Filed pursuant to Rule 424(b)(5)

Registration No. 333-274076

Prospectus Supplement

(To Prospectus dated September 8, 2023)

5,970,152 American Depositary Shares

Representing 5,970,152 Ordinary Shares

YOSHITSU CO., LTD

We are offering 5,970,152 American depositary

shares, or “ADSs,” each representing one of our ordinary shares (“Ordinary Shares”), directly to certain institutional

investors pursuant to that certain securities purchase agreement, dated January 26, 2024 (the “Securities Purchase Agreement”),

at a purchase price of $0.67 per ADS.

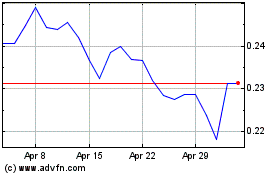

The ADSs are listed on The Nasdaq Capital Market,

or “Nasdaq,” under the symbol “TKLF.” On January 25, 2024, the last reported sale price of the ADSs on Nasdaq

was $0.785 per ADS.

In a concurrent private placement, we are also

offering to the institutional investors, warrants to purchase an aggregate of up to 5,970,152 ADSs (the “Warrants”) at an

exercise price of $0.67 per ADS. The Warrants are immediately exercisable and will expire on the date that is five and one-half year anniversary

of their issuance. The Warrants and the ADSs issuable upon the exercise of such Warrants are not being registered under the Securities

Act of 1933, as amended (the “Securities Act”), and are not being offered pursuant to this prospectus supplement and the accompanying

prospectus and are being offered pursuant to an exemption from the registration requirements of the Securities Act provided in Section

4(a)(2) of the Securities Act and Rule 506(b) promulgated thereunder.

We have retained Maxim Group LLC as our placement

agent in connection with this offering. The placement agent is not purchasing or selling any of the securities offered pursuant to this

prospectus supplement and the accompanying prospectus. We have agreed to pay the placement agent the fees set forth in the table below

and to pay the placement agent for certain offering expenses. See “Plan of Distribution” beginning on page S-13 of this prospectus

supplement for more information regarding these arrangements.

We are an “emerging growth company”

as defined in the Jumpstart Our Business Act of 2012, as amended, and, as such, will be subject to reduced public company reporting requirements.

The aggregate market value of our outstanding

voting and non-voting common equity held by non-affiliates, or public float, as of January 26, 2024, was approximately $12.83 million,

which was calculated based on 14,258,568 Ordinary Shares held by non-affiliates as of January 26, 2024 and a per share price of $0.90,

which was the closing price of the ADSs on Nasdaq on December 20, 2023. We have not sold any securities pursuant to General Instruction

I.B.5. of Form F-3 during the prior 12 calendar month period that ends on and includes the date of this prospectus supplement.

INVESTING IN OUR SECURITIES INVOLVES

RISKS. SEE “RISK FACTORS” ON PAGE S-6 OF THIS PROSPECTUS SUPPLEMENT AND ON PAGE 6 OF THE ACCOMPANYING PROSPECTUS AND IN

THE DOCUMENTS INCORPORATED BY REFERENCE IN THIS PROSPECTUS SUPPLEMENT CONCERNING FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN THE

ADSs.

Neither the U.S. Securities and Exchange Commission

nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this

prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

| | |

Per ADS | | |

Total | |

| Public offering price | |

$ | 0.67 | | |

$ | 4,000,002 | |

| Placement agent’s fees(1) | |

$ | 0.05 | | |

$ | 300,000 | |

| Proceeds, before expenses, to us | |

$ | 0.62 | | |

$ | 3,700,002 | |

(1) We will pay the placement agent a placement

agent fee equal to 7.5% of the gross proceeds of the offering and certain expenses incurred in this offering. See “Plan of Distribution”

on page S-13 of this prospectus supplement for more information regarding the compensation to placement agent.

We expect that delivery of the ADSs being offered

pursuant to this prospectus supplement and the accompanying prospectus will be made on or about January 30, 2024, subject to customary

closing conditions.

Placement Agent

Maxim Group LLC

The date of this prospectus supplement is January

26, 2024

TABLE OF CONTENTS

Prospectus

Supplement

Prospectus

No dealer, salesperson, or other person is authorized

to give any information or to represent anything not contained in this prospectus supplement or the accompanying prospectus. You must

not rely on any unauthorized information or representations. This prospectus supplement and the accompanying prospectus are an offer to

sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information

contained in this prospectus supplement and the accompanying prospectus is current only as of their respective dates.

ABOUT THIS PROSPECTUS SUPPLEMENT

On August 18, 2023, we filed with the U.S. Securities

and Exchange Commission (the “SEC”) a registration statement on Form F-3 (File No. 333-274076), utilizing a shelf registration

process relating to the securities described in this prospectus supplement, which registration statement was declared effective by the

SEC on September 8, 2023. Under this shelf registration process, we may, from time to time, in one or more offerings, offer and sell up

to $100,000,000 of our Ordinary Shares, including Ordinary Shares represented by ADSs, each representing one Ordinary Share, debt securities,

warrants, and units, or any combination thereof, together or separately, as described in the accompanying prospectus. We are selling ADSs

in this offering. Other than ADSs being sold pursuant to this offering, we have not sold any securities under this shelf registration

statement.

This document is in two parts. The first part

is this prospectus supplement, which describes the specific terms of this offering and also adds to and updates information contained

in the accompanying prospectus and the documents incorporated by reference into the prospectus supplement. The second part, the accompanying

prospectus, gives more general information, some of which does not apply to this offering. You should read this entire prospectus supplement

as well as the accompanying prospectus and the documents incorporated by reference that are described under “Incorporation of Documents

by Reference” and “Where You Can Find Additional Information” in this prospectus supplement and the accompanying prospectus.

If the description of the offering varies between

this prospectus supplement and the accompanying prospectus, you should rely on the information contained in this prospectus supplement.

However, if any statement in one of these documents is inconsistent with a statement in another document having a later date—for

example, a document incorporated by reference in this prospectus supplement and the accompanying prospectus—the statement in the

document having the later date modifies or supersedes the earlier statement. Except as specifically stated, we are not incorporating by

reference any information submitted under any Report of Foreign Private Issuer on Form 6-K into this prospectus supplement or the accompanying

prospectus.

Any statement contained in a document incorporated

by reference, or deemed to be incorporated by reference, into this prospectus supplement or the accompanying prospectus will be deemed

to be modified or superseded for purposes of this prospectus supplement or the accompanying prospectus to the extent that a statement

contained herein, therein or in any other subsequently filed document which also is incorporated by reference in this prospectus supplement

or the accompanying prospectus modifies or supersedes that statement. Any such statement so modified or superseded will not be deemed,

except as so modified or superseded, to constitute a part of this prospectus supplement or the accompanying prospectus.

We further note that the representations, warranties,

and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus

supplement and the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases,

for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or

covenant to you unless you are a party to such agreement. Moreover, such representations, warranties, or covenants were accurate only

as of the date when made or expressly referenced therein. Accordingly, such representations, warranties, and covenants should not be relied

on as accurately representing the current state of our affairs unless you are a party to such agreement.

You should rely only on the information contained

or incorporated by reference in this prospectus supplement and the accompanying prospectus. We have not, and the placement agent has not,

authorized any other person to provide you with any information that is different. If anyone provides you with different or inconsistent

information, you should not rely on it. We are offering to sell, and seeking offers to buy, the ADSs only in jurisdictions where offers

and sales are permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering of the ADSs in

certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement

and the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the offering of the ADSs and the

distribution of this prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement and the

accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to

buy, any securities offered by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it

is unlawful for such person to make such an offer or solicitation.

