Form SC TO-I/A - Tender offer statement by Issuer: [Amend]

January 24 2024 - 6:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

(Amendment No. 2)

(RULE 14d-100)

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

VNET Group, Inc.

(Name of Subject Company (Issuer))

VNET Group, Inc.

(Name of Filing Person (Issuer))

0.00% Convertible Senior Notes due 2026

(Title of Class of Securities)

90138V AB3

(CUSIP Number of Class of Securities)

Qiyu Wang

Chief Financial Officer

VNET Group, Inc.

Guanjie Building, Southeast 1st Floor 10# Jiuxianqiao East Road

Chaoyang District

Beijing, 100016

The People’s Republic of China

Phone: (86) 10 8456-2121

Facsimile: (86) 10 8456-4234

with copy to:

James C. Lin, Esq.

Gerhard Radtke, Esq.

Davis Polk & Wardwell

c/o 19th Floor, The Hong Kong Club Building

3A Chater Road

Central, Hong Kong

(852) 2533 3300

(Name, address and telephone number of person authorized to receive notices and communications on behalf of the filing person)

☐

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

Check the appropriate boxes below to designate any transactions to which the statement relates:

☐

third-party tender offer subject to Rule 14d-1.

☒

issuer tender offer subject to Rule 13e-4.

☐

going-private transaction subject to Rule 13e-3.

☐

amendment to Schedule 13D under Rule 13d-2.

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☒

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

☐

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

☐

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

INTRODUCTORY STATEMENT

This Amendment No. 2 (this “Amendment No. 2”) further amends and supplements the Tender Offer Statement on Schedule TO that was initially filed with the U.S. Securities and Exchange Commission (the “Commission”) by VNET Group, Inc. (the “Company”) on December 28, 2023, as subsequently amended and supplemented by the Amendment No. 1 filed with the Commission on January 16, 2024 (as so amended and supplemented, the “Schedule TO”) to purchase for cash on the Repurchase Date, at the option of the Holders, the Company’s 0.00% Convertible Senior Notes due 2026 (the “Notes”), upon the terms and subject to the conditions set forth in the Repurchase Right Notice to Holders of the Notes, dated as of December 28, 2023 (together with any amendments or supplements thereto, the “Repurchase Right Notice”), filed as Exhibit (a)(1) to the Schedule TO. This Amendment No. 2 serves to file Amendment No. 2 to the Repurchase Right Notice, dated January 24, 2024 attached hereto as Exhibit (a)(1)(B).

Except as otherwise set forth in this Amendment No. 2, the information set forth in the Schedule TO remains unchanged and is incorporated herein by reference to the extent relevant to the items in this Amendment No. 2. Capitalized terms used but not defined herein shall have the meanings ascribed to them in the Schedule TO. You should read this Amendment No. 2 together with the Schedule TO, including the Repurchase Right Notice.

This Amendment No. 2 is intended to satisfy the disclosure requirements of Rule 13e-4(c)(3) under the Securities Exchange Act of 1934, as amended.

ITEMS 1 THROUGH 9 (OTHER THAN ITEM 5).

Items 1 through 9, other than Item 5, are hereby amended and updated by the Amendment No. 2 to the Repurchase Right Notice dated January 24, 2024 as follows.

(1) The Section captioned “How will the Company fund the purchase of the Notes” on page 2 of the Repurchase Right Notice is hereby deleted and replaced with the following:

“How will the Company fund the purchase of the Notes?

The Company plans to use (i) proceeds from the Investment Agreement with SDHG, (ii) proceeds from the Facility Agreement with CNCB (Hong Kong) Investment Limited and (iii) the Company’s own funds to pay the Repurchase Price for the Notes.

The Company has successfully secured an aggregate amount of US$299 million from the Investment Agreement with SDHG, all of which will be used to pay the Repurchase Price for the Notes.

