false

--10-31

0001762239

0001762239

2024-01-26

2024-01-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(D) OF THESECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): January 26, 2024 (January 22, 2024)

Kaival

Brands Innovations Group, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

001-40641 |

83-3492907 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(I.R.S. Employer

Identification No.) |

4460

Old Dixie Highway

Grant-Valkaria,

Florida 32949

(Address

of principal executive office, including zip code)

Telephone:

(833) 452-4825

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common Stock, par

value $0.001 per share |

KAVL |

The Nasdaq Stock Market,

LLC |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 3.03 Material Modification to Rights of Security

Holders.

To the extent required by Item

3.03 of Form 8-K, the information contained in Item 5.03 of this Current Report on Form 8-K is incorporated herein by reference.

Item 5.02 Departure of Directors or Certain Officers;

Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 25, 2024, James P.

Cassidy provided written notice to the board of directors (the “Board”) of Kaival Brands Innovations Group, Inc. (the

“Company”) of his resignation from the Board, effective immediately. Mr. Cassidy’s resignation was due to his

other professional commitments and not as a result of any disagreement with the Board or the Company.

Mr. Cassidy served on the Board as the appointee of GoFire, Inc. (“GoFire”),

the holders of the majority of the Company’s outstanding Series B Convertible Preferred Stock. In its capacity as such holder, GoFire

has the right to appoint Mr. Cassidy’s replacement. The Board plans to work with GoFire to fill the vacancy on the Board occasioned

by Mr. Cassidy’s resignation.

Item 5.03 Amendments to Articles of Incorporation

or Bylaws; Change in Fiscal Year.

On January 22, 2024, the Company

filed a Certificate of Amendment to the Company’s Amended and Restated Certificate of Incorporation with the Secretary of State

of Delaware (the “Certificate of Amendment”) to effectuate a reverse stock split of the Company’s issued and

outstanding shares of common stock, par value $0.001 per share (the “Common Stock”) at a ratio of 1-for-21 (the “Reverse

Stock Split”). A copy of the Certificate of Amendment is attached hereto as Exhibit 3.1 and is incorporated herein by reference.

The Reverse Stock Split became

effective at 8:00 a.m., Eastern Standard Time, on January 22, 2024 (the “Effective Date”). The Common Stock began trading

on a post-Reverse Stock Split basis on the Nasdaq Capital Market (“Nasdaq”) under the symbol “KAVL” on

January 25, 2024. The new CUSIP number for the Common Stock following the Reverse Stock Split is 483104402.

The Reverse Stock Split was approved by the Board under authority granted by the Company’s majority stockholder via written consent

to action in lieu of a special meeting of the stockholders of the Company pursuant to the Delaware General Corporation Law on December

11, 2023.

As of

the Effective Date, every twenty-one (21) shares of the Company’s issued and outstanding Common Stock has been combined into one

share of Common Stock. As a result, the Company’s issued and outstanding Common Stock has been proportionally reduced from approximately

58,661,090 shares to approximately 2,793,386

shares. The ownership percentage of each of the Company’s stockholders will remain unchanged, other than as a result of fractional

shares. No fractional shares of Common Stock will be issued in connection with the Reverse Stock Split, and stockholders that would hold

a fractional share of Common Stock as a result of the Reverse Stock Split will have such fractional shares of Common Stock rounded up

to the nearest whole share of Common Stock.

The number

of shares of Common Stock available for issuance under the Company’s equity incentive plans and the Common Stock issuable pursuant

to outstanding equity awards and common stock purchase warrants immediately prior to the Reverse Stock Split will be proportionately adjusted

by the ratio of the Reverse Stock Split. The exercise prices of such outstanding options and warrants will also be adjusted in accordance

with their respective terms. The number of authorized shares of common stock will not be affected by the Reverse Stock Split.

Among other considerations, the

Company has effected the Reverse Stock Split to satisfy the $1.00 minimum bid price requirement for continued listing on the Nasdaq Capital

Market under Rule 5550(a)(2) of the Nasdaq Listing Rules.

Item 9.01 Financial Statements and Exhibits.

Cautionary Note Regarding Forward-Looking Statements

This Current Report and any statements of the Company’s management and

partners related to the subject matter hereof includes statements that constitute “forward-looking statements” (as defined

in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended), which are

statements other than historical facts. You can identify forward-looking statements by words such as “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “forecast,” “intend,”

“may,” “plan,” “position,” “should,” “strategy,” “target,” “will,”

and similar words. All forward-looking statements in this Report speak only as of the date hereof. Although the Company believes that

the plans, intentions, and expectations reflected in or suggested by the forward-looking statements are reasonable, there is no assurance

that these plans, intentions, or expectations will be achieved. Therefore, actual outcomes and results could materially and adversely

differ from what is expressed, implied, or forecasted in such statements. The Company’s business may be influenced by many factors

that are difficult to predict, involve uncertainties that may materially affect results, and are often beyond our control. Actual results

(including, without limitation, the anticipated benefits of the Reverse Stock Split, including the effect the Reverse Stock Split will

have on the Company’s ability to regain compliance with the Nasdaq Listing standards, and the timing for filling the vacancy on

the Board occasioned by Mr. Cassidy’s departure) may differ materially and adversely from those expressed or implied by such forward-looking

statements. Factors that could cause or contribute to such differences include, but are not limited to: (i) uncertainties relating to

the Company’s ability to stay compliant with Nasdaq continuing listing requirements, (ii) the results of international marketing

and sales efforts by Philip Morris International, the Company’s international distribution partner, (iii) how quickly domestic and

international markets adopt the Company’s products, general economic uncertainty in key global markets and a worsening of global

economic conditions or low levels of economic growth, (iv) the effects of steps that the Company is taking to raise capital, reduce operating

costs and diversity its product offerings, (v) the Company’s inability to generate and sustain profitable sales growth, including

sales growth in U.S. and international markets, (vi) circumstances or developments that may make the Company unable to implement or realize

anticipated benefits, or that may increase the costs, of the Company’s current and planned business initiatives, (vii) significant

changes in the Company’s relationships with its distributors or sub-distributors and (viii) other factors detailed by us in the

