).

The

Bridge Note accrues interest at an annual fixed rate of 8%, and the principal amount thereof will

be due and payable in full, together with all accrued and unpaid interest thereon, on the earlier to occur of a) the closing date (or

later date of capital being provided pertaining to such continued offering that the following threshold is tripped) of the Company’s

next capital raise that includes gross proceeds of at least $5,000,000 or b) February 1, 2025. The Bridge Note provides for optional

conversion at the discretion of the Lender, contains covenants, and provides for certain events of default including if the Company fails

to pay when due any amount owed thereunder, fails to comply with any agreement, covenant, condition, provision or term contained therein

and other customary events of default.

The

foregoing description of the Bridge Note does not purport to be complete and is qualified in its entirety by reference to the full text

of such document, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item

2.03. Creation of a Certain Direct Financial Obligation.

The

information set forth under Item 1.01 of this Report is incorporated herein by reference.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

HARVARD

APPARATUS REGENERATIVE TECHNOLOGY, INC. |

| |

|

|

| Date:

February 6, 2024 |

By: |

/s/

Joseph Damasio |

| |

|

Joseph

Damasio |

| |

|

Chief

Financial Officer |

EXHIBIT

10.1

BRIDGE

NOTE

| $500,000

|

Holliston,

Massachusetts |

| |

February

1, 2024 |

FOR

VALUE RECEIVED, Harvard Apparatus Regenerative Technology, Inc., a Delaware corporation (the “Borrower”), promises

to pay to the order of Junli He (the “Lender”), at the addresses for Lender on file in the Borrower’s

personnel records, or at such other place as may be designated from time to time by the Lender, in lawful money of the United States

of America, the principal sum of Five Hundred Thousand Dollars ($500,000), together with interest on the unpaid principal balance

hereof from the date hereof until this Bridge Note (this “Note”) is paid or satisfied in full, at an annual

rate of interest, calculated on the basis of actual number of days elapsed in a 360 day year, at a fixed rate of eight percent (8%) or

the maximum rate permissible by law, whichever is less (the “Interest Rate”).

1.

Repayment. This Note shall mature on the earlier to occur of (i) the closing date (or later date of capital being provided

pertaining to such continued offering that the following threshold is tripped) of the Borrower’s next capital raise that includes

gross proceeds of at least $5,000,000 (the “Offering”), or (ii) February 1, 2025 unless maturity is accelerated

under this Note (the “Maturity Date”), on which date all principal and accrued interest hereunder shall be

due and payable in full.

2.

Optional Conversion to Equity. In the event the Borrower issues equity securities (including instruments or securities convertible

into or exchangeable for such equity securities) (“Equity Securities”) in a transaction or series of related

transactions resulting in aggregate gross proceeds to the Borrower of at least Five Hundred Thousand Dollars ($500,000), excluding the

indebtedness evidenced by this Note (a “Qualified Financing”), on or before the Maturity Date, then the indebtedness

evidenced by this Note may be converted at Lender’s option, to that number of Equity Securities of the Borrower equal to (x) the

sum of the full balance of this Note (all principal and accrued interest), divided by (y) the per unit price paid by the purchasers

of such Equity Securities in the Qualified Financing. Lender shall give notice to the Borrower prior to the initial closing of the Qualified

Financing (or the closing of any add-on to the Qualified Financing, as applicable) as to whether the Lender elects to convert the indebtedness

evidenced by this Note to equity in accordance with this Section 2.

3.