On January 15, 2024, the Company, as parent guarantor, VNET Group Limited, a wholly owned subsidiary of the Company, as borrower (the “Borrower”), CNCB (Hong Kong) Investment Limited, as original lender (the “Lender”), and CNCB (Hong Kong) Investment Limited in its capacity as arranger, facility agent and security agent, entered into a term facility agreement (the “Facility Agreement”) that established a credit facility of CNH200,000,000 (with an increase option) (the “Facility”) which the Company intends to use to finance the Repurchase Price. The Company irrevocably and unconditionally, jointly and severally with several affiliates of the Company, guarantees punctual performance by the Borrower of all the Borrower’s obligations under the Finance Documents (as defined in the Facility Agreement). The interest rate on each loan under the Facility is 8.00% per annum. The Facility Agreement contains provisions customarily found in credit agreements for similar financings, including, among other things, conditions precedent to the utilization of each loan under the Facility, a right to require that all outstanding amounts and all interest thereon are repaid upon an event of default, and indemnification to the Lender against liabilities it may incur in connection with the Facility. The Borrower shall repay each loan under the Facility in full on the termination date (being the date falling 364 days after the first utilization date or, if such day is not a business day, the preceding business day). The Company, the Borrower and/or certain other parties have entered into a series of security documents (collectively, the “Transaction Security Documents”). The Transaction Security Documents include, among other things, various charges or pledges over receivables, tangible assets and equity interests directly or beneficially held by the Company or the Borrower, as the case may be.

On January 24, 2024, the Borrower successfully drew a loan under the Facility in an aggregate amount of CNH192,000,000 (approximately US$27 million), net of interest payable for the first Interest Period (as

defined in the Facility Agreement) and the arrangement fee pursuant to the Facility Agreement, all of which will be used to fund the Repurchase Price for the Notes.

After careful assessment, the Company no longer needs to explore additional equity and/or debt financing activities to secure additional funds to pay the Repurchase Price and will fund the remaining portion of the Repurchase Price with its own funds. (Page 5)”

(2) the Section captioned “Source of Funds” on page 5 of the Repurchase Right Notice is hereby deleted and replaced with the following:

“2.4 Source of Funds. If the Repurchase Right is exercised for any Notes, the Company plans to use (i) proceeds from the Investment Agreement with SDHG, (ii) proceeds from the Facility Agreement with CNCB (Hong Kong) Investment Limited and (iii) the Company’s own funds to pay the Repurchase Price for the Notes.

The Company has successfully secured an aggregate amount of US$299 million from the Investment Agreement with SDHG, all of which will be used to pay the Repurchase Price for the Notes.

On January 15, 2024, the Company, as parent guarantor, the Borrower, the Lender, and CNCB (Hong Kong) Investment Limited in its capacity as arranger, facility agent and security agent, entered into the Facility Agreement that established a Facility of CNH200,000,000 (with an increase option) which the Company intends to use to finance the Repurchase Price. The Company irrevocably and unconditionally, jointly and severally with several affiliates of the Company, guarantees punctual performance by the Borrower of all the Borrower’s obligations under the Finance Documents (as defined in the Facility Agreement). The interest rate on each loan under the Facility is 8.00% per annum. The Facility Agreement contains provisions customarily found in credit agreements for similar financings, including, among other things, conditions precedent to the utilization of each loan under the Facility, a right to require that all outstanding amounts and all interest thereon are repaid upon an event of default, and indemnification to the Lender against liabilities it may incur in connection with the Facility. The Borrower shall repay each loan under the Facility in full on the termination date (being the date falling 364 days after the first utilization date or, if such day is not a business day, the preceding business day). The Company, the Borrower and/or certain other parties have entered into a series of Transaction Security Documents. The Transaction Security Documents include, among other things, various charges or pledges over receivables, tangible assets and equity interests directly or beneficially held by the Company or the Borrower, as the case may be.

On January 24, 2024, the Borrower successfully drew a loan under the Facility in an aggregate amount of CNH192,000,000 (approximately US$27 million), net of interest payable for the first Interest Period (as defined in the Facility Agreement) and the arrangement fee pursuant to the Facility Agreement, all of which will be used to fund the Repurchase Price for the Notes.

