Form S-1/A - General form for registration of securities under the Securities Act of 1933: [Amend]

February 05 2024 - 8:21AM

Edgar (US Regulatory)

As

filed with the Securities and Exchange Commission on February 5, 2024

Registration

No. 333-276662

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON

D.C. 20549

Amendment No.

1 to

Form

S-1

REGISTRATION

STATEMENT

UNDER THE SECURITIES ACT OF 1933

One World Products, Inc.

(Exact

name of Registrant as specified in its charter)

| Nevada |

|

2834 |

|

61-1744826 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

Number) |

6605

Grand Montecito Pkwy, Suite

100,

Las Vegas,

Nevada 89149

(800) 605-3210

(Address,

including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Isiah

L. Thomas III

Chief

Executive Officer

6605

Grand Montecito Pkwy, Suite

100, Las

Vegas, Nevada

89149

(800)

605-3210

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

with

a copy to:

Alison

Newman, Esq.

Laura

M. Holm, Esq

Fox

Rothschild LLP

100

Park Avenue

New

York, NY 10017

(212)

878-7951

As

soon as practicable after the effective date of this registration statement.

(Approximate

date of commencement of proposed sale to the public)

If

any securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the

following box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering.

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering.

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 2-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer

☐ |

| Non-accelerated filer ☒ |

Smaller reporting company

☒ |

| |

Emerging growth company ☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this Registration Statement shall hereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date

as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY

NOTE

One

World Products Inc is filing this Amendment No. 1 (“Amendment”) to its Registration Statement on Form S-1 (File

No. 333-276662) (the ‘‘Registration Statement”) as an exhibits-only filing. Accordingly, this Amendment consists only of the facing

page, this explanatory note, Item 16(a) of Part II of the Registration Statement, the signature page to the Registration

Statement and the exhibits filed herewith. The prospectus is unchanged and therefore has been omitted from this filing.

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

ITEM

16. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES.

| (a) | Exhibits.

The following exhibits are filed herewith: |

| Exhibit |

|

Description |

| 2.1 |

|

Agreement and Plan of Merger dated February 21, 2019, among the Registrant, OWP Merger Subsidiary Inc. and OWP Ventures, Inc. (incorporated by reference to Exhibit 2.1 of the Form 8-K filed with the Securities and Exchange Commission by One World Pharma, Inc. on February 25, 2019) |

| 2.2 |

|

Agreement and Plan of Merger dated October 11, 2021, between One World Pharma, Inc. and One World Products, Inc. (incorporated by reference to Exhibit 2.1 of the Form 8-K filed with the Securities and Exchange Commission by One World Pharma, Inc. on November 30, 2021) |

| 2.3 |

|

Articles of Merger Pursuant to NRS 92A.200 as filed with the Nevada Secretary of State on November 23, 2021 (incorporated by reference to Exhibit 2.1 of the Form 8-K filed with the Securities and Exchange Commission by One World Pharma, Inc. on November 30, 2021) |

| 3.1 |

|

Articles of Incorporation of the Registrant (incorporated by reference to Exhibit 3.1 of the Registrant’s Registration Statement on Form S-1 filed with the Securities and Exchange Commission on November 24, 2014) |

| 3.2 |

|

Certificate of Amendment to Articles of Incorporation of the Registrant (incorporated by reference to Exhibit 3.1 of the Registrant’s Current Report on Form 8-K filed with the Securities and Exchange Commission on January 8, 2019) |

| 3.3 |

|

Certificate of Amendment to Articles of Incorporation of the Registrant (incorporated by reference to Exhibit 3.1 of the Registrant’s Current Report on Form 8-K filed with the Securities and Exchange Commission on February 25, 2020) |

| 3.4 |

|

Certificate of Designation of Series A Preferred Stock of the Registrant dated June 1, 2020 (incorporated by reference to Exhibit 3.4 of the Registrant’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on June 26, 2020) |

