FALSE000003931100000393112024-01-252024-01-25

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: January 25, 2024

INDEPENDENT BANK CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Michigan | 0-7818 | 38-2032782 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | |

4200 East Beltline Grand Rapids, Michigan | 49525 |

| (Address of principal executive office) | (Zip Code) |

Registrant’s telephone number,

including area code:

(616) 527-5820

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

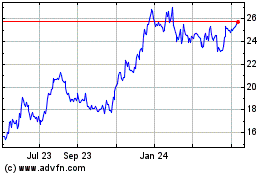

| Common stock, no par value | IBCP | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition

On January 25, 2024, Independent Bank Corporation issued a press release announcing its financial results for the quarter ended December 31, 2023. A copy of the press release is attached as Exhibit 99.1. Attached Exhibit 99.2 contains supplemental data to that press release and attached Exhibit 99.3 contains a slide presentation for our earnings conference call.

The information in this Form 8-K and the attached Exhibits shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

Exhibits.

| | | | | |

| Press release dated January 25, 2024. |

| |

| Supplemental data to the Registrant’s press release dated January 25, 2024. |

| |

| Earnings conference call presentation. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | |

| | | INDEPENDENT BANK CORPORATION |

| | | (Registrant) |

| | | | |

| Date | January 25, 2024 | | By | s/Gavin A. Mohr |

| | | Gavin A. Mohr, Principal Financial Officer |

Exhibit 99.1

NEWS RELEASE

Independent Bank Corporation

4200 East Beltline

Grand Rapids, MI 49525

616.527.5820

| | | | | |

| For Release: | Immediately |

| Contact: | William B. Kessel, President and CEO, 616.447.3933 Gavin A. Mohr, Chief Financial Officer, 616.447.3929 |

INDEPENDENT BANK CORPORATION REPORTS 2023 FOURTH QUARTER RESULTS

Fourth Quarter Highlights

Highlights for the fourth quarter of 2023 include:

•An increase in net interest income of $0.7 million (1.7%) over the third quarter of 2023;

•An increase in book value and tangible book value per share of $1.42 and $1.43 respectively;

•Net growth in loans of $49.4 million (or 5.2% annualized) from September 30, 2023; and

•The payment of a 23 cent per share dividend on common stock on November 13, 2023.

GRAND RAPIDS, Mich., January 25, 2024 - Independent Bank Corporation (NASDAQ: IBCP) reported fourth quarter 2023 net income of $13.7 million, or $0.65 per diluted share, versus net income of $15.1 million, or $0.71 per diluted share, in the prior-year period. For the year ended December 31, 2023, the Company reported net income of $59.1 million, or $2.79 per diluted share, compared to net income of $63.4 million, or $2.97 per diluted share, in 2022.

William B. (“Brad”) Kessel, the President and Chief Executive Officer of Independent Bank Corporation, commented: “'Our fourth quarter performance capped off another remarkably strong year, with our organization performing exceptionally well despite continued challenges in the macroeconomic environment. For the fourth quarter of 2023, I am particularly pleased with the double digit annualized growth in our commercial loan portfolio, the year over year 4.1% growth in our core deposit base, the linked quarter growth in our net interest income and our strong asset quality metrics which enabled us to release a small amount of loan loss reserves. Significantly impacting our quarterly results was the change in price of the fair value of our capitalized mortgage servicing rights of $3.6 million ($0.14 per diluted share, after tax). Adding back this non-cash adjustment, our fourth quarter 2023 annualized return on assets was 1.26% versus 1.24% for the three months ended December 31, 2022. During 2023, we continued to make investments in talent and technology which we believe will enable us to consistently add new customers, grow our market share, generate profitable growth, and further increase the value of our franchise in 2024 and beyond.”

Significant items impacting comparable 2023 and 2022 results include the following:

•Changes in the fair value due to price of capitalized mortgage loan servicing rights (the “MSR Changes”) of $(3.6) million ($(0.14) per diluted share, after taxes) and $(0.3) million ($(0.01) per diluted share, after taxes)

for the three-month and full-year ended December 31, 2023, respectively, as compared to $(0.5) million ($(0.02) per diluted share, after taxes) and $14.3 million ($0.53 per diluted share, after taxes) for the three-months and full-year ended December 31, 2022, respectively.

•The provision for credit losses was a credit of $0.6 million ($0.02 per diluted share, after taxes) and expense of $6.2 million ($0.23 per diluted share, after tax) in the fourth quarter and full year ended December 31, 2023, respectively, as compared to an expense of $1.4 million ($0.05 per diluted share, after taxes) and expense of $5.3 million ($0.20 per diluted share, after tax) in the fourth quarter and full year ended December 31, 2022, respectively.

Operating Results

The Company’s net interest income totaled $40.1 million during the fourth quarter of 2023, a decrease of $0.5 million, or 1.2% from the year-ago period, and up $0.7 million, or 1.7%, from the third quarter of 2023. The Company’s tax equivalent net interest income as a percent of average interest-earning assets (the “net interest margin”) was 3.26% during the fourth quarter of 2023, compared to 3.52% in the year-ago period, and 3.23% in the third quarter of 2023. The year-over-year quarterly decrease in net interest income was due to a decrease in the net interest margin that was partially offset by an increase in average earnings assets. Average interest-earning assets were $4.93 billion in the fourth quarter of 2023, compared to $4.64 billion in the year ago quarter and $4.89 billion in the third quarter of 2023.

For the year ended December 31, 2023, net interest income totaled $156.3 million, an increase of $6.8 million, or 4.5% from the prior year ended December 31, 2022. The Company’s net interest margin for the year ended December 31, 2023 was 3.26% compared to 3.32% in 2022. The increase in net interest income for the year ended December 31, 2023 compared to 2022 reflects an increase in average interest- earning assets that was partially offset by a decrease in the net interest margin.

Non-interest income totaled $9.1 million and $50.7 million, respectively, for the fourth quarter and full year of 2023, compared to $11.5 million and $61.9 million in the respective, comparable year ago periods. These changes were primarily due to variances in mortgage banking related revenues.

Net gains on mortgage loans in the fourth quarters of 2023 and 2022, were approximately $2.0 million and $1.5 million, respectively. For the full year of 2023, net gains on mortgage loans totaled $7.4 million compared to $6.4 million in 2022. The increase in net gains on mortgage loans was due to a combination of higher profit margins on mortgage loan sales and an increase in the volume of mortgage loans sold.

Mortgage loan servicing, net, generated a loss of $2.4 million and a gain of $0.7 million in the fourth quarters of 2023 and 2022, respectively. For the full year of 2023 and 2022, mortgage loan servicing, net, generated income of $4.6 million and $18.8 million, respectively. The significant variances in mortgage loan servicing, net is primarily due to changes in the fair value of capitalized mortgage loan servicing rights attributed to a decrease in interest rates that resulted in a lower earnings rate on escrow deposits and an increase in prepayment speeds. Mortgage loan servicing, net activity is summarized in the following table:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Twelve months ended |

| 12/31/2023 | | 12/31/2022 | | 12/31/2023 | | 12/31/2022 |

| (In thousands) |

| Mortgage loan servicing, net: | | | | | | | |

| Revenue, net | $ | 2,216 | | | $ | 2,180 | | | $ | 8,828 | | | $ | 8,577 | |

| Fair value change due to price | (3,644) | | | (503) | | | (280) | | | 14,272 | |

| Fair value change due to pay-downs | (1,014) | | | (990) | | | (3,922) | | | (4,076) | |

| Total | $ | (2,442) | | | $ | 687 | | | $ | 4,626 | | | $ | 18,773 | |

Non-interest expenses totaled $31.9 million in the fourth quarter of 2023, compared to $32.1 million in the year-ago period. For the full year of 2023, non-interest expenses totaled $127.1 million versus $128.3 million in 2022.

The Company recorded an income tax expense of $4.2 million and $14.6 million in the fourth quarter and full year of 2023, respectively. This compares to an income tax expense of $3.5 million and $14.4 million in the fourth quarter and full year of 2022, respectively.

Asset Quality

A breakdown of non-performing loans by loan type is as follows:

| | | | | | | | | | | | | | | | | |

| 12/31/2023 | | 12/31/2022 | | 12/31/2021 |

| Loan Type | (Dollars in thousands) |

| Commercial | $ | 28 | | | $ | 38 | | | $ | 62 | |

| Mortgage | 6,425 | | | 4,745 | | | 4,914 | |

| Installment | 970 | | | 598 | | | 569 | |

| Sub total | 7,423 | | | 5,381 | | | 5,545 | |

| Less - government guaranteed loans | 2,191 | | | 1,660 | | | 435 | |

| Total non-performing loans | $ | 5,232 | | | $ | 3,721 | | | $ | 5,110 | |

| Ratio of non-performing loans to total portfolio loans | 0.14 | % | | 0.11 | % | | 0.18 | % |

| Ratio of non-performing assets to total assets | 0.11 | % | | 0.08 | % | | 0.11 | % |

| Ratio of allowance for credit losses to total non-performing loans | 1044.69 | % | | 1409.16 | % | | 924.70 | % |

The provision for credit losses was credit of $0.6 million and an expense of $1.4 million in the fourth quarters of 2023 and 2022, respectively. The provision for credit losses was an expense of $6.2 million and $5.3 million in the full year of 2023 and 2022, respectively. The quarterly decrease in the provision for credit losses in 2023 compared to 2022, was primarily the result of a change in allocation rates due to subjective factors (prior year allocation rates were increased while current year rates decreased). The Company recorded loan net charge-offs of $0.2 million and $0.1 million in the fourth quarters of 2023 and 2022, respectively. At December 31, 2023, the allowance for credit losses totaled $54.7 million, or 1.44% of total portfolio loans compared to $52.4 million, or 1.51% of total portfolio loans at December 31, 2022.

Balance Sheet, Liquidity and Capital

Total assets were $5.26 billion at December 31, 2023, an increase of $263.9 million from December 31, 2022. Loans, excluding loans held for sale, were $3.79 billion at December 31, 2023, compared to $3.47 billion at December 31, 2022. Deposits totaled $4.62 billion at December 31, 2023, an increase of $243.8 million from December 31, 2022. This increase is primarily due to growth in reciprocal, time and brokered time deposit account balances that were partially offset by decreases in non-interest bearing and savings and interest-bearing checking deposit account balances.