After careful assessment, the Company no longer needs to explore additional equity and/or debt financing activities to secure additional funds to pay the Repurchase Price and will fund the remaining portion of the Repurchase Price with its own funds.”

As permitted by General Instruction F to Schedule TO, all of the information set forth in the Repurchase Right Documents is incorporated by reference into the Schedule TO-I, as amended by this Amendment No. 2.

ITEM 12. EXHIBITS.

| |

(a)

|

|

|

|

|

|

Exhibits.

|

|

| |

|

|

|

(a)(1)*

|

|

|

|

|

| |

|

|

|

(a)(1)(A)*

|

|

|

|

|

| |

|

|

|

(a)(1)(B)†

|

|

|

|

|

| |

|

|

|

(a)(5)(A)*

|

|

|

|

|

| |

|

|

|

(b)(1)*

|

|

|

CNH200,000,000 Term Facility Agreement (with increase option), dated January 15, 2024 among the Company, VNET Group Limited, CNCB (Hong Kong) Investment Limited, as original lender, and CNCB (Hong Kong) Investment Limited, as arranger, facility agent and security agent.

|

|

| |

|

|

|

(d)(1)*

|

|

|

|

|

| |

|

|

|

(d)(2)*

|

|

|

|

|

| |

|

|

|

(d)(3)*

|

|

|

|

|

| |

|

|

|

(d)(4)*

|

|

|

|

|

| |

|

|

|

(d)(5)*

|

|

|

|

|

| |

|

|

|

(g)

|

|

|

Not applicable.

|

|

| |

|

|

|

(h)

|

|

|

Not applicable.

|

|

| |

(b)

|

|

|

|

|

|

Filing Fee Exhibit.

|

|

| |

|

|

|

†

|

|

|

|

|

*

Previously filed.

†

Filed herewith.

EXHIBIT INDEX

| |

Exhibit No.

|

|

|

Description

|

|

| |

(a)(1)*

|

|

|

|

|

| |

(a)(1)(A)*

|

|

|

|

|

| |

(a)(1)(B)†

|

|

|

|

|

| |

(a)(5)(A)*

|

|

|

Press Release issued by the Company, dated as of December 28, 2023.

|

|

| |

(b)(1)*

|

|

|

CNH200,000,000 Term Facility Agreement (with increase option), dated January 15, 2024 among the Company, VNET Group Limited, CNCB (Hong Kong) Investment Limited, as original lender, and CNCB (Hong Kong) Investment Limited, as arranger, facility agent and security agent.

|

|

| |

(d)(1)*

|

|

|

|

|

| |

(d)(2)*

|

|

|

|

|

| |

(d)(3)*

|

|

|

|

|

| |

(d)(4)*

|

|

|

|

|

| |

(d)(5)*

|

|

|

|

|

| |

(b)†

|

|

|

Filing Fee Table

|

|

*

Previously filed.

†

Filed herewith.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

VNET Group, Inc.

By:

/s/ Qiyu Wang

Name:

Qiyu Wang

Title:

Chief Financial Officer

Dated: January 24, 2024

Exhibit (a)(1)(B)

AMENDMENT NO. 2

VNET GROUP, INC.

NOTICE OF REPURCHASE OF NOTES

AT OPTION OF HOLDERS

0.00% CONVERTIBLE SENIOR NOTES DUE 2026

CUSIP No. 90138V AB3

This Amendment No. 2 (this “Amendment No. 2”)

further amends the information previously provided in Repurchase Right Notice, dated December 28, 2023 of VNET Group, Inc. (the

“Company”), as subsequently amended and supplemented by the Amendment No. 1 filed with the U.S. Securities and Exchange

Commission on January 16, 2024 (as so amended and supplemented, the “Repurchase Right Notice”), whereby each Holder of

the Notes, at such Holder’s option, may require the Company to repurchase for cash on February 1, 2024 (the “Repurchase

Date”), all of such Holder’s Notes, or any portion thereof that is an integral multiple of US$1,000 principal amount, subject

to the terms and conditions of the Indenture (the “Repurchase Right”). Except as amended and supplemented hereby, the information

in the Repurchase Right Notice remains unchanged. To the extent there are any conflicts between the information in this Amendment No. 2

and the information in the Repurchase Right Notice, the information in this Amendment No. 2 hereby replaces and supersedes such information.

