false

0001812727

0001812727

2024-01-11

2024-01-11

0001812727

RELI:CommonStock0.086ParValuePerShareMember

2024-01-11

2024-01-11

0001812727

RELI:SeriesWarrantsToPurchaseSharesOfCommonStockParValue0.086PerShareMember

2024-01-11

2024-01-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest reported): January 11, 2024

Reliance

Global Group, Inc.

(Exact

name of registrant as specified in its charter)

| Florida |

|

001-40020 |

|

46-3390293 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

Number) |

300

Blvd. of the Americas, Suite 105, Lakewood, NJ 08701

(Address

of principal executive offices)

(732)

380-4600

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2.)

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CF$ 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on which Registered |

| Common

Stock, $0.086 par value per share |

|

RELI |

|

The

Nasdaq Stock Market LLC

(The

Nasdaq Capital Market) |

| Series

A Warrants to purchase shares of Common Stock, par value $0.086 per share |

|

RELIW |

|

The

Nasdaq Stock Market LLC

(The

Nasdaq Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into Material Definitive Agreement.

As

previously disclosed, Reliance Global Group, Inc., a Florida corporation (the “Company”), Fortman Insurance Services, LLC,

Fortman Insurance Agency, LLC, Jonathan Fortman, and Zachary Fortman (collectively, the “Parties”) entered into a purchase

agreement on or around May 1, 2019 (the “Purchase Agreement”), whereby the Company purchased the business and certain assets

noted within the Purchase Agreement, as well as that certain second amendment to the Purchase Agreement on or around May 18, 2023 (the

“Second Amendment”). On January 11, 2024, the Parties entered into that certain third amendment to the Purchase Agreement

(the “Third Amendment”), pursuant to which the Parties agreed to a total remaining balance of $423,107 owed to both Jonathan

Fortman and Zachary Fortman each under the Purchase Agreement, for a combined total amount owed of $846,214 (the “Remaining Balances”).

In satisfaction of such Remaining Balances, the Company agreed to pay $11,000.00 on the first business day of each month to both Jonathan

Fortman and Zachary Fortman each until the Remaining Balances are paid in full. In addition, the Parties agreed under the Third Amendment

that the remaining Balances shall accrue interest at the rate of 10% per annum until the Remaining Balances are paid in full, with an

effective date of January 2, 2024, for purposes of the commencement of interest accrual.

The

foregoing description of the terms of the Third Amendment and the transactions contemplated thereby does not purport to be complete,

and is qualified in its entirety by reference to the copy of the Third Amendment filed hereto as Exhibit 10.1, and is incorporated herein

by reference.

Item

3.02. Unregistered Sales of Equity Securities

To

the extent required by Item 3.02 of Form 8-K, the information contained in Item 1.01 of this Current Report on Form 8-K is incorporated

herein by reference.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

| Exhibit

No. |

|

Description |

| 10.1 |

|

Third Amendment to the Purchase Agreement, dated as of January 11, 2024, by and between Reliance Global Group, Inc., Fortman Insurance Services, LLC, Fortman Insurance Agency, LLC, Jonathan Fortman, and Zachary Fortman |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Reliance

Global Group, Inc. |

| |

|

|

| Dated:

January 11, 2024 |

By:

|

/s/

Ezra Beyman |

| |

|

Ezra

Beyman |

| |

|

Chief

Executive Officer |

Exhibit

10.1

THIRD

AMENDMENT TO THE PURCHASE AGREEMENT

ENTERED

INTO ON MAY 1, 2019

THIS

THIRD AMENDMENT to the Purchase Agreement (as defined below) (the “Amendment”) is entered into as of January 11, 2024, with

an effective date of January 2, 2024 (the “Effective Date”), by and between RELIANCE GLOBAL GROUP, INC., a Florida corporation

(the “Company”), Fortman Insurance Services, LLC, an Ohio limited liability company (the “Subsidiary”), Fortman

Insurance Agency, LLC, an Ohio limited liability company (the “Seller”), Jonathan Fortman (“First Holder”), and

Zachary Fortman (“Second Holder”, and collectively with the First Holder, the “Holders”) (the Company, Subsidiary,

Seller, and Holders are collectively referred to herein as the “Parties”).

BACKGROUND

A.

Subsidiary, Seller, and Holders entered into that certain purchase agreement on or around May 1, 2019, with respect to the Subsidiary’s

acquisition of the business and certain assets of the Seller, which was amended in August of 2022 (as amended from time to time, the

“Purchase Agreement”); and

B.

The Parties entered into that certain second amendment to the Purchase Agreement on or around May 18, 2023 (the “Second Amendment”);

and

C.

The Parties desire to amend the Purchase Agreement as set forth expressly below.

NOW

THEREFORE, in consideration of the execution and delivery of the Amendment and other good and valuable consideration, the receipt and

sufficiency of which are hereby acknowledged, the Parties agree as follows:

1.

The Parties hereby acknowledge and agree that the First Holder Make-Up Payment (as defined in the Second Amendment) shall be equal to

$423,107 (the “First Holder Make-Up Payment”). The unpaid portion of the First Holder Make-Up Payment (excluding accrued

interest at all times) shall bear interest at the rate of 10% per annum, beginning on January 2, 2024, and continuing until the First

Holder Make-Up Payment has been paid in full. The Company shall pay the First Holder Make-Up Payment and accrued interest thereunder

to the First Holder in monthly installments of $11,000, payable on the first business day of each month, beginning January 2, 2024, and

until the First Holder Make-Up Payment is paid in full. The Parties acknowledge and agree that the final payment may be less than $11,000.

