false

0000876343

0000876343

2024-02-06

2024-02-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 6, 2024

LINEAGE

CELL THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| California |

|

001-12830 |

|

94-3127919 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

2173

Salk Avenue, Suite 200

Carlsbad, California 92008

(Address of Principal Executive Offices and Zip Code)

Registrant’s

telephone number, including area code: (442) 287-8990

Not

Applicable

(Former name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

shares |

|

LCTX |

|

NYSE

American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

1.01 |

Entry

into a Material Definitive Agreement. |

On

February 6, 2024, Lineage Cell Therapeutics, Inc. (the “Company” or “Lineage”) entered into a stock purchase

agreement (the “purchase agreement”) with certain investors relating to the purchase and sale in a registered direct

offering of an aggregate of 13,461,540 common shares of the Company. The offering price was $1.04 per common share. The

aggregate gross proceeds to Lineage from the offering are expected to be $14.0 million before deducting estimated offering expenses

payable by Lineage. Broadwood Partners, L.P., which is affiliated with Neal Bradsher, a member of the Company’s board of directors,

agreed to purchase 6,730,770 common shares in the offering, and Don M. Bailey, a member of the Company’s board of directors,

agreed to purchase approximately 100,000 common shares in the offering.

The closing of the offering is expected to occur

on or about February 8, 2024, subject to customary closing conditions. Lineage intends to use the proceeds from the offering for general

corporate purposes, which may include clinical trials, research and development activities, general and administrative costs, and to

meet working capital needs.

The

purchase agreement contains customary representations, warranties and agreements by Lineage, and customary conditions to closing.

The representations and warranties in the purchase agreement were made only for purposes of the purchase agreement and

as of a specific date, were solely for the benefit of the parties to the purchase agreement, and may be subject to limitations

agreed upon by such parties.

The

offering is being made pursuant to Lineage’s registration statement on Form S-3 (File No. 333-254167), filed with the U.S. Securities

and Exchange Commission on March 11, 2021, and declared effective by the SEC on March 19, 2021, and a prospectus supplement thereunder.

A

copy of the purchase agreement is filed as 10.1. The foregoing description of the terms of the purchase agreement is qualified

in its entirety by reference to such exhibit. A copy of the opinion of Sheppard Mullin Richter & Hampton LLP relating to the

legality of the issuance and the sale of the common shares of Lineage is filed as Exhibit 5.1.

This

report shall not constitute an offer to sell or the solicitation of an offer to buy any securities of the Company, nor shall there be

any offer, solicitation, or sale of the Company’s securities in any state or jurisdiction in which such offer, solicitation or

sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction.

On

February 6, 2024, Lineage issued a press release announcing the offering, a copy of which is attached as Exhibit 99.1 and is incorporated

herein by reference.

| Item

9.01 |

Financial

Statements and Exhibits. |

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

LINEAGE

CELL THERAPEUTICS, INC. |

| |

|

| Dated:

February 6, 2024 |

By: |

/s/

George A. Samuel III |

| |

Name: |

George

A. Samuel III |

| |

Title: |

General

Counsel and Corporate Secretary |

Exhibit

5.1

|

|

Sheppard,

Mullin, Richter & Hampton LLP

12275

El Camino Real, Suite 100

San

Diego, CA 92130

www.sheppardmullin.com |

February

6, 2024

VIA

E-MAIL

Lineage

Cell Therapeutics, Inc.

Attn:

Board of Directors

2173

Salk Avenue, Suite 200

Carlsbad,

CA 92008

Ladies

and Gentlemen:

We

have acted as counsel to Lineage Cell Therapeutics, Inc., a California corporation (the “Company”), in connection

with the issuance and sale of up to 13,461,540 common shares (the “Shares”) of the Company, no par value. The

Shares are to be sold by the Company pursuant to a Registration Statement on Form S-3 (File No. 333-254167) (the “Registration

Statement”), filed with the U.S. Securities and Exchange Commission (the “Commission”) under the Securities

Act of 1933, as amended (the “Act”), the prospectus included in the Registration Statement (the “Base Prospectus”),

and the prospectus supplement to be filed with the Commission pursuant to Rule 424(b) of the rules and regulations of the Act (the “Prospectus

Supplement” and together with the Base Prospectus, the “Prospectus”).

In

connection with this opinion, we have examined and relied upon the Registration Statement, the Prospectus, the Company’s restated

articles of incorporation and amended and restated bylaws, each as currently in effect, and originals or copies certified to our satisfaction

of such records, documents, certificates, memoranda and other instruments as in our judgment are necessary or appropriate to enable us

to render the opinion expressed below. We have assumed the genuineness and authenticity of all documents submitted to us as originals,

and the conformity to originals of all documents submitted to us as copies; the accuracy, completeness and authenticity of certificates

of public officials; and the due execution and delivery of all documents by all persons other than the Company where due execution and

delivery are a prerequisite to the effectiveness thereof. As to certain factual matters, we have relied upon a certificate of an officer

of the Company and have not independently verified such matters.

