Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant ☒

|

|

|

Filed by a Party other than the Registrant ☐

|

|

| |

|

|

Check the appropriate box:

|

|

|

☒ Preliminary Proxy Statement

|

|

|

☐ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)

|

|

|

☐ Definitive Proxy Statement

|

|

|

☐ Definitive Additional Materials

|

|

|

☐ Soliciting Material Pursuant to §240.14a-12

|

|

Moleculin Biotech, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

| |

☒ No fee required.

|

| |

☐ Fee paid previously with preliminary materials.

|

| |

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11

|

| |

|

|

Moleculin Biotech, Inc.

5300 Memorial Drive, Suite 950

Houston, TX 77007

(713) 300-5160

___________, 2024

Dear Fellow Stockholder:

On behalf of the Board of Directors (the “Board”) and management of Moleculin Biotech, Inc. (the “Company”), you are cordially invited to attend the Special Meeting of Stockholders of the Company to be held on February 14, 2024 at 10:30 a.m. local time at the corporate offices of Moleculin Biotech, Inc., 5300 Memorial Drive, Suite 950, Houston, TX 77007 (the “Special Meeting”).

The attached Notice of the Special Meeting (the “Notice”) and proxy statement (“Proxy Statement”) describe in greater detail all of the formal business that will be transacted at the Special Meeting. Directors and officers of the Company will be available at the Special Meeting to respond to any questions that you may have regarding the business to be transacted.

The Company’s Board has determined that each of the proposals that will be presented to the stockholders for their consideration at the Special Meeting are in the best interests of the Company and its stockholders, and unanimously recommends and urges you to vote “FOR” the proposals set forth in this Proxy Statement. If any other business is properly presented at the Special Meeting, the proxies will be voted in accordance with the recommendations of the Company’s Board.

We encourage you to attend the Special Meeting in person, but if you are unable to attend, it is important that you vote in advance via the Internet, by telephone, or sign, date and return the enclosed proxy card in the enclosed postage-paid envelope. Your cooperation is appreciated since one-third of the common stock must be represented, either in person or by proxy, to constitute a quorum for the transaction of business at the Special Meeting.

On behalf of the Board and all of the employees of the Company, we thank you for your continued support.

Very truly yours,

MOLECULIN BIOTECH, INC.

|

By:

|

/s/ Walter V. Klemp

|

|

| |

Walter V. Klemp

|

|

| |

Chairman of the Board and Chief Executive Officer

|

|

Important Notice Regarding the Availability of Proxy Materials

for the Special Meeting to be Held on February 14, 2024:

Electronic Copies of the Notice of Special Meeting and Proxy Statement are available at

https://materials.proxyvote.com/60855D

Moleculin Biotech, Inc.

5300 Memorial Drive, Suite 950

Houston, TX 77007

(713) 300-5160

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS TO BE HELD FEBRUARY 14, 2024

NOTICE IS HEREBY GIVEN that a Special Meeting of Stockholders (the “Special Meeting”) of Moleculin Biotech, Inc. (the “Company”) will be at the corporate offices at 5300 Memorial Drive, Suite 950, Houston, TX 77007, on February 14, 2024 at 10:30 a.m., local time, for the following purposes:

1. Proposal 1. For purposes of complying with Nasdaq Listing Rule 5635(d), to approve the issuance of up to 14,089,672 shares of Company common stock upon the exercise of certain warrants issued on December 26, 2023 in a private placement (collectively, the “Nasdaq Proposal”).

2. Proposal 2. To approve an adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the Nasdaq Proposal (the “Adjournment Proposal”).

Please refer to the proxy statement for the Special Meeting (the “Proxy Statement”) for detailed information on the Nasdaq Proposal and Adjournment Proposal.

The Board of Directors (the “Board”) is not aware of any other business that will be presented for consideration at the Special Meeting. If any other matters should be properly presented at the Special Meeting or any adjournments or postponements of the Special Meeting for action by stockholders, the persons named in the form of proxy will vote the proxy in accordance with their best judgment on that matter.

The Board recommends that you vote “FOR” the Nasdaq Proposal and “FOR” the Adjournment Proposal.

