In Tuesday’s pre-market, U.S. index futures indicate a lower

opening, as investors and analysts eagerly await the release of

earnings reports from major banks, which promise to offer valuable

insights into the current condition of the American consumer and

the broader economic outlook.

At 5:26 AM, Dow Jones futures (DOWI:DJI) fell 196 points, or

0.52%. S&P 500 futures dropped 0.60% and Nasdaq-100 futures

retreated 0.77%. The yield on 10-year Treasury bonds was at

4.007%.

In the commodities market, West Texas Intermediate crude oil for

February rose 0.87% to $73.31 per barrel. Brent crude for March

rose 1.20%, near $79.09 per barrel. Iron ore with a 62%

concentration level, traded on the Dalian exchange, fell 0.6%, to

$130.65 per metric ton.

On Tuesday’s economic agenda, investors await the Empire State

manufacturing activity index for January, published by the New York

Fed at 08:30 AM.

European stocks faced an unfavorable opening on Tuesday,

reacting to information from the World Economic Forum in Davos. The

Stoxx 600 index fell, with banks showing notable declines.

Significantly, speeches at the Forum, including leaders such as Li

Qiang, Ursula von der Leyen, Jake Sullivan, and Volodymyr

Zelenskyy, are drawing attention on Tuesday. The Forum, under the

theme “Rebuilding Trust”, discussed urgent economic and

geopolitical issues. In the UK, wage growth slowed to 6.6%, and job

vacancies decreased.

Asian markets suffered declines, led by Hong Kong and Japan.

Hong Kong’s Hang Seng fell 2.06%, while Japan’s Nikkei 225 ended

its six-day winning streak, closing down 0.79%. The S&P/ASX 200

in Australia and South Korea’s Kospi also recorded declines. On the

other hand, China’s mainland CSI 300 index rose 0.61%. These

movements occur in a context of mixed economic data, including the

stability of Japan’s corporate goods price index and concerns about

a recession in the U.S.

Friday’s session saw two-year U.S. Treasury yields hit their

lowest level since May due to a surprising drop in the Producer

Price Index. This raised expectations of interest rate cuts by the

Federal Reserve, with an 80% chance of a reduction in March.

Bitcoin fell, while oil rose following attacks in Yemen. The Dow

Jones dropped 118.04 points, or 0.31%, to 37,592.98 points. The

S&P 500 rose 3.59 points, or 0.08%, to 4,783.83 points. The

Nasdaq advanced 2.57 points, or 0.02%, to 14,972.76 points. Last

week, the Nasdaq gained 3.1%, the S&P 500 advanced 1.8%, and

the Dow rose 0.3%.

For this Tuesday’s quarterly earnings front, scheduled to

present their financial reports before the market opens are

Goldman Sachs (NYSE:GS), Morgan

Stanley (NYSE:MS), Applied Blockchain

(NASDAQ:APLD), PNC Financial (NYSE:PNC), and

others. After the market close, the numbers from

Interactive Brokers (NASDAQ:IBKR),

Progress Software (NASDAQ:PRGS), Pinnacle

Financial Partners (NASDAQ:PNFP), Fulton Financial

Corp (NASDAQ:FULT), among others, will be awaited.

Wall Street Corporate Highlights for Today

Apple (NASDAQ:AAPL) – Apple has reduced the

prices of some iPhones by up to 5% in China due to growing

competition in the smartphone market, seeking to boost sales in a

competitive market. iPhone 15 sales were disappointing, with local

rivals like Huawei gaining ground. Additionally, Apple may

circumvent the import ban of some Apple Watch models, due to a

patent dispute with Masimo (NASDAQ:MASI), through

an undisclosed redesign. Apple stated that the modified watches

“definitely do not contain pulse oximetry functionality”.

