SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

INFORMATION STATEMENT

PURSUANT TO SECTION 14(C)

OF THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED

SCHEDULE 14C

(RULE 14C-101)

Information Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

Check the appropriate box:

|

☒

|

Preliminary Information Statement

|

|

☐

|

Definitive Information Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

SOW GOOD INC.

(Name of Registrant As Specified In Its Charter)

Payment of Filing Fee (Check the Appropriate Box):

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Fee computed on table in exhibit required by Item 25(b) of Schedule 14A (17 CFR 240.14a-101) per Item 1 of this Schedule and Exchange Act Rules 14c-5(g) and 0-11.

|

SOW GOOD INC.

NOTICE OF STOCKHOLDER ACTION BY WRITTEN CONSENT

January 9, 2024

Dear Stockholders:

We are furnishing the attached Information Statement to the holders of common stock, par value $0.0001 per share (the “Common Stock”), of Sow Good Inc., a Nevada corporation (the “Company,” “we,” “us” or “our”). The purpose of the Information Statement is to notify stockholders in accordance with Chapter 78 of the Nevada Revised Statutes (the “NRS”) that the Board of Directors (the “Board”) has approved and, in lieu of a meeting of the stockholders of the Company, certain stockholders who hold a majority of the aggregate issued and outstanding shares of our voting stock (the “Voting Stockholders”).

On January 9, 2024, the Voting Stockholders took action by written consent to approve the following actions:

| |

●

|

Approve the adoption of the 2024 Stock Incentive Plan (the “2024 Plan”).

|

| |

●

|

Approve the reincorporation of the Company from the State of Nevada to the State of Delaware (the “Conversion”).

|

| |

●

|

Approve the Certificate of Incorporation and the Bylaws of the Company to be filed in the State of Delaware to reflect the actions taken pursuant to the Conversion.

|

| |

●

|

Approve an amendment to the Company’s 2020 Stock Incentive Plan (the “2020 Plan Amendment”) as adopted by the Board on December 15, 2023. The 2020 Plan Amendment relates to an increase in the number of shares of Common Stock of the Company remaining for issuance under the 2020 Stock Incentive Plan (the “2020 Plan”) by 2,150,000 shares of Common Stock.

|

| |

●

|

Approve the stock option grants to Claudia Goldfarb and Ira Goldfarb granted by the Board on December 15, 2023.

|

This notice and accompanying Information Statement shall constitute notice to you of the Voting Stockholders taking the aforementioned stockholder actions by written consent, without a meeting, pursuant to the requirements of the NRS.

The accompanying Information Statement is being provided to you for your information to comply with the requirements of Regulation 14C of the Securities Exchange Act of 1934, (“Exchange Act”). This Information Statement constitutes notice to you of the aforementioned corporate actions to be taken without a meeting, pursuant to the requirements of the NRS. You are urged to read this Information Statement carefully in its entirety. However, no action is required on your part in connection with this document, including with respect to the approval of the Plan Amendments. No meeting of our stockholders will be held or proxies requested because we have received written consent to these matters from the Voting Stockholders.

Under Rule 14c-2(b) of the Exchange Act, none of the actions described in the Information Statement may be taken earlier than 20 calendar days after we have sent or given the Information Statement to our stockholders. We intend to distribute this Notice and Information Statement to our stockholders on or about January 9, 2024. The record date established for purposes of determining the number of issued and outstanding shares of voting stock, and thus voting power, was January 9, 2024.

THIS IS FOR YOUR INFORMATION ONLY. YOU DO NOT NEED TO DO ANYTHING IN RESPONSE TO THIS INFORMATION STATEMENT. THIS IS NOT A NOTICE OF MEETING OF STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

| |

Sincerely

|

| |

|

| |

/s/ Claudia Goldfarb

|

| |

Name: Claudia Goldfarb

|

| |

Title: Chief Executive Officer

|

SOW GOOD INC.

1440 North Union Bower Rd.

Irving, TX 75061

(214) 623-6055

INFORMATION STATEMENT

We Are Not Asking You for a Proxy and

You Are Requested Not To Send Us a Proxy

INTRODUCTION

This Information Statement is being furnished to the stockholders of Sow Good Inc. (the “Company,” “we,” “us,” or “our”) in connection with the actions to be taken by us as a result of written consents in lieu of a meeting of stockholders pursuant to the NRS dated January 9, 2024.

This Information Statement and Notice of Stockholder Action by Written Consent is being furnished by us to our stockholders of record as of January 9, 2024 (the “Record Date”), to inform our stockholders that the Board of Directors of the Company (the “Board”) and the holders of approximately 59% of our outstanding voting securities as of such date (the “Voting Stockholders”), have taken and approved the following actions (together, the “Corporate Actions”):

| |

●

|

Approve the adoption of the 2024 Stock Incentive Plan (the “2024 Plan”).

|

| |

●

|

Approve the reincorporation of the Company from the State of Nevada to the State of Delaware (the “Conversion”).

|

| |

●

|

Approve the Certificate of Incorporation and the Bylaws of the Company to be filed in the State of Delaware to reflect the actions taken pursuant to the Conversion.

|

| |

●

|

Approve an amendment to the Company’s 2020 Stock Incentive Plan (the “2020 Plan Amendment”) as adopted by the Board on December 15, 2023. The 2020 Plan Amendment relates to an increase in the number of shares of Common Stock of the Company remaining for issuance under the 2020 Stock Incentive Plan (the “2020 Plan”) by 2,150,000 shares of Common Stock.

|

| |

●

|

Approve the stock option grants to Claudia Goldfarb and Ira Goldfarb granted by the Board on December 15, 2023.

|

This Information Statement is being sent to you to notify you of the Corporate Action being taken by written consent in lieu of a meeting of our stockholders. On January 9, 2024, our Board adopted and approved the Corporate Actions.

On the Record Date, the Voting Stockholders, representing approximately 59% of the voting power of our Company as of the Record Date, adopted and approved by written consent the Corporate Actions.

Section 78.320 of Chapter 78 of the NRS provides that the written consent of the holders of outstanding shares of voting capital stock having not less than the minimum number of votes which would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted can approve an action in lieu of conducting a special stockholders’ meeting convened for the specific purpose of such action. The NRS, however, require that in the event an action is approved by written consent, a company must provide notice of the taking of any corporate action without a meeting to all stockholders who were entitled to vote upon the action but who have not consented to the action.

We are distributing this Information Statement to our Stockholders in full satisfaction of any notice requirements we may have under the NRS and of Regulation 14C of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”).

This Information Statement is dated as of January 9, 2024 and is first being sent or given to our stockholders of record on or about January 9, 2024.

On the Record Date, there were 6,029,371 shares of our Common Stock issued and outstanding and entitled to notice of and to vote on all matters presented to stockholders. Holders of Common Stock are entitled to one vote per share.

Pursuant to the NRS, at least a majority of the voting power of the Company, or at least 3,014,687 votes, were required to approve the Corporate Action by written consent. On the Record Date, the Voting Stockholders, as the holders of 3,550,368 votes representing 59% of the outstanding shares of our voting securities, executed written consents adopting, approving and ratifying the Corporate Action, thereby satisfying the requirement under the NRS that at least a majority of the voting power vote in favor of the Corporate Action by written consent.