Only stockholders of record as of the close of business on December 26, 2023 are entitled to receive notice of, to attend and to vote at the Special Meeting. If you are a beneficial owner as of that date, you will receive communications from your broker, bank or other nominee about the Special Meeting and how to direct the vote of your shares, and you are welcome to attend the Special Meeting online, all as described in more detail in the attached Proxy Statement. The Special Meeting may be adjourned or postponed from time to time without notice other than by announcement at the meeting.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting to Be Held on February 14, 2024. The Notice of Special Meeting and Proxy Statement are available on the Internet at https://materials.proxyvote.com/60855D and on our corporate website at www.moleculin.com under “Investors—SEC Filings.”

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE SIGN AND DATE THE ENCLOSED PROXY AND RETURN IT IN THE ENVELOPE PROVIDED.

| |

By Order of the Board of Directors,

|

| |

|

| |

MOLECULIN BIOTECH, INC.

|

| |

/s/ Walter V. Klemp

|

|

Houston, Texas

|

Walter V. Klemp

|

|

________________, 2024

|

Chairman of the Board and Chief Executive Officer

|

TABLE OF CONTENTS

Moleculin Biotech, Inc.

5300 Memorial Drive, Suite 950

Houston, TX 77007

(713) 300-5160

PROXY STATEMENT

GENERAL INFORMATION

For the Special Meeting of Stockholders

To Be Held on February 14, 2024

Our Board of Directors is soliciting proxies to be voted at the Special Meeting of Stockholders (the “Special Meeting”) to be held at the corporate offices at 5300 Memorial Drive, Suite 950, Houston, TX 77007, on February 14, 2024 at 10:30 a.m., local time, for the purposes set forth in the attached Notice of Special Meeting of Stockholders (the “Notice”) and in this Proxy Statement. This Proxy Statement and the proxies solicited hereby are being first sent or delivered to stockholders of the Company on or about ___________, 2024.

As used in this Proxy Statement, the terms “Company,” “we,” “us,” “our” and “Moleculin” refer to Moleculin Biotech, Inc., and the terms “Board of Directors” and “Board” refers to the Board of Directors of the Company.

Questions and Answers about these Proxy Materials and the Special Meeting

What information is contained in this Proxy Statement?

This information relates to the proposals to be voted on at the Special Meeting, the voting process, and certain other required information.

Can I access the Company’s proxy materials electronically?

Yes. The Proxy Statement and form of Proxy are available at https://materials.proxyvote.com/60855D. To view this material, you must have available the control number located on the proxy card or, if shares are held in the name of a broker, bank or other nominee, the voting instruction form.

What does it mean if I receive more than one set of proxy materials?

It means your shares are registered differently or are in more than one account. Please provide voting instructions for each account for which you have received a set of proxy materials.

Who is soliciting my vote pursuant to this Proxy Statement?

Our Board is soliciting your vote at the Special Meeting. We have engaged Okapi Partners LLC. (“Okapi “), a proxy solicitation firm, at an approximate costs of $10,000, to solicit proxies on behalf of the Company. Okapi may solicit the return of proxies, either by mail, telephone, email or through personal contact. The cost of solicitation will be borne by us, including the fees of Okapi as well as the reimbursement of their expenses. Our directors and employees may also solicit proxies in person, by telephone, fax, electronic transmission or other means of communication. We will not pay these directors and employees any additional compensation for these services. We will ask banks, brokerage firms, and other institutions, nominees, and fiduciaries to forward these proxy materials to their principal, and to obtain authority to execute proxies, and will reimburse them for their expenses.

Who is entitled to vote?

Only stockholders of record at the close of business on December 26, 2023 (the "Record Date") will be entitled to vote at the Special Meeting.

How many shares are eligible to be voted?

As of the Record Date, we had 33,412,696 shares of common stock outstanding. Each outstanding share of our common stock will entitle its holder to one vote on each of the matters to be voted on at the Annual Meeting.

What am I voting on?

You are voting on the following matters:

1. Nasdaq Proposal. For purposes of complying with Nasdaq Listing Rule 5635(d), to approve the issuance of up to 14,089,672 shares of Company common stock upon the exercise of certain warrants issued on December 26, 2023 in a private placement (collectively, the “Nasdaq Proposal”).

2. Adjournment Proposal. To approve an adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the Nasdaq Proposal (the “Adjournment Proposal”).

How does the Board recommend that I vote?

The Board unanimously recommends that you vote your shares as follows:

| |

●

|

“FOR” the Nasdaq Proposal; and

|

| |

●

|

“FOR” the Adjournment Proposal

|

None of our directors have informed us in writing that he or she intends to oppose any action intended to be taken by us at the Special Meeting.

