UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED

IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 3)1

Gildan Activewear Inc.

(Name

of Issuer)

Common Shares

(Title of Class of Securities)

375916103

(CUSIP Number)

Usman Nabi

Browning West LP

1999 Avenue of the Stars

Suite 1150

Los Angeles, California 90067

(310) 984-7600

Andrew M. Freedman

Olshan Frome Wolosky LLP

1325 Avenue of the Americas

New York, New York 10019

(212) 451-2300

(Name, Address and Telephone Number of Person

Authorized to Receive Notices

and Communications)

January 31, 2024

(Date of Event Which Requires

Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box ¨.

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

1

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Browning West, LP |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

DELAWARE |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

8,640,448 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

8,640,448 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

8,640,448 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

5.0% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

PN, IA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Usman Nabi |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

USA |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

8,640,448 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

8,640,448 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

8,640,448 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

5.0% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN, HC |

|

The following constitutes

Amendment No. 3 to the Schedule 13D filed by the undersigned (“Amendment No. 3”). This Amendment No. 3 amends the Schedule

13D as specifically set forth herein.

| Item 4. | Purpose of Transaction. |

Item 4 is hereby amended

to add the following:

On January 29, 2024, the

Issuer announced that the Board has called an Annual and Special Meeting of Shareholders (the “Meeting”) to be held on May

28, 2024, in response to the Reporting Persons’ requisition for a Special Meeting, delivered on January 9, 2024, seeking the removal

and replacement of eight incumbent directors and requesting the Board set a date in March 2024. Despite having called the Special Meeting

as part of a combined Meeting, the Issuer simultaneously announced that it would be seeking a court judgment to invalidate and cancel

the Special Meeting.

In response to the Issuer’s

announcement, the Reporting Persons issued a press release (the “January 29 Press Release”) voicing their severe disappointment

with, among other things, the Board’s decision to set a meeting date for nearly five months after receiving the Reporting Persons’

valid requisition.

Usman S. Nabi, of the Reporting

Persons, and Peter M. Lee commented as follows in the January 29 Press Release:

“Through its actions,

including refusing to set a timely date for the Meeting, the Board is once again demonstrating a complete disregard for sound corporate

governance and a total lack of respect for the will of shareholders. It appears the Board has learned nothing from its recent string of

ill-conceived decisions and publicity stunts, which seem to have only succeeded in alienating shareholders. Indeed, it is as if the Board

is oblivious to the fact that holders of approximately 35% of Gildan’s outstanding shares publicly support our campaign and efforts

to expeditiously reinstate Glenn Chamandy as Chief Executive Officer. It is clear to us – and presumably to all other Gildan shareholders

– that setting a Meeting date nearly five months after receiving a valid requisition for a Special Meeting is a transparent attempt

to buy time for a seemingly unqualified Chief Executive Officer with a record of value destruction and an entrenched Board.

With respect to Gildan’s

comments regarding Browning West’s requisition and the Company’s planned court application, we are severely disappointed by

the Board’s continued attempts to distract shareholders by focusing on a U.S. regulatory question that is entirely irrelevant to

our valid requisition under Canadian law. The Board has acknowledged in its own press release that it agrees with the view of a critical

mass of shareholders that a speedy resolution of the current situation is in the Company’s best interest, which is precisely what

a more urgently called Special Meeting would provide. Why then is the Board choosing to waste shareholder resources on a legal action

that does not change the reality that Browning West – and more significantly, ~35% of Gildan’s outstanding shares –

clearly support holding a Special Meeting? The Board is also fully aware that Browning West can easily pivot from a Special Meeting and

pursue the exact same Board reconstitution through a regular proxy process. The only logical explanation for why the Board is pursuing

a legal challenge is that it is being led astray by its high-priced legal advisors, who are economically incentivized to recommend scorched-earth

tactics. Any legal action at this point only further impugns the Board’s credibility and will serve as another justification for

replacing a majority of the sitting directors. Browning West is considering all of its rights.

The Board should recognize

Gildan’s stakeholders have been suffering through a vacuum of credible leadership for almost two months, and each day of delay

risks permanent damage to the Company. We urge the Board to reconsider its self-serving decision and hold our requisitioned Special Meeting

without unjustifiable delay.”

