false

0001745916

0001745916

2024-02-05

2024-02-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): February 5, 2024

PennyMac

Financial Services, Inc.

(Exact name of registrant as specified in

its charter)

| Delaware |

001-38727 |

83-1098934 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

| 3043 Townsgate Road, Westlake Village, California |

91361 |

| (Address of principal executive offices) |

(Zip Code) |

(818) 224-7442

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.0001 par value |

PFSI |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01 Other Events.

As

previously disclosed in the current and periodic reports of PennyMac Financial Services, Inc. (the “Company”), on November 5,

2019, Black Knight Servicing Technologies, LLC (“Black Knight”), now a wholly-owned subsidiary of Intercontinental Exchange, Inc.

(NYSE: ICE), filed a Complaint and Demand for Jury Trial in the Fourth Judicial Circuit Court in and for Duval County, Florida (the “Florida

State Court”), captioned Black Knight Servicing Technologies, LLC v. PennyMac Loan Services, LLC (“PLS”),

Case No. 2019-CA-007908, alleging breach of contract and misappropriation of MSP® System trade secrets. On November 6, 2019,

PLS filed unlawful monopolization claims against Black Knight pursuant to the Sherman Act and Clayton Act seeking injunctive relief. On

March 30, 2020, the Florida State Court granted a motion to compel arbitration filed by the Company, after which all claims of the

Company and Black Knight were consolidated into a binding arbitration.

On

November 28, 2023, the arbitrator issued an interim award (the “Interim Award”) granting in part and denying in part

Black Knight’s breach of contract claim. The arbitrator’s Interim Award also denied in full Black Knight’s claim of

trade secrets misappropriation. The Interim Award granted Black Knight monetary damages in the amount of $155,230,792, plus prejudgment

interest and reasonable attorney fees, and it denied in full all of Black Knight’s claims for injunctive and declaratory relief.

On

January 12, 2024, the arbitrator issued the final award (the “Final Award”), reducing Black Knight’s monetary damages

to $150,231,878, plus interest. As a result of the Final Award, the Company reported a pretax expense accrual of $158.4 million in its

financial results for the fourth quarter of fiscal year 2023 on February 1, 2024.

The

Final Award also grants PLS’ claim that Black Knight engaged in unlawful monopolization in violation of Section 2 of the Sherman

Act and grants PLS’ claim for injunctive relief under the Sherman Act and Clayton Act. As a result of the Final Award, PLS’

loan servicing technology, known as Servicing Systems Environment, or SSE, and all related intellectual property and software developed

by or on behalf of PLS, remain the proprietary technology of PLS, free and clear of any restrictions on use. Accordingly, the Company,

through PLS, is exploring and expects to aggressively pursue any potential opportunities to create further value for its stakeholders

from its significant investment in SSE while continuing to utilize modern technology to benefit borrowers and lower the cost of homeownership.

On

February 5, 2024, the Company filed a Motion to Confirm the Arbitration Award (the “Motion”) in the Florida State Court.

The Motion has been furnished with this Form 8-K as Exhibit 99.1.

The

information in Item 8.01 of this report, including the exhibit hereto, shall not be deemed “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of Section 18, nor shall it be deemed incorporated

by reference into any disclosure document relating to the Company, except to the extent, if any, expressly set forth by specific reference

in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

|

PENNYMAC FINANCIAL SERVICES, INC. |

| |

|

| Dated: February 5, 2024 |

|

/s/ Daniel S. Perotti |

| |

|

Daniel S. Perotti |

| |

|

Senior Managing Director and Chief Financial Officer |

Exhibit 99.1

IN

THE CIRCUIT COURT, FOURTH

JUDICIAL CIRCUIT, IN AND FOR

DUVAL COUNTY, FLORIDA

CASE

NO.: 2019-CA-007908

DIVISION: CV-D

BLACK

KNIGHT SERVICING

TECHNOLOGIES, LLC,

Plaintiff,

v.

PENNYMAC

LOAN SERVICES, LLC

MOTION

TO CONFIRM ARBITRATION AWARD AND

TO DETERMINE RELIEF IS PUBLIC

I. Introduction

PennyMac

moves to confirm (1) the final arbitration award entered by arbitrator David H. Lichter on January 12, 2024 and (2) the

interim award dated November 28, 2023, as corrected on January 3, 2024 (the interim award), which is incorporated into

the final award. PennyMac requests judgment be entered consistent with the awards.

Intercontinental

Exchange, Inc. (ICE), which acquired Black Knight in September 2023, will not agree to publicly file the entire relief

section of the interim award, pages 181 through 184, claiming the injunctive relief imposed against Black Knight (now ICE) is confidential.

PennyMac disagrees. There is no legal or contractual basis for concealing the scope and purpose of the injunction, and the public interest

strongly favors disclosing this information. The order confirming the award should make the arbitrator's full, unredacted ruling (on

pages 181 through 184 of the interim award) immediately part of the final judgment and public record.

There

are other portions of the interim award both PennyMac and ICE agree should be sealed at least temporarily under an agreed protective

order entered by the arbitrator. Whether to seal those disputed portions will have to be decided by the Court. PennyMac is filing a separate

motion pursuant to Florida Rule of Judicial Administration 2.420(e) to address those disputes.

II. Relevant

Background and Award Rulings

Black

Knight filed suit in 2019, alleging PennyMac breached the parties' master services agreement (MSA) and violated the Florida Uniform

Trade Secrets Act, FLA. STAT. § 688.001, et seq. (FUTSA), during its development of a new mortgage servicing software

system called SSE.

PennyMac

moved to compel arbitration pursuant to the MSA, which this Court granted over Black Knight's objection that PennyMac waived arbitration

by filing separate antitrust and unfair competition claims pursuant to the Sherman Act, 15 U.S.C. § 2, Clayton Act, 15 U.S.C. §

12, et seq., and state unfair competition laws. A copy of the MSA was attached to PennyMac's motion. (See Doc. No. 11

(filed Jan. 6, 2020).) PennyMac joined its claims in the arbitration.

Arbitration

commenced on all claims in April 2020. After extensive discovery and a 26- day final hearing, the arbitrator entered a 185-page interim

award on November 28, 2023.

An

excerpt of the interim award—with a portion of the arbitrator's ruling (on page 183) redacted as ICE insisted—is attached

as Exhibit A. A full, unredacted copy will be provided for in camera review

in connection with PennyMac's separate motion to determine what if any portions of the interim award should be sealed.

The

interim award fully disposed of all substantive issues and claims, leaving only the prejudgment interest and attorneys' fees and costs

amounts to be determined. (EX. A at 181-84.)

As

to Black Knight's claims, the arbitrator found PennyMac did not violate FUTSA and did not breach the MSA by misappropriating Black Knight's

alleged trade secrets, but PennyMac did breach the MSA as to its use of certain Black Knight confidential information. (EX. A at 182-

83.) The arbitrator initially miscalculated Black Knight's damages, but corrected the error and ultimately awarded Black Knight $150,231,878

in damages. (See EX. A at 182; EX. B (order disposing modification motions).) The arbitrator also denied Black Knight's

request for injunctive relief, including ownership of SSE under the MSA's derivative works provision. (EX. A at 89, 182.)

As

to PennyMac's claims, the arbitrator found Black Knight engaged in anticompetitive conduct violating the Sherman Act. (Id. at

183.) He did not award any monetary damages, but he enjoined Black Knight from certain actions he deemed anticompetitive that are described

in the part of the interim award ruling ICE is seeking to redact to prevent public disclosure. (Id.)

As

to the attorneys' fees and costs and prejudgment interest amounts, the parties agreed not to seek fees and costs, and on January 12,

2024, the arbitrator issued the final award setting prejudgment interest at $6,958,795.45. A copy of the final award is attached as Exhibit C.

On February 1, ICE

represented to PennyMac in writing it will not seek to vacate the award.