How many votes are required to hold the Special Meeting and what are the voting procedures?

Quorum Requirement: As of the Record Date, 33,412,696 shares of the Company’s common stock were issued and outstanding. The holders of one-third in voting power of the outstanding shares of common stock entitled to vote at the Special Meeting, present in person or represented by proxy, constitutes a quorum and is required to transact business at the Special Meeting. If you submit a properly executed proxy, then you will be considered part of the quorum.

Required Votes: Each outstanding share of our common stock is entitled to one vote on each proposal at the Special Meeting. If there is a quorum at the Special Meeting, the matters to be voted upon by the stockholders require the following votes for such matter to be approved:

| |

●

|

Approval of the Nasdaq Proposal: The affirmative vote of the holders of a majority in voting power of the votes cast (excluding abstentions and broker non-votes) is necessary to approve the Nasdaq Proposal. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

|

| |

●

|

Approval of the Adjournment Proposal: The affirmative vote of the holders of a majority in voting power of the votes cast (excluding abstentions and broker non-votes) is necessary to approve the Adjournment Proposal. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

|

If a broker indicates on its proxy that it submits to the Company that it does not have authority to vote certain shares held in “street name,” the shares not voted are referred to as “broker non-votes.” Broker non-votes occur when brokers do not have discretionary voting authority to vote certain shares held in “street name” on particular proposals under the rules of the New York Stock Exchange, and the “beneficial owner” of those shares has not instructed the broker how to vote on those proposals. If you are a beneficial owner and you do not provide instructions to your broker, bank or other nominee, your broker, bank or other nominee is permitted to vote your shares for or against “routine” matters. Brokers are not permitted to exercise discretionary voting authority to vote your shares for or against “non-routine” matters.

How can I vote my shares in person and participate at the Special Meeting?

If you plan to attend the Special Meeting and vote in person on February 14, 2024, or at a later date if the meeting is adjourned or postponed, we will give you a ballot when you arrive. However, if your shares are held in the name of your broker, bank or other nominee, you must bring a power of attorney executed by the broker, bank or other nominee that owns the shares of record for your benefit and authorizing you to vote the shares.

Even if you plan to attend the Special Meeting in person, the Company recommends that you vote your shares in advance, so that your vote will be counted if you later decide not to attend the Special Meeting.

How can I vote my shares without attending the Special Meeting?

If you are the stockholder of record, you may vote by one of the following three methods:

If you elect to vote by mail and you requested and received a printed set of proxy materials, you may mark, sign, date and mail the proxy card you received from us in the return envelope. If you did not receive a printed proxy card and wish to vote by mail, you may do so by requesting a paper copy of the proxy materials (as described below), which will include a proxy card.

Whichever method of voting you use, the proxies identified on the proxy card will vote the shares of which you are the stockholder of record in accordance with your instructions. If you submit a proxy card properly voted and returned through available channels without giving specific voting instructions, the proxies will vote the shares as recommended by our Board.

If you own your shares in “street name,” that is, through a brokerage account or in another nominee form, you must provide instructions to the broker or nominee as to how your shares should be voted. Your broker or nominee will usually provide you with the appropriate instruction forms at the time you receive the proxy materials. If you own your shares in this manner, you cannot vote in person at the Special Meeting unless you receive a proxy to do so from the broker or the nominee.

How may I cast my vote over the Internet or by Telephone?

Voting over the Internet: If you are a stockholder of record, you may use the Internet to transmit your vote up until 11:59 P.M., Eastern Time, February 13, 2024 (the day before the Special Meeting). Visit https://materials.proxyvote.com/60855D and have your proxy card in hand when you access the website and follow the instructions to obtain your records and to create an electronic voting instruction form.

Voting by Telephone: If you are a stockholder of record, you may call 1-800-690-6903, toll-free in the United States, U.S. territories and Canada, and use any touch-tone telephone to transmit your vote up until 11:59 P.M., Eastern Time, February 13, 2024 (the day before the Special Meeting). Have your proxy card in hand when you call and then follow the instructions.

If you hold your shares in “street name,” that is through a broker, bank or other nominee, that institution will instruct you as to how your shares may be voted by proxy, including whether telephone or Internet voting options are available.

How may a stockholder bring any other business before the Special Meeting?

The Company’s Fourth Amended and Restated Bylaws (the “Bylaws”) provide that the only matters that may be brought before a special meeting are the matters specified in the notice of meeting, and, as such, stockholders shall not be permitted to propose business at the Special Meeting.