Our

opinion is expressed only with respect to the California Corporations Code. We express no opinion to the extent that any other laws are

applicable to the subject matter hereof and express no opinion and provide no assurance as to compliance with any federal or state securities

law, rule or regulation.

On

the basis of the foregoing, and in reliance thereon, we are of the opinion that the Shares, when sold and issued in accordance with the

Registration Statement and the Prospectus, will be validly issued, fully paid and nonassessable.

We

hereby consent to the filing of this opinion as an exhibit to a Current Report on Form 8-K, for incorporation by reference into the Registration

Statement. We also hereby consent to the reference to our firm under the heading “Legal Matters” in the Prospectus. In giving

this consent, we do not thereby admit that we are within the category of persons whose consent is required under Section 7 of the Act

or the rules and regulations under the Act.

This

opinion letter is rendered as of the date first written above and we disclaim any obligation to advise you of facts, circumstances, events

or developments which hereafter may be brought to our attention and which may alter, affect or modify the opinion expressed herein. Our

opinion is expressly limited to the matters set forth above and we render no opinion, whether by implication or otherwise, as to any

other matters relating to the Company, the Shares or any other agreements or transactions that may be related thereto or contemplated

thereby. We are expressing no opinion as to any obligations that parties other than the Company may have under or in respect of the Shares

or as to the effect that their performance of such obligations may have upon any of the matters referred to above. No opinion may be

implied or inferred beyond the opinion expressly stated above.

| |

Regards, |

| |

|

| |

/s/

Sheppard, Mullin, Richter & Hampton LLP |

| |

SHEPPARD,

MULLIN, RICHTER & HAMPTON LLP |

Exhibit

10.1

STOCK

PURCHASE AGREEMENT

THIS

STOCK PURCHASE AGREEMENT (this “Agreement”) is entered into as of February 6, 2024 (the “Effective Date”),

between Lineage Cell Therapeutics, Inc., a California corporation (the “Company”), and each purchaser identified on the signature

pages hereto (each, including its successors and assigns, a “Purchaser” and collectively the “Purchasers”).

Article

1

PURCHASE

AND SALE OF SHARES

1.1

Sale of Shares. Each Purchaser hereby irrevocably agrees to purchase from the Company, and the Company agrees to sell to each Purchaser

pursuant to the Registration Statement (as defined below), the number of common shares, no par value (“Shares”), shown beneath

such Purchaser’s signature on the signature page of this Agreement, at the price of $1.04 per Share (the “Purchase

Price”).

Article

2

REPRESENTATIONS

AND WARRANTIES OF THE COMPANY

Except

as set forth in the most current prospectus (the “Prospectus”) included in Registration Statement on Form S-3 (File No. 333-

254167) (the “Registration Statement”) under the Securities Act of 1933, as amended (the “Securities Act”) registering

the offer and sale of the Shares, and in a prospectus supplement filed in accordance with Rule 424(b) under the Securities Act describing

the offer of the Shares pursuant to this Agreement (the “Prospectus Supplement”), including all documents and information

incorporated by reference therein, the Company represents and warrants to each Purchaser that:

2.1

Organization. The Company is a corporation duly organized, validly existing and in good standing under the laws of the state of California.

The Company is duly qualified to do business in the state of California and in each other state in which it is doing business and where

the failure to so qualify could have a material adverse effect on its business, operations, or properties, or could subject the Company

to fines or penalties that are material to the Company’s financial condition.

2.2

Authority; Enforceability. The Company has the power and authority to execute and deliver this Agreement and to perform all of its

obligations hereunder. This Agreement has been duly authorized, executed and delivered by the Company and is the valid and binding agreement

of the Company, enforceable in accordance with its terms subject to: (i) laws of general application relating to bankruptcy, insolvency

and the relief of debtors; and (ii) general principles of equity.

2.3

Valid Issuance of Shares. The Shares that are being purchased by such Purchaser hereunder, when issued, sold and delivered in accordance

with the terms of this Agreement, including payment of the Purchase Price, will be duly and validly issued, fully paid, and nonassessable.

2.4

Capitalization. The Company is authorized to issue the following shares of capital stock: 450,000,000 common shares, no par value,

and 2,000,000 preferred shares, no par value. As of December 31, 2023, there were: no preferred shares issued; 174,986,671 common shares

issued and outstanding; 22,331,332 common shares issuable upon exercise of outstanding equity awards granted under the Company’s

equity incentive plans (collectively, the “Equity Incentive Plans”) or granted outside the Equity Incentive Plans pursuant

to approval by the independent members of the Company’s board of directors in reliance upon the exception for inducement grants

to new employees under the NYSE American Company Guide; 0 common shares of issuable upon exercise of outstanding warrants; and 27,078,144

common shares reserved for issuance under Equity Incentive Plans. Except for equity awards granted under the Equity Incentive Plans,

since December 31, 2023, the Company has not entered into any commitment, arrangement, or agreement obligating the Company to issue,

sell, purchase, redeem, acquire any preferred shares or common shares or other equity securities of the Company.