COMMONLY USED DEFINED TERMS

Unless otherwise indicated or the context requires

otherwise, references in this prospectus supplement are to:

| ● | “ADRs” are to the

American Depositary Receipts that may evidence the ADSs; |

| ● | “China” or the

“PRC” are to the People’s Republic of China; |

| ● | “Japanese yen,”

“JPY,” or “¥” are to the legal currency of Japan; |

| ● | “Kaika International”

are to Kaika International Co., Ltd., formerly known as Tokyo Lifestyle Co., Ltd., a stock company incorporated pursuant to the laws

of Japan, which was wholly owned by Yoshitsu (defined below); |

| ● | “Palpito” are to

Palpito Co., Ltd., a company incorporated pursuant to the laws of Japan, which was 40% owned by Yoshitsu and 60% by two unrelated third

parties; |

| ● | “U.S. dollars,”

“$” and “dollars” are to the legal currency of the United States; |

| ● | “U.S. GAAP” are

to generally accepted accounting principles in the United States; |

| ● | “we,” “us,”

“our,” “our Company,” or the “Company” are to Yoshitsu and its subsidiary, as the case may be; and |

| ● | “Yoshitsu”

are to Yoshitsu Co., Ltd, a stock company incorporated pursuant to the laws of Japan. |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus,

and our SEC filings that are incorporated by reference into this prospectus supplement contain or incorporate by reference forward-looking

statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended

(“Exchange Act”). Many of the forward-looking statements contained in this prospectus supplement can be identified by the

use of forward-looking words such as “anticipate,” “believe,” “could,” “expect,” “should,”

“plan,” “intend,” “estimate,” and “potential,” among others.

Forward-looking statements appear in a number

of places in this prospectus supplement, the accompanying prospectus, and our SEC filings that are incorporated by reference into this

prospectus supplement. These forward-looking statements include, but are not limited to, statements regarding our intent, belief, or current

expectations. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available

to our management. These forward-looking statements speak only as of the respective dates of this prospectus supplement, the accompanying

prospectus, and the documents incorporated by reference herein and therein, as applicable, and are subject to risks and uncertainties,

and actual results may differ materially from those expressed or implied in the forward-looking statements due to of various factors,

including, but not limited to, those identified under the section entitle d “Item 3. Key Information—3.D. Risk Factors”

in our annual report on Form 20-F for the fiscal year ended March 31, 2023 (the “2023 Annual Report”), the section entitled

“Risk Factors” beginning on page S-6 of this prospectus supplement, and the section entitled “Risk Factors”

on page 6 of the accompanying prospectus. These risks and uncertainties include factors relating to:

| ● | assumptions about our future

financial and operating results, including revenue, income, expenditures, cash balances, and other financial items; |

| ● | our ability to execute our

growth strategies, including our ability to meet our goals; |

| ● | current and future economic

and political conditions; |

| ● | our capital requirements and

our ability to raise any additional financing which we may require; |

| ● | our ability to attract customers

and further enhance our brand recognition; |

| ● | our ability to hire and retain

qualified management personnel and key employees in order to enable us to develop our business; |

| ● | trends and competition in the

beauty and health products industry; and |

| ● | other risk factors discussed

under “Item 3. Key Information—3.D. Risk Factors” in our 2023 Annual Report. |

Because forward-looking statements are inherently

subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control, you should

not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking

statements may not be achieved or occur, and actual results could differ materially from those projected in the forward-looking statements.

Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible

for management to predict all risk factors and uncertainties. As a result of these factors, we cannot assure you that the forward-looking

statements in this prospectus supplement or incorporated by reference herein will prove to be accurate. Except as required by applicable

law, we do not plan to publicly update or revise any forward-looking statements contained in this prospectus supplement, the accompanying

base prospectus, and the documents incorporated by reference herein and therein and any free writing prospectus, whether as a result of

any new information, future events, changed circumstances, or otherwise.

You should read this prospectus supplement, the

accompanying base prospectus, and the documents incorporated by reference herein and therein completely and with the understanding that

our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary

statements.

PROSPECTUS SUPPLEMENT SUMMARY

The following summary highlights, and should

be read in conjunction with, the more detailed information contained elsewhere in this prospectus supplement, the accompanying prospectus,

and the documents incorporated therein by reference. You should read carefully the entire documents, including our financial statements

and related notes, to understand our business, the Ordinary Shares, and the other considerations that are important to your decision to

invest in our securities. You should pay special attention to the “Risk Factors” sections beginning on page S-6 of this

prospectus supplement and on page 6 of the accompanying prospectus.

Our Corporate Structure

We began our operations

through Yoshitsu, a stock company incorporated on December 28, 2006 pursuant to the laws of Japan. On October 24, 2019, Yoshitsu incorporated

a wholly owned subsidiary, Tokyo Lifestyle Co., Ltd., pursuant to the laws of Japan. On August 25, 2022, Tokyo Lifestyle Co., Ltd. changed

its name to Kaika International Co., Ltd.

On December 25, 2020,

we established a new company in Japan, Palpito, owned 40% by Yoshitsu and 60% by two unrelated third parties. Palpito is a retailer and

wholesaler of art toys, which are toys and collectibles created by artists and designers that are either self-produced or made by small,

independent toy companies, typically in very limited editions.

On January 13, 2022,

we closed our initial public offering (“IPO”) of 6,250,000 ADSs at a public offering price of $4.00 per ADS, which included

250,000 ADSs issued pursuant to the partial exercise of the underwriters’ over-allotment option. Each ADS represents one Ordinary

Share. The closing for the sale of the over-allotment shares took place on February 21, 2022. Gross proceeds of our IPO, including the

proceeds from the sale of the over-allotment shares, totaled $25.0 million, before deducting underwriting discounts and other related

expenses. Net proceeds of our IPO, including over-allotment shares, were approximately $21.4 million. In connection with the IPO, the

ADSs began trading on Nasdaq under the symbol “TKLF” on January 18, 2022.

On July 20, 2022, we

entered into a definitive agreement (the “Agreement”) with All Seas Global Limited (the “Seller”). Mr. Mei Kanayama,

the representative director of our Company, holds 100% of the equity interests in the Seller, and hence, we and the Seller are related

parties under common control. Tokyo Lifestyle Limited is a company principally engaged in the import and retail of Japanese beauty and

cosmetic products in Hong Kong and engaged in the live e-commerce business through its wholly-owned subsidiary, Shenzhen Qingzhiliangpin

Network Technology Co., Ltd. (“Qingzhiliangpin”). Pursuant to the Agreement, we agreed to acquire 100% of the equity interests

in Tokyo Lifestyle Limited in consideration of the sum of ¥392,000,000 in cash (approximately US$2,842,173), subject to certain terms.

The transaction contemplated by the Agreement was approved by our board of directors at a meeting on June 27, 2022, and closed on July

27, 2022. This acquisition is a critical initiative of our business strategy to boost our business expansion in the Southeast Asia market

and advance the digital transformation of live streaming e-commerce in our retail business.