On January 31, 2024, the

Reporting Persons announced that, after careful consideration, they have decided to nominate a slate of eight highly qualified candidates

for election to the Board at the Issuer’s Annual Meeting scheduled for May 28, 2024, rather than via a Special Meeting. In their

press release (the “January 31 Press Release”), the Reporting Persons noted that they had submitted a requisition for the

Special Meeting as it was the fastest path to reverse the Board’s mistakes, but the Board has acted in a far more entrenched manner

than they could have imagined, by, among other things, both delaying and converging the Annual Meeting with the Special Meeting. As the

Annual and Special Meeting are now to be held on the same date, the Reporting Persons believe there are several advantages to utilizing

the Annual Meeting path instead of the Special Meeting:

| (i) | Running a slate of director candidates at the Issuer’s Annual Meeting enables the Reporting Persons

to simplify the voting process for shareholders while accomplishing the same outcome. If the Board

had promptly convened the Reporting Persons’ requisitioned Special Meeting, shareholders would have been asked to vote on the removal

and election of directors. At the Annual Meeting, all of the sitting directors’ terms will expire, meaning shareholders will only

be voting on the election of candidates for the Board. This provides a cleaner and more convenient format for shareholders to easily elect

the Reporting Persons’ slate of eight highly qualified candidates in place of eight value-destroying incumbents; |

| (ii) | Running a slate of director candidates at the Issuer’s Annual Meeting positions the Reporting Persons

to eliminate the costly sideshow created by the Board’s scorched earth legal tactics. Now that the Board is finally allowing corporate

democracy to play out at the Annual Meeting, there is no need for these directors to continue to waste precious shareholder capital on

litigation aimed at invalidating the Reporting Persons’ requisition. Unlike the current Board, the Reporting Persons are focused

on preserving value by minimizing the absurd level of shareholder funds being wasted to aggressively attack the Issuer’s largest

owners; and |

| (iii) | Running a slate of director candidates at the Issuer’s Annual Meeting allows shareholders to reject

the seemingly unqualified Chief Executive Officer Vincent Tyra, who has a troubling record of value destruction. When the Reporting Persons

submitted their requisition for the Special Meeting on January 9, 2024, Mr. Tyra had not yet been appointed as Chief Executive Officer

and a member of the Board. By focusing their efforts on the Annual Meeting, the Reporting Persons can give all shareholders the opportunity

to reject Mr. Tyra and his track record of value destruction in an unambiguous manner. |

Copies of the January 29

Press Release and January 31 Press Release are attached hereto as Exhibits 99.1 and 99.2, respectively, which are incorporated herein

by reference.

| Item 7. | Material to be Filed as Exhibits. |

Item 7 is hereby amended

to add the following exhibits:

| 99.1 | January 29 Press Release. |

| 99.2 | January 31 Press Release. |

SIGNATURES

After reasonable inquiry

and to the best of his knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete

and correct.

Dated: February 2, 2024

| |

Browning West, LP |

| |

|

|

| |

By: |

/s/ Samuel Green |

| |

|

Name: |

Samuel Green |

| |

|

Title: |

Chief Compliance Officer and Chief Financial Officer |

| |

/s/ Usman Nabi |

| |

Usman Nabi |

Exhibit 99.1

Browning West Reacts to the Gildan Activewear Board’s

Attempt to Simultaneously Delay and Cancel a Validly Requisitioned Special Meeting

Notes the Board’s May 28th Meeting

Date is Nearly Five Months from the Date of Browning West’s Requisition

Questions the Board’s Contradictory Decision

to Pursue Irrelevant and Wasteful Litigation to Cancel the Special Meeting, While Claiming the Board Agrees With Feedback from a Critical

Mass of Shareholders That a Speedy Resolution is in the Company’s Best Interest

Warns the Board’s Apparent Desperation and

Refusal to Convene a Timely Meeting Increase the Risk of Permanent Damage to the Company

LOS ANGELES--(BUSINESS WIRE)--Browning West, LP (together

with its affiliates, “Browning West” or “we”), which is a long-term shareholder of Gildan Activewear Inc. (NYSE:

GIL) (TSX: GIL) (“Gildan” or the “Company”) and beneficially owns approximately 5.0% of the Company’s outstanding

shares, today responded to the Company’s announcement that its Board of Directors (the “Board”) has “called”

a so-called annual and special meeting of shareholders (the “Meeting”) to be held on May 28, 2024, while also seeking to cancel

the special meeting of shareholders (the “Special Meeting”). This follows Browning West submitting a valid requisition for

the Special Meeting and requesting the Board set a date in March 2024.

