Form NT 10-Q - Notification of inability to timely file Form 10-Q or 10-QSB

January 12 2024 - 5:00PM

Edgar (US Regulatory)

| |

SEC FILE NUMBER

001-05742

|

| |

CUSIP NUMBER

767754872

|

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 12b-25

NOTIFICATION OF LATE FILING

| (Check One): |

|

¨

Form 10-K ¨ Form 20-F ¨

Form 11-K x Form 10-Q

¨

Form 10-D ¨ Form N-CEN ¨

Form N-CSR

|

| |

|

For Period Ended: December 2, 2023 |

| |

|

| |

|

¨ Transition Report on Form 10-K |

| |

|

| |

|

¨ Transition Report on Form 20-F |

| |

|

| |

|

¨ Transition Report on Form 11-K |

| |

|

| |

|

¨ Transition Report on Form 10-Q |

| |

|

| |

|

For the Transition Period Ended: Not applicable |

| Nothing in this form shall be construed to imply that the Commission has verified any information contained herein. |

If the notification relates to a portion of the filing checked above,

identify the Item(s) to which the notification relates:

PART I—REGISTRANT INFORMATION

Rite Aid Corporation

Full Name of Registrant

Not applicable

Former Name if Applicable

P.O. Box 3165

Address of Principal Executive Office (Street

and Number)

Harrisburg, Pennsylvania 17105

City, State and Zip Code

PART II—RULES 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable effort

or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate)

| ¨ |

|

(a) |

|

The reasons described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense; |

| |

(b) |

|

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-CEN or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and |

| |

(c) |

|

The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART III—NARRATIVE

State below in reasonable detail why Form 10-K, 20-F, 11-K, 10-Q, 10-D,

N-CEN, N-CSR, or the transition report or portion thereof, could not be filed within the prescribed time period.

Rite Aid Corporation (the “Company,” “we” or

“our”) has determined that it is unable to file, without unreasonable effort or expense, its Quarterly Report on Form 10-Q

for the fiscal quarter ended December 2, 2023 (the “Q3 Form 10-Q”) by the prescribed due date for the reasons described below.

As previously disclosed, on October 15, 2023, the Company and certain

of its direct and indirect subsidiaries filed voluntary petitions to commence proceedings under chapter 11 (the “Chapter 11 Cases”)

of title 11 of the United States Code in the United States Bankruptcy Court for the District of New Jersey. Due to the considerable time

and resources needed to address the ongoing Chapter 11 Cases, and the resulting diversion of the attention of the Company’s management

and other personnel responsible for preparation of the Q3 Form 10-Q, the Company is unable to file the Q3 Form 10-Q within the prescribed

time period.

In addition, during the Company’s preparation of its financial

statements for the third fiscal quarter ended December 2, 2023, the Company’s management preliminarily identified a misapplication

of U.S. GAAP relating to the Company’s methodology of recording provisional closed store charges, prompting the need for further

analysis under Accounting Standards Codification Topic 420 (“ASC Topic 420”). The Company’s management has preliminarily

determined that the impact of such misapplication on previously issued financial statements is not material and is still evaluating the

impact on internal control over financial reporting (“ICFR”). The resolution of this matter may result in the Company filing

amendments to its Form 10-K for the fiscal year ended March 4, 2023 and its Form 10-Q for the fiscal quarters ended June 3, 2023 and September

2, 2023, respectively. The Company’s management has discussed this matter with Deloitte & Touche LLP, the Company’s independent

registered public accounting firm.

The Company has been working diligently to finalize this review; however,

given the added complexity of the Chapter 11 Cases, the Company was unable to complete and file the Q3 Form 10-Q by the prescribed due

date without unreasonable effort and expense. The Company currently anticipates filing the Q3 Form 10-Q as promptly as practicable following

the resolution of the above noted review; however, there can be no assurance as to when the Company will be able to file the Q3 Form 10-Q.

Forward-Looking Statements

Certain matters discussed in this Form 12b-25 constitute forward-looking

statements within the meaning of the federal securities laws. All statements contained in this notification, other than statements of

historical fact, are forward-looking statements, including, without limitation, statements regarding the anticipated timing of the filing

of the Q3 Form 10-Q; expectations with regard to the anticipated impact of the misapplication; the Company’s preliminary analysis

with respect to ASC Topic 420 and the Company’s ICFR; and any assumptions underlying any of the foregoing.

These forward-looking statements are neither promises nor guarantees,

but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements

to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

Important factors that could cause actual results to differ materially from expectations include, but are not limited to, the effectiveness

of the Company’s ICFR and disclosure controls and procedures; the potential for a material weakness in the Company’s ICFR

or other potential control deficiencies of which the Company is not currently aware; the risk that the completion and filing of the Q3

Form 10-Q will take longer than expected; additional information that may arise during the finalization of the Q3 Form 10-Q; our ability

to obtain a waiver from the lenders party to our debtor-in-possession credit facilities (holding a majority of our outstanding borrowings

thereunder) as a consequence of our inability to timely provide financial statements, as well as the modifications that may be required

of past compliance certifications that we have provided to such lenders; and the risks discussed in detail in Item 1A. Risk Factors of

the Company’s most recent Annual Report on Form 10-K, in the Company’s subsequent Quarterly Reports on Form 10-Q, and in other

documents that we file or furnish with the Securities and Exchange Commission. The Company undertakes no obligation to update publicly

any forward-looking statements, whether as a result of future events, new information or otherwise, except as required by law.

PART IV—OTHER INFORMATION

| |

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

|

|

|

Name and telephone number of person to contact in regard to this notification |

| |

|

|

|

|

|

|

| |

|

|

|

Matthew C. Schroeder |

|

|

|

(717) |

|

|

|

761-2633 |

| |

|

|

|

(Name) |

|

|

|

(Area Code) |

|

|

|

(Telephone Number) |

| |

|

|

| (2) |

|

|

|

Have all other periodic reports required under Section 13 or 15(d)

of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such

shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify report(s).

Yes x

No ¨

|

| |

|

|

| (3) |

|

|

|

Is it anticipated that any significant change in results of operations

from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report

or portion thereof ?

Yes x

No ¨

|

| |

|

|

| |

|

|

|

If so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made. |

When the Company completes the preparation of the Q3 Form 10-Q, including the application of Financial Accounting Standards Board Accounting

Standards Codification (“ASC”) Topic 852 – Reorganizations, which specifies the accounting and financial reporting requirements

for entities reorganizing through Chapter 11 bankruptcy proceedings, as well as any impact of the misapplication of ASC 420 discussed

in Part III above, the Company expects to report a significant increase in net loss for the quarter ended December 2, 2023, as compared

to the corresponding quarter ended November 26, 2022. Such increase would result in part from an increase in impairment charges resulting

from store closures and higher professional expenses.

Rite Aid Corporation

(Name of Registrant as Specified in Charter)

has caused this notification to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

|

|

| Date: January 12, 2024 |

By: |

/s/ Matthew C. Schroeder |

| |

|

Matthew C. Schroeder |

| |

|

Executive Vice President and Chief Financial Officer |

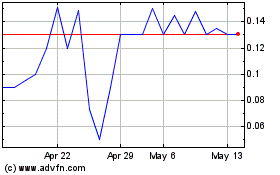

Rite Aid (CE) (USOTC:RADCQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rite Aid (CE) (USOTC:RADCQ)

Historical Stock Chart

From Apr 2023 to Apr 2024