All capitalized terms used but not defined herein shall have the meanings ascribed to them in the Repurchase Right Notice.

The Repurchase Right Notice is amended as follows:

| (1) | The Section captioned “How will the Company fund the purchase of the Notes” on page 2 of the Repurchase

Right Notice is hereby deleted and replaced with the following: |

“How will the Company fund the purchase

of the Notes?

The Company plans to use (i) proceeds from

the Investment Agreement with SDHG, (ii) proceeds from the Facility Agreement with CNCB (Hong Kong) Investment Limited and (iii) the

Company’s own funds to pay the Repurchase Price for the Notes.

The Company has successfully secured an aggregate

amount of US$299 million from the Investment Agreement with SDHG, all of which will be used to pay the Repurchase Price for the Notes.

On January 15, 2024, the Company, as parent

guarantor, VNET Group Limited, a wholly owned subsidiary of the Company, as borrower (the “Borrower”), CNCB (Hong Kong) Investment

Limited, as original lender (the “Lender”), and CNCB (Hong Kong) Investment Limited in its capacity as arranger, facility

agent and security agent, entered into a term facility agreement (the “Facility Agreement”) that established a credit facility

of CNH200,000,000 (with an increase option) (the “Facility”) which the Company intends to use to finance the Repurchase Price.

The Company irrevocably and unconditionally, jointly and severally with several affiliates of the Company, guarantees punctual performance

by the Borrower of all the Borrower’s obligations under the Finance Documents (as defined in the Facility Agreement). The interest

rate on each loan under the Facility is 8.00% per annum. The Facility Agreement contains provisions customarily found in credit agreements

for similar financings, including, among other things, conditions precedent to the utilization of each loan under the Facility, a right

to require that all outstanding amounts and all interest thereon are repaid upon an event of default, and indemnification to the Lender

against liabilities it may incur in connection with the Facility. The Borrower shall repay each loan under the Facility in full on the

termination date (being the date falling 364 days after the first utilization date or, if such day is not a business day, the preceding

business day). The Company, the Borrower and/or certain other parties have entered into a series of security documents (collectively,

the “Transaction Security Documents”). The Transaction Security Documents include, among other things, various charges or

pledges over receivables, tangible assets and equity interests directly or beneficially held by the Company or the Borrower, as the case

may be.

On January 24, 2024, the Borrower successfully

drew a loan under the Facility in an aggregate amount of CNH192,000,000 (approximately US$27 million), net of interest payable

for the first Interest Period (as defined in the Facility Agreement) and the arrangement fee pursuant to the Facility Agreement, all of

which will be used to fund the Repurchase Price for the Notes.

After careful assessment, the Company no longer

needs to explore additional equity and/or debt financing activities to secure additional funds to pay the Repurchase Price and will fund

the remaining portion of the Repurchase Price with its own funds. (Page 5)”

(2) the Section captioned “Source of Funds”

on page 5 of the Repurchase Right Notice is hereby deleted and replaced with the following:

“2.4 Source of Funds. If the Repurchase

Right is exercised for any Notes, the Company plans to use (i) proceeds from the Investment Agreement with SDHG, (ii) proceeds

from the Facility Agreement with CNCB (Hong Kong) Investment Limited and (iii) the Company’s own funds to pay the Repurchase

Price for the Notes.

The Company has successfully secured an aggregate

amount of US$299 million from the Investment Agreement with SDHG, all of which will be used to pay the Repurchase Price for the Notes.