| 3.5 |

|

Bylaws of the Registrant (incorporated by reference to Exhibit 3.2 of the Registrant’s Registration Statement on Form S-1 filed with the Securities and Exchange Commission on November 24, 2014) |

| 3.6 |

|

Certificate of Designation of Series B Preferred Stock of the Registrant dated February 2, 2021 (incorporated by reference to Exhibit 3.1 of the Registrant’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on February 8, 2021) |

| 3.7 |

|

Certificate of Amendment to Certificate of Designation of the Series B Preferred Stock of One World Products, Inc., Pursuant to NRS 78.1955, filed with the Secretary of State of the State of Nevada on August 2, 2022. (incorporated by reference to Exhibit 3.1 of the Form 8-K filed with the Securities and Exchange Commission by One World Pharma, Inc. on August 4, 2022) |

| 4.1 |

|

Description

of Securities (incorporated by reference to Exhibit 4.1 of the Registrant’s Annual Report on Form 10-K filed

with the Securities and Exchange Commission on April 15, 2021) |

| 4.2 |

|

Promissory Note of One World Pharma, Inc. in the Principal Amount of $290,000 issued to AJB Capital Investments LLC, dated January 20, 2021 (incorporated by reference to Exhibit 4.1 of the Form 8-K filed with the Securities and Exchange Commission by One World Pharma, Inc. on January 25, 2021) |

| 4.3 |

|

Promissory Note of One World Pharma, Inc. in the principal amount of $750,000 issued to AJB Capital Investments LLC, dated September 24, 2021 (incorporated by reference to Exhibit 4.1 of the Form 8-K filed with the Securities and Exchange Commission by One World Pharma, Inc. on September 27, 2021) |

| 4.4 |

|

Common Stock Purchase Warrant to purchase 1,500,000 shares of common stock of One World Pharma, Inc. issued to AJB Capital Investments LLC, dated September 24, 2021 (incorporated by reference to Exhibit 4.2 of the Form 8-K filed with the Securities and Exchange Commission by One World Pharma, Inc. on September 27, 2021) |

| 4.5 |

|

Common Stock Purchase Warrant to purchase 2,000,000 shares of common stock of One World Pharma, Inc. issued to AJB Capital Investments LLC, dated September 24, 2021 (incorporated by reference to Exhibit 4.3 of the Form 8-K filed with the Securities and Exchange Commission by One World Pharma, Inc. on September 27, 2021) |

| 5.1* |

|

Opinion of Fox Rothschild LLP. |

| 10.1 |

|

Promissory Note between OWP Ventures, Inc. and Dr. Kenneth Perego, II, dated December 29, 2021 (incorporated by reference to Exhibit 10.1 of the Form 10-K filed with the Securities and Exchange Commission by One World Pharma, Inc. on April 15, 2022). |

| 10.2 |

|

Addendum to Commercial Lease dated November 1, 2021, between Ripper Series, LLC and OWP Ventures, Inc. (incorporated by reference to Exhibit 10.2 of the Form 10-K filed with the Securities and Exchange Commission by One World Pharma, Inc. on April 15, 2022). |

| 10.3 |

|

Commercial Lease dated December 2, 2018, between Larry R. Haupert dba Rexco and One World Pharma S.A.S. (incorporated by reference to Exhibit 10.3 of the Form 8-K filed with the Securities and Exchange Commission by One World Pharma, Inc. on February 25, 2019) |

| 10.4 |

|

Commercial Lease dated October 16, 2018, between Ripper Series, LLC and OWP Ventures, Inc. (incorporated by reference to Exhibit 10.4 of the Form 8-K filed with the Securities and Exchange Commission by One World Pharma, Inc. on February 25, 2019) |

| 10.5+ |

|

One World Pharma, Inc. 2019 Stock Incentive Plan (incorporated by reference to Exhibit 10.1 of the Registrant’s Current Report on Form 8-K filed with the Securities and Exchange Commission on February 25, 2020) |