Microsoft (NASDAQ:MSFT) – Microsoft will offer

the “Copilot Pro” subscription for $20/month, allowing enhanced

access to its AI. This subscription integrates AI into popular

Microsoft apps, and the minimum requirement of 300 users for the

enterprise version has been removed, making the service more

accessible to smaller businesses, competing with Google in the

enterprise AI market.

Microsoft (NASDAQ:MSFT),

Vodafone (NASDAQ:VOD) – Vodafone and Microsoft

have entered into a 10-year partnership to expand digital and cloud

services to over 300 million customers in Europe and Africa.

Vodafone will invest $1.5 billion in Azure-based AI and replace

physical data centers with more efficient cloud services. Microsoft

will become an investor in Vodafone’s IoT platform and help expand

its mobile financial platform in Africa. The collaboration aims to

improve customer service with AI, including a TOBi chatbot, and

promote sustainability with “digital twins” for process

improvements.

Taiwan Semiconductor Manufacturing (NYSE:TSM) –

TSMC is expected to announce a 23% drop in fourth-quarter profit,

due to strong performance in 2022. However, the company projects

better growth in 2023, driven by a recovery in semiconductor

demand. Last quarter’s revenue exceeded expectations, reflecting

the depletion of electronic device manufacturers’ inventories.

Analysts are optimistic about demand for Apple’s wafers, and TSMC’s

report is scheduled for Thursday.

Baidu (NASDAQ:BIDU) – Baidu has denied any

connection to a Chinese military lab after a report on the matter

caused its shares to plummet. The company stated it has not

commercially collaborated or provided customized services to the

authors of an academic paper and that there was no physical link

between its AI system and the Chinese military lab. The initial

report was corrected by the South China Morning Post.

Wipro (NYSE:WIT) – Shares of the Indian tech

consultancy Wipro rose after beating profit expectations for the

third quarter, driven by an increase in large deals. CEO Thierry

Delaporte stated there were signs of a return to growth in IT

consulting.

Tesla (NASDAQ:TSLA) – Tesla’s CEO Elon Musk

wants at least 25% voting control in the company to lead in

artificial intelligence and robotics. He would consider a two-class

share structure but is facing post-IPO hurdles. Musk is willing to

build products outside of Tesla if necessary, should he not gain

sufficient influence.

Stellantis (NYSE:STLA) – Stellantis plans to

temporarily lay off about 2,250 workers at its Mirafiori plant in

Italy due to weak demand. The layoffs will occur from February 12

to March 3, affecting workers producing the electric Fiat 500 and

Maserati models.

Toyota Motor (NYSE:TM) – Toyota plans to

manufacture approximately 10.3 million vehicles globally in 2024,

renewing its annual production record for the second consecutive

year. Strong demand for hybrid vehicles and the easing of

semiconductor shortages are driving this increase in

production.

Boeing (NYSE:BA) – Boeing faces new delays in

737 MAX jet deliveries to China following an incident with an

Alaska Airlines plane (NYSE:ALK). China Southern Airlines will

delay receiving the MAX 9 planes to conduct additional safety

inspections, while Beijing awaits more information from U.S.

investigations. This affects Boeing’s relationship with China,

which has already faced previous suspensions of orders and

deliveries due to safety issues.

Embraer (NYSE:ERJ) – Embraer expects its

agricultural aircraft Ipanema to set a new delivery record in 2024,

driven by Brazil’s robust agricultural sector. Deliveries are

expected to reach 70 units, surpassing the previous record of 67 in

2011, due to growing demand in the country, one of the world’s

leading agricultural producers. The Ipanema is used for

agricultural spraying and has been a success among Brazilian

farmers. Each plane is sold for 3.6 million reais (approximately

$741,412).

Gol Linhas Aereas Inteligentes (NYSE:GOL) – The

Brazilian airline was considering filing for Chapter 11 bankruptcy

protection in the United States. Gol is seeking ways to manage high

debt and exploring financial options to strengthen its balance

sheet.

