UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________

FORM 6-K

_______________________________________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

_______________________________________________

For the month of February 2024

Commission File Number: 001-37669

_______________________________________________

Nomad Foods Limited

(Translation of registrant’s name in English)

_______________________________________________

No. 1 New Square

Bedfont Lakes Business Park

Feltham, Middlesex TW14 8HA

+ (44) 208 918 3200

(Address of Principal Executive Offices)

_______________________________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Repricing of Senior Secured Term Loan

On February 2, 2024, Nomad Foods Limited (the “Company”) entered into an Amendment Agreement by and among the Company, and Citibank Europe Plc, UK Branch as security agent and agent on behalf of certain other finance parties thereto (the “Amendment Agreement”) relating to that certain Senior Facilities Agreement originally dated July 3, 2014 (as amended and restated from time to time, including pursuant to amendment and restatement agreements dated May 3, 2017, June 22, 2021, November 8, 2022 and September 15, 2023, the “Senior Facilities Agreement”). Pursuant to the Amendment Agreement, as of the closing of the repricing, which occurred on February 2, 2024, the Senior Facilities Agreement has been amended (as amended the “Amended Senior Facilities Agreement”) to reduce the margin on the Company’s existing EUR denominated Term Loan B of EUR 130 million principal due 2029 (the “Term Loan”) by 75 basis points. The description of the Amended Senior Facilities Agreement contained herein is not intended to be complete and is qualified in its entirety by reference to the full text of the Amended Senior Facilities Agreement, which is attached hereto as Exhibit 99.1.

On February 5, 2024, the Company issued a press release announcing the repricing of the Term Loan. A copy of the press release is furnished as Exhibit 99.2 to this Report on Form 6-K. This Report on Form 6-K (other than Exhibit 99.2) is hereby incorporated by reference into the registration statements on (i) Form S-8 filed with the Securities and Exchange Commission (the “Commission”) on May 3, 2016 (File No. 333-211095), (ii) Form F-3, initially filed with the Commission on March 30, 2017 and declared effective on May 2, 2017 (File No. 333-217044) and (iii) Form F-3ASR filed with the Commission on March 1, 2023, which was automatically effective upon filing with the Commission (File No. 333-270190).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| | |

| NOMAD FOODS LIMITED |

| |

| By: | | /s/ Samy Zekhout |

| Name: | | Samy Zekhout |

| Title: | | Chief Financial Officer |

Dated: February 5, 2024

Exhibit Index

| | | | | | | | |

Exhibit

Number | | Exhibit Title |

| |

| | Amendment Agreement by and among the Company and Citibank Europe Plc, UK Branch as agent on behalf of certain other finance parties thereto relating to that certain Senior Facilities Agreement originally dated July 3, 2014 (as amended and restated from time to time, including pursuant to amendment and restatement agreements dated May 3, 2017, June 22, 2021, November 8, 2022 and September 15, 2023) |

| | Press Release issued by Nomad Foods Limited on February 5, 2024 relating to the repricing of its existing USD term loan. |

The taking of (a) any of the Finance Documents (including this document) or (b) any certified copy thereof or (c) any document which constitutes substitute documentation thereof including written confirmations or references (the "Stamp Duty Sensitive Documents") into Austria may cause the imposition of Austrian stamp duty. The same, inter alia, applies to (i) the sending of Stamp Duty Sensitive Documents to an Austrian addressee by fax, (ii) the sending of any e-mail communication to which an electronic scan copy (e.g., pdf or tif) of a Stamp Duty Sensitive Document is attached to an Austrian addressee and (iii) the sending of any e-mail communication carrying an electronic or digital signature which refers to a Stamp Duty Sensitive Document to an Austrian addressee. Accordingly, in particular, keep any Stamp Duty Sensitive Documents outside of Austria and avoid (A) sending Stamp Duty Sensitive Documents by fax to an Austrian addressee, (B) sending any e-mail communication to which an electronic scan copy of a Stamp Duty Sensitive Document is attached to an Austrian addressee and (C) sending any e-mail communication carrying an electronic or digital signature which refers to a Stamp Duty Sensitive Document to an Austrian addressee. EXECUTION VERSION Amendment agreement Dated _________________2024 for NOMAD FOODS LIMITED as Listco with CITIBANK EUROPE PLC, UK BRANCH acting as Agent RELATING TO A SENIOR FACILITIES AGREEMENT ORIGINALLY DATED 3 JULY 2014 AS AMENDED AND/OR AMENDED AND RESTATED FROM TIME TO TIME Ref: L-296544 2 February