Cash and cash equivalents totaled $169.8 million at December 31, 2023, versus $74.4 million at December 31, 2022. Securities available for sale (“AFS”) totaled $679.4 million at December 31, 2023, versus $779.35 million at December 31, 2022.

Total shareholders’ equity was $404.4 million at December 31, 2023, or 7.68% of total assets compared to $347.6 million or 6.95% at December 31, 2022. Tangible common equity totaled $374.1 million at December 31, 2023, or $17.96 per share compared to $316.7 million or $15.04 per share at December 31, 2022. The increase in shareholder equity as well as tangible common equity are primarily the result of earnings retention and a decline in accumulated other comprehensive loss related to unrealized losses on securities available for sale.

The Company’s wholly owned subsidiary, Independent Bank, remains significantly above “well capitalized” for regulatory purposes with the following ratios:

| | | | | | | | | | | | | | | | | |

| Regulatory Capital Ratios | 12/31/2023 | | 12/31/2022 | | Well

Capitalized

Minimum |

| | | | | |

| Tier 1 capital to average total assets | 8.80 | % | | 8.56 | % | | 5.00 | % |

| Tier 1 common equity to risk-weighted assets | 11.21 | % | | 10.97 | % | | 6.50 | % |

| Tier 1 capital to risk-weighted assets | 11.21 | % | | 10.97 | % | | 8.00 | % |

| Total capital to risk-weighted assets | 12.46 | % | | 12.22 | % | | 10.00 | % |

At December 31, 2023, in addition to liquidity available from our normal operating, funding, and investing activities, we had unused credit lines with the FHLB and FRB of approximately $1.0 billion and $515.4 million, respectively. We also had approximately $813.8 million in fair value of unpledged securities AFS and HTM at December 31, 2023 which could be pledged for an estimated additional borrowing capacity at the FHLB and FRB of approximately $754.6 million.

Share Repurchase Plan

On December 19, 2023, the Board of Directors of the Company authorized the 2024 share repurchase plan. Under the terms of the 2024 share repurchase plan, the Company is authorized to purchase up to 1,100,000 shares, or approximately 5% of its then outstanding common stock. The repurchase plan is authorized to last through December 31, 2024. For the full year of 2023, the Company repurchased 298,601 shares at a weighted average price of $17.27 per share.

Earnings Conference Call

Brad Kessel, President and CEO, Gavin A. Mohr, CFO and Joel Rahn, EVP – Commercial Banking will review the quarterly results in a conference call for investors and analysts beginning at 11:00 am ET on Thursday, January 25, 2024.

To participate in the live conference call, please dial 1-833-470-1428 (Access Code # 216359). Also, the conference call will be accessible through an audio webcast with user-controlled slides via the following site/URL: https://events.q4inc.com/attendee/712732859.

A playback of the call can be accessed by dialing 1-866-813-9403 (Access Code # 634318). The replay will be available through February 1, 2024.

About Independent Bank Corporation

Independent Bank Corporation (NASDAQ: IBCP) is a Michigan-based bank holding company with total assets of approximately $5.3 billion. Founded as First National Bank of Ionia in 1864, Independent Bank Corporation operates a branch network across Michigan's Lower Peninsula through one state-chartered bank subsidiary. This subsidiary (Independent Bank) provides a full range of financial services, including commercial banking, mortgage lending, investments and insurance. Independent Bank Corporation is committed to providing exceptional personal service and value to its customers, stockholders and the communities it serves.

For more information, please visit our Web site at: IndependentBank.com.

Forward-Looking Statements

This presentation contains forward-looking statements, which are any statements or information that are not historical facts. These forward-looking statements include statements about our anticipated future revenue and expenses and our future plans and prospects.

Forward-looking statements involve inherent risks and uncertainties, and important factors could cause actual results to differ materially from those anticipated. For example, deterioration in general business and economic conditions or turbulence in domestic or global financial markets could adversely affect our revenues and the values of our assets and liabilities, reduce the availability of funding to us, lead to a tightening of credit, and increase stock price volatility. Our results could also be adversely affected by changes in interest rates; increases in unemployment rates; deterioration in the credit quality of our loan portfolios or in the value of the collateral securing those loans; deterioration in the value of our investment securities; legal and regulatory developments; changes in customer behavior and preferences; breaches in data security; and management’s ability to effectively manage the multitude of risks facing our business. Key risk factors that could affect our future results are described in more detail in our Annual Report on Form 10-K for the year ended December 31, 2022 and the other reports we file with the SEC, including under the heading “Risk Factors.” Investors should not place undue reliance on forward-looking statements as a prediction of our future results.

Any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise.

INDEPENDENT BANK CORPORATION AND SUBSIDIARIES

Consolidated Statements of Financial Condition

| | | | | | | | | | | | | | |

| | December 31, |

| | 2023 | | 2022 |

| | (unaudited) |

| | (In thousands, except share

amounts) |

| Assets | | | | |

| Cash and due from banks | | $ | 68,208 | | | $ | 70,180 | |

| Interest bearing deposits | | 101,573 | | | 4,191 | |

| Cash and Cash Equivalents | | 169,781 | | | 74,371 | |

| Securities available for sale | | 679,350 | | | 779,347 | |

| Securities held to maturity (fair value of $318,606 at December 31, 2023 and $335,418 at December 31, 2022) | | 353,988 | | | 374,818 | |

| Federal Home Loan Bank and Federal Reserve Bank stock, at cost | | 16,821 | | | 17,653 | |

| Loans held for sale, carried at fair value | | 12,063 | | | 26,518 | |

| Loans held for sale, carried at lower of cost or fair value | | — | | | 20,367 | |

| Loans | | | | |

| Commercial | | 1,679,731 | | | 1,466,853 | |

| Mortgage | | 1,485,872 | | | 1,368,409 | |

| Installment | | 625,298 | | | 630,090 | |

| Total Loans | | 3,790,901 | | | 3,465,352 | |

| Allowance for credit losses | | (54,658) | | | (52,435) | |

| Net Loans | | 3,736,243 | | | 3,412,917 | |

| Other real estate and repossessed assets, net | | 569 | | | 455 | |

| Property and equipment, net | | 35,523 | | | 35,893 | |

| Bank-owned life insurance | | 54,341 | | | 55,204 | |

| Capitalized mortgage loan servicing rights, carried at fair value | | 42,243 | | | 42,489 | |

| Other intangibles | | 2,004 | | | 2,551 | |

| Goodwill | | 28,300 | | | 28,300 | |

| Accrued income and other assets | | 132,500 | | | 128,904 | |

| Total Assets | | $ | 5,263,726 | | | $ | 4,999,787 | |

| | | | |

| Liabilities and Shareholders’ Equity | | | | |

| Deposits | | | | |

| Non-interest bearing | | $ | 1,076,093 | | | $ | 1,269,759 | |

| Savings and interest-bearing checking | | 1,905,701 | | | 1,973,308 | |

| Reciprocal | | 832,020 | | | 602,575 | |

| Time | | 524,325 | | | 321,492 | |

| Brokered time | | 284,740 | | | 211,935 | |

| Total Deposits | | 4,622,879 | | | 4,379,069 | |

| Other borrowings | | 50,026 | | | 86,006 | |

| Subordinated debt | | 39,510 | | | 39,433 | |

| Subordinated debentures | | 39,728 | | | 39,660 | |

| Accrued expenses and other liabilities | | 107,134 | | | 108,023 | |

| Total Liabilities | | 4,859,277 | | | 4,652,191 | |

| | | | |

| Shareholders’ Equity | | | | |

| Preferred stock, no par value, 200,000 shares authorized; none issued or outstanding | | — | | | — | |

| Common stock, no par value, 500,000,000 shares authorized; issued and outstanding: 20,835,633 shares at December 31, 2023 and 21,063,971 shares at December 31, 2022 | | 317,483 | | | 320,991 | |

| Retained earnings | | 159,108 | | | 119,368 | |

| Accumulated other comprehensive loss | | (72,142) | | | (92,763) | |

| Total Shareholders’ Equity | | 404,449 | | | 347,596 | |

| Total Liabilities and Shareholders’ Equity | | $ | 5,263,726 | | | $ | 4,999,787 | |

INDEPENDENT BANK CORPORATION AND SUBSIDIARIES

Consolidated Statements of Operations

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended | | |

| December 31,

2023 | | September 30, 2023 | | December 31,

2022 | | December 31, | | |

| | | | 2023 | | 2022 | | |

| | (unaudited) | | |

| INTEREST INCOME | | (In thousands, except per share amounts) | | |

| Interest and fees on loans | | $ | 54,333 | | | $ | 51,419 | | | $ | 42,093 | | | $ | 197,725 | | | $ | 139,057 | | | |

| Interest on securities | | | | | | | | | | | | |

| Taxable | | 5,646 | | | 5,865 | | | 5,845 | | | 23,314 | | | 20,676 | | | |

| Tax-exempt | | 3,434 | | | 3,409 | | | 2,807 | | | 13,209 | | | 8,391 | | | |

| Other investments | | 1,948 | | | 1,739 | | | 233 | | | 5,429 | | | 884 | | | |

| Total Interest Income | | 65,361 | | | 62,432 | | | 50,978 | | | 239,677 | | | 169,008 | | | |

| INTEREST EXPENSE | | | | | | | | | | | | |

| Deposits | | 23,111 | | | 20,743 | | | 8,543 | | | 75,075 | | | 14,151 | | | |

| Other borrowings and subordinated debt and debentures | | 2,139 | | | 2,262 | | | 1,833 | | | 8,273 | | | 5,296 | | | |

| Total Interest Expense | | 25,250 | | | 23,005 | | | 10,376 | | | 83,348 | | | 19,447 | | | |

| Net Interest Income | | 40,111 | | | 39,427 | | | 40,602 | | | 156,329 | | | 149,561 | | | |

| Provision for credit losses | | (617) | | | 1,350 | | | 1,390 | | | 6,210 | | | 5,341 | | | |

| Net Interest Income After Provision for Credit Losses | | 40,728 | | | 38,077 | | | 39,212 | | | 150,119 | | | 144,220 | | | |

| NON-INTEREST INCOME | | | | | | | | | | | | |

| Interchange income | | 3,336 | | | 4,100 | | | 3,402 | | | 13,996 | | | 13,955 | | | |