2.5

Disclosure Documents; Financial Statements. The Company has filed all reports required to be filed by it under the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), including pursuant to Section 13(a) or 15(d) thereof (the foregoing materials

being collectively referred to herein as the “SEC Reports”), during the twelve (12) months prior to the date hereof. None

of the SEC Reports, when filed, contained any untrue statement of a material fact or omitted to state a material fact required to be

stated therein or necessary in order to make the statements therein, in light of the circumstances under which they were made, not misleading.

The financial statements of the Company included in the SEC Reports (i) have been prepared in accordance with United States generally

accepted accounting principles (“GAAP”) applied on a consistent basis during the periods involved, except as may be otherwise

specified in such financial statements or the notes thereto, or, in the case of unaudited statements, as permitted by Form 10-Q, and

except that the unaudited financial statements may not contain footnotes and are subject to normal and recurring year-end adjustments

that will not, individually or in the aggregate, be material in amount; and (ii) fairly present in all material respects the consolidated

financial position of the Company and its subsidiaries on a consolidated basis as of the respective dates thereof and the consolidated

results of operations and cash flows of the Company and its subsidiaries for the periods covered thereby, subject, in the case of unaudited

financial statements, to normal year-end audit adjustments that will not, individually or in the aggregate, be material in amount.

2.6

Absence of Certain Changes. Since September 30, 2023, except as specifically disclosed in SEC Reports, (i) there has not been any

material adverse change in the financial condition, assets, liabilities, revenues, or business of the Company and its subsidiaries, taken

as a whole, (ii) the Company has not incurred any liabilities (contingent or otherwise) other than (A) trade payables, accrued expenses,

licensing fees and similar expenses, and other liabilities incurred in the ordinary course of business consistent with past practice,

(B) liabilities not required to be reflected in the Company’s financial statements pursuant to GAAP or not required to be disclosed

in filings made with the Securities and Exchange Commission (“SEC”), and (C) liabilities arising under this Agreement, and

(iii) the Company has not declared or made any dividend or distribution of cash or other property to its shareholders or purchased, redeemed,

or made any agreements to purchase or redeem any shares of its capital stock.

2.7

Internal Controls. The Company maintains a process of “internal control over financial reporting” (as defined in Rules

13a-15(f) and 15d-15(f) under the Exchange Act) that is designed to provide reasonable assurances: (i) that transactions are recorded

as necessary to permit preparation of financial statements in accordance with GAAP; (ii) that receipts and expenditures are being made

only in accordance with the authorizations of management and directors of the Company; and (iii) regarding prevention or timely detection

of the unauthorized acquisition, use or disposition of the assets of the Company and its subsidiaries that could have a material effect

on the financial statements. The Company maintains a system of “disclosure controls and procedures” (as defined in Rules

13a-15(e) and 15d-15(e) under the Exchange Act) that is designed to provide reasonable assurances that all material information required

to be disclosed by the Company in the reports that it files or submits under the Exchange Act is accumulated and communicated to the

Company’s management, as appropriate, to allow timely decisions regarding required disclosure, and otherwise to ensure that information

required to be disclosed by the Company in the reports that it files or submits under the Exchange Act is recorded, processed, summarized

and reported within the time periods specified in the rules and regulations of the SEC.

2.8

Registration Statement.

(a)

The Company has prepared and filed the Registration Statement in conformity with the requirements of the Securities Act. The Registration

Statement is effective under the Securities Act and no stop order preventing or suspending the effectiveness of the Registration Statement

or suspending or preventing the use of the Prospectus has been issued by the SEC and no proceedings for that purpose have been instituted

or, to the knowledge of the Company, are threatened by the SEC. The Company shall file a final Prospectus Supplement with the SEC pursuant

to Rule 424(b) no later than two (2) business days after the Effective Date. The Registration Statement, and the Prospectus together

with the Prospectus Supplement, do not, and will not, contain an untrue statement of a material fact or omit to state a material fact

necessary in order to make the statements contained therein, in light of the circumstances under which they were made, not misleading.

(b)

When issued pursuant to this Agreement and the Registration Statement, the Shares will be free of restrictions on transfer under the

Securities Act, other than such restrictions as may be applicable under Rule 144 under the Securities Act with respect to sales or transfers

of securities by an affiliate (as defined in Rule 144) of the Company should such Purchaser be or become an affiliate of the Company.

2.9

Listing and Maintenance Requirements. The Company has not, in the 12 months preceding the date hereof, received notice from the NYSE

American to the effect that the Company is not in compliance with the listing or maintenance requirements of the NYSE American.

2.10

Taxes. Since January 1, 2021, the Company has filed when due all federal, state, and local income tax returns, and all other returns

with respect to taxes which are required to be filed with the appropriate authorities of the jurisdictions where business is transacted

by the Company, or where the Company owns any property, and any taxes due, as reflected on such tax returns, have been paid.

2.11

Subsidiaries. The Company’s subsidiaries are shown in its Quarterly Report on Form 10-Q for the three and nine months ended

September 30, 2023.