| 10.6+ |

|

Form of Stock Option Grant Notice for grants under the 2019 Stock Incentive Plan (incorporated by reference to Exhibit 10.2 of the Registrant’s Current Report on Form 8-K filed with the Securities and Exchange Commission on February 25, 2020) |

| 10.7+ |

|

Form of Option Agreement for grants under the 2019 Stock Incentive Plan (incorporated by reference to Exhibit 10.3 of the Registrant’s Current Report on Form 8-K filed with the Securities and Exchange Commission on February 25, 2020) |

| 10.8 |

|

Promissory Note dated May 4, 2020, made by OWP Ventures, Inc. in favor of Customers Bank (incorporated by reference to Exhibit 10.1 of the Form 8-K filed with the Securities and Exchange Commission by One World Pharma, Inc. on May 8, 2020) |

| 10.9 |

|

Letter Agreement, dated May 28, 2021, between One World Pharma, Inc. and Vahé Gabriel (incorporated by reference to Exhibit 10.1 of the Form 8-K filed with the Securities and Exchange Commission by One World Pharma, Inc. on June 3, 2021) |

| 10.10+ |

|

Letter Agreement between One World Pharma, Inc. and Isiah L. Thomas, III, dated June 3, 2020 (incorporated by reference to Exhibit 10.2 of the Form 8-K filed with the Securities and Exchange Commission by One World Pharma, Inc. on June 9, 2020) |

| 10.11 |

|

Securities Purchase Agreement, dated as of January 20, 2021, between One World Pharma, Inc. and AJB Capital Investments LLC (incorporated by reference to Exhibit 10.1 of the Form 8-K filed with the Securities and Exchange Commission by One World Pharma, Inc. on January 25, 2021) |

| 10.12 |

|

Security Agreement, dated as of January 20, 2021, between One World Pharma, Inc. and AJB Capital Investments LLC (incorporated by reference to Exhibit 10.2 of the Form 8-K filed with the Securities and Exchange Commission by One World Pharma, Inc. on January 25, 2021) |

| 10.13 |

|

Securities Purchase Agreement, dated as of February 7, 2021, between One World Pharma, Inc. and ISIAH International LLC (incorporated by reference to Exhibit 10.1 of the Form 8-K filed with the Securities and Exchange Commission by One World Pharma, Inc. on February 8, 2021) |

| 10.14 |

|

Securities Purchase Agreement, dated September 24, 2021, between One World Pharma, Inc. and AJB Capital Investments LLC (incorporated by reference to Exhibit 10.1 of the Form 8-K filed with the Securities and Exchange Commission by One World Pharma, Inc. on September 27, 2021) |

| 10.15 |

|

Security Agreement, dated September 24, 2021, between One World Pharma, Inc. and AJB Capital Investments LLC (incorporated by reference to Exhibit 10.2 of the Form 8-K filed with the Securities and Exchange Commission by One World Pharma, Inc. on September 27, 2021) |

| 10.16 |

|

Form

of Demand Note between One World Pharma, Inc. and Isiah L. Thomas, III, dated December 16, 2020 (incorporated by reference to Exhibit

10.14 of the Registrant’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on April

15, 2021) |

| 10.17 |

|

Purchase Agreement, dated September 1, 2022, between One World Products, Inc. and Tysadco Partners, LLC (incorporated by reference to Exhibit 10.1 of the Form 8-K filed with the Securities and Exchange Commission by One World Pharma, Inc. on September 7, 2022) |

| 10.18 |

|

Securities Purchase Agreement, dated September 1, 2022, between One World Products, Inc. and Tysadco Partners, LLC (incorporated by reference to Exhibit 10.1 of the Form 8-K filed with the Securities and Exchange Commission by One World Pharma, Inc. on September 7, 2022). |

| 10.19 |

|

Registration Rights Agreement, dated September 1, 2022, between One World Products, Inc. and Tysadco Partners, LLC (incorporated by reference to Exhibit 10.1 of the Form 8-K filed with the Securities and Exchange Commission by One World Pharma, Inc. on September 7, 2022). |