| Service charges on deposit accounts | | 3,061 | | | 3,309 | | | 3,153 | | | 12,361 | | | 12,288 | | | |

| Net gains (losses) on assets | | | | | | | | | | | | |

| Mortgage loans | | 1,961 | | | 2,099 | | | 1,486 | | | 7,436 | | | 6,431 | | | |

| Securities available for sale | | — | | | — | | | — | | | (222) | | | (275) | | | |

| Mortgage loan servicing, net | | (2,442) | | | 2,668 | | | 687 | | | 4,626 | | | 18,773 | | | |

| Other | | 3,181 | | | 3,435 | | | 2,740 | | | 12,479 | | | 10,737 | | | |

| Total Non-interest Income | | 9,097 | | | 15,611 | | | 11,468 | | | 50,676 | | | 61,909 | | | |

| NON-INTEREST EXPENSE | | | | | | | | | | | | |

| Compensation and employee benefits | | 19,049 | | | 19,975 | | | 20,394 | | | 78,965 | | | 81,007 | | | |

| Data processing | | 2,909 | | | 3,071 | | | 2,670 | | | 11,862 | | | 10,183 | | | |

| Occupancy, net | | 1,933 | | | 1,971 | | | 2,225 | | | 7,908 | | | 8,907 | | | |

| Interchange expense | | 1,110 | | | 1,119 | | | 1,042 | | | 4,332 | | | 4,242 | | | |

| Furniture, fixtures and equipment | | 974 | | | 927 | | | 933 | | | 3,756 | | | 4,007 | | | |

| FDIC deposit insurance | | 796 | | | 677 | | | 572 | | | 3,005 | | | 2,142 | | | |

| Communications | | 535 | | | 568 | | | 629 | | | 2,406 | | | 2,871 | | | |

| Legal and professional | | 585 | | | 543 | | | 588 | | | 2,208 | | | 2,133 | | | |

| Loan and collection | | 456 | | | 520 | | | 679 | | | 2,174 | | | 2,657 | | | |

| Advertising | | 879 | | | 360 | | | 489 | | | 2,165 | | | 2,074 | | | |

| Conversion related expense | | — | | | — | | | — | | | — | | | 50 | | | |

| Costs (recoveries) related to unfunded lending commitments | | 348 | | | 451 | | | (77) | | | 424 | | | 599 | | | |

| Other | | 2,304 | | | 1,854 | | | 1,947 | | | 7,914 | | | 7,469 | | | |

| Total Non-interest Expense | | 31,878 | | | 32,036 | | | 32,091 | | | 127,119 | | | 128,341 | | | |

| Income Before Income Tax | | 17,947 | | | 21,652 | | | 18,589 | | | 73,676 | | | 77,788 | | | |

| Income tax expense | | 4,204 | | | 4,109 | | | 3,503 | | | 14,609 | | | 14,437 | | | |

| Net Income | | $ | 13,743 | | | $ | 17,543 | | | $ | 15,086 | | | $ | 59,067 | | | $ | 63,351 | | | |

| Net income per common share | | | | | | | | | | | | |

| Basic | | $ | 0.66 | | | $ | 0.84 | | | $ | 0.72 | | | $ | 2.82 | | | $ | 3.00 | | | |

| Diluted | | $ | 0.65 | | | $ | 0.83 | | | $ | 0.71 | | | $ | 2.79 | | | $ | 2.97 | | | |

INDEPENDENT BANK CORPORATION AND SUBSIDIARIES

Selected Financial Data

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31,

2023 | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 |

| (unaudited) |

| (Dollars in thousands except per share data) |

| Three Months Ended | | | | | | | | | |

| Net interest income | $ | 40,111 | | | $ | 39,427 | | | $ | 38,350 | | | $ | 38,441 | | | $ | 40,602 | |

| Provision for credit losses | (617) | | | 1,350 | | | 3,317 | | | 2,160 | | | 1,390 | |

| Non-interest income | 9,097 | | | 15,611 | | | 15,417 | | | 10,551 | | | 11,468 | |

| Non-interest expense | 31,878 | | | 32,036 | | | 32,248 | | | 30,957 | | | 32,091 | |

| Income before income tax | 17,947 | | | 21,652 | | | 18,202 | | | 15,875 | | | 18,589 | |

| Income tax expense | 4,204 | | | 4,109 | | | 3,412 | | | 2,884 | | | 3,503 | |

| Net income | $ | 13,743 | | | $ | 17,543 | | | $ | 14,790 | | | $ | 12,991 | | | $ | 15,086 | |

| | | | | | | | | |

| Basic earnings per share | $ | 0.66 | | | $ | 0.84 | | | $ | 0.70 | | | $ | 0.62 | | | $ | 0.72 | |

| Diluted earnings per share | 0.65 | | | 0.83 | | | 0.70 | | | 0.61 | | | 0.71 | |

| Cash dividend per share | 0.23 | | | 0.23 | | | 0.23 | | | 0.23 | | | 0.22 | |

| | | | | | | | | |

| Average shares outstanding | 20,840,680 | | 20,922,431 | | 21,040,349 | | 21,103,831 | | 21,064,556 |

| Average diluted shares outstanding | 21,049,030 | | 21,114,445 | | 21,222,535 | | 21,296,980 | | 21,266,876 |

| | | | | | | | | |

| Performance Ratios | | | | | | | | | |

| Return on average assets | 1.04 | % | | 1.34 | % | | 1.18 | % | | 1.06 | % | | 1.21 | % |

| Return on average equity | 14.36 | | | 18.68 | | | 16.29 | | | 14.77 | | | 17.94 | |

| Efficiency ratio (1) | 64.27 | | | 57.52 | | | 59.26 | | | 62.07 | | | 60.82 | |

| | | | | | | | | |

| As a Percent of Average Interest-Earning Assets (1) | | | | | | | | | |

| Interest income | 5.29 | % | | 5.10 | % | | 4.89 | % | | 4.66 | % | | 4.41 | % |

| Interest expense | 2.03 | | | 1.87 | | | 1.65 | | | 1.34 | | | 0.89 | |

| Net interest income | 3.26 | | | 3.23 | | | 3.24 | | | 3.32 | | | 3.52 | |

| | | | | | | | | |

| Average Balances | | | | | | | | | |

| Loans | $ | 3,764,752 | | | $ | 3,694,534 | | | $ | 3,567,920 | | | $ | 3,494,169 | | | $ | 3,449,944 | |

| Securities | 1,027,240 | | | 1,071,211 | | | 1,111,670 | | | 1,146,075 | | | 1,164,809 | |

| Total earning assets | 4,928,697 | | | 4,892,208 | | | 4,763,295 | | | 4,696,786 | | | 4,637,475 | |

| Total assets | 5,233,666 | | | 5,192,114 | | | 5,044,746 | | | 4,988,440 | | | 4,934,859 | |

| Deposits | 4,612,797 | | | 4,577,796 | | | 4,447,843 | | | 4,417,106 | | | 4,350,748 | |

| Interest bearing liabilities | 3,635,771 | | | 3,554,179 | | | 3,415,621 | | | 3,304,868 | | | 3,159,374 | |

| Shareholders' equity | 379,614 | | | 372,667 | | | 364,143 | | | 356,720 | | | 333,610 | |

(1)Presented on a fully tax equivalent basis assuming a marginal tax rate of 21%.

INDEPENDENT BANK CORPORATION AND SUBSIDIARIES

Selected Financial Data (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31,

2023 | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 |

| (unaudited) |

| (Dollars in thousands except per share data) |

| End of Period | | | | | | | | | |

| Capital | | | | | | | | | |

| Tangible common equity ratio | 7.15 | % | | 6.67 | % | | 6.75 | % | | 6.60 | % | | 6.37 | % |

| Tangible common equity ratio excluding accumulated other comprehensive loss | 8.31 | | | 8.20 | | | 8.09 | | | 7.95 | | | 7.98 | |

| Average equity to average assets | 7.20 | | | 7.18 | | | 7.22 | | | 7.15 | | | 6.76 | |

| Total capital to risk-weighted assets (2) | 13.71 | | | 13.58 | | | 13.66 | | | 13.80 | | | 13.62 | |

| Tier 1 capital to risk-weighted assets (2) | 11.50 | | | 11.37 | | | 11.42 | | | 11.53 | | | 11.36 | |

| Common equity tier 1 capital to risk-weighted assets (2) | 10.58 | | | 10.44 | | | 10.46 | | | 10.55 | | | 10.38 | |

| Tier 1 capital to average assets (2) | 9.04 | | | 8.94 | | | 8.97 | | | 8.92 | | | 8.86 | |

| Common shareholders' equity per share of common stock | $ | 19.41 | | | $ | 17.99 | | | $ | 17.91 | | | $ | 17.40 | | | $ | 16.50 | |

| Tangible common equity per share of common stock | 17.96 | | | 16.53 | | | 16.45 | | | 15.94 | | | 15.04 | |

| Total shares outstanding | 20,835,633 | | 20,850,455 | | 20,943,694 | | 21,138,303 | | 21,063,971 |

| | | | | | | | | |

| Selected Balances | | | | | | | | | |

| Loans | $ | 3,790,901 | | | $ | 3,741,486 | | | $ | 3,631,114 | | | $ | 3,509,809 | | | $ | 3,465,352 | |

| Securities | 1,033,338 | | | 1,043,540 | | | 1,092,703 | | | 1,137,103 | | | 1,154,165 | |

| Total earning assets | 4,954,696 | | | 4,884,720 | | | 4,830,185 | | | 4,860,696 | | | 4,688,246 | |

| Total assets | 5,263,726 | | | 5,200,018 | | | 5,135,564 | | | 5,138,934 | | | 4,999,787 | |

| Deposits | 4,622,879 | | | 4,585,612 | | | 4,487,636 | | | 4,544,749 | | | 4,379,069 | |

| Interest bearing liabilities | 3,676,050 | | | 3,573,187 | | | 3,501,280 | | | 3,481,511 | | | 3,274,409 | |

| Shareholders' equity | 404,449 | | | 374,998 | | | 375,162 | | | 367,714 | | | 347,596 | |

(2)December 31, 2023 are Preliminary.

