UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

PrimeEnergy Resources Corporation

(Name of Issuer)

Common Stock, $0.10 par value

(Title of Class of Securities)

74158E104

(CUSIP Number)

Gifford Fong

3658 Mt. Diablo Boulevard, Suite 200

Lafayette, CA 94549

925-299-7800

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

February 1, 2024

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(b)(3) or (4), check the following box ☐.

CUSIP No. 74158E104

|

1

|

NAME OF REPORTING PERSON

Gifford Fong

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ☐ (b) ☐

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

112,116(1)

|

|

8

|

SHARED VOTING POWER

0

|

|

9

|

SOLE DISPOSITIVE POWER

54,364(1)

|

|

10

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

112,116(1)

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.18%(2)

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

(1)

|

Includes 18,758 shares held directly by Timothy Fong and 38,994 shares held directly by Steven Fong, for which exclusive voting rights have been granted to Gifford Fong. Gifford Fong expressly disclaims dispositive power over the shares held by Timothy Fong and Steven Fong.

|

|

(2)

|

Based on 1,820,576 shares of Common Stock outstanding as of November 13, 2023 as disclosed on the Issuer’s Quarterly Report on Form 10-Q for the three months ended September 30, 2023, less 5,000 shares the Issuer purchased on January 24, 2024 and which the Issuer intends to cancel.

|

CUSIP No. 74158E104

| |

Item 1.

|

Security and Issuer

|

|

(a)

|

Title of Class of Securities:

|

Common Stock, $0.10 par value (the “Shares”)

PrimeEnergy Resources Corporation (the “Issuer”)

|

(c)

|

Address of Issuer’s Principal Executive Offices:

|

9821 Katy Freeway

Houston, TX 77024

| |

Item 2.

|

Identity and Background

|

|

(a)

|

Name of Reporting Person:

|

Gifford Fong

|

(b)

|

Principal Business Address:

|

Gifford Fong

3658 Mt. Diablo Boulevard, Suite 200

Lafayette, CA 94549

|

(c)

|

Occupation, Employment and Other Information:

|

Mr. Fong is a member of the Board of Directors of the Issuer.

|

(d)

|

Criminal Convictions:

|

Mr. Fong has not, during the past five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

Mr. Fong has not, during the past five years, been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining further violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

United States.

| |

Item 3.

|

Source and Amount of Funds or Other Consideration

|

Not applicable.

| |

Item 4.

|

Purpose of Transaction

|

No Shares were bought or sold by Mr. Fong. This Statement is being filed solely to report an increase in the beneficial ownership due to a reduction in the Issuer’s outstanding Shares.

Mr. Fong has no current plans or proposals which relate to or would result in: (a) the acquisition by any person of additional securities of the Issuer, or the disposition of securities of the Issuer; (b) an extraordinary corporate transaction, such as a merger, reorganization or liquidation, involving the Issuer or any of its subsidiaries; (c) a sale or transfer of a material amount of assets of the Issuer or any of its subsidiaries; (d) any change in the present board of directors or management of the Issuer, including any plans or proposals to change the number or term of directors or to fill any existing vacancies on the board; (e) any material change in the present capitalization or dividend policy of the Issuer; (f) any other material change in the Issuer’s business or corporate structure; (g) changes in the Issuer’s charter, bylaws or instruments corresponding thereto or other actions which may impede the acquisition of control of the Issuer by any person; (h) causing a class of securities of the Issuer to be delisted from a national securities exchange or to cease to be authorized to be quoted in an inter-dealer quotation system of a registered national securities association; (i) a class of equity securities of the Issuer becoming eligible for termination of registration pursuant to Section 12(g)(4) of the Securities Exchange Act of 1934, as amended; or (j) any action similar to any of those enumerated above.

| |

Item 5.

|

Interest in Securities of the Company

|

(a)-(b) Mr. Fong is the beneficial owner of an aggregate of 112,116 Shares, which includes (i) 54,364 Shares held directly by Mr. Fong, with sole voting and dispositive power, (ii) 38,994 Shares as to which Mr. Fong has sole voting power, pursuant to a Voting Agreement, dated June 3, 2023, between Mr. Fong and Steven Fong, who is the record holder of such Shares, and (iii) 18,758 Shares as to which Mr. Fong has sole voting power, pursuant to a Voting Agreement, dated June 3, 2023, between Mr. Fong and Timothy Fong, who is the record holder of such Shares. Mr. Fong has no dispositive power over nor any pecuniary interest in the Shares held by Steven Fong and Timothy Fong. Based on 1,820,576 Shares outstanding as of November 13, 2023 as disclosed on the Issuer’s Quarterly Report on Form 10-Q for the three months ended September 30, 2023, less 5,000 Shares the Issuer purchased on January 24, 2024 and which the Issuer intends to cancel, Mr. Fong may be deemed the beneficial owner of 6.18% of the Issuer’s outstanding Shares.