Certain Definitions. The following terms shall have the following meanings:

(a)

“Act of Bankruptcy” shall mean if (i) the Borrower shall (1) be or become unable to pay its debts in the ordinary

course of business, or (2) apply for or consent to the appointment of, or the taking of possession by, a receiver, custodian, trustee,

liquidator or the like of the Borrower or of all or a substantial part of the Borrower’s property, or (3) commence a voluntary

case under any bankruptcy, insolvency, reorganization, arrangement, readjustment of debt, dissolution, liquidation or similar proceeding

under the laws of any jurisdiction, or (4) file a petition seeking to take advantage of any other law relating to bankruptcy, insolvency,

reorganization, winding up or composition or adjustment of debts, or (5) admit in writing the Borrower’s inability to pay the Borrower’s

debts as they mature, or (6) make an assignment for the benefit of the Borrower’s creditors; or (ii) a proceeding or case shall

be commenced, without the application or consent of the Borrower, in any court of competent jurisdiction, seeking (1) the liquidation,

reorganization, dissolution, winding up or the composition or adjustment of debts of the Borrower, (2) the appointment of a trustee,

receiver, custodian or liquidator or the like of the Borrower or of all or any substantial part of the Borrower’s property, or

(3) similar relief in respect of the Borrower under any law relating to bankruptcy, insolvency, reorganization, winding up or composition

or adjustment of debts.

(b)

“Sale of the Company” shall mean a transaction or series of transactions involving or resulting in (a) any

sale, transfer, assignment, or conveyance of all or substantially all of the assets of the Borrower; or (b) any sale, transfer, assignment

or conveyance, merger, exchange, consolidation or other business combination, whether voluntary or by operation of law, to which the

Borrower is a party as a result of which the holders of the Borrower’s equity interests prior to such transaction or series of

transactions will own less than a majority of the outstanding equity interests of the surviving entity after such transaction or series

of transactions.

4.

Payments. The Borrower may prepay this Note any time without penalty or premium. All payments under this note shall be paid

directly to Lender. All payments hereunder shall be applied first to costs, expenses, and other fees (including reasonable attorneys’

fees) which are due and payable under this Note, second to accrued interest then due and payable under this Note and finally to reduce

the principal amount outstanding under this Note.

5.

Events of Default. The occurrence of any one or more of the following events shall constitute an “Event of Default”:

(a)

The Borrower shall fail to make when due, whether by acceleration or otherwise, any payment of principal of, interest on, or costs, expenses,

and other fees (including reasonable attorneys’ fees) under this Note when due; or

(b)

The Borrower shall fail to comply with any agreement, covenant, condition, provision or term contained in this Note; or

(c)

An Act of Bankruptcy shall occur; or

(d)

A Sale of the Company shall occur; or

(e)

A judgment or judgments for the payment of money in excess of the sum of $100,000 in the aggregate shall be rendered against the Borrower

and the Borrower shall not pay or discharge the same or provide for its discharge in accordance with its terms, or procure a stay of

execution thereof, prior to any execution on such judgments by such judgment creditor, within thirty (30) days from the date of entry

thereof.

6.

Remedies. If (a) any Event of Default described in Section 5(c) above shall occur, the outstanding unpaid principal balance

of this Note, the accrued interest thereon, the costs, expenses, and other fees (including reasonable attorneys’ fees) thereunder

and all other obligations of the Borrower to the Lender shall automatically become immediately due and payable in full; or (b) any other

Event of Default in Section 5 shall occur and be continuing, then the Lender may declare that the outstanding unpaid principal balance

of this Note, the accrued and unpaid interest thereon, the costs, expenses, and other fees (including reasonable attorneys’ fees)

thereunder and all other obligations of the Borrower to the Lender to become immediately due and payable, in each case without further

demand or notice of any kind, all of which are hereby expressly waived, anything in this Note to the contrary notwithstanding. In addition,

upon any Event of Default, the Lender may exercise all rights and remedies under any other instrument, document or agreement in favor

of the Lender, and enforce all rights and remedies under any applicable law. The rights and remedies provided in this Note are cumulative

and are in addition to all rights or remedies that the Lender otherwise may have in law or in equity or by statute or otherwise.

7.

No Waiver. Time is of the essence. No delay or failure on the part of the Lender in exercising any right or remedy hereunder,

or at law or at equity, shall operate as a waiver of or preclude the exercise of any such right or remedy, and no single or partial exercise

by the Lender of any such right or remedy shall preclude or estop another or further exercise thereof or exercise of any other right

or remedy. No waiver by the Lender hereof shall be effective unless in writing signed by the Lender. A waiver on any one occasion shall

not be construed as a waiver of any such right or remedy on any prior or subsequent occasion.