As a reminder, Browning West is seeking to reconstitute

Gildan’s Board and replace the following directors with ethical and qualified candidates: Donald Berg, Maryse

Bertrand, Marc Caira, Shirley Cunningham, Charles Herington, Luc Jobin,

Craig Leavitt, and Chris Shackelton.

Usman S. Nabi and Peter M. Lee of Browning West commented:

“Through its actions, including refusing to set

a timely date for the Meeting, the Board is once again demonstrating a complete disregard for sound corporate governance and a total lack

of respect for the will of shareholders. It appears the Board has learned nothing from its recent string of ill-conceived decisions and

publicity stunts, which seem to have only succeeded in alienating shareholders. Indeed, it is as if the Board is oblivious to the fact

that holders of approximately 35% of Gildan’s outstanding shares publicly support our campaign and efforts to expeditiously reinstate

Glenn Chamandy as Chief Executive Officer. It is clear to us – and presumably to all other Gildan shareholders – that setting

a Meeting date nearly five months after receiving a valid requisition for a Special Meeting is a transparent attempt to buy time

for a seemingly unqualified Chief Executive Officer with a record of value destruction and an entrenched Board.

With respect to Gildan’s comments regarding Browning

West’s requisition and the Company’s planned court application, we are severely disappointed by the Board’s continued

attempts to distract shareholders by focusing on a U.S. regulatory question that is entirely irrelevant to our valid requisition under

Canadian law. The Board has acknowledged in its own press release that it agrees with the view of a critical mass of shareholders that

a speedy resolution of the current situation is in the Company’s best interest, which is precisely what a more urgently called Special

Meeting would provide. Why then is the Board choosing to waste shareholder resources on a legal action that does not change the reality

that Browning West – and more significantly, ~35% of Gildan’s outstanding shares – clearly support holding a Special

Meeting? The Board is also fully aware that Browning West can easily pivot from a Special Meeting and pursue the exact same Board reconstitution

through a regular proxy process. The only logical explanation for why the Board is pursuing a legal challenge is that it is being led

astray by its high-priced legal advisors, who are economically incentivized to recommend scorched-earth tactics. Any legal action at this

point only further impugns the Board’s credibility and will serve as another justification for replacing a majority of the sitting

directors. Browning West is considering all of its rights.

The Board should recognize Gildan’s stakeholders

have been suffering through a vacuum of credible leadership for almost two months, and each day of delay risks permanent damage to the

Company. We urge the Board to reconsider its self-serving decision and hold our requisitioned Special Meeting without unjustifiable delay.”

No Solicitation

This press release is for informational purposes only

and is not a solicitation of proxies. If Browning West determines to solicit proxies in respect of any meeting of shareholders of the

Company, any such solicitation will be undertaken by way of an information circular or as otherwise permitted by applicable Canadian corporate

and securities laws.

Disclaimer for Forward-Looking Information

Certain information in this news release may constitute

“forward-looking information” within the meaning of applicable securities legislation. Forward-looking statements and information

generally can be identified by the use of forward-looking terminology such as “outlook,” “objective,” “may,”

“will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,”

“should,” “plans,” “continue,” or similar expressions suggesting future outcomes or events. Forward-looking

information in this news release may include, but is not limited to, statements of Browning West regarding (i) how Browning West intends

to exercise its legal rights as a shareholder of the Company, and (ii) its plans to make changes at the Board and management of the Company.

Although Browning West believes that the expectations

reflected in any such forward-looking information are reasonable, there can be no assurance that such expectations will prove to be correct.

Such forward-looking statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ

materially from those contained in the statements including, without limitation, the risks that (i) the Company may use tactics to thwart

the rights of Browning West as a shareholder and (ii) the actions being proposed and the changes being demanded by Browning West, may

not take place for any reason whatsoever. Except as required by law, Browning West does not intend to update these forward-looking statements.