| 10.20 |

|

Convertible

Promissory Note Purchase Agreement, dated September 16, 2022, between One World Products, Inc. and Dr. John McCabe (incorporation

be reference to Exhibit 10.15 of the form 10-Q filed with the Securities and Exchange Commission on November 14, 2022) |

| 10.21 |

|

Convertible

Note, dated September 16, 2022, between One World Products, Inc. and Dr. John McCabe (incorporation

be reference to Exhibit 10.16 of the form 10-Q filed with the Securities and Exchange Commission

on November 14, 2022)

|

| 10.22+ |

|

Offer Letter dated April 25, 2023 by and between the Company and Joerg Sommer (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on June 1, 2023)

|

| 10.23*+ |

|

Offer Letter dated February 14,

2022 by and between the Company and Timothy Woods |

| 14.1 |

|

One World Pharma, Inc. Code of Business Conduct and Ethics (incorporated by reference to Exhibit 14.1 of the Registrant’s Current Report on Form 8-K filed with the Securities and Exchange Commission on February 25, 2020) |

| 21.1 |

|

Subsidiaries (incorporated by reference to Exhibit 21.1 of the Form 10-K filed with the Securities and Exchange Commission by One World Pharma, Inc. on April 15, 2022). |

| 23.1** |

|

Consent

of M&K CPAS PLLC (incorporated by reference to Exhibit 23.1 in the Company’s Registration Statement on Form S-1, File No.

333-276662 (“Registration Statement”). filed with the SEC on January 23, 2024). |

| 23.2* |

|

Consent of Fox Rothschild LLP (included in Exhibit 5.1) |

| 24.1** |

|

Power of Attorney (included in the signature page to the Company’s Registration Statement on Form S-1, File No. 333-276662, filed with the SEC on January 23, 2024) |

| 101.INS** |

|

XBRL

Instance Document |

| 101.SCH** |

|

XBRL

Schema Document |

| 101.CAL** |

|

XBRL

Calculation Linkbase Document |

| 101.DEF** |

|

XBRL

Definition Linkbase Document |

| 101.LAB** |

|

XBRL

Labels Linkbase Document |

| 101.PRE** |

|

XBRL

Presentation Linkbase Document |

| 107** |

|

Filing Fee Table (incorporated by reference to Exhibit 107 in the Company’s Registration Statement on Form S-1, File No. 333-276662, filed with the SEC on January 23, 2024). |

+ Indicates management contract or compensatory

plan

*

Filed herewith

** Previously filed

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the registrant has duly caused this Registration Statement on Form S-1 to be signed

on its behalf by the undersigned, thereunto duly authorized, in Las Vegas, State of Nevada, on February 5, 2024.

| |

One

World Products, Inc. |

| |

|

|

| |

By: |

/s/

Isiah L. Thomas III |

| |

|

Isiah

L. Thomas III, Chief Executive Officer |

Pursuant

to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the

capacities and on the dates stated:

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Isiah L. Thomas III |

|

Chief

Executive Officer and Chairman |

|

|

| Isiah

L. Thomas III |

|

(Principal

Executive Officer and Financial Officer) |

|

February

5, 2024 |

| |

|

|

|

|

| /s/

Dr. Kenneth Perego, II |

|

Vice

Chairman of the Board |

|

|

| Dr.

Kenneth Perego, II |

|

|

|

February

5, 2024 |

| |

|

|

|

|

| /s/

Timothy Woods |

|

|

|

|

| Timothy

Woods |

|

Chief

Financial Officer |

|

February

5, 2024 |

| |

|

|

|

|

| /s/

Terry L. Buffalo |

|

|

|

|

| Terry

L. Buffalo |

|

Director |

|

February

5, 2024 |

| |

|

|

|

|

| /s/ Joerg Sommer |

|

|

|

|

| Joerg Sommer |

|

President |

|

February 5, 2024 |

Exhibit

5.1

101

Park Avenue, 17th Floor

New

York, NY 10178

Tel

212.878.7900 Fax 212.692.0940

www.foxrothschild.com

February

5, 2024

One

World Products, Inc.