2.12

No Conflict. The Company is not in violation or default of any provision of its Restated Articles of Incorporation or bylaws, in

each case as amended (together, the “Governing Documents”), and is not in violation or default in any material respect of

any instrument, judgment, order, writ, decree or contract to which it is a party or by which it is bound, or, to its knowledge, of any

provision of any federal or state statute, rule or regulation applicable to it. The execution and delivery of this Agreement and consummation

of the sale of the Shares contemplated by this Agreement (a) do not and will not violate any provisions of (i) any rule, regulation,

statute, or law, (ii) the terms of any order, writ or decree of any court or judicial or regulatory authority or body, (iii) the Governing

Documents, or (iv) the rules and regulations of the NYSE American applicable to the listing of the Company’s common shares, (b)

will not conflict with or result in a breach of any condition or provision or constitute a default under or pursuant to the terms of

any Material Contract (as defined below), and (c) will not result in the creation or imposition of any lien, charge or encumbrance upon

any of the Shares or upon any of the assets or properties of the Company. The term “Material Contract” means any contract,

agreement, license, lease, deed of trust, mortgage, lien, debenture, promissory note, or instrument to which the Company is a party (i)

the termination of or default under which could have a material adverse effect on the business, financial condition, assets or prospects

of the Company, or (ii) that constitutes a lien or security interest on any real or personal property of the Company the loss of which

through a foreclosure sale would have a material adverse effect on the business, financial condition, assets or prospects of the Company.

2.13

Litigation. Other than as disclosed in the SEC Reports, there is no lawsuit, arbitration proceeding, or administrative action or

proceeding pending or, to the Company’s knowledge, threatened against the Company which (a) questions the validity of this Agreement

or any action taken or to be taken by the Company in connection with this Agreement or the issue and sale of the Shares hereunder, (b)

alleges any infringement of any trademark, service mark, or patent by the Company, or (c) if adversely decided would have a material

adverse effect upon the business, financial condition, assets or prospects of the Company.

2.14

Patents and Trademarks. The Company is the sole and exclusive owner of or has a valid license to use all patents, trademarks, service

marks, trade names, copyrights, trade secrets, information, proprietary rights and processes presently used by the Company in its business

as now conducted, without any conflict with or, to the Company’s knowledge, infringement of the rights of others, except as disclosed

in the SEC Reports. The Company has not received any communications alleging that it has violated or, by conducting its business as presently

conducted, violates any of the patents, trademarks, service marks, trade names, copyrights or trade secrets or other proprietary rights

of any other person or entity.

2.15

Title to Property. The Company has good and marketable title to its property and assets free and clear of all mortgages, liens, loans

and encumbrances. Title to all of the personal and real property used by the Company is held in the name of the Company or a subsidiary

or is licensed or leased from a third party. With respect to the property leased or licensed from a third party, the Company is in compliance

with such leases and licenses in all material respects and, to Company’s knowledge, the Company holds a valid leasehold or license.

All facilities, machinery, equipment, fixtures, vehicles and other properties owned, leased or used by the Company are in good operating

condition and repair (subject to ordinary wear and tear) and are reasonably fit and usable for the purposes for which they are being

used.

2.16

Regulatory Permits. The Company possesses all certificates, authorizations and permits issued by the appropriate federal, state,

local or foreign regulatory authorities necessary to conduct its businesses as described in the SEC Reports (“Permits”),

except where the failure to possess such Permits would not result in a material adverse effect upon the business, financial condition,

assets or prospects of the Company, and the Company has not received any notice of proceedings relating to the revocation or modification

of any Permit, the revocation or proposed modification of which would result in a material adverse effect upon the business, financial

condition, assets or prospects of the Company.

2.17

Employee Benefit Plans. Other than the Equity Incentive Plans and similar equity incentive plans previously maintained by the Company

and/or maintained or previously maintained by Company subsidiaries, the Company does not have and has never maintained or sponsored any

Employee Benefit Plan as defined in the Employee Retirement Income Security Act of 1974, as amended.

2.18

Labor Agreements and Actions; Employee Compensation. The Company is not bound by or subject to (and none of its assets or properties

is bound by or subject to) any written or oral contract, commitment or arrangement with any labor union, and no labor union has requested

or, to the Company’s knowledge, has sought to represent any of the employees, representatives or agents of the Company. There is

no strike or other labor dispute involving the Company pending, nor to the Company’s knowledge, threatened, that could have a material

adverse effect on the assets, properties, financial condition, operating results or business of the Company, nor is the Company aware

of any labor organization activity involving its employees. The Company is not aware that any officer or key employee, or that any group

of key employees, intends to terminate their employment the Company, nor does the Company have a present intention to terminate the employment

of any of the foregoing. The employment of each officer and employee of the Company is terminable at the will of the Company. To its

knowledge, the Company has complied in all material respects with all applicable state and federal equal employment opportunity and other

laws related to employment.

Article

3

REPRESENTATIONS

AND WARRANTIES OF PURCHASERS

Each

Purchaser, severally and not jointly and severally, hereby represents and warrants with respect to only itself to the Company the following:

3.1

Organization. Such Purchaser, if not a natural person, is a corporation, limited liability company, partnership, trust or other entity

duly organized, validly existing and in good standing under the laws of the state or other jurisdiction in which it is incorporated or

otherwise organized.

