As

filed with the Securities and Exchange Commission on January 16, 2024

Registration

No. 333-273841

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

POST-EFFECTIVE

AMENDMENT NO. 1 TO FORM F-1

REGISTRATION

STATEMENT UNDER

THE

SECURITIES ACT OF 1933

GENIUS

GROUP LIMITED

(Exact

name of Registrant as specified in its charter)

Not

Applicable

(Translation

of Registrant’s name into English)

| Singapore |

|

8200 |

|

Not

Applicable |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

number) |

8

Amoy Street, #01-01

Singapore

049950

Tel:

+65 8940 1200

(Address,

including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Puglisi

& Associates

850

Library Avenue, Suite 204

Newark,

DE 19711

Tel:

(302) 738-6680

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

of all communications, including communications

sent

to agent for service, should be sent to:

Jolie

Kahn, Esq.

12

E. 49th Street, 11th floor

New

York, NY 10017

Tel:

(516) 217-6379

Fax:

(866) 705-3071 |

|

Katten

Muchin Rosenman LLP

525

W. Monroe Street

Chicago,

IL 60661-3693

Attn:

Mark D. Wood

Alyse

Sagalchik

Tel:

(312) 902-5200 |

Approximate

date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☒ 333-273841

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

| |

|

Emerging

growth company |

| |

|

|

| |

|

☒ |

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

†

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards

Board to its Accounting Standards Codification after April 5, 2012.

The

Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective

on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY

NOTE

The

Registration Statement on Form F-1 (No. 333-273841)

of Genius Group Limited was declared effective by the Securities and Exchange Commission (the “Commission”) as of

5:00 PM Eastern Time on January 11, 2024. This Post-Effective Amendment No. 1 to that Registration Statement is being filed with

the Commission pursuant to Rule 462(d) solely to file updated Exhibits 5.1 and 5.2 as part of the Registration Statement. This

Post-Effective Amendment No. 1 does not modify any provision of Part I or Part II of the Registration statement other than supplementing

Item 8 of Part II as set forth below and shall become effective upon filing with the Commission in accordance with Rule 462(d) under the Securities

Act of 1933, as amended.

Item

8. Exhibits and Financial Statement Schedules.

The

exhibits listed below are filed or incorporated by reference as part of this Registration Statement on Form F-1.

Signatures

Pursuant

to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that

it meets all of the requirements for filing on Form F-1 and has duly caused this registration statement to be signed on its behalf by

the undersigned, thereunto duly authorized, in Singapore, on January 16, 2024.

| GENIUS

GROUP LIMITED |

|

| |

|

|

| By: |

/s/

Roger James Hamilton |

|

| Name: |

Roger

James Hamilton |

|

| Title: |

Chief

Executive Officer |

|

Pursuant

to the requirements of the Securities Act, this registration statement has been signed by the following persons in the capacities and

on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Roger James Hamilton |

|

Chief

Executive Officer, Chairman |

|

January

16, 2024 |

| Roger

James Hamilton |

|

(principal

executive officer) |

|

|

| |

|

|

|

|

| /s/

Suraj Naik |

|

Chief

Technology Officer, |

|

January

16, 2024 |

| Suraj

Naik |

|

Director |

|

|

| |

|

|

|

|

| /s/

Jeremy Harris |

|

Chief

Financial Officer |

|

January

16, 2024 |

| Jeremy

Harris |

|

(principal

financial and accounting officer) |

|

|

| |

|

|

|

|

| /s/

Richard J. Berman |

|

Director |

|

January

16, 2024 |

| Richard

J. Berman |

|

|

|

|

| |

|

|

|

|

| /s/

Salim Ismail |

|

Director |

|

January

16, 2024 |

| Salim

Ismail |

|

|

|

|

| |

|

|

|

|

| /s/

Eric Pulier |

|

Director |

|

January

16, 2024 |

| Eric

Pulier |

|

|

|

|

Power

of Attorney

KNOW

ALL PERSONS BY THESE PRESENTS that each individual whose signature appears below hereby constitutes and appoints Roger Hamilton, as his