III. Legal

Discussion

| A. | Award

is Binding Under the MSA. |

The

parties agreed their claims were subject to "binding arbitration." (MSA § 18.3.) The MSA further required the arbitrator

to render a "final judgment and award." (Id. § 18.3.4.) The arbitrator has done so, and the award is binding. See

Capital Factors, Inc. v. Alba Rent-A-Car, Inc., 965 So.2d 1178, 1182 (Fla. 4th DCA 2007) ("[A] decision by arbitrators

is as binding and conclusive . . . as the judgment of a court.") (quotation and citation omitted).

| B. | Court

Has Jurisdiction to Confirm. |

The

parties agreed "[a]rbitration will be conducted . . . in accordance with the rules of AAA . . . ." (MSA § 18.3.2.)

The AAA Commercial Rules provide "[p]arties to an arbitration under these rules shall be deemed to have consented that

judgment upon the arbitration award may be entered in any [] court having jurisdiction thereof." R-52(c), AAA Commercial Arbitration

Rules (as revised October 1, 2013).

The

Florida Arbitration Code, FLA. STAT. § 682.001, et seq. (FAC), governs here to the extent not in conflict with the

Federal Arbitration Act (FAA). See, e.g., Shotts v. OP Winter Haven, Inc., 86 So. 3d 456, 463-64 (Fla. 2011).

The FAC provides "[a]n agreement to arbitrate providing for arbitration in this state confers exclusive jurisdiction on the court

to enter judgment on an award under this chapter." FLA. STAT. § 682.181(2). This Court has jurisdiction to confirm the award.

As

to venue, a petition for relief "must be filed . . . in the court of the county in which [the arbitration] was held." Id.

§ 682.19. The hearing was held in Duval County, Florida.

| C. | Confirmation

Should be Ordered. |

"[U]nder

[FAC] section 682.13(1) and [Florida] case law the standard of judicial review of statutory arbitration awards is extremely limited."

Schnurmacher Holding, Inc. v. Noriega, 542 So. 2d 1327, 1329 (Fla. 1989) (remanding with instruction to confirm arbitral

award).

Courts

"shall issue a confirming order unless the award is modified or corrected . . . or is vacated " FLA. STAT. § 682.12

(emphasis added); see also 9 U.S.C. § 9.

This

motion is timely, as the FAC does not provide for a specific time within which to move to confirm an arbitral award, see FLA.

STAT. § 682.12, and PennyMac is doing so well within the permissive 1-year FAA period. See 9 U.S.C. § 9.

ICE has

stated in writing it will not seek to vacate the award.

Courts

routinely confirm interim and final awards together. See, e.g., Calton & Assocs., Inc. v. Simmers, 2023 WL

204833, at *10 (M.D. Fla. Jan. 17, 2023) ("The Interim Arbitration Award and Final Award are confirmed."); Diamond

Resorts U.S. Collection Dev., LLC v. Royce, 2019 WL 11638841, at *2 (M.D. Fla. Apr. 18, 2019) ("The Interim Award of Arbitrator

dated November 16, 2016, as modified and finalized by the Final Award dated January 31, 2017 (Doc. 30-3) is CONFIRMED.");

EIG Servs., Inc. v. One Call Med., Inc., 348 So. 3d 682 (Fla. 1st DCA 2022) (affirming trial court's confirmation of

both interim and final award); Steele v. Bus. Acquisitions Brokerage, Inc., No. CL-01-12042-AA, 2004 WL 5738875 (Fla.

15th Jud. Cir., Aug. 10, 2004) (confirming interim and final awards together).

| D. | Award

Ruling Should be Made Public. |

The

parties agree the interim award references certain materials they designated as confidential under a protective order and aspects of

it should be sealed pursuant to Florida Rule of Judicial Administration 2.420. These requests are addressed in PennyMac's separate

motion.

For

purposes of this motion, PennyMac asks only that, in confirming the award, the Court also recognize the injunctive relief awarded under

the Sherman and Clayton Acts is public. No part of the awarded relief is covered by the agreed protective order. And, redacting the injunctive

relief effectively invalidates the award because ICE customers impacted by the ruling, other than PennyMac, will not know about it.

While

ICE may be unhappy with the ruling, given the impact of the relief awarded, it cannot be withheld. See, e.g., In re Google

Play Store Antitr. Litig., 2021 WL 4305017, at *1 (N.D. Cal. Aug. 18, 2021) (violations of antitrust laws are "matters

where the public interest is particularly strong"); Russell-Brown v. Univ. of Fla., Bd. of Trs., 2018 WL 914595, at *2 (N.D.