3.2

Authority; Enforceability. Such Purchaser has the power and authority to execute and deliver this Agreement and to perform all of

its obligations under this Agreement. This Agreement has been duly authorized and executed by such Purchaser and is the valid and binding

agreement of such Purchaser enforceable in accordance with its terms, except (i) to the extent limited by any bankruptcy, insolvency,

or similar law affecting the rights of creditors generally, and (ii) as limited by laws relating to the availability of specific performance,

injunctive relief or other equitable remedies.

3.3

No Conflict. The execution and delivery of this Agreement, and consummation of the transactions contemplated hereunder, including

the purchase of the Shares, by such Purchaser do not and will not violate any provisions of (i) any rule, regulation, statute, or law

applicable to such Purchaser or (ii) the terms of any order, writ, or decree of any court or judicial or regulatory authority or body

by which such Purchaser is bound, or (iii) the articles of incorporation, bylaws, or similar charter or governing documents of such Purchaser.

3.4

Understandings or Arrangements. Such Purchaser is acquiring the Shares as principal for its own account and has no direct or indirect

arrangement or understandings with any other persons to distribute or regarding the distribution of such Shares (this representation

and warranty not limiting such Purchaser’s right to sell the Shares in compliance with applicable federal and state securities

laws). Such Purchaser is acquiring the Shares hereunder in the ordinary course of its business.

3.5

Access to Information. Such Purchaser acknowledges that it has had the opportunity to review this Agreement and the SEC Reports and

has been afforded, (i) the opportunity to ask such questions as it has deemed necessary of, and to receive answers from, representatives

of the Company concerning the terms and conditions of the offering of the Shares and the merits and risks of investing in the Shares;

(ii) access to information about the Company and its financial condition, results of operations, business, properties, management and

prospects sufficient to enable it to evaluate its investment; and (iii) the opportunity to obtain such additional information that the

Company possesses or can acquire without unreasonable effort or expense that is necessary to make an informed investment decision with

respect to the investment in the Shares.

3.6

Certain Transactions and Confidentiality. Other than consummating the transactions contemplated hereunder, such Purchaser has not,

nor has any person acting on behalf of or pursuant to any understanding with such Purchaser, directly or indirectly executed any purchases

or sales, including short sales, of the securities of the Company during the period commencing as of the time that such Purchaser first

received a term sheet (written or oral) from the Company or any other person representing the Company setting forth the material pricing

terms of the transactions contemplated hereunder and ending immediately prior to the execution hereof. Notwithstanding the foregoing,

in the case of a Purchaser that is a multi-managed investment vehicle whereby separate portfolio managers manage separate portions of

such Purchaser’s assets and the portfolio managers have no direct knowledge of the investment decisions made by the portfolio managers

managing other portions of such Purchaser’s assets, the representation set forth above shall only apply with respect to the portion

of assets managed by the portfolio manager that made the investment decision to purchase the Shares covered by this Agreement. Other

than to other parties to this Agreement or to such Purchaser’s representatives, including, without limitation, its officers, directors,

partners, legal and other advisors, employees, agents and affiliates, such Purchaser has maintained the confidentiality of all disclosures

made to it in connection with this transaction (including the existence and terms of this transaction).

3.7

Place of Business or Residence. Such Purchaser principal place of business or residence is as set forth on the signature page of

this Agreement.

Article

4

CLOSING

4.1

Time and Place of Closing. The consummation of the purchase and sale of the Shares (the “Closing”) shall take place on

the second Trading Day after the execution and delivery of this Agreement by Purchasers and the Company or on such other date as the

Purchasers and the Company may agree (such date, the “Closing Date”). On the Closing Date, each Purchaser shall pay in full

the Purchase Price for the Shares purchased by wire transfer of the Purchase Price for the Shares being purchased by such Purchaser,

in immediately available funds, to an account designated by the Company. The Purchase Price shall be paid in United States Dollars. On

the Closing Date, the Company shall issue to each Purchaser the Shares purchased, against payment of the Purchase Price. The Closing

shall take place remotely by electronic transfer of the documents required to be delivered at or before the Closing. A “Trading

Day” means a day on which the NYSE American is open for trading.

4.2

Documents to be Delivered By the Company. The Company shall deliver the following documents to each Purchaser at the Closing:

(a)

Prospectus. A copy of the Prospectus and Prospectus Supplement, each of which may be delivered in accordance with Rule 172 under

the Securities Act;

(b)

Shares. A copy of the irrevocable instructions to the transfer agent of the Company’s common shares instructing such transfer

agent to deliver the Shares purchased by such Purchaser, registered in the name of such Purchaser, on an expedited basis via The Depository

Trust Company Deposit or Withdrawal at Custodian system (“DWAC”).

4.3

Conditions of the Company’s Obligation to Close. The obligation of the Company to sell the Shares to each Purchaser on the

Closing Date is conditioned upon the following:

(a)

Payment and Delivery. The Company’s receipt of the Purchase Price for the Shares being sold to such Purchaser;

(b)

Representations and Warranties. The representations and warranties made by such Purchaser in Article 3 of this Agreement

shall be true and correct in all material respects when made and on the Closing Date; provided, that any representation and warranty

that is itself qualified by a materiality standard shall be true and correct in all respects; and

(c)

Performance of Covenants. Such Purchaser shall have fully performed all covenants and agreements required to be performed by such

Purchaser on or before the Closing Date.

