false

0001509261

0001509261

2024-01-23

2024-01-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

January 23, 2024

REZOLUTE, INC.

(Exact Name of Registrant as Specified in Charter)

| Nevada |

|

001-39683 |

|

27-3440894 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

275 Shoreline Drive, Suite 500, Redwood City,

CA 94065

(Address of Principal Executive Offices, and

Zip Code)

650-206-4507

Registrant’s Telephone Number, Including

Area Code

Not Applicable

(Former Name

or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| |

¨ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

RZLT |

Nasdaq Capital Market |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 3.02 |

Unregistered Sale of Equity Securities. |

The disclosure contained

in Item 5.02 of this Current Report on Form 8-K regarding the issuance of an inducement grant pursuant to Nasdaq Listing Rule 5635(c)(4)

in the form of stock options to purchase 275,000 shares (the “Inducement Grant”) of Rezolute, Inc. (the “Company”)

common stock to Daron Evans at an exercise price of $1.02, in connection with his employment, is incorporated by reference. The Inducement

Grant is exempt from the registration requirements of the Securities Act of 1933, as amended, by virtue of Section 4(a)(2) thereof and/or

Regulation D promulgated thereunder.

| Item 5.02 |

Departures of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Appointment of Chief

Financial Officer

On

January 23, 2024, the Company’s Board of Directors approved the appointment of Mr. Evans, 50 years of age, to serve as the Company’s

Chief Financial Officer. Prior to joining the Company, he served as Chief Executive Officer of AlloRock, Inc., a biotechnology company

in the cardiometabolic disease space, as well as Chief Executive Officer of Specialty Renal Products, Inc., a medical device company in

the dialysis space. Previously, Mr. Evans served as Chief Executive Officer of Nephros, Inc, and Chief Financial Officer of Nile Therapeutics,

Inc. Since 2015, Mr. Evans has been Managing Director of PoC Capital, LLC, a fund focused on investing in public life science companies.

In

connection with Mr. Evans’ appointment as Chief Financial Officer of the Company, the Company extended Mr. Evans an employment offer

letter (the “Offer Letter”). The Offer Letter provides for the following compensation: (i) an annual base salary of $275,000;

(ii) eligibility to receive an annual performance bonus with a target of 50% of Mr. Evans’ base salary, on December 31st

of each year; and (iii) the Inducement Grant. The stock options issued as the Inducement Grant will vest and become exercisable as to

25% of the underlying shares on the first anniversary of the grant date, and will vest and become exercisable as to the remaining 75%

of the underlying shares in 36 equal monthly installments from the first anniversary of the grant date, subject to his continued employment

with the Company on such vesting dates. If the Company is acquired during his employment, all remaining options will automatically vest.

All

stock awards are subject to recovery to other penalties pursuant to (i) the Company’s clawback policy, as may be adopted or amended

from time to time, or (ii) any applicable law, rule or regulation or applicable stock exchange rule, including, without limitation, Section

304 of the Sarbanes-Oxley Act of 2002, Section 954 of the Dodd-Frank Wall Street Reform and Consumer Protection Act and any applicable

stock exchange listing rule adopted pursuant thereto.

Mr.

Evans will be subject to customary restrictive covenants in the Offer Letter, including nondisclosure of confidential information, nondisparagement

and the return of Company property. The foregoing description of the terms of the Offer Letter is qualified in its entirety by reference

to the Employment Agreement, which is filed as an exhibit to this Current Report on Form 8-K and is incorporated herein by reference.

There are no understandings

or arrangements with any persons regarding the appointment of Mr. Evans to the position of Chief Financial Officer, there are no reportable

related-party transactions with Mr. Evans, and there are no family relationships between him and any other officer or director of the

Company. Additionally, Mr. Evans has not engaged in any transaction with the Company that would

be reportable as a related party transaction under Item 404(a) of Regulation S-K.

| Item 7.01 |

Regulation FD Disclosure. |

On January 23, 2024,

the Company issued a press release announcing that the U.K. Medicines and Healthcare products Regulatory Agency has awarded the innovative

medicine designation, the Innovation Passport, to RZ358 for the treatment of hypoglycemia due to congenital hyperinsulinism.