On October 26, 2022,

the board of directors of Tokyo Lifestyle Limited approved the acquisition of REIWATAKIYA (MYS) SDN. BHD. (“Reiwatakiya”)

from the Seller, who held 60% equity interests in Reiwatakiya. Reiwatakiya is an entity incorporated on June 14, 2022 and is not in operation

as of the date of this prospectus supplement. It is expected to principally engage in the import and retail of Japanese beauty and cosmetic

products in Malaysia. The 60% equity interests in Reiwatakiya were transferred to Tokyo Lifestyle Limited on October 26, 2022 with no

consideration. As Tokyo Lifestyle Limited and Reiwatakiya previously were controlled by the same ultimate controlling shareholder before

this acquisition of a business between entities under common control, and therefore, the related acquired assets and liabilities were

transferred at Reiwatakiya’s historical carrying value. On January 4, 2023, Tokyo Lifestyle Limited acquired the remaining 40% of

the equity interests in Reiwatakiya from a third-party shareholder with no consideration and Reiwatakiya became the wholly owned subsidiary

of Tokyo Lifestyle Limited.

On June 30, 2023, we

entered into two share transfer agreements (the “Agreements”) with Seihinkokusai Co., Ltd. (“Seihinkokusai”),

an entity of which Mr. Mei Kanayama’s wife is a director and the representative director, to sell our 100% equity interests in Kaika

International and 40% equity interests in Palpito to Seihinkokusai, for cash consideration of ¥5,000,000 (approximately $37,595) and

¥40,000,000 (approximately $300,760), respectively. The transactions were negotiated at arm’s length and were approved by our

board on June 30, 2023. The cash consideration was fully received, and the transactions were completed on July 1, 2023.

On September 6, 2023,

Tokyo Lifestyle Limited incorporated a wholly-owned subsidiary, RAKKISTAR HOLDING INC., in the Province of Ontario, Canada. On October

17, 2023, Tokyo Lifestyle Limited incorporated a wholly-owned subsidiary, Tokyo Lifestyle Holding Inc. (“TSL Holding”), in

the State of Delaware. On October 26, 2023, TSL Holding incorporated a wholly-owned subsidiary, REIWATAKIYA BOS LLC, a limited liability

company in the Commonwealth of Massachusetts. On November 8, 2023, TSL Holding incorporated a wholly-owned subsidiary, REIWATAKIYA NYC

LLC, a limited liability company in the State of New York. These companies are currently not engaging in any active business operations.

The chart below illustrates our corporate and

shareholding structure:

Notes: all percentages reflect the equity interests held by each of

our shareholders.

| (1) |

Represents 12,975,050 Ordinary Shares held by Tokushin G. K., which is owned by Mr. Kanayama and his family, as of the date of this prospectus supplement. |

| |

|

| (2) |

Represents 2,672,754 ADSs held by Yingjia Yang, each representing one Ordinary Share, as of the date of this prospectus supplement, according to a Schedule 13G filed by Yingjia Yang on December 31, 2021 with the SEC. |

| (3) |

Represents 2,672,460 ADSs held by Grand Elec-Tech Limited, which is 100% owned by Zhiyong Chen, as of the date of this prospectus supplement, according to a Schedule 13G filed by Grand Elec-Tech Limited on December 31, 2021 with the SEC. |

| (4) |

Represents 2,063,300 Ordinary Shares held by Prometheus Capital Fund I, L.P., whose sole general partner is Prometheus Capital GP Limited, as of the date of this prospectus supplement. |

| (5) |

Represents 2,400,054 Ordinary Shares held by two shareholders of Yoshitsu, each of whom holds less than 5% of our Ordinary Shares, as of the date of this prospectus supplement. |

Our Company

Business Overview

Headquartered in Tokyo, we are a retailer and

wholesaler of Japanese beauty and health products, as well as sundry products and other products. We currently offer approximately 39,500

stock keeping units (“SKUs”) of beauty products, including cosmetics, skin care, fragrance, and body care, among others; 15,000

SKUs of health products, including over-the-counter (“OTC”) drugs, nutritional supplements, and medical supplies and devices;

41,600 SKUs of sundry products, including home goods, 150 SKUs of electronic products, including entertainment gaming products, such as

Nintendo Switch and Xbox Series, 590 SKUs of luxury products, including branded watches, perfume, handbags, clothes, and jewelry, and

44,800 SKUs of other products, including food, alcoholic beverages. We also provide advertising services by key opinion leaders.

We currently sell our

products through directly-operated physical stores, through online stores, and to franchise stores and wholesale customers. Leveraging

our deep understanding of consumer needs and preferences, we have been expanding our operations since 2019; we opened five new online

stores, added a franchise store in Canada, and developed 30 new wholesale customers during the fiscal year ended March 31, 2021; we opened

three new directly-operated physical stores in Hong Kong, opened two new overseas online stores and two new domestic online stores, added

two franchise stores, and developed 16 new wholesale customers during the fiscal year ended March 31, 2022; and we opened two new directly-operated

physical store in Japan and six new directly-operated physical stores in Hong Kong, opened two new overseas online stores and two new

domestic online stores, added one franchise stores, and developed 71 new wholesale customers during the period from April 1, 2022 to the

date of this prospectus supplement. We believe our distribution channels are a trusted destination for consumers to discover and purchase

branded Japanese beauty and health products, sundry products, electronic products, luxury products, and other products.

Since our inception,

we have built a large base of customers, which has been essential for our growth. During the six months ended September 30, 2023 and the

fiscal years ended March 31, 2023, 2022, and 2021, our physical stores served approximately 389,820, 542,276, 431,484, and 537,537 customers,

respectively, and orders placed by our repeat customers accounted for approximately 40%, 40%, 47%, and 48% of total orders in our physical

stores, respectively. During the same periods, our online stores served approximately 425,800, 615,571, 2,091,231, and 2,203,000 customers,

respectively, and orders placed by our repeat customers accounted for approximately 45%, 54%, 39%, and 26% of total orders in our online

stores, respectively. During the same periods, our franchise stores served approximately 201,500, 154,344, 259,746, and 204,500 customers,

and orders placed by our repeat customers accounted for approximately 48%, 54%, 51%, and 45% of total orders in our franchise stores,

respectively.

Since our inception,

we have established long-term relationships with over 130 suppliers, consisting primarily of cosmetics and pharmaceutical companies and

distributors, including many well-known Japanese brands, such as Shiseido, Sato, Kao, and Kosé.

Our revenue decreased

from $77,615,549 during the six months ended September 30, 2022 to $74,164,149 during the six months ended September 30, 2023, representing

a slight decrease of 4.4%. Our net income increased from $327,593 during the six months ended September 30, 2022 to $1,954,355 during

the six months ended September 30, 2023, representing an increase of 496.6%.

Our revenue increased

from $224,758,556 during the fiscal year ended March 31, 2021 to $234,752,580 during the fiscal year ended March 31, 2022, representing

a slight increase of 4.4%. However, due to the negative impact of the recent resurgence of the COVID-19 on our revenue and an increase

in our operating expenses, our revenue decreased to $169,724,346 during the fiscal year ended March 31, 2023, representing a decrease

of 27.7%. Our net income decreased from $4,952,327 during the fiscal year ended March 31, 2021 to $3,924,148 during the fiscal year ended

March 31, 2022, representing a decrease of 20.8%. During the fiscal year ended March 31, 2023, our net income decreased to a net loss

of $8,048,822, representing a decrease of 305.1%.

