0001534701false00015347012024-01-312024-01-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

January 31, 2024

Date of Report (date of earliest event reported)

Phillips 66

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-35349 | 45-3779385 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

2331 CityWest Boulevard

Houston, Texas 77042

(Address of Principal Executive Offices and Zip Code)

(832) 765-3010

Registrant's telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

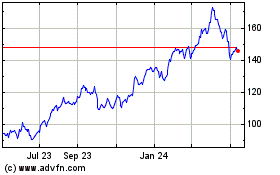

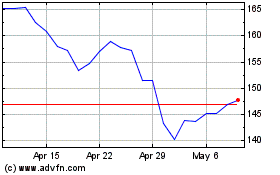

| Common stock, $0.01 par value | PSX | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 31, 2024, Phillips 66 issued a press release announcing the company's financial and operating results for the quarter ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 hereto and incorporated herein by reference. Additional financial and operating information about the quarter is furnished as Exhibit 99.2 hereto and incorporated herein by reference.

The information in this report and the exhibits attached hereto shall not be deemed to be “filed” for purposes of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | | | | |

| | — | |

| | — | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 104 | — | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | PHILLIPS 66 |

| | |

| By: | /s/ J. Scott Pruitt |

| | J. Scott Pruitt Vice President and Controller |

| | |

Date: January 31, 2024

Phillips 66 Delivers Strong 4Q 2023 Results, Advances Strategic Priorities

Fourth Quarter

•Fourth-quarter earnings of $1.3 billion or $2.86 per share; adjusted earnings of $1.4 billion or $3.09 per share

•$2.2 billion of operating cash flow

•$1.6 billion returned to shareholders through dividends and share repurchases

•Strong Refining operations at 92% utilization and 107% market capture

•Record NGL fractionation volumes and LPG export volumes

Full-Year 2023

•Earnings of $7.0 billion or $15.48 per share; adjusted earnings of $7.2 billion or $15.81 per share

•$7.0 billion of operating cash flow, $8.8 billion excluding working capital

•$5.9 billion returned to shareholders through dividends and share repurchases

•Quarterly dividend increased 8% to $1.05 per common share

•$1.2 billion in run-rate business transformation savings

•Strong Refining operations with four consecutive quarters above industry-average crude utilization

•Advancing Midstream NGL wellhead-to-market strategy; acquired all outstanding DCP Midstream, LP public common units

HOUSTON, Jan. 31, 2024 – Phillips 66 (NYSE: PSX), a leading diversified and integrated downstream energy company, announced fourth-quarter earnings of $1.3 billion, compared with earnings of $2.1 billion in the third quarter. Excluding special items of $102 million, the company had adjusted earnings of $1.4 billion in the fourth quarter, compared with third-quarter adjusted earnings of $2.1 billion. In addition, the company provided an update on progress toward its strategic priorities.

“In the fourth quarter, our team’s operating and commercial excellence allowed us to capture value across our diversified and integrated portfolio and deliver strong earnings,” said Mark Lashier, president and CEO of Phillips 66.

“In Refining, we increased market capture and continued to deliver above industry average crude utilization. In Midstream, our NGL wellhead-to-market business continues to exceed our expectations, achieving strong results and record volumes in the quarter.

“As we look forward, we will continue to execute our strategic priorities to deliver significant shareholder value. During 2023, we distributed well over 50% of our operating cash flow to shareholders through dividends and share repurchases. We have distributed $8.3 billion to shareholders since July 2022, on pace to achieve our $13 billion to $15 billion target by year-end 2024.”

“The Board is pleased with the company’s results, which reflect management’s progress on our strategic priorities and our collective commitment to deliver shareholder value today and in the future,” stated Glenn Tilton, Lead Independent Director.

Midstream | | | | | | | | | | | | | | | | | |

| Millions of Dollars |

| | | | | |

| |

| Pre-Tax Income | | Adjusted Pre-Tax Income |

| Q4 2023 | Q3 2023 | | Q4 2023 | Q3 2023 |

| Transportation | $ | 334 | 386 | | 334 | 285 |

| NGL and Other | 425 | 335 | | 423 | 293 |

| | | | | |

| NOVONIX | (3) | (9) | | (3) | (9) |

| Midstream | $ | 756 | 712 | | 754 | 569 |

Midstream fourth-quarter 2023 pre-tax income was $756 million, compared with $712 million in the third quarter of 2023. Results in the fourth quarter included a $2 million tax benefit. The third quarter included a gain of $101 million on the sale of an investment and a gain of $46 million from a change in inventory method for an acquired business, partially offset by $4 million of restructuring costs.

Transportation fourth-quarter adjusted pre-tax income was $334 million, compared with adjusted pre-tax income of $285 million in the third quarter. The increase mainly reflects recognition of deferred revenue related to throughput and deficiency agreements.

NGL and Other adjusted pre-tax income was $423 million in the fourth quarter, compared with adjusted pre-tax income of $293 million in the third quarter. The increase was primarily due to higher margins and volumes at the Sweeny Hub, as well as lower operating costs.

In the fourth quarter, the fair value of the company’s investment in NOVONIX, Ltd. decreased by $3 million, compared with a $9 million decrease in the third quarter.

Chemicals

| | | | | | | | | | | | | | | | | |

| Millions of Dollars |

| | | | | |

| |

| Pre-Tax Income | | Adjusted Pre-Tax Income |

| Q4 2023 | Q3 2023 | | Q4 2023 | Q3 2023 |

| | | | | |

| | | | | |

| | | | | |

| Chemicals | $ | 106 | | 104 | | | 106 | | 104 | |

The Chemicals segment reflects Phillips 66’s equity investment in Chevron Phillips Chemical Company LLC (CPChem). Chemicals fourth-quarter 2023 reported and adjusted pre-tax income was $106 million, in line with third quarter 2023 pre-tax income of $104 million.

Global olefins and polyolefins utilization was 94% for the quarter.

Refining

| | | | | | | | | | | | | | | | | |

| Millions of Dollars |

| | | | | |

| |

| Pre-Tax Income | | Adjusted Pre-Tax Income |

| Q4 2023 | Q3 2023 | | Q4 2023 | Q3 2023 |

| Refining | $ | 814 | | 1,710 | | | 797 | | 1,740 | |

Refining fourth-quarter 2023 reported pre-tax income was $814 million, compared with pre-tax income of $1.7 billion in the third quarter of 2023. Results in the fourth quarter included a $17 million tax benefit. Results in the third quarter included a $30 million legal accrual.

Adjusted pre-tax income for Refining was $797 million in the fourth quarter, compared with adjusted pre-tax income of $1.7 billion in the third quarter. The decrease was primarily due to lower realized margins, which decreased from $18.96 per barrel in the third quarter to $14.41 per barrel in the fourth quarter. Realized margins declined primarily due to lower market crack spreads, partially offset by inventory hedge impacts, higher Gulf Coast clean product realizations and strong commercial results. The composite RIN adjusted market crack spread decreased 53% from $28.64 per barrel in the third quarter to $13.41 per barrel in the fourth quarter.

Refining pre-tax turnaround expense for the fourth quarter was $100 million, including $14 million related to the Rodeo renewables facility. Crude utilization rate was 92% and clean product yield was 87%. Market capture increased from 66% to 107%.

Marketing and Specialties | | | | | | | | | | | | | | | | | |

| Millions of Dollars |

| | | | | |

| |

| Pre-Tax Income | | Adjusted Pre-Tax Income |

| Q4 2023 | Q3 2023 | | Q4 2023 | Q3 2023 |

| Marketing and Specialties | $ | 432 | | 633 | | | 432 | | 633 | |

Marketing and Specialties fourth-quarter 2023 reported and adjusted pre-tax income was $432 million, compared with $633 million in the third quarter of 2023, mainly due to seasonally lower domestic wholesale fuel margins.

Corporate and Other

| | | | | | | | | | | | | | | | | |

| Millions of Dollars |

| |

| | | | | |

| Pre-Tax Loss | | Adjusted Pre-Tax Loss |

| Q4 2023 | Q3 2023 | | Q4 2023 | Q3 2023 |

| Corporate and Other | $ | (347) | | (346) | | | (297) | | (295) | |

Corporate and Other fourth-quarter 2023 pre-tax costs were $347 million, compared with pre-tax costs of $346 million in the third quarter of 2023. Results in the fourth and third quarter included restructuring costs of $50 million and $51 million, respectively.

Adjusted pre-tax costs were $297 million in the fourth quarter, in line with adjusted third-quarter pre-tax costs of $295 million.