On January 24, 2024,

the Company issued a press release announcing the appointment of Mr. Evans as the Company’s Chief Financial officer.

The information in this

Item 7.01, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, nor shall it be deemed

incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before

or after the date hereof, except as expressly set forth by specific reference in such filing to this Current Report on Form 8-K.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

REZOLUTE, INC. |

| |

|

|

| |

|

|

| DATE: January 29, 2024 |

By: |

/s/ Nevan Charles Elam |

| |

|

Nevan Charles Elam |

| |

|

Chief Executive Officer |

Exhibit 10.1

January 23, 2024

VIA EMAIL:

Dear Daron:

We are very excited to offer you the position

of Chief Financial Officer, at Rezolute, Inc., a Nevada corporation (“Company”). If you accept this offer, your first

day of employment will be today, January 23, 2024 (“Effective Date”) and you will report to Nevan Elam, Chief Executive

Officer.

Additional terms of your employment are more fully

described below in this letter (“Letter”).

1. Status

and Term. You will be a full-time, “at-will” employee of the Company and your employment is not for a specified term,

which means that you or the Company is free to terminate the employment relationship at any time, for any reason.

2. Location.

Your principal place of work will be the Rezolute, Inc. office in Redwood City, CA. You will be expected to be flexible with your

work hours and travel as required to fulfill your work duties.

3. Compensation

and Benefits. As compensation for your services, you will be entitled to the following compensation and benefits:

(a) Base

Salary. From the Effective Date, the Company shall pay you a base salary of Two Hundred Seventy-Five Thousand ($275,000) per annum

(“Base Salary”), payable in accordance with the Company’s payroll practices, but no less than once a month.

(b) Bonus

Compensation. You will be eligible to receive an annual performance bonus of up to Fifty (50%) of your base salary. Determination

of the actual bonus amount shall be based on the Company’s performance as well as your individual performance for the year. Your

discretionary bonus, if any, will be earned on December 31st of each calendar year. In order to remain eligible to receive

an annual performance bonus, you must continue to be employed by the Company, in good standing, through the date that the bonus is paid.

Notwithstanding anything herein to the contrary, subsequent to the approval of the board of directors, any bonus amount due to you will

be paid within the first quarter of the year following the date that the bonus was earned.

(c) Long

Term Incentives. Through the term of your employment, you will be eligible to receive awards under Rezolute’s Equity Incentive

Plans (pursuant to the terms and conditions of the plans) as determined by the board of directors in its sole discretion.

In addition, as an inducement to the commencement of your

employment, today the board of directors approved an initial grant of stock options as outlined below, which are intended to constitute

“employment inducement” awards under Nasdaq Rule 5635(c)(4) (“Inducement Awards”). The Inducement Awards

are subject to the terms of an award agreement between you and Rezolute.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Effective

Grant Date |

|

Type

of Award |

|

Number of Shares

Subject to the Award |

|

|

Exercise

Price |

|

|

Vesting Period |

| January 23, 2024 |

|

Stock Option |

|

|

275,000 |

|

|

|

$1.02 |

|

|

Four year vesting with a one year cliff |

You will receive formal award agreements and additional information

regarding your award over the coming weeks. With respect to your Inducement Awards, in the event that there is a Change in Control Event

(as defined below) and within 12 months of such event, your employment is terminated (i) by

the Company without cause or (ii) by you with Good Reason (as defined below), then all of the stock options granted as part of the

Inducement Awards shall accelerate and become exercisable for a period of 90 days from the date of your last day of employment with the

Company.

(d) Tracking-Free

Vacation. Rezolute, Inc. is striving to build a results-driven culture that enables our employees to flexibly manage their vacation

time. Through our tracking-free vacation (“TFV”) program, employees, working closely with their manager, can set their vacation

schedules so that the employee’s goals and objectives, as well as their time away to refresh and relax, are built into their annual

plan. Additional information on our TFV program can be found in the Employee Handbook Addendum.

(e) Insurance

Coverage. During the term hereof, the Company shall provide you with medical, dental, vision, life and disability insurance in accordance

with the Company’s policies which will be separately furnished to you.

(f) 401k

Retirement Plan. During the term hereof, you shall be entitled to participate in the Company’s 401k retirement plan.