Fla. Feb. 14, 2018) ("That public access to a case might affect a party's reputation is not enough. Many cases, indeed nearly

all, may affect a party's or attorney's reputation. This is an unavoidable collateral consequence of litigation. A plaintiff knows at

the outset that litigation may have this effect.") (citing Doe v. Public Citizen, 749 F.3d 246, 271 (4th Cir. 2014) ("When

parties call on the courts, they must accept the openness that goes with subsidized dispute resolution by public (and publicly accountable)

officials.")).

IV. Conclusion

Based

on the parties' agreement to arbitrate all claims addressed by the arbitrator, PennyMac asks the Court to confirm the interim award,

as corrected and clarified by order dated January 3, 2024, and the final award, and enter a public final judgment consistent with

the awards.

| |

Respectfully

Submitted, |

| |

|

| |

AKERMAN

LLP |

| |

|

| |

/s/

William P. Heller |

| |

William P. Heller |

| |

Fla. Bar No. 0987263 |

| |

Las Olas

Centre II |

| |

350 East Las Olas Blvd., Suite 1600 |

| |

Ft. Lauderdale, FL 33301 |

| |

954-463-2700 phone |

| |

954-463-2224 fax |

| |

Primary E-mail: william.heller@akerman.com |

| |

Secondary E-mail: lorraine.corsaro@akerman.com |

| |

|

| |

GIBSON, DUNN & CRUTCHER

LLP |

| |

|

| |

/s/

Thad A. Davis |

| |

Thad A. Davis (pro hac vice

pending) |

| |

555 Mission Street, Suite 3000 |

| |

San Francisco, CA 94105-0921 |

| |

Telephone: 415.393.8200 |

| |

Facsimile: 415.393.8306 |

| |

Email: TDavis@gibsondunn.com |

| |

|

| |

Attorneys for PennyMac Loan

Services, LLC |

CERTIFICATE

OF SERVICE

I

HEREBY CERTIFY that on the 5th day of February, 2024, a true and correct copy of the foregoing was electronically filed with the e-portal

filing system with a copy served via electronic mail upon all counsel of record.

| |

/s/

Celia C. Falzone |

| |

Attorney |

Exhibit A

EXHIBIT A

AMERICAN

ARBITRATION ASSOCIATION

| In the Arbitration

Matter Between : | |

|

| | |

|

| PENNYMAC LOAN SERVICES, LLC, | |

|

| | |

|

| Claimant, | |

|

| | |

|

| and | |

AAA Case No. 01-20-0005-0778 |

| | |

|

| BLACK KNIGHT

SERVICING TECHNOLOGIES, LLC, AND BLACK KNIGHT, INC. | |

|

| | |

|

| Respondents. | |

|

| | |

|

| / |

|

INTERIM

AWARD

I,

THE UNDERSIGNED ARBITRATOR, having been designated in accordance with paragraph 18.3.1 of the Master Services Agreement ("MSA"

or "Agreement") between Fidelity Information Services, Inc. (Respondents' predecessor) and PennyMac Loan Services, LLC,

dated April 30, 2008, having been duly sown, and having heard the allegations and proofs of the parties, does hereby issue this

INTERIM AWARD, as follows:

I. THE

PARTIES

PennyMac

Loan Services, LLC ("Claimant" or "PennyMac") was founded in 2008 by former employees of Countrywide Home Loans.

At its founding, which occurred during the financial crisis, PennyMac entered the residential mortgage loan servicing business, initially

by acquiring and servicing distressed mortgage loans. Claimant eventually transitioned to a mortgage bank, buying closed loans and servicing

them; it also became an originator of mortgage loans.

EXHIBIT

A

PennyMac

Loan Services, LLC v. Black Knight Technologies, Inc.,

et al.

Case

No. 01-20-0005-0778

INTERIM AWARD

In

making this Interim Award, the Arbitrator has very carefully considered the documentary evidence, testimony, the parties’ submissions

and their arguments. Based on the foregoing and for the reasons given, the Tribunal decides and awards as follows:

EXHIBIT A

PennyMac

Loan Services, LLC v. Black Knight Technologies, Inc.,

et al.