Financial Position, Liquidity and Return of Capital

Phillips 66 generated $2.2 billion in cash from operations in the fourth quarter of 2023.

During the fourth quarter, Phillips 66 funded $634 million of capital expenditures and investments, $1.2 billion of share repurchases and $457 million in dividends. The company ended the quarter with 430 million shares outstanding.

As of Dec. 31, 2023, the company had $3.3 billion of cash and cash equivalents and $6.4 billion of committed capacity available under credit facilities. The company’s consolidated debt-to-capital ratio was 38% and its net debt-to-capital ratio was 34%.

Strategic Priorities and Business Update

Phillips 66 is executing its strategic priorities to increase mid-cycle adjusted EBITDA by $4 billion to $14 billion by 2025 and grow shareholder distributions.

The company achieved $1.2 billion in run-rate cost and sustaining capital savings as of Dec. 31, 2023, through business transformation. The company is targeting $1.4 billion run-rate savings by the end of 2024.

In Refining, the company continues to improve asset reliability and market capture through high-return, low-capital projects. The company is implementing 10 to 15 projects annually to increase market capture by 5% by 2025. In 2023, completed projects added over 1% to market capture based on mid-cycle pricing.

Phillips 66 is capturing value from its Midstream NGL wellhead-to-market strategy. Through the end of 2023, the company’s increased ownership of DCP Midstream has provided an incremental $1.25 billion toward its 2025 mid-cycle adjusted EBITDA target, including approximately $250 million of synergies. The company remains focused on capturing over $400 million of run-rate commercial and operating synergies by 2025.

In Chemicals, CPChem completed construction and began operations of a 1 billion pounds per year propylene splitter at its Cedar Bayou facility in the fourth quarter. CPChem is building world-scale petrochemical facilities with joint-venture partner QatarEnergy on the U.S. Gulf Coast and in Ras Laffan, Qatar. Both projects are expected to start up in 2026.

Phillips 66 is converting its San Francisco Refinery in Rodeo, California, into one of the world’s largest renewable fuels facilities. Construction continues on the Rodeo Renewed refinery conversion project that is expected to begin operations in the first quarter of 2024. The conversion will reduce emissions from the facility and produce lower carbon intensity transportation fuels. Upon completion, the facility will have over 50,000 BPD (800 million gallons per year) of renewable fuel production capacity.

Since July 2022 the company has distributed $8.3 billion through share repurchases and dividends and is on pace to achieve the $13 billion to $15 billion target by year-end 2024.

Phillips 66 also plans to monetize assets that no longer fit its long-term strategy. These asset dispositions are expected to generate over $3 billion in proceeds that will support the company’s strategic priorities, including returns to shareholders. Timing of these dispositions will be subject to satisfactory market conditions and any necessary regulatory approvals. Total proceeds from asset dispositions in 2023 were $392 million.

Investor Webcast

Members of Phillips 66 executive management will host a webcast at noon ET to provide an update on the company’s strategic initiatives and discuss the company’s fourth-quarter performance. To access the webcast and view related presentation materials, go to phillips66.com/investors and click on “Events & Presentations.” For detailed supplemental information, go to phillips66.com/supplemental.

| | | | | | | | | | | | | | | | | | | | |

| Earnings | | | | | | |

| Millions of Dollars |

| 2023 | | 2022 |

| Q4 | Q3 | Year | | Q4 | Year |

| Midstream | $ | 756 | | 712 | | 2,774 | | | 656 | | 4,734 | |

| Chemicals | 106 | | 104 | | 600 | | | 52 | | 856 | |

| Refining | 814 | | 1,710 | | 5,266 | | | 1,640 | | 7,816 | |

| Marketing and Specialties | 432 | | 633 | | 2,135 | | | 539 | | 2,402 | |

| Corporate and Other | (347) | | (346) | | (1,306) | | | (340) | | (1,169) | |

| Pre-Tax Income | 1,761 | | 2,813 | | 9,469 | | | 2,547 | | 14,639 | |

| Less: Income tax expense | 476 | | 670 | | 2,230 | | | 535 | | 3,248 | |

| Less: Noncontrolling interests | 25 | | 46 | | 224 | | | 128 | | 367 | |

| Phillips 66 | $ | 1,260 | | 2,097 | | 7,015 | | | 1,884 | | 11,024 | |

| | | | | | |

| Adjusted Earnings | | | | | | |

| Millions of Dollars |

| 2023 | | 2022 |

| Q4 | Q3 | Year | | Q4 | Year |

| Midstream | $ | 754 | | 569 | | 2,627 | | | 674 | | 1,752 | |

| Chemicals | 106 | | 104 | | 600 | | | 52 | | 856 | |

| Refining | 797 | | 1,740 | | 5,293 | | | 1,626 | | 7,891 | |

| Marketing and Specialties | 432 | | 633 | | 2,135 | | | 539 | | 2,402 | |

| Corporate and Other | (297) | | (295) | | (1,076) | | | (280) | | (1,010) | |

| Pre-Tax Income | 1,792 | | 2,751 | | 9,579 | | | 2,611 | | 11,891 | |

| Less: Income tax expense | 405 | | 660 | | 2,173 | | | 574 | | 2,613 | |

| Less: Noncontrolling interests | 25 | | 21 | | 243 | | | 138 | | 377 | |

| Phillips 66 | $ | 1,362 | | 2,070 | | 7,163 | | | 1,899 | | 8,901 | |

| | | | | | |

|

|

About Phillips 66

Phillips 66 (NYSE: PSX) is a leading diversified and integrated downstream energy provider that manufactures, transports and markets products that drive the global economy. The company’s portfolio includes Midstream, Chemicals, Refining, and Marketing and Specialties businesses. Headquartered in Houston, Phillips 66 has employees around the globe who are committed to safely and reliably providing energy and improving lives while pursuing a lower-carbon future. For more information, visit phillips66.com or follow @Phillips66Co on LinkedIn.

- # # # -

| | | | | | | | |

| CONTACTS | | |

| Jeff Dietert (investors) | Owen Simpson (investors) | Thaddeus Herrick (media) |

| 832-765-2297 | 832-765-2297 | 855-841-2368 |

| jeff.dietert@p66.com | owen.simpson@p66.com | thaddeus.f.herrick@p66.com |

| | |

| | |

CAUTIONARY STATEMENT FOR THE PURPOSES OF THE “SAFE HARBOR” PROVISIONS

OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This news release contains forward-looking statements within the meaning of the federal securities laws. Words such as “adjusted EBITDA,” “anticipated,” “estimated,” “expected,” “planned,” “scheduled,” “targeted,” “believe,” “continue,” “intend,” “will,” “would,” “objective,” “goal,” “project,” “efforts,” “strategies” and similar expressions that convey the prospective nature of events or outcomes generally indicate forward-looking statements. However, the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements included in this news release are based on management’s expectations, estimates and projections as of the date they are made. These statements are not guarantees of future performance and you should not unduly rely on them as they involve certain risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecast in such forward-looking statements. Factors that could cause actual results or events to differ materially from those described in the forward-looking statements include: fluctuations in NGL, crude oil, refined petroleum product and natural gas prices, and refining, marketing and petrochemical margins; changes in governmental policies or laws that relate to NGL, crude oil, natural gas, refined petroleum products, or renewable fuels that regulate profits, pricing, or taxation, or other regulations that limit or restrict refining, marketing and midstream operations or restrict exports; the effects of any widespread public health crisis and its negative impact on commercial activity and demand for refined petroleum products; our ability to timely obtain or maintain permits necessary for capital projects; changes to worldwide government policies relating to renewable fuels and greenhouse gas emissions that adversely affect programs including the renewable fuel standards program, low carbon fuel standards and tax credits for biofuels; our ability to achieve the expected benefits of the integration of DCP Midstream, LP (DCP), including the realization of synergies; the success of the company’s business transformation initiatives and the realization of savings and cost reductions from actions taken in connection therewith; unexpected changes in costs for constructing, modifying or operating our facilities; our ability to successfully complete, or any material delay in the completion of, asset dispositions or acquisitions that we may pursue; unexpected difficulties in manufacturing, refining or transporting our products; the level and success of drilling and production volumes around our midstream assets; risks and uncertainties with respect to the actions of actual or potential competitive suppliers and transporters of refined petroleum products, renewable fuels or specialty products; lack of, or disruptions in, adequate and reliable transportation for our NGL, crude oil, natural gas, and refined products; potential liability from litigation or for remedial actions, including removal and reclamation obligations under environmental regulations; failure to complete construction of capital projects on time and within budget; our ability to comply with governmental regulations or make capital expenditures to maintain compliance with laws; limited access to capital or significantly higher cost of capital related to illiquidity or uncertainty in the domestic or international financial markets, which may also impact our ability to repurchase shares and declare and pay dividends; potential disruption of our operations due to accidents, weather events, including as a result of climate change, acts of terrorism or cyberattacks; general domestic and international economic and political developments including armed hostilities (including the Russia-Ukraine war), expropriation of assets, and other political, economic or diplomatic developments; international monetary conditions and exchange controls; changes in estimates or projections used to assess fair value of intangible assets, goodwill and property and equipment and/or strategic decisions with respect to our asset portfolio that cause impairment charges; investments required, or reduced demand for products, as a result of environmental rules and regulations; changes in tax, environmental and other laws and regulations (including alternative energy mandates); political and societal concerns about climate change that could result in changes to our business or increase expenditures, including litigation-related expenses; the operation, financing and distribution decisions of equity affiliates we do not control; and other economic, business, competitive and/or regulatory factors affecting Phillips 66’s businesses generally as set forth in our filings with the Securities and Exchange Commission. Phillips 66 is under no obligation (and expressly disclaims any such obligation) to update or alter its forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Non-GAAP Financial Information—This news release includes the terms “adjusted earnings,” “adjusted pre-tax income (loss),” “adjusted pre-tax costs,” “adjusted earnings per share,” “realized refining margin per barrel,” and “net debt-to-capital ratio.” These are non-GAAP financial measures that are included to help facilitate comparisons of operating performance across periods and to help facilitate comparisons with other companies in our industry. Where applicable, these measures exclude items that do not reflect the core operating results of our businesses in the current period or other adjustments to reflect how management analyzes results. Reconciliations of these non-GAAP financial measures to the most comparable GAAP financial measure are included within this release.