(g) Other

Benefits. During the term hereof and subject to any contribution therefor generally required of employees of the Company, you shall

be entitled to participate in other employee benefit plans from time to time in effect for employees of the Company generally, including

without limitation, pension and/or profit-sharing plans.

(h) Business

Expenses. The Company shall pay or reimburse you for all reasonable and necessary business expenses incurred or paid by you in

the performance of your duties and responsibilities. Reimbursable expenses must be substantiated in writing (by valid receipts or

any other reasonable method of invoicing, showing proof of payment for an eligible reimbursement cost) within thirty (30) days of

the date any such expense is incurred. Any such expense will be reimbursed to you via check or electronic funds transfer by the

thirtieth (30th) day following the date of receipt by the Company of your written substantiation.

4. Confidential

Information; Assignment of Inventions.

(a) You

acknowledge that the Company and its Affiliates will continually develop Confidential Information (as defined below), that you may develop

Confidential Information for the Company or its Affiliates, and that you may learn of Confidential Information during the course of your

employment with the Company. You agree that, except as required for the proper performance of your duties for the Company, you will not,

directly or indirectly, use or disclose any Confidential Information. You understand and agree that this restriction will continue to

apply after your employment terminates, regardless of the reason for termination.

(b) You agree that all Confidential Information, including, without limitation all work products, inventions methods, processes, designs, software, apparatuses, compositions of matter, procedures, improvements, property, data documentation, information or materials that you, jointly or separately prepared, conceived, discovered, reduced to practice, developed or created during, in connection with, for the purpose of, related to, or as a result of your employment with the Company, and/or to which you have access as a result of your employment with the Company (collectively, “Inventions”) is and shall remain the sole and exclusive property of the Company.

(c) By signing this Letter you unconditionally and irrevocably transfer and assign to the Company all rights, title and interest in the Inventions (as defined above, including all patent, copyright, trade secret and any other intellectual property rights therein) and will take any steps and execute any further documentation from time to time reasonably necessary to effect such assignment free of charge to the Company. You will further execute, upon request, whether during, or after the termination of, your employment with the Company, any and all applications for patents, assignments and other papers, which the Company may deem necessary or appropriate for securing such Inventions for the Company.

(d) Except as required for the proper performance of your duties, you will not copy any and all papers, documents, drawings, systems, data bases, memoranda, notes, plans, records, reports files, data (including original data), disks, electronic media etc. containing Confidential Information (“Documents”) or remove any Documents, or copies, from Company premises. You will return to the Company immediately after your employment terminates, and at such other times as may be specified by the Company, all Documents and copies and all other property of the Company and its Affiliates then in his possession or control.

5. Conflicting

Agreements. You hereby represent and warrant that the execution of this Letter and the performance of his obligations hereunder will

not breach or be in conflict with any other agreement to which you are a party or are bound to and that you are not subject to any covenants

against competition or similar covenants that would affect the performance of your obligations hereunder. You will not disclose to or

use any confidential or proprietary information of a third party without such party’s consent.

6. Definitions.

Words or phrases which are initially capitalized or are within quotation marks shall have the meanings provided in this Section 6

and as provided elsewhere herein. For purposes of this Letter, the following definitions apply:

(a) “Affiliates”

means all persons and entities directly or indirectly controlling, controlled by or under common control with the Company, where control

may be by either management authority or equity interest.

(b) “Change

in Control Event” means either of the following: (i) sale of substantially all the Company’s assets or (ii) merger,

consolidation or reorganization resulting in a change in more than 50% of the board of directors combined with a transfer of majority

ownership or equity of the Company.

(c) “Confidential

Information” means any and all information, inventions, discoveries, ideas, writings, communications, research, engineering

methods, developments in chemistry, manufacturing information, practices, processes, systems, technical and scientific information, formulae,

designs, concepts, products, intellectual property, trade secrets, projects, improvements and developments that relate to the business

of the Company or any Affiliate and are not generally known by others, including but not limited to (i) products and services, technical

data, methods and processes, (ii) marketing activities and strategic plans, (iii) financial information, costs and sources of

supply, (iv) the identity and special needs of customers and prospective customers and vendors and prospective vendors, and (v) the

people and organizations with whom the Company or any Affiliate has or plans to have business relationships and those relationships. Confidential