A53735636 CONTENTS CLAUSE PAGE 1. Definitions and interpretation .................................................................................................... 2 2. Background ............................................................................................................................... 3 3. Conditions precedent ................................................................................................................ 3 4. Conditions subsequent ............................................................................................................. 3 5. Amendment .............................................................................................................................. 3 6. Confirmation ............................................................................................................................. 4 7. Agent's books and records ....................................................................................................... 5 8. Further assurance ..................................................................................................................... 5 9. Indemnity .................................................................................................................................. 5 10. Representations ........................................................................................................................ 5 11. Termination ............................................................................................................................... 6 12. Appointment as Obligors' Agent ............................................................................................... 6 13. Miscellaneous ........................................................................................................................... 6 14. Governing law ........................................................................................................................... 6 THE SCHEDULES SCHEDULE PAGE SCHEDULE 1 Conditions Precedent ........................................................................................................ 7 SCHEDULE 2 Conditions Subsequent ..................................................................................................... 8

A53735636 THIS AGREEMENT is entered into on ____________2024 between: (1) NOMAD FOODS LIMITED, a public listed company incorporated in the British Virgin Islands with registered number 1818482, for itself and as Obligors' Agent under (and as defined in) the Original Facilities Agreement (as the context requires) ("Listco"); and (2) CITIBANK EUROPE PLC, UK BRANCH as agent of the other Finance Parties under (and as defined in) the Original Facilities Agreement (the "Agent"). IT IS AGREED as follows: 1. Definitions and interpretation 1.1 Definitions In this Agreement: "2024 Consent Letter" means the consent request letter dated ____________ 2024 provided by Listco to the Agent. "Amended Facilities Agreement" means the Original Facilities Agreement, as amended by this Agreement. "Effective Date" means the date of the notification by the Agent under paragraph 3.3 of Clause 3 (Conditions precedent). "Intercreditor Agreement" means the intercreditor agreement originally dated 3 July 2014, as amended and/or amended and restated from time to time, between, among others, Listco, Nomad Foods Europe Midco Limited, the Agent and Kroll Trustee Services Limited as the security agent. “Lenders” has the meaning given to it in the Original Facilities Agreement. "Long Stop Date" means 9 February 2024. "Original Facilities Agreement" means the senior facilities agreement originally dated 3 July 2014 as amended and/or amended and restated from time to time up to, but excluding, the Effective Date between, among others, Listco, the financial institutions named in it as the Original Lenders, the Agent and Kroll Trustee Services Limited as the security agent. "Party" means a party to this Agreement. 1.2 Incorporation of defined terms and interpretation (a) Unless a contrary indication appears, a term defined in the Amended Facilities Agreement has the same meaning in this Agreement (notwithstanding that the Effective Date may not have occurred). (b) The principles of construction set out in the Amended Facilities Agreement shall have effect as if set out in this Agreement mutatis mutandis (notwithstanding that the Effective Date may not have occurred). 1.3 Clauses In this Agreement any reference to a "Clause" or a "Schedule" is, unless the context otherwise requires, a reference to a Clause in or a Schedule to this Agreement. 2 February 1 February

A53735636 3 1.4 Third party rights (a) Unless otherwise provided in this Agreement, a person who is not a party to this Agreement has no right under the Contracts (Rights of Third Parties) Act 1999 to enforce or to enjoy the benefit of any term of this Agreement. (b) Each of the Secured Parties (as defined in the Intercreditor Agreement) may enforce and enjoy the benefit of any provision of this Agreement expressed to be in their favour or for their benefit (or, as the case may be, being a confirmation given in their favour or for their benefit), subject always to the terms of Clause 13 (Miscellaneous) and Clause 14 (Governing law) below. 1.5 Designation (a) In accordance with the Original Facilities Agreement, Listco and the Agent designate this Agreement as a Finance Document (each as defined in the Original Facilities Agreement). (b) Paragraph (a) above shall be without prejudice to the operation of the Amended Facilities Agreement, pursuant to which, this Agreement shall become, on the Effective Date, a Finance Document. 2. Background Pursuant to the 2024 Consent Letter, each of the Facility B3 Lenders has irrevocably authorised the Agent to enter into this Agreement. 3. Conditions precedent 3.1 The Effective Date shall only occur if the requirements of paragraphs 3.2 and 3.3 below have then been satisfied. 3.2 Listco shall deliver, or shall procure are delivered, to the Agent the conditions precedent documents listed in Schedule 1 (Conditions Precedent) in form and substance satisfactory to the Agent (acting reasonably). 3.3 The Agent shall promptly notify Listco and the Lenders upon the date that it has received all of the documents and other evidence listed in Schedule 1 (Conditions Precedent). 3.4 The Agent shall not be liable for any damages, costs or losses whatsoever as a result of giving any such notification or for any damages, costs or losses whatsoever in connection with this Agreement (unless directly caused by its gross negligence or wilful misconduct). 4. Conditions subsequent Listco shall provide or procure the provision of all the documents and other evidence set out in Schedule 2 (Conditions Subsequent) each in form and substance satisfactory to the Agent (acting reasonably) within five Business Days of the date of this Agreement. 5. Amendment 5.1 In accordance with paragraphs (h) and (i) of clause 41.2 (Exceptions) of the Original Facilities Agreement, on and with effect from the Effective Date, the Original Facilities Agreement shall be

