UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE

ACT OF 1934

For the month of January 2024

Commission File Number: 001-40086

Portage Biotech Inc.

(Translation of registrant’s

name into English)

N/A

(Translation of registrant’s

name into English)

British Virgin Islands

(Jurisdiction of incorporation or

organization)

Clarence Thomas Building, P.O.

Box 4649, Road Town, Tortola, British Virgin Islands, VG1110

(Address of principal executive offices)

c/o Portage Development Services

Inc., Ian Walters, 203.221.7378

61 Wilton Road, Westport, Connecticut

06880

(Name, telephone, e-mail and/or facsimile

number and Address of Company Contact Person)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

☒ Form 20-F ☐ Form

40-F

INCORPORATION BY REFERENCE

This report on Form 6-K (including the exhibit

attached hereto) shall be deemed to be incorporated by reference into the registration statement on Form F-3 (File No. 333-253468) and

Form S-8 (File No. 333-275842) of Portage Biotech Inc. (including any prospectuses forming a part of such registration statements) and

to be a part thereof from the date on which this report is filed, to the extent not superseded by documents or reports subsequently filed

or furnished.

Exhibits

The following Exhibit is filed with this report:

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Portage Biotech, Inc. |

| |

|

|

| Date: January 18, 2024 |

By: |

/s/ Allan Shaw |

| |

Name: |

Allan Shaw |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

1 Corporate Presentation Nasdaq: PRTG January 2024

2 Legal Disclaimer Forward - Looking Information This presentation contains forward - looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 . Statements in this presentation that are not statements of historical fact are forward - looking statements . Words such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “estimate,” “believe,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions are intended to identify forward - looking statements, though not all forward - looking statements contain these identifying words . These statements are based on the beliefs and assumptions of our management based on information currently available to management . Such forward - looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward - looking statements . Factors that could cause or contribute to such differences include, but are not limited to, the Company's ability to obtain financing in the future to cover its operational costs and progress its plans for clinical development ; the Company’s estimates regarding its capital requirements ; the Company’s ability to continue as a going concern ; the Company's plans and ability to develop and commercialize product candidates and the timing of these development programs ; the Company’s clinical development of its product candidates, including the results of current and future clinical trials ; the benefits and risks of the Company's product candidates as compared to others ; the Company's maintenance and establishment of intellectual property rights in its product candidates ; the Company’s estimates of future revenues and profitability ; the Company's estimates of the size of the potential markets for its product candidates ; the Company’s selection and licensing of product candidates ; and other factors set forth in “Item 3 - Key Information - Risk Factors” in the Company’s Annual Report on Form 20 - F for the year ended March 31 , 2023 , and those discussed in the Company’s other reports filed with the Securities and Exchange Commission from time to time . Except as required by law, we undertake no obligation to update any forward - looking statements to reflect events or circumstances after the date of such statements .

3 Immuno - Oncology Company with Two Potential Best in Class Compounds in the Clinic Investment Highlights Cost - Efficient Business Model Multiple Data Catalysts in 2024 and 2025 Experienced Leadership Team from Bristol Myers Squibb

4 Allan Shaw CFO Justin Fairchild VP Clin Dev Proven Leadership with Oncology and Financing Expertise Board of Directors Gregory Bailey, MD Rob Glassman, MD Linda M. Kozick Jim Mellon Mark Simon Ian Walters, MD CEO, Chairman Rob Kramer, PhD CSO Steve Innaimo VP PM & Operations Brian Wiley CBO Steven Mintz St. Germain Capital Corp Over 10 Oncology Approvals, Several Billion $ Exits

5 Our Formula for Success De - Risked Development Structured to Create Significant Value Strong Academic & Industry Network First/Best in Class I/O Agents Potential for Large Returns • Compounds with broad targets, single agent activity • Address ~70 - 80% of patients that don’t respond • Randomized studies early • Enrich patient population when possible • Active CRADA with National Cancer Institute • Programs vetted with Big Pharma companies likely to transact • >$35B market growth to >$100B • Data catalysts create meaningful inflections • Partner with large oncology - focused companies • Retain IP exclusivity

6 Five Data Catalysts Anticipated to Drive Value Adenosine Platform Final Data Interim Data # of PTS STAGE INDICATION ASSET SITC 2024 ASCO 2024 21 - 27 Phase 1a A2A exp Solid Tumors PORT - 6 (A2A) ASCO 2025 SITC 2024 18 Phase 1a* A2B exp Solid Tumors PORT - 7 (A2B) SITC 2025 ASCO 2025 20 Phase 1b* A2B exp Solid Tumors PORT - 6 (A2A) ASCO 2026 SITC 2025 20 Phase 1b* A2B exp Solid Tumors PORT - 7 (A2B) ASCO 2026 SITC 2025 20 Phase 1b* A2A exp Solid Tumors PORT - 6 (A2A) + CPI ASCO 2026 SITC 2025 20 Phase 1b* A2B exp Solid Tumors PORT - 7 (A2B) + CPI ASCO 2026 SITC 2025 20 Phase 1b* Biomarker enriched PORT 6/7 (A2A/2B) +CPI * Planned based on data and available liquidity Other potential upside from legacy programs

Adenosine Portfolio Validated mechanism impacting multiple immune cells Opportunity to modulate adenosine in 4 different ways: PORT - 6 A2AR Antagonist PORT - 7 A2BR Antagonist PORT - 8 A2AR/A2BR Dual Antagonist PORT - 9 Gut - Restricted A2BR Antagonist

Targeting Adenosine in Cancer Immunotherapy to Enhance T - Cell Function; Virgano, et al; Frontiers in Immunology 2019 modified slightly and used under CC BY 4.0 8 TME=tumor microenvironment Leveraging A2A and A2B Alone or in Combo Allows for Customization of Treatment Macrophage Treg T cell NK Cell Endothelial Cell CAF MDSC Tumor Cell Neutrophil DC Promote adaptive response (A2A and A2B) Correct the TME (A2A and A2B) Decrease proliferation, metastasis and survival (A2A and A2B) Tumor is complex system governed by numerous immune cells

9 Difference in A2A Small Molecules 10+ hrs ^ single agent activity in mouse models Competitive inhibitors won’t block in settings of high adenosine ARCUS CORVUS Potency Selectivity 2.5 hrs ^ Portage’s PORT - 6 is potentially best in class for potency, selectivity and durability* Relative profiles of A2A antagonists based on public profiles Bubble size illustrates how long receptors are occupied In Phase 1, no efficacy at QD 17% ORR at 80mg BID, need longer occupancy Couldn’t escalate due to tox (poor selectivity) * Based on pre - clinical data ^ Receptor Occupancy reflects prolonged pharmacodynamic effect

10 Fast Follower with Precedent for Biomarker Selection * Expression data from Labcorp % A2A high* Tumor type 50 RCC 38 BC 34 NSCLC 32 Gastric 26 Prostate Best % Change in Tumor Lesion by High/ Low A 2A R levels Enrich patient population with biomarker/clinical data iTEOS independent monotherapy activity in biomarker defined population (data from retrospective analysis ASCO 2021) Positive effect of adenosine antagonist in patients with high adenosine expression demonstrated Tumors with High Adenosine Survival curve by High/ Low A 2A R levels

11 SITC 2023 Monotherapy activity with favorable immunologic changes TT - 10=PORT - 6

12 PORT - 7: Highly Selective and Potent A2B Adenosine Receptor Antagonist High potency and selectivity may provide important safety and efficacy advantages • Activity in 4T1, CT26, and other disease models (asthma, fibrosis, sickle cell) Data on File Binding Affinity Functional Receptor Antagonism receptor Selectivity Ki (nm) Receptor 1 9 A2B >3000x >30,000 A1 >1000x >10,000 A2A >3000x >30,000 A3 Selectivity Ki (nm) Receptor 1 13 A2B 23x 300 A1 138x 1,800 A2A >4,000x 60,000 A3 Portage only company believed to be developing potent/selective A2B inhibitor

