UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

☐ Preliminary

Proxy Statement

☐ Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive

Proxy Statement

☐ Definitive

Additional Materials

☒ Soliciting

Material Under Rule 14a-12

PARKS! AMERICA, INC.

(Name of Registrant as Specified in Its Charter)

FOCUSED COMPOUNDING FUND, LP

ANDREW KUHN

GEOFF GANNON

JAMES FORD

(Name of Persons(s) Filing Proxy Statement,

if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No

fee required

☐ Fee

paid previously with preliminary materials

☐ Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

Focused Compounding Fund, LP,

issued a press release. The press release is below:

Focused Compounding Nominates Jacob McDonough (The

Guy Who LITERALLY Wrote the Book on Capital Allocation) For Parks! America’s June 6th Annual Meeting

DALLAS, Jan. 29, 2024 (GLOBE NEWSWIRE) -- Focused

Compounding is pleased to announce the nomination of Jacob McDonough to their board slate for Parks! America Inc’s (OTC: PRKA) June

6th annual meeting. Mr. McDonough earned a Bachelor of Arts in Finance from Michigan State University and is the Founder and

Portfolio Manager of McDonough Investments, a capital management firm that manages capital for clients as a registered investment adviser.

He is the author of “Capital Allocation: The Financials of a New England Textile Mill (1955-1985),” a book that covers Warren

Buffett’s capital reallocation from a failing textile mill to other profitable companies during the early days of his control over

Berkshire Hathaway. We believe that Mr. McDonough’s experience in capital management and capital reallocation will allow him to

maximize shareholder value as a director.

To hear Jacob’s thoughts on the capital

allocation crossroads Parks! America now finds itself at, Geoff Gannon of Focused Compounding picked Jacob’s brain on his special

area of expertise: how rational, thoughtful capital allocation in the first few years of Buffett’s time at Berkshire got the compounding

snowball rolling.

Here are 3 simple questions focused on the ways in which Parks! America’s situation today is a lot like the one

Buffett faced when he first assumed capital allocation duties at Berkshire.

Capital Reallocation: How to Solve

the Decade-Long Missouri Problem

“Should

you find yourself in a chronically leaking boat, energy devoted to changing vessels is likely to be more productive than energy devoted

to patching leaks.”

-

Warren Buffett

Note: From 2008-2023, Missouri has

cost the company at least $6.9 million ($2 million purchase price + $1.5 million cumulative EBIT losses + $3.4 million cumulative cap-ex).

This extreme underestimate of the Missouri park’s true cost does not include interest on borrowed money or reflect opportunity costs.

It is unadjusted for inflation. And most importantly…

…just the seemingly small

initial purchase price ($2 million) invested at 10% a year for 15 years would have grown to be $8.4 million by now. Capital allocation

mistakes really snowball when left to fester for a decade and a half.

Geoff Gannon: For a decade and a half

now, the Missouri park has been a money-losing business that the company has poured more and more cap-ex into. When Buffett first took

over at Berkshire in ‘65, the New Bedford textile mill had a recent record almost as bad as the Missouri park. What did Buffett

do when he found himself in a similar situation to the one Parks! America now faces in Missouri?

Jacob McDonough: After Warren Buffett

took over Berkshire Hathaway in 1965, the company was able to substantially reduce overhead costs. This was the crucial first step in

the transformation of the textile mill into the Berkshire we know today. This could’ve been accomplished by cutting unnecessary

costs at headquarters, or from reducing the scope of operations within unprofitable business segments. Either way, a meaningful level

of free cash flow was generated in 1965 and 1966 that was invested more efficiently elsewhere outside of Berkshire’s historical

operation.

Incentives: How to Get Hard-Working Employees,

Park Managers, Executives,

and the Board To Think And (More Importantly) Act Like Owners

“Show me the incentives, and I’ll

show you the outcome.”

-

Charlie Munger

Geoff Gannon: Parks! America’s front-line

employees, park managers, and corporate executives are paid using just a base salary and (in a few cases) a discretionary bonus set by

the board. When Buffett put Ken Chace in charge of the textile mills, he faced a similar situation: a key manager who had never been paid

to think like an owner. How did Buffett get Chace to think like an owner and focus on truly important goals like return on capital instead

of meaningless goals like size?