Since our inception,

we have financed our operations primarily through bank loans. As of the date of this prospectus supplement, we have approximately $54.4

million in short-term borrowings outstanding, with a maturity date on March 29, 2024, which loans we expect to be able to renew upon their

maturity based on our past experience and our credit history, and approximately $10.8 million in long-term borrowings outstanding, with

maturity dates ranging from March 29, 2024 to December 2053. See “Item 3. Key Information—D. Risk Factors—Risks

Related to Our Business—We rely substantially on short-term borrowings to fund our operations, and the failure to renew these short-term

borrowings or the failure to continue to obtain financing on favorable terms, if at all, may adversely affect our ability to operate our

business,” “Item 3. Key Information—D. Risk Factors—Risks Related to Our Business—Our substantial indebtedness

could materially and adversely affect our business, financial condition, results of operations, and cash flows,” and “Item

5. Operating and Financial Review and Prospects—B. Liquidity and Capital Resources” in the 2023 Annual Report.

Sales to the China market

represent a significant part of our revenue. During the six months ended September 30, 2023, sales to the China market accounted for approximately

59.3% of our revenue. During the fiscal years ended March 31, 2023, 2022, and 2021, sales to the China market accounted for approximately

51.1%, 84.2%, and 77.4% of our revenue, respectively, mainly due to the increased online sales in China. See “Item 3. Key Information—D.

Risk Factors—Risks Related to Our Business—Sales to the China market represented approximately 51.1%, 84.2%, and 77.4% of

our revenue for the fiscal years ended March 31, 2023, 2022, and 2021, respectively, and we expect such sales to continue to represent

a significant part of our revenue and any negative impact to our ability to sell our products to customers based in China could materially

and adversely affect our results of operations” in the 2023 Annual Report. As we plan to expand into new markets by opening new

stores, including adding additional directly-operated physical stores in Japan and Hong Kong, and adding new franchise stores in the U.S.,

Canada, Australia, New Zealand, the U.K., Malaysia, and Taiwan during the next three years, we expect the percentage of sales to the China

market to decrease in the future.

Corporate Information

Our headquarters are located at Harumi Building,

2-5-9 Kotobashi, Sumida-ku, Tokyo, 130-0022, Japan, and our phone number is +81356250668. Our English website address is www.ystbek.co.jp/en/.

The information contained in, or accessible from, our website or any other website does not constitute a part of this prospectus supplement.

Our agent for service of process in the United States is Cogency Global Inc., located at 122 East 42nd Street, 18th Floor, New York, NY

10168.

The Offering

| ADSs offered by us pursuant to this prospectus supplement |

|

5,970,152 ADSs representing 5,970,152 Ordinary Shares |

| |

|

|

| Offering Price |

|

$0.67 per ADS |

| |

|

|

| Total Ordinary Shares outstanding before this offering |

|

36,250,054 |

| |

|

|

| Total Ordinary Shares outstanding immediately after this offering |

|

42,220,206 |

| |

|

|

| ADSs outstanding before this offering |

|

11,595,214 |

| |

|

|

| ADSs outstanding immediately after this offering |

|

17,565,366 |

| |

|

|

| Use of proceeds |

|

We intend to use the net proceeds from this offering to expand overseas markets and for daily operations. See “Use of Proceeds” on page S-9 of this prospectus supplement. |

| |

|

|

| Risk factors |

|

Investing in our securities involves a high degree of risk. For a discussion of factors you should consider carefully before deciding to invest in our securities, see the information contained in or incorporated by reference under the heading “Risk Factors” beginning on page S-6 of this prospectus supplement, on page 6 of the accompanying prospectus, and in the other documents incorporated by reference into this prospectus supplement. |

| |

|

|

| Listing |

|

The ADSs are listed on Nasdaq under the symbol “TKLF.” |

| |

|

|

| Concurrent Private Placement |

|

In a concurrent private placement, we are selling to the purchasers of ADSs in this offering five and a half year Warrants to purchase 5,970,152 ADSs at an exercise price of $0.67 per share. We will receive gross proceeds from the concurrent private placement transaction solely to the extent such Warrants are exercised for cash. The Warrants and the ADSs issuable upon the exercise of the Warrants are not being offered pursuant to this prospectus supplement and the accompanying prospectus and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and Rule 506(b) promulgated thereunder. See “Concurrent Private Placement Transaction.” |

Unless otherwise indicated, the number of Ordinary

Shares outstanding prior to and after this offering is based on 36,250,054 Ordinary Shares issued and outstanding as of January 26, 2024

and the 5,970,152 ADSs to be issued in this offering, and excludes, as of such date, (i) the 300,000 ADSs issuable upon exercise of the

warrants offered to the representative of underwriters in connection with the Company’s initial public offering closed on January

13, 2022 and (ii) the 5,970,152 ADSs issuable upon exercise of the Warrants to be issued to the investors in the private placement concurrent

with this offering pursuant to the Securities Purchase Agreement.

RISK FACTORS

The following is a summary of certain risks

that should be carefully considered along with the other information contained or incorporated by reference in this prospectus supplement,

the accompanying prospectus, and the documents incorporated by reference, as updated by our subsequent filings under the Exchange Act.

Particularly, you should carefully consider the risk factors incorporated by reference to our 2023 Annual Report and in the accompanying

prospectus. If any of the following events actually occur, our business, operating results, prospects, or financial condition could be

materially and adversely affected. The risks described below are not the only ones that we face. Additional risks not presently known

to us or that we currently deem immaterial may also significantly impair our business operations and could result in a complete loss of

your investment.

Risks Related to this Offering and the ADSs

Since our management will have broad discretion

in how we use the proceeds from this offering, we may use the proceeds in ways with which you disagree.

Our management will have significant flexibility

in applying the net proceeds of this offering. You will be relying on the judgment of our management with regard to the use of those net

proceeds, and you will not have the opportunity, as part of your investment decision, to influence how the proceeds are being used. Because

of the number and variability of factors that will determine our use of the net proceeds from this offering, their ultimate use may vary

substantially from their currently intended use. It is possible that the net proceeds will be invested in a way that does not yield a

favorable, or any, return for us. Our management might not apply the net proceeds or our existing cash, cash equivalents, and investments

in ways that ultimately increase the value of your investment. If we do not invest or apply the net proceeds from this offering or our

existing cash, cash equivalents, and investments in ways that enhance shareholder value, we may fail to achieve expected business and

financial results, which could cause the price of the ADS to decline. The failure of our management to use such funds effectively could

have a material adverse effect on our business, financial condition, operating results, and cash flow.

Our existing shareholders will experience

immediate dilution as a result of this offering and you may experience future dilution as a result of future equity offerings or other

equity issuances.

Our existing shareholders will experience an immediate

dilution relative to net tangible book value per ADS. Our net tangible book value on September 30, 2023 was $27,966,448, or $0.77 per

ADS. After giving effect to the sale of the ADS of approximately $4 million in this offering at an offering price of $0.67 per ADS, and

after deducting the placement agent fees and estimated offering expenses payable by us in connection with this offering, our as-adjusted

net tangible book value as of September 30, 2023 would have been $31,378,430, or $0.74 per ADS. This represents an immediate decrease

in net tangible book value of $0.03 per ADS to our existing shareholders and an immediate increase in net tangible book value of $0.07

per ADS to the investors participating in this offering. In addition, we are issuing Warrants to purchase 5,970,152 ADSs in a concurrent

private placement. Our existing shareholders will incur additional dilution upon exercise of these Warrants as well as any other outstanding

warrants or options.

