Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

January 09 2024 - 5:01PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus filed pursuant to Rule 433

supplementing the Preliminary Prospectus Supplement

dated January 9, 2024

Registration No. 333-268289

January 9, 2024

Summary of Final Terms and Details of the Issue

$400,000,000 4.800% Senior Notes due 2029

|

|

|

| Issuer: |

|

Constellation Brands, Inc. |

|

|

| Principal Amount: |

|

$400,000,000 aggregate principal amount. |

|

|

| Title of Securities: |

|

4.800% Senior Notes due 2029 (the “2029 notes”). |

|

|

| Final Maturity Date: |

|

January 15, 2029. |

|

|

| Public Offering Price: |

|

99.889% of principal amount plus accrued interest, if any, from and including January 11, 2024. |

|

|

| Coupon: |

|

4.800% per annum. |

|

|

| Interest Payment Dates: |

|

January 15 and July 15. |

|

|

| Record Dates: |

|

January 1 and July 1. |

|

|

| First Interest Payment Date: |

|

July 15, 2024. |

|

|

| Benchmark UST: |

|

3.750% UST due December 31, 2028. |

|

|

| Benchmark UST Price & Yield: |

|

98-31 3⁄4 / 3.975%. |

|

|

| Spread to Benchmark UST: |

|

85 basis points. |

|

|

| Yield to Maturity: |

|

4.825%. |

|

|

| Optional Redemption: |

|

Prior to December 15, 2028 (one month prior to the maturity date of the 2029 notes) (the “Par Call Date”), the Company may redeem the 2029 notes at its option, in whole or in part, at any time |

|

|

|

|

|

and from time to time, at a redemption price (expressed as a percentage of principal amount and rounded to three decimal places) equal to the

greater of: (1) (a) the

sum of the present values of the remaining scheduled payments of principal and interest thereon discounted to the redemption date (assuming the 2029 notes matured on the Par Call Date) on a semi-annual basis (assuming a 360-day year consisting of

twelve 30-day months) at the Treasury Rate plus 15 basis points less (b) interest accrued to the date of redemption, and

(2) 100% of the principal amount of the 2029 notes to be redeemed,

plus, in either case, accrued and unpaid interest thereon to the redemption date.

On or after the Par Call Date, the Company may redeem the 2029 notes, in whole or in

part, at any time and from time to time, at a redemption price equal to 100% of the principal amount of the 2029 notes being redeemed plus accrued and unpaid interest thereon to the redemption date. |

|

|

| Mandatory Offer to Redeem Upon Change of Control Triggering Event: |

|

If the Company experiences a change of control triggering event, the Company must offer to repurchase the 2029 notes at 101% of their principal amount, plus accrued and unpaid interest, if any, to, but excluding, the repurchase

date. |

|

|

| Trade Date: |

|

January 9, 2024. |

|

|

| Settlement Date: |

|

January 11, 2024, which will be the second business day following the date of pricing of the 2029 notes (T+2). |

|

|

| Distribution: |

|

SEC Registered. |

|

|

| CUSIP/ISIN Numbers: |

|

CUSIP: 21036P BQ0 ISIN:

US21036PBQ00 |

2

|

|

|

| Joint Bookrunners: |

|

BofA Securities, Inc. Goldman Sachs & Co.

LLC J.P. Morgan Securities LLC Wells Fargo Securities,

LLC BNP Paribas Securities Corp. PNC Capital Markets LLC

Scotia Capital (USA) Inc. |

|

|

| Co-Managers: |

|

BBVA Securities Inc. BMO Capital Markets

Corp. MUFG Securities Americas Inc. M&T Securities,

Inc. TD Securities (USA) LLC Truist Securities, Inc.

Academy Securities, Inc. Fifth Third Securities, Inc.

Rabo Securities USA, Inc. Siebert Williams Shank & Co.,

LLC |

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this

communication relates. Before you invest, you should read the prospectus in that registration statement and other documents that the issuer has filed with the SEC for more complete information about the issuer and this offering. You may obtain these

documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer or any Joint Bookrunner will arrange to send you the prospectus, at no cost, if you request it by calling, as applicable, (i) the issuer’s

Secretary at 1-585-678-7100, (ii) BofA Securities, Inc. at (800) 294-1322 (toll free), (iii) Goldman Sachs & Co. LLC at (866) 471-2526 (toll free), (iv) J.P. Morgan Securities LLC at (212) 834-4533 (collect),

or (v) Wells Fargo Securities, LLC at (800) 645-3751 (toll free).

Any disclaimer or other notice that may appear below is not applicable to

this communication and should be disregarded. Such disclaimer or notice was automatically generated as a result of this communication being sent by Bloomberg or another email system.

3

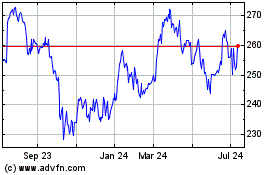

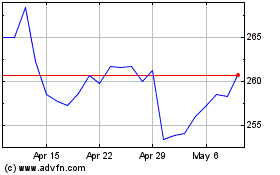

Constellation Brands (NYSE:STZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Constellation Brands (NYSE:STZ)

Historical Stock Chart

From Apr 2023 to Apr 2024