Shell (NYSE:SHEL) – Shell agreed to sell its

onshore oil business in Nigeria for over $1.3 billion to a local

consortium called Renaissance. The transaction, subject to

government approval, allows Shell to exit a challenging operating

environment in the Niger Delta while maintaining a presence in the

country. In addition to the initial sale price, Shell will receive

up to $1.1 billion in additional payments after completion. The

sale reflects Shell’s strategy of portfolio simplification and

focus on disciplined investments in integrated positions and

deep-water gas in Nigeria.

Berkshire Hathaway (NYSE:BRK.A) – Warren

Buffett’s Berkshire Hathaway has been increasing its stake in

Japan’s five largest general trading companies since last summer.

The stakes could reach 9.9%, pending board approvals. The company

holds shares in firms such as Sumitomo, Mitsubishi, Mitsui, Itochu,

and Marubeni, which are diversified conglomerates in the Japanese

economy. Japan’s stock market is booming, with the Nikkei 225 index

exceeding its highest levels since 1990. Berkshire Hathaway views

these investments as long-term and aims to own 9.9% of each of the

five companies.

Blackstone (NYSE:BX) – Blackstone, the world’s

largest alternative asset manager, plans to double its private

equity team in Singapore over the next two years, seeking

opportunities in Southeast Asia and getting closer to investors.

The expansion follows the trend of global managers establishing

offices in Singapore.

Goldman Sachs (NYSE:GS) – Goldman Sachs revised

its U.S. GDP growth estimate for 2024 upwards to 2.3%, surpassing

the previous forecast of 2.1%. The financial institution

highlighted expectations of more robust economic growth and reduced

recession risk in a statement on Sunday.

Morgan Stanley (NYSE:MS) – Morgan Stanley will

release its fourth-quarter results and strategic outlook under new

CEO Ted Pick’s leadership. Earnings per share of $1.07 are

expected, down from $1.31 the previous year. Investors are watching

the wealth management unit and the strategy of building connections

between workplace businesses and wealth management operations.

Thomson Reuters (NYSE:TRI) – Thomson Reuters

increased its offer to acquire Swedish billing and tax solutions

company Pagero by 25% to approximately $789 million. With about 54%

control, it surpassed rival bids, valuing Pagero at 8.1 billion

kronor. Vertex withdrew its previous offer, making Thomson Reuters’

new offer 39% higher than before. The acquisition strengthens

Thomson Reuters’ position in the tax and accounting services

market.

Kroger (NYSE:KR), Albertsons

(NYSE:ACI) – Supermarket chains Kroger and Albertsons plan to delay

the closure of their $24.6 billion merger to the first half of

Kroger’s 2024 fiscal year, instead of early 2024, due to antitrust

concerns and ongoing regulatory investigations. Kroger will invest

in price reductions and improvements in customer experience.

FedEx Corp (NYSE:FDX) – FedEx reported that it

has not seen significant changes in air transport due to

disruptions in the Red Sea. While maritime transport accounts for

90% of global trade, so far, the impact has been limited. CEO Raj

Subramaniam stated that air freight rates have remained stable,

while the Houthi militia attacks have not caused major changes in

the air transport sector.

AstraZeneca (NASDAQ:AZN) – AstraZeneca stated

that it has not faced supply issues due to transport disruptions in

the Red Sea caused by Houthi militant attacks in Yemen. The company

is closely monitoring the situation but did not reveal details

about its supply lines

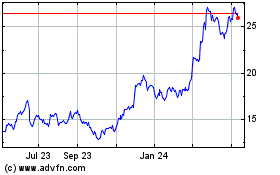

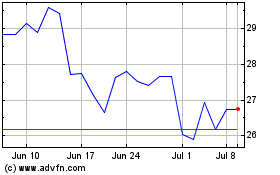

Embraer (NYSE:ERJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Embraer (NYSE:ERJ)

Historical Stock Chart

From Apr 2023 to Apr 2024