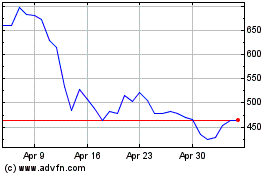

Bitcoin falls below $40,000

On Monday, the cryptocurrency market experienced a significant

setback, with Bitcoin (COIN:BTCUSD) dropping notably below the

$40,000 mark, marking its lowest value of the year. By Tuesday,

Bitcoin had stabilized, trading at $39,482. Meanwhile, Ethereum

(COIN:ETHUSD) continued its downward trend, priced at $2,220, a

decrease of 3.93% from the previous day. Sylvia Jablonski of

Defiance ETFs interprets this drop as a possible “sell the news”

event but remains optimistic about Bitcoin’s future recovery. In

contrast, Fernando Pereira reaffirms his prediction of a steeper

decline. “Bitcoin began the week breaking the critical support of

$40,000, with a higher likelihood now of seeking the next support

at $36,000, as has been indicated in recent days,” Pereira

highlighted.

Cryptographic tokens continue to fall due to institutional sales

Major cryptographic tokens, including Solana (COIN:SOLUSD),

Avalanche (COIN:AVAXUSD), Dogecoin (COIN:DOGEUSD), continued their

decline due to institutional sales linked to recently launched

ETFs, with some coins registering drops of over 20% in the last

week. While UMA Network (COIN:UMAUSD) saw gains, analysts warned

that the recent correction in bitcoin’s price (COIN:BTCUSD)

eliminated profits for short-term investors, suggesting the

possibility of a further market downturn.

Sharp fall and quick recovery of OKX’s OKB token

The native token of OKX (COIN:OKBUSD) experienced a sharp drop

of over 50% in three minutes due to mass liquidations, hitting a

low of $25.17. It later recovered to $47.89, a decrease of 8.3% in

the last 24 hours. OKX has promised to reimburse affected users’

losses, planning to announce a specific compensation plan and

improve its risk and liquidity policies. Currently, OKB has a

market value of $2.860 billion.

Avalanche Foundation establishes criteria for meme coin purchases

The Avalanche Foundation, supporting the Avalanche blockchain,

introduced an “eligibility framework” for meme coin purchases. To

be eligible, coins must be independent, native to the Avalanche

blockchain, and cannot be centralized around creators or whales.

Additionally, they must meet criteria such as a minimum of 2,000

holders, over $200,000 in liquidity, a market value of at least $1

million, and $100,000 in average daily trading volume for two

weeks.

Mode receives a donation of 2 million OP tokens from the Optimism

Foundation

Mode, a Layer 2 DeFi platform, is set to receive a significant

donation from the Optimism Foundation, totaling 2 million OP tokens

(COIN:OPUSD), valued at approximately $5.3 million. This donation

aims to boost user growth on the Mode platform, which operates with

Optimism’s OP Stack technology. In return, Mode will support the

Optimism Collective, contributing a portion of its revenue and

adopting the Chains Law for governance. Its goal is to become a

central hub for DeFi applications on Optimism’s Superchain.

Morgan Stanley predicts the global financial future with emerging

cryptocurrencies

With technological advancements and geopolitical shifts, the

global financial system faces challenges. The dominance of the US

dollar is questioned by cryptocurrencies like Bitcoin. Morgan

Stanley (NYSE:MS) presented a view on the future of encryption in

2024. While the dollar represents 25% of the global GDP, it

constitutes nearly 60% of global foreign exchange reserves.

Countries like China and the European Union are seeking

alternatives. The cryptocurrency market is growing rapidly, with

Bitcoin becoming a sovereign reserve asset. The bank says

understanding the interactions between fiat currencies, Bitcoin,

E-Money, and stablecoins is crucial for macro investors.

JPMorgan downgrades Coinbase shares due to challenges in the

cryptocurrency market

JPMorgan (NYSE:JPM) downgraded Coinbase’s (NASDAQ:COIN) shares

to “underweight,” pointing to Bitcoin’s (COIN:BTCUSD) fall and the

underperformance of BTC spot ETFs. Despite recognizing Coinbase as

a leader in the cryptocurrency market, analysts predict weak

performance for the COIN stock, which has already fallen 28.5% in

the last month. With pressure on cryptocurrency prices and inflated

expectations for ETFs, JPMorgan adjusted its price target forecast

to $80 by December 2024.

New spot Bitcoin ETFs accumulate over 100,000 BTC in assets

The nine new spot Bitcoin ETFs, excluding the converted

Grayscale Bitcoin Trust (AMEX:GBTC), now hold over 100,000 BTC,

equivalent to about $4 billion in assets under management.

BlackRock’s ETF (NASDAQ:IBIT) leads with 40,213 BTC, followed by

Fidelity’s ETF (AMEX:FBTC) with 34,152 BTC. Although these ETFs

have seen significant inflows, the GBTC experienced net outflows of

about $640.5 million in a single day, totaling $3.45 billion in

outflows to date. Despite GBTC’s withdrawals, experts suggest the

possibility of Grayscale’s acquisition by new participants to gain

advantage and credibility in the growing bitcoin ETF market.

ARK Invest reinforces investment strategy by accumulating ARKB ETF

shares and reducing BITO participation

ARK Invest, led by Cathie Wood, continues its investment

strategy by acquiring 523,541 shares of the Ark 21Shares Spot

Bitcoin ETF (AMEX:ARKB) for $21 million, while selling 648,091

units of the ProShares Bitcoin Strategy ETF (AMEX:BITO) for $12.85

million. This move aims to strengthen ARKB’s position, one of the

best-performing ETFs, in ARKW’s portfolio. ARKB is now the 15th

largest holding, while BITO drops to the 20th position in the

portfolio.