This Information Statement and the accompanying notice constitute notice to you of action by written consent as required under the NRS. Because we have obtained sufficient stockholder approval of the Corporate Action, no other consents or votes will be solicited in connection with this Information Statement.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

Under federal securities laws, the Corporate Action may not be completed until 20 calendar days after the date of distribution of this Information Statement to our stockholders. Therefore, notwithstanding the execution and delivery of the written consent, the Corporate Action will not occur until that time has elapsed. The Corporate Actions to be effective at least 20 days after the mailing of this Information Statement are as follows:

| |

●

|

Approve the adoption of the 2024 Stock Incentive Plan (the “2024 Plan”).

|

| |

●

|

Approve the reincorporation of the Company from the State of Nevada to the State of Delaware (the “Conversion”).

|

| |

●

|

Approve the Certificate of Incorporation and the Bylaws of the Company to be filed in the State of Delaware to reflect the actions taken pursuant to the Conversion.

|

| |

●

|

Approve an amendment to the Company’s 2020 Stock Incentive Plan (the “2020 Plan Amendment”) as adopted by the Board on December 15, 2023. The 2020 Plan Amendment relates to an increase in the number of shares of Common Stock of the Company remaining for issuance under the 2020 Stock Incentive Plan (the “2020 Plan”) by 2,150,000 shares of Common Stock.

|

| |

●

|

Approve the stock option grants to Claudia Goldfarb and Ira Goldfarb granted by the Board on December 15, 2023.

|

DESCRIPTION OF STOCKHOLDER ACTIONS

ADOPTION OF THE 2024 PLAN

Introduction and Reasons for Adoption of the 2024 Plan

On January 9, 2024, our Board approved and adopted, subject to stockholder approval, the 2024 Plan which is attached hereto as Annex A, and our stockholders approved the 2024 Plan on January 9, 2024. The 2024 Plan will become effective upon the effectiveness of this Information Statement. This summary is not a complete description of all provisions of the 2024 Plan and is qualified in its entirety by reference to the 2024 Plan, which will be filed as an annex to this Information Statement.

Background of the 2024 Plan

The 2024 Plan is established to maintain and enhance the key policies and practices adopted by our management and board of directors to align employee and stockholder interests. In addition, our future success depends, in large part, upon our ability to maintain a competitive position in attracting, retaining and motivating key personnel. We believe that the adoption of the 2024 Plan is essential to permit our management to continue to provide long-term, equity-based incentives to present and future employees.

The 2024 Plan was approved by the stockholders in order to ensure (i) favorable federal income tax treatment for grants of incentive stock options under Section 422 of the United States Internal Revenue Code of 1986, as amended (the “Code”), and (ii) eligibility to receive a federal income tax deduction for certain compensation paid under the 2024 Plan by complying with Rule 162(m) of the Code. The Company originally reserved a total of 3,000,000 shares of our authorized common stock for issuance under the 2024 Plan.

General

The 2024 Plan enables our board of directors to provide equity-based incentives through grants of awards to the Company’s present and future employees, directors, consultants and other third-party service providers.

The 2024 Plan authorizes the grant of Incentive Stock Options, or ISOs, Non-Qualified Stock Options, or NSOs, restricted share awards, stock unit awards, SARs, other stock-based awards, performance-based stock awards, (collectively, “stock awards”) and cash-based awards (stock awards and cash-based awards are collectively referred to as “awards”). ISOs may be granted only to our employees, including officers, and the employees of our parent or subsidiaries. All other awards may be granted to our employees, officers, our non-employee directors, and consultants and the employees and consultants of our subsidiaries, and affiliates.

Administration

The 2024 Plan will be administered by the compensation committee of our Board (the “Compensation Committee”). Subject to the limitations set forth in the 2024 Plan, the Compensation Committee will have the authority to determine, among other things, to whom awards will be granted, the number of shares subject to awards, the term during which an option or SAR may be exercised and the rate at which the awards may vest or be earned, including any performance criteria to which they may be subject. The Compensation Committee also will have the authority to determine the consideration and methodology of payment for awards. To the extent permitted by applicable law, the board of directors or Compensation Committee may also authorize one or more of our officers to designate employees, other than officers under Section 16 of the Exchange Act, to receive awards and/or to determine the number of such awards to be received by such persons subject to a maximum total number of awards.

Stock Options

The 2024 Plan authorizes the grant of Incentive Stock Options and Non-Qualified Stock Options (each an “Option”). Options granted under the 2024 Plan entitle the grantee, upon exercise, to purchase a specified number of shares of common stock from us at a specified exercise price per share. The Compensation Committee determines the exercise price for a stock option, within the terms and conditions of the 2024 Plan, provided that the exercise price will not be less than 100% of the fair market value of our shares on the date of grant. Options granted under the 2024 Plan will vest at the rate specified by the Compensation Committee.

Stock options granted under the 2024 Plan generally must be exercised by the optionee before the earlier of the expiration of such option or the expiration of a specified period following the optionee’s termination of employment. The Compensation Committee determines the term of the stock options up to a maximum of 10 years. Each stock option agreement will also set forth the extent to which the option recipient will have the right to exercise the option following the termination of the recipient’s service with us, and the right to exercise the option of any executors or administrators of the award recipient’s estate or any person who has acquired such options directly from the award recipient by bequest or inheritance.

Exercise of Stock Options

An Option’s exercise price may be paid in cash or if provided for in the stock option agreement evidencing the award, (1) by surrendering, or attesting to the ownership of, shares which have already been owned by the optionee, (2) future services or services rendered to the company or its affiliates prior to the award, (3) by delivery of an irrevocable direction to a securities broker to sell shares and to deliver all or part of the sale proceeds to us in payment of the aggregate exercise price, (4) by delivery of an irrevocable direction to a securities broker or lender to pledge shares and to deliver all or part of the loan proceeds to us in payment of the aggregate exercise price, (5) by a “net exercise” arrangement, (6) by delivering a full-recourse promissory note, or (7) by any other form that is consistent with applicable laws, regulations, and rules.

Stock Appreciation Rights

Stock Appreciation Rights, or SARs, generally provide for payments to the recipient based upon increases in the price of shares over the exercise price of the SAR. The Compensation Committee determines the exercise price for a SAR, which generally cannot be less than 100% of the fair market value of shares on the date of grant. A SAR granted under the 2024 Plan vests at the rate specified in the SAR agreement as determined by the Compensation Committee. The Compensation Committee determines the term of SARs granted under the 2024 Plan. Upon the exercise of a SAR, we will pay the participant an amount in stock, cash, or a combination of shares and cash as determined by the Compensation Committee, equal to the product of (1) the excess of the per share fair market value of shares on the date of exercise over the exercise price, multiplied by (2) the number of shares with respect to which the SAR is exercised.

Restricted Stock Awards

The 2024 Plan also authorizes the grant of Restricted Stock Awards on terms and conditions established by the Compensation Committee. The terms of any awards of restricted shares under the 2024 Plan will be set forth in a restricted share agreement to be entered into between us and the recipient. The Compensation Committee will determine the terms and conditions of such restricted share agreements, which need not be identical. A restricted share award may be subject to vesting requirements or transfer restrictions or both. Restricted shares may be issued for such consideration as the Compensation Committee may determine, including cash, cash equivalents, full recourse promissory notes, past services and future services. Award recipients who are granted restricted shares generally have all of the rights of a stockholder with respect to those shares, provided that dividends and other distributions will not be paid in respect of unvested shares unless otherwise determined by the Compensation Committee and, in such case, only once such unvested shares vest.

Stock Unit Awards

The 2024 Plan also authorizes the grant of Stock Unit Awards. Stock Unit Awards give recipients the right to acquire a specified number of shares (or cash amount) at a future date upon the satisfaction of certain conditions, including any vesting arrangement, established by the Compensation Committee and as set forth in a stock unit award agreement. A stock unit award may be settled by cash, delivery of shares, a combination of cash and stock as deemed appropriate by the Compensation Committee. Recipients of stock unit awards generally will have no voting or dividend rights prior to the time the vesting conditions are satisfied and the award is settled. At the Compensation Committee’s discretion and as set forth in the stock unit award agreement, stock units may provide for the right to dividend equivalents. Dividend equivalents may not be distributed prior to settlement of the stock unit to which the dividend equivalents pertain and the value of any dividend equivalents payable or distributable with respect to any unvested stock units that do not vest will be forfeited.