6605 Grand Montecito Parkway, Suite 100

Las Vegas, Nevada 89149

Re: Common

Stock of One World Products, Inc. Registered on Form S-1 Registration Statement filed with the SEC on January 23, 2024, as amended

on February 5, 2024 (File No. 333-276662) (the “Registration Statement”)

Ladies

and Gentlemen:

We

have acted as counsel to One World Products, Inc., a Nevada corporation (the “Company”), in connection with the Company’s

registration of 21,366,700 shares (the “Shares”) of common stock of the Company, par value $0.001 per share (the “Common

Stock”), to be sold by the selling stockholder listed in the Registration Statement under “Selling Stockholder,” consisting

of 20,000,000 shares of Common Stock issuable to the selling stockholder pursuant to the terms of the Purchase Agreement described in

the Registration Statement, and 1,366,700 shares of Common Stock issuable to the selling stockholder upon conversion of Series B Preferred

Stock issued to the Selling Stockholder in connection with entering into the Purchase Agreement (the “Commitment Shares”).

The Shares are included in the Registration Statement filed by the Company with the Securities and Exchange Commission (the “SEC”)

on January 23, 2024, as amended on February 5, 2024 (File No. 333-276662).

In

connection with this opinion, we have examined and relied upon the originals, or copies certified or otherwise identified to our satisfaction,

of such records, documents, certificates and other instruments as in our judgment are necessary or appropriate to enable us to render

the opinions expressed below. As to certain factual matters, we have relied upon certificates of the officers of the Company and have

not sought to independently verify such matters.

In

rendering this opinion, we have assumed the genuineness and authenticity of all signatures on original documents; the legal capacity

of all natural persons; the authenticity of all documents submitted to us as originals; the conformity to originals of all documents

submitted to us as certified or photocopies; the authenticity of the originals of such latter documents; the accuracy and completeness

of all documents and records reviewed by us; the accuracy, completeness and authenticity of certificates issued by any governmental official,

office or agency and the absence of change in the information contained therein from the effective date of any such certificate; and

the due authorization, execution and delivery of all documents where authorization, execution and delivery are prerequisites to the effectiveness

of such documents.

Our

opinion herein is expressed solely with respect to Chapter 78 of the Nevada (including the statutory provisions, all applicable provisions

of the Nevada Constitution, and reported judicial decisions interpreting the foregoing) and is based on these laws as in effect on the

date hereof. We express no opinion as to whether the laws of any jurisdiction are applicable to the subject matter hereof. We are not

rendering any opinion as to compliance with any federal or other state law, rule, or regulation relating to securities, or to the sale

or issuance thereof.

On

the basis of the foregoing and in reliance thereon, and subject to the qualifications herein stated, we are of the opinion that the Shares

have been duly authorized and that (i) the 20,000,000 Shares issuable pursuant to the Purchase

Agreement, when issued and sold by the Company and delivered by the Company against payment therefor, in accordance with the Purchase

Agreement in the manner described in the Registration Statement, will be validly issued, fully paid and non-assessable, and (ii)

upon conversion of the Commitment Shares, the 1,366,700 shares of Common Stock included in the Shares will be duly and validly issued

and fully paid and nonassessable.

This

opinion is rendered only to you and is solely for your benefit in connection with the Registration Statement and may be relied upon by

and persons entitled to rely upon it pursuant to the applicable provisions of the Securities Act of 1933, as amended (“Act”).

This opinion letter has been prepared for your use in connection with the registration of the Shares pursuant to the Registration Statement,

speaks as of the date the Registration Statement becomes effective, and we assume no obligation to advise you of any changes in the foregoing

subsequent to that date.

