false

0000788611

0000788611

2024-01-12

2024-01-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(D) OF THE

THE

SECURITIES EXCHANGE ACT OF 1934

Date

of report (Date of earliest event reported): January 12, 2024

SIGMA

ADDITIVE SOLUTIONS, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-38015 |

|

27-1865814 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

3900

Paseo del Sol

Santa

Fe, New Mexico 87507

(Address

of Principal Executive Offices) (Zip Code)

Registrant’s

telephone number, including area code: (505) 438-2576

Former

name or former address, if changed since last report

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.001 per share |

|

SASI |

|

The

NASDAQ Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.01 Completion of Acquisition or Disposition of Assets.

On

January 12, 2024, Sigma Additive Solutions, Inc. (“we,” “us,” “our,” “Sigma” or the “company”)

completed the sale of assets consisting primarily of patents, software code and other intellectual property to Divergent Technologies,

Inc., or Divergent, for a purchase price of $1,626,242, resulting in net proceeds to the Company of $1,533,563, after reimbursement

by the Company of certain of Divergent’s legal fees. The sale was made pursuant to the Asset Purchase Agreement with Divergent

previously reported in our Current Report on Form 8-K filed with the Securities and Exchange Commission (“SEC”) on October

13, 2023.

Item

7.01 Regulation FD Disclosure

On

January 16, 2023, the company issued a press release announcing completion of the sale of assets to Divergent and the transactions contemplated

thereby. A copy of this press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K (this “Current Report”).

The

information set forth under Item 7.01 of this Current Report, including Exhibit 99.1 attached hereto, is being furnished and shall not

be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of such section. The information in Item 7.01 of this Current Report, including Exhibit 99.1,

shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless

of any incorporation by reference language in any such filing, except as expressly set forth by specific reference in such a filing.

This Current Report will not be deemed an admission as to the materiality of any information in this Current Report that is required

to be disclosed solely by Regulation FD.

Item

9.01 Financial Statements and Exhibits

(b)

Pro Forma Financial Information

There

is hereby incorporated herein by reference the unaudited pro forma condensed combined financial statements of the company as of and for

the periods ended September 30, 2023 and December 31, 2022 set forth on pages 69 through 72 and the notes thereto set forth on pages

73 through 77 of the definitive proxy statement filed by the company with the SEC on December 1, 2023.

(d)

Exhibits

See

the accompanying Index to Exhibits, which information is hereby incorporated herein by reference.

INDEX

TO EXHIBITS

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

January 16, 2024 |

SIGMA

ADDITIVE SOLUTIONS, INC. |

| |

|

|

| |

By:

|

/s/

William Kerby |

| |

|

William

Kerby |

| |

|

Chief

Executive Officer |

Exhibit

99.1

Sigma

Additive Solutions Completes Quality Assurance Software Asset Sale to Divergent Technologies

Company

Focus Transitions to NextTrip and Travel Operations with Clean Balance Sheet

Santa

Fe, NM – January 16, 2024 – Sigma Additive Solutions, Inc. (NASDAQ:SASI) (“Sigma”, “we,”

“our,” or the “Company”) today announced it has closed the sale of intellectual property assets related to its

additive quality assurance product to Divergent Technologies, Inc. in conjunction with its recent acquisition of NextTrip Holdings, Inc.

(“NextTrip”).

On

October 6, 2023, Sigma entered into an Asset Purchase Agreement with Divergent Technologies to sell certain Sigma assets, consisting

primarily of patents, software code and other intellectual property, to Divergent Technologies for a purchase price of $1.6 million with

the closing expected subsequent to the acquisition of NextTrip. The acquisition, which was first announced in October 2023, closed on

December 29, 2023, at which time NextTrip became a wholly owned subsidiary of the Company. The combination of the acquisition and sale

of assets was targeted to maximize shareholder value, using the proceeds to eliminate legacy debt and contingent liabilities associated

with the wind-down of Sigma’s historical business. This leaves the Company with no debt other than zero interest loans from the

Company’s current Chairman and CEO, thus giving the Company a clean path moving forward.

Bill

Kerby, Chief Executive Officer of Sigma, commented, “With the close of the acquisition completed, the sale of Sigma legacy assets

streamlines the Company to allow us to focus 100% of our efforts on our NextTrip travel operations. The Company has now been restructured

to allow legacy shareholders to benefit from any growth while the travel principals primarily benefit at a future date based on meeting

business milestones, and with the asset sale complete we are now well positioned to introduce our travel agent participation program

with a clean structure.