We may, in the future, issue additional ADSs or

Ordinary Shares or other securities convertible into or exchangeable for the ADSs or Ordinary Shares. We cannot assure you that we will

be able to sell the ADSs or other securities in any other offering or other transactions at a price per ADS that is equal to or greater

than the price per ADS paid by investors in this offering. The price per ADS at which we sell additional ADSs or Ordinary Shares or other

securities convertible into or exchangeable for the ADSs or Ordinary Shares in future transactions may be higher or lower than the price

per ADS in this offering. If we do issue any such additional ADSs or Ordinary Shares, such issuance will also cause a reduction in the

proportionate ownership and voting power of all other shareholders.

The sale or availability

for sale of substantial amounts of the ADSs or Ordinary Shares could adversely affect the market price of the ADSs.

Sales of substantial

amounts of the ADSs or Ordinary Shares in the public market, or the perception that these sales could occur, could adversely affect the

market price of the ADSs and could materially impair our ability to raise capital through equity offerings in the future. As of the date

of this prospectus supplement, 36,250,054 of our Ordinary Shares are issued and outstanding. Among these shares, 11,595,214 are in the

form of ADSs. All the ADSs are freely tradable without restriction or additional registration under the Securities Act. The remaining

Ordinary Shares outstanding are available for sale, subject to volume and other restrictions as applicable under Rules 144 and 701 under

the Securities Act. We cannot predict what effect, if any, market sales of securities held by our significant shareholders or any other

shareholder or the availability of these securities for future sale will have on the market price of the ADSs.

The market price

of the ADSs may be volatile or may decline regardless of our operating performance.

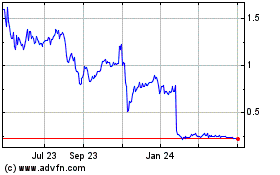

From the closing of our

initial public offering on January 13, 2022 to January 25, 2024, the closing price of the ADSs has ranged from $0.51 to $29.52 per ADS.

The trading price of the ADSs is likely to continue to be volatile and could fluctuate widely due to factors beyond our control. This

may happen because of broad market and industry factors, including the performance and fluctuation of the market prices of other companies

with business operations located mainly in Japan that have listed their securities in the United States.

In addition to market

and industry factors, the price and trading volume for the ADSs may be highly volatile for factors specific to our own operations, including

the following:

| |

● |

actual or anticipated fluctuations in our revenue and other operating results; |

| |

|

|

| |

● |

the financial projections we may provide to the public, any changes in these projections, or our failure to meet these projections; |

| |

|

|

| |

● |

actions of securities analysts who initiate or maintain coverage of us, changes in financial estimates by any securities analysts who follow our Company, or our failure to meet these estimates or the expectations of investors; |

| |

|

|

| |

● |

announcements by us or our competitors of significant products or features, technical innovations, acquisitions, strategic partnerships, joint ventures, or capital commitments; |

| |

● |

price and volume fluctuations in the overall stock market, including as a result of trends in the economy as a whole; |

| |

|

|

| |

● |

the trading volume of the ADSs on Nasdaq; |

| |

|

|

| |

● |

sales of the ADSs or Ordinary Shares by us, members of our senior management and directors or our shareholders or the anticipation that such sales may occur in the future; |

| |

|

|

| |

● |

lawsuits threatened or filed against us; and |

| |

|

|

| |

● |

other events or factors, including those resulting from war or incidents of terrorism, or responses to these events. |

In addition, the stock

markets have experienced extreme price and volume fluctuations that have affected and continue to affect the market prices of equity securities

of many companies. Stock prices of many companies have fluctuated in a manner unrelated or disproportionate to the operating performance

of those companies. In the past, stockholders have filed securities class action litigation following periods of market volatility. If

we were to become involved in securities litigation, it could subject us to substantial costs, divert resources and the attention of management

from our business, and adversely affect our business.

Techniques employed by short sellers may

drive down the market price of the ADSs.

Short selling is the practice of selling securities

that the seller does not own but rather has borrowed from a third party with the intention of buying identical securities back at a later

date to return to the lender. The short seller hopes to profit from a decline in the value of the securities between the sale of the borrowed

securities and the purchase of the replacement shares, as the short seller expects to pay less in that purchase than it received in the

sale. As it is in the short seller’s interest for the price of the security to decline, many short sellers publish, or arrange for

the publication of, negative opinions regarding the relevant issuer and its business prospects in order to create negative market momentum

and generate profits for themselves after selling a security short. These short attacks have, in the past, led to selling of shares in

the market.

We may, in the future, be the subject of unfavorable

allegations made by short sellers. Any such allegations may be followed by periods of instability in the market price of the ADSs and

negative publicity. If and when we become the subject of any unfavorable allegations, whether such allegations are proven to be true or

untrue, we could have to expend a significant amount of resources to investigate such allegations and/or defend ourselves. While we would

strongly defend against any such short seller attacks, we may be constrained in the manner in which we can proceed against the relevant

short seller by principles of freedom of speech, applicable federal or state law, or issues of commercial confidentiality. Such a situation

could be costly and time-consuming and could distract our management from growing our business. Even if such allegations are ultimately

proven to be groundless, allegations against us could severely impact our business operations and shareholder’s equity, and the

value of any investment in the ADSs could be greatly reduced or rendered worthless.

USE OF PROCEEDS

We estimate that the net proceeds from this offering

will be approximately $3,411,982, after deducting the placement agent fees and the estimated offering expenses payable by us.

We intend to use the net proceeds from this offering

for the purposes and in the amounts set forth below:

| |

● |

60% of the net proceeds to expand overseas markets, mainly the North American market; and |

| |

● |

40% of the net proceeds for daily operations. |

The amounts and timing of our use of proceeds

will vary depending on a number of factors, including the amount of cash generated or used by our operations, and the rate of growth,

if any, of our business. As a result, we will retain broad discretion in the allocation of the net proceeds of this offering. In particular,

we reserve the right to change the use of these proceeds as a result of certain contingencies such as competitive developments, acquisition

and investment opportunities and other factors. See “Risk Factors—Risks Related to this Offering and the ADSs—Since

our management will have broad discretion in how we use the proceeds from this offering, we may use the proceeds in ways with which you

disagree.”

DIVIDEND POLICY

We have not declared or paid dividends to shareholders

since inception and do not plan to pay cash dividends in the foreseeable future. We currently intend to retain most, if not all, of our

available funds and any future earnings to fund the operation, development, and growth of our business.

CAPITALIZATION

The following table sets forth our capitalization

as of September 30, 2023:

| ● | on an actual basis, as derived

from our audited consolidated financial statements as of September 30, 2023, which are incorporated by reference into this prospectus

supplement; and |

| ● | on an as-adjusted basis to

reflect the issuance and sale of 5,970,152 ADSs at the offering price of $0.67 per ADS, after deducting placement agent fees and estimated

offering expenses payable by us. |

You should read this table together with our consolidated

financial statements and notes included in the information incorporated by reference into this prospectus supplement and the accompanying

prospectus.

| | |

As of September 30, 2023 | |

| | |

Actual $ | | |

As-Adjusted $ | |

| | |

| |

| Shareholders’ Equity: | |

| | |

| |

| Ordinary Shares (100,000,000 shares authorized, 36,250,054 shares issued outstanding, and 42,220,206 shares outstanding on an as-adjusted basis) | |

| 14,694,327 | | |

| 18,106,309 | |

| Additional paid-in capital | |

| 9,078,915 | | |

| 9,078,915 | |

| Accumulated earnings | |

| 15,532,199 | | |

| 15,532,199 | |

| Accumulated other comprehensive loss | |

| (11,338,993 | ) | |

| (11,338,993 | ) |

| Total Shareholders’ Equity | |

| 27,966,448 | | |

| 31,378,430 | |

| Total Capitalization | |

| 94,013,340 | | |

| 97,425,322 | |

The preceding table excludes (i) the 300,000 ADSs

issuable upon exercise of the warrants offered to the representative of underwriters in connection with the Company’s initial public

offering closed on January 13, 2022 and (ii) the 5,970,152 ADSs issuable upon exercise of the Warrants to be issued in a concurrent private

placement to the investors in this offering pursuant to the Securities Purchase Agreement.