or her true and lawful attorney-in-fact and agent with full power of substitution, for him or her and in his or her name, place and stead,

in any and all capacities, to sign any and all amendments, including post-effective amendments, to this registration statement, and to

sign any registration statement for the same offering covered by this registration statement that is to be effective upon filing pursuant

to Rule 462(b) promulgated under the Securities Act of 1933 increasing the number of shares for which registration is sought, and all

post-effective amendments thereto, and to file the same, with all exhibits thereto and all documents in connection therewith, making

such changes in this registration statement as such attorney-in-fact and agent so acting deem appropriate, with the SEC, granting unto

said attorney-in-fact and agent, full power and authority to do and perform each and every act and thing requisite and necessary to be

done with respect to the offering of securities contemplated by this registration statement, as fully to all intents and purposes as

he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agent or any of them, or his,

her or their substitute or substitutes, may lawfully do or cause to be done or by virtue hereof.

Pursuant

to the requirements of the Securities Act, this registration statement has been signed by the following persons in the capacities and

on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Roger James Hamilton |

|

Chief

Executive Officer, |

|

January

16, 2024 |

| Roger

James Hamilton |

|

Chairman

(principal executive officer) |

|

|

| |

|

|

|

|

| /s/

Jeremy Harris |

|

Chief

Financial Officer |

|

January

16, 2024 |

| Jeremy

Harris |

|

(principal

financial and accounting officer) |

|

|

| |

|

|

|

|

| /s/

Suraj Naik |

|

Chief

Technology Officer, Director |

|

January

16, 2024 |

| Suraj

Naik |

|

|

|

|

| |

|

|

|

|

| /s/

Richard J. Berman |

|

Director |

|

January

16, 2024 |

| Richard

J. Berman |

|

|

|

|

| |

|

|

|

|

| /s/

Salim Ismail |

|

Director |

|

January

16, 2024 |

| Salim

Ismail |

|

|

|

|

| |

|

|

|

|

| /s/

Eric Pulier |

|

Director |

|

January

16, 2024 |

| Eric

Pulier |

|

|

|

|

Signature

of Authorized Representative in The United States

Pursuant

to the Securities Act of 1933, the undersigned, the duly authorized representative in the United States of Genius Group Limited, has

signed this registration statement or amendment thereto in Newark, Delaware on January 16, 2024.

| PUGLISI

& ASSOCIATES |

|

| |

|

|

| By: |

/s/

Mr. Donald J. Puglisi |

|

| Name: |

Mr.

Donald J. Puglisi |

|

| Title: |

Managing

Director |

|

EXHIBIT

5.1

| From : Leonard Ching |

Mob : +65 9819 4320 |

| leonard.ching@allenandgledhill.com |

Fax : +65 6302 3111 |

| |

|

| Our reference: LCTP/ |

16 January 2024 |

| Your reference: |

|

| |

|

|

Genius Group Limited

8 Amoy Street #01-01

Singapore 049950

Board of Directors of Genius Group Limited |

|

Dear

Sirs

GENIUS GROUP LIMITED (THE “COMPANY”) – REGISTRATION STATEMENT ON FORM F-1

| 1. |

We have acted as Singapore

legal counsel to the Company in connection with the preparation of the Company’s Registration Statement on Form F-1, as amended

(File No. 333-273841), including a related prospectus filed therewith (collectively, the “Registration Statement”),

filed with the Securities and Exchange Commission under the Securities Act of 1933, as amended (the “Securities Act”).

