false

0001377121

0001377121

2024-01-31

2024-01-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d)

of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): January 31, 2024

PROTAGONIST THERAPEUTICS, INC.

(Exact name of registrant as specified

in its charter)

| Delaware |

|

001-37852 |

|

98-0505495 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

Protagonist Therapeutics, Inc.

7707 Gateway Blvd., Suite 140

Newark, California 94560-1160

(Address of principal executive offices,

including zip code)

(510) 474-0170

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, par value $0.00001 |

|

PTGX |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry into a Material

Definitive Agreement

Collaboration and License Agreement

On January 31, 2024, Protagonist Therapeutics,

Inc. (the “Company”) entered into a License and Collaboration Agreement (the “Collaboration Agreement”)

with Takeda Pharmaceuticals USA, Inc. (“Takeda”) for the development, manufacture and commercialization of the Company’s

rusfertide product candidate (“Rusfertide”) and other specified second-generation injectable hepcidin mimetic compounds

(the “Licensed Products”). The Collaboration Agreement will become effective (the “Effective Date”)

upon the receipt of clearance under the Hart-Scott-Rodino Antitrust Improvements Act of 1976.

Collaboration and Licenses. The Company

and Takeda have agreed that the parties will, as further described below, jointly develop and commercialize the Licensed Products in the

United States (the “Profit-Share Territory”) and that Takeda solely and exclusively will develop and commercialize

the Licensed Products in all other countries (the “Takeda Territory”). Each of the Company and Takeda is obligated

to use commercially reasonable efforts to develop and commercialize at least one Licensed Product in the Profit-Share Territory, and Takeda

is also obligated to use commercially reasonable efforts to develop and commercialize at least one Licensed Product in major regions of

the Takeda Territory.

The Company and Takeda have agreed to share

costs of the development, manufacture and commercialization activities for the Licensed Products under the Collaboration Agreement in

the Profit-Share Territory, provided that (i) the Company will lead, and will be responsible for its costs associated with, completion

of the ongoing Phase 3 VERIFY program evaluating Rusfertide for the treatment of Polycythemia Vera (the “VERIFY Program”);

(ii) Takeda will lead, and will be responsible for its costs associated with, pre-commercialization activities related to Rusfertide in

the Profit-Share Territory, and (iii) Takeda will lead commercialization of rusfertide globally, with Protagonist holding an option to

co-detail in the U.S. Takeda is solely responsible for all costs for the development, manufacture and commercialization activities under

the Collaboration Agreement in the Takeda Territory, and will have sole responsibility and decision-making authority with respect to such

activities in the Takeda Territory.

The Company has agreed to grant to Takeda

a non-transferable, sublicensable, except for certain specified exceptions, license to certain intellectual property of the

Company as needed to perform the activities under the Collaboration Agreement. Such license is co-exclusive with the Company

in the Profit-Share Territory and exclusive, even as to the Company, in the Takeda Territory, subject to certain retained rights to allow

the Company to exercise its rights and perform its obligations under the Collaboration Agreement.

Financial Terms; Opt-out Rights.

Upfront Payment; Profit Share;

Booking of Revenues. Under the terms of the Collaboration Agreement, Takeda has agreed to pay the Company an upfront payment of $300 million

within 30 days after the Effective Date. For so long as a Licensed Product is being sold in the Profit-Share Territory, the Company and

Takeda will share in all operating profits and losses arising from such Licensed Product in the Profit-Share Territory (50 percent to

the Company and 50 percent to Takeda) as further defined in the Collaboration Agreement. The Collaboration Agreement provides that Takeda

will book sales of Licensed Products globally.

Royalties. Takeda has agreed

to pay the Company tiered royalties of 10% – 17% on net sales of Licensed Products in the Takeda Territory. If the Company has exercised

an Opt-out Right (as defined below), Takeda has agreed to pay the Company royalties of 14% – 29% on worldwide net sales of Licensed

Products with respect to which the Company has exercised an Opt-out Right. Royalty payments may be reduced in certain specified circumstances.

Milestone Payments; Opt-out Payment.

The Collaboration Agreement provides for aggregate development, regulatory and commercial milestone payments from Takeda to the Company

for Licensed Products of (i) up to $330 million if the Company does not exercise an Opt-out Right and remains in the 50:50 profit-

and loss-sharing arrangement in the Profit-Share Territory; and (ii) up to $975 million if the Company exercises the Full Opt-out Right

(as defined below). Milestone payments as to Licensed Products other than Rusfertide may be reduced in certain specified circumstances.

In addition to the milestone payments

described above, in the event the Company exercises the Full Opt-out Right during the Initial Opt-out Period (as defined below), the Company

will receive: (a) a $200 million payment following its exercise of the Full Opt-out Right, and (b) an additional $200 million payment

following FDA approval of the New Drug Application for Rusfertide for polycythemia vera (together, the “Opt-out Payment”).