This news release also includes the term “mid-cycle adjusted EBITDA,” which is a non-GAAP financial measure. Mid-cycle adjusted EBITDA, as used in this release, is a forward-looking non-GAAP financial measure. EBITDA is defined as estimated net income plus estimated net interest expense, income taxes, and depreciation and amortization. Adjusted EBITDA is defined as estimated EBITDA plus the proportional share of selected equity affiliates’ estimated net interest expense, income taxes, and depreciation and amortization less the portion of estimated adjusted EBITDA attributable to noncontrolling interests. Net income is the most directly comparable GAAP financial measure for the consolidated company and income before income taxes is the most directly comparable GAAP financial measure for operating segments. Mid-cycle adjusted EBITDA is defined as the average adjusted EBITDA generated over a complete economic cycle. Mid-cycle adjusted EBITDA estimates or targets depend on future levels of revenues and expenses, including amounts that will be attributable to noncontrolling interests, which are not reasonably estimable at this time. Accordingly, we cannot provide a reconciliation of projected mid-cycle adjusted EBITDA to consolidated net income or segment income before income taxes without unreasonable effort.

References in the release to earnings refer to net income attributable to Phillips 66. References in the release to shareholder distributions refers to the sum of dividends paid to Phillips 66 stockholders and proceeds used by Phillips 66 to repurchase shares of its common stock. References to run-rate cost savings includes cost savings and references to run-rate synergies include costs savings and other benefits that will be reflected in the sales and other operating revenues, purchased crude oil and products costs, operating expenses, selling, general and administrative expenses and equity in earnings of affiliates lines on our consolidated statement of income when realized. References to run-rate sustaining capital savings includes savings that will be reflected in the capital expenditures and investments on our consolidated statement of cash flows when realized. References to run-rate savings represent the sum of run-rate cost savings and run-rate sustaining capital savings.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Millions of Dollars |

| Except as Indicated |

| 2023 | | | | 2022 |

| Q4 | Q3 | Year | | | | Q4 | | Year |

| Reconciliation of Consolidated Earnings to Adjusted Earnings | | | | | | | | | |

| Consolidated Earnings | $ | 1,260 | | 2,097 | | 7,015 | | | | | 1,884 | | | 11,024 | |

| Pre-tax adjustments: | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Certain tax impacts | (19) | | — | | (19) | | | | | — | | | — | |

| | | | | | | | | |

| Hurricane-related costs | — | | — | | — | | | | | (14) | | | (21) | |

| | | | | | | | | |

| | | | | | | | | |

| Net gain on asset disposition | — | | (101) | | (123) | | | | | — | | | — | |

Alliance shutdown-related costs1 | — | | — | | — | | | | | — | | | 26 | |

| Regulatory compliance costs | — | | — | | — | | | | | — | | | 70 | |

| Legal accrual | — | | 30 | | 30 | | | | | — | | | — | |

Business transformation restructuring costs2 | 50 | | 51 | | 177 | | | | | 60 | | | 159 | |

| Loss on early redemption of DCP debt | — | | — | | 53 | | | | | — | | | — | |

| Merger transaction costs | — | | — | | — | | | | | — | | | 13 | |

| Gain on consolidation | — | | — | | — | | | | | — | | | (3,013) | |

| Change in inventory method for acquired business | — | | (46) | | (46) | | | | | — | | | — | |

DCP integration restructuring costs3 | — | | 4 | | 38 | | | | | 18 | | | 18 | |

Tax impact of adjustments4 | (12) | | 10 | | (26) | | | | | (14) | | | 635 | |

| Other tax impacts | 83 | | — | | 83 | | | | | (25) | | | — | |

| Noncontrolling interests | — | | 25 | | (19) | | | | | (10) | | | (10) | |

| Adjusted earnings | $ | 1,362 | | 2,070 | | 7,163 | | | | | 1,899 | | | 8,901 | |

Earnings per share of common stock (dollars) | $ | 2.86 | | 4.69 | | 15.48 | | | | | 3.97 | | | 23.27 | |

Adjusted earnings per share of common stock (dollars)5 | $ | 3.09 | | 4.63 | | 15.81 | | | | | 4.00 | | | 18.79 | |

| | | | | | | | | |

| Reconciliation of Segment Pre-Tax Income (Loss) to Adjusted Pre-Tax Income (Loss) | | | | | | | | | |

| Midstream Pre-Tax Income | $ | 756 | | 712 | | 2,774 | | | | | 656 | | | 4,734 | |

| Pre-tax adjustments: | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Certain tax impacts | (2) | | — | | (2) | | | | | — | | | — | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Net gain on asset disposition | — | | (101) | | (137) | | | | | — | | | — | |

| | | | | | | | | |

| Merger transaction costs | — | | — | | — | | | | | — | | | 13 | |

| Gain on consolidation | — | | — | | — | | | | | — | | | (3,013) | |

| Change in inventory method for acquired business | — | | (46) | | (46) | | | | | — | | | — | |

DCP integration restructuring costs3 | — | | 4 | | 38 | | | | | 18 | | | 18 | |

| Adjusted pre-tax income | $ | 754 | | 569 | | 2,627 | | | | | 674 | | | 1,752 | |

| Chemicals Pre-Tax Income | $ | 106 | | 104 | | 600 | | | | | 52 | | | 856 | |

| Pre-tax adjustments: | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| None | — | | — | | — | | | | | — | | | — | |

| Adjusted pre-tax income | $ | 106 | | 104 | | 600 | | | | | 52 | | | 856 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Refining Pre-Tax Income | $ | 814 | | 1,710 | | 5,266 | | | | | 1,640 | | | 7,816 | |

| Pre-tax adjustments: | | | | | | | | | |

| | | | | | | | | |

| Certain tax impacts | (17) | | — | | (17) | | | | | — | | | — | |

| | | | | | | | | |

| | | | | | | | | |

| Hurricane-related costs | — | | — | | — | | | | | (14) | | | (21) | |

| | | | | | | | | |

| | | | | | | | | |

| Net loss on asset disposition | — | | — | | 14 | | | | | — | | | — | |

Alliance shutdown-related costs1 | — | | — | | — | | | | | — | | | 26 | |

| Regulatory compliance costs | — | | — | | — | | | | | — | | | 70 | |

| Legal accrual | — | | 30 | | 30 | | | | | — | | | — | |

| Adjusted pre-tax income | $ | 797 | | 1,740 | | 5,293 | | | | | 1,626 | | | 7,891 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Marketing and Specialties Pre-Tax Income | $ | 432 | | 633 | | 2,135 | | | | | 539 | | | 2,402 | |

| Pre-tax adjustments: | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| None | — | | — | | — | | | | | — | | | — | |

| Adjusted pre-tax income | $ | 432 | | 633 | | 2,135 | | | | | 539 | | | 2,402 | |

| Corporate and Other Pre-Tax Loss | $ | (347) | | (346) | | (1,306) | | | | | (340) | | | (1,169) | |

| Pre-tax adjustments: | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Business transformation restructuring costs2 | 50 | | 51 | | 177 | | | | | 60 | | | 159 | |

| Loss on early redemption of DCP debt | — | | — | | 53 | | | | | — | | | — | |

| Adjusted pre-tax loss | $ | (297) | | (295) | | (1,076) | | | | | (280) | | | (1,010) | |

| | | | | | | | | |

1Costs related to the shutdown of the Alliance Refinery totaled $26 million pre-tax in the second quarter of 2022. Shutdown-related costs recorded in the Refining segment include pre-tax charges for the disposal of materials and supplies of $20 million, and asset retirements of $6 million recorded in depreciation and amortization expense. |

