Safe and Green Development Corporation Announces Strategic Property Monetization Initiative throughout 2024

January 09 2024 - 9:00AM

Safe and Green Development Corporation (NASDAQ: SGD) (“SG Devco” or

the “Company”) is pleased to announce that it will strategically

look to monetize its real estate holdings throughout 2024. The

company has already initiated this strategy with the previously

announced Contribution Agreement of Lago Vista wherein the property

is valued at $11.5M as an equity interest in the development.

The Company will look to continue this by strategically

identifying markets where the Company’s land may have

increased in value, as demonstrated by third-party appraisals, due

to the entitlements that the Company was able to secure over the

past three years. This strategy is expected to yield non-dilutive

capital and accelerate the progress of other active projects.

David Villarreal, President & CEO of Safe and Green

Development Corporation stated, “Over the past three years we have

worked diligently to garner valuable entitlements on the land we

have acquired. We will analyze certain markets to determine how we

can best monetize the appreciation of the land value. We believe

this strategy will enable us to align our focus with minimal

dilution to our shareholder base.”

About Safe and Green Development Corporation

Safe and Green Development Corporation is a leading real estate

development company. Formed in 2021, it focuses on the development

of sites using purpose-built, prefabricated modules built from both

wood and steel, sourced from one of Safe & Green Holdings

Corp’s factories operated by SG Holdings’ SG Echo subsidiary. More

information about SG DevCo can be found

at www.sgdevco.com.

Safe Harbor Statement Statements in this press

release that are not strictly historical in nature are

forward-looking statements. These statements are only predictions

based on current information and expectations and include

statements regarding strategically look to monetize its real estate

holdings throughout 2024, strategically identifying markets where

the Company’s land may have increased in value, expected to

yield non-dilutive capital and accelerate the progress of other

active projects and strategy enabling the Company to align its

focus with minimal dilution to its shareholder base . Actual events

or results may differ materially from those projected in any of

such statements due to various factors, including the risk that the

Company may be unable to monetize its real estate holdings as

contemplated and other factors discussed in the Company’s Form 10

registration statement and its subsequent filings with the SEC.

Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date hereof.

All forward-looking statements are qualified in their entirety by

this cautionary statement and Safe and Green Development

Corporation undertakes no obligation to revise or update this press

release to reflect events or circumstances after the date

hereof.

For investor relations and media inquiries, please

contact: Barwicki Investor Relations Andrew@Barwicki.com

516-662-9461

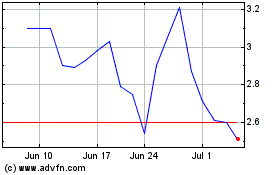

Safe and Green (NASDAQ:SGBX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Safe and Green (NASDAQ:SGBX)

Historical Stock Chart

From Apr 2023 to Apr 2024