Reconciliation of Non-GAAP Financial Measures

Independent Bank Corporation

Independent Bank Corporation believes non-GAAP measures are meaningful because they reflect adjustments commonly made by management, investors, regulators and analysts to evaluate the adequacy of common equity and performance trends. Tangible common equity is used by the Company to measure the quality of capital.

Reconciliation of Non-GAAP Financial Measures

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (Dollars in thousands) |

| Net Interest Margin, Fully Taxable Equivalent ("FTE") | | | | | | | |

| | | | | | | |

| Net interest income | $ | 40,111 | | | $ | 40,602 | | | $ | 156,329 | | | $ | 149,561 | |

| Add: taxable equivalent adjustment | 178 | | | 453 | | | 900 | | | 1,878 | |

| Net interest income - taxable equivalent | $ | 40,289 | | | $ | 41,055 | | | $ | 157,229 | | | $ | 151,439 | |

| Net interest margin (GAAP) (1) | 3.25 | % | | 3.48 | % | | 3.24 | % | | 3.28 | % |

| Net interest margin (FTE) (1) (2) | 3.26 | % | | 3.52 | % | | 3.26 | % | | 3.32 | % |

| | | | | | | |

Adjusted Return on Average Assets | | | | | | | |

| | | | | | | |

Net income | $ | 13,743 | | | $ | 15,086 | | | | | |

Add: change in price of capitalized mortgage servicing rights, net of tax | 2,879 | | | 397 | | | | | |

Adjusted net income | $ | 16,622 | | | $ | 15,483 | | | | | |

Average assets | $ | 5,233,666 | | | $ | 4,934,859 | | | | | |

Adjusted return on average assets (1) | 1.26 | % | | 1.24 | % | | | | |

(1)Quarter to date are Annualized.

(2)2023 taxable equivalent adjustments have been updated.

Tangible Common Equity Ratio

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31,

2023 | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 |

| (Dollars in thousands) |

| Common shareholders' equity | $ | 404,449 | | | $ | 374,998 | | | $ | 375,162 | | | $ | 367,714 | | | $ | 347,596 | |

| Less: | | | | | | | | | |

| Goodwill | 28,300 | | | 28,300 | | | 28,300 | | | 28,300 | | | 28,300 | |

| Other intangibles | 2,004 | | | 2,141 | | | 2,278 | | | 2,415 | | | 2,551 | |

| Tangible common equity | 374,145 | | | 344,557 | | | 344,584 | | | 336,999 | | | 316,745 | |

| Addition: | | | | | | | | | |

| Accumulated other comprehensive loss for regulatory purposes | 66,344 | | | 86,507 | | | 74,712 | | | 75,013 | | | 86,966 | |

| Tangible common equity excluding other comprehensive loss adjustments | $ | 440,489 | | | $ | 431,064 | | | $ | 419,296 | | | $ | 412,012 | | | $ | 403,711 | |

| | | | | | | | | |

| Total assets | $ | 5,263,726 | | | $ | 5,200,018 | | | $ | 5,135,564 | | | $ | 5,138,934 | | | $ | 4,999,787 | |

| Less: | | | | | | | | | |

| Goodwill | 28,300 | | | 28,300 | | | 28,300 | | | 28,300 | | | 28,300 | |

| Other intangibles | 2,004 | | | 2,141 | | | 2,278 | | | 2,415 | | | 2,551 | |

| Tangible assets | 5,233,422 | | | 5,169,577 | | | 5,104,986 | | | 5,108,219 | | | 4,968,936 | |

| Addition: | | | | | | | | | |

Net unrealized losses on available for sale securities and derivatives, net of tax | 66,344 | | | 86,507 | | | 74,712 | | | 75,013 | | | 86,966 | |

Tangible assets excluding other comprehensive loss adjustments | $ | 5,299,766 | | | $ | 5,256,084 | | | $ | 5,179,698 | | | $ | 5,183,232 | | | $ | 5,055,902 | |

| | | | | | | | | |

| Common equity ratio | 7.68 | % | | 7.21 | % | | 7.31 | % | | 7.16 | % | | 6.95 | % |

| Tangible common equity ratio | 7.15 | % | | 6.67 | % | | 6.75 | % | | 6.60 | % | | 6.37 | % |

| Tangible common equity ratio excluding other comprehensive loss | 8.31 | % | | 8.20 | % | | 8.09 | % | | 7.95 | % | | 7.98 | % |

| | | | | | | | | |

| Tangible Common Equity per Share of Common Stock: |

| | | | | | | | | |

| Common shareholders' equity | $ | 404,449 | | | $ | 374,998 | | | $ | 375,162 | | | $ | 367,714 | | | $ | 347,596 | |

| Tangible common equity | $ | 374,145 | | | $ | 344,557 | | | $ | 344,584 | | | $ | 336,999 | | | $ | 316,745 | |

| Shares of common stock outstanding (in thousands) | 20,836 | | | 20,850 | | | 20,944 | | | 21,138 | | | 21,064 | |

| | | | | | | | | |

| Common shareholders' equity per share of common stock | $ | 19.41 | | | $ | 17.99 | | | $ | 17.91 | | | $ | 17.40 | | | $ | 16.50 | |

| Tangible common equity per share of common stock | $ | 17.96 | | | $ | 16.53 | | | $ | 16.45 | | | $ | 15.94 | | | $ | 15.04 | |

The tangible common equity ratio removes the effect of goodwill and other intangible assets from capital and total assets. Tangible common equity per share of common stock removes the effect of goodwill and other intangible assets from common shareholders’ equity per share of common stock.

Exhibit 99.2

INDEPENDENT BANK CORPORATION AND SUBSIDIARIES

Supplemental Data

Non-performing assets

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2023 | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 |

| (Dollars in thousands) |

| Non-accrual loans | $ | 6,991 | | | $ | 6,969 | | | $ | 6,876 | | | $ | 6,216 | | | $ | 5,381 | |

| Loans 90 days or more past due and still accruing interest | 432 | | | — | | | — | | | — | | | — | |

| Subtotal | 7,423 | | | 6,969 | | | 6,876 | | | 6,216 | | | 5,381 | |

| Less: Government guaranteed loans | 2,191 | | | 2,254 | | | 2,882 | | | 2,330 | | | 1,660 | |

| Total non-performing loans | 5,232 | | | 4,715 | | | 3,994 | | | 3,886 | | | 3,721 | |

| Other real estate and repossessed assets | 569 | | | 443 | | | 658 | | | 499 | | | 455 | |

| Total non-performing assets | $ | 5,801 | | | $ | 5,158 | | | $ | 4,652 | | | $ | 4,385 | | | $ | 4,176 | |

| | | | | | | | | |

| As a percent of Portfolio Loans | | | | | | | | | |

| Non-performing loans | 0.14 | % | | 0.13 | % | | 0.11 | % | | 0.11 | % | | 0.11 | % |

| Allowance for credit losses | 1.44 | | | 1.48 | | | 1.49 | | | 1.44 | | | 1.51 | |

| Non-performing assets to total assets | 0.11 | | | 0.10 | | | 0.09 | | | 0.09 | | | 0.08 | |

| Allowance for credit losses as a percent of non-performing loans | 1,044.69 | | | 1,176.99 | | | 1,351.13 | | | 1,300.82 | | | 1,409.16 | |

Allowance for credit losses

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Twelve months ended December 31, |

| 2023 | | 2022 |

| Loans | | Securities | | Unfunded

Commitments | | Loans | | Securities | | Unfunded

Commitments |

| (Dollars in thousands) |

| Balance at beginning of period | $ | 52,435 | | $ | 168 | | $ | 5,080 | | $ | 47,252 | | $ | — | | $ | 4,481 |

| Additions (deductions) | | | | | | | | | | | |

| Provision for credit losses | 3,221 | | 2,989 | | — | | 5,173 | | 168 | | — |

| Recoveries credited to allowance | 2,798 | | — | | — | | 2,496 | | — | | — |

| Charges against the allowance | (3,796) | | (3,000) | | — | | (2,486) | | — | | — |

| Costs included in non-interest expense | — | | — | | 424 | | — | | — | | 599 |

| Balance at end of period | $ | 54,658 | | $ | 157 | | $ | 5,504 | | $ | 52,435 | | $ | 168 | | $ | 5,080 |

| | | | | | | | | | | |

| Net loans charged (recovered) against the allowance to average Portfolio Loans | 0.03 | % | | | | | | 0.00 | % | | | | |

Capitalization

| | | | | | | | | | | |

| December 31, |

| 2023 | | 2022 |

| (In thousands) |

| Subordinated debt | $ | 39,510 | | | $ | 39,433 | |

| Subordinated debentures | 39,728 | | | 39,660 | |

| Amount not qualifying as regulatory capital | (734) | | | (657) | |

| Amount qualifying as regulatory capital | 78,504 | | | 78,436 | |

| Shareholders’ equity | | | |

| Common stock | 317,483 | | | 320,991 | |

| Retained earnings | 159,108 | | | 119,368 | |

| Accumulated other comprehensive income | (72,142) | | | (92,763) | |

| Total shareholders’ equity | 404,449 | | | 347,596 | |

| Total capitalization | $ | 482,953 | | | $ | 426,032 | |

Non-Interest Income

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | Twelve months ended |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 | | December 31, |

| | | | 2023 | | 2022 |

| (In thousands) |

| Interchange income | $ | 3,336 | | | $ | 4,100 | | | $ | 3,402 | | | $ | 13,996 | | | $ | 13,955 | |

| Service charges on deposit accounts | 3,061 | | | 3,309 | | | 3,153 | | | 12,361 | | | 12,288 | |

| Net gains (losses) on assets | | | | | | | | | |

| Mortgage loans | 1,961 | | | 2,099 | | | 1,486 | | | 7,436 | | | 6,431 | |

| Securities | — | | | — | | | — | | | (222) | | | (275) | |

| Mortgage loan servicing, net | (2,442) | | | 2,668 | | | 687 | | | 4,626 | | | 18,773 | |

| Investment and insurance commissions | 1,010 | | | 875 | | | 728 | | | 3,456 | | | 2,898 | |

| Bank owned life insurance | 141 | | | 124 | | | 58 | | | 474 | | | 360 | |

| Other | 2,030 | | | 2,436 | | | 1,954 | | | 8,549 | | | 7,479 | |

| Total non-interest income | $ | 9,097 | | | $ | 15,611 | | | $ | 11,468 | | | $ | 50,676 | | | $ | 61,909 | |