Interest shall be computed on the basis of a 365-day year and the actual number of days elapsed. For the avoidance of doubt, the Company

may make additional partial payments or full payment at any time.

2.

The Parties hereby acknowledge and agree that the Second Holder Make-Up Payment (as defined in the Second Amendment) shall be equal to

$423,107 (the “Second Holder Make-Up Payment”). The unpaid portion of the Second Holder Make-Up Payment (excluding accrued

interest at all times) shall bear interest at the rate of 10% per annum, beginning on January 2, 2024, and continuing until the Second

Holder Make-Up Payment has been paid in full. The Company shall pay the Second Holder Make-Up Payment and accrued interest thereunder

to the Second Holder in monthly installments of $11,000, payable on the first business day of each month, beginning January 2, 2024,

and until the Second Holder Make-Up Payment is paid in full. The Parties acknowledge and agree that the final payment may be less than

$11,000. Interest shall be computed on the basis of a 365-day year and the actual number of days elapsed. For the avoidance of doubt,

the Company may make additional partial payments or full payment at any time.

3.

The Holders each represent and warrant that, as of the Effective Date, each of the Holders are an “accredited investor” as

defined in Rule 501(a) under the Securities Act.

4.

All questions concerning the construction, validity, enforcement and interpretation of this Amendment shall be governed by and construed

and enforced in accordance with the laws of New York, without regard to the principles of conflicts of law thereof. Each party agrees

that all legal proceedings concerning the interpretations, enforcement and defense of the transactions contemplated by this Amendment

(whether brought against a party hereto or its respective affiliates, directors, officers, shareholders, partners, members, employees

or agents) shall be commenced exclusively in the state or federal courts located in New York, New York. Each party hereby irrevocably

submits to the exclusive jurisdiction of the state or federal courts sitting in New York, New York, for the adjudication of any dispute

hereunder or in connection herewith or with any transaction contemplated hereby or discussed herein, and hereby irrevocably waives, and

agrees not to assert in any action or proceeding, any claim that it is not personally subject to the jurisdiction of any such court,

that such action or proceeding is improper or is an inconvenient venue for such proceeding.

5.

This Amendment shall be deemed part of, but shall take precedence over and supersede any provisions to the contrary contained in the

Purchase Agreement. Except as specifically modified hereby, all of the provisions of the Purchase Agreement, which are not in conflict

with the terms of this Amendment, shall remain in full force and effect.

[Signature

page to follow]

IN

WITNESS WHEREOF, the Parties hereto have executed this Amendment as of the date first above written.

| RELIANCE GLOBAL GROUP, INC. |

|

FORTMAN

INSURANCE AGENCY, LLC |

| |

|

|

|

|

| By: |

/s/

Joel Markovits |

|

By: |

/s/

Jonathan Fortman |

| Name: |

Joel

Markovits |

|

Name: |

Jonathan

Fortman |

| Title: |

Chief

Financial Officer |

|

Title: |

Member |

| |

|

|

|

|

| FORTMAN INSURANCE SERVICES, LLC |

|

By: |

/s/

Jonathan Fortman |

| |

|

Jonathan Fortman, an individual |

| By: |

/s/

Ezra Beyman |

|

|

|

| Name: |

Ezra

Beyman |

|

By: |

/s/

Zachary Fortman |

| Title: |

Manager |

|

Zachary Fortman, an individual |

v3.23.4

Cover

|

Jan. 11, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 11, 2024

|

| Entity File Number |

001-40020

|

| Entity Registrant Name |

Reliance

Global Group, Inc.

|

| Entity Central Index Key |

0001812727

|

| Entity Tax Identification Number |

46-3390293

|

| Entity Incorporation, State or Country Code |

FL

|

| Entity Address, Address Line One |

300

Blvd. of the Americas

|

| Entity Address, Address Line Two |

Suite 105

|

| Entity Address, City or Town |

Lakewood

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

08701

|

| City Area Code |

(732)

|

| Local Phone Number |

380-4600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock 0. 086 Par Value Per Share [Member] |

|

| Title of 12(b) Security |

Common

Stock, $0.086 par value per share

|

| Trading Symbol |

RELI

|

| Security Exchange Name |

NASDAQ

|

| Series Warrants To Purchase Shares Of Common Stock Par Value 0. 086 Per Share [Member] |

|

| Title of 12(b) Security |

Series

A Warrants to purchase shares of Common Stock, par value $0.086 per share

|

| Trading Symbol |

RELIW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RELI_CommonStock0.086ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RELI_SeriesWarrantsToPurchaseSharesOfCommonStockParValue0.086PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

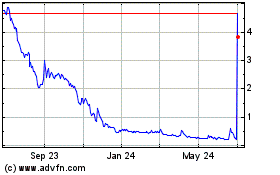

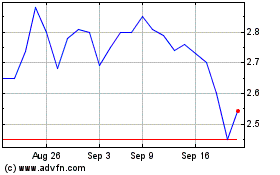

Reliance Global (NASDAQ:RELI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Reliance Global (NASDAQ:RELI)

Historical Stock Chart

From Apr 2023 to Apr 2024