(c) Mr. Fong did not effect any transactions in Shares in the sixty days prior to the filing of this Statement.

(d) No persons other than Mr. Fong, Steven Fong and Timothy Fong are known to have the right to receive, or the power to direct the receipt of dividends from, or proceeds from the sale of, their respective Shares reflected in this Statement.

(e) Not applicable.

| |

Item 6.

|

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

|

As described in Item 5, each of Steven Fong and Timothy Fong entered into a Voting Agreement with Mr. Fong, each dated as of June 3, 2023, which granted Mr. Fong exclusive and irrevocable voting rights over the respective shares held by Steven Fong and Timothy Fong. Copies of the Voting Agreements are filed herewith as Exhibits 99.1 and 99.2

| |

Item 7.

|

Material to be Filed as Exhibits

|

SIGNATURES

After reasonable inquiry and to the best of our knowledge and belief, we certify that the information set forth in this statement as of February 1, 2024.

| |

By:

|

/s/ Gifford Fong

|

| |

|

Gifford Fong

|

Exhibit 99.1

Voting Agreement

This voting agreement is entered into as of June 3rd, 2023, by and between Steven Fong and Gifford Fong.

Whereas:

Steven Fong is the record and beneficial owner of 38,994 shares of common stock, par value $.10 per share (the "PrimeEnergy shares") of PrimeEnergy Resources Corporation, a Delaware corporation ("PrimeEnergy); and

Steven Fong wishes to give to Gifford Fong the exclusive voting rights with respect to the PrimeEnergy shares;

Now Therefore,

For and in consideration of the premises, and of the mutual rights and benefits between the parties, Steven Fong hereby gives to Gifford Fong voting rights with respect to the PrimeEnergy Shares to which Steven Fong is entitled. The voting rights hereby granted are exclusive and irrevocable. The voting rights are not assignable. Nothing herein shall restrict the sale by Steven Fong of all or any number of the PrimeEnergy shares at any time by Steven Fong, in which event, the voting rights with respect to the PrimeEnergy Shares sold shall terminate; provided that this Agreement shall remain in effect as to the remainder of such shares.

This Agreement and the voting rights hereby granted, shall remain in full force and effect until the death or pem1anent incapacity of either Steven Fong or Gifford Fong, the termination by written agreement of both Steven Fong and Gifford Fong, whichever shall first occur.

Steven Fong and Gifford Fong understand and agree that PrimeEnergy may rely on this Agreement in c01mection with the preparation and filing of appropriate documents with the Securities and Exchange Commission regarding the voting rights hereby granted.

Signed and to be effective as of June 3rd, 2023.

Exhibit 99.2

Voting Agreement

This voting agreement is entered into as of June 3rd, 2023, by and between Timothy Fong and Gifford Fong.

Whereas:

Timothy Fong is the record and beneficial owner of 18758 shares of common stock, par value $.10 per share (the "PrimeEnergy shares") of PrimeEnergy Resources Corporation, a Delaware corporation ("PrimeEnergy); and

Timothy Fong wishes to give to Gifford Fong the exclusive voting rights with respect to the PrimeEnergy shares;

Now Therefore,

For and in consideration of the premises, and of the mutual rights and benefits between the parties, Timothy Fong hereby gives to Gifford Fong voting rights with respect to the PrimeEnergy Shares to which Timothy Fong is entitled. The voting rights hereby granted are exclusive and irrevocable. The voting rights are not assignable. Nothing herein shall restrict the sale by Timothy Fong of all or any number of the PrimeEnergy shares at any time by Timothy Fong, in which event, the voting rights with respect to the PrimeEnergy Shares sold shall terminate; provided that this Agreement shall remain in effect as to the remainder of such shares.

This Agreement and the voting rights hereby granted, shall remain in full force and effect until the death or permanent incapacity of either Timothy Fong or Gifford Fong, the termination by written agreement of both Timothy Fong and Gifford Fong, whichever shall first occur.

Timothy Fong and Gifford Fong understand and agree that PrimeEnergy may rely on this Agreement in connection with the preparation and filing of appropriate documents with the Securities and Exchange Commission regarding the voting rights hereby granted.

Signed and to be effective as of June 3rd, 2023.

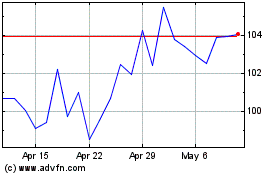

PrimeEnergy Resources (NASDAQ:PNRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

PrimeEnergy Resources (NASDAQ:PNRG)

Historical Stock Chart

From Apr 2023 to Apr 2024