The Registration Statement has been filed to register the sale of: |

| |

(a) |

up to 23,571,429 ordinary

shares of the Company (the “Investor Shares”); |

| |

(b) |

up to 23,571,429 Series

2024-A ordinary share warrants each to purchase one ordinary share of the Company (the “Series 2024-A Ordinary Share Warrants”)

and up to 23,571,429 Series 2024-C ordinary share warrants each to purchase one ordinary share of the Company (the “Series

2024-C Ordinary Share Warrants”, and together with the Series 2024-A Ordinary Share Warrants, the “Ordinary Share

Warrants”); |

| |

(c) |

up to 23,571,429 pre-funded

Series 2024-B ordinary share warrants each to purchase one ordinary share of the Company (the “Pre-Funded Warrants”

and, together with the Ordinary Share Warrants, the “Investor Warrants”); |

| |

(d) |

up to 47,142,858 ordinary

shares of the Company issuable pursuant to the exercise of the Ordinary Share Warrants (the “Ordinary Warrant Shares”); |

| |

(e) |

up to 23,571,429 ordinary

shares of the Company issuable pursuant to the exercise of the Pre-Funded Warrants (the “Pre-Funded Warrant Shares”

and, together with the Ordinary Warrant Shares, the “Investor Warrant Shares”); |

| |

(f) |

placement agent warrants

to purchase up to 1,035,714 ordinary shares of the Company (the “Placement Agent Warrants”); and |

| |

(g) |

up to 1,035,714 ordinary

shares of the Company issuable pursuant to the exercise of the Placement Agent Warrants (the “Placement Agent Shares”

and, together with the Investor Shares, the Investor Warrant Shares and the Placement Agent Warrants, the “Registered Securities”). |

We

have taken instructions solely from the Company. This opinion is being rendered solely to the Company in connection with the filing of

the Registration Statement.

| 2. |

For the purpose of rendering

this opinion, we have examined: |

| |

(a) |

copies of (i) the securities

purchase agreement (the “Securities Purchase Agreement”) entered into by the Company and each of the purchasers

signatory thereto, containing the form of the constitutive documents for each of the Series 2024-A Ordinary Share Warrants, the Series

2024-C Ordinary Share Warrants and the Pre-Funded Warrants, (ii) the convertible bridge loan agreement in the principal amount of

US$2.1 million entered into by the Company and Roger James Hamilton, dated 16 October 2023, as amended (the “Loan Document”),

and (iii) the engagement agreement, as amended to date, a copy of which was filed as Exhibit 1.1 to the Registration Statement (the

“Engagement Agreement”); |

| |

(b) |

a copy of the Registration

Statement; |

| |

(c) |

a copy of the Constitution

of the Company; |

| |

(d) |

a

copy of the Certificate Confirming Incorporation of Company dated 15 January 2024 issued by the Accounting and Corporate Regulatory

Authority of Singapore (“ACRA”) confirming that the Company is a public company limited by shares; |

| |

(e) |

a copy of the Notice of

Annual General Meeting (the “2023 AGM”) dated 19 June 2023 (the “Notice of AGM”) containing

the resolutions of the Company’s shareholders (the “Shareholders”) to approve, among other things, issuances

of shares and instruments (the “Shareholders’ Resolutions”); |

| |

(f) |

a copy of the minutes of

the 2023 AGM which was held on 12 July 2023 evidencing that all of the Shareholders’ Resolutions in the Notice of AGM have

been duly passed; |

| |

(g) |

copies of the resolutions

in writing of the board of directors of the Company dated 3 January 2024 and 12 January 2024 (the “Board Resolutions”);

and |

| |

(h) |

such other documents as

we have considered necessary or desirable in order that we may render this opinion. |

| 3. |

Save as expressly provided

in paragraph 5 of this legal opinion, we express no opinion whatsoever with respect to any agreement or document described in paragraph

2 of this legal opinion. |

| |

(a) |

the correctness of all

facts stated in all documents submitted to us; |

| |

(b) |

the

genuineness of all signatures and seals on all documents and the completeness, and the conformity to original documents, of all copies

submitted to us; |

| |

(c) |

that

copies of each of the Board Resolutions and the Shareholders’ Resolutions submitted to us for examination are true, complete

and up-to-date copies and have not been modified, supplemented or superseded; |

| |

(d) |

that

the Board Resolutions and the Shareholders’ Resolutions have not been rescinded or modified and they remain in full force and

effect and that no other resolution or other action has been taken which may affect the validity of the Board Resolutions or the