2Restructuring costs, related to Phillips 66’s multi-year business transformation efforts, are primarily due to consulting fees and severance costs. Additionally, fourth-quarter of 2022 included a held-for-sale asset impairment of $45 million. |

3Restructuring costs, related to the integration of DCP Midstream, primarily reflect severance costs and consulting fees. A portion of these costs are attributable to noncontrolling interests. |

4We generally tax effect taxable U.S.-based special items using a combined federal and state statutory income tax rate of approximately 24%. Taxable special items attributable to foreign locations likewise use a local statutory income tax rate. Nontaxable events reflect zero income tax. These events include, but are not limited to, most goodwill impairments, transactions legislatively exempt from income tax, transactions related to entities for which we have made an assertion that the undistributed earnings are permanently reinvested, or transactions occurring in jurisdictions with a valuation allowance. |

5Q4 2023, Q3 2023 and full year 2022 are based on adjusted weighted-average diluted shares of 440,582 thousand, 447,255 thousand, and 473,728 respectively. Other periods are based on the same weighted-average diluted shares outstanding as that used in the GAAP diluted earnings per share calculation. Income allocated to participating securities, if applicable, in the adjusted earnings per share calculation is the same as that used in the GAAP diluted earnings per share calculation. |

| | | | | | | |

| | | |

| | | |

| Millions of Dollars | | |

| Except as Indicated | | |

| December 31, 2023 | | |

| Debt-to-Capital Ratio | | | |

| Total Debt | $ | 19,359 | | | |

| Total Equity | 31,650 | | | |

| Debt-to-Capital Ratio | 38 | % | | |

| Total Cash | 3,323 | | | |

| Net Debt-to-Capital Ratio | 34 | % | | |

|

| | | | | | | | |

| | |

| Millions of Dollars |

| Except as Indicated |

| 2023 |

| Q4 | Q3 |

Reconciliation of Refining Income Before Income Taxes to

Realized Refining Margins | | |

| Income before income taxes | $ | 814 | | 1,710 | |

| Plus: | | |

| Taxes other than income taxes | 87 | | 93 | |

| Depreciation, amortization and impairments | 227 | | 211 | |

| Selling, general and administrative expenses | 48 | | 39 | |

| Operating expenses | 1,086 | | 1,142 | |

| Equity in (earnings) loss of affiliates | 85 | | (208) | |

| Other segment (income) expense, net | 5 | | (10) | |

| Proportional share of refining gross margins contributed by equity affiliates | 167 | | 416 | |

| Special items: | | |

| Certain tax impacts | (15) | | — | |

| | |

| | |

| Realized refining margins | $ | 2,504 | | 3,393 | |

Total processed inputs (thousands of barrels) | 156,720 | | 156,300 | |

Adjusted total processed inputs (thousands of barrels)* | 173,786 | | 178,929 | |

Income before income taxes (dollars per barrel)** | $ | 5.19 | | 10.94 | |

Realized refining margins (dollars per barrel)***** | $ | 14.41 | | 18.96 | |

| *Adjusted total processed inputs include our proportional share of processed inputs of an equity affiliate. | |

| **Income before income taxes divided by total processed inputs. | |

| ***Realized refining margins per barrel, as presented, are calculated using the underlying realized refining margin amounts, in dollars, divided by adjusted total processed inputs, in barrels. As such, recalculated per barrel amounts using the rounded margins and barrels presented may differ from the presented per barrel amounts. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | Exhibit 99.2 |

| Phillips 66 Earnings Release Supplemental Data |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CONSOLIDATED INCOME STATEMENT* |

| | | | | | | | | | | | | | |

| | | | Millions of Dollars, Except as Indicated |

| | | | 2023 | | 2022 |

| | | | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | YTD | | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | YTD |

| Revenues and Other Income | | | | | | | | | | | |

| Sales and other operating revenues | 34,396 | | 35,090 | | 39,643 | | 38,270 | | 147,399 | | | 36,179 | | 48,577 | | 44,955 | | 40,279 | | 169,990 | |

| Equity in earnings of affiliates | 611 | | 563 | | 562 | | 281 | | 2,017 | | | 685 | | 917 | | 782 | | 584 | | 2,968 | |

| Net gain (loss) on dispositions | 34 | | (12) | | 102 | | (9) | | 115 | | | 1 | | — | | 1 | | 5 | | 7 | |

| Other income (loss)** | 48 | | 99 | | 15 | | 197 | | 359 | | | (143) | | (185) | | 3,026 | | 39 | | 2,737 | |

| Total Revenues and Other Income | 35,089 | | 35,740 | | 40,322 | | 38,739 | | 149,890 | | | 36,722 | | 49,309 | | 48,764 | | 40,907 | | 175,702 | |

| | | | | | | | | | | | | | |

| Costs and Expenses | | | | | | | | | | | |

| Purchased crude oil and products | 29,341 | | 30,571 | | 34,330 | | 33,844 | | 128,086 | | | 33,495 | | 42,645 | | 38,646 | | 35,146 | | 149,932 | |

| Operating expenses | 1,578 | | 1,384 | | 1,633 | | 1,559 | | 6,154 | | | 1,340 | | 1,431 | | 1,612 | | 1,728 | | 6,111 | |

| Selling, general and administrative expenses | 605 | | 593 | | 669 | | 658 | | 2,525 | | | 433 | | 488 | | 617 | | 630 | | 2,168 | |

| Depreciation and amortization | 476 | | 495 | | 488 | | 518 | | 1,977 | | | 338 | | 359 | | 430 | | 502 | | 1,629 | |

| Impairments | 8 | | 4 | | 3 | | 9 | | 24 | | | — | | 2 | | — | | 58 | | 60 | |

| Taxes other than income taxes | 207 | | 174 | | 171 | | 155 | | 707 | | | 149 | | 118 | | 133 | | 130 | | 530 | |

| Accretion on discounted liabilities | 6 | | 7 | | 6 | | 10 | | 29 | | | 6 | | 6 | | 5 | | 6 | | 23 | |

| Interest and debt expense | 192 | | 266 | | 221 | | 218 | | 897 | | | 135 | | 133 | | 158 | | 193 | | 619 | |

| Foreign currency transaction (gains) losses | 25 | | 2 | | (12) | | 7 | | 22 | | | (2) | | 21 | | 5 | | (33) | | (9) | |

| Total Costs and Expenses | 32,438 | | 33,496 | | 37,509 | | 36,978 | | 140,421 | | | 35,894 | | 45,203 | | 41,606 | | 38,360 | | 161,063 | |

| Income before income taxes | 2,651 | | 2,244 | | 2,813 | | 1,761 | | 9,469 | | | 828 | | 4,106 | | 7,158 | | 2,547 | | 14,639 | |

| Income tax expense | 574 | | 510 | | 670 | | 476 | | 2,230 | | | 171 | | 924 | | 1,618 | | 535 | | 3,248 | |

| Net Income | 2,077 | | 1,734 | | 2,143 | | 1,285 | | 7,239 | | | 657 | | 3,182 | | 5,540 | | 2,012 | | 11,391 | |

| Less: net income attributable to noncontrolling interests | 116 | | 37 | | 46 | | 25 | | 224 | | | 75 | | 15 | | 149 | | 128 | | 367 | |

| Net Income Attributable to Phillips 66 | 1,961 | | 1,697 | | 2,097 | | 1,260 | | 7,015 | | | 582 | | 3,167 | | 5,391 | | 1,884 | | 11,024 | |

| | | | | | | |

| | | | | | | | | | | | | | |

| Net Income Attributable to Phillips 66 Per Share of Common Stock (dollars) | | | | | | | | | | | |

| Basic | 4.21 | | 3.73 | | 4.72 | | 2.87 | | 15.56 | | | 1.29 | | 6.55 | | 11.19 | | 3.99 | | 23.36 | |