Company’s public filings with the Securities and Exchange Commission, including the disclosures under the heading “Risk Factors”

in the Company’s Annual Report on Form 10-K for the fiscal year ended October 31, 2022, filed with the Securities and Exchange Commission

on January 27, 2023 and accessible at www.sec.gov. All forward-looking statements included in this Report are expressly qualified

in their entirety by such cautionary statements. Except as required under the federal securities laws and the Securities and Exchange

Commission’s rules and regulations, the Company does not have any intention or obligation to update any forward-looking statements

publicly, whether as a result of new information, future events, or otherwise.

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

| Dated: January 26, 2024 |

Kaival Brands Innovations Group, Inc. |

| |

|

|

| |

By: |

/s/ Barry M. Hopkins |

| |

|

Barry M. Hopkins |

| |

|

Executive Chairman and Interim Chief Executive Officer and President |

Exhibit 3.1

CERTIFICATE OF AMENDMENT TO THE

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF KAIVAL BRANDS INNOVATIONS GROUP, INC.

The undersigned, for the purposes

of amending the Certificate of Incorporation of Kaival Brands Innovations Group, Inc. (the “Corporation”), a corporation

organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “DGCL”), does

hereby certify that:

FIRST: The Board of Directors

of the Corporation (the “Board”) duly adopted resolutions by unanimous written

consent to action in accordance with Section 141(f) of the DCGL on December 11, 2023 and January 9, 2024 proposing and

declaring advisable an amendment to the Certificate of Incorporation, as amended (the “Certificate”) of said Corporation

to consummate a reverse stock split of the Corporation’s common stock, par value $0.001 per share (the “Common Stock”)

at a ratio ranging between 1-to-2 and 1-to-30, with the exact ratio to be determined by the Board, in its sole discretion (the “Reverse

Split”) (provided that it is effected by December 11, 2024, the one year anniversary of the Voting Stockholders’ approval

of the Reverse Split).

SECOND: That upon the effectiveness

of this Certificate of Amendment (the “Split Effective Time”) each share of the Common Stock issued and outstanding

immediately prior to the date and time of the filing hereof with the Secretary of State of Delaware shall be automatically changed and

reclassified into a smaller number of shares such that each twenty-one (21) shares of issued Common Stock immediately prior to the Split

Effective Time is reclassified into one (1) share of Common Stock. Notwithstanding the immediately preceding sentence, there shall be

no fractional shares issued and, in lieu thereof, a holder of Common Stock on the Split Effective Time who would otherwise be entitled

to a fraction of a share as a result of the reclassification, following the Split Effective Time, shall receive a full share of Common

Stock upon the surrender of such stockholders’ old stock certificate. No stockholders will receive cash in lieu of fractional shares.

THIRD: That upon this Certificate

of Amendment becoming effective, Paragraph 6 of the Certificate is amended by adding thereunder a new paragraph at the end of such Paragraph,

which states as follows:

“(a) Reverse Stock Split. Upon

effectiveness of a Certificate of Amendment effectuating the same (the “Split Effective Time”), each share of Common

Stock issued and outstanding immediately prior to the Split Effective Time shall be automatically changed and reclassified into a smaller

number of shares such that each twenty-one (21) shares of issued Common Stock immediately prior to the Split Effective Time is reclassified

into one (1) share of Common Stock. Notwithstanding the immediately preceding sentence, there shall be no fractional shares issued and,

in lieu thereof, a holder of Common Stock on the Split Effective Time who would otherwise be entitled to a fraction of a share as a result

of the reclassification, following the Split Effective Time, shall receive a full share of Common Stock upon the surrender of such stockholders’

old stock certificate. No stockholders will receive cash in lieu of fractional shares.

FOURTH: That

in lieu of a meeting and vote of the stockholders of the Corporation, the holder of in excess of fifty percent (50%) of the outstanding

Common Stock has acted by written consent to approve said amendment in accordance

with the provisions of Section 228 of the DGCL, and written notice of the adoption of the amendments has been given as provided in Section

228 of the DGCL to every stockholder entitled to such notice.

FIFTH: The aforesaid amendment

was duly adopted in accordance with the applicable provisions of Section 242 of the DGCL.

SIXTH: The aforesaid amendment

shall be effective as of 8:00 am Eastern Standard Time on January 22, 2024.

IN WITNESS WHEREOF, the

Corporation has caused this Amendment to the Certificate of Incorporation of the Corporation to be duly executed by the undersigned this

22nd day of January, 2024.

| |

KAIVAL BRANDS INNOVATIONS GROUP, INC. |

| |

|

|

| |

By: |

/s/ Barry M. Hopkins |

| |

|

Name: Barry M. Hopkins |

| |

|

Title: Executive Chairman and Interim Chief Executive Officer and President |

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

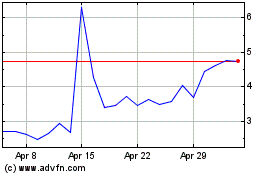

Kaival Brands Innovations (NASDAQ:KAVL)

Historical Stock Chart

From Mar 2024 to Apr 2024

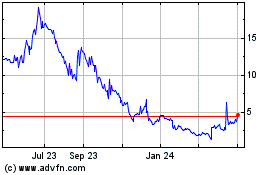

Kaival Brands Innovations (NASDAQ:KAVL)

Historical Stock Chart

From Apr 2023 to Apr 2024