DILUTION

Our net tangible book value on September 30, 2023

was $27,966,448, or $0.77 per ADS. “Net tangible book value” is total assets minus the sum of liabilities and intangible assets.

“Net tangible book value per share” is net tangible book value divided by the total number of shares outstanding.

After giving effect to the sale of the 5,970,152

ADSs in this offering, at an offering price of $0.67 per ADS, and after deducting the placement agent fees and estimated offering expenses

payable by us in connection with this offering (assuming no exercise of the Warrants issued in the concurrent private placement), our

as-adjusted net tangible book value as of September 30, 2023 would have been $31,378,430, or $0.74 per ADS. This represents an immediate

decrease in net tangible book value of $0.03 per ADS to our existing shareholders and an immediate increase in net tangible book value

of $0.07 per ADS to the investor participating in this offering.

The following table illustrates the net tangible

book value dilution per ADS to shareholders after the issuance of the ADSs in this offering:

| Public offering price per ADS | |

$ | 0.67 | |

| Net tangible book value per ADS as of September 30, 2023 | |

$ | 0.77 | |

| Decrease per ADS attributable to existing investors under this prospectus supplement | |

$ | 0.03 | |

| As-adjusted net tangible book value per ADS after this offering | |

$ | 0.74 | |

| Net tangible book value increase per ADS to new investors | |

$ | 0.07 | |

The foregoing table and discussion is based on

36,250,054 Ordinary Shares outstanding as of September 30, 2023 and excludes (i) the 300,000 ADSs issuable upon exercise of the warrants

offered to the representative of underwriters in connection with the Company’s initial public offering closed on January 13, 2022

and (ii) the 5,970,152 ADSs issuable upon exercise of the Warrants offered in a concurrent private placement to the investors in this

offering pursuant to the Securities Purchase Agreement.

DESCRIPTION OF SECURITIES WE ARE OFFERING

We are offering 5,970,152 ADSs representing 5,970,152

Ordinary Shares pursuant to this prospectus supplement and the accompanying prospectus. The material terms and provisions of our Ordinary

Shares and ADSs are described under the caption “Description of Share Capital” and “Description of American Depositary

Shares” beginning on pages 8 and 15 of the accompanying prospectus, respectively.

CONCURRENT PRIVATE PLACEMENT TRANSACTION

Concurrently with the sale of ADSs in this offering,

we will issue and sell to the investors in this offering Warrants to purchase up to an aggregate of 5,970,152 ADSs at an exercise price

equal to $0.67 per ADS.

The private placement Warrants and the ADSs issuable

upon the exercise of such Warrants are not being registered under the Securities Act, are not being offered pursuant to this prospectus

supplement and the accompanying prospectus, and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities

Act and Rule 506(b) promulgated thereunder. Accordingly, purchasers may only sell ADSs issued upon exercise of the private placement Warrants

pursuant to an effective registration statement under the Securities Act covering the resale of those ADSs, an exemption under Rule 144

under the Securities Act or another applicable exemption under the Securities Act.

Exercisability. The private placement Warrants

are exercisable for a period of five and one half years commencing January 30, 2024 and expiring July 30, 2029. The Warrants will be exercisable,

at the option of each holder, in whole or in part by delivering to us a duly executed exercise notice and, at any time a registration

statement registering the issuance of the ADSs underlying the Warrants under the Securities Act is effective and available for the issuance

of such ADSs, or an exemption from registration under the Securities Act is available for the issuance of such ADSs, by payment in full

in immediately available funds for the number of ADSs purchased upon such exercise. If a registration statement registering the issuance

of the ADSs underlying the private placement Warrants under the Securities Act is not effective or available at any time after 75 days

from January 30, 2024, the holder may, in its sole discretion, elect to exercise the private placement Warrant through a cashless exercise,

in which case the holder would receive upon such exercise the net number of ADSs determined according to the formula set forth in the

Warrant.

Exercise Limitation. A holder will not

have the right to exercise any portion of the private placement Warrants if the holder (together with its affiliates) would beneficially

own in excess of 4.99% (or, upon election of the holder, 9.99%) of the number of Ordinary Shares or ADSs outstanding immediately after

giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Warrants. However, any holder

may increase or decrease such percentage, provided that any increase will not be effective until the 61st day after such election.

Exercise Price Adjustment. The exercise

price of the private placement Warrants is subject to appropriate adjustment in the event of, among other things, certain share dividends

and distributions, share splits, share combinations, reclassifications, or similar events affecting our Ordinary Shares and/or ADSs and

also upon any distributions of assets, including cash, shares, or other property to our shareholders.

Exchange Listing. There is no established

trading market for the private placement Warrants and we do not expect a market to develop. In addition, we do not intend to apply for

the listing of the private placement Warrants on any national securities exchange or other trading market.

Fundamental Transactions. If a fundamental

transaction occurs, then the successor entity will succeed to, and be substituted for us, and may exercise every right and power that

we may exercise and will assume all of our obligations under the private placement Warrants with the same effect as if such successor

entity had been named in the Warrant itself. If holders of our Ordinary Shares and/or the ADSs are given a choice as to the securities,

cash, or property to be received in a fundamental transaction, then the holder shall be given the same choice as to the consideration

it receives upon any exercise of the private placement Warrant following such fundamental transaction. In addition, the successor entity,

at the request of warrant holders, will be obligated to purchase any unexercised portion of the private placement Warrants in accordance

with the terms of such Warrants.

Rights as a Shareholder. Except as otherwise

provided in the private placement Warrants or by virtue of such holder’s ownership of ADSs or Ordinary Shares, the holder of a private

placement Warrant will not have the rights or privileges of a holder of the ADSs or Ordinary Shares, including any voting rights, until

the holder exercises the Warrant.

PLAN OF DISTRIBUTION

Maxim Group LLC (the “placement agent”

or “Maxim”) has agreed to act as the exclusive placement agent in connection with this offering. The placement agent is not

purchasing or selling the ADSs offered by this prospectus supplement, nor is the placement agent required to arrange the purchase or sale

of any specific number or dollar amount of ADSs, but has agreed to use its best efforts to arrange for the sale of all of the ADSs offered

hereby. We have entered into the Securities Purchase Agreement with certain investors, pursuant to which we will sell to the investors

5,970,152 ADSs in this takedown from our shelf registration statement and Warrants to purchase up to 5,970,152 ADSs in a concurrent private

placement for a purchase price of $0.67 per ADS. We have negotiated the price for the securities offered in this offering with the investors.

The factors considered in determining the price included the recent market price of the ADSs, the general condition of the securities

market at the time of this offering, the history of, and the prospects, for the industry in which we compete, our past and present operations,

and our prospects for future revenue.