Case

No. 01-20-0005-0778

1. Black

Knight’s claim that PennyMac breached the MSA with respect to Respondents’ Confidential Information (Count I) is hereby GRANTED,

and Respondents’ claim that Claimant breached the MSA by misappropriating Black Knight’s trade secrets (Count I) is DENIED;

2. Black

Knight is awarded a total of $155,230,792 on its breach of contract claim, plus interest calculated thereon at the applicable Florida

statutory rate for each year between November 1, 2019 and November 1, 2025;81

3. The

parties shall confer to see whether they can reach agreement on the amount of prejudgment interest to be added to the total contract

damage amount and shall inform the Arbitrator of the result of their discussions no later than the same time the parties inform the Tribunal

of the results of their discussion relating to attorney’s fees. If the parties are unable to agree on the appropriate number for

prejudgment interest, they should submit on that date briefs of no more than three pages each (double-spaced, 12” margins,

but not including any tables or charts) describing why their respective calculations are correct;

4. Pursuant

to paragraph 18.3.4 of the Master Services Agreement, Black Knight is awarded its reasonable attorney’s fees on its breach of contract

claim;

81

The prejudgment interest shall not be calculated on the entire amount from November 1, 2019; instead it should be calculated

on the damages for a given year (as calculated by Mr. Bratic) pursuant to the applicable Florida statutory interest rate for a given

period and carried forward on the sum for that particular period’s damages and then added together (unless the parties agree otherwise

or persuade the Arbitrator via briefing of a more legally appropriate manner in which to make the calculation).

EXHIBIT A

PennyMac

Loan Services, LLC v. Black Knight Technologies, Inc.,

et al.

Case

No. 01-20-0005-0778

5. Black

Knight’s claim that PennyMac has misappropriated its trade secrets under Florida’s Uniform Trade Secrets Act (Count II) is

DENIED in its entirety;

6. PennyMac’s

claim for attorney’s fees under Florida’s Uniform Trade Secrets Act is DENIED;

7. Black

Knight’s claim for injunctive relief under Florida’s Uniform Trade Secrets Act (Count III) is DENIED AS MOOT based

on the other rulings herein;

8. Black

Knight’s claim for declaratory relief (Count IV) is DENIED AS MOOT based on the Tribunal’s other rulings;

9. PennyMac’s

claim under Section 2 of the Sherman Act for monopolization (Count I) is hereby GRANTED;

10. PennyMac’s

claim for monetary damages under Section 2 of the Sherman Act is hereby DENIED;

11. PennyMac’s

claim for injunctive relief under the Sherman and Clayton Acts is hereby GRANTED, such that: [*****]

EXHIBIT A

PennyMac

Loan Services, LLC v. Black Knight Technologies, Inc.,

et al.

Case

No. 01-20-0005-0778

12.

PennyMac’s claim for attorney’s fees under the Sherman Act is GRANTED;

13.

PennyMac’s claim for attempted monopolization (Count II) is DENIED AS MOOT;

14. PennyMac’s

claim under Florida’s Deceptive and Unfair Trade Practices Act (Count III) is DENIED AS MOOT;

15. PennyMac’s

claim for violation of California’s Unfair Competition Law (Count IV) is DENIED AS MOOT;

16.

All other claims for relief not expressly allowed herein are DENIED;

17.

All other defenses not expressly addressed herein are DENIED; and

18.

The parties are hereby directed to the confer on the issue of attorney’s fees. The Tribunal has awarded each party attorney’s

fees on certain of their claims. This raises at least two issues: (i) Can the attorney’s fees expended on the successful portion

of the claims be parsed out from the non-successful portions; and (ii) assuming the answer to (i) is yes, would the attorney’s

fees awarded to each side effectively cancel out the other side’s fees? Following such conferral, the parties are directed to file

with the Arbitrator, no later than December 29, 2023, a submission which will inform the Tribunal whether the parties have reached

agreement on these issues and the nature of such agreement; if the parties have not reached agreement, each party should brief the issue

for the Arbitrator setting forth why their respective position is correct. The briefs should be limited to ten pages, double-spaced,

with 1” margins.