Capitalized Mortgage Loan Servicing Rights

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Twelve months ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (In thousands) |

| Balance at beginning of period | $ | 46,057 | | | $ | 43,158 | | | $ | 42,489 | | | $ | 26,232 | |

| Originated servicing rights capitalized | 844 | | | 824 | | | 3,956 | | | 6,061 | |

| Change in fair value | (4,658) | | | (1,493) | | | (4,202) | | | 10,196 | |

| Balance at end of period | $ | 42,243 | | | $ | 42,489 | | | $ | 42,243 | | | $ | 42,489 | |

Mortgage Loan Activity

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Twelve months ended |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 | | December 31, |

| | | | 2023 | | 2022 |

| (Dollars in thousands) |

| Mortgage loans originated | $ | 108,011 | | $ | 172,914 | | $ | 138,889 | | $ | 554,461 | | $ | 935,807 |

| Mortgage loans sold | 86,473 | | 115,269 | | 80,584 | | 407,613 | | 602,797 |

| Net gains on mortgage loans | 1,961 | | 2,099 | | 1,486 | | 7,436 | | 6,431 |

| Net gains as a percent of mortgage loans sold ("Loan Sales Margin") | 2.27 | % | | 1.82 | % | | 1.84 | % | | 1.82 | % | | 1.07 | % |

| Fair value adjustments included in the Loan Sales Margin | 0.69 | % | | (0.32) | % | | 0.19 | % | | 0.62 | % | | (1.12) | % |

Non-Interest Expense

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Twelve months ended |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 | | December 31, |

| | | | 2023 | | 2022 |

| (In thousands) |

| Compensation | $ | 12,656 | | | $ | 13,054 | | | $ | 12,728 | | | $ | 52,502 | | | $ | 50,535 | |

| Performance-based compensation | 2,644 | | | 2,955 | | | 4,147 | | | 11,064 | | | 15,875 | |

| Payroll taxes and employee benefits | 3,749 | | | 3,966 | | | 3,519 | | | 15,399 | | | 14,597 | |

| Compensation and employee benefits | 19,049 | | | 19,975 | | | 20,394 | | | 78,965 | | | 81,007 | |

| Data processing | 2,909 | | | 3,071 | | | 2,670 | | | 11,862 | | | 10,183 | |

| Occupancy, net | 1,933 | | | 1,971 | | | 2,225 | | | 7,908 | | | 8,907 | |

| Interchange expense | 1,110 | | | 1,119 | | | 1,042 | | | 4,332 | | | 4,242 | |

| Furniture, fixtures and equipment | 974 | | | 927 | | | 933 | | | 3,756 | | | 4,007 | |

| FDIC deposit insurance | 796 | | | 677 | | | 572 | | | 3,005 | | | 2,142 | |

| Communications | 535 | | | 568 | | | 629 | | | 2,406 | | | 2,871 | |

| Legal and professional | 585 | | | 543 | | | 588 | | | 2,208 | | | 2,133 | |

| Loan and collection | 456 | | | 520 | | | 679 | | | 2,174 | | | 2,657 | |

| Advertising | 879 | | | 360 | | | 489 | | | 2,165 | | | 2,074 | |

| Amortization of intangible assets | 137 | | | 136 | | | 146 | | | 547 | | | 785 | |

| Supplies | 138 | | | 135 | | | 125 | | | 501 | | | 556 | |

| Costs (recoveries) related to unfunded lending commitments | 348 | | | 451 | | | (77) | | | 424 | | | 599 | |

| Correspondent bank service fees | 55 | | | 56 | | | 67 | | | 233 | | | 299 | |

| Provision for loss reimbursement on sold loans | (1) | | | 7 | | | — | | | 20 | | | 57 | |

| Conversion related expenses | — | | | — | | | — | | | — | | | 50 | |

| Net losses (gains) on other real estate and repossessed assets | 1 | | | 1 | | | — | | | 19 | | | (214) | |

| Other | 1,974 | | | 1,519 | | | 1,609 | | | 6,594 | | | 5,986 | |

| Total non-interest expense | $ | 31,878 | | | $ | 32,036 | | | $ | 32,091 | | | $ | 127,119 | | | $ | 128,341 | |

Average Balances and Tax Equivalent Rates

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, |

| 2023 | | 2022 |

| Average

Balance | | Interest | | Rate (2) | | Average

Balance | | Interest | | Rate (2) |

| (Dollars in thousands) |

| Assets | | | | | | | | | | | |

| Taxable loans | $ | 3,757,453 | | | $ | 54,259 | | | 5.74 | % | | $ | 3,442,621 | | | $ | 42,023 | | | 4.86 | % |

| Tax-exempt loans (1) | 7,299 | | | 94 | | | 5.11 | | | 7,323 | | | 89 | | | 4.82 | |

| Taxable securities | 719,093 | | | 5,646 | | | 3.14 | | | 847,735 | | | 5,845 | | | 2.76 | |

| Tax-exempt securities (1) | 308,147 | | | 3,592 | | | 4.66 | | | 317,074 | | | 3,241 | | | 4.09 | |

| Interest bearing cash | 119,884 | | | 1,647 | | | 5.45 | | | 5,069 | | | 48 | | | 3.76 | |

| Other investments | 16,821 | | | 301 | | | 7.10 | | | 17,653 | | | 185 | | | 4.16 | |

| Interest Earning Assets | 4,928,697 | | | 65,539 | | | 5.29 | | | 4,637,475 | | | 51,431 | | | 4.41 | |

| Cash and due from banks | 56,423 | | | | | | | 58,485 | | | | | |

| Other assets, net | 248,546 | | | | | | | 238,899 | | | | | |

| Total Assets | $ | 5,233,666 | | | | | | | $ | 4,934,859 | | | | | |

| | | | | | | | | | | |

| Liabilities | | | | | | | | | | | |

| Savings and interest-bearing checking | 2,603,044 | | | 13,084 | | | 1.99 | | | 2,519,294 | | | 6,046 | | | 0.95 | |

| Time deposits | 903,491 | | | 10,027 | | | 4.40 | | | 503,081 | | | 2,497 | | | 1.97 | |

| Other borrowings | 129,236 | | | 2,139 | | | 6.57 | | | 136,999 | | | 1,833 | | | 5.31 | |

| Interest Bearing Liabilities | 3,635,771 | | | 25,250 | | | 2.76 | % | | 3,159,374 | | | 10,376 | | | 1.30 | |

| Non-interest bearing deposits | 1,106,262 | | | | | | | 1,328,373 | | | | | |

| Other liabilities | 112,019 | | | | | | | 113,502 | | | | | |

| Shareholders’ equity | $ | 379,614 | | | | | | | $ | 333,610 | | | | | |

| | | | | | | | | | | |

| Total liabilities and shareholders’ equity | $ | 5,233,666 | | | | | | | $ | 4,934,859 | | | | | |

| | | | | | | | | | | |

| Net Interest Income | | | $ | 40,289 | | | | | | | $ | 41,055 | | | |

| | | | | | | | | | | |

| Net Interest Income as a Percent of Average Interest Earning Assets | | | | | 3.26 | % | | | | | | 3.52 | % |

| | | | | |

| |

| (1) | Interest on tax-exempt loans and securities is presented on a fully tax equivalent basis assuming a marginal tax rate of 21%. |

| (2) | Annualized |

Average Balances and Tax Equivalent Rates

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Twelve Months Ended December 31, |

| 2023 | | 2022 |

| Average

Balance | | Interest | | Rate | | Average

Balance | | Interest | | Rate (2) |

| (Dollars in thousands) |

| Assets | | | | | | | | | | | |

| Taxable loans | $ | 3,624,406 | | | $ | 197,462 | | | 5.45 | % | | $ | 3,227,803 | | | $ | 138,765 | | | 4.30 | % |

| Tax-exempt loans (1) | 6,855 | | | 333 | | | 4.86 | | | 7,771 | | | 370 | | | 4.76 | |

| Taxable securities | 771,121 | | | 23,314 | | | 3.02 | | | 945,665 | | | 20,676 | | | 2.19 | |

| Tax-exempt securities (1) | 317,553 | | | 14,039 | | | 4.42 | | | 331,322 | | | 10,191 | | | 3.08 | |

| Interest bearing cash | 83,587 | | | 4,416 | | | 5.28 | | | 28,773 | | | 142 | | | 0.49 | |

| Other investments | 17,557 | | | 1,013 | | | 5.77 | | | 17,768 | | | 742 | | | 4.18 | |

| Interest Earning Assets | 4,821,079 | | | 240,577 | | | 4.99 | | | 4,559,102 | | | 170,886 | | | 3.75 | |

| Cash and due from banks | 58,473 | | | | | | | 59,507 | | | | | |

| Other assets, net | 236,072 | | | | | | | 207,114 | | | | | |

| Total Assets | $ | 5,115,624 | | | | | | | $ | 4,825,723 | | | | | |

| | | | | | | | | | | |

| Liabilities | | | | | | | | | | | |

| Savings and interest-bearing checking | 2,564,097 | | | 44,728 | | | 1.74 | | | 2,526,296 | | | 10,278 | | | 0.41 | |

| Time deposits | 785,684 | | | 30,347 | | | 3.86 | | | 399,987 | | | 3,873 | | | 0.97 | |

| Other borrowings | 128,945 | | | 8,273 | | | 6.42 | | | 121,871 | | | 5,296 | | | 4.35 | |

| Interest Bearing Liabilities | 3,478,726 | | | 83,348 | | | 2.40 | % | | 3,048,154 | | | 19,447 | | | 0.64 | |

| Non-interest bearing deposits | 1,164,816 | | | | | | | 1,338,736 | | | | | |

| Other liabilities | 103,721 | | | | | | | 94,638 | | | | | |

| Shareholders’ equity | $ | 368,361 | | | | | | | $ | 344,195 | | | | | |

| | | | | | | | | | | |

| Total liabilities and shareholders’ equity | $ | 5,115,624 | | | | | | | $ | 4,825,723 | | | | | |