| Diluted | 4.20 | | 3.72 | | 4.69 | | 2.86 | | 15.48 | | | 1.29 | | 6.53 | | 11.16 | | 3.97 | | 23.27 | |

| | | | | | | | | | | | | | |

| Weighted-Average Common Shares Outstanding (thousands) | | | | | | | | | | | |

| Basic | 464,810 | | 454,450 | | 444,283 | | 437,365 | | 450,136 | | | 449,298 | | 483,088 | | 481,388 | | 471,859 | | 471,497 | |

| Diluted | 467,034 | | 456,168 | | 447,258 | | 440,575 | | 453,210 | | | 450,011 | | 485,035 | | 483,036 | | 474,327 | | 473,731 | |

| | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Effective tax rate (%) | 21.7 | % | 22.7 | % | 23.8 | % | 27.0 | % | 23.6 | % | | 20.7 | % | 22.5 | % | 22.6 | % | 21.0 | % | 22.2 | % |

| Adjusted effective tax rate (%) | 21.6 | % | 22.4 | % | 24.0 | % | 22.6 | % | 22.7 | % | | 20.7 | % | 21.9 | % | 22.3 | % | 22.0 | % | 22.0 | % |

| * Refer to Change in Basis of Presentation discussion on page 14. | | | | | | | |

| ** Includes the unrealized investment loss on our investment in NOVONIX Limited (NOVONIX). See NOVONIX Investment table on page 5 for more details. | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Phillips 66 Earnings Release Supplemental Data |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| RECONCILIATION OF INCOME (LOSS) BEFORE INCOME TAXES BY SEGMENT TO |

| NET INCOME ATTRIBUTABLE TO PHILLIPS 66 |

| | | | | | | | | | | | | | |

| | | | Millions of Dollars |

| | | | 2023 | | 2022 |

| | | | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | YTD | | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | YTD |

| | | | | | | | | | | | | | |

| Midstream* | 702 | | 604 | | 712 | | 756 | | 2,774 | | | 212 | | 258 | | 3,608 | | 656 | | 4,734 | |

| Chemicals | 198 | | 192 | | 104 | | 106 | | 600 | | | 396 | | 273 | | 135 | | 52 | | 856 | |

| Refining | 1,608 | | 1,134 | | 1,710 | | 814 | | 5,266 | | | 173 | | 3,096 | | 2,907 | | 1,640 | | 7,816 | |

| Marketing and Specialties | 426 | | 644 | | 633 | | 432 | | 2,135 | | | 296 | | 739 | | 828 | | 539 | | 2,402 | |

| Corporate and Other | (283) | | (330) | | (346) | | (347) | | (1,306) | | | (249) | | (260) | | (320) | | (340) | | (1,169) | |

| Income before income taxes | 2,651 | | 2,244 | | 2,813 | | 1,761 | | 9,469 | | | 828 | | 4,106 | | 7,158 | | 2,547 | | 14,639 | |

| Less: income tax expense | 574 | | 510 | | 670 | | 476 | | 2,230 | | | 171 | | 924 | | 1,618 | | 535 | | 3,248 | |

| Net Income | 2,077 | | 1,734 | | 2,143 | | 1,285 | | 7,239 | | | 657 | | 3,182 | | 5,540 | | 2,012 | | 11,391 | |

| Less: net income attributable to noncontrolling interests | 116 | | 37 | | 46 | | 25 | | 224 | | | 75 | | 15 | | 149 | | 128 | | 367 | |

| Net Income Attributable to Phillips 66 | 1,961 | | 1,697 | | 2,097 | | 1,260 | | 7,015 | | | 582 | | 3,167 | | 5,391 | | 1,884 | | 11,024 | |

| * Refer to Change in Basis of Presentation discussion on page 14. | | | | | | | |

| | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | |

| | | | |

| | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | |

| RECONCILIATION OF ADJUSTED INCOME (LOSS) BEFORE INCOME TAXES BY SEGMENT TO |

| ADJUSTED NET INCOME ATTRIBUTABLE TO PHILLIPS 66 |

| | | | | | | | | | | | | | |

| | | | Millions of Dollars |

| | | | 2023 | | 2022 |

| | | | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | YTD | | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | YTD |

| Midstream | | | | | | | | | | | | | | |

| Transportation* | 270 | | 284 | | 285 | | 334 | | 1,173 | | | 278 | | 250 | | 229 | | 237 | | 994 | |

| NGL and Other* | 420 | | 357 | | 293 | | 423 | | 1,493 | | | 92 | | 248 | | 412 | | 448 | | 1,200 | |

| | | | | | | | | | | |

| NOVONIX** | (12) | | (15) | | (9) | | (3) | | (39) | | | (158) | | (240) | | (33) | | (11) | | (442) | |

| Total Midstream | 678 | | 626 | | 569 | | 754 | | 2,627 | | | 212 | | 258 | | 608 | | 674 | | 1,752 | |

| Chemicals | 198 | | 192 | | 104 | | 106 | | 600 | | | 396 | | 273 | | 135 | | 52 | | 856 | |

| Refining | | | | | | | | | | | |

| Atlantic Basin/Europe | 142 | | 149 | | 444 | | 160 | | 895 | | | 152 | | 1,111 | | 530 | | 618 | | 2,411 | |

| Gulf Coast | 705 | | 257 | | 342 | | 348 | | 1,652 | | | 58 | | 958 | | 746 | | 360 | | 2,122 | |

| Central Corridor | 739 | | 630 | | 361 | | 480 | | 2,210 | | | (135) | | 513 | | 1,343 | | 716 | | 2,437 | |

| West Coast | 22 | | 112 | | 593 | | (191) | | 536 | | | 115 | | 610 | | 264 | | (68) | | 921 | |

| Total Refining | 1,608 | | 1,148 | | 1,740 | | 797 | | 5,293 | | | 190 | | 3,192 | | 2,883 | | 1,626 | | 7,891 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Total Marketing and Specialties | 426 | | 644 | | 633 | | 432 | | 2,135 | | | 296 | | 739 | | 828 | | 539 | | 2,402 | |

| Corporate and Other | (248) | | (236) | | (295) | | (297) | | (1,076) | | | (249) | | (235) | | (246) | | (280) | | (1,010) | |

| Adjusted income before income taxes | 2,662 | | 2,374 | | 2,751 | | 1,792 | | 9,579 | | | 845 | | 4,227 | | 4,208 | | 2,611 | | 11,891 | |

| Less: adjusted income tax expense | 576 | | 532 | | 660 | | 405 | | 2,173 | | | 175 | | 927 | | 937 | | 574 | | 2,613 | |

| Adjusted Net Income | 2,086 | | 1,842 | | 2,091 | | 1,387 | | 7,406 | | | 670 | | 3,300 | | 3,271 | | 2,037 | | 9,278 | |

| Less: adjusted net income attributable to noncontrolling interests | 121 | | 76 | | 21 | | 25 | | 243 | | | 75 | | 15 | | 149 | | 138 | | 377 | |

| Adjusted Net Income Attributable to Phillips 66 | 1,965 | | 1,766 | | 2,070 | | 1,362 | | 7,163 | | | 595 | | 3,285 | | 3,122 | | 1,899 | | 8,901 | |

| * Refer to Change in Basis of Presentation discussion on page 14. | | | | | | | |

| ** Represents the change in fair value of our investment in NOVONIX. See NOVONIX Investments table on page 5 for more details. | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Phillips 66 Earnings Release Supplemental Data |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| | |

| | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | |

| | |

| | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| SPECIAL ITEMS INCLUDED IN INCOME (LOSS) BEFORE INCOME TAXES BY SEGMENT | | |

| AND NET INCOME ATTRIBUTABLE TO PHILLIPS 66 | | |

| | | | | | | | | | | | | | | | |

| | | | Millions of Dollars | | |

| | | | 2023 | | 2022 | | |

| | | | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | YTD | | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | YTD | | |

| Midstream | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Certain tax impacts | — | | — | | — | | 2 | | 2 | | | — | | — | | — | | — | | — | | | |

| Net gain on asset disposition | 36 | | — | | 101 | | — | | 137 | | | — | | — | | — | | — | | — | | | |

| | | | | | | | | | | | | |

| Merger transaction costs | — | | — | | — | | — | | — | | | — | | — | | (13) | | — | | (13) | | | |

| Gain related to merger of businesses | — | | — | | — | | — | | — | | | — | | — | | 3,013 | | — | | 3,013 | | | |