8.

Costs of Collection. Borrower agrees to pay all costs of collection, including attorney’s fees, in the event this Note

is not paid when due.

9.

Waiver of Presentment. The Borrower, sureties, endorsers, guarantors and all other persons liable for all or any part of the

principal balance evidenced by this Note severally waive presentment for payment, protest and notice of nonpayment. Such parties hereby

consent without affecting their liability to any extension or alteration of the time or terms of payments hereof, any renewal, any release

of any party of all or part of the security given for the payment hereof, any acceptance of additional security of any kind, and any

release of, or resort to any party liable for payment hereof.

10.

Assignment. Neither the Lender nor the Borrower may, in whole or in part, directly or indirectly, assign this Note or its

rights hereunder or delegate its duties hereunder without, in each instance, the specific prior written signed consent of all other parties

hereto (and any attempted assignment without such consent shall be void).

11.

Jurisdiction; Waiver of Jury Trial. THE PROVISIONS OF THIS NOTE SHALL BE GOVERNED BY AND INTERPRETED IN ACCORDANCE WITH THE

LAWS OF MASSACHUSETTS, WITHOUT REGARD TO ITS CONFLICTS OF LAW PRINCIPLES. AS A SPECIFICALLY BARGAINED INDUCEMENT FOR LENDER TO EXTEND

CREDIT TO BORROWER, AND AFTER HAVING THE OPPORTUNITY TO CONSULT COUNSEL, THE LENDER AND BORROWER HEREBY EXPRESSLY WAIVE THE RIGHT TO

TRIAL BY JURY IN ANY LAWSUIT OR PROCEEDING RELATED TO THIS NOTE OR ARISING IN ANY WAY FROM ANY INDEBTEDNESS OR OTHER TRANSACTIONS INVOLVING

THE LENDER AND THE BORROWER.

12.

General. This Note may be amended, supplemented, or otherwise modified only by a written instrument executed by the Parties.

This Note sets forth the entire understanding of the Parties hereto and supersede all prior agreements whether written or oral relating

to the same subject matter. If any provision of this Note shall be declared by any court having valid jurisdiction over this Note to

be illegal, void or unenforceable, all other provisions of this Note shall not be affected and shall remain in full force and effect.

If any provision of this Note is so broad as to be unenforceable, that provision shall be interpreted to be only so broad as is enforceable.

[The

signature page follows.]

[Signature

page to Bridge Note]

| |

|

HARVARD

APPARATUS REGENERATIVE TECHNOLOGY, INC. |

| |

|

|

|

| |

|

By: |

/s/

Joseph L. Damasio, Jr. |

| |

|

Name: |

Joseph

L. Damasio, Jr. |

| |

|

Its: |

Chief

Financial Officer |

| Accepted

and agreed to: |

|

|

| |

|

|

| LENDER |

|

|

| |

|

|

| /s/

Junli He |

|

|

| Junli

He |

|

|

v3.24.0.1

Cover

|

Feb. 01, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 01, 2024

|

| Entity File Number |

001-35853

|

| Entity Registrant Name |

Harvard

Apparatus Regenerative Technology, Inc.

|

| Entity Central Index Key |

0001563665

|

| Entity Tax Identification Number |

45-5210462

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

84

October Hill Road

|

| Entity Address, Address Line Two |

Suite 11

|

| Entity Address, City or Town |

Holliston

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

01746

|

| City Area Code |

(774)

|

| Local Phone Number |

233-7300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock

|

| Trading Symbol |

HRGN

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Biostage,

Inc.

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

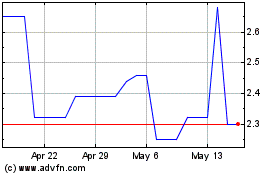

Harvard Apparatus Regene... (QB) (USOTC:HRGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Harvard Apparatus Regene... (QB) (USOTC:HRGN)

Historical Stock Chart

From Apr 2023 to Apr 2024