Shareholders’ Resolutions; |

| |

(e) |

that

the appointment of any corporate representatives in relation to the Shareholders’ approval obtained under the Shareholders’

Resolutions had been validly authorised; |

| |

(f) |

that

the Company was converted into a public company on 31 July 2019 in accordance and in compliance with Section 31(2) of the Companies

Act 1967 of Singapore; |

| |

(g) |

that

(i) the information disclosed by the electronic searches made on 15 January 2024 (the “ACRA Searches”)

of the electronic records of the ACRA against the Company is true and complete, (ii) such information has not since then been materially

altered, and (iii) the ACRA Searches did not fail to disclose any material information which has been delivered for filing but did

not appear on the public file at the time of the ACRA Searches; |

| |

(h) |

that

where a document has been submitted to us in draft form, it will be executed in the form of that draft; |

| |

(i) |

that

(a) none of the parties involved in the transaction or any of their respective officers or employees has notice of any matter which

would adversely affect the validity or regularity of the Board Resolutions and the Shareholders’ Resolutions and (b) the Board

Resolutions and the Shareholders’ Resolutions have not been rescinded or modified and they remain in full force and effect

and that no other resolution or action has been taken which may affect the validity of the Board Resolutions and the Shareholders’

Resolutions; |

| |

(j) |

that

save as disclosed in the Board Resolutions, no director of the Company has an interest in the transactions contemplated by the Registration

Statement; and |

| |

(k) |

the

Registered Securities will be issued either (i) pursuant to the Shareholders’ Resolutions obtained at the 2023 AGM before the

conclusion of the next Annual General Meeting of the Company subsequent to the date of this letter or the date by which the next

Annual General Meeting of the Company subsequent to the date of this letter is required by law to be held, whichever is the earlier

(the “Shareholders’ Resolutions Expiration Date”); or (ii) in the event that the Registered Securities are

issued after the Shareholders’ Resolutions Expiration Date, pursuant to a further approval of the Shareholders validly obtained

pursuant to Section 161 of the Companies Act 1967 of Singapore. |

| 5. |

Based

upon and subject to the foregoing, and subject to any matters or documents not disclosed to us, we are of the opinion that the Registered

Securities to be issued by the Company pursuant to the Shareholders’ Resolutions obtained at the 2023 AGM referred to in Paragraph

4(k) above and, in the event that the Registered Securities are to be issued after the Shareholders’ Resolutions Expiration

Date, assuming that a further approval of the Shareholders is validly obtained pursuant to Section 161 of the Companies Act 1967

of Singapore, being (i) the Investor Shares, when issued and sold as contemplated in the Registration Statement, and upon payment

and delivery in accordance with the Securities Purchase Agreement or the Loan Agreement, as applicable, will be validly issued, fully

paid and non-assessable, (ii) the Investor Warrant Shares, when issued and sold as contemplated in the Registration Statement and

paid for in accordance with the terms of the Investor Warrants, will be validly issued, fully paid and non-assessable, and (iii)

the Placement Agent Shares, when issued as contemplated in the Registration Statement and the Engagement Letter, and paid for in

accordance with the terms of the Placement Agent Warrants, will be validly issued, fully paid and non-assessable. |

| 6. |

For

the purposes of this opinion, we have assumed that the term “non-assessable” in relation to the Registered Securities

offered means under Singapore law that holders of such securities, having fully paid up all amounts due on such shares as to the

issue price thereon, are under no further personal liability to contribute to the assets or liabilities of the Company in their capacities

purely as holders of such securities. |

| 7. |

This

opinion relates only to the laws of general application of the Republic of Singapore as published at the date hereof and as currently

applied by the courts of the Republic of Singapore, and is given on the basis that it will be governed by and construed in accordance

with the laws of the Republic of Singapore. We have made no investigation of, and do not express or imply any views on, the laws

of any country other than the Republic of Singapore. In respect of the Registration Statement, we have assumed due compliance with

all matters concerning the laws of all jurisdictions. |

| 8. |

We

hold ourselves out as only having legal expertise and our statements in this letter are made only to the extent that a law firm practising