Information also includes such information that the Company or any Affiliate may receive or has received belonging to customers or others

who do business with the Company or any Affiliate and any publication or literary creation of yours, developed in whole or in part while

you are employed by the Company, in whatever form published the content of which, in whole or in part, relates to the business of the

Company or any Affiliate. Confidential Information shall not include any information or materials that you can prove by written evidence

(i) is or becomes publicly known through lawful means and without breach of this Letter by you; (ii) was rightfully in your

possession or part of your general knowledge prior to the Effective Date; or (iii) is disclosed to you without confidential or proprietary

restrictions by a third party who rightfully possesses the information or materials without confidential or proprietary restrictions.

(d) “Good

Reason” means a material reduction in your duties or material reduction in compensation, except for a reduction in compensation

that affects all members of management on the same percentage basis.

(c) “Person”

means an individual, a corporation, an association, a partnership, an estate, a trust and any other entity or organization.

7. Withholding.

All payments made under this Letter shall be reduced by any tax or other amounts required to be withheld under applicable law.

8. Severability.

If any portion or provision of this Letter shall to any extent be declared illegal or unenforceable by a court of competent jurisdiction,

then the remainder of this Letter, or the application of such portion or provision in circumstances other than those as to which it is

so declared illegal or unenforceable, shall not be affected thereby, and each portion and provision of this Letter shall be valid and

enforceable to the fullest extent permitted by law.

9. Waiver.

No waiver of any provision hereof shall be effective unless made in writing and signed by the waiving party. The failure of either party

to require the performance of any term or obligation of this Letter, or the waiver by either party of any breach of this Letter, shall

not prevent any subsequent enforcement of such term or obligation or be deemed a waiver of any subsequent breach.

10. Notices.

Any and all notices, requests, demands and other communications provided for by this Letter shall be in writing and shall be effective

when delivered in person or by overnight courier or delivery service, or 3 business days after being deposited in the United States mail,

postage prepaid, registered or certified, and addressed to you at your last known address on the books of the Company or, in the case

of the Company, at the Company’s principal place of business, to the attention of the Chief Executive Officer, or to such other

address as either party may specify by notice to the other actually received.

11. Entire

Letter. This Letter constitutes the entire Letter between the parties and supersedes all prior communications, agreements and understandings,

written or oral, with respect to the terms and conditions of your employment.

12. Amendment.

This Letter may be amended or modified only by a written instrument signed by you and an expressly authorized representative of the Company.

13. Headings.

The headings and captions in this Letter are for convenience only and in no way define or describe the scope or content of any provision

of this Letter.

14. Counterparts.

This Letter may be executed in two or more counterparts, each of which shall be an original and all of which together shall constitute

one and the same instrument.

15. Governing

Law. This Letter shall be construed and enforced under and be governed in all respects by the laws of the State of California, without

regard to the conflict of laws principles thereof.

Daron, we look forward to you joining the Rezolute

team!

Sincerely,

Rezolute, Inc.

Nevan Elam

Chief Executive Officer

Agreed and accepted:

Daron Evans

Date: January 23, 2024

Exhibit 99.1

Rezolute Receives Innovation

Passport Designation from the U.K. Innovative Licensing and Access Pathway Steering Group for RZ358 in the Treatment of Hypoglycemia Due

to Congenital Hyperinsulinism

REDWOOD

CITY, Calif., January 23, 2024 -- Rezolute, Inc. (Nasdaq: RZLT), a clinical-stage biopharmaceutical

company committed to developing novel, transformative therapies for serious metabolic and rare diseases, today announced that the

U.K. Medicines and Healthcare products Regulatory Agency (MHRA) has awarded the innovative medicine designation, the Innovation Passport,

to RZ358 for the treatment of hypoglycemia due to congenital hyperinsulinism (HI). The Innovation Passport designation was granted

based on the substantial unmet medical need in this condition and the potential for RZ358 to benefit patients as evidenced by the Phase

2 RIZE study in congenital HI, which safely demonstrated significant improvements in hypoglycemia events.

The

Innovation Passport designation in the U.K. is the entry point to the Innovative Licensing and Access Pathway (ILAP). The goal of ILAP

is to accelerate the time to market and facilitate patient access to medicines. The Innovation Passport is the first step in the

ILAP process, which activates the Medicines and Healthcare products Regulatory Agency (MHRA) and its partner agencies, including the National

Institute for Health and Care Excellence (NICE), and the Scottish Medicines Consortium (SMC).

“Congenital

hyperinsulinism is the most frequent cause of severe, persistent hypoglycemia in newborn babies, infants and children,” said Susan

Stewart, J.D., Chief Regulatory Officer at Rezolute. “The Innovation Passport opens the door for Rezolute to discuss access considerations

for potential future indications for RZ358. We are thrilled to receive this designation and work closely with the U.K. and other regulatory

authorities to bring this meaningful therapy to patients in need.”

About Congenital Hyperinsulinism

Congenital hyperinsulinism (congenital

HI) is the most common cause of recurrent and persistent hypoglycemia in children. Patients with congenital HI typically present with

signs or symptoms of hypoglycemia within the first month of life. These episodes can result in significant brain injury and death if not

recognized and managed appropriately. Additionally, recurrent, or cumulative, hypoglycemia can lead to progressive and irreversible damage

over time, including serious and devastating brain injury, seizures, neuro-developmental problems, feeding difficulties, and significant

impact on patient and family quality of life. In cases of congenital HI that are unresponsive to medical management, surgical removal

of the pancreas may be required. In those with diffuse congenital HI where the whole pancreas is affected, a near-total pancreatectomy

can be undertaken, although about half of these children will continue to have hypoglycemia and require medical treatment for congenital

HI.

About RZ358

RZ358 is a fully human monoclonal

antibody that works downstream from the pancreas and instead binds to a unique allosteric site on insulin receptors in the liver, fat,

and muscle. The antibody counteracts the effects of excess insulin binding and activity, thereby improving hypoglycemia. Rezolute believes

that RZ358 is ideally suited as a potential therapy for congenital HI and other conditions characterized by excessive insulin activity

(hyperinsulinism). Because RZ358 acts downstream from the pancreas, it has the potential to be universally effective at treating congenital

HI, regardless of the causative genetic defect, as well as acquired forms of HI such as those mediated by insulinomas and other tumor

types. RZ358 received Orphan Drug Designation in the United States and European Union for the treatment of congenital HI, as well as

Pediatric Rare Disease Designation in the U.S. In the Phase 2 RIZE study, participants with congenital HI ages 2 and older nearly universally

achieved significant improvements in hypoglycemia across multiple endpoints, including the primary and key secondary endpoints planned

for the sunRIZE study. At doses and exposures that are planned for the Phase 3 study, RZ358 was generally safe and well-tolerated, and

resulted in median improvements in hypoglycemia exceeding 80%. Based on the RIZE clinical trial outcomes and the evidence of benefit

in this serious condition with substantial unmet medical need, RZ358 was subsequently granted a priority medicines (PRIME) designation

by the European Medicines Agency (EMA) and an Innovation Passport designation by the U.K. Innovative Licensing and Access Pathway (ILAP)

Steering Group for the treatment of congenital HI.

About Rezolute, Inc.

Rezolute

strives to disrupt current treatment paradigms by developing transformative therapies for devastating rare and chronic metabolic diseases.

Its novel therapies hold the potential to both significantly improve outcomes and reduce the treatment burden for patients, treating

physicians, and the healthcare system. Rezolute is steadfast in its mission to create profound, positive, and lasting impacts on patients’

lives. Patient, clinician, and advocate voices are integrated in the Company’s drug development process. Rezolute places an emphasis

on understanding the patient’s lived experiences, enabling the Company to boldly address a range of severe conditions. For more

information, visit www.rezolutebio.com.