Other Stock Awards

Under the 2024 Plan, the Compensation Committee may grant other awards based in whole or in part by reference to our shares. The Compensation Committee will set the number of shares under the stock awards and all other terms and conditions of such awards.

Change in Capital Structure or Change in Control

In the event of a recapitalization, stock split, or similar capital transaction, the Compensation Committee will make appropriate and equitable adjustments to the number of shares reserved for issuance under the 2024 Plan, the number of shares that can be issued as incentive stock options, the number of shares subject to outstanding awards and the exercise price under each outstanding option or SAR. Additionally, the Compensation Committee may provide, in an individual award agreement or in any other written agreement between a participant and us, that the stock award will be subject to acceleration of vesting and exercisability in the event of a change of control.

Duration, Amendment and Termination

Unless sooner terminated, the 2024 Plan will terminate on the tenth anniversary of its effective date. Our Board will have the authority to amend, suspend, or terminate the 2024 Plan, provided that such action does not materially impair the existing rights of any participant without such participant’s written consent. No ISOs may be granted more than 10 years after years after the later of (i) the approval of the Plan by the board (or if earlier, the stockholders) and (ii) the approval by the board (or if earlier, the stockholders) of any amendment to the Plan that constitutes the adoption of a new plan for purposes of Section 422 of the Code.

The Compensation Committee will have the authority to modify outstanding awards under the 2024 Plan. Subject to the terms of the 2023 Plan, the Compensation Committee will have the authority to cancel any outstanding stock award in exchange for new stock awards, including awards having the same or a different exercise price cash, or other consideration, without stockholder approval but with the consent of any adversely affected participant.

Restrictions on Transfer

Unless the Compensation Committee provides otherwise, no award granted under the 2024 Plan may be transferred in any manner (prior to the vesting and lapse of any and all restrictions applicable to shares issued under such award), except by will, the laws of descent and distribution, or pursuant to a domestic relations order, provided that all ISOs may only be transferred or assigned only to the extent consistent with Section 422 of the Code.

Federal Income Tax Information

The following is a general summary of the current federal income tax treatment of awards, which are authorized to be granted under the 2024 Plan, based upon the current provisions of the Code and regulations promulgated thereunder. The rules governing the tax treatment of such awards are quite technical, so the following discussion of tax consequences is necessarily general in nature and is not complete. In addition, statutory provisions are subject to change, as are their interpretations, and their application may vary in individual circumstances. Finally, this discussion does not address the tax consequences under applicable state and local law.

THE FOREGOING IS ONLY A SUMMARY OF THE EFFECT OF U.S. FEDERAL INCOME TAXATION WITH RESPECT TO THE GRANT AND EXERCISE OF AWARDS UNDER THE 2024 PLAN. IT DOES NOT PURPORT TO BE COMPLETE, AND DOES NOT DISCUSS THE TAX CONSEQUENCES OF AN INDIVIDUAL’S DEATH OR THE PROVISIONS OF THE INCOME TAX LAWS OF ANY MUNICIPALITY, STATE OR FOREIGN COUNTRY IN WHICH ANY ELIGIBLE INDIVIDUAL MAY RESIDE.

Incentive Stock Options

A participant will not recognize income on the grant or exercise of an Incentive Stock Option. However, the difference between the exercise price and the fair market value of the common stock on the date of exercise is an adjustment item for purposes of the alternative minimum tax. If a participant does not exercise an Incentive Stock Option within certain specified periods after termination of employment, the participant will recognize ordinary income on the exercise of an Incentive Stock Option in the same manner as on the exercise of a Non-Qualified Stock Option, as described below. The general rule is that gain or loss from the sale or exchange of shares of common stock acquired on the exercise of an Incentive Stock Option will be treated as capital gain or loss. If certain holding period requirements are not satisfied, however, the participant generally will recognize ordinary income at the time of the disposition. Gain recognized on the disposition in excess of the ordinary income resulting therefrom will be capital gain, and any loss recognized will be a capital loss.

Non-Qualified Stock Options

A participant generally is not required to recognize income on the grant of a Non-Qualified Stock Option, a stock appreciation right, restricted stock units, a performance grant, or a stock award. Instead, ordinary income generally is required to be recognized on the date the Non-Qualified Stock Option or stock appreciation right is exercised, or in the case of restricted stock units, performance grants, and stock awards, upon the issuance of shares and/or the payment of cash pursuant to the terms of the incentive award. In general, the amount of ordinary income required to be recognized is (a) in the case of a Non-Qualified Stock Option, an amount equal to the excess, if any, of the fair market value of the shares on the exercise date over the exercise price, (b) in the case of a stock appreciation right, the amount of cash and/or the fair market value of any shares received upon exercise plus the amount of taxes withheld from such amounts, and (c) in the case of restricted stock units, performance grants, and stock awards, the amount of cash and/or the fair market value of any shares received in respect thereof, plus the amount of taxes withheld from such amounts.

Gain or Loss on Sale or Exchange of Shares

In general, gain or loss from the sale or exchange of shares of common stock granted or awarded under the 2024 Plan will be treated as capital gain or loss, provided that the shares are held as capital assets at the time of the sale or exchange. However, if certain holding period requirements are not satisfied at the time of a sale or exchange of shares acquired upon exercise of an incentive stock option (a “disqualifying disposition”), a participant generally will be required to recognize ordinary income upon such disposition.

Deductibility by Company

The Company generally is not allowed a deduction in connection with the grant or exercise of an Incentive Stock Option. However, if a participant is required to recognize ordinary income as a result of a disqualifying disposition, we will be entitled to a deduction equal to the amount of ordinary income so recognized. In general, in the case of a Non-Qualified Stock Option (including an Incentive Stock Option that is treated as a Non-Qualified Stock Option), a stock appreciation right, restricted stock, restricted stock units, performance grants, and stock awards, the Company will be allowed a deduction in an amount equal to the amount of ordinary income recognized by a participant, provided that certain income tax reporting requirements are satisfied.

Performance-Based Compensation

Subject to certain exceptions, Section 162(m) of the Code disallows federal income tax deductions for compensation paid by a publicly-held corporation to certain executives (generally the five highest paid officers) to the extent the amount paid to an executive exceeds $1 million for the taxable year. The 2024 Plan has been designed to allow the Compensation Committee to grant stock options, stock appreciation rights, restricted stock, restricted stock units, and performance grants that qualify under an exception to the deduction limit of Section 162(m) for performance-based compensation.

CONVERSION OF THE COMPANY FROM NEVADA TO DELAWARE

General

On January 9, 2024, the Board and the Voting Stockholders approved the Conversion. The Conversion will result in the reincorporation of the Company from the State of Nevada to the State of Delaware.