We entered into the Securities Purchase Agreement

directly with the investors on January 26, 2024, and we will only sell to investors who have entered into the Securities Purchase Agreement.

We expect to deliver the ADSs being offered pursuant

to this prospectus supplement on or about January 30, 2024, subject to customary closing conditions.

We have agreed to pay the placement agent a placement

agent fee equal to 7.5% of the gross proceeds of this offering. We have also agreed to reimburse the placement agent up to $50,000 for

the reasonable and accounted fees and expenses of legal counsel.

The following table shows per ADS and total placement

agent fees we will pay to the placement agent in connection with the sale of the ADSs pursuant to this prospectus supplement and the accompanying

prospectus, assuming the purchase of all of the ADSs offered hereby:

| | |

Per ADS | | |

Total | |

| Public offering price | |

$ | 0.67 | | |

$ | 4,000,002 | |

| Placement agent’s fees | |

$ | 0.05 | | |

$ | 300,000 | |

| Proceeds, before expenses, to us | |

$ | 0.62 | | |

$ | 3,700,002 | |

After deducting certain fees and expenses due

to placement agent and our estimated offering expenses, we expect the net proceeds from this offering to be approximately $3,411,982.

Lock-Up Agreements

Our directors, executive officers, and shareholders

holding at least 10% of the outstanding Ordinary Shares, have agreed for a period of six months, after the date of the lock-up agreements,

subject to certain exceptions, not to directly or indirectly offer, sell, or otherwise transfer or dispose of, directly or indirectly,

any ADSs or Ordinary Shares of the Company or any securities convertible into or exercisable or exchangeable for the ADSs or Ordinary

Shares of the Company.

Securities Issuance Standstill

We have agreed, for a period of 90 days after

the closing of this offering, that neither our Company nor any of our subsidiaries will issue, enter into any agreement to issue, or announce

the issuance or proposed issuance of any ADSs, Ordinary Shares, or Ordinary Share Equivalents or file any registration statement, or amendment

or supplement thereto, with the SEC, other than a prospectus filed with the SEC pursuant to Rule 424(b) in connection with this offering,

subject to certain exceptions in the placement agency agreement.

Right of First Refusal

Pursuant to the terms of the placement

agency agreement, for a period of nine (9) months from the closing of this offering, we grant Maxim the right of first refusal to

act as sole managing underwriter and sole book runner, sole placement agent, or sole sales agent, for any and all future public or

private equity, equity-linked, or debt (excluding commercial bank debt) offerings of our Company or any successor to or any

subsidiary of our Company for which we retain the service of an underwriter, agent, advisor, finder, or other person or entity in

connection with such offering during such nine (9) month period. We have agreed not to offer to retain any entity or person in connection with any such offering on terms more favorable than terms on

which we offer to retain the placement agent.

Indemnification

We have agreed to indemnify the placement agent

and specified other persons against certain civil liabilities and to reimburse the placement agent related fees and expenses that may

be incurred by the placement agent in investigating, preparing, pursuing, or defending actions related to such civil liabilities.

The placement agent may be deemed to be an underwriter

within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by it, and any profit realized on the resale

of the ADSs sold by it while acting as principal, might be deemed to be underwriting discounts or commissions under the Securities Act.

As an underwriter, the placement agent would be required to comply with the Securities Act and the Exchange Act, including without limitation,

Rule 10b-5 and Regulation M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of Ordinary

Shares and warrants by the placement agent acting as principal. Under these rules and regulations, the placement agent:

| ● | may not engage in any stabilization activity in connection

with our securities; and |

| ● | may not bid for or purchase any of our securities, or attempt

to induce any person to purchase any of our securities, other than as permitted under the Exchange Act, until it has completed its participation

in the distribution in the securities offered by this prospectus supplement. |

Other Relationships

The placement agent and certain of its affiliates

are full service financial institutions engaged in various activities, which may include securities trading, commercial and investment

banking, financial advisory, investment management, investment research, principal investment, hedging, financing, and brokerage activities.

The placement agent and certain of its affiliates may, in the future, perform various commercial and investment banking and financial

advisory services for us and our affiliates, for which they would receive customary fees and expenses.

In the ordinary course of their various business

activities, the placement agent and certain of its affiliates may make or hold a broad array of investments and actively trade debt and

equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and the accounts

of their customers, and such investment and securities activities may involve securities and/or instruments issued by us and our affiliates.

The placement agent and certain of its respective affiliates may also communicate independent investment recommendations, market color,

or trading ideas and/or publish or express independent research views in respect of such securities or instruments and may at any time

hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

LEGAL MATTERS

We are being represented by Hunter Taubman Fischer

& Li LLC with respect to certain legal matters of U.S. federal securities and New York State law. The validity of the securities offered

in this offering and certain other legal matters as to Japanese law will be passed upon for us by City-Yuwa Partners. Hunter Taubman Fischer

& Li LLC may rely upon City-Yuwa Partners with respect to matters governed by Japanese law. Certain legal matters in connection with

this offering will be passed upon for the placement agent by Loeb & Loeb LLP with respect to U.S. laws.

EXPERTS

The consolidated financial statements as of March

31, 2023 incorporated in this prospectus supplement by reference to the 2023 Annual Report have been so incorporated in reliance on the

report of Marcum Asia CPAs LLP, our independent registered public accounting firm since 2022, and Friedman LLP, our independent registered

public accounting firm from 2020 through 2022, given the authority of said firms as experts in auditing and accounting. The office of

Marcum Asia CPAs LLP is located at Seven Penn Plaza Suite 830, New York, NY 10001. The office of Friedman LLP is located at One Liberty

Plaza, 165 Broadway 21st Floor, New York, NY 10006.

INCORPORATION OF DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference”

into this prospectus supplement certain information that we file with the SEC. This means that we can disclose important information to

you by referring you to those documents. Any statement contained in a document incorporated by reference in this prospectus supplement

shall be deemed to be modified or superseded for purposes of this prospectus supplement to the extent that a statement contained herein,

or in any subsequently filed document, which also is incorporated by reference herein, modifies or supersedes such earlier statement.

Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus

supplement.

We hereby incorporate by reference into this prospectus

supplement the following documents:

| |

(1) |

our annual report on Form 20-F for the fiscal year ended March 31, 2023, filed with the SEC on July 31, 2023; |

| |

|

|

| |

(2) |

our unaudited condensed consolidated financial statements for the six months ended September 30, 2023 and 2022 on Form 6-K, filed with the SEC on December 22, 2023; |

| |

(3) |

our report of foreign private issuer on Form 6-K filed with the SEC on July 31, 2023; |

| |

(4) |

any future annual reports on Form 20-F filed with the SEC after the date of this prospectus supplement and prior to the termination of the offering of the securities offered by this prospectus supplement; and |

| |

(5) |

any future reports of foreign private issuer on Form 6-K that we furnish to the SEC after the date of this prospectus supplement that are identified in such reports as being incorporated by reference into the registration statement of which this prospectus supplement forms a part. |

The 2023 Annual Report contains a description

of our business and audited consolidated financial statements with a report by our independent auditors. These statements were prepared

in accordance with U.S. GAAP.

Unless expressly incorporated by reference, nothing

in this prospectus supplement shall be deemed to incorporate by reference information “furnished to,” but not “filed

with,” the SEC. Copies of all documents incorporated by reference in this prospectus supplement, other than exhibits to those documents

unless such exhibits are specially incorporated by reference in this prospectus supplement, will be provided at no cost to each person,

including any beneficial owner, who receives a copy of this prospectus supplement on the written or oral request of that person made to:

Yoshitsu Co., Ltd

Harumi Building, 2-5-9 Kotobashi,

Sumida-Ku, Tokyo, 130-0022

Japan

+81356250668

You should rely only on the information that we

incorporate by reference or provide in this prospectus supplement. We have not authorized anyone to provide you with different information.