How may I revoke or change my vote?

If you are the record owner of your shares, and you completed and submitted a proxy card, you may revoke your proxy at any time before it is voted at the Special Meeting by:

| |

●

|

submitting a new proxy card with a later date;

|

| |

●

|

delivering written notice to our Corporate Secretary on or before 10:30 A.M. Central Time on February 14, 2024 (the Special Meeting date and time), stating that you are revoking your proxy;

|

| |

●

|

attending the Special Meeting and voting your shares in person; or

|

| |

●

|

if you are a record owner of your shares and you submitted your proxy by telephone or via the Internet, you may change your vote or revoke your proxy with a later telephone or Internet proxy, as the case may be.

|

Please note that attendance at the Special Meeting will not, in itself, constitute revocation of your proxy.

If you own your shares in “street name,” you may later revoke your voting instructions by informing the bank, broker or other holder of record in accordance with that entity’s procedures.

Who is paying for the costs of this proxy solicitation?

The Company will bear the cost of preparing, printing and mailing the materials in connection with this solicitation of proxies. In addition to mailing these materials, officers and regular employees of the Company may, without being additionally compensated, solicit proxies personally and by mail, telephone, facsimile or electronic communication.

We have also engaged Okapi at an approximate costs of $10,000, to solicit proxies on behalf of the Company.

Are there any rights of appraisal?

The Board of Directors is not proposing any action for which the laws of the State of Delaware, our Fourth Amended and Restated Certificate of Incorporation or our Bylaws provide a right of a stockholder to obtain appraisal of or payment for such stockholder’s shares.

Who will count the votes?

The inspector of election appointed for the Special Meeting will receive and tabulate the ballots and voting instruction forms. The Board has appointed ______ to serve as the inspector of election.

Where do I find the voting results of the Special Meeting?

The voting results will be disclosed in a Current Report on Form 8-K that we will file with the SEC within four (4) business days after the Special Meeting.

How can I obtain the Company’s corporate governance information?

Our corporate governance information is available on our website at www.moleculin.com under “Investors—Governance.” Our stockholders may also obtain written copies at no cost by writing to us at Moleculin Biotech, Inc., 5300 Memorial Drive, Suite 950, Houston, TX 77007, Attention: Corporate Secretary, or by calling (713) 300-5160.

BENEFICIAL OWNERSHIP OF COMMON STOCK

The following table sets forth information, as of December 26, 2023, regarding beneficial ownership of our common stock by:

• each of our directors;

• each of our named executive officers;

• all directors and executive officers as a group; and

• each person, or group of affiliated persons, known by us to beneficially own more than five percent of our shares of common stock.

Beneficial ownership is determined according to the rules of the SEC, and generally means that person has beneficial ownership of a security if he or she possesses sole or shared voting or investment power of that security and includes options that are currently exercisable or exercisable within 60 days. Each director or officer, as the case may be, has furnished us with information with respect to beneficial ownership. Except as otherwise indicated, we believe that the beneficial owners of common stock listed below, based on the information each of them has given to us, have sole investment and voting power with respect to their shares, except where community property laws may apply. Except as otherwise noted below, the address for each person or entity listed in the table is c/o Moleculin Biotech, Inc., 5300 Memorial Drive, Suite 950, Houston, Texas 77007.

| |

|

As of December 26, 2023

|

|

| |

|

Shares beneficially

owned

|

|

|

Percent of

Class (1)

|

|

|

Name of Beneficial Owner

|

|

|

|

|

|

|

|

|

|

Walter V. Klemp

|

|

|

1,373,283 |

|

(2) |

|

4.1 |

% |

|

Jonathan P. Foster

|

|

|

424,694 |

|

(3) |

|

1.3 |

% |

|

Donald Picker

|

|

|

294,262 |

|

(4) |

|

0.9 |

% |

|

Robert George

|

|

|

64,106 |

|

(5) |

|

Less than 1 |

% |

|

Michael Cannon

|

|

|

49,446 |

|

(6) |

|

Less than 1 |

% |

|

John Climaco

|

|

|

46,946 |

|

(6) |

|

Less than 1 |

% |

|

Elizabeth Cermak

|

|

|

39,445 |

|

(6) |

|

Less than 1 |

% |

|

Joy Yan

|

|

|

25,001 |

|

(6) |

|

Less than 1 |

% |

|

Directors and Executive Officers as a Group (8 persons)

|

|

|

2,317,183 |

|

(7) |

|

6.7 |

% |

(1) Based on 33,412,696 shares of common stock outstanding as of December 26, 2023.