4.4

Conditions of Each Purchaser’s Obligation to Close. The obligation of each Purchaser to purchase the Shares from the Company

on any Closing Date is conditioned upon the following:

(a)

Delivery. Such Purchaser’s receipt of the items required to be delivered by the Company under Section 4.2.

(b)

Representations and Warranties. The representations and warranties made by the Company in Article 2 of this Agreement shall

be true and correct in all material respects when made and on the Closing Date, unless made as of a specific date in which case they

shall be accurate as of such date, and such Purchaser shall have received from the Company a certificate, dated as of the Closing Date,

to such effect signed by the Chief Executive Officer of the Company; provided, that any representation and warranty that is itself qualified

by a materiality standard shall be true and correct in all respects.

(c)

Performance. The Company shall have performed and complied with all agreements, obligations and conditions contained in this Agreement

that are required to be performed or complied with by it on or before the Closing Date.

(d)

Bankruptcy; Insolvency. The Company shall not be subject to (i) any order for relief, or subject to any pending proceeding for

reorganization or liquidation, under the United States Bankruptcy Code, as amended, or under any other law pertaining to insolvency of

the Company or creditor’s rights generally, (ii) any appointment of a receiver for the Company or any of its assets, or (iii) any

plan or action of dissolution or liquidation of the Company or its business.

(e)

No Material Adverse Event. No material adverse event shall have occurred since the date hereof.

(f)

Listing. The common shares of the Company shall be designated for quotation or listed on the NYSE American, and the NYSE American

shall not have suspended the listing or trading of the Company’s common shares, nor shall suspension by the SEC or the NYSE American

have been threatened, as of the Closing Date, either (A) in writing by the SEC or the NYSE American, or (B) by falling below the minimum

listing maintenance requirements of the NYSE American.

Article

5

ADDITIONAL COVENANTS

5.1

Further Assurances. Each party will execute, acknowledge, and deliver such additional certificates and documents and will take such

additional actions as the other party may reasonably request on or after a Closing Date to effect, complete or perfect the issue and

sale of the Shares to the Purchasers.

5.2

Purchasers’ Market Activity. Each Purchaser agrees that such Purchaser shall not, prior to the public announcement by the Company

that it has entered into this Agreement, engage in any stabilization activity in connection with the Company’s common shares, or

otherwise bid for or engage in any purchase or sale, including any short sale (as defined in SEC Rule SHO) of the Company’s common

shares, directly or through or in arrangement with and any entity in control of, controlled by, or under common control with such Purchaser.

Each Purchaser covenants and agrees that until such time as the transactions contemplated by this Agreement are publicly disclosed by

the Company, such Purchaser will maintain the confidentiality of the existence and terms of this Agreement.

5.3

Public Disclosure by the Company. On or after the first Trading Day following the execution of this Agreement, the Company shall

issue a press release and file a Current Report on Form 8-K describing the terms of the transactions contemplated by this Agreement,

in the form required by the Exchange Act.

5.4

Publicity. No Purchaser shall issue any press release or make any similar public statement or communication disclosing the terms

of this Agreement or the transactions hereunder without the prior written consent of the Company, provided that the Company’s consent

shall not unreasonably be withheld or delayed if such disclosure is required by law and such Purchaser shall have provided the Company

with a copy of the proposed press release or other public statement or communication a reasonable time prior to the public release or

dissemination thereof.

Article

6

MISCELLANEOUS

6.1

Governing Law. This Agreement shall be construed and governed in all respects by the internal laws of the State of California without

giving effect to any choice of law rule that would cause the application of the laws of any jurisdiction other than the internal laws

of the State of California to the rights and duties of the parties. All disputes and controversies arising out of or in connection with

this Agreement shall be resolved non-exclusively by the state and federal courts located in the State of New York and the State of California,

and each party agrees to submit to the jurisdiction of said courts.

6.2

Successors and Assigns. The parties may not assign their rights or obligations under this Agreement, directly or by operation of

law, without the consent of the other party. The provisions of this Agreement shall inure to the benefit of, and be binding upon, the

respective successors, assigns, heirs, executors and administrators of each Purchaser and the Company.

6.3

Entire Agreement; Amendment. This Agreement constitutes the full and entire understanding and agreement among the parties with regard

to the subject matter of this Agreement. This Agreement and any term of this Agreement may be amended, waived, discharged or terminated

only by a written instrument signed by the parties.

6.4

Notices, etc. All notices and other communications required or permitted to be given pursuant to this Agreement shall be in writing

and shall be deemed given (a) three days after being deposited in the United States mail, certified postage prepaid, return receipt requested,

or (b) when delivered by hand, by messenger or next Business Day air freight service, or (c) if sent by email, on the date sent, if sent

at or prior to 5:30 p.m. (New York City time) on a Business Day, or on the next Business Day, if sent on a day that is not a Business

Day or later than 5:30 p.m. (New York City time) on a Business Day, in any case addressed as follows:

| To

any Purchaser: |

At

the address or email address of such Purchaser shown on the signature page of this Agreement |

| |

|

| To

the Company: |

Lineage

Cell Therapeutics, Inc.