We are not making any offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume

that the information contained or incorporated in this prospectus supplement by reference is accurate as of any date other than the date

of the document containing the information.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

As permitted by SEC rules, this prospectus supplement

omits certain information and exhibits that are included in the registration statement of which this prospectus supplement forms a part.

Since this prospectus supplement may not contain all of the information that you may find important, you should review the full text of

these documents. If we have filed a contract, agreement, or other document as an exhibit to the registration statement of which this prospectus

supplement forms a part, you should read the exhibit for a more complete understanding of the document or matter involved. Each statement

in this prospectus supplement, including statements incorporated by reference as discussed above, regarding a contract, agreement, or

other document is qualified in its entirety by reference to the actual document.

We are subject to periodic reporting and other

informational requirements of the Exchange Act as applicable to foreign private issuers. Accordingly, we are required to file reports,

including annual reports on Form 20-F, and other information with the SEC. All information filed with the SEC can be inspected over the

Internet at the SEC’s website at www.sec.gov.

As a foreign private issuer, we are exempt under

the Exchange Act from, among other things, the rules prescribing the furnishing and content of proxy statements, and our executive officers,

directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16

of the Exchange Act. In addition, we will not be required under the Exchange Act to file periodic or current reports and financial statements

with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act.

PROSPECTUS

$100,000,000 of

Ordinary Shares

Debt Securities

Warrants

and

Units

YOSHITSU CO., LTD

We may, from time to time, in one or more offerings,

offer and sell up to $100,000,000 of our ordinary shares (“Ordinary Shares”), including Ordinary Shares represented by American

depositary shares (“ADSs”), each representing one Ordinary Share, debt securities, warrants, and units, or any combination

thereof, together or separately as described in this prospectus. In this prospectus, references to the term “securities” refers,

collectively, to our Ordinary Shares (including ones represented by ADSs), debt securities, warrants, and units. The prospectus supplement

for each offering of securities will describe in detail the plan of distribution for that offering. For general information about the

distribution of the securities offered, please see “Plan of Distribution” in this prospectus.

This prospectus provides a general description

of the securities we may offer. We will provide the specific terms of the securities offered in one or more supplements to this prospectus.

We may also authorize one or more free writing

prospectuses to be provided to you in connection with these offerings. You should read this prospectus, any prospectus supplement, and

any free writing prospectus before you invest in any of our securities. The prospectus supplement and any related free writing prospectus

may add, update, or change information contained in this prospectus. You should read this prospectus carefully, the applicable prospectus

supplement, and any related free writing prospectus, as well as the documents incorporated or deemed to be incorporated by reference,

before you invest in any of our securities. This prospectus may not be used to offer or sell any securities unless accompanied by the

applicable prospectus supplement.

The ADSs are listed on the Nasdaq Capital Market,

or “Nasdaq,” under the symbol “TKLF.” On August 17, 2023, the last reported sale price of the ADSs on Nasdaq was

$1.06 per ADS. The aggregate market value of the voting and non-voting common equity held by non-affiliates, or public float, as of August

18, 2023, was approximately $19,819,410, which was calculated based on 14,258,568

Ordinary Shares held by non-affiliates and the price of $1.39 per share, which was the closing price of the ADSs on Nasdaq on July

21, 2023. Pursuant to General Instruction I.B.5 of Form F-3, in no event will we sell our securities in a public primary offering

with a value exceeding more than one-third of our public float in any 12-month period so long as our public float remains below $75 million.

During the 12 calendar months prior to and including the date of this prospectus, we have not offered or sold any securities pursuant

to General Instruction I.B.5 of Form F-3.

We are a “foreign private issuer” and

we are currently an “emerging growth company” under applicable U.S. federal securities laws and are eligible for

reduced public company reporting requirements. Subject to any other conditions as prescribed in the Jumpstart Our Business Startups Act

of 2012 (the “JOBS Act”), we will no longer be an “emerging growth company,” as defined in

the JOBS Act, from the last day of the fiscal year ending March 31, 2027.

We are a “controlled company” as

defined under the Nasdaq Stock Market Rules. Our largest shareholder, Mr. Mei Kanayama, holds more than 50% of the shareholder voting

power of our outstanding share capital, and can exert substantial influence over matters such as electing directors and approving material

mergers, acquisitions, strategic collaborations, or other business combination transactions. For so long as we remain a controlled company

as defined under that rule, we are exempt from, and our shareholders generally are not provided with the benefits of, some of the Nasdaq

Stock Market corporate governance requirements, including the requirement that a majority of our directors be independent, as defined

in the Nasdaq rules, and the requirement that our compensation and corporate governance and nominating committees consist entirely of

independent directors. As a foreign private issuer, however, Nasdaq corporate governance rules allow

us to follow corporate governance practice in our home country, Japan, with respect to appointments to our board of directors and committees.

We have followed home country practice as permitted by Nasdaq rather than relying on the “controlled company” exception to

the corporate governance rules.

Investing in our securities involves a high

degree of risk. Before making an investment decision, please read the information under the heading “Risk Factors” beginning

on page 6 of this prospectus and risk factors set forth in our most recent annual report on Form 20-F (the “2023 Annual

Report”), in other reports incorporated herein by reference, and in an applicable prospectus supplement under the heading “Risk

Factors.”

We may offer and sell the securities from time

to time at fixed prices, at market prices, or at negotiated prices, to or through underwriters, to other purchasers, through agents, or

through a combination of these methods. If any underwriters are involved in the sale of any securities with respect to which this prospectus

or any prospectus supplements are being delivered, the names of such underwriters and any applicable commissions or discounts will be

set forth in the applicable prospectus supplement. The offering price of such securities and the net proceeds we expect to receive from

such sale will also be set forth in a prospectus supplement. See “Plan of Distribution” elsewhere in this prospectus for a

more complete description of the ways in which the securities may be sold.

Neither the U.S. Securities and Exchange Commission

nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is September

8, 2023.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement

that we filed with the SEC utilizing a “shelf” registration process. Under this shelf registration process, we may, from time

to time, sell the securities described in this prospectus in one or more offerings, up to a total offering amount of $100,000,000.

This prospectus provides you with a general description

of the securities we may offer. This prospectus and any accompanying prospectus supplement do not contain all of the information included

in the registration statement. We have omitted parts of the registration statement in accordance with the rules and regulations of

the SEC. Statements contained in this prospectus and any accompanying prospectus supplement about the provisions or contents of any agreement

or other documents are not necessarily complete. If the SEC rules and regulations require that an agreement or other document be

filed as an exhibit to the registration statement, please see that agreement or document for a complete description of these matters.

This prospectus may be supplemented by a prospectus supplement that may add, update, or change information contained or incorporated by

reference in this prospectus. You should read both this prospectus and any prospectus supplement or other offering materials together

with additional information described under the headings “Where You Can Find Additional Information” and “Incorporation

of Documents by Reference.”

Each time we sell securities under this shelf

registration, we will provide a prospectus supplement that will contain certain specific information about the terms of that offering,

including a description of any risks related to the offering. A prospectus supplement may also add, update, or change information contained