| | | | | | | | | | | |

| Net Interest Income | | | $ | 157,229 | | | | | | | $ | 151,439 | | | |

| | | | | | | | | | | |

| Net Interest Income as a Percent of Average Interest Earning Assets | | | | | 3.26 | % | | | | | | 3.32 | % |

| | | | | |

| |

| (1) | Interest on tax-exempt loans and securities is presented on a fully tax equivalent basis assuming a marginal tax rate of 21%. |

| |

Commercial Loan Portfolio Analysis as of December 31, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Commercial Loans |

| | | Watch Credits | | Percent of Loan Category in Watch Credit |

| Loan Category | All Loans | | Performing | | Non-accrual | | Total | |

| (Dollars in thousands) |

| Land | $ | 10,620 | | | $ | 1 | | | $ | — | | | $ | 1 | | | — | % |

| Land Development | 17,966 | | | — | | | — | | | — | | | — | |

| Construction | 101,178 | | | — | | | — | | | — | | | — | |

| Income Producing | 625,927 | | | 4,177 | | | — | | | 4,177 | | | 0.7 | |

| Owner Occupied | 449,287 | | | 15,165 | | | — | | | 15,165 | | | 3.4 | |

| Total Commercial Real Estate Loans | $ | 1,204,978 | | | $ | 19,343 | | | $ | — | | | $ | 19,343 | | | 1.6 | |

| | | | | | | | | |

| Other Commercial Loans | $ | 474,753 | | | $ | 16,537 | | | 28 | | | $ | 16,565 | | | 3.5 | |

| Total non-performing commercial loans | | | | | $ | 28 | | | | | |

Commercial Loan Portfolio Analysis as of December 31, 2022

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Commercial Loans |

| | | Watch Credits | | Percent of Loan Category in Watch Credit |

| Loan Category | All Loans | | Performing | | Non-accrual | | Total | |

| (Dollars in thousands) |

| Land | $ | 9,285 | | | $ | 180 | | | $ | — | | | $ | 180 | | | 1.9 | % |

| Land Development | 16,220 | | | — | | | — | | | — | | | — | |

| Construction | 114,277 | | | — | | | — | | | — | | | — | |

| Income Producing | 469,696 | | | 6,177 | | | — | | | 6,177 | | | 1.3 | |

| Owner Occupied | 426,404 | | | 16,525 | | | — | | | 16,525 | | | 3.9 | |

| Total Commercial Real Estate Loans | $ | 1,035,882 | | | $ | 22,882 | | | $ | — | | | $ | 22,882 | | | 2.2 | |

| | | | | | | | | |

| Other Commercial Loans | $ | 430,971 | | | $ | 9,157 | | | 38 | | | $ | 9,195 | | | 2.1 | |

| Total non-performing commercial loans | | | | | $ | 38 | | | | | |

Earnings Call: Fourth Quarter 2023 January 25, 2024 (NASDAQ: IBCP)

Cautionary note regarding forward-looking statements This presentation contains forward-looking statements, which are any statements or information that are not historical facts. These forward-looking statements include statements about our anticipated future revenue and expenses and our future plans and prospects. Forward-looking statements involve inherent risks and uncertainties, and important factors could cause actual results to differ materially from those anticipated. For example, deterioration in general business and economic conditions or turbulence in domestic or global financial markets could adversely affect our revenues and the values of our assets and liabilities, reduce the availability of funding to us, lead to a tightening of credit, and increase stock price volatility. Our results could also be adversely affected by changes in interest rates; increases in unemployment rates; deterioration in the credit quality of our loan portfolios or in the value of the collateral securing those loans; deterioration in the value of our investment securities; legal and regulatory developments; changes in customer behavior and preferences; breaches in data security; and management’s ability to effectively manage the multitude of risks facing our business. Key risk factors that could affect our future results are described in more detail in our Annual Report on Form 10-K for the year ended December 31, 2022 and the other reports we file with the SEC, including under the heading “Risk Factors.” Investors should not place undue reliance on forward-looking statements as a prediction of our future results. Any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise. 2 2

• Formal Remarks − William B. (Brad) Kessel President and Chief Executive Officer − Gavin A. Mohr Executive Vice President and Chief Financial Officer − Joel Rahn Executive Vice President – Commercial Banking • Question and Answer session • Closing Remarks Note: This presentation is available at www.IndependentBank.com in the Investor Relations area under the “Presentations” tab. Agenda 3

4Q23 Overview • Total loans increased 5.2% annualized while maintaining conservative approach to new loan production • New loan production continues to be largely focused on new commercial clients that bring deposits to the bank • Asset quality remained exceptional with NPAs/Total Assets at 0.11% and NCO of $0.2 million in the quarter • Total watch credits of $35.1 million • Deposit base remains stable with short-term brokered deposits added to fund new loan production • Continued rotation into higher yielding assets contributed to net interest margin increasing to 3.26% • Disciplined expense control results in decline in non-interest expense from 3Q23 • Continued high level of profitability with core ROAA of 1.26% (excluding impact of fair value adjustment in MSRs) • Total Capital Ratio increased 13 bps to 13.71% • Tangible book value per share increased 8.7% from end of prior quarter • Balance sheet liquidity remains strong with loan-to-deposit ratio of 82% • Net income of $13.7 million, or $0.65 per diluted share • Decline in net income from prior quarter driven by unfavorable fair value adjustment in mortgage loan servicing • Strong profitability, prudent balance sheet management, and AOCI recapture results in further growth in tangible book value per share Healthy Capital & Liquidity Positions Positive Trends in Key Metrics Solid Loan Growth and Strong Asset Quality 4Q’23 Earnings 4 4

$ 4 .1 $ 4 .1 $ 4 .2 $ 4 .3 $ 4 .3 $ 4 .4 $ 4 .5 $ 4 .5 $ 4 .6 $ 4 .6 0 .1 1 % 0 .0 9 % 0 .0 7 % 0 .1 1 % 0 .3 3 % 0 .7 8 % 1 .2 6 % 1 .5 7 % 1 .8 0 % 2 .1 7 % Q 3 '2 1 Q 4 '2 1 Q 1 '2 2 Q 2 '2 2 Q 3 '2 2 Q 4 '2 2 Q 1 '2 3 Q 2 '2 3 Q 3 '2 3 Q 4 '2 3 Total Deposits Cost Of Deposits Non-interest Bearing 23% Savings and Interest- bearing Checking 41% Reciprocal 18% Time 11% Brokered 6% Low-Cost Deposit Franchise Focused on Core Deposit Growth • Substantial core funding – $3.81 billion of non-maturity deposit accounts (82.5% of total deposits). • Core deposit decrease of $11.3 million (1.0% annualized) in 4Q'23. • Time deposit increase of $46.4 (38.5% annualized) million in 4Q’23. • Total deposits increased $243.8 million (5.6%) since 12/31/22 with non-interest bearing down $193.7 million, savings and interest- bearing checking down $67.6 million, reciprocal up $229.4 million, time up $202.8 million and brokered time up $72.8 million. • Deposits by Customer Type: − Retail – 48.9% − Commercial – 35.5% − Municipal – 15.6% Deposit Composition 12/31/23 Cost of Deposits (%)/Total Deposits ($B) Core Deposits: 82.5% 5 $4.6B

0 .2 7 % 0 .2 7 % 0 .2 8 % 0 .3 3 % 0 .3 6 % 0 .4 2 % 0 .5 1 % 0 .6 0 % 0 .7 3 % 0 .8 2 % 0 .8 5 % 0 .8 5 % 0 .7 4 % 0 .6 3 % 0 .3 0 % 0 .2 3 % 0 .3 9 % 0 .1 4 % 0 .1 2 % 0 .1 1 % 0 .1 0 % 0 .1 0 % 0 .1 2 % 0 .3 3 % 0 .7 9 % 1 .2 5 % 1 .5 7 % 1 .8 0 % 1 .9 9 % 0 500,000 1,000,000 1,500,000 2,000,000 2,500,000 3,000,000 3,500,000 4,000,000 4,500,000 5,000,000 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% D e c -1 6 M a r- 1 7 J u n -1 7 S e p -1 7 D e c -1 7 M a r- 1 8 J u n -1 8 S e p -1 8 D e c -1 8 M a r- 1 9 J u n -1 9 S e p -1 9 D e c -1 9 M a r- 2 0 J u n -2 0 S e p -2 0 D e c -2 0 M a r- 2 1 J u n -2 1 S e p -2 1 D e c -2 1 M a r- 2 2 J u n -2 2 S e p -2 2 D e c -2 2 M a r- 2 3 J u n -2 3 S e p -2 3 D e c -2 3 IB COF Fed Funds Spot Fed Effective Total Deposits Historic IBC Cost of Funds (excluding sub debt) vs. the Federal Funds Rate (with Deposit Balances) D e p o s it B a la n c e s ( $ i n t h o u s a n d s ) 6 F e d e ra l F u n d s R a te Cumulative Cycle Beta = 36.0%

Commercial 44% Mortgage 39% Installment 16% Held for Sale 0% $ 2 .9 $ 2 .9 $ 3 .0 $ 3 .3 $ 3 .4 $ 3 .4 $ 3 .5 $ 3 .6 $ 3 .7 $ 3 .8 4 .1 3 % 4 .0 8 % 3 .8 2 % 4 .0 1 % 4 .3 9 % 4 .9 0 % 5 .0 7 % 5 .3 6 % 5 .5 3 % 5 .7 3 % Q 3 '2 1 Q 4 '2 1 Q 1 '2 2 Q 2 '2 2 3 Q '2 2 4 Q '2 2 1 Q '2 3 2 Q '2 3 3 Q '2 3 4 Q '2 3 Total Portfolio Loans Yield on Loans Diversified Loan Portfolio Focused on High Quality Growth • Portfolio loan changes in 4Q'23: − Commercial – increased $53.6 million. …Average new origination yield of 7.72% vs a 6.77% portfolio yield. − Mortgage – increased $10.0 million. …Average new origination yield of 7.68% vs a 4.64% portfolio yield. − Installment – decreased $14.2 million. …Average new origination yield of 8.68% vs a 5.44% portfolio yield. • Mortgage loan portfolio weighted average FICO of 746 and average balance of $183,419. • Installment weighted average FICO of 754 and average balance of $25,758. • Commercial loan rate mix: − 50% fixed / 50% variable. − Indices – 51% tied to Prime, 1% tied to a US Treasury rate and 48% tied to SOFR. • Mortgage loan (including HELOC) rate mix: − 61% fixed / 39% adjustable or variable. − 21% tied to Prime, 9% tied to a US Treasury rate and 70% tied to SOFR. Note: Portfolio loans exclude loans HFS. Loan Composition 12/31/23 Yield on Loans (%)/ Total Portfolio Loans ($B) 7 $3.8B