2173 Salk Avenue, Suite 200

Carlsbad, CA 92008

Attention: Chief Executive Officer

Email: bculley@lineagecell.com |

Any

party may change its address for the purpose of this Agreement by giving notice to each other party in accordance with this Section.

For purposes of this Agreement, a “Business Day” shall be any day on which the banks in New York are not required or permitted

to close.

6.5

Expenses. Each Purchaser and the Company shall bear their own expenses, including fees and expenses of their own advisers, counsel,

accountants and other experts, if any, and all other expenses incurred by the party incident to the negotiation, preparation, execution,

delivery and performance of this Agreement. The Company shall pay all stamp taxes and other taxes and duties levied in connection with

the delivery of the Shares to each Purchaser.

6.6

Brokers. No Purchaser shall have any liability to any broker, finder, investment banker, or other advisor retained or engaged by

the Company or any subsidiary of the Company in connection with the transactions contemplated by this Agreement.

6.7

Titles and Subtitles. The titles or headings of the Articles and Sections of this Agreement are for convenience of reference only

and are not to be considered in construing this Agreement.

6.8

Severability. If one or more provisions of this Agreement are held to be unenforceable under applicable law, each such unenforceable

provision shall be excluded from this Agreement and the balance of this Agreement shall be interpreted as if each such unenforceable

provision were so excluded, and the balance of this Agreement as so interpreted shall be enforceable in accordance with its terms.

6.9

Counterparts. This Agreement may be executed in any number of counterparts, each of which shall be an original, but all of which

together shall constitute one instrument. This Agreement may be executed with electronic signatures (e.g., DocuSign) or with signatures

transmitted by email delivery of a pdf format data file, and no party shall deny the validity of a signature or this Agreement signed

and so transmitted on the basis that a signed document is not an original.

6.10

Termination. This Agreement may be terminated by any Purchaser with respect to itself, by written notice to the Company, or by the

Company with respect to all Purchasers, by written notice to all Purchasers, in either case if the Closing has not been consummated on

or before the fifth Business Day after the Effective Date other than due to a breach of this Agreement or any covenant or agreement hereunder

by the party seeking to so terminate this Agreement. Termination of this Agreement will not affect the right of any party not in breach

of its covenants and agreements under this Agreement to sue for any breach of this Agreement by the other party.

[Signature

pages follow.]

IN

WITNESS WHEREOF, the undersigned parties have executed this Agreement as of the date first above written.

| LINEAGE

CELL THERAPEUTICS, INC. |

|

| |

|

|

| By |

|

|

| Name:

|

Brian

M. Culley |

|

| Title:

|

Chief

Executive Officer |

|

[REMAINDER

OF PAGE INTENTIONALLY LEFT BLANK.

SIGNATURE

PAGE FOR PURCHASERS FOLLOWS]

IN

WITNESS WHEREOF, the undersigned parties have executed this Agreement as of the date first above written.

| Name

of Purchaser: |

|

|

| Signature

of Authorized Signatory of Purchaser: |

|

|

| Name

of Authorized Signatory: |

|

|

| Title

of Authorized Signatory: |

|

|

| Email

Address of Purchaser: |

|

|

| Address

of Purchaser’s Principal Place of Business or Residence: |

|

|

| |

|

|

| |

|

|

| Address

for Notice to Purchaser (if different from address of principal place of business or residence): |

|

|

| |

|

|

| |

|

|

| Aggregate

Purchase Price: |

|

$ |

| Number

of Shares: |

|

|

| EIN

Number: |

|

|

[SIGNATURE

PAGES CONTINUE]

Exhibit

99.1

LINEAGE

CELL THERAPEUTICS ANNOUNCES $14.0 MILLION REGISTERED DIRECT OFFERING

CARLSBAD,

CA – February 6, 2024 - Lineage Cell Therapeutics, Inc. (NYSE American and TASE: LCTX), a clinical-stage biotechnology

company developing allogeneic cell therapies for unmet medical needs, today announced that it entered into a definitive agreement with

certain investors for the purchase and sale of 13,461,540 of the company’s common shares in a registered direct offering

at an offering price of $1.04 per common share. The price per share was the closing price of the company’s common shares

on NYSE American on February 5, 2024. The parties entered into the definitive agreement before markets opened on February 6,

2024. The closing of the offering is expected to occur on or about February 8, 2024, subject to the satisfaction of customary

closing conditions. Broadwood Partners, L.P., which is affiliated with Neal Bradsher, a member of the Company’s board of

directors, agreed to purchase 6,730,770 common shares in the offering, and Don M. Bailey, a member of the Company’s board of

directors, agreed to purchase approximately 100,000 common shares in the offering.

The

aggregate gross proceeds to Lineage from the offering at the closing are expected to be $14.0 million before deducting estimated

offering expenses payable by Lineage. Lineage intends to use the proceeds from the offering for general corporate purposes, which may

include clinical trials, research and development activities, general and administrative costs, and to meet working capital needs.