Taurus receives approval to offer tokenized securities to retail

customers

Swiss fintech Taurus, backed by Deutsche Bank, received

regulatory approval from FINMA to expand its TDX trading market,

allowing retail customers to participate in tokenized asset

trading. This approval increases the liquidity of digital

securities and allows companies to access primary and secondary

markets. Taurus also announced a list of issuers that have chosen

TDX as their preferred platform for trading digital securities,

including Investis Group, la Mobilière, Qoqa, SCCF, Swissroc, and

Teylor.

Cosmos community rejects proposal to reduce inflation

The Cosmos community voted against Proposal 868, which sought to

reduce the minimum inflation parameter on the network from 7% to 0%

when more than two-thirds of the ATOM supply were staked to the

network. The proposal, presented by Stakelab, aimed to alleviate

inflationary pressure on the ATOM token (COIN:ATOMUSD). However,

the majority voted against the measure, citing network security

concerns as the primary reason. The inflation rate has been a topic

of debate in the Cosmos community, with differing opinions on its

optimization.

Activists create a legal defense fund for Tornado Cash developers

An activist group launched a legal defense fund for Tornado Cash

developers Alexey Pertsev and Roman Storm, who face charges in the

US. The developers were accused of conspiracy related to money

laundering and operating an unlicensed money transmission business

related to Tornado Cash. The defense fund aims to raise funds to

support the legal defense of the accused, who face significant

legal costs. Donations are being accepted through various

fundraising platforms.

TrueUSD (TUSD) deviation from its $1 peg increases amid red market

The value of TrueUSD (COIN:TUSDUSD) dropped to $0.9785 in the

last 24 hours, as major cryptocurrencies like Bitcoin (COIN:BTCUSD)

and Ethereum (COIN:ETHUSD) faced substantial selling. The project

team attributed the price deviations to community mining linked to

the Binance Launchpool, but community concerns persist.

Agreement in Texas allows US investors to withdraw assets from Abra

The Texas State Securities Board reached a principle agreement

with Abra and its CEO, Bill Barhydt, allowing US investors to

withdraw their assets from the cryptographic platform. The

agreement stipulates that Abra must notify users with balances over

$10, granting them a seven-day withdrawal period. Unclaimed assets

will be converted to fiat currency and sent to remaining Texas

investors. The agreement concludes actions brought against Abra by

the board following the state’s coercive action in June 2023.

Mt. Gox reimbursement in Bitcoin and Bitcoin Cash for affected

customers progresses

Former clients of the defunct exchange Mt. Gox reported

receiving emails requesting identity confirmation and account

details. The reimbursement of 850,000 BTC lost during the 2014

hack, valued at $33 billion, appears to be underway. Beneficiaries

will receive payments in bitcoin (COIN:BTCUSD) or bitcoin cash

(COIN:BCHUSD) in their previously indicated exchange accounts. This

reimbursement could impact BTC prices, especially if it coincides

with increased flows to exchange-traded funds (ETFs) and Bitcoin’s

halving in April.

Socket successfully recovers 1,032 Ether after exploitation in

Bungee bridge protocol

The interoperability protocol Socket announced that it recovered

1,032 Ether (about $2.3 million) following an exploitation in its

Bungee bridge protocol. The previous security incident affected

wallets with infinite approvals for Socket contracts. Blockchain

security company PeckShield reported a theft of at least $3.3

million in funds. The exploitation resulted from an “incomplete

validation of user input.” Socket plans to release a recovery and

distribution plan for affected users.

Blockchain gaming project Gamee suffers theft of 600 million GMEE

Tokens on Polygon

The blockchain gaming project Gamee, backed by Animoca Brands,

confirmed a theft of 600 million GMEEE tokens (COIN:GMEEEUSD) on

Polygon due to “unauthorized access”. The tokens, valued at $15

million at the time of the incident, were subsequently converted

into ETH and MATIC through various decentralized exchanges. The

price of the GMEE token, which had fallen by 64%, recovered in a

surge of 16.5% over the last 24 hours. The project assured that

only the team’s token reserves were affected and that no community

assets were compromised. The token has seen a rise of 325% over the

last 3 months.

Donald Trump reinforces opposition to CBDCs

At a rally in New Hampshire, Donald Trump reinforced his

opposition to central bank digital currencies (CBDCs), stating that

he would never allow their creation. He mentioned Vivek Ramaswamy,

a critic of CBDCs, who recently suspended his campaign. Trump

argued that CBDCs represent a threat to financial freedom and would

grant the government absolute control over people’s money. With

other candidates critical of CBDCs leaving the race, the focus on

cryptocurrencies in the elections may diminish.

Polymer Labs raises $23 million for Ethereum interoperability hub

Polymer Labs raised $23 million in its Series A funding round,

focused on developing an Ethereum-based interoperability hub. The

round was led by Blockchain Capital, Maven 11, and Distributed

Global, with support from investors like Coinbase Ventures,

Placeholder, and Digital Currency Group. Polymer Labs, which had

previously raised $3.6 million, is creating a Layer 2 network using

Inter-Blockchain Communication to enhance interoperability and

overcome challenges in the Ethereum ecosystem.

Bitcoin Cash (COIN:BCHUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bitcoin Cash (COIN:BCHUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024