10.18%, Commercial Industrial, $157 8.87%, Retail, $136 6.08%, Office, $93 5.23%, Construction, $80 3.23%, Multifamily, $50 2.50%, 1-4 Family, $38 1.75%, Land, Vacant Land and Development, $27 0.68%, Special Purpose, $10 9% $149 9% $147 6% $99 6% $90 5% $73 4% $71 3% $54 3% $51 3% $43 $40 $40 $40 $35 $30 $73 $1,141MM Manufacturing Construction Health Care and Social Assistance Retail Hotel and Accomodations Real Estate Rental and Leasing Transportation Other Services (except Public Administration) Wholesale Professional, Scientific, and Technical Services Arts, Entertainment, and Recreation Food Service Finance and Insurance Assisted Living Other Services Concentrations within $1.7B Commercial Loan Portfolio C&I or Owner Occupied Loans by Industry as a % of Total Commercial Loans ($ in millions) Investor RE by Collateral Type as a % of Total Commercial Loans ($ in millions) Note: $1.1 billion, or 67.8% of the commercial loan portfolio is C&I or owner occupied, while $541 million, or 32.2% is investment real estate. The percentage concentrations are based on the entire commercial portfolio of $1.7 billion as of December 31, 2023 8 $541MM

$5.3 $4.8 $4.4 $7.2 $13.2 $2.3 $3.1 $1.9 $4.4 $4.9 $3.3 0.3% 0.2% 0.2% 0.3% 0.5% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 1.2% 1.4% $- $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 2016 2017 2018 2019 2020 2021 2022 Q1'23 Q2'23 Q3'23 Q4'23 30-89 Days PD 30-89 Days PD / Total Loans $13.4 $8.2 $8.6 $9.5 $7.9 $5.1 $3.7 $3.9 $4.0 $5.2 $5.2 $5.0 $1.6 $1.3 $1.9 $0.8 $0.2 $0.5 $0.5 $0.7 $0.4 $0.6 $- $5.0 $10.0 $15.0 $20.0 2016 2017 2018 2019 2020 2021 2022 Q1'23 Q2'23 Q3'23 Q4'23 Non-performing Loans 90+ Days PD ORE/ORA $5.0 $1.6 $1.3 $1.9 $0.8 $0.2 $0.5 $0.5 $0.7 $0.4 $0.6 $- $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 2016 2017 2018 2019 2020 2021 2022 Q1'23 Q2'23 Q3'23 Q4'23 $13.4 $8.2 $8.6 $9.5 $7.9 $5.1 $3.7 $3.9 $4.0 $4.7 $5.2 0.4% 0.3% 0.3% 0.3% 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.0% 0.1% 0.2% 0.3% 0.4% 0.5% 0.6% 0.7% 0.8% 0.9% $- $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 $16.0 2016 2017 2018 2019 2020 2021 2022 Q1'23 Q2'23 Q3'23 Q4'23 Non-performing Loans (NPLs) NPLs / Total Loans Note 1: Non-performing loans and non-performing assets exclude troubled debt restructurings that are performing. Note 2: 12/31/16 30 to 89 days delinquent data excludes $1.63 million of payment plan receivables that were held for sale. Credit Quality Summary Non-performing Loans ($ in Millions) ORE/ORA ($ in Millions) 30 to 89 Days Delinquent ($ in Millions) Non-performing Assets ($ in Millions) 9

10.3 10.4 10.6 10.4 10.4 10.6 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 8.8 8.9 8.9 8.9 8.9 9.0 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 6.2 6.4 6.6 6.7 6.7 7.2 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 • Long-term capital Priorities: Capital retention to support organic growth, acquisitions and return of capital through strong and consistent dividends and share repurchases. • Well capitalized in all regulatory capital measurements. • Tangible common equity ratio excluding the impact of unrealized losses on securities AFS and HTM is 8.3% Strong Capital Position TCE / TA (%) Leverage Ratio (%) CET1 Ratio (%) Total RBC Ratio (%) 10 13.5 13.6 13.8 13.6 13.6 13.7 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23

$30.5 $32.0 $31.0 $30.3 $31.4 $33.8 $34.3 $33.0 $36.1 $39.9 $40.6 $38.4 $38.4 $39.4 $40.1 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 3.36 3.31 3.12 3.05 3.02 3.18 3.13 3.00 3.26 3.49 3.52 3.32 3.24 3.23 3.26 0.06 0.09 0.09 0.08 0.07 0.08 0.08 0.12 0.77 2.18 3.65 4.38 4.99 5.26 5.33 0.30 0.23 0.39 0.14 0.12 0.11 0.10 0.10 0.12 0.45 0.92 1.39 1.72 1.93 2.11 0 1 2 3 4 5 6 Q 2 '2 0 Q 3 '2 0 Q 4 '2 0 Q 1 '2 1 Q 2 '2 1 Q 3 '2 1 Q 4 '2 1 Q 1 '2 2 Q 2 '2 2 Q 3 '2 2 Q 4 '2 2 Q 1 '2 3 Q 2 '2 3 Q 3 '2 3 Q 4 '2 3 Net Interest Margin (FTE) Average Effective FF Yield Cost of Funds Net Interest Margin/Income • Net interest income was $40.1 million in 4Q'23 compared to $40.6 million in the prior year quarter. A decrease in the net interest margin was partially offset by an increase in average earnings assets. • Net interest margin was 3.26% during the fourth quarter of 2023, compared to 3.52% in the year-ago quarter and 3.23% in the third quarter of 2023. Yields, NIM and Cost of Funds (%) Net Interest Income ($ in Millions) 11

4Q23 3Q23 Change Avg Bal Inc/Exp Yield Avg Bal Inc/Exp Yield Avg Bal Inc/Exp Yield Cash $119,884 $1,647 5.45% $108,389 $1,468 5.37% $11,495 $179 0.08% Investments 1,044,061 9,539 3.65% 1,089,285 9,729 3.57% (45,224) (190) 0.08% Commercial loans 1,642,191 28,544 6.90% 1,566,874 26,804 6.79% 75,317 1,740 0.12% Mortgage loans 1,491,933 17,759 4.76% 1,479,029 16,941 4.58% 12,904 818 0.19% Consumer loans 630,628 8,050 5.06% 648,631 7,692 4.70% (18,003) 358 0.36% Earning assets $4,928,697 $65,539 5.29% $4,892,208 $62,634 5.10% $36,489 $2,905 0.20% Nonmaturity deposits $2,603,044 $13,084 1.99% $2,598,170 $12,272 1.87% $4,874 812 0.13% CDARS deposits 97,709 1,065 4.32% 96,409 989 4.07% 1,300 76 0.25% Retail Time deposits 506,534 4,880 3.82% 452,585 3,970 3.48% 53,949 910 0.34% Brokered deposits 299,248 4,082 5.41% 267,816 3,512 5.20% 31,432 570 0.21% Bank borrowings 50,018 659 5.23% 60,017 794 5.25% (9,999) (135) -0.02% IBC debt 79,218 1,480 7.41% 79,182 1,468 7.36% 36 12 0.06% Cost of funds $3,635,771 $25,250 2.76% $3,554,179 $23,005 2.57% $81,592 $2,245 0.19% Free funds $1,292,926 $1,338,029 ($45,103) Net interest income $40,289 $39,629 $660 Net interest margin 3.26% 3.23% 0.03% Q3'23 3.23% Change in earning asset mix 0.04% Increase in loan & investment yield 0.16% Change in funding mix -0.05% Increase in funding costs -0.12% Q4'23 3.26% 4Q'23 NIM Changes Linked Quarter Average Balances and FTE Rates ($ in thousands) Linked Quarter Analysis 12

Interest Rate Risk Management • The decrease in the base case modeled NII is due to an adverse shift in the funding mix and the change in rates during the quarter which caused the yield curve to invert further. These changes were partially offset by improvement in asset mix with an increase in loans and a decline in investments and earning asset growth. • The NII sensitivity profile is largely unchanged during the quarter for smaller rate changes of +/- 100 basis points. The exposure to rising rates increased modestly for larger rate increases. asset and liability duration both moved lower but liability duration declined more caused by the adverse shift in the funding mix. • Base-rate is a static balance sheet applying the spot yield curve from the valuation date. • Stable core funding base. Transaction accounts fund 37.8% of assets and other non-maturity deposits fund another 18.8% of assets. Moderate wholesale funding of just 7.9% of assets. • 33.0% of assets reprice in 1 month and 45.9% reprice in the next 12 months. • Continually evaluating strategies to manage NII through hedging as well as product pricing and structure. Changes in Net Interest Income (Dollars in 000’s) Simulation analyses calculate the change in net interest income over the next twelve months, under immediate parallel shifts in interest rates, based upon a static statement of financial condition, which includes derivative instruments, and does not consider loan fees. 13 December 31, 2023 -200 -100 Base-rate 100 200 Net Interest Income $167,785 $168,952 $169,495 $168,321 $165,965 Change from Base -1.01% -0.32% -0.69% -2.08% September 30, 2023 -200 -100 Base-rate 100 200 Net Interest Income $169,475 $171,069 $172,118 $171,200 $169,245 Change from Base -1.54% -0.61% -0.53% -1.67%