The

securities described above are being offered and sold by Lineage pursuant to a “shelf” registration statement on Form S-3

(File No. 333-254167), including a base prospectus, previously filed with the Securities and Exchange Commission, or the SEC, on March

11, 2021, and declared effective by the SEC on March 19, 2021. Such securities may be offered only by means of a prospectus, including

a prospectus supplement, forming a part of the effective registration statement. A final prospectus supplement and an accompanying base

prospectus relating to the securities will be filed with the SEC. Electronic copies of the prospectus supplement and the accompanying

base prospectus may be obtained, when available, by visiting the SEC’s website at http://www.sec.gov.

This

press release does not constitute an offer to sell or the solicitation of an offer to buy any of the securities described herein, nor

shall there be any sale of these securities in any state or other jurisdiction in which such an offer, solicitation or sale would be

unlawful prior to registration or qualification under the securities laws of any such state or other jurisdiction.

About

Lineage Cell Therapeutics, Inc.

Lineage

Cell Therapeutics is a clinical-stage biotechnology company developing novel cell therapies for unmet medical needs. Lineage’s

programs are based on its robust proprietary cell-based therapy platform and associated in-house development and manufacturing capabilities.

With this platform Lineage develops and manufactures specialized, terminally differentiated human cells from its pluripotent and progenitor

cell starting materials. These differentiated cells are developed to either replace or support cells that are dysfunctional or absent

due to degenerative disease or traumatic injury or administered as a means of helping the body mount an effective immune response to

cancer. Lineage’s clinical and preclinical programs are in markets with billion dollar opportunities and include five allogeneic

(“off-the-shelf”) product candidates: (i) OpRegen, a retinal pigment epithelial cell therapy in Phase 2a development for

the treatment of geographic atrophy secondary to age-related macular degeneration, is being developed under a worldwide collaboration

with Roche and Genentech, a member of the Roche Group; (ii) OPC1, an oligodendrocyte progenitor cell therapy in Phase 1/2a development

for the treatment of acute spinal cord injuries; (iii) VAC2, a dendritic cell therapy produced from Lineage’s VAC technology platform

for immuno-oncology and infectious disease, currently in Phase 1 clinical development for the treatment of non-small cell lung cancer;

(iv) ANP1, an auditory neuronal progenitor cell therapy for the potential treatment of auditory neuropathy; and (v) PNC1, a photoreceptor

neural cell therapy for the potential treatment of vision loss due to photoreceptor dysfunction or damage. For more information, please

visit www.lineagecell.com or follow the company on Twitter @LineageCell.

Forward-Looking

Statements

Lineage

cautions you that all statements, other than statements of historical facts, contained in this press release, are forward-looking statements.

Forward-looking statements, in some cases, can be identified by terms such as “believe,” “may,” “will,”

“estimate,” “continue,” “anticipate,” “design,” “intend,” “expect,”

“could,” “plan,” “potential,” “predict,” “seek,” “should,” “would,”

“contemplate,” “project,” “target,” “objective,” or the negative version of these words

and similar expressions. In this press release, forward-looking statements include, but are not limited to, statements relating to the

offering, the completion of the offering and the expected use of proceeds from the offering. Forward-looking statements involve known

and unknown risks, uncertainties and other factors that may cause Lineage’s actual results, performance or achievements to be materially

different from future results, performance or achievements expressed or implied by the forward-looking statements in this press release,

including, without limitation, risk and uncertainties related to: the satisfaction of the closing conditions related to

the offering, whether Lineage will complete the offering on the anticipated terms, or at all, and those risks and uncertainties

inherent in Lineage’s business and other risks discussed in Lineage’s filings with the SEC. Lineage’s forward-looking

statements are based upon its current expectations and involve assumptions that may never materialize or may prove to be incorrect. All

forward-looking statements are expressly qualified in their entirety by these cautionary statements. Further information regarding these

and other risks is included under the heading “Risk Factors” in Lineage’s periodic reports with the SEC, including

Lineage’s most recent Annual Report on Form 10-K filed with the SEC and its other reports, which are available from the SEC’s

website. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they were

made. Lineage undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date

on which they were made, except as required by law.

Lineage

Cell Therapeutics, Inc. IR

Ioana

C. Hone

(ir@lineagecell.com)

(442)

287-8963

LifeSci

Advisors

Daniel

Ferry

(daniel@lifesciadvisors.com)

(617)

430-7576

Russo

Partners – Media Relations

Nic

Johnson or David Schull

(Nic.johnson@russopartnersllc.com)

(David.schull@russopartnersllc.com)

(212)

845-4242

###

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

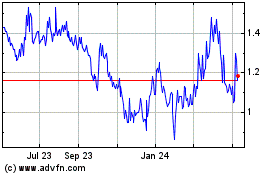

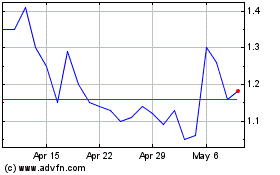

Lineage Cell Therapeutics (AMEX:LCTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lineage Cell Therapeutics (AMEX:LCTX)

Historical Stock Chart

From Apr 2023 to Apr 2024