Forward-Looking Statements

This release, like many written

and oral communications presented by Rezolute and our authorized officers, may contain certain forward-looking statements regarding our

prospective performance and strategies within the meaning of Section 27A of the Securities Act and Section 21E of the Securities

Exchange Act of 1934, as amended. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking

statements contained in the Private Securities Litigation Reform Act of 1995 and are including this statement for purposes of said safe

harbor provisions. Forward-looking statements, which are based on certain assumptions and describe future plans, strategies, and expectations

of Rezolute, are generally identified by use of words such as "anticipate," "believe," "estimate," "expect,"

"intend," "plan," "project," "seek," "strive," "try," or future or conditional

verbs such as "could," "may," "should," "will," "would," or similar expressions. These forward-looking statements include,

but are not limited to statements regarding the Innovation Passport designation, the PRIME designation and the meaning of the designations

on the ability of RZ358 to become an effective treatment for congenital hyperinsulinism, the effectiveness or future effectiveness of

RZ358 for the treatment of congenital hyperinsulinism, and statements regarding clinical trial timelines for RZ358. Our ability to predict

results or the actual effects of our plans or strategies is inherently uncertain. Accordingly, actual results may differ materially from

anticipated results. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the

date of this release. Except as required by applicable law or regulation, Rezolute undertakes no obligation to update these forward-looking

statements to reflect events or circumstances that occur after the date on which such statements were made. Important factors that may

cause such a difference include any other factors discussed in our filings with the SEC, including the Risk Factors contained in the

Rezolute’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, which are available at the SEC’s website

at www.sec.gov. You are urged to consider these factors carefully in evaluating the forward-looking statements in this release and are

cautioned not to place undue reliance on such forward-looking statements, which are qualified in their entirety by this cautionary statement.

Investors &

Media:

Christen Baglaneas

Rezolute, Inc.

cbaglaneas@rezolutebio.com

(508)272-6717

Investors:

Stephanie Carrington

ICR Westwicke

RezoluteIR@westwicke.com

(646)277-1282

Exhibit 99.2

Rezolute Expands Leadership

Team with Appointment of Daron Evans, MS, MBA, as Chief Financial Officer

REDWOOD

CITY, Calif., January 24, 2024 -- Rezolute, Inc. (Nasdaq: RZLT), a clinical-stage biopharmaceutical

company committed to developing novel, transformative therapies for serious metabolic and rare diseases, today announced the addition

of Daron Evans, MS, MBA, to its leadership team as Chief Financial Officer as well as the grant of share options as a material inducement

for his appointment (the “Inducement Grant”).

About

Mr. Evans

“This

is a pivotal year for Rezolute as we initiated our Phase 3 clinical study for RZ358 in congenital hyperinsulinism and anticipate reporting

topline data from our Phase 2 study for RZ402 in diabetic macular edema in the second quarter of 2024,” said Nevan Charles Elam,

Chief Executive Officer and Founder of Rezolute. “As a seasoned biotech leader and entrepreneur, Mr. Evans has recognized the

value of our novel therapies for rare and metabolic disease. His experience in corporate finance, capital markets, and strategic transactions

will help shepherd Rezolute through its next chapter in late-stage development and support its mission to help patients in need.”

Mr. Evans

has over 15 years of experience leading public and private life science companies through financial operations, investor relations, and

business development activities. Prior to joining Rezolute, he served as Chief Executive Officer of AlloRock, Inc., a biotechnology

company in the cardiometabolic disease space, as well as Chief Executive Officer of Specialty Renal Products, Inc., a medical device

company in the dialysis space. Previously, Mr. Evans served as Chief Executive Officer of Nephros, Inc. (Nasdaq:NEPH), and Chief

Financial Officer of Nile Therapeutics, Inc. (Nasdaq:NLTX). Since 2015, Mr. Evans has been Managing Director of PoC Capital,

LLC, a fund focused on investing in public life science companies. He holds a Bachelor of Science in Chemical Engineering from Rice University,

a Master of Science in Biomedical Engineering from a joint program at the University of Texas at Arlington and Southwestern Medical School,

and a Master of Business Administration from the Fuqua School of Business at Duke University.

“Rezolute

is on the precipice of potentially making a significant impact on the lives of patients and their families in multiple indications,”

said Mr. Evans. “I am very impressed with the dedication and experience of the Rezolute team and am honored to join the mission

at this critical time.”