Advisors

Olshan Frome Wolosky LLP is serving as legal counsel,

Goodmans LLP is serving as Canadian legal counsel, and Longacre Square Partners is serving as strategic advisor to Browning West. Carson

Proxy is serving as proxy advisor.

About Browning West, LP

Browning West is an independent investment partnership

based in Los Angeles, California. The partnership employs a concentrated, long-term, and fundamental approach to investing and focuses

primarily on investments in North America and Western Europe.

Browning West seeks to identify and invest in a limited

number of high-quality businesses and to hold these investments for multiple years. Backed by a select group of leading foundations, family

offices, and university endowments, Browning West’s unique capital base allows it to focus on long-term value creation at its portfolio

companies.

Contacts

Browning West

info@browningwest.com

310-984-7600

Longacre Square Partners

Charlotte Kiaie / Scott Deveau, 646-386-0091

browningwest@longacresquare.com

Carson Proxy

Christine Carson, 416-804-0825

christine@carsonproxy.com

###

Exhibit 99.2

Browning West to Run Slate of Eight Highly Qualified

Director Candidates for Election at Gildan Activewear’s Annual Meeting

Chooses Annual Meeting Path to Simplify Voting

Process for Shareholders, Mitigate the Board’s Self-Serving and Wasteful Legal Tactics, and Provide a Forum for Rejecting Unqualified

CEO and Director Vincent Tyra

LOS ANGELES--(BUSINESS WIRE)--Browning West, LP (together

with its affiliates, “Browning West” or “we”), which is a long-term shareholder of Gildan Activewear Inc. (NYSE:

GIL) (TSX: GIL) (“Gildan” or the “Company”) and beneficially owns approximately 5.0% of the Company’s outstanding

shares, today announced that, after careful consideration, it has decided to nominate a slate of eight highly qualified candidates for

election to the Board of Directors (the “Board”) at the Company’s annual meeting of shareholders (the “Annual

Meeting”) scheduled for May 28, 2024, rather than via a special meeting of shareholders (the “Special Meeting”).

Browning West initially chose to requisition a Special

Meeting because it was the fastest path to reverse the Board’s succession mistakes. However, the Board has acted in a far more entrenched

manner than previously imagined and has both delayed and converged the Annual Meeting with the Special Meeting. Because both meetings

are now being held on the same day, we believe there are several advantages to utilizing the Annual Meeting path, rather than the Special

Meeting, including:

| · | Running a slate of director candidates at Gildan’s Annual Meeting enables Browning West to simplify

the voting process for shareholders while accomplishing the same outcome. If the Board had promptly convened our requisitioned Special

Meeting, shareholders would have been asked to vote on the removal and election of directors. At the Annual Meeting, all of the

sitting directors’ terms will expire, meaning shareholders will only be voting on the election of candidates for the Board. This

provides a cleaner and more convenient format for shareholders to easily elect our slate of eight highly qualified candidates in place

of eight value-destroying incumbents. |

| · | Running a slate of director candidates at Gildan’s Annual Meeting positions Browning West to

eliminate the costly sideshow created by the Board’s scorched earth legal tactics. Now that the Board is finally allowing corporate

democracy to play out at the Annual Meeting, there is no need for these directors to continue to waste precious shareholder capital on

litigation aimed at invalidating our requisition. Unlike the current Board, we are focused on preserving value by minimizing the absurd

level of shareholder funds being wasted to aggressively attack the Company’s largest owners. |

| · | Running a slate of director candidates at Gildan’s Annual Meeting allows shareholders to reject

the seemingly unqualified Chief Executive Officer Vincent Tyra, who has a troubling record of value destruction. When Browning West

submitted its requisition for the Special Meeting on January 9, 2024, Mr. Tyra had not yet been appointed as Chief Executive Officer and

a member of the Board. By focusing our efforts on the Annual Meeting, we can give all Gildan shareholders the opportunity to reject Mr.

