PNM Resources Shares Lower Premarket as Avangrid Deal Crumbles

January 02 2024 - 6:36AM

Dow Jones News

By Colin Kellaher

Shares of PNM Resources slipped in premarket trading Tuesday

after the power company's $4.3 billion deal to be acquired by

Avangrid unraveled.

PNM, based in Albuquerque, N.M., said Avangrid walked away from

the 2020 agreement to buy PNM for $50.30 a share after the

companies were unable to win New Mexico regulatory approval.

New Mexico's supreme court is reviewing a decision by state

regulators denying the transaction, but Avangrid, which is

81.5%-owned by Spain's Iberdrola, said there was still no clear

timing on the resolution of the court's review or any subsequent

regulatory actions as 2023 came to a close.

PNM said it will continue to target long-term earnings growth of

5%, adding that it plans to give a financial update, including

preliminary 2023 results and 2024 guidance, on Feb. 6.

PNM shares, which ended 2023 at $41.60 amid investor doubts that

the deal would go through, were recently down 3.9% to $39.99 in

premarket trading.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

January 02, 2024 06:21 ET (11:21 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

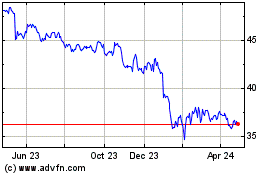

PNM Resources (NYSE:PNM)

Historical Stock Chart

From Apr 2024 to May 2024

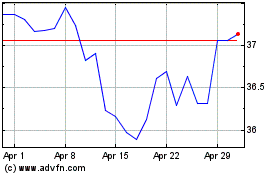

PNM Resources (NYSE:PNM)

Historical Stock Chart

From May 2023 to May 2024