A53735636 4 amended such that paragraph (c) of the definition of “Margin” in clause 1.1 (Definitions) of the Original Facilities Agreement shall be deleted and replaced with the following: “in relation to any Facility B3 Loan, 2.75 per cent. per annum;”. 6. Confirmation 6.1 On and from the Effective Date, the provisions of the Original Facilities Agreement, the Intercreditor Agreement and the other Finance Documents (as defined in the Original Facilities Agreement) (including, without limitation, the guarantee and indemnity of each Obligor) shall, save as amended by this Agreement, continue in full force and effect. 6.2 Immediately prior to the Effective Date: (a) Listco, for itself and for and on behalf of each Obligor, acknowledges and confirms its acceptance of this Agreement and (on and from the Effective Date) the Amended Facilities Agreement and agrees that it and each such Obligor (as defined in the Original Facilities Agreement) is bound, with effect from the Effective Date, as an Obligor by the terms of the Amended Facilities Agreement, and confirms, for the benefit of the Finance Parties, that the guarantees and indemnities set out in clause 23 (Guarantee and indemnity) of the Amended Facilities Agreement shall apply, on and from the Effective Date, in respect of all of the obligations of each Obligor under the Finance Documents and extend to all new obligations of any such Obligor under any such Finance Document (including any arising from this Agreement and/or the amendment (and any other transactions consequent thereon) referred to in Clause 5 (Amendment)); and (b) Listco, for itself and for and on behalf of each Obligor, acknowledges and confirms its acceptance of this Agreement and (on and from the Effective Date) the Intercreditor Agreement and agrees that it and each such Debtor (as defined in the Intercreditor Agreement) is bound, with effect from the Effective Date, as a Debtor by the terms of the Intercreditor Agreement, and confirms, for the benefit of the Secured Parties, that the guarantees and indemnities set out in clause 28 (Guarantee and indemnity) of the Intercreditor Agreement shall apply, on and from the Effective Date, in respect of all of the obligations of each Debtor under the relevant Debt Documents and extend to all new obligations of any such Debtor under any such Debt Document (including any arising from this Agreement and/or the amendment (and any other transactions consequent thereon) referred to in Clause 5 (Amendment)). 6.3 Listco hereby confirms that each Obligor has irrevocably authorised it (and, to the extent legally possible, has relieved it from the restrictions pursuant to section 181 of the German Civil Code (Bürgerliches Gesetzbuch) and/or any similar restrictions applicable pursuant to any other applicable law) to sign on its behalf this Agreement and all other documents required to implement the transactions, confirmations, accessions, redesignations, utilisations (or other borrowings) and/or amendments effected or to be effected pursuant to this Agreement (including, without limitation, the amendment pursuant to Clause 5 (Amendment)). 6.4 For the avoidance of any doubt, no waiver is given by entering into this Agreement or the transactions contemplated by this Agreement.

A53735636 5 7. Agent's books and records Upon the occurrence of the Effective Date, the Agent shall (in each case) update the register of Lenders (as defined in the Original Facilities Agreement) to reflect (to the extent applicable) each transaction contemplated in this Agreement and/or the amendment (and any other transactions consequent thereon) referred to in Clause 5 (Amendment). 8. Further assurance Listco shall ensure that each member of the Group shall, at the request of the Agent (acting reasonably) and at Listco's own expense, do all such acts and things which are necessary or desirable to give effect to the transactions, confirmations, accessions, redesignations, utilisations (or other borrowings) and/or amendments effected or to be effected pursuant to this Agreement (including, without limitation, the amendment pursuant to Clause 5 (Amendment)). 9. Indemnity Listco shall promptly indemnify each Party and each Finance Party for any costs, expense, loss or liability incurred in connection with this Agreement and each other agreement referred to in this Agreement and/or as a result of any payments to be made by (or on behalf of or at the direction of) Listco or any other member of the Group pursuant to this Agreement or any other agreement referred to in this Agreement on or prior to the Effective Date (including as a result of any such payment not being made in whole or in part by the relevant member of the Group on the relevant due date for payment). 10. Representations Listco, on behalf of itself and each Obligor, makes each of the Repeating Representations contained in the Amended Facilities Agreement (by reference to the facts and circumstances then existing) on: (a) the date of this Agreement; and (b) the Effective Date, but as if: (i) references to "this Agreement", "Transaction Document", "Transaction Documents" and "Finance Document" in those representations and warranties (or any similar terms) were instead, on the date of this Agreement, references to this Agreement and to the Original Facilities Agreement and, on the Effective Date, to this Agreement and to the Amended Facilities Agreement; (ii) references to the "Closing Date" in those representations and warranties were instead, on the date of this Agreement, to the date of this Agreement and, on the Effective Date, to the Effective Date; and (iii) in the case of paragraph (a) above, the Effective Date had occurred on the date of this Agreement.

A53735636 6 11. Termination Unless otherwise agreed in writing between Listco and the Agent, if the Effective Date has not occurred on or prior to the Long Stop Date, this Agreement shall terminate and shall be of no further force or effect and the provisions of the Original Facilities Agreement and the other Finance Documents (including the guarantee and indemnity of each Guarantor (as defined in the Original Facilities Agreement)) shall continue in full force and effect as if this Agreement had not been entered into. 12. Appointment as Obligors' Agent Listco confirms that its appointment as Obligors' Agent by each other Obligor under the Original Facilities Agreement has not been revoked or varied. 13. Miscellaneous 13.1 The provisions of clause 22.1 (Transaction expenses), clause 37 (Notices), clause 39 (Partial invalidity) and clause 48 (Enforcement) of the Original Facilities Agreement shall be incorporated into this Agreement as if set out in full in this Agreement, mutatis mutandis, and as if references in those clauses to "this Agreement" or "the Finance Documents" (or any similar terms) are references to this Agreement. 13.2 This Agreement may be executed in any number of counterparts, and this has the same effect as if the signatures on the counterparts were on a single copy of this Agreement. 14. Governing law This Agreement and any non-contractual obligations arising out of or in connection with it are governed by English law. This Agreement has been entered into on the date stated at the beginning of this Agreement.

A53735636 7 SCHEDULE 1 CONDITIONS PRECEDENT 1.1 A copy of the constitutional documents of Listco (or confirmation that the constitutional documents have not been amended, rescinded, supplemented or superseded since they were previously delivered to the Agent). 1.2 A copy of a resolution of the board of directors of Listco: (a) approving the terms of and the transactions contemplated by this Agreement (and the Amended Facilities Agreement) and the Finance Documents to which it is a party and resolving that it executes, delivers and performs this Agreement (and the Amended Facilities Agreement) and the Finance Documents; (b) authorising a specified person or persons to execute this Agreement (and the Amended Facilities Agreement) and the Finance Documents to which it is a party on its behalf and any other documents and notices to be signed by or on behalf of it under or in connection with this Agreement (and the Amended Facilities Agreement) and the Finance Documents; and (c) confirming, on behalf of itself and each of the Obligors, each of the matters specified in Clause 6 (Confirmation) of this Agreement, including that the guarantee issued under and in accordance with clause 23 (Guarantee and indemnity) of the Original Facilities Agreement will be legal, valid and binding and in full force and effect notwithstanding the proposed amendments to the Original Facilities Agreement referred to in Clause 5 (Amendment) of this Agreement. 1.3 A specimen of the signature of each person authorised by the resolutions referred to above in relation to this Agreement and who has signed a new Finance Document entered into in connection with this Agreement. 1.4 A certificate of a director of Listco certifying that: (a) each copy document relating to it is correct, complete and in full force and effect and has not been amended or superseded; (b) there has been no breach of guaranteeing, borrowing or similar restrictions by it or any Obligor as at the date of such certificate; and (c) borrowing or guaranteeing or securing, as appropriate, the Total Commitments would not cause any borrowing, guaranteeing, securing or similar limit binding on it or any other Obligor to be exceeded. 2. Other documents and evidence 2.1 Evidence that all fees, costs and expenses due to any of the Finance Parties have been paid or will be paid on or prior to the Effective Date.

A53735636 8 SCHEDULE 2 CONDITIONS SUBSEQUENT 1.1 In relation to Listco: (a) a certificate from its registered agent, in form and substance satisfactory to the Agent, dated no earlier than three Business Days before the date of this Agreement (including a copy of its register of directors); (b) a certified copy of the register of charges maintained by it under the BVI Business Companies Act 2004; (c) a certificate of good standing issued by the BVI Registrar of Corporate Affairs dated no earlier than three Business Days before the date of this Agreement; and (d) (if applicable) a copy of any power of attorney under which any Finance Document is executed on behalf of Listco. 1.2 A certificate of a director of Listco certifying that each copy document relating to it is correct, complete and in full force and effect and has not been amended or superseded.