“We

are now executing our strategic growth plans and expanding our reach into new markets as a public company. After the soft launch of our

travel booking engine in November, we anticipate full re-activation of the platform and going live in the next 30 days with ramp up of

marketing to our 6+ million customer database. We are also working to introduce a Groups Booking Technology and a white label widget

for the travel agency industry, both of which are wide-open and underserved areas.

“Looking

ahead into 2024 we are highly optimistic that the NextTrip ecosystem is launching in an exciting year for the travel industry. According

to the International Air Transport Association, over 4.7 billion people are expected to travel in 2024, a historic high that exceeds

the pre-pandemic level of 4.5 billion recorded in 2019. The ITIJ reports that in 2023 international arrivals were higher than 2022 in

all regions across the world and expects this trend will continue in 2024 with many regions surpassing 2019 levels by the end of the

year. Taken together, we believe the launch and ramp of our booking platform comes at an opportune time to capture the resurgence in

travel as we look to build long-term value for our shareholders,” concluded Kerby.

About

NextTrip

NextTrip

is a technology-driven platform delivering innovative solutions for business and leisure travel. NextTrip Leisure provides individual

and group travelers with vacations to the most popular and sought-after destinations in Mexico, the Caribbean and across the world. NextTrip

Business is an online corporate travel and expense management solution with a large inventory of travel options and discounted rates.

NextTrip Solutions offers travel technologies that make the jobs of alternative lodging property managers, wholesalers, distributors

and other travel industry players easier and more efficient. For more information and to book a trip, visit https://investors.nexttrip.com/.

About

Sigma Additive Solutions

Sigma

Additive Solutions, Inc. has historically been a provider of in-process quality assurance (IPQA™) solutions to the additive manufacturing

industry. Sigma has specialized in the development and commercialization of real-time monitoring and analytics known as PrintRite3D®

for 3D metal and polymer advanced manufacturing technologies. PrintRite3D detects and classifies defects and anomalies real-time during

the manufacturing process, enabling significant cost-savings and production efficiencies by reducing waste, increasing yield, and shortening

cycle times.

As

previously disclosed in Sigma’s filings with the SEC, Sigma completed its acquisition of NextTrip in December 2023. With the sale

of assets related to its additive quality assurance now complete, Sigma’s business has transitioned to that of NextTrip.

Forward-Looking

Statements

This

press release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended (which Sections were adopted as part of the Private Securities Litigation

Reform Act of 1995). Statements preceded by, followed by or that otherwise include the words “believe,” “anticipate,”

“estimate,” “expect,” “intend,” “plan,” “project,” “prospects,”

“outlook,” and similar words or expressions, or future or conditional verbs such as “will,” “should,”

“would,” “may,” and “could” are generally forward-looking in nature and not historical facts. These

forward-looking statements involve known and unknown risks, uncertainties and other factors, including approval of the corporate name

change and authorized share increase by Sigma shareholders, continuing risks relating to the recent acquisition of NextTrip and post-closing

matters related to the asset sale to Divergent. Among the important factors that could cause actual results to differ materially from

those indicated by such forward-looking statements are risks relating to, among other things, Sigma’s ability to obtain shareholder

approval of the name change and authorized share increase, post-closing matters related to the asset sale, amongst other things. Sigma

disclaims any intention to, and undertakes no obligation to, revise any forward-looking statements, whether as a result of new information,

a future event, or otherwise, except as required by applicable law. For additional information regarding risks and uncertainties that

could impact Sigma’s forward-looking statements, please see disclosures contained in the Definitive Proxy Statement filed by Sigma

with the SEC on December 1, 2023 and Sigma’s other filings with the SEC, including the “Risk Factors” in Sigma’s

most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, and which may be viewed at www.sec.gov.

Contacts

Chris

Tyson

Executive

Vice President

MZ

Group - MZ North America

949-491-8235

SASI@mzgroup.us

www.mzgroup.us

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

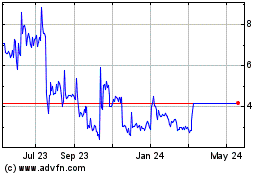

Sigma Additive Solutions (NASDAQ:SASI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sigma Additive Solutions (NASDAQ:SASI)

Historical Stock Chart

From Apr 2023 to Apr 2024