EXHIBIT A

PennyMac

Loan Services, LLC v. Black Knight Technologies, Inc.,

et al.

Case

No. 01-20-0005-0778

| ORDERED and ADJUDGED this 28th

day of November, 2023. |

|

| |

|

| /s/ David H. Lichter |

|

| David H. Lichter, Arbitrator |

|

| |

|

| cc: counsel of record |

|

| Angela Romero Valedon, Esq., |

|

| Vice-President, AAA |

|

Exhibit B

EXHIBIT B

AMERICAN

ARBITRATION ASSOCIATION

| In the Matter of the Arbitration Between | |

Case No. 01-20-0005-0778 |

| | |

|

| PENNYMAC LOAN SERVICES, LLC, | |

|

| | |

|

| Claimant, | |

|

| | |

|

| V. | |

|

| | |

|

| BLACK KNIGHT

SERVICING TECHNOLOGIES, LLC, et al. | |

|

| | |

|

| Respondents. | |

|

| | |

|

| / |

|

DISPOSITION

OF APPLICATIONS FOR

CORRECTION/CLARIFICATION

OF INTERIM AWARD

I,

THE UNDERSIGNED ARBITRATOR, having been designated in accordance with the arbitration agreement entered into between the above-named

parties and dated April 30, 2008, and having been duly sworn, and having duly heard the proofs and allegations of the parties, and

having previously rendered an Interim Award dated November 28, 2023, and Claimant PennyMac Loan Services, LLC ("Claimant"),

having filed on December 6, 2023 an application to Correct and Clarify Interim Arbitration Award, and Respondents Black Knight Servicing

Technologies, LLC, Black Knight Inc. ("Respondents"), having responded on December 18, 2023, and Respondents having filed

on December 19, 2023 a Motion to Correct and Clarify Interim Arbitration Award (the "Motion") and Claimant having responded

thereto on December 29, 2023, does hereby DECIDE as follows:

EXHIBIT B

PennyMac

v. Black Knight

Servicing Technologies, LLC, et al

Case

No. 01-20-0005-0778

The

Tribunal will GRANT PennyMac's Application to Correct and Clarify the Interim Award. The total amount to be awarded to Black Knight

on its breach of contract damages claim is $150,231,878. The Interim Award correctly

noted that the damages award was meant to cover a period of six years extending from November 1,

2019 to November 1, 2025. That Interim Award, however, contained an award number which inadvertently included two extra months,

that is, November and December 2025. This inaccurately inflated the contract damages award by an additional $4,998,913.83,

which is a computational error subject to correction under R-50 of AAA's Commercial Rules. As a result, the correct number is the original

amount awarded ($155,230,792) minus the amounts inadvertently awarded for November and December 2025 ($4,998,913.83), which

results in a corrected contract damages figure of $150,231.878.1

Respondents

in their Motion ask the Tribunal to modify its Interim Award in several respects. Black Knight wants a change of damage methodologies

both in the calculation of lost profits and prejudgment interest, using a new declaration by its expert Mr. Bratic, and deploying

a new argument under the MSA. This is not allowed under Rule 50. The Bratic Declaration is new evidence which Claimant cannot counter

at this juncture and is not permissible. Moreover, Respondents have now abandoned, at least in part, the discounted lost profits for

which Black Knight previously advocated in their post-hearing and rebuttal briefs and elsewhere; it is far too late for Black Knight

to reverse course. The MSA

also does not apply here, because Fla. Stat. § 55.03 sets the methodology for computation of interest, unless there is a controlling

contract. The MSA expired on October 31, 2019, and is not controlling. It

also provides an inapplicable interest calculation methodology based upon items which formed no part of the Tribunal's award.

The Arbitrator therefore declines to correct or clarify the Interim Award in the manner Black Knight requests.

1

This number does not include the amount to be awarded as prejudgment interest or the period for which such interest is to be awarded,

which figure and dates will be included in the Final Award.

EXHIBIT B

PennyMac

v. Black Knight

Servicing Technologies, LLC, et al

Case

No. 01-20-0005-0778

In

all other respects the Interim Award dated November 28, 2023, is reaffirmed and remains in full force and effect.