| Change in inventory method for acquired business | — | | — | | 46 | | — | | 46 | | | — | | — | | — | | — | | — | | | |

| DCP integration restructuring costs* | (12) | | (22) | | (4) | | — | | (38) | | | — | | — | | — | | (18) | | (18) | | | |

| Total Midstream | 24 | | (22) | | 143 | | 2 | | 147 | | | — | | — | | 3,000 | | (18) | | 2,982 | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Chemicals | — | | — | | — | | — | | — | | | — | | — | | — | | — | | — | | | |

| | | | | | | | | | | | | |

| Refining | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Certain tax impacts | — | | — | | — | | 17 | | 17 | | | — | | — | | — | | — | | — | | | |

| Hurricane-related (costs) recovery | — | | — | | — | | — | | — | | | (17) | | — | | 24 | | 14 | | 21 | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net loss on asset disposition | — | | (14) | | — | | — | | (14) | | | — | | — | | — | | — | | — | | | |

| Alliance shutdown-related costs** | — | | — | | — | | — | | — | | | — | | (26) | | — | | — | | (26) | | | |

| Regulatory compliance costs | — | | — | | — | | — | | — | | | — | | (70) | | — | | — | | (70) | | | |

| | | | | | | | | | | | | |

| Legal accrual | — | | — | | (30) | | — | | (30) | | | — | | — | | — | | — | | | | |

| Total Refining | — | | (14) | | (30) | | 17 | | (27) | | | (17) | | (96) | | 24 | | 14 | | (75) | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Marketing and Specialties | — | | — | | — | | — | | — | | | — | | — | | — | | — | | — | | | |

| | | | | | | | | | | | | |

| Corporate and Other | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Business transformation restructuring costs*** | (35) | | (41) | | (51) | | (50) | | (177) | | | — | | (25) | | (74) | | (60) | | (159) | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Loss on early redemption of DCP debt | — | | (53) | | — | | — | | (53) | | | — | | — | | — | | — | | — | | | |

| Total Corporate and Other | (35) | | (94) | | (51) | | (50) | | (230) | | | — | | (25) | | (74) | | (60) | | (159) | | | |

| | | | | | | | | | | | | |

| Total Special Items (Pre-tax) | (11) | | (130) | | 62 | | (31) | | (110) | | | (17) | | (121) | | 2,950 | | (64) | | 2,748 | | | |

| | | | | | | | | | | | | |

| Less: Income Tax Expense (Benefit) | | | | | | | | | | | | | |

| Tax impact of pre-tax special items**** | (2) | | (22) | | 10 | | (12) | | (26) | | | (4) | | (28) | | 681 | | (14) | | 635 | | | |

| Other tax impacts | — | | — | | — | | 83 | | 83 | | | — | | 25 | | — | | (25) | | — | | | |

| | | | | | | | | | | | | |

| Total Income Tax Expense (Benefit) | (2) | | (22) | | 10 | | 71 | | 57 | | | (4) | | (3) | | 681 | | (39) | | 635 | | | |

| | | | | | | | | | | | | |

| Less: Income (Loss) Attributable to Noncontrolling Interests | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Loss on early redemption of DCP debt | — | | (30) | | — | | — | | (30) | | | — | | — | | — | | — | | — | | | |

| Change in inventory method for acquired business | — | | — | | 26 | | — | | 26 | | | — | | — | | — | | — | | — | | | |

| DCP integration restructuring costs* | (5) | | (9) | | (1) | | — | | (15) | | | — | | — | | — | | (10) | | (10) | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total Income (Loss) Attributable to Noncontrolling Interests | (5) | | (39) | | 25 | | — | | (19) | | | — | | — | | — | | (10) | | (10) | | | |

| | | | | | | | | | | | | |

| Total Phillips 66 Special Items (After-tax) | (4) | | (69) | | 27 | | (102) | | (148) | | | (13) | | (118) | | 2,269 | | (15) | | 2,123 | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| * Restructuring costs, related to the integration of DCP Midstream, primarily reflect severance costs and consulting fees. A portion of these costs are attributable to noncontrolling interests. | | |

| ** Costs related to the shutdown of the Alliance Refinery totaled $26 million pre-tax in the second quarter of 2022. Shutdown-related costs recorded in the Refining segment include pre-tax charges for the disposal of materials and supplies of $20 million, and asset retirements of $6 million recorded in depreciation and amortization expense. |

| *** Restructuring costs related to Phillips 66’s multi-year business transformation efforts are primarily due to consulting fees and severance costs. Additionally, fourth quarter of 2022 included a held-for-sale asset impairment of $45 million. |

| **** We generally tax effect taxable U.S.-based special items using a combined federal and state annual statutory income tax rate of approximately 24%. Taxable special items attributable to foreign locations likewise use a local statutory income tax rate. Nontaxable events reflect zero income tax. These events include, but are not limited to, most goodwill impairments, transactions legislatively exempt from income tax, transactions related to entities for which we have made an assertion that the undistributed earnings are permanently reinvested, or transactions occurring in jurisdictions with a valuation allowance. | | |

| | | | | | | | | | | | | |

| SPECIAL ITEMS INCLUDED IN INCOME (LOSS) BEFORE INCOME TAXES BY BUSINESS LINES/REGIONS | | |

| | |

| | | | | | | | | | | | | |

| Millions of Dollars | | |

| 2023 | | 2022 | | |

| 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | YTD | | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | YTD | | |

| | | | | | | | | | | | | |

| Midstream | | | | | | | | | | | | | |

| Transportation | 36 | | — | | 101 | | — | | 137 | | | — | | — | | 182 | | — | | 182 | | | |

| NGL and Other | (12) | | (22) | | 42 | | 2 | | 10 | | | — | | — | | 2,818 | | (18) | | 2,800 | | | |

| | | | | | | | | | | | | |

| NOVONIX | — | | — | | — | | — | | — | | | — | | — | | — | | — | | — | | | |

| Total Midstream | 24 | | (22) | | 143 | | 2 | | 147 | | | — | | — | | 3,000 | | (18) | | 2,982 | | | |

| | | | | | | | | | | | | | | | |

| Refining | | | | | | | | | | | | | |

| Atlantic Basin/Europe | — | | — | | — | | 15 | | 15 | | | — | | (9) | | — | | — | | (9) | | | |

| Gulf Coast | — | | (14) | | — | | 2 | | (12) | | | (17) | | (52) | | 24 | | 14 | | (31) | | | |

| Central Corridor | — | | — | | — | | — | | — | | | — | | (22) | | — | | — | | (22) | | | |

| West Coast | — | | — | | (30) | | — | | (30) | | | — | | (13) | | — | | — | | (13) | | | |

| Total Refining | — | | (14) | | (30) | | 17 | | (27) | | | (17) | | (96) | | 24 | | 14 | | (75) | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Phillips 66 Earnings Release Supplemental Data |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CASH FLOW INFORMATION* |

| | | | | | | | | | | | | | |

| | | | Millions of Dollars |

| | | | 2023 | | 2022 |

| | | | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | YTD | | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | YTD |

| Cash Flows From Operating Activities | | | | | | | | | | | |

| Net income | 2,077 | | 1,734 | | 2,143 | | 1,285 | | 7,239 | | | 657 | | 3,182 | | 5,540 | | 2,012 | | 11,391 | |

| Depreciation and amortization | 476 | | 495 | | 488 | | 518 | | 1,977 | | | 338 | | 359 | | 430 | | 502 | | 1,629 | |

| Impairments | 8 | | 4 | | 3 | | 9 | | 24 | | | — | | 2 | | — | | 58 | | 60 | |

| Accretion on discounted liabilities | 6 | | 7 | | 6 | | 10 | | 29 | | | 6 | | 6 | | 5 | | 6 | | 23 | |

| Deferred income taxes | 146 | | 119 | | 408 | | 167 | | 840 | | | 142 | | 148 | | 856 | | 174 | | 1,320 | |

| Undistributed equity earnings | (242) | | (324) | | (201) | | (55) | | (822) | | | (100) | | (390) | | (495) | | (323) | | (1,308) | |

| Loss on early redemption of debt | — | | 53 | | — | | — | | 53 | | | — | | — | | — | | — | | — | |

| Net (gain) loss on dispositions | (34) | | 12 | | (102) | | 9 | | (115) | | | (1) | | — | | (1) | | (5) | | (7) | |

| Gain related to merger of businesses | — | | — | | — | | — | | — | | | — | | — | | (3,013) | | — | | (3,013) | |

| Unrealized investment loss** | 11 | | 15 | | 8 | | 4 | | 38 | | | 169 | | 221 | | 28 | | 15 | | 433 | |