We

hereby consent to the filing of this opinion as an exhibit to the Registration Statement. In giving such consent, we do not admit that

we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the

SEC thereunder. This opinion is expressed as of the date hereof, and we disclaim any undertaking to advise you of any subsequent changes

in the facts stated or assumed herein or of any subsequent changes in applicable law.

Very

truly yours,

Fox

Rothschild LLP

Exhibit 10.23

One

World Products, Inc.

3471

W. Oquendo Road, Suite 301

Las

Vegas, NV 89118

February

14, 2022

Timothy

Woods

8191

Quinn Terrace

Vienna,

VA 22180

Dear

Mr. Woods:

We

are pleased to confirm the terms of your employment with One World Products, Inc. (the “Company”), effective

February 14, 2022 (the “Effective Date”). The details of your employment are as follows:

| Title;

Duties: |

|

You

will be employed as the Company’s Chief Financial Officer, performing such duties as are normally associated with this position

and as may be assigned to you from time to time by the Board of Directors of the Company and the Company’s CEO. While serving

as CFO, you will report directly to the CEO and the Company’s Board of Directors (the “Board”). |

| |

|

|

| At-Will

Employment: |

|

Your

employment will be at-will, meaning you or the Company can terminate the employment relationship between you and the Company at any

time. |

| |

|

|

| Compensation: |

|

You

will be paid an annual base salary in the amount of $90,000. Your base salary and performance will be reviewed by the Board on an

annual basis, and may be adjusted upward, but not downward, in the sole discretion of the Board based on such review. Your annual

salary will be paid in accordance with the Company’s regular payroll practices. |

| |

|

|

| Expenses: |

|

You

will be reimbursed for all reasonable out-of-pocket business expenses incurred by you while employed by the Company in the performance

of your services up to $2,000 per month upon submission of expense statements, invoices or such other supporting information as the

Board may reasonably require. Additional expenses must be approved in advance. |

| |

|

|

| Benefits: |

|

You

shall be entitled to participate in and be provided with such benefit plans and programs offered to and or made available to the

Company’s employees from time to time. |

| Personnel

Policies: |

|

Your

employment is subject to the Company’s personnel policies and procedures as they may be adopted, interpreted or revised from

time to time in the Company’s sole discretion. |

| |

|

|

| Location: |

|

Your

place of employment may be at your home address if you so elect. |

| |

|

|

| No

Conflict Representation: |

|

You

hereby represent that the provision of services by you to the Company does not and will not breach any agreement with any current

or former employer. |

| |

|

|

| Confidential

Information Obligations: |

|

You

and the Company will enter into a Confidential Information Agreement that contains provisions that will survive termination or expiration

of this letter agreement. |

Nothing

other than an express written agreement signed by both parties may modify any term of this letter agreement. This letter agreement shall

be governed by and construed and interpreted in accordance with the laws of the State of Nevada without reference to principles of conflicts

of law.

Please

sign this letter agreement to acknowledge your acceptance and agreement to the terms herein. We look forward to working with you and

expect that you will be a great asset to our team.

| |

Sincerely, |

| |

|

| |

ONE WORLD PRODUCTS, INC. |

| |

|

| |

By: |

/s/

Isiah L. Thomas III |

| |

Name: |

Isiah

L. Thomas III |

| |

Title: |

Chief

Executive Officer |

Acknowledged

and agreed

this

15th day of February, 2022:

| /s/

Timothy Woods |

|

| Timothy

Woods |

|

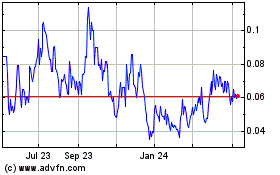

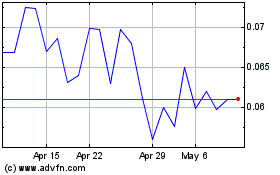

One World Products (QB) (USOTC:OWPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

One World Products (QB) (USOTC:OWPC)

Historical Stock Chart

From Apr 2023 to Apr 2024