(2) Includes 238,500 shares held by AnnaMed, Inc. that have been included in the amount for Mr. Klemp. Mr. Klemp has voting and dispositive power over the shares held by AnnaMed, Inc. Includes 453,903 shares underlying options exercisable within 60 days of August 21, 2023.

(3) Includes 344,138 shares underlying options exercisable within 60 days of December 26, 2023.

(4) Of the amount in the table, 105,000 shares held by IntertechBio Corp. have been included in the amounts for Dr. Picker. Dr. Picker shares voting and dispositive power over the shares held by IntertechBio Corp. Includes 99,256 shares underlying options exercisable within 60 days of August 21, 2023.

(5) Includes 49,446 shares underlying options exercisable within 60 days of December 26, 2023.

(6) Consists solely of shares underlying options exercisable within 60 days of December 26, 2023.

(7) Consists of the shares identified in footnotes (2)-(6).

PROPOSAL 1: THE NASDAQ PROPOSAL

We are asking stockholders to approve the issuance of up to 14,089,672 shares of our common stock upon the exercise of certain Warrants (defined below) issued in a Private Placement (as defined below) that closed on December 26, 2023, as contemplated by Nasdaq Listing Rules 5635(d), as described in more detail below.

On December 20, 2023, we entered into Securities Purchase Agreements (the “Purchase Agreements”) with an institutional investor and certain of our executive officers (including Walter V. Klemp, our Chairman and Chief Executive Officer, and Jonathan P. Foster, our Chief Financial Officer), employees, advisors and Robert George, a member of our board of directors (collectively, the “Investors”) for the sale of 3,602,253 shares (the “Shares”) of our common stock, and pre-funded warrants to purchase 3,442,583 shares of common stock in lieu thereof (the “Pre-Funded Warrants”) in a registered direct offering (the “Offering”). In a concurrent private placement (the “Private Placement”), we also sold to the Investors unregistered warrants to purchase up to an aggregate of 14,089,672 shares of common stock (the “Warrants”). The combined purchase price of one share of common stock (or pre-funded warrant in lieu thereof) and accompanying Warrant was $0.64 for the institutional investor, and $0.69 for the executive officers, employees, advisors and the member of our board of directors who participated in the Offering. The closing of the Offering and Private Placement occurred on December 26, 2023.

As required by Nasdaq Listing Rules 5635(d), the Warrants will only become exercisable on the effective date of the approval of our shareholders of this proposal at the Special Meeting. Under the terms of the Purchase Agreements we are required to hold a meeting of our stockholders in order to seek such approval within 60 days of the closing of the Offering, and if we do not obtain such approval at the first meeting, we have agreed to call a meeting every 90 days thereafter to seek such approval.

Description of Warrants

The following is a description of the Warrants that we are asking our stockholders to approve at the Special Meeting.

Each Warrant has an initial exercise price per share equal to $0.64, will become exercisable upon, and only upon, the approval of this Nasdaq Proposal at the Special Meeting, and will expire on the five-year anniversary of the date of the foregoing approval.

Subject to limited exceptions, a holder of Warrants will not have the right to exercise any portion of its Warrants if the holder, together with its affiliates, would beneficially own in excess of 4.99% of the number of shares of our common stock outstanding immediately after giving effect to such exercise. A holder may increase or decrease the beneficial ownership limitation up to 9.99%, provided, however, that any increase in the beneficial ownership limitation shall not be effective until 61 days following notice of such change to the Company.

If at the time a holder exercises its Warrants, a registration statement registering the issuance of the shares of common stock underlying the Warrants under the Securities Act is not then effective or available, then in lieu of making the cash payment otherwise contemplated to be made to us upon such exercise in payment of the aggregate exercise price, the holder may elect instead to receive upon such exercise (either in whole or in part) the net number of shares of common stock determined according to a formula set forth in the Warrants.

In the event of a Fundamental Transaction (as defined in the Warrant), we or any successor entity shall, at the holder’s option, purchase the holder’s Warrants for an amount of cash equal to the value of the Warrants as determined in accordance with the Black Scholes Value (as defined in the Warrant), provided that if the Fundamental Transaction involves a change of control (as described in the Warrant) and it is not within our control, including not approved by our Board of Directors, a holder shall only be entitled to receive the same type or form of consideration at the Black Scholes Value of the unexercised portion of the Warrant, that is being offered and paid to the holders of our common stock in connection with the change of control.

