0001592057FALSE00015920572023-09-192023-09-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): January 23, 2024

| | | | | | | | | | | |

| Enviva Inc. |

| (Exact name of registrant as specified in its charter) |

|

| Delaware | 001-37363 | 46-4097730 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 7272 Wisconsin Ave. | Suite 1800 | | |

| Bethesda, | MD | | 20814 |

| (Address of principal executive offices) | | (Zip code) |

| | | | | |

| (301) | 657-5560 |

| (Registrant’s telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | EVA | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On January 23, 2024, Enviva Inc. (the “Company”) was notified by the New York Stock Exchange (the “NYSE”) that the average closing price of the Company’s shares of common stock, par value $0.001 per share (the “Common Stock”), had fallen below $1.00 per share over a period of 30 consecutive trading days, which is the minimum average closing price required to maintain continued listing on the NYSE under Section 802.01C of the NYSE Listed Company Manual.

Under the NYSE’s rules, the Company has a period of six months following receipt of the notice to regain compliance with the minimum share price requirement. To regain compliance, on the last trading day in any calendar month during the cure period, the Common Stock must have (i) a closing price of at least $1.00 per share and (ii) an average closing price of at least $1.00 per share over the 30-trading-day period ending on the last trading day of such month.

The Company intends to consider available options to cure the deficiency and regain compliance.

The notice has no immediate impact on the listing of the Common Stock, which will continue to be listed and traded on the NYSE during the six-month cure period, subject to the Company’s compliance with the other listing requirements of the NYSE. The Common Stock will continue to trade under the symbol “EVA,” but will have an added designation of “.BC” to indicate that the Company currently is not in compliance with the NYSE’s continued listing requirements. If the Company is unable to regain compliance, the NYSE will initiate procedures to suspend and delist the Common Stock.

The notice does not affect the Company’s ongoing business operations or its reporting requirements with the Securities and Exchange Commission.

If the Common Stock ultimately were to be delisted for any reason, it could negatively impact the Company by (i) reducing the liquidity and market price of the Common Stock; (ii) reducing the number of investors willing to hold or acquire the Common Stock, which could negatively impact the Company’s ability to raise equity financing; (iii) limiting the Company’s ability to use a registration statement to offer and sell freely tradable securities, thereby preventing the Company from accessing the public capital markets; and (iv) impairing the Company’s ability to provide equity incentives to its employees.

Item 7.01. Regulation FD Disclosure.

On January 29, 2024, the Company issued a press release with respect to the receipt of the notice of noncompliance from the NYSE. A copy of the press release is furnished as Exhibit 99.1 hereto and is incorporated by reference herein.

The information in this Item 7.01 (including the exhibit) shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and is not incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01. Financial Statements and Exhibits.

Exhibits.

| | | | | |

| EXHIBIT NUMBER | DESCRIPTION |

| |

| 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

*Furnished herewith.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this Current Report to be signed on its behalf by the undersigned hereunto duly authorized.

ENVIVA INC.

Date: January 29, 2024 By: /s/ Jason E. Paral

Name: Jason E. Paral

Title: Executive Vice President, General Counsel, and Secretary

Enviva Receives Continued Listing Standard Notice from the NYSE

BETHESDA, Md., January 29, 2024 — Enviva Inc. (NYSE: EVA) (“Enviva” or the “Company”) today announced that on January 23, 2024 it received notification (the “Notice”) from the New York Stock Exchange (the “NYSE”) that the Company is no longer in compliance with NYSE continued listing criteria that requires listed companies to maintain an average closing share price of at least $1.00 over a consecutive 30-trading-day period.

The Company can regain compliance at any time within the six-month cure period following receipt of the Notice if, on the last trading day of any calendar month during such cure period, the Company has both (i) a closing share price of at least $1.00 and (ii) an average closing share price of at least $1.00 over the 30-trading-day period ending on the last trading day of the applicable calendar month.

The Notice has no immediate impact on the listing of the Company’s shares of common stock (the “Common Stock”), which will continue to be listed and traded on the NYSE during the cure period, subject to the Company’s compliance with the other listing requirements of the NYSE. The Common Stock will continue to trade under the symbol “EVA,” but will have an added designation of “.BC” to indicate that the Company currently is not in compliance with the NYSE’s continued listing requirements. If the Company is unable to regain compliance during the cure period, the NYSE may initiate procedures to suspend and delist the Common Stock.

The Notice does not affect the Company’s ongoing business operations nor its reporting requirements with the Securities and Exchange Commission (the “SEC”).

About Enviva

Enviva Inc. (NYSE: EVA) is the world’s largest producer of industrial wood pellets, a renewable and sustainable energy source produced by aggregating a natural resource, wood fiber, and processing it into a transportable form, wood pellets. Enviva owns and operates ten plants with an expected annual production of approximately 5.0 million metric tons in Virginia, North Carolina, South Carolina, Georgia, Florida, and Mississippi, and is constructing its 11th plant in Epes, Alabama. Additionally, Enviva is planning construction of its 12th plant, near Bond, Mississippi. Enviva sells most of its wood pellets through long-term, take-or-pay off-take contracts with customers located primarily in the United Kingdom, the European Union, and Japan, helping to accelerate the energy transition and to defossilize hard-to-abate sectors like steel, cement, lime, chemicals, and aviation. Enviva exports its wood pellets to global markets through its deep-water marine terminals at the Port of Chesapeake, Virginia, the Port of Wilmington, North Carolina, and the Port of Pascagoula, Mississippi, and from third-party deep-water marine terminals in Savannah, Georgia, Mobile, Alabama, and Panama City, Florida.

To learn more about Enviva, please visit our website at www.envivabiomass.com. Follow Enviva on social media @Enviva.

Cautionary Note Concerning Forward Looking Statements

The information included herein and in any oral statements made in connection herewith include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact included herein are forward-looking statements. When used herein, including any oral statements made in connection herewith, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms, and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Except as otherwise required by applicable law, Enviva disclaims any duty to revise or update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date hereof. Enviva cautions you that these forward-looking statements are subject to risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Enviva. These risks include, but are not limited to factors, as described in Enviva’s filings with the SEC, including the detailed factors discussed under the heading “Risk Factors” in Enviva’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as supplemented in the Company’s Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, June 30, and September 30, 2023.

Should one or more of the risks or uncertainties described herein and in any oral statements made in connection therewith occur, or should underlying assumptions prove incorrect, actual results and plans could different materially from those expressed in any forward-looking statements. Additional information concerning these and other factors that may impact Enviva’s expectations and projections can be found in Enviva’s periodic filings with the SEC. Enviva’s SEC filings are available publicly on the SEC’s website at www.sec.gov.

Contact:

Kate Walsh

Senior Vice President, Investor Relations & Corporate Communications

Investor.Relations@envivabiomass.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

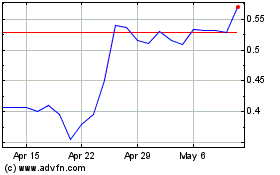

Enviva (NYSE:EVA)

Historical Stock Chart

From Apr 2024 to May 2024

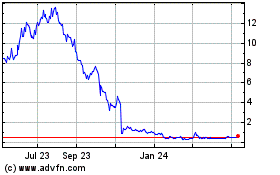

Enviva (NYSE:EVA)

Historical Stock Chart

From May 2023 to May 2024