Purposes of the Conversion

The primary reason that the Board has approved the Conversion is because the corporate laws of the State of Delaware are more comprehensive, widely-used and extensively interpreted than the corporate laws of other states, including Nevada. As a result of the flexibility and responsiveness of the Delaware corporate laws to the legal and business needs of corporations, many major corporations have incorporated in Delaware or have changed their corporate domiciles to Delaware in a manner similar to the Conversion. The Delaware judiciary has become particularly familiar with corporate law matters and a substantial body of court decisions has developed construing the laws of Delaware, thus providing greater clarity and predictability with respect to our corporate legal and governance affairs. Any benefits provided to the Company by Delaware law directly benefit the Company’s stockholders. In approving the Conversion, the Board and the Consenting Stockholder considered, among others, the following benefits of Delaware law to the Company and its stockholders:

| |

●

|

the Company would be governed by the Delaware General Corporation Law (the “DGCL”), which is generally acknowledged to be the most advanced and flexible corporate statute in the country;

|

| |

●

|

the responsiveness and efficiency of the Division of Corporations of the Secretary of State of the State of Delaware;

|

| |

●

|

the Delaware General Assembly, which each year considers and adopts statutory amendments proposed by the Corporation Law Section of the Delaware State Bar Association in an effort to ensure that the corporate statute continues to be responsive to the changing needs of businesses;

|

| |

●

|

the Delaware Court of Chancery, which has exclusive jurisdiction over matters relating to the DGCL and in which cases are heard by judges, without juries, who have many years of experience with corporate issues, which can lead to quick and effective resolution of corporate litigation; and the Delaware Supreme Court, which is highly regarded; and

|

| |

●

|

the well-established body of case law construing Delaware law, which has developed over the last century and which provides businesses and investors with a greater degree of predictability than most, if not all, other jurisdictions.

|

Delaware is a nationally recognized leader in adopting and implementing comprehensive modern and flexible corporate laws. The DGCL is frequently revised and updated to accommodate changing legal and business needs and is more comprehensive, widely used and interpreted than other state corporate laws, including the NRS.

In addition, Delaware courts (such as the Court of Chancery and the Delaware Supreme Court) are highly regarded for their considerable expertise in dealing with corporate legal issues and for producing a substantial body of case law construing the DGCL, with multiple cases concerning areas that Nevada courts have not considered. Because the judicial system is based largely on legal precedents, the abundance of Delaware case law should serve to enhance the relative clarity and predictability of many areas of corporate law, which in turn may offer added advantages to us by allowing the Board and management to make corporate decisions and take corporate actions with greater assurance as to the validity and consequences of those decisions and actions.

The Conversion may also make it easier to attract future candidates willing to serve on the Board because many such candidates are already familiar with the DGCL, including provisions relating to director indemnification, from their past business experience.

In addition, underwriters and other members of the financial services industry may be more willing and better able to assist in capital-raising programs for corporations having the greater flexibility afforded by the DGCL. Certain international investment funds, sophisticated investors and brokerage firms may be more comfortable and more willing to invest in a Delaware corporation than in a corporation incorporated in another U.S. jurisdiction whose corporate laws may be less understood and perceived to be outdated and unresponsive to stockholder rights.

There are many differences between Nevada and Delaware corporate law, and the following highlights certain of the most significant differences between the corporate law of the two jurisdictions relating to the rights of stockholders.

While both states implement versions of the Business Judgment Rule (“BJR”), which creates a presumption that, in making a business judgment, the directors acted in a manner that satisfies their obligations and shields them from liability to stockholders, Delaware’s implementation of the BJR has been more driven by judicial decisions than Nevada’s statutorily codified version and constitutes a more stringent standard than Nevada’s in some situations. In addition, while Delaware permits a corporation to limit the liability of director in its Articles of Incorporation (but not for acts not in good faith, involving intentional misconduct, or for paying dividends or repurchasing stock other than as permitted by Delaware law), the limitation allowed is somewhat less extensive than the exculpation under Nevada law, which provides, without the need of a special provision in the charter document, that neither directors nor officers may be liable to stockholders except for a breach of fiduciary duty that also involved intentional misconduct, fraud, or a knowing violation of law. Both jurisdictions permit indemnification of directors and officers, though Nevada permits it under a somewhat broader basis reflecting the standard for limitation of liability mentioned above.

Delaware also follows certain doctrines that may impose additional judicial scrutiny of actions of the board of directors under certain circumstances, such as specific duties to shareholders in the context of a likely sale of the company or of substantially all its assets, or judicial review under an “entire fairness” standard for certain transactions presenting the possibility of a conflict of interest. Nevada, in contrast, permits the board of directors to consider the interests of constituencies other than just the stockholders (such as, but not limited to, the corporation’s employees, creditors, customers or community), in exercising their powers with a view to the interests of the corporation.

Access to the books and records of a corporation is permitted to stockholders of a Delaware corporation under a broader set of circumstances than to stockholders of a Nevada corporation. Delaware also restricts committees of the board of directors from taking certain actions that would be permissible under Nevada law. Directors of a Delaware corporation may generally be removed by the vote of a majority of the shares of stock issued and outstanding of the class that elected such director, while Nevada requires 66 2/3% of the voting power to remove a director.

Both Delaware and Nevada have statutes restricting certain business “combinations” (e.g. a merger, acquisition, liquidation, issuance or reclassification of securities, among others) with an “interested stockholder” within a certain time period (three years in the case of Delaware) unless certain requirements are met, though the restrictions vary. Nevada has an additional statute that restricts, unless reinstated by a vote of the stockholders, the voting rights of persons acquiring a “controlling interest” (i.e., increasing ownership beyond 20%, 33 1/3% or 50%) in a corporation outside of acquisitions authorized by the board of directors. Delaware does not have an analogous statute. Each of these statutes may have an antitakeover effect, inhibiting attempts by others to acquire us or our assets, including at prices in excess of market prices for our stock. The Corporation did not opt out of any such antitakeover statute in its Nevada Articles of Incorporation, nor will it in its Delaware Certificate of Incorporation.

Delaware restricts the payment of dividends, making of distributions and repurchase of stock to being made only out of “surplus” or, if no surplus exists, out of net profits for the fiscal year in which the dividend is declared and/or the preceding fiscal year, subject to certain conditions. Nevada employs a different test: (i) that the corporation’s assets would not be less than the sum of its total liabilities, after giving effect to the distribution and any amount needed to satisfy preferential rights of preferred stockholders upon dissolution; and (ii) that the corporation would be able to pay its debts as they become due in the usual course of business.

Delaware also limits the composition and authority to act of committees established by the Board of Directors in certain circumstances where Nevada would not.

The Board and the Voting Stockholders did not approve the Conversion to prevent a change in control of the Company and are not aware of any present attempt by any person to acquire control of the Company or to obtain representation on the Board.

Effects of the Conversion

By virtue of the Conversion, all of the rights, privileges and powers of the Company, all property owned by the Company, all debts due to the Company and all other causes of action belonging to the Company immediately prior to the Conversion will remain vested in the Company following the Conversion. In addition, by virtue of the Conversion, all debts, liabilities and duties of the Company immediately prior to the Conversion will remain attached to the Company following the Conversion. The Company will remain as the same entity following the Conversion, and the Conversion will not effect any change in our business, management or operations or the location of our principal executive offices. Further, the Company will retain its tax and financial history attributes following the Conversion.

Upon effectiveness of the Conversion, all of our issued and outstanding shares of capital stock will be automatically converted into issued and outstanding shares of capital stock of the Company incorporated in Delaware, without any action on the part of our stockholders. The Conversion will have no effect on the ability of our shares of capital stock to trade. The Company will continue to file periodic reports and other documents as and to the extent required by the rules and regulations of the SEC. Shares of our capital stock that are freely tradeable prior to the Conversion will continue to be freely tradeable, and shares of the Company’s common stock that are subject to restrictions prior to the Conversion will continue to be subject to the same restrictions as shares of the Company incorporated in Delaware. The Conversion will not change the respective positions of the Company or our stockholders under federal securities laws.

Upon effectiveness of the Conversion, our directors and officers will become all of the directors and officers of the Company incorporated in Delaware. We believe that the Conversion will not affect any of our material contracts with any third parties, and that our rights and obligations under such material contractual arrangements will continue as rights and obligations of the Company incorporated in Delaware.

The Company stockholders will not be required to exchange their stock certificates for new stock certificates. Our stockholders should not destroy any stock certificate(s) and should not submit any certificate(s) to us or our transfer agent unless and until requested to do so.

