false

0001622244

0001622244

2023-12-21

2023-12-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 21, 2023

One

World Products, Inc.

(Exact

name of registrant as specified in charter)

| Nevada |

|

000-56151 |

|

61-1744826 |

(State

or other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 6605

Grand Montecito Parkway, Suite 100, Las Vegas, NV |

|

89149 |

| (Address

of principal executive offices) |

|

(zip

code) |

Registrant’s

telephone number, including area code: (800) 605-3201

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of registrant under any

of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

The

information set forth in Item 2.04 is incorporated by reference into this Item 1.01.

Item 1.03.

Bankruptcy or Receivership.

One

World Products, Inc., a Nevada corporation (the “Company,” “we” or “us”) plans to be a producer of

raw cannabis and hemp plant ingredients for both medical and industrial uses across the globe. The Company is a holding company and conducts

its business through its wholly-owned subsidiaries. The Company’s principal subsidiary is One World Products Pharma SAS, a Colombian

company (“OWP-Colombia”) which has received licenses from Colombian regulators to cultivate, produce, distribute and export

the raw ingredients of the cannabis and hemp plant for medicinal, scientific and industrial purposes. OWP-Colombia owns land in Colombia

where the Company will cultivate cannabis crops and owns extraction and distillation equipment which the Company purchased for approximately

$1.2 million, which is currently held in a warehouse facility. The Company is also in the process of securing a new warehouse and operations

facility in the Bogota Free Trade Zone.

Due

to challenging economic conditions and under prior management, OWP-Colombia experienced significant operational and managerial challenges

over the past several years, resulting its accumulation of financial obligation of approximately $1.2 million, which are substantially

past due. Without adequate resources and in an effort to forestall the imposition of interest, late charges, fines and any court-mandated

order(s) to cease operations, OWP-Colombia filed for protection under Colombian Law 1116 of 2006, which is the primary legislation governing

business insolvency proceedings (restructuring and liquidation) (“Reorganization Proceedings”) in Colombia on December 22,

2023. During the Reorganization Proceeding, management intends to satisfy OWP-Colombia’s continuing financial obligations through

the negotiation and/or settlement with creditors and the Colombian governmental authorities. Subject to court approval, the Company intends

to continue normal operations during the Reorganization Proceeding. At this time, the Company cannot predict the length of time of the

Reorganization Proceeding.

Item 2.04

Triggering Events that Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

The

filing of the Restructuring Petition constituted an event of default that could have accelerated obligations under a promissory note

in the amount of $300,000 which AJB Capital Investments, LLC (the “Lender”) advanced to the Company on June 23, 2023. Effective

as of December 21, 2023, the Lender signed a letter waiving any events of default based on the filing of the Reorganization Proceeding,

which waiver will continue until OWP-Colombia emerges from and/or the Reorganization Proceeding is terminated as determined by an order

of the court.

Item

7.01 Regulation FD Disclosure.

The

reorganization and continuing operations of OWP-Colombia will not impact the efforts of the Company to operationalize the partnership

and distribution agreements with Smokiez Edibles and Kx Family Care, which are coordinated and managed through the Company’s U.S.

team while allowing for local implementation.

The

Company intends to acquire a Colombian subsidiary domiciled within the Bogota Free Trade Zone that will possess all requisite licenses

for the cultivation, production, distribution and export of cannabis and hemp infused products. We anticipate this process to be completed

within four to six weeks and revenue generation commencing thereafter. In addition, the Company will continue to pursue its business

strategy described in is press releases and filings with the Securities and Exchange Commission, which are publicly available at the

SEC website at www.sec.gov.

Forward-Looking

Statements

Certain

statements in this Current Report on Form 8-K may be considered forward-looking statements, including statements with respect to the

Company’s pursuit of bankruptcy protection. Forward-looking statements generally relate to future events and can be identified

by terminology such as “may,” “should,” “could,” “might,” “plan,” “possible,”

“strive,” “budget,” “expect,” “intend,” “estimate,” “believe,”

“predict,” “potential,” “pursue,” “aim,” “goal,” “mission,” “anticipate”

or “continue,” or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements

are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or

implied by such forward-looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered

reasonable by the Company and its management, are inherently uncertain. The Company’s actual results may differ materially from

those anticipated in these forward-looking statements as a result of certain risks and other factors, which include the following: risks

and uncertainties relating to the Company’s reorganization proceeding, including but not limited to, the Company’s ability

to obtain court approval with respect to motions in the Reorganization Proceeding, the effects of the Reorganization Proceeding on the

Company and on the interests of various constituents, the rulings of the bankruptcy court in Colombia (the “Bankruptcy Court”)

in the Reorganization Proceedings and the outcome of the Reorganization Proceeding, in general, the length of time the Company will operate

under the Reorganization Proceedings, risks associated with any third-party motions in the Reorganization Proceedings, the potential

adverse effects of the Reorganization Proceedings on the Company’s liquidity or results of operations and increased legal and other

professional costs necessary to execute the Company’s reorganization; the conditions to which the Company’s cash collateral

or equipment is subject and the risk that these conditions may not be satisfied for various reasons, including for reasons outside of

the Company’s control; the consequences of the acceleration of the Company’s debt obligations and the trading price and volatility

of the Company’s common stock, and the risks and uncertainties set forth in the Company’s Annual Report on Form 10-K for

the fiscal year ended December 31, 2022, and other documents filed by the Company from time to time with the SEC. Forward-looking statements

speak only as of the date they are made. Investors are cautioned not to put undue reliance on forward-looking statements, and the

Company assumes no obligation and does not intend to update or revise these forward-looking statements other than as required by applicable

law. The Company does not give any assurance that it will achieve its expectations.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

One

World Products, Inc. |

| |

|

|

| |

Date:

January 19, 2024 |

| |

|

|

| |

By:

|

/s/ Dr.

Kenneth Perego, II |

| |

Name:

|

Dr.

Kenneth Perego, II |

| |

Title:

|

Vice

Chairman of the Board |

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

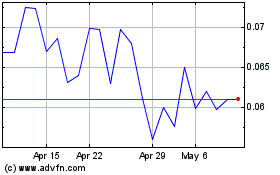

One World Products (QB) (USOTC:OWPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

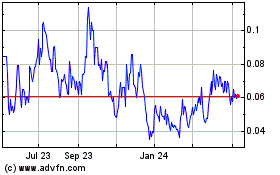

One World Products (QB) (USOTC:OWPC)

Historical Stock Chart

From Apr 2023 to Apr 2024