Subject to approval of this proposal at the Special Meeting, we may at any time during the term of the Warrants reduce the then current exercise price to any amount and for any period of time deemed appropriate by our board of directors.

Purpose of the Nasdaq Proposal

Our common stock is listed on The Nasdaq Capital Market and trades under the ticker symbol “MBRX.” Nasdaq Listing Rule 5635(d) requires stockholder approval of transactions other than public offerings of greater than 20% of the outstanding common stock of the issuer at a price that is less than the lower of: (i) the Nasdaq Official Closing Price (as reflected on Nasdaq.com) immediately preceding the signing of the binding agreement; or (ii) the average Nasdaq Official Closing Price of the common stock (as reflected on Nasdaq.com) for the five trading days immediately preceding the signing of the binding agreement (the “Minimum Price”).

In order to permit the Offering to be priced above the Minimum Price, the Warrants issued in the Private Placement were not permitted to be exercised until shareholder approval was received. This proposal is included in this proxy statement for purposes of seeking this approval.

Potential Consequences if the Nasdaq Proposal is Not Approved

The Board is not seeking the approval of our stockholders to authorize our entry into the Purchase Agreements or the issuance of the Warrants, as the Offering and Private Placement have already been completed and the Shares, Pre-Funded Warrants and Warrants, have already been issued. We are only asking for approval to allow the Warrants to become exercisable.

We agreed in the Purchase Agreements to hold a special meeting of stockholders at the earliest practicable date, but in no event later than 60 days after December 26, 2023 for the purpose of obtaining approval of this Nasdaq Proposal, with the recommendation of our Board of Directors that such proposal be approved. We agreed to solicit proxies from our stockholders for this proposal in the same manner as all other management proposals in this proxy statement and we agreed that all management-appointed proxyholders will vote their proxies in favor of this proposal. If we do not obtain approval of this Nasdaq Proposal at this Special Meeting, we are required to call a new meeting every 90 days to seek approval of this Nasdaq Proposal until the earlier of the date we receive approval of this Nasdaq Proposal, or the date the Warrants are no longer outstanding. As such, the failure of our stockholders to approve this Nasdaq Proposal will mean that we may incur substantially costs and expenses in the future in connection with calling additional meetings every 90 days for the life of the Warrants. The costs and expenses associated with seeking such approval could adversely impact our ability to fund our operations.

In addition, to the extent this Nasdaq Proposal is approved and if the Warrants are exercised by the holders for cash, we would receive up to $9.0 million in proceeds. If this Nasdaq Proposal is not approved, the Warrants will not be exercisable by the holders.

Potential Adverse Effects of the Approval of the Nasdaq Proposal

If this Proposal No. 1 is approved, existing stockholders will suffer dilution in their ownership interests in the future as a result of the potential issuance of shares of common stock upon exercise of the Warrants. Assuming the full exercise of the Warrants, an aggregate of 14,089,672 additional shares of common stock will be outstanding and the ownership interest of our existing stockholders would be correspondingly reduced.

The sale into the public market of these shares also could materially and adversely affect the market price of our common stock.

Interests of Certain Persons

In connection with the Offering and Private Placement, Walter V. Klemp, our Chairman and Chief Executive Officer, Jonathan P. Foster, our Chief Financial Officer, Robert George, one of our directors, and certain other employees and advisors, purchased an aggregate of 326,086 shares in the Offering and purchased Warrants to purchase an aggregate of up to 652,172 shares of common stock in the Private Placement. These individuals would benefit from the approval of this Nasdaq Proposal as their Warrants will not become exercisable unless this Nasdaq Proposal is approved.

Vote Required and Recommendation of the Board of Directors

The affirmative vote of the holders of a majority in voting power of the votes cast (excluding abstentions and broker non-votes) is necessary to approve the Nasdaq Proposal. Abstentions and broker non-votes will have no effect on the outcome of this proposal. The Board recommends that stockholders vote FOR the Nasdaq Proposal.

PROPOSAL 2: APPROVAL OF AN ADJOURNMENT OF THE SPECIAL MEETING, IF NECESSARY, TO SOLICIT ADDITIONAL PROXIES IF THERE ARE NOT SUFFICIENT VOTES IN FAVOR OF THE NASDAQ PROPOSAL

Overview

If the Special Meeting is convened and a quorum is present, but there are not sufficient votes to approve Proposal 1, one or more of our proxy holders may move to adjourn the Special Meeting at that time in order to enable our Board to solicit additional proxies.