SO

ORDERED this 3rd

day of January, 2024.

| /s/

David H. Lichter |

|

| David H. Lichter, Arbitrator |

|

| Cc: | Counsel

of Record |

| | Angela

Romero Valedon, Vice President, AAA |

Exhibit C

EXHIBIT C

AMERICAN

ARBITRATION ASSOCIATION

| In the Matter of the Arbitration Between | |

Case No. 01-20-0005-0778 |

| | |

|

| PENNYMAC LOAN SERVICES, LLC, | |

|

| | |

|

| Claimant, | |

|

| | |

|

| V. | |

|

| | |

|

| BLACK KNIGHT

SERVICING TECHNOLOGIES, LLC, et al. | |

|

| | |

|

| Respondents. | |

|

| | |

|

| / |

|

FINAL

AWARD

I,

THE UNDERSIGNED ARBITRATOR, having been designated in accordance with the arbitration agreement entered into between the above-named

parties (or their predecessors) and dated April 30, 2008, and having been duly sworn, and having duly heard the proofs and allegations

of the Parties, and having issued an Interim Award on November 28, 2023 and a Disposition on Application for Correction/Clarification

of Interim Award dated January 3, 2024, hereby AWARDS as follows:

1. The

Interim Award dated November 28, 2023 as corrected by the Disposition

on Application for Correction/Clarification of Interim Award dated January 3,

2024, is hereby incorporated into this Final Award.

EXHIBIT C

PennyMac

v. Black Knight

Servicing Technologies, LLC, et al

Case

No. 01-20-0005-0778

2. Black

Knight is entitled to prejudgment interest on the award of contract damages. See Argonaut Ins. Co. v. May Plumbing

Co., 474 So.2d 212, 214- 15 (Fla. 1985). This interest is calculated for the period running from October 31,

2019 through November 29, 2023, as prejudgment interest runs from "the date of the loss"

through the date of the judgment, in this case, the Interim Award. Id. PennyMac has appropriately calculated

the amount of that interest in accordance with Fla. Stat. § 55.03, for a total of $6,958,795.45.

3. Respondents

are entitled to post-judgment interest on the Interim Award in accordance with Fla. Stat. § 55.03. That is, from the date after

the Interim Award, November 30, 2023, as corrected by the Disposition on Application for Correction/Clarification of Interim Award

dated January 3, 2024, through December 31, 2023, Black Knight is entitled to interest in the amount of 8.54% on the amount

of the Interim Award ($150,231,878.00), representing a daily rate of .0233973%, and beginning January 1, 2024, interest in the amount

of 9.09%, representing a daily rate of .0248361%, all as set forth by the Florida Department of Financial Services. See www.myfloridacfo.com.

4. The

administrative fees and expenses of the American Arbitration Association totaling $147,225.00 shall be borne as incurred, and the compensation

and expenses of the arbitrator totaling $444,030.36 shall be borne equally by the Claimant and Respondents. Therefore, Respondents shall

reimburse the sum of $0.10, representing that portion of said fees and expenses in excess of the apportioned costs previously incurred

by Claimant.

5. The

above sums are to be paid on or before sixty (60) days from the date of this Award.

EXHIBIT C

PennyMac

v. Black Knight

Servicing Technologies, LLC, et al

Case

No. 01-20-0005-0778

6. This

Award is in full settlement of all claims and counterclaims submitted to this Arbitration. All claims and defenses not expressly granted

herein are hereby denied.

| January 12, 2024 |

/s/ David H.

Lichter |

| |

David H. Lichter,

Arbitrator |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

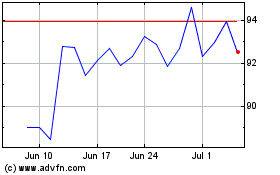

PennyMac Financial Servi... (NYSE:PFSI)

Historical Stock Chart

From Apr 2024 to May 2024

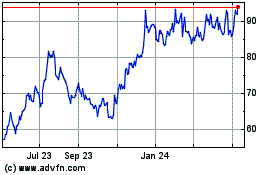

PennyMac Financial Servi... (NYSE:PFSI)

Historical Stock Chart

From May 2023 to May 2024