Interchange income $3,336 Service Chg Dep $3,061 Gain (Loss)- Mortgage Sale $1,961 Gain (Loss)- Securities $- Mortgage loan servicing, net $(2,442) Investment & insurance commissions $1,010 Bank owned life insurance $141 Other income $2,030 $ 1 5 .8 $ 1 8 .9 $ 1 4 .6 $ 1 6 .9 $ 1 1 .5 $ 1 0 .5 $ 1 5 .4 $ 1 5 .6 $ 9 .1 3 0 .3 % 3 5 .4 % 2 7 .6 % 2 7 .3 % 1 8 .4 % 1 6 .4 % 1 8 .4 % 2 0 .0 % 1 2 .2 % -5.0 5.0 15.0 25.0 35.0 45.0 55.0 $- $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 Q 4 '2 1 Q 1 '2 2 Q 2 '2 2 Q 3 '2 2 Q 4 '2 2 Q 1 '2 3 Q 2 '2 3 Q 3 '2 3 Q 4 '2 3 Non-interest Income Non-interest Inc/Operating Rev (%) Strong Non-interest Income • The $3.1 million comparative quarterly decrease in mortgage loan servicing; net is primarily attributed to changes in the fair value of capitalized mortgage loan servicing rights associated with changes in mortgage loan interest rates and expected future prepayment levels. • Mortgage banking: − $2.0 million in net gains on mortgage loans in 4Q'23 vs. $1.5 million in the year ago quarter. The increase is primarily due to higher mortgage loan sales as well as increased profit margins and fair value adjustments. − $108.0 million in mortgage loan originations in 4Q'23 vs. $138.9 million in 4Q’22 and $172.9 million in 3Q’23. − 4Q'23 mortgage loan servicing includes a $3.6 million ($0.14 per diluted share, after tax) decrease in fair value adjustment due to price compared to a decrease of $0.5 million ($0.02 per diluted share, after tax) in the year ago quarter. Source: Company documents. 4Q23 Non-interest Income (thousands) Non-interest Income Trends ($M) 14 $9.3M

61.7% 63.2% 64.8% 63.1% 61.3% 59.8% 60.4% 59.6% 59.9% 60.8% Q 3 '2 1 Q 4 '2 1 1 Q '2 2 2 Q '2 2 3 Q '2 2 4 Q '2 2 1 Q '2 3 2 Q '2 3 3 Q '2 3 4 Q '2 3 $ 3 4 .0 $ 3 1 .5 $ 3 2 .4 $ 3 2 .4 $ 3 2 .1 $ 3 1 .0 $ 3 2 .2 $ 3 2 .0 $ 3 1 .9 $- $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 Q 4 '2 1 Q 1 '2 2 Q 2 '2 2 Q 3 '2 2 Q 4 '2 2 Q 1 '2 3 Q 2 '2 3 Q 3 '2 3 Q 4 '2 3 Compensation and Benefits Loan and Collection Occupancy Data Processing FDIC Insurance Other Focus on Improved Efficiency • 4Q'23 efficiency ratio of 64.3%. • Compensation and employee benefits expense of $19.0 million, a decrease of $1.3 million from the prior year quarter. • Compensation (salaries and wages) decreased $0.1 million due primarily to decreases in mortgage/retail operations and branch personnel, vacation accrual true up and lower severance that were partially offset by raises. • $1.5 million decrease in performance-based compensation expense. • Payroll taxes and employee benefits increased $0.2 million primarily due to a higher healthcare related costs. • Data processing costs increased by $0.2 million primarily to core data processor annual asset growth and CPI related cost increases as well as the purchase of a new lending solution software. • Opportunities exist to gain additional efficiencies as we continue to optimize our delivery channels. Non-interest Expense ($M) Efficiency Ratio (4 quarter rolling average) Source: Company documents. 15

Look-Back on 2023 Forecast Outlook for 2023 *as of January, 2023 • IBCP forecast of low double digit (approximately 10%-12%) overall loan growth is based on increases in commercial loans and mortgage loans with installment loans remaining flat. Expect much of this growth to occur in the last three quarters of 2023. • This growth forecast also assumes a stable Michigan economy. • IBCP forecast of high single digit (7%-9%) growth is primarily supported by an increase in earning assets and a favorable shift in the earning asset base. Expect net interest margin (NIM) to be stable to slightly higher (0.05% - 0.10%) in 2023 compared to full-year 2022. • Primary driver is an increase in earning asset yield. The forecast assumes a 0.50% Fed rate increase in February, a 0.25% increase in March and a 0.25% decrease in September and December in the federal funds rate while long-term interest rates decline slightly over year-end 2022 levels. • Very difficult area to forecast. Future provision levels under CECL will be particularly sensitive to loan growth and mix, projected economic conditions, watch credit levels and loan default volumes. • The allowance as a percentage of total loans was at 1.51% at 12/31/22. • A full year 2023. provision (expense) for credit losses of approximately 0.25% to 0.35% of average total portfolio loans would not be unreasonable. 4Q'23 Update • Total portfolio loans increased $49.4 million (5.2% annualized) in 4Q’23 and $325.5 million (9.4%) for the full year 2023 which is slightly lower than our forecasted range. • Commercial and mortgage loans had positive growth for the fourth quarter and full year in 2023. • 4Q'23 net interest income was $0.5 million (4.8% annualized) lower than the prior year quarter. The net interest margin was 3.26% for the current quarter and 3.52 for the prior year quarter and up 0.03% from the linked quarter. • The $0.5 million decrease in net interest income is due to a 0.26% decrease in net interest margin that was partially offset by a $291.2 million increase in average earning assets. Full year 2023 increase of $6.8 million or 4.5%. • The provision for credit losses was a credit of $0.6 million (0.07% annualized). The 4Q'23 provision credit was primarily the result of a change in allocation rates due to subjective factors and the payoff of one problem credit ($1.0 million). Full year 2023 provision expense was $6.2 million or 0.17% of average total loans for the year. LENDING Continued growth NET INTEREST INCOME Growth driven primarily by higher average earning assets PROVISION FOR CREDIT LOSSES Steady asset quality metrics 16

Look-Back on 2023 Forecast Outlook for 2023 *as of January, 2023 • IBCP forecasted 2023 quarterly range of $11M to $13M with the total for the year down 20% to 25% from 2022 actual of $61.9M • Expect mortgage loan origination volumes in 2023 to be down by approximately 20%, a decline in mortgage loan servicing net of approximately 80%, interchange income in 2023 to increase approximately 2.0% to 3.0% as compared to 2022 and service charges on deposits to be collectively comparable to 2022 (a decline in NSF fees to be largely offset by an increase in treasury management related service charges). • IBCP forecasted 2023 quarterly range of $32.0M to $33.5M with the total for the year up 1.5% to 2.5% from the 2022 actual of $128.3M. • The primary driver is an increase in data processing and FDIC deposit insurance premiums. • Approximately an 18.8% effective income tax rate in 2023. This assumes a 21% statutory federal corporate income tax rate during 2023. • 2023 share repurchase authorization at approximately 5% (1.1 million) of outstanding shares. • Share repurchases will be dependent on capital levels, capital allocation options and share price trends. We are not modeling any share repurchases in 2023. 4Q'23 Update • Non-interest income totaled $9.1 million in 4Q'23, which was below the forecasted range. 4Q'23 mortgage loan originations, sales and gains totaled $108.0 million, $86.5 million and $2.0 million, respectively. • Mortgage loan servicing net, generated a loss of $2.4 million in 4Q'23. • Full year 2023 mortgage originations decreased $381.3 million (40.8%). • Full year 2023 quarterly average of $13.4 million which is above our original forecast. • Total non-interest expense was $31.9 million in the 4Q’23, which was below our forecasted range. • The comparative quarterly decrease is primarily due to declines in compensation and employee benefits, occupancy, net, communications expense and loan and collection expense that were partially offset by increases in data processing, FDIC insurance expense, advertising and costs related to unfunded lending commitments. The decrease in compensation and employee benefits is primarily related to a lower expected level of incentive compensation. Full year 2023 quarterly average of $31.8 million. • Actual effective income tax rate of 23.4% and 19.8% for the 4Q’23 and full year, respectively. • 10,200 shares were repurchased in the fourth quarter of 2023 at a average share price of $19.08. 298,601 shares at an average share price of 17.27 have been repurchased for the full year of 2023. NON-INTEREST INCOME NON-INTEREST EXPENSES INCOME TAXES SHARE REPURCHASES 17

Outlook for 2024 Outlook for 2024 *as of January, 2024 • IBCP forecast of mid-single digit (approximately 6%-8%) overall loan growth is based on increases in commercial loans and mortgage loans with installment loans remaining flat. Expect much of this growth to occur in the first three quarters of 2024. • This growth forecast also assumes a stable Michigan economy. • The forecast assumes 0.25% Fed rate cuts in May, June, August and October in the federal funds rate while long-term interest rates decline slightly over year-end 2023 levels. • IBCP forecast of mid-single digit (6%-8%) growth is primarily supported by an increase in earning assets and a favorable shift in the earning asset base. Expect the net interest margin (NIM) to increase (0.10% - 0.15%) in 2024 compared to full-year 2023. Primary driver is an increase in earning asset yield that is partially offset by an increase in yield on interest bearing liabilities. • Very difficult area to forecast. Future provision levels under CECL will be particularly sensitive to loan growth and mix, projected economic conditions, watch credit levels and loan default volumes. • The allowance as a percentage of total loans was at 1.44% at 12/31/23 • A full year 2024 provision (expense) for credit losses of approximately 0.15%-0.25% of average total portfolio loans would not be unreasonable. LENDING Continued growth NET INTEREST INCOME Growth driven primarily by higher average earning assets PROVISION FOR CREDIT LOSSES Steady asset quality metrics 18

Outlook for 2024 Outlook for 2024 *as of January, 2024 • IBCP forecasts 2024 quarterly range of $11.5M to $13.0M with the total for the year down 0.5% to 1.0% from 2023 actual of $50.7M • Expect mortgage loan origination volumes in 2024 to increase by approximately 7%, a decline in mortgage loan servicing net of approximately 19%, interchange income in 2024 to increase approximately 1.5% to 2.5% as compared to 2023, service charges on deposits to be collectively comparable to 2023 and other income to decline approximately 5%comparable to 2023 actuals. • IBCP forecasts 2024 quarterly range of $32.5M to $33.5M with the total for the year up 3.5% to 4.25% from the 2023 actual of $127.1M. • The primary driver is an increase in compensation and employee benefits, data processing, loan and collection and advertising. • Approximately a 20% effective income tax rate in 2024 This assumes a 21% statutory federal corporate income tax rate during 2024. • 2024 share repurchase authorization at approximately 5% (1.1 million) of outstanding shares. • Share repurchases will be dependent on capital levels, capital allocation options and share price trends. We are not modeling any share repurchases in 2024. NON-INTEREST INCOME NON-INTEREST EXPENSES INCOME TAXES SHARE REPURCHASES 19