Inducement

Grant

In connection

with Mr. Evans’ appointment, on January 23, 2024, the Company’s Board of Directors, upon recommendation of the Compensation

Committee, approved the grant of an inducement stock option of 275,000 shares of the Company’s common stock in accordance with Nasdaq

Listing Rule 5635(c)(4). The option has an exercise price of $1.02 per share, which is equal to the closing price of Rezolute’s

common stock on January 23, 2024. The stock options will vest and become exercisable as to 25% of the underlying shares on the first

anniversary of the grant date, and will vest and become exercisable as to the remaining 75% of the underlying shares in 36 equal monthly

installments from the first anniversary of the grant date, subject to his continued employment with Rezolute on such vesting dates. If

the Company is acquired during his employment, all remaining options will automatically vest.

About Rezolute, Inc.

Rezolute

strives to disrupt current treatment paradigms by developing transformative therapies for devastating rare and chronic metabolic diseases.

Its novel therapies hold the potential to both significantly improve outcomes and reduce the treatment burden for patients, treating

physicians, and the healthcare system. Rezolute is steadfast in its mission to create profound, positive, and lasting impacts on patients’

lives. Patient, clinician, and advocate voices are integrated in the Company’s drug development process. Rezolute places an emphasis

on understanding the patient’s lived experiences, enabling the Company to boldly address a range of severe conditions. For more

information, visit www.rezolutebio.com.

Forward-Looking Statements

This release, like many written

and oral communications presented by Rezolute and our authorized officers, may contain certain forward-looking statements regarding our

prospective performance and strategies within the meaning of Section 27A of the Securities Act and Section 21E of the Securities

Exchange Act of 1934, as amended. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking

statements contained in the Private Securities Litigation Reform Act of 1995 and are including this statement for purposes of said safe

harbor provisions. Forward-looking statements, which are based on certain assumptions and describe future plans, strategies, and expectations

of Rezolute, are generally identified by use of words such as "anticipate," "believe," "estimate," "expect,"

"intend," "plan," "project," "seek," "strive," "try," or future or conditional

verbs such as "could," "may," "should," "will," "would," or similar expressions. These forward-looking statements include,

but are not limited to statements regarding the appointment of Daron Evans as Chief Financial Officer, the Inducement Grant for Daron

Evans’ appointment, the Innovation Passport designation, the PRIME designation and the meaning of the designations on the ability

of RZ358 to become an effective treatment for congenital hyperinsulinism, the effectiveness or future effectiveness of RZ358 for the treatment

of congenital hyperinsulinism, and statements regarding clinical trial timelines for RZ358. Our ability to predict results or the actual

effects of our plans or strategies is inherently uncertain. Accordingly, actual results may differ materially from anticipated results.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this release.

Except as required by applicable law or regulation, Rezolute undertakes no obligation to update these forward-looking statements to reflect

events or circumstances that occur after the date on which such statements were made. Important factors that may cause such a difference

include any other factors discussed in our filings with the SEC, including the Risk Factors contained in the Rezolute’s Annual Report

on Form 10-K and Quarterly Reports on Form 10-Q, which are available at the SEC’s website at www.sec.gov. You are urged

to consider these factors carefully in evaluating the forward-looking statements in this release and are cautioned not to place undue

reliance on such forward-looking statements, which are qualified in their entirety by this cautionary statement.

Investors &

Media:

Christen Baglaneas

Rezolute, Inc.

cbaglaneas@rezolutebio.com

(508)272-6717

Investors:

Stephanie Carrington

ICR Westwicke

RezoluteIR@westwicke.com

(646)277-1282

v3.24.0.1

Cover

|

Jan. 23, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 23, 2024

|

| Entity File Number |

001-39683

|

| Entity Registrant Name |

REZOLUTE, INC.

|

| Entity Central Index Key |

0001509261

|

| Entity Tax Identification Number |

27-3440894

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

275 Shoreline Drive

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

Redwood City

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94065

|

| City Area Code |

650

|

| Local Phone Number |

206-4507

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

RZLT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

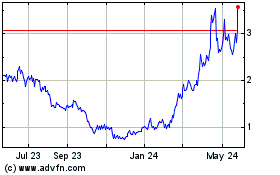

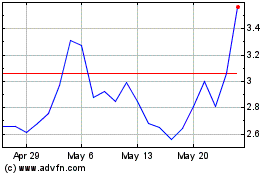

Rezolute (NASDAQ:RZLT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rezolute (NASDAQ:RZLT)

Historical Stock Chart

From Apr 2023 to Apr 2024