On January 15, 2024, the Company, as parent

guarantor, the Borrower, the Lender, and CNCB (Hong Kong) Investment Limited in its capacity as arranger, facility agent and security

agent, entered into the Facility Agreement that established a Facility of CNH200,000,000 (with an increase option) which the Company intends

to use to finance the Repurchase Price. The Company irrevocably and unconditionally, jointly and severally with several affiliates of

the Company, guarantees punctual performance by the Borrower of all the Borrower’s obligations under the Finance Documents (as defined

in the Facility Agreement). The interest rate on each loan under the Facility is 8.00% per annum. The Facility Agreement contains provisions

customarily found in credit agreements for similar financings, including, among other things, conditions precedent to the utilization

of each loan under the Facility, a right to require that all outstanding amounts and all interest thereon are repaid upon an event of

default, and indemnification to the Lender against liabilities it may incur in connection with the Facility. The Borrower shall repay

each loan under the Facility in full on the termination date (being the date falling 364 days after the first utilization date or, if

such day is not a business day, the preceding business day). The Company, the Borrower and/or certain other parties have entered into

a series of Transaction Security Documents. The Transaction Security Documents include, among other things, various charges or pledges

over receivables, tangible assets and equity interests directly or beneficially held by the Company or the Borrower, as the case may be.

On January 24, 2024, the Borrower successfully

drew a loan under the Facility in an aggregate amount of CNH192,000,000 (approximately US$27 million), net of interest payable

for the first Interest Period (as defined in the Facility Agreement) and the arrangement fee pursuant to the Facility Agreement, all of

which will be used to fund the Repurchase Price for the Notes.

After careful assessment, the Company no longer

needs to explore additional equity and/or debt financing activities to secure additional funds to pay the Repurchase Price and will fund

the remaining portion of the Repurchase Price with its own funds.”

January 24, 2024

VNET GROUP, INC.

Exhibit (b)

Calculation of Filing Fee Tables

Schedule TO

(Form Type)

VNET Group, Inc.

(Name of Issuer)

Table 1 – Transaction

Valuation

| | |

Transaction

Valuation | | |

Fee Rate | | |

Amount of

Filing Fee | |

| Fees to Be Paid | |

– | | |

| | |

– | |

| Fees Previously Paid | |

$ | 600,000,000

| (1) | |

| 0.01476 | %(2) | |

$ | 88,560 | (2) |

| Total Transaction Valuation | |

$ | 600,000,000 | | |

| | | |

| | |

| Total Fees Due for Filing | |

| | | |

| | | |

$ | 88,560 | (2) |

| Total Fees Previously Paid | |

| | | |

| | | |

$ | 88,560 | (2) |

| Total Fee Offsets | |

| | | |

| | | |

| – | |

| Net Fee Due | |

| | | |

| | | |

| – | |

| (1) | Calculated solely for purposes of determining the filing fee. The purchase price of the 0.00% Convertible Senior Notes due 2026 (the

“Notes”), as described herein, is US$1,000 per US$1,000 principal amount outstanding. As of December 28, 2023, there

was US$600,000,000 aggregate principal amount of Notes outstanding, resulting in an aggregate maximum purchase price of US$600,000,000. |

| (2) | The filing fee of $88,560 was previously paid in connection with the filing of the Tender Offer Statement on Schedule TO on December 28,

2023 by VNET Group, Inc. (File No. 005-86326). The amount of the filing fee was calculated in accordance with Rule 0-11

of the Securities Exchange Act of 1934, as amended, and equals $147.60 for each US$1,000,000 of the value of the transaction. |

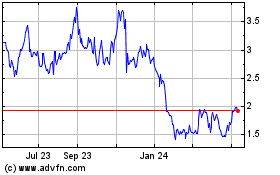

VNET (NASDAQ:VNET)

Historical Stock Chart

From Mar 2024 to Apr 2024

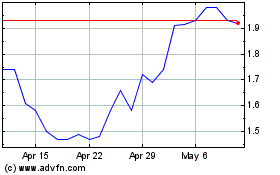

VNET (NASDAQ:VNET)

Historical Stock Chart

From Apr 2023 to Apr 2024