13 ADPORT - 601: Adaptive Phase 1a/1b Study * Phase 1a Starting Dose (10 mg BID) (n=12 - 15) A2AR (PORT - 6) indications: A2BR (PORT - 7) indications: Colorectal Cancer, Non - small Cell Lung Cancer, Endometrial Cancer, Ovarian Cancer, Prostate Cancer with high A2B expression Prostate Cancer, Non - small Cell Lung Cancer, Head & Neck Cancer, Renal Cell Cancer with high A2A expression PORT - 6 1a: MONOTHERAPY (Safety) Phase 1a Starting Dose (200 mg QD) (n=9 - 12) PORT - 7 100 mg 800 mg Recommended P2 Dose Recommended P2 Dose PORT - 6 + PORT - 7 PORT - 6 + CPI PORT - 7 + CPI COMBO (Safety) PORT - 6/PORT - 7 + other Portage agents Clinical Catalysts In collaboration with * Planned depending data and available liquidity (Efficacy) COMBO 1b: MONOTHERAPY (Efficacy) ᬞ Cross over at progression PORT - 6 and/or PORT - 7 + SOC n=20 ᬜ ᬝ Randomized SOC n=10 PORT - 6 and/or PORT - 7 n=20 ᬚ ᬛ Monotherapy in biomarker defined patient population

14 iNKT Engager • Composition, formulations with antigens, other I/O agents • Liposomes/particles 2031 - 2041 Patent Exclusivity Strong U.S. and Global IP Positions on Platforms and Products Broad and deep intellectual property covering: Adenosine Antagonist • Composition of matter patents • Use patents filed Nanolipogel & DNA Aptamers • Optimized co - delivery platforms • New IP for aptamers • Composition patents for products VLP Delivery Platform • First - in - class systemic STING agonist

15 2024 2025 1H 2H 1H 2H Key Upcoming Clinical Development Milestones* ADPORT - 601 (PORT - 6) Phase 1b start *At conferences we will present multiple arms & tumor types, 2024 and beyond are planed depending on data and available liquidity ADPORT - 601 (PORT - 6) ASCO - Phase1b interim ADPORT - 601 (PORT - 6) SITC Phase 1b final ADPORT - 601 (PORT - 6) ASCO - P1a interim ADPORT - 601 (PORT - 7) Phase 1a start ADPORT - 601 (PORT - 6) SITC – Phase 1A final ADPORT - 601 (PORT - 7) ASCO Phase 1a final Data ADPORT - 601 (PORT - 7) SITC – Phase 1A interim Trials ADPORT - 601 (PORT - 7) Phase 1b start

16 Summary Financial Data ~$8.7 million + Cash Balance (9/30/23) $ - Debt 19,778,225 * Shares Outstanding (09/30/23) 41.00% Insider Ownership 59.00% Public Float 2,342,160 Options & RSUs Outstanding (9/30/23) 9,631,580 # Warrants Outstanding (10/3/23) $(~4.3 million) Cash Burn During Quarter Ended 9/30/23 + Pro forma Cash Balance, giving effect to the completion of the $6 million equity financing closed October 3, 2023, which generated net proceeds of $5.3 million (“the Financing”) * Pro forma shares, giving effect to Financing for 1,970,000 shares of common stock closed October 3,2023. Excludes 1,187,895 Pre - funded Warrants (or common stock equivalents) to purchase shares at a nominal exercise price of $0.001 per Warrant Share . # Reflects issuance of Series A, B, C Warrants and Placement Agent Warrants from Financing to purchase ordinary shares at a weighted average price of $2.14.

17 Novel, Clinical Stage I/O Portfolio with Small Molecule Focus • Manufacturing simplicity, low capital investment • Five potential phase 1b/2 clinical data reads over next 2 years* Engine for Efficient Drug Development & Commercialization • Expert scientific oversight • Lean structure with financial flexibility Preferred Partner for Pharma in I/O • Deep industry network facilitates engagement with big pharma and biotech • Packaged for commercialization/acquisition Expert Leadership with Track Record of Success • Proven success, more than 10 oncology approvals • Formation of Biohaven Pharmaceuticals, sale to Pfizer Accelerating I/O Development in Untapped Growth Areas * depending data and available liquidity

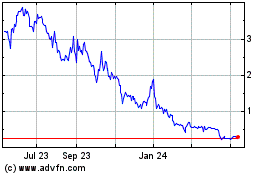

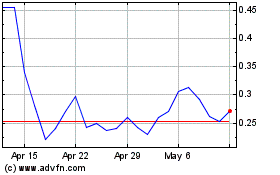

Portage Biotech (NASDAQ:PRTG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Portage Biotech (NASDAQ:PRTG)

Historical Stock Chart

From Apr 2023 to Apr 2024