| Other | 14 | | (115) | | (354) | | 36 | | (419) | | | 40 | | 80 | | (105) | | 202 | | 217 | |

| Net working capital changes | (1,263) | | (1,045) | | 286 | | 207 | | (1,815) | | | (115) | | (1,825) | | (101) | | 2,109 | | 68 | |

| Net Cash Provided by Operating Activities | 1,199 | | 955 | | 2,685 | | 2,190 | | 7,029 | | | 1,136 | | 1,783 | | 3,144 | | 4,750 | | 10,813 | |

| | | | | | | | | | | | | | |

| Cash Flows From Investing Activities | | | | | | | | | | | |

| Capital expenditures and investments | (378) | | (551) | | (855) | | (634) | | (2,418) | | | (370) | | (376) | | (735) | | (713) | | (2,194) | |

| Return of investments in equity affiliates | 60 | | 59 | | 40 | | 42 | | 201 | | | 15 | | 33 | | 30 | | 47 | | 125 | |

| Proceeds from asset dispositions | 77 | | 13 | | 280 | | 22 | | 392 | | | 1 | | 1 | | 1 | | 1 | | 4 | |

| Advances/loans—related parties | — | | — | | — | | — | | — | | | — | | (75) | | — | | — | | (75) | |

| Collection of advances/loans—related parties | — | | — | | 1 | | 2 | | 3 | | | — | | 101 | | 135 | | 426 | | 662 | |

| | | | | | | | | | | |

| Other | (24) | | 47 | | 49 | | (40) | | 32 | | | (74) | | 25 | | 32 | | 7 | | (10) | |

| Net Cash Used in Investing Activities | (265) | | (432) | | (485) | | (608) | | (1,790) | | | (428) | | (291) | | (537) | | (232) | | (1,488) | |

| | | | | | | | | | | | | | |

| Cash Flows From Financing Activities | | | | | | | | | | | |

| Issuance of debt | 2,488 | | 2,559 | | 678 | | 535 | | 6,260 | | | — | | — | | — | | 453 | | 453 | |

| Repayment of debt | (1,223) | | (1,236) | | (1,166) | | (627) | | (4,252) | | | (24) | | (1,457) | | (476) | | (926) | | (2,883) | |

| Issuance of common stock | 10 | | 2 | | 91 | | 20 | | 123 | | | 23 | | 44 | | — | | 36 | | 103 | |

| Repurchase of common stock | (800) | | (1,309) | | (752) | | (1,153) | | (4,014) | | | — | | (66) | | (694) | | (753) | | (1,513) | |

| Dividends paid on common stock | (486) | | (474) | | (465) | | (457) | | (1,882) | | | (404) | | (467) | | (466) | | (456) | | (1,793) | |

| Distributions to noncontrolling interests | (58) | | (67) | | (15) | | (23) | | (163) | | | (77) | | (24) | | (3) | | (81) | | (185) | |

| | | | | | | | | | | |

| Repurchase of noncontrolling interests | — | | (3,957) | | — | | (110) | | (4,067) | | | — | | — | | — | | (500) | | (500) | |

| Other | (48) | | (11) | | (28) | | (10) | | (97) | | | (30) | | (7) | | (18) | | (15) | | (70) | |

| Net Cash Used in Financing Activities | (117) | | (4,493) | | (1,657) | | (1,825) | | (8,092) | | | (512) | | (1,977) | | (1,657) | | (2,242) | | (6,388) | |

| | | | | | | | | | | | | | |

| Effect of Exchange Rate Changes on Cash and Cash Equivalents | 15 | | 34 | | (33) | | 27 | | 43 | | | (8) | | (41) | | (15) | | 113 | | 49 | |

| | | | | | | | | | | | | | |

| Net Change in Cash and Cash Equivalents | 832 | | (3,936) | | 510 | | (216) | | (2,810) | | | 188 | | (526) | | 935 | | 2,389 | | 2,986 | |

| Cash and cash equivalents at beginning of period | 6,133 | | 6,965 | | 3,029 | | 3,539 | | 6,133 | | | 3,147 | | 3,335 | | 2,809 | | 3,744 | | 3,147 | |

| Cash and Cash Equivalents at End of Period | 6,965 | | 3,029 | | 3,539 | | 3,323 | | 3,323 | | | 3,335 | | 2,809 | | 3,744 | | 6,133 | | 6,133 | |

| * Refer to Change in Basis of Presentation discussion on page 14. | | | | | | | |

| ** Represents the unrealized loss on our investment in NOVONIX. See NOVONIX Investment table on page 5 for more details. | | | | | | | |

| | | | | | | | | | | | | | |

| CAPITAL PROGRAM |

| | | | | | | | | | | | | | |

| | | | Millions of Dollars |

| | | | 2023 | | 2022 |

| | | | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | YTD | | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | YTD |

| Consolidated Capital Expenditures and Investments | | | | | | | | | | | |

| Midstream*† | 124 | | 176 | | 160 | | 165 | | 625 | | | 163 | | 105 | | 461 | | 314 | | 1,043 | |

| Chemicals | — | | — | | — | | — | | — | | | — | | — | | — | | — | | — | |

| Refining | 227 | | 329 | | 382 | | 401 | | 1,339 | | | 172 | | 221 | | 211 | | 324 | | 928 | |

| Marketing and Specialties | 11 | | 25 | | 287 | | 41 | | 364 | | | 11 | | 19 | | 30 | | 29 | | 89 | |

| Corporate and Other | 16 | | 21 | | 26 | | 27 | | 90 | | | 24 | | 31 | | 33 | | 46 | | 134 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Consolidated Capital Expenditures and Investments | 378 | | 551 | | 855 | | 634 | | 2,418 | | | 370 | | 376 | | 735 | | 713 | | 2,194 | |

| * Includes 100% of DCP Midstream, LLC Class A Segment (DCP Midstream Class A Segment), DCP Sand Hills Pipeline, LLC (DCP Sand Hills) and DCP Southern Hills Pipeline, LLC (DCP Southern Hills) capital expenditures and investments from August 18, 2022, forward, net of acquired cash. | | | | | | | |

| † Refer to Change in Basis of Presentation discussion on page 14. | | | | | | | |

| | | | | | | | | | | | | | |

Proportional Share of Selected Equity Affiliates Capital Expenditures and Investments* | | | | | | | | | | | |

| CPChem (Chemicals) | 142 | | 377 | | 254 | | 236 | | 1,009 | | | 113 | | 161 | | 158 | | 269 | | 701 | |

| WRB (Refining) | 45 | | 47 | | 36 | | 61 | | 189 | | | 42 | | 47 | | 36 | | 52 | | 177 | |

| Selected Equity Affiliates | 187 | | 424 | | 290 | | 297 | | 1,198 | | | 155 | | 208 | | 194 | | 321 | | 878 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | | |

| * Our share of joint ventures' capital spending, excluding DCP Midstream, LLC (DCP Midstream) due to the consolidation of DCP Midstream Class A Segment. Refer to Change in Basis of Presentation discussion on page 14. | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Phillips 66 Earnings Release Supplemental Data |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| MIDSTREAM | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | Millions of Dollars, Except as Indicated | | | | |

| | | | 2023 | | 2022 | | | | |

| | | | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | YTD | | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | YTD | | | | |

| Income before Income Taxes | | | | | | | | | | | | | | | |

| Transportation* | 306 | | 284 | | 386 | | 334 | | 1,310 | | | 278 | | 250 | | 411 | | 237 | | 1,176 | | | | | |

| NGL and Other* | 408 | | 335 | | 335 | | 425 | | 1,503 | | | 92 | | 248 | | 3,230 | | 430 | | 4,000 | | | | | |

| | | | | | | | | | | | | | | |

| NOVONIX | (12) | | (15) | | (9) | | (3) | | (39) | | | (158) | | (240) | | (33) | | (11) | | (442) | | | | | |

| Income before Income Taxes | 702 | | 604 | | 712 | | 756 | | 2,774 | | | 212 | | 258 | | 3,608 | | 656 | | 4,734 | | | | | |

| * Refer to Change in Basis of Presentation discussion on page 14. | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Equity in Earnings of Affiliates | | | | | | | | | | | |

| Transportation | 125 | | 130 | | 131 | | 141 | | 527 | | | 154 | | 133 | | 133 | | 125 | | 545 | | | | | |

| NGL and Other | 26 | | 40 | | 26 | | 30 | | 122 | | | 73 | | 186 | | 81 | | 31 | | 371 | | | | | |