In this proposal, we are asking our stockholders to authorize one or more of our proxy holders to adjourn the Special Meeting to another time and place, if necessary, to solicit additional proxies in the event that there are not sufficient votes to approve Proposal 1. If our stockholders approve this proposal, one or more of our proxy holders can adjourn the Special Meeting and any adjourned session of the Special Meeting to allow for additional time to solicit additional proxies, including the solicitation of proxies from our stockholders that have previously voted. Among other things, approval of this proposal could mean that, even if we had received proxies representing a sufficient number of votes to defeat Proposal 1, we could adjourn the Special Meeting without a vote on such proposals and seek to convince our stockholders to change their votes in favor of such proposals.

If it is necessary to adjourn the Special Meeting, no notice of the adjourned meeting is required to be given to our stockholders, other than an announcement at the Special Meeting of the time and place to which the Special Meeting is adjourned, so long as the meeting is adjourned for 30 days or less and no new record date is fixed for the adjourned meeting. At the adjourned meeting, we may transact any business which might have been transacted at the original meeting.

Vote Required and Recommendation of the Board of Directors

The affirmative vote of the holders of a majority in voting power of the votes cast (excluding abstentions and broker non-votes) is necessary to approve the Nasdaq Proposal. Abstentions and broker non-votes will have no effect on the outcome of this proposal. The Board recommends that stockholders vote FOR the approval to authorize the adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the Nasdaq Proposal.

OTHER BUSINESS

As of the date of this Proxy Statement, management does not know of any other matters that will be brought before the Special Meeting requiring action of the shareholders. However, if any other matters requiring the vote of the shareholders properly come before the Special Meeting, it is the intention of the persons named in the enclosed form of proxy to vote the proxies in accordance with the discretion of management. The persons designated as proxies will also have the right to approve any and all adjournments of the Special Meeting for any reason.

SHAREHOLDERS SHARING THE SAME ADDRESS

The SEC has adopted rules that permit companies and intermediaries (such as brokers, banks and other nominees) to implement a delivery procedure called “householding.” Under this procedure, multiple shareholders who reside at the same address may receive a single copy of the Proxy Statement and other proxy materials, unless the affected shareholder has provided contrary instructions. This procedure reduces printing costs and postage fees.

Under applicable law, if you consented or were deemed to have consented, your broker, bank or other intermediary may send only one copy of the Proxy Statement and other proxy materials to your address for all residents that own shares of the Company’s common stock in street name. If you wish to revoke your consent to householding, you must contact your broker, bank or other intermediary. If you are receiving multiple copies of the Proxy Statement and other proxy materials, you may be able to request householding by contacting your broker, bank or other intermediary. Upon written or oral request, we will promptly deliver a separate set of the Proxy Statement or other proxy materials to any beneficial owner at a shared address to which a single copy of any of those documents was delivered. If you wish to request copies free of charge of the Proxy Statement or other proxy materials, please send your request to Investor Relations, Moleculin Biotech, Inc., 5300 Memorial Drive, Suite 950, Houston, TX 77007 or call the Company with your request at (713) 300-5160.

Whether or not you expect to be present at the Special Meeting, please sign and return the enclosed proxy promptly. Your vote is important. If you are a stockholder of record and attend the Special Meeting and wish to vote in person, you may withdraw your proxy at any time prior to the vote.

| By Order of the Board of Directors |

|

|

MOLECULIN BIOTECH, INC.

|

|

| |

|

|

/s/ WALTER V. KLEMP

|

|

|

Walter V. Klemp

|

|

|

Chairman of the Board, President and Chief Executive Officer

|

|

| Houston, Texas |

|

| ______________, 2024 |

|

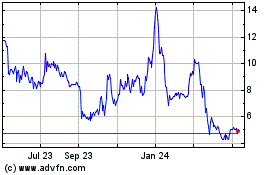

Moleculin Biotech (NASDAQ:MBRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

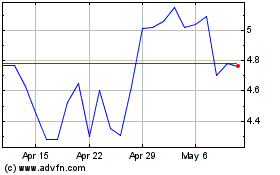

Moleculin Biotech (NASDAQ:MBRX)

Historical Stock Chart

From Apr 2023 to Apr 2024