Singapore law in the Republic of Singapore, having our role in connection with the filing of the Registration Statement, would reasonably

be expected to have become aware of relevant facts and/or to have identified the implications of those facts. As the primary purpose

of our professional engagement was not to establish or confirm factual matters or financial, accounting or statistical matters and

because of the wholly or partially non-legal character of many of the statements in the Registration Statement, we express no opinion

or belief on and do not assume any responsibility for the accuracy, completeness or fairness of any of the statements contained in

the Registration Statement and we make no representation that we have independently verified the accuracy, completeness or fairness

of such statements. Without limiting the foregoing, we express no opinion or belief and assume no responsibility for, and have not

independently verified the accuracy, completeness or fairness of any financial statements and schedules and other financial and statistical

data included or incorporated in the Registration Statement and we have not examined the accounting, financial or statistical records

from which such financial statements, schedules and data are derived. |

| 9. |

Our

opinion is strictly limited to the matters stated herein and is not to be read as extending by implication to any other matter in

connection with the filing of the Registration Statement or otherwise including, but without limitation, any other document signed

in connection with the same. Subject to the foregoing, we consent to the use of this opinion as an exhibit to the Registration Statement,

and further consent to all references to us, if any, in the Registration Statement, and any amendments thereto. In giving such consent,

we do not hereby admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act

or the rules or regulations promulgated thereunder. Further, save for the use of this opinion as an exhibit to the Registration Statement,

this opinion is not to be circulated to, or relied upon by, any other person (other than persons entitled to rely on it pursuant

to applicable federal securities laws in the United States, if applicable) or quoted or referred to in any public document or filed

with any governmental body or agency without our prior written consent. |

| 10. |

This

opinion is given on the basis of the laws of the Republic of Singapore in force as at the date of this opinion and we undertake no

responsibility to notify you of any change in the laws of the Republic of Singapore after the date of this opinion. |

| Yours

faithfully |

|

| |

|

|

/s/

Allen & Gledhill LLP |

|

| |

|

|

Allen

& Gledhill LLP |

|

EXHIBIT

5.2

Jolie

Kahn, Esq.

12

E. 49th Street, 11th floor

New

York, NY 10017

January

16, 2024

Genius

Group Limited

8

AMOY STREET #01-01

SINGAPORE

U0 049950

Ladies

and Gentlemen:

We

have acted as counsel to Genius Group Limited., a Singapore corporation (the “Company”), in connection with the Company’s

registration statement on Form F-1, as amended (the “Registration Statement”), filed with the Securities and Exchange

Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Securities Act”),

relating to the (i) issuance to the placement agent (or its designees) warrants to purchase 1,035,714 ordinary shares of the Company

(the “Placement Agent Warrants”), and (ii) issuance and sale of up to 23,571,429 Series 1 units with each Series

1 unit consisting of one ordinary share and one Series 2024-A warrant to purchase one ordinary share (the “Series 2024-A Warrants”)

and one Series 2024-C warrant to purchase one ordinary share (the “Series 2024-C Warrants”). The Company has

also offered to those purchasers, whose purchase of Series 1 units in in this offering would otherwise result in the purchaser, together

with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of

the Company’s outstanding ordinary shares following the consummation of this offering, the opportunity to purchase, if such purchaser

so chooses, to purchase, in lieu of some or all Series 1 units, up to 23,571,429 Series 2 units. Each Series 2 unit will consist

of one pre-funded Series 2024-B warrant to purchase one ordinary share (the “Series 2024-B Warrants”; and with

the Series 2024-A Warrants and the Series 2024-C Warrants, the “Investor Warrants”) and one Series 2024-A Warrant

and one Series C Warrant. The Series 1 units and the Series 2 units are to be sold by the Company pursuant to (i) a Securities Purchase

Agreement (the “Purchase Agreement”) entered into by and between the Company and each of the purchasers signatory

thereto, the form of which is filed as Exhibit 10.20 to the Registration Statement or the 2023 loan agreement between the Company and

Roger Hamilton, its Chief Executive Officer (the “Loan Agreement”), and (ii) the Placement Agent Warrants are being

issued pursuant to an engagement agreement by and between the Company and the placement agent, as amended to date (the “Engagement

Agreement”), a copy of which was filed as Exhibit 1.1 to the Registration Statement.

In

connection with this opinion, we have examined originals or copies, certified or otherwise identified to our satisfaction, of (i) the

Registration Statement, including the form of prospectus included therein and the documents incorporated by reference therein, (ii) the

Constitution of the Company, as amended to date, and a Certificate Confirming Incorporation of the Company, (iii) the Engagement Agreement,

the form of Purchase Agreement, the form of Placement Agent Warrant and the forms of Investor Warrants, and (iv) certain resolutions

of the Board of Directors of the Company. We have also examined originals or copies, certified or otherwise identified to our satisfaction,

of such other documents, certificates and records as we have deemed necessary or appropriate, and we have made such investigations of

law as we have deemed appropriate as a basis for the opinions expressed below.

In

rendering the opinions expressed below, we have assumed and have not verified (i) the genuineness of the )signatures on all documents

that I have examined, (ii) the legal capacity of all natural persons, (iii) the authenticity of all documents supplied to us as originals

and (iv) the conformity to the authentic originals of all documents supplied to us as certified or photostatic or faxed copies.

| |

1. |

Based

upon and subject to the foregoing and subject also to the limitations, qualifications, exceptions and assumptions set forth herein,

we are of the opinion that:the Series 1 units and the Series 2 units have been duly authorized for issuance, and, when issued, delivered

and paid for in accordance with the terms of the Securities Purchase Agreement or the Loan Agreement as applicable, will be validly

issued and will constitute the legal, valid and binding obligations of the Company, enforceable against the Company in accordance

with their terms, except as the same may be limited by applicable bankruptcy, insolvency, reorganization, moratorium or similar laws

affecting the enforcement of creditors’ rights generally and equitable principles of general applicability; |

| |

2. |

the

Investor Warrants have been duly and validly authorized, and when issued and sold in accordance with the terms and conditions of

the Purchase Agreement or Loan Agreement, as applicable, such Investor Warrants will constitute the legal, valid and binding obligations

of the Company, enforceable against the Company in accordance with their terms, except as the same may be limited by applicable bankruptcy,

insolvency, reorganization, moratorium or similar laws affecting the enforcement of creditors’ rights generally and equitable

principles of general applicability; and |

| |

3. |

the

Placement Agent Warrants have been duly and validly authorized, and when issued in accordance with the terms and conditions of the

Engagement Agreement, such Placement Agent Warrants will constitute the legal, valid and binding obligations of the Company, enforceable

against the Company in accordance with their terms, except as the same may be limited by applicable bankruptcy, insolvency, reorganization,

moratorium or similar laws affecting the enforcement of creditors’ rights generally and equitable principles of general applicability. |

We

express no opinion other than as to the federal laws of the United States of America and the laws of New York State. We hereby consent

to the filing of this opinion as an exhibit to the Registration Statement and the reference to this firm under the caption “Legal

Matters” in the prospectus included in the Registration Statement. In giving this consent, we do not admit that we are “experts”

under the Securities Act or under the rules and regulations of the Commission relating thereto with respect to any part of the Registration

Statement.

Very

truly yours,

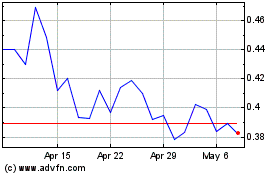

Genius (AMEX:GNS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Genius (AMEX:GNS)

Historical Stock Chart

From Apr 2023 to Apr 2024