Jacob McDonough: Buffett is famous for

granting autonomy to the managers of his businesses. Ken Chace had plenty of autonomy at Berkshire. Autonomy can be a helpful tool in

recruiting and retaining talent within an organization. With that being said, Chace was still held responsible for generating an adequate

return on capital for all investments and capital expenditures.

Buffett and Charlie Munger also praised the incentive

program instituted by Les Schwab at his tire retail operation. A portion of the profits from each individual store was paid out to the

manager of that store, as well as to the rest of the employees working on the front-line at the store. This incentivizes employees to

think like owners, potentially leading to less waste and higher productivity.

To Pay Out or to Re-Invest: The Ultimate

Test of Capital Stewardship

“We

feel noble intentions should be checked periodically against results. We test the wisdom of retaining earnings by assessing whether retention,

over time, delivers shareholders at least $1 of market value for each $1 retained.”

- Warren

Buffett

Geoff Gannon: Let’s wrap-up by defining

what success looks like. How can owners tell the difference between good capital allocation and bad? Walk us through Buffett’s “Market

Value Test” for deciding whether or not to return capital to owners. For example: if the Georgia park makes a ton of money (note:

over the last 10 years, the Georgia park has produced $25.9 million in cumulative EBIT) but then corporate HQ sinks everything

Georgia earns into money-losing businesses like Missouri and Aggieland – do shareholders benefit from the Georgia park’s earnings

the same way they would have if those earnings had simply been paid out in dividends or share buybacks?

Jacob McDonough: Opportunity cost

is an important topic to consider in an investment. This is the case whether you are deciding to buy a new loom for a textile manufacturing

facility, acquiring a new company, or purchasing a share of a stock. Not only does a company need to weigh one project or acquisition

against all other available alternatives that it has, but also needs to consider what each shareholder could achieve with that capital.

Money is fungible. This is what the “Market Value Test” means to me. If a dollar retained by the company isn’t translating

into real value, then shareholders could instead put that money to work elsewhere. Growth of a business alone is meaningless unless you

factor in how much capital went into generating that growth.

Thanks, Jacob.

Whether you plan to support the incumbent board’s slate or the

Focused Compounding slate, please take advantage of the chance to read Capital Allocation: The Financials of a New England Textile

Mill 1955-1985 for free. You can find it here:

https://www.mcdonough-investments.com/_files/ugd/662cde_668e3018ef6e40fbb571f89677f88474.pdf

Reading Jacob’s methodically researched

book will give you the right ideas on how to judge whoever is elected to allocate capital on your behalf and is required reading for all

value focused directors and owners.

Contact:

Andrew Kuhn (469) 207-5844

andrew@focusedcompounding.com

Additional Information

Focused Compounding Group, LP, Focused Compounding

Capital Management, LLC, Andrew Kuhn, Geoffrey Gannon and James Ford (collectively, the “Focused

Compounding Group”) have filed a contested definitive Proxy Statement (the “Proxy Statement”) together with a proxy

card with the SEC in connection with the proxy solicitation the Focused Compounding Group initiated regarding the Special meeting

of Shareholders of Parks! America, Inc. (“Parks!”) scheduled for February 26, 2024 (the “Proxy Solicitation”).

Parks! has also scheduled an Annual Meeting of Shareholders for June 6, 2024.

SHAREHOLDERS

ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), THE PROXY STATEMENT TO BE FILED IN CONNECTION

WITH THE ANNUAL MEETING WHEN AVAILABLE, AND ANY OTHER RELEVANT DOCUMENTS THAT THE FOCUSED COMPOUNDING GROUP FILES WITH THE SEC CAREFULLY

IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

Shareholders

may obtain, free of charge, copies of the Proxy Statement, and any amendments or supplements thereto and any other documents

(including the proxy card) at the SEC’s website (http://www.sec.gov).

Certain Information Regarding

Participants

The respective

members of the Focused Compounding Group may be deemed to be participants in the solicitation of proxy cards from shareholders in connection

with the Proxy Statement. Additional information regarding the identity of these participants, and their direct or indirect interests,

by security holdings or otherwise, is set forth in the Proxy Statement and certain other materials filed with the SEC in connection with

the Proxy Solicitation.

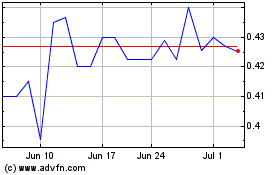

Parks America (PK) (USOTC:PRKA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Parks America (PK) (USOTC:PRKA)

Historical Stock Chart

From Apr 2023 to Apr 2024