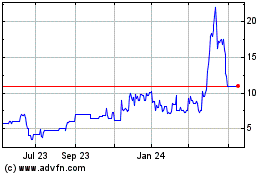

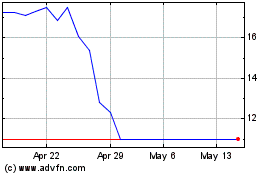

We cannot predict whether the stock price for our common stock will increase, remain the same or decrease if and when the Conversion is completed. We do not expect the reincorporation to have any direct effect on the market price of our stock.

Procedure for Effecting the Share Classification

To accomplish the Conversion, the Board has adopted a plan of conversion, which is attached hereto as Annex B (the “Plan of Conversion”). The Plan of Conversion provides that we will convert into a Delaware corporation and will thereafter be subject to all of the provisions of the DGCL.

The Board will cause the Conversion to be effected as soon as practicable thereafter by filing with the Secretary of State of the State of Nevada articles of conversion (the “Nevada Articles of Conversion”) and will file with the Secretary of State of the State of Delaware (a) a certificate of conversion (the “Delaware Certificate of Conversion”) and (b) a certificate of incorporation, which will govern the Company as a Delaware corporation (the “Delaware Certificate of Incorporation”). In addition, the Board will adopt Bylaws for the Company.

Notwithstanding the foregoing, the Conversion may be delayed by the Board or the Plan of Conversion may be terminated and abandoned by action of the Board at any time prior to the effective time of the Conversion, whether before or after approval by our stockholders, if the Board determines for any reason that such delay or termination would be in the best interests of the Company and our stockholders. The Conversion would become effective upon the filing (and acceptance thereof by the Secretary of State of the State of Nevada and the Secretary of State of the State of Delaware, as applicable) of the Nevada Articles of Conversion, the Delaware Certificate of Conversion and the Delaware Certificate of Incorporation.

Vote Required

Pursuant to NRS 78.385 and 78.390, the approval of the Conversion required a majority of our outstanding voting capital stock. As discussed above, the Voting Stockholders have consented to the Conversion.

Dissenter’s Rights

Pursuant to NRS 92A.300 to 92A,500, the Stockholders of the Company are entitled to dissenter’s rights in connection with the Conversion as set forth above. Stockholders of the Company will be entitled to dissent from the Conversion, if consummated, and obtain payment of the fair value (as defined in NRS 92A.320) of their shares of the Company stock, in lieu of becoming stockholders of the Delaware entity. Accordingly, the Company is providing the Advance Notice of Dissenter’s Rights as set forth in Annex C attached hereto (“Dissenter’s Rights Notice”).

ADOPTION OF THE CERTIFICATE OF INCORPORATION

General

On January 9, 2024, the Board and Voting Stockholders approved the Certificate of Incorporation for the Company, which is attached hereto as Annex D (the “Certificate of Incorporation”). The following summary of the Certificate of Incorporation is qualified in its entirety by the entire text of the Certificate of Incorporation, which is filed as an annex to this Information Statement and is incorporated by reference into this Information Statement.

Reasons for the Adoption of the Certificate of Incorporation

In connection with the Conversion, the Company must file a Certificate of Incorporation in the State of Delaware.

ADOPTION OF THE AMENDED AND RESTATED BYLAWS

General

On January 9, 2024, the Board and Voting Stockholders approved the amended and restated Bylaws for the Company, which are attached hereto as Annex E (the “New Bylaws”). The following summary of the New Bylaws is qualified in its entirety by the entire text of the New Bylaws, which are filed as an annex to this Information Statement and are incorporated by reference into this Information Statement. The Board believes the adoption of the New Bylaws is in the best interests of the shareholders as the New Bylaws provide the Company with the flexibility necessary to carry out its business plan and attract potential strategic partners.

Reasons for the Adoption of the Bylaws

The overall goal of the amendments described below is to improve and enhance the Company’s corporate governance structure. Therefore, the Board believes that the New Bylaws will make the administration of the future operations of the Company more efficient and provide more flexibility for the management of the Company within the limits of applicable law. The adoption of the New Bylaws will not alter the directors’ fiduciary obligations of the Company.

AMENDMENT TO THE COMPANY’S 2020 STOCK INCENTIVE PLAN TO EFFECT AN INCREASE IN THE AUTHORIZED SHARES AVALIABLE FOR ISSUANCE

General

On December 5, 2019 the Board adopted the 2020 Plan and on December 15, 2023, our Board approved an amendment to the 2020 Plan (the “2020 Plan Amendment”) to effect an increase in the number of shares that remain available for issuance under the 2020 Plan by an additional 2,150,000 shares up to an aggregate of 2,272,954 shares available for issuance under the 2020 Plan.

We believe that our continued ability to offer equity incentive awards under the 2020 Plan are critical to our ability to continue to attract, motivate, and retain highly qualified executives and employees. We believe that the 2020 Plan has been an effective component of our compensation program and has heightened our ability to attract, retain and motivate highly qualified executives and employees. We further believe that the awards granted under the 2020 Plan have provided an effective inducement to incentivize plan participants to pursue our goals and objectives, including the creation of long-term value for our stockholders. The Board has determined that the 2020 Plan as amended by the 2020 Plan Amendment is in the best interests of the Company and its stockholders.

The following descriptions of the 2020 Plan, as amended by the 2020 Plan Amendment, are qualified in their entirety by the terms of the 2020 Plan document, a copy of which is attached to this Informational Statement as Annex F, and the 2020 Plan Amendment, a copy of which is attached to this Informational Statement as Annex G.

References to the 2020 Plan in the remainder of this discussion refer to the 2020 Plan, as amended by the 2020 Plan Amendment, unless otherwise specified or the context otherwise references the 2020 Plan prior to it being amended by the 2020 Plan Amendment.

Why We Approved the 2020 Plan Amendment

The Board and Voting Stockholders have determined that it is in the best interests of the Company and its stockholders to approve the 2020 Plan Amendment to increase the number of shares available for issuance under the 2020 Plan by an additional 2,150,000 shares up to an aggregate of 2,272,954 shares available under the 2020 Plan. We believe the 2020 Plan and the 2020 Plan Amendment will allow us to continue to utilize a broad array of equity incentives in order to attract and retain talent, and to continue to provide incentives that align the interests of our employees and directors with the interests of our stockholders.

Before the 2020 Plan Amendment, the number of shares available for issuance under the 2020 Plan would be too limited to effectively operate as an incentive and retention tool for employees, officers, directors, non-employee directors and consultants of the Company and its affiliates (as defined in the 2020 Plan). The 2020 Plan and the approved increase will enable us to continue our policy of equity ownership by employees, officers, directors, non-employee directors and consultants of the Company and its affiliates as an incentive to contribute to the creation of long-term value for our stockholders. Absent sufficient equity incentives, we would need to consider additional cash-based incentives to provide a market-competitive total compensation package necessary to attract, retain and motivate the talent that is critical to driving our success. Payment of cash incentives would then reduce the cash available for product development, marketing, operations, and other corporate purposes.

The Plan

Our Board approved the 2020 Plan on December 5, 2019. Under the 2020 Plan, equity-based awards may be made to employees, officers, directors, non-employee directors and consultants of the Company and its affiliates in the form of (i) Incentive Stock Options (to eligible employees only); (ii) Nonqualified Stock Options; (iii) Restricted Stock; (iv) Stock Awards; (v) Stock Appreciation Rights; or (vi) any combination of the foregoing. The 2020 Plan will terminate on the tenth anniversary of its effective date. The Compensation Committee of the Board serves as the 2020 Plan administrator and subject to the terms of the 2020 Plan, the Compensation Committee will have complete authority and discretion to determine the terms of awards under the 2020 Plan.