| | | | | | | | | | | | | | | |

| NOVONIX | — | | — | | — | | — | | — | | | — | | — | | — | | — | | — | | | | | |

| Total | 151 | | 170 | | 157 | | 171 | | 649 | | | 227 | | 319 | | 214 | | 156 | | 916 | | | | | |

| | | | | | | | | | | | | | | | | | |

| NOVONIX Investment | | | | | | | | | | | |

| Unrealized Investment Loss | (11) | | (15) | | (8) | | (4) | | (38) | | | (169) | | (221) | | (28) | | (15) | | (433) | | | | | |

| Unrealized Foreign Currency Transaction Gain (Loss) | (1) | | — | | (1) | | 1 | | (1) | | | 11 | | (19) | | (5) | | 4 | | (9) | | | | | |

| Change in Fair Value of NOVONIX Investment | (12) | | (15) | | (9) | | (3) | | (39) | | | (158) | | (240) | | (33) | | (11) | | (442) | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Depreciation and Amortization* | | | | | | | | | | | |

| Transportation | 40 | | 40 | | 41 | | 47 | | 168 | | | 39 | | 43 | | 46 | | 46 | | 174 | | | | | |

| NGL and Other** | 184 | | 194 | | 190 | | 187 | | 755 | | | 50 | | 50 | | 115 | | 179 | | 394 | | | | | |

| | | | | | | | | | | | | | | |

| NOVONIX | — | | — | | — | | — | | — | | | — | | — | | — | | — | | — | | | | | |

| Total | 224 | | 234 | | 231 | | 234 | | 923 | | | 89 | | 93 | | 161 | | 225 | | 568 | | | | | |

| * Excludes D&A of all non-consolidated affiliates. | | | | | | | | | | | |

| ** Refer to Change in Basis of Presentation discussion on page 14. | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Operating and SG&A Expenses* | | | | | | | | | | | |

| Transportation | 179 | | 178 | | 187 | | 208 | | 752 | | | 186 | | 187 | | 224 | | 217 | | 814 | | | | | |

| NGL and Other** | 371 | | 373 | | 429 | | 365 | | 1,538 | | | 81 | | 89 | | 281 | | 393 | | 844 | | | | | |

| | | | | | | | | | | | | | | |

| NOVONIX | — | | — | | — | | — | | — | | | — | | — | | — | | — | | — | | | | | |

| Total | 550 | | 551 | | 616 | | 573 | | 2,290 | | | 267 | | 276 | | 505 | | 610 | | 1,658 | | | | | |

| * Excludes operating and SG&A expenses of all non-consolidated affiliates. | | | | | | | | | | | |

| ** Refer to Change in Basis of Presentation discussion on page 14. | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Transportation Volumes (MB/D) | | | | | | | | | | | |

| Pipelines* | 3,039 | | 3,254 | | 3,039 | | 2,945 | | 3,069 | | | 3,099 | | 3,066 | | 3,084 | | 3,109 | | 3,089 | | | | | |

| Terminals | 3,203 | | 3,149 | | 3,167 | | 3,464 | | 3,246 | | | 2,900 | | 2,917 | | 3,066 | | 3,039 | | 2,981 | | | | | |

| * Pipelines represent the sum of volumes transported through each separately tariffed consolidated pipeline segment, excluding NGL pipelines. | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| PSX Other Volumes | | | | | | | | | | | | | | | |

| NGL Fractionated (MB/D)* | 660 | | 738 | | 703 | | 743 | | 711 | | | 452 | | 469 | | 508 | | 686 | | 529 | | | | | |

| NGL Production (MB/D)** | 421 | | 444 | | 432 | | 452 | | 437 | | | 400 | | 438 | | 434 | | 420 | | 423 | | | | | |

| NGL Pipelines Throughput (MB/D)*** | 918 | | 898 | | 880 | | 892 | | 897 | | | 885 | | 927 | | 946 | | 894 | | 913 | | | | | |

| Wellhead Volume (Bcf/D)** | 4.5 | | 4.5 | | 4.6 | | 4.7 | | 4.6 | | | 4.1 | | 4.4 | | 4.5 | | 4.5 | | 4.4 | | | | | |

| * Includes 100% of DCP Midstream Class A Segment from August 18, 2022, forward. | | | | | | | | | | | |

| ** Includes 100% of DCP Midstream Class A Segment. | | | | | | | | | | | |

| *** Includes 100% of DCP Midstream Class A Segment and Phillips 66's direct interest in DCP Sand Hills and DCP Southern Hills. | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Market Indicator | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Weighted-Average NGL Price ($/gal)* | 0.74 | | 0.61 | | 0.67 | | 0.65 | | 0.67 | | | 1.10 | | 1.15 | | 0.98 | | 0.76 | | 1.00 | | | | | |

| * Based on index prices from the Mont Belvieu market hub, which are weighted by NGL component mix. | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Phillips 66 Earnings Release Supplemental Data |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| MIDSTREAM (continued) |

| | | | | | | | | | | | | | |

| | | | Millions of Dollars |

| | | | 2023 | | 2022 |

| | | | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | YTD | | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | YTD |

| Reconciliation of Midstream Income before Income Taxes to Adjusted EBITDA | | | | | | | | | | | |

| Income before income taxes* | 702 | | 604 | | 712 | | 756 | | 2,774 | | | 212 | | 258 | | 3,608 | | 656 | | 4,734 | |

| Plus: | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Depreciation and amortization | 224 | | 234 | | 231 | | 234 | | 923 | | | 89 | | 93 | | 161 | | 225 | | 568 | |

| EBITDA* | 926 | | 838 | | 943 | | 990 | | 3,697 | | | 301 | | 351 | | 3,769 | | 881 | | 5,302 | |

| | | | | | | | | | | | | | |

| Special Item Adjustments (pre-tax): | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Certain tax impacts | — | | — | | — | | (2) | | (2) | | | — | | — | | — | | — | | — | |

| Net gain on asset disposition | (36) | | — | | (101) | | — | | (137) | | | — | | — | | — | | — | | — | |

| Merger transaction costs | — | | — | | — | | — | | — | | | — | | — | | 13 | | — | | 13 | |

| Gain related to merger of businesses | — | | — | | — | | — | | — | | | — | | — | | (3,013) | | — | | (3,013) | |

| Change in inventory method for acquired business | — | | — | | (46) | | — | | (46) | | | — | | — | | — | | — | | — | |

| DCP integration restructuring costs | 12 | | 19 | | 4 | | — | | 35 | | | — | | — | | — | | 18 | | 18 | |

| Total Special Item Adjustments (pre-tax) | (24) | | 19 | | (143) | | (2) | | (150) | | | — | | — | | (3,000) | | 18 | | (2,982) | |

| Change in Fair Value of NOVONIX Investment** | 12 | | 15 | | 9 | | 3 | | 39 | | | 158 | | 240 | | 33 | | 11 | | 442 | |

| EBITDA, Adjusted for Special Items and Change in Fair Value of NOVONIX Investment* | 914 | | 872 | | 809 | | 991 | | 3,586 | | | 459 | | 591 | | 802 | | 910 | | 2,762 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Other Adjustments (pre-tax): | | | | | | | | | | | |

| Proportional share of selected equity affiliates income taxes | 4 | | 5 | | 4 | | 5 | | 18 | | | 2 | | 4 | | 4 | | 3 | | 13 | |

| Proportional share of selected equity affiliates net interest | 13 | | 12 | | 13 | | 13 | | 51 | | | 41 | | 39 | | 26 | | 13 | | 119 | |

| Proportional share of selected equity affiliates depreciation and amortization | 41 | | 39 | | 39 | | 37 | | 156 | | | 56 | | 57 | | 51 | | 45 | | 209 | |

| Adjusted EBITDA attributable to noncontrolling interests, excluding PSXP | (226) | | (168) | | (47) | | (51) | | (492) | | | (24) | | (21) | | (206) | | (176) | | (427) | |

| Adjusted EBITDA* | 746 | | 760 | | 818 | | 995 | | 3,319 | | | 534 | | 670 | | 677 | | 795 | | 2,676 | |

| * Refer to Change in Basis of Presentation discussion on page 14. | | | | | | | |

| ** See NOVONIX Investment table on page 5 for more details. | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Phillips 66 Earnings Release Supplemental Data |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| MIDSTREAM (continued) |

| | | | | | | | | | | | | | |

| | | | Millions of Dollars |

| | | | 2023 | | 2022 |

| | | | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | YTD | | 1st Qtr | 2nd Qtr | 3rd Qtr | 4th Qtr | YTD |

| Transportation | | | | | | | | | | | |