Tyra and his track record of value destruction in an unambiguous manner. |

Usman S. Nabi and Peter M. Lee of Browning West commented:

“Although we are gratified that our efforts have

resulted in Gildan’s Board setting a date for a shareholder vote, we believe the Board has once again embarrassed itself and impugned

what little credibility it has left in the lead-up to this week’s Annual Meeting announcement. The Board responded to our January

9th requisition by spending three weeks disregarding the feedback of numerous long-standing shareholders, leaking misinformation

about Glenn Chamandy, and waging a low-road smear campaign and incessant legal harassment of shareholders. Only under immense public pressure

has the Board reactively set an Annual Meeting date, which is still nearly five months after it received our valid Special Meeting

requisition. While the Board claims it will use some of this time to pursue a resolution with us, this appears to be another instance

of the Board’s entrenchment tactics, particularly in light of the fact that the Company just initiated litigation against us. We

urge shareholders to continue to judge this Board based on its actions rather than its seemingly hollow words.

Gildan stakeholders have been suffering through a vacuum

of credible leadership for almost two months, and each day of delay risks permanent damage to the Company. Now that we have pivoted, the

Board can no longer use the excuse of its wasteful court process to delay the Annual Meeting, which should immediately be moved forward

to early May to align with recent years’ scheduling. We also warn the Board to avoid any self-directed refreshes or other maneuvers

to insulate insiders from accountability. In our view, the Board has completely forfeited its right to make material decisions between

now and the Annual Meeting.”

No Solicitation

This press release is for informational purposes only

and is not a solicitation of proxies. If Browning West determines to solicit proxies in respect of any meeting of shareholders of the

Company, any such solicitation will be undertaken by way of an information circular or as otherwise permitted by applicable Canadian corporate

and securities laws.

Disclaimer for Forward-Looking Information

Certain information in this news release may constitute

“forward-looking information” within the meaning of applicable securities legislation. Forward-looking statements and information

generally can be identified by the use of forward-looking terminology such as “outlook,” “objective,” “may,”

“will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,”

“should,” “plans,” “continue,” or similar expressions suggesting future outcomes or events. Forward-looking

information in this news release may include, but is not limited to, statements of Browning West regarding (i) how Browning West intends

to exercise its legal rights as a shareholder of the Company, and (ii) its plans to make changes at the Board and management of the Company.

Although Browning West believes that the expectations

reflected in any such forward-looking information are reasonable, there can be no assurance that such expectations will prove to be correct.

Such forward-looking statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ

materially from those contained in the statements including, without limitation, the risks that (i) the Company may use tactics to thwart

the rights of Browning West as a shareholder and (ii) the actions being proposed and the changes being demanded by Browning West, may

not take place for any reason whatsoever. Except as required by law, Browning West does not intend to update these forward-looking statements.

Advisors

Olshan Frome Wolosky LLP is serving as legal counsel,

Goodmans LLP is serving as Canadian legal counsel, and Longacre Square Partners is serving as strategic advisor to Browning West. Carson

Proxy is serving as proxy advisor.

About Browning West, LP

Browning West is an independent investment partnership

based in Los Angeles, California. The partnership employs a concentrated, long-term, and fundamental approach to investing and focuses

primarily on investments in North America and Western Europe.

Browning West seeks to identify and invest in a limited

number of high-quality businesses and to hold these investments for multiple years. Backed by a select group of leading foundations, family

offices, and university endowments, Browning West’s unique capital base allows it to focus on long-term value creation at its portfolio

companies.

Contacts

Browning West

info@browningwest.com

310-984-7600

Longacre Square Partners

Greg Marose / Charlotte Kiaie, 646-386-0091

browningwest@longacresquare.com

Carson Proxy

Christine Carson, 416-804-0825

christine@carsonproxy.com

###

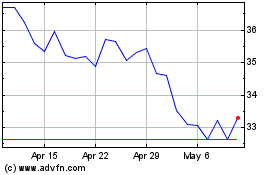

Gildan Activewear (NYSE:GIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

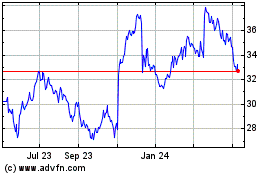

Gildan Activewear (NYSE:GIL)

Historical Stock Chart

From Apr 2023 to Apr 2024