The total number of shares initially authorized for issuance under the 2020 Plan was 320,000 shares. The 2020 Plan was subsequently amended on September 29, 2020, January 4, 2021 and March 19, 2021 to increase the number of shares authorized for issuance under the 2020 Plan. Shares surrendered or withheld to pay the exercise price of a stock option or to satisfy tax withholding requirements will not be added back to the number of shares available under the 2020 Plan. To the extent that any shares of common stock awarded or subject to issuance or purchase pursuant to awards under the 2020 Plan are not delivered or purchased, or are reacquired by the Company, for any reason, including a forfeiture of restricted stock or failure to earn performance shares, or the termination, expiration or cancellation of a stock option, or any other termination of an award without payment being made in the form of shares of common stock will be added to the number of shares available for awards under the 2020 Plan. The number of shares available for issuance under the 2002 Plan will be adjusted for any increase or decrease in the number of outstanding shares of common stock resulting from payment of a stock dividend on common stock, a stock split or subdivision or combination of shares of common stock, or a reorganization or reclassification of common stock, or any other change in the structure of shares of common stock, as determined by the Board. Shares available for awards under the 2020 Plan will consist of authorized and unissued shares.

Two types of options may be granted under the 2020 Plan: (1) Incentive Stock Options which may only be issued to eligible employees of the Company and are required to have the exercise price of the option not less than the fair market value of the common stock on the grant date; or in the case of an Incentive Stock Option granted to a Ten Percent Stockholder, one hundred ten percent (110%) of the fair market value of the common stock at the grant date; and (2) Non-qualified Stock Options which may be issued to participants under the 2020 Plan and which may have an exercise price less than the fair market value of the common stock on the grant date, but not less than par value of the stock.

The Board may grant or sell restricted stock to participants (i.e., shares that are subject to restrictions or limitations as to the participant’s ability to sell, transfer, pledge or assign such shares) under the 2020 Plan. Except for these restrictions and any others imposed by the Board, upon the grant of restricted stock, the recipient generally will have rights of a stockholder with respect to the restricted stock. During the applicable restriction period, the recipient may not sell, exchange, transfer, pledge or otherwise dispose of the restricted stock. The Board may also grant awards of common stock to participants under the 2020 Plan, as well as awards of performance shares, which are awards for which the payout is subject to achievement of such performance objectives established by the Board. Performance shares may be settled in cash.

Each equity-based award granted under the 2020 Plan will be evidenced by an award agreement that specifies the terms of the award and such additional limitations, terms and conditions as the Board may determine, consistent with the provisions of the 2020 Plan.

Upon the occurrence of a change in control, unless otherwise provided in an award agreement, any stock option or restricted stock award granted under the 2020 Plan will immediately vest in full and become exercisable. The 2020 Plan defines a change in control as (i) an acquisition by any person, entity or “group”, within the meaning of Section 13(d)(3) or 14(d)(2) of the Securities Exchange Act of 1934 of beneficial ownership of 33% or more of either the then outstanding shares of common stock or the combined voting power of the Company’s then outstanding voting securities entitled to vote generally in the election of directors, (ii) individuals who, as of December 5, 2019, constitute the Board (the “Incumbent Board”) cease for any reason to constitute at least a majority of the Board, provided that any person becoming director subsequent to December 5, 2019 whose election, or nomination for election by the Company’s stockholders was approved by a vote of at least a majority of the directors then comprising the Incumbent Board shall be, considered as though such person were a member of the Incumbent Board; or (iii) approval by the stockholders of the Company of (A) a reorganization, merger or consolidation, in each case, with respect to which persons who were the stockholders of the Company immediately prior to such reorganization, merger or consolidation do not immediately thereafter, own more than 50% of the combined voting power; or (B) a liquidation or dissolution of the Company; or (C) the sale of all or substantially all of the assets of the Company.

Subsequent to the effective date of the 2024 Plan, we will not grant any additional awards under our 2020 Plan. Instead, we will grant equity awards under our 2024 Plan. Our 2020 Plan, however, will continue to govern the terms and conditions of all outstanding equity awards granted under the 2020 Plan.

APPROVAL OF NEW OPTION GRANTS UNDER THE 2020 STOCK INCENTIVE PLAN

Grant of New Options Under the 2020 Stock Incentive Plan

On December 15, 2023, the Board granted the following awards under the 2020 Plan subject to approval by the Voting Stockholders:

SOW GOOD INC. 2020 STOCK INCENTIVE PLAN GRANTS

|

Name and position

|

|

Exercise Price

|

|

|

Number of

Options

|

|

|

Claudia Goldfarb

Chief Executive Officer & Director

|

|

$ |

9.75 |

|

|

|

450,000 |

|

|

Claudia Goldfarb

Chief Executive Officer & Director

|

|

$ |

40.00 |

|

|

|

450,000 |

|

|

Ira Goldfarb

Executive Chairman & Director

|

|

$ |

9.75 |

|

|

|

500,000 |

|

|

Ira Goldfarb

Executive Chairman & Director

|

|

$ |

40.00 |

|

|

|

500,000 |

|

|

Total for Executive Group

|

|

|

|

|

|

|

1,900,000 |

|

Compensation of Directors and Executive Officers

We currently qualify as a “smaller reporting company” as such term is defined in Rule 405 of the Securities Act and Item 10 of Regulation S-K. Accordingly, and in accordance with relevant SEC rules and guidance, we have elected, with respect to the disclosures required by Item 402 (Executive Compensation) of Regulation S-K, to comply with the disclosure requirements applicable to smaller reporting companies. The following Compensation Overview is not comparable to the “Compensation Discussion and Analysis” that is required of SEC reporting companies that are not smaller reporting companies.

The following Compensation Overview describes the material elements of compensation for our executive officers identified in the Summary Compensation Table (“Named Executive Officers”) for the fiscal year ended December 31, 2023. As more fully described below, our board’s compensation committee reviews and recommends policies, practices, and procedures relating to the total direct compensation of our executive officers, including the Named Executive Officers, and the establishment and administration of certain of our employee benefit plans to our board of directors.

Compensation Program Objectives and Rewards

Our compensation philosophy is based on the premise of attracting, retaining, and motivating exceptional leaders, setting high goals, working toward the common objectives of meeting the expectations of customers and stockholders, and rewarding outstanding performance. Following this philosophy, we consider all relevant factors in determining executive compensation, including the competition for talent, our desire to link pay with performance, the use of equity to align executive interests with those of our stockholders, individual contributions, teamwork, and each executive’s total compensation package. We strive to accomplish these objectives by compensating all executives with compensation packages consisting of a combination of competitive base salary and incentive compensation.

The compensation received by our Named Executive Officers is based primarily on the levels at which we can afford to retain them and their responsibilities and individual contributions. Our compensation policy also reflects our strategy of minimizing general and administration expenses and utilizing independent professional consultants. Our compensation committee and board of directors apply the compensation philosophy and policies described below to determine the compensation of Named Executive Officers.

The primary purpose of the compensation and benefits we consider is to attract, retain, and motivate highly talented individuals who will engage in the behavior necessary to enable us to succeed in our mission, while upholding our values in a highly competitive marketplace. Different elements are designed to engender different behaviors, and the actual incentive amounts which may be awarded to each Named Executive Officer are subject to the annual review of our compensation committee who will make recommendations regarding compensation to our board of directors. The following is a brief description of the key elements of our planned executive compensation structure.

| |

●

|

Base salary and benefits are designed to attract and retain employees over time.

|

| |

●

|

Incentive compensation awards are designed to focus employees on the business objectives for a particular year.

|

| |

●

|

Equity incentive awards, such as stock options and non-vested stock, focus executives’ efforts on the behaviors within the recipients’ control that they believe are designed to ensure our long-term success as reflected in increases to our stock prices over a period of several years, growth in our profitability and other elements.

|

| |

●

|

Severance and change in control plans are designed to facilitate a company’s ability to attract and retain executives as we compete for talented employees in a marketplace where such protections are commonly offered.

|

Benchmarking

We have not yet adopted benchmarking but may do so in the future. When making compensation decisions, our compensation committee and board of directors may compare each element of compensation paid to our Named Executive Officers against a report showing comparable compensation metrics from a group that includes both publicly-traded and privately-held companies. Our board believes that while such peer group benchmarks are a point of reference for measurement, they are not necessarily a determining factor in setting executive compensation. Each executive officer’s compensation relative to the benchmark varies based on the scope of responsibility and time in the position. We have not yet formally established our peer group for this purpose.

The Elements of The Company’s Compensation Program

Base Salary

Executive officer base salaries are based on job responsibilities and individual contribution. Our compensation committee and board of directors review the base salaries of our executive officers, including our Named Executive Officers, considering factors such as corporate progress toward achieving objectives (without reference to any specific performance-related targets) and individual performance experience and expertise. Additional factors reviewed by our compensation committee and board of directors in determining appropriate base salary levels and raises include subjective factors related to corporate and individual performance. For the year ended December 31, 2023, all executive officer base salary decisions were approved by the board of directors at the time we entered into the respective employment agreements with our Named Executive Officers.

Incentive Compensation Awards

No bonuses were granted in 2022. In July 2023, the Board approved a bonus in the amount of $195,462 to Ira Goldfarb and a bonus in the amount of $173,250 to Claudia Goldfarb.

On December 15, 2023 the Company entered into Amended and Restated Employment Agreements with Ira Goldfarb and Claudia Goldfarb. Under each Amended and Restated Employment Agreement Ira Goldfarb and Claudia Goldfarb are entitled to a discretionary cash bonus of up to 100% of his or her then-current base salary, based on revenue and EBITDA targets set forth in each of their Amended and Restated Employment Agreements.

If our revenue grows, industry conditions improve, and bonuses become affordable and justifiable, we expect to use the following parameters in justifying and quantifying bonuses for other officers of the Company: (1) the growth in our revenue, (2) the growth in our earnings before interest, taxes, depreciation and amortization, as adjusted (“EBITDA”), and (3) our stock price. The board has not adopted specific performance goals and target bonus amounts, but may do so in the future.

Equity Incentive Awards

We believe equity incentive awards motivate our employees to work to improve our business and stock price performance, thereby further linking the interests of our senior management and our stockholders. The board considers several factors in determining whether awards are granted to an executive officer, including those previously described above in the summary of the 2024 Plan, as amended, as well as the executive’s position, his or her performance and responsibilities, and the amount of options or other awards, if any, currently held by the officer and their vesting schedule. Our policy prohibits backdating options or granting them retroactively.

Benefits and Perquisites

At this stage of our business we have benefits that are generally comparable to those offered by other small private and public companies and no prerequisites for our employees. We may adopt additional benefits and confer other fringe benefits for our executive officers in the future.

Executive Officer Compensation

The following table sets forth the total compensation paid in all forms to our named executive officers of the Company during the periods indicated:

Summary Compensation Table

|

Name and

Principal

|

|

|

|

|

|

|

|

|

|

Stock

|

|

|

Option

|

|

|

Non-Equity Incentive Plan

|

|

|

Non Qualified Deferred Compensation

|

|

|

All Other

|

|

|

|

|

|

|

Position

|

|

Year

|

|

|

Salary

|

|

|

Awards

|

|

|

Awards

|

|

|

Compensation

|

|

|

Earnings

|

|

|

Compensation

|

|

|

Total

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ira Goldfarb,(1)

Executive Chairman

|

|

2023

|

|

|

$ |

165,000 |

|

|

$ |

– |

|

|

$ |

|

|

|

$ |

195,462 |

|

|

$ |

– |

|

|

$ |

– |

|

|

$ |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Claudia Goldfarb,(2)

Chief Executive Officer

|

|

2023

|

|

|

$ |

146,250 |

|

|

$ |

– |

|

|

$ |

|

|

|

$ |

173,250 |

|

|

$ |

– |

|

|

$ |

– |

|

|

$ |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Keith Terreri,(3)

Chief Financial Officer

|

|

2023

|

|

|

$ |

11,423 |

|

|

$ |

– |

|

|

$ |

154,089 |

|

|

$ |

– |

|

|

$ |

– |

|

|

$ |

– |

|

|

$ |

165,512 |

|

(1) Mr. Goldfarb was appointed Executive Chairman of the Board of Directors on October 1, 2020. We have agreed to compensate Mr. Goldfarb a total of $330,000 in cash per year commencing on January 1, 2022, and a total of $625,000 in cash per year commencing on December 15, 2023. On December 15, 2023, we granted Mr. Goldfarb an option to purchase 500,000 shares of common stock at an exercise price of $40.00 per share. The estimated value using the Monte Carlo Simulation, based on a volatility rate of % and a call option value of $ , was $ . On December 15, 2023, we granted Mr. Goldfarb an option to purchase 500,000 shares of common stock at an exercise price of $9.75 per share. The estimated value using the Black-Scholes Pricing Model, based on a volatility rate of 132% and a call option value of $9.03, was $4,515,000.

(2) Mrs. Goldfarb was appointed Chief Executive Officer on October 1, 2020. We have agreed to compensate Mrs. Goldfarb a total of $292,500 in cash per year commencing on January 1, 2022, and $575,000 in cash per year commencing on December 15, 2023. On December 15, 2023, we granted Mrs. Goldfarb an option to purchase 450,000 shares of common stock at an exercise price of $40.00 per share. The estimated value using the Monte Carlo Simulation, based on a volatility rate of % and a call option value of $ , was $ . On December 15, 2023, we granted Mrs. Goldfarb an option to purchase 450,000 shares of common stock at an exercise price of $9.75 per share. The estimated value using the Black-Scholes Pricing Model, based on a volatility rate of 132% and a call option value of $9.03, was $4,063,500.

(3) Mr. Terreri was appointed Chief Financial Officer on November 20, 2023. We have agreed to compensate Mr. Terreri a total of $270,000 in cash per year. On November 13, 2023, we granted Mr. Terreri an option to purchase 27,000 shares of common stock at an exercise price of $6.19 per share. The estimated value using the Black-Scholes Pricing Model, based on a volatility rate of 129% and a call option value of $5.71, was $154,089.

Employment Agreements and Offer Letters

We have entered into written employment agreements with two of our executive officers. Further, we have executed an Offer Letter with one of our executive officers.

On December 15, 2023, the Company entered into an Amended and Restated Employment Agreement with Executive Chairman and Chairman of the Board of Directors Ira Goldfarb (the “A&R Employment Agreement of Ira Goldfarb”). The A&R Employment Agreement of Ira Goldfarb amended and restated Mr. Goldfarb’s employment agreement with the Company dated, October 1, 2020. The A&R Employment Agreement of Ira Goldfarb provides that Mr. Goldfarb will be entitled to receive an annual base salary of $625,000. Additionally, beginning with the fiscal year 2024, Mr. Goldfarb is entitled to a discretionary cash bonus of up to 100% of this then-current base salary, based on revenue and EBITDA targets set forth in the A&R Employment Agreement of Ira Goldfarb.

On December 15, 2020, pursuant to the A&R Employment Agreement of Ira Goldfarb, Mr. Goldfarb was granted stock options entitling him to purchase up to 500,000 shares of Common Stock (the “Initial Option Grant”), pursuant the terms and conditions of a stock purchase agreement and the 2020 Equity Incentive Plan. The price per share subject to the Initial Option Grant is equal to the closing price per share of the Common Stock on the effective date of the grant. The shares granted under the Initial Option Grant will vest equally over a five-year period from grant date. In the case of a Change of Control (as defined in the A&R Employment Agreement of Ira Goldfarb) all shares granted in the Initial Option Grant will vest immediately.

Additionally, pursuant to the A&R Employment Agreement of Ira Goldfarb, Mr. Goldfarb was granted additional stock options entitling him to purchase up to 500,000 shares of Common Stock (the “Additional Option Grant”), pursuant the terms and conditions of a stock purchase agreement and the 2020 Equity Incentive Plan. The shares granted under the Additional Option Grant will vest upon the Company’s stock price trading on a national securities exchange operated by Nasdaq or the New York Stock Exchange with a closing transaction price above $40.00 per share for a period of twenty consecutive trading days, and the exercise price per share under the Additional Option Grant is$40.00. In the case of a Change of Control (as defined in the A&R Employment Agreement of Ira Goldfarb) all shares granted in the Additional Option Grant will vest immediately.

On December 15, 2023, the Company entered into an Amended and Restated Employment Agreement with Chief Executive Officer and member of the Board of Directors Claudia Goldfarb (the “A&R Employment Agreement of Claudia Goldfarb”). The A&R Employment Agreement of Claudia Goldfarb amended and restated Mrs. Goldfarb’s employment agreement with the Company dated, October 1, 2020. The A&R Employment Agreement of Claudia Goldfarb provides that Mrs. Goldfarb will be entitled to receive an annual base salary of $575,000. Additionally, beginning with the fiscal year 2024, Mrs. Goldfarb is entitled to a discretionary cash bonus of up to 100% of this then-current base salary, based on revenue and EBITDA targets set forth in the A&R Employment Agreement.

On the December 15, 2023, pursuant to the A&R Employment Agreement of Claudia Goldfarb, Mrs. Goldfarb was granted stock options entitling her to purchase up to 450,000 shares of Common Stock (the “Initial Option Grant”), pursuant the terms and conditions of a stock purchase agreement and the 2020 Equity Incentive Plan. The price per share subject to the Initial Option Grant is equal to the closing price per share of the Common Stock on the effective date of the grant. The shares granted under the Initial Option Grant will vest equally over a five-year period from grant date. In the case of a Change of Control (as defined in the A&R Employment Agreement of Claudia Goldfarb) all shares granted in the Initial Option Grant will vest immediately.

Additionally, pursuant to the A&R Employment Agreement of Claudia Goldfarb, Mrs. Goldfarb was granted additional stock options entitling her to purchase up to 450,000 shares of Common Stock (the “Additional Option Grant”), pursuant the terms and conditions of a stock purchase agreement and the 2020 Equity Incentive Plan. The shares granted under the Additional Option Grant will vest upon the Company’s stock price trading on a national securities exchange operated by Nasdaq or the New York Stock Exchange with a closing transaction price above $40.00 per share for a period of twenty consecutive trading days, and the exercise price per share under the Additional Option Grant shall be $40.00. In the case of a Change of Control (as defined in the A&R Employment Agreement of Claudia Goldfarb) all shares granted in the Additional Option Grant will vest immediately.

On November 20, 2023, the Company’s board of directors appointed Keith Terreri as the Company’s Chief Financial Officer, effective December 4, 2023. In connection with this appointment as Chief Financial Officer, the Company executed an Offer Letter with Mr. Terreri (the “Keith Terreri Offer Letter”), which sets his base salary at $270,000 per year and his target bonus of up to $67,500 per year based on criteria determined by the Company. Pursuant to the Offer Letter, Mr. Terreri was granted 27,000 stock options, representing the right to purchase shares of the Company’s common stock, subject to Mr. Terreri’s continuous service to the Company through each vesting date.

The summaries above are qualified in their entirety by the text of the respective agreements. Copies of the A&R Employment Agreement of Ira Goldfarb and the A&R Employment Agreement of Claudia Goldfarb are attached as Exhibits 10.1, and 10.2 to the Company’s current report on Form 8-K for the filed with the Securities and Exchange Commission on December 15, 2023. A copy of the Keith Terreri Offer Letter is attached as Exhibit 10.1 to the Company’s current report on Form 8-K filed with the Securities and Exchange Commission on November 20, 2023.

Outstanding Equity Awards

The following table sets forth information with respect to unexercised stock options, stock that has not vested, and equity incentive plan awards held by our executive officers on December 31, 2023.

Outstanding Option Awards at Fiscal Year-End

|

Name

|

|

Number of Securities Underlying

Unexercised Options

(#) Exercisable

|

|

|

Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable

|

|

|

Option Exercise

Price

|

|

Option

Expiration Date

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ira Goldfarb, Executive Chairman

|

|

|

-0- |

|

|

|

50,000 |

(1) |

|

$ |

5.25 |

|

October 1, 2030

|

| |

|

|

9,900 |

|

|

|

6,600 |

(2) |

|

$ |

4.00 |

|

December 27, 2030

|

| |

|

|

50,000 |

|

|

|

25,000 |

(3) |

|

$ |

3.70 |

|

January 3, 2031

|

| |

|

|

-0- |

|

|

|

500,000 |

(4) |

|

$ |

9.75 |

|

December 14, 2033

|

| |

|

|

-0- |

|

|

|

500,000 |

(5) |

|

$ |

40.00 |

|

December 14, 2033

|

|

Claudia Goldfarb, Chief Executive Officer

|

|

|

-0- |

|

|

|

50,000 |

(1) |

|

$ |

5.25 |

|

October 1, 2030

|

| |

|

|

9,900 |

|

|

|

6,600 |

(2) |

|

$ |

4.00 |

|

December 27, 2030

|

| |

|

|

50,000 |

|

|

|

25,000 |

(3) |

|

$ |

3.70 |

|

January 3, 2031

|

| |

|

|

-0- |

|

|

|

450,000 |

(4) |

|

$ |

9.75 |

|

December 14, 2033

|

| |

|

|

-0- |

|

|

|

450,000 |

(5) |

|

$ |

40.00 |

|

December 14, 2033

|

|

Keith Terreri, Chief Financial Officer

|

|

|

-0- |

|

|

|

27,000 |

(6) |

|

$ |

6.19 |

|

November 12, 2033

|

| (1)Options granted on October 2, 2020, vests 60% on third anniversary, 20% on fourth anniversary, and 20% on fifth anniversary. |

| (2)Options granted on December 28, 2020, vests 60% on third anniversary, 20% on fourth anniversary, and 20% on fifth anniversary. |

| (3)Options granted on January 4, 2021, vesting in three equal annual installments beginning on the first anniversary of the grant date. |

| (4)Options granted on December 15, 2023, vests 20% on first anniversary, 20% on second anniversary, 20% on third anniversary, 20% on fourth anniversary and 20% on fifth anniversary. |

| (5)Options granted on November 13, 2023, vests 60% on third anniversary, 20% on fourth anniversary, and 20% on fifth anniversary. |

Option Exercises and Stock Vested

None of our executive officers exercised any stock options or acquired stock through vesting of an equity award during the year ended December 31, 2023.

Director Compensation

The following table summarizes the compensation paid or accrued by us to our directors that are not Named Executive Officers for the year ended December 31, 2023:

|

Name

|

|

Fees

Earned

or Paid

in Cash

|

|

|

Stock

Award

|

|

|

Option

Awards

|

|

|

Non-Equity Incentive Compensation

|

|

|

Change in Pension

Value and Nonqualified Deferred Compensation Earnings

|

|

|

All other Compensation

|

|

|

Total

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bradley Berman(1)

|

|

$ |

25,000 |

|

|

$ |

2,644 |

|

|

$ |

– |

|

|

$ |

– |

|

|

$ |

– |

|

|

$ |

– |

|

|

$ |

27,644 |

|

|

Lyle Berman(2)

|

|

$ |

25,000 |

|

|

$ |

2,644 |

|

|

$ |

– |