Opt-out Rights. The Company

will have the right to opt-out entirely of profit- and loss-sharing in the Profit-Share Territory as to all Licensed Products (the “Full

Opt-out Right”) during the 90-day period beginning 120 days after filing of a New Drug Application with the United States Food

and Drug Administration for Rusfertide for Polycythemia Vera (the “Initial Opt-out Period”); and (ii) for convenience

without receipt of the Opt-out Payment (generally following the Initial Opt-out Period). In addition, if the Company does not exercise

the Full Opt-out Right, the Company may opt-out of profit- and loss-sharing in the Profit-Share Territory as to Licensed Products other

than Rusfertide on a Licensed Product-by-Licensed Product basis (each, a “Partial Opt-out Right” and either the Full

Opt-out Right or a Partial Opt-out right being an “Opt-out Right”). Following the Company’s exercise of an Opt-out

Right, the Company has agreed to transition to Takeda applicable development and commercial activities, and Takeda has agreed to assume

sole operational and financial responsibility for such activities.

Governance. The activities of the parties

for the Profit-Share Territory are to be conducted pursuant to joint development plans and joint commercialization plans, on a Licensed Product-by-Licensed Product

basis, and overseen by a joint steering committee (the “JSC”) and various subcommittees, including a Joint Commercialization

Committee and a Joint Development Committee. The JSC shall be composed of an equal number of representatives from each of the Company

and Takeda.

Exclusivity; Right of First Negotiation.

During the term of the Collaboration Agreement, neither party nor any of its respective affiliates is permitted outside of the Collaboration

Agreement to directly or indirectly develop, manufacture, or commercialize injectable hepcidin mimetic products beyond agreed-upon stages

of development (pre-clinical in vitro research activities in the case of the Company, and up to Phase 2b clinical development in

the case of Takeda, respectively are permitted). In addition, the Company has granted to Takeda a 120-day right of first negotiation with

respect to other Company products in the hepcidin pathway.

Termination. Unless earlier terminated,

the Collaboration Agreement expires on a Licensed Product-by-Licensed Product and country-by-country basis on the

later of (a) in the Takeda Territory, the expiration of the royalty term for such Licensed Product in such country or (b) in

the Profit-Share Territory, until the parties agree to permanently stop commercializing such Licensed Product. Takeda may terminate the

Collaboration Agreement for convenience in its entirety or as to a major region by providing advance written notice following the earliest

of (i) the receipt of Phase 3 data with respect to the VERIFY Program, (ii) the third anniversary of the Effective Date or (iii) upon

the occurrence of certain specified adverse events related to the clinical development of Rusfertide. Either party may terminate the Collaboration

Agreement in its entirety (A) in the event of a material breach by the other party, subject to a cure period and (B) in the

event of the insolvency of the other party, in each case subject to specified conditions.

The foregoing description of the terms of

the Collaboration Agreement is qualified in its entirety by reference to the full text of the Collaboration Agreement, a copy of which

the Company intends to file with the U.S. Securities and Exchange Commission as an exhibit to the Company’s Quarterly Report on

Form 10-Q for the quarter ending March 31, 2024.

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Protagonist Therapeutics, Inc. |

| |

|

| Dated: January 31, 2024 |

|

| |

|

| |

By: |

/s/ Asif Ali |

| |

Asif Ali |

| |

|

Chief Financial Officer |

v3.24.0.1

Cover

|

Jan. 31, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 31, 2024

|

| Entity File Number |

001-37852

|

| Entity Registrant Name |

PROTAGONIST THERAPEUTICS, INC.

|

| Entity Central Index Key |

0001377121

|

| Entity Tax Identification Number |

98-0505495

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

7707 Gateway Blvd.

|

| Entity Address, Address Line Two |

Suite 140

|

| Entity Address, City or Town |

Newark

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94560-1160

|

| City Area Code |

510

|

| Local Phone Number |

474-0170

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.00001

|

| Trading Symbol |

PTGX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

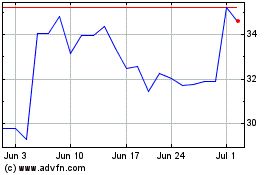

Protagonist Therapeutics (NASDAQ:PTGX)

Historical Stock Chart

From Mar 2024 to Apr 2024

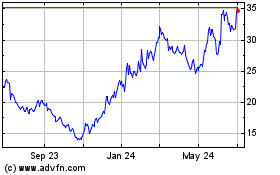

Protagonist Therapeutics (NASDAQ:PTGX)

Historical Stock Chart

From Apr 2023 to Apr 2024