Nomad Foods Announces Term Loan Repricing

Feltham, England – February 5, 2024—Nomad Foods Limited (“Nomad Foods” or the “Company”) announced today that it has repriced its existing EUR denominated Term Loan B of EUR 130 million principal due 2029 (the “Term Loan”). The closing of the repricing of the Term Loan occurred on February 2, 2024, subject to customary closing conditions. Following the closing, the margin on the Term Loan will be reduced by 75 basis points to EURIBOR + 2.75%, which is expected to result in approximately €1 million of annual cash interest savings. There are no changes to the maturity of the Term Loan as a result of this repricing.

Samy Zekhout, Nomad Foods’ Chief Financial Officer, stated, “The successful execution of this accretive transaction to reprice our €130 million term loan highlights the strength of our operating performance and improving capital market conditions as we continue to focus on our costs, while executing our growth strategy.”

“We are pleased with the results of our refinancing," said Noam Gottesman, Nomad Foods’ Co-Chairman and Founder, "We believe that this attractive repricing, coupled with our highly cash generative business model, continues to give us the financial flexibility to execute on our strategic objectives and drive strong shareholder returns.”

About Nomad Foods

Nomad Foods (NYSE: NOMD) is Europe’s leading frozen food company. The Company’s portfolio of iconic brands, which includes Birds Eye, Findus, iglo, Ledo and Frikom, have been a part of consumers’ meals for generations, standing for great tasting food that is convenient, high quality and nutritious. Nomad Foods is headquartered in the United Kingdom. Additional information may be found at www.nomadfoods.com.

Enquiries

Investor Relations Contact

Amit Sharma

+1-917-922-0211

Forward-Looking Statements

This press release contains ''forward-looking statements'' that are based on estimates and assumptions and are subject to risks and uncertainties. Forward-looking statements are all statements other than statements of historical fact or statements in the present tense, and can be identified by words such as “targets”, “aims”, “aspires”, “assumes” ''believes'', ''estimates'', ''anticipates'', ''expects'', ''intends'', “hopes”, ''may'', ''would'', ''should'', “could”, ''will'', ''plans'', ''predicts'' and ''potential'', as well as the negatives of these terms and other words of similar meaning. The forward-looking statements in this press release include, but are not limited to, expectations regarding the Company’s ability to consummate the repricing of the Term Loan, the expected reduction of margin and interest rates thereon, the Company’s financial flexibility and ability to execute its strategic objectives and growth strategy, and the Company’s ability to drive strong shareholder returns. Such forward-looking statements are based on numerous assumptions regarding the Company's present and future business strategies and the environment in which it will operate, which may prove not to be accurate. The Company cautions that these forward-looking statements are not guarantees and that actual results could differ materially from those expressed or implied in these forward-looking statements. Undue reliance should, therefore, not be placed on such forward-looking statements. Any forward-looking statements contained in this announcement apply only as at the date of this announcement and are not intended to give any assurance as to future results. The Company will update this announcement as required by applicable law, including the Prospectus Rules, the Listing Rules, the Disclosure and Transparency Rules, and any other applicable law or regulations, but otherwise expressly disclaims any obligation or undertaking to update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

This press release constitutes a public disclosure of inside information by Nomad Foods Limited under Regulation (EU) 596/2014 (16 April 2014) and Implementing Regulation (EU) No 2016/1055 (10 June 2016). The person responsible for making this release on behalf of Nomad Foods Limited is Samy Zekhout, Chief Financial Officer.

This press release does not constitute an offer to sell or the solicitation of an offer to buy any security and shall not constitute an offer, solicitation or sale in the United States or in any jurisdiction in which, or to any persons to whom, such offering, solicitation or sale would be unlawful.

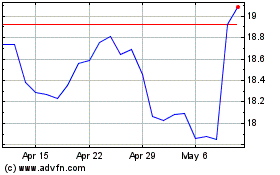

Nomad Foods (NYSE:NOMD)

Historical Stock Chart

From Apr 2024 to May 2024

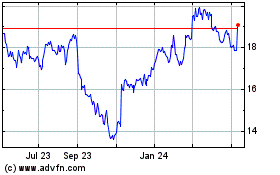

Nomad Foods (NYSE:NOMD)

Historical Stock Chart

From May 2023 to May 2024