U.S. index futures remained firm and stable in the pre-market on

Wednesday, as investors closely watched the progress of the S&P

500 index, which is moving towards hitting record milestones.

At 05:49 AM, the Dow Jones futures (DOWI:DJI) fell 2 points, or

0.01%. The S&P 500 futures fell 0.03% and the Nasdaq-100

futures retreated 0.01%. The yield rate of 10-year Treasury bonds

was at 3.872%.

In the commodities market, West Texas Intermediate crude oil for

February fell 0.67%, to $75.06 per barrel. Brent crude for February

fell 0.54%, near $80.63 per barrel. Iron ore with a concentration

of 62%, traded on the Dalian exchange, rose 0.5%, to $182.3 per

metric ton at its closing, heading for a second consecutive year of

gains.

European markets are up with the oil and gas sectors leading the

gains, and the European blue-chip index approaching its all-time

high.

Asian stocks advanced on Wednesday, following gains on Wall

Street. Tokyo’s Nikkei 225 rose 1.2%, while Hong Kong’s Hang Seng

and the Shanghai Composite also recorded gains. Shares of Chinese

video game companies recovered losses after government attempts to

ease market fears. Other Asian indices, such as the Kospi in Seoul

and the S&P/ASX 200 in Sydney, also showed increases, while

Bangkok’s SET had a slight decline and Mumbai’s Sensex rose.

On Tuesday, Dow Jones (+0.43%), S&P 500 (+0.42%), and Nasdaq

(+0.54%), marked a positive start to the last week of trading in

2023. The increase was led by Intel (NASDAQ:INTC),

due to a $3.2 billion grant from the Israeli government. Optimism

about moderate interest rates and the lack of significant economic

data kept some traders on the sidelines. Energy and semiconductor

sectors posted notable gains, along with stocks in networks, banks,

and telecommunications.

Wall Street Corporate Highlights for Today

Apple (NASDAQ:AAPL) – Apple has appealed the

import ban on its watches following patent infringement allegations

by Masimo (NASDAQ:MASI). The company seeks a temporary suspension

of the ban pending a decision by U.S. Customs. The legal dispute

continues as Apple halts sales of specific models. Apple will no

longer replace out-of-warranty models of the Apple Watch Series 6

and later, offering assistance through software, not hardware.

Apple’s wearables business generated $8.28 billion in the third

quarter of 2023. In other news, the Apple executive known for

leading the design of the iPhone and Apple Watch, Tang Tan, is

leaving the company to join LoveFrom, led by Jony Ive. He will work

on an early-stage artificial intelligence hardware project with

software resources provided by OpenAI. Apple’s shares are slightly

down in pre-market trading on Wednesday after falling for the past

four sessions.

Intel (NASDAQ:INTC) – Intel will invest $25

billion in Israel after securing $3.2 billion in incentives from

the Israeli government. The investment aims to expand wafer

manufacturing in Kiryat Gat and is part of Intel’s efforts to

create a more resilient global supply chain. This is the largest

investment ever made by a company in Israel. The Israeli government

has requested that Intel commence operations at the factory by 2028

and continue until at least 2035, while the company has also

committed to spending $16.6 billion with local suppliers, creating

direct and indirect jobs.

Micron Technology (NASDAQ:MU) – Micron

Technology has resolved an intellectual property theft lawsuit with

Fujian Jinhua, a state-backed Chinese company. The companies have

agreed to withdraw their legal actions against each other. This

agreement comes after the Chinese government blocked Micron’s chips

in May due to cybersecurity concerns.

Nvidia (NASDAQ:NVDA) – Nvidia and its employees

donated $15 million to Israeli charities and nonprofit

organizations assisting victims of the conflict between Israel and

Hamas. The donation included matching employee contributions and

additional humanitarian aid, such as computer donations and meals

for evacuees.

NetEase (NASDAQ:NTES), Tencent

(USOTC:TCEHY) – Shares of Chinese online gaming companies like

NetEase and Tencent rebounded in Hong Kong trading after a sharp

decline caused by stricter regulations. The Chinese regulator

proposed measures to curb excessive spending on games and ban

rewards. However, a subsequent statement mentioned the approval of

105 new online games, generating optimism in the sector and

boosting stocks. NetEase’s U.S.-listed shares are down 4% in

pre-market trading.

Toyota Motor (NYSE:TM) – Toyota’s global

production in November reached a record high with an 11% increase,

driven by strong demand in Japan and overseas following supply

chain disruptions the previous year. Global sales also rose by 14%,

indicating that Toyota is on track for record sales of over 10

million vehicles in 2023, with one-third of vehicles sold being

gasoline-electric hybrids. In related news regarding the shutdown

of its factories in Japan due to a safety scandal, Toyota

subsidiary Daihatsu Motor, specializing in small cars, will

compensate 423 domestic suppliers. The company will also help small

subcontractors access government support funds.

Tesla (NASDAQ:TSLA) – Tesla plans to launch a

refreshed version of the Model Y at its Shanghai factory, with

production scheduled to begin in 2024. The production overhaul was

previously reported in March.

Nio (NYSE:NIO) – Chinese electric car

manufacturer Nio has unveiled its executive sedan ET9, featuring

self-developed technologies, including semiconductors and

autonomous driving. The vehicle is expected to be delivered in the

first quarter of 2025, with an estimated price of $112,178, and the

company aims to expand its charging infrastructure and attract

investments. U.S. startup ClearMotion has secured a contract to

provide its active suspension technology to Nio, covering 750,000

vehicles in the ET9 model. This technology reduces vehicle motion

by approximately 75% compared to the best existing

technologies.

Cummins (NYSE:CMI) – Cummins, a truck engine

manufacturer, has agreed to pay a record fine of $1.675 billion for

installing devices that allowed excessive pollution emissions from

its engines, in violation of the U.S. Clean Air Act. The tampering

devices were used in RAM 2500 and 3500 pickups from 2013 to 2019,

resulting in excess nitrogen oxide production. This is the largest

civil penalty ever imposed for an environmental violation in the

United States.

Mullen Automotive (NASDAQ:MULN) – Mullen

Automotive’s shares are down over 2% in pre-market trading on

Wednesday, after rising 12% on Tuesday and falling 31% on Friday.

The electric vehicle manufacturer’s shares have faced significant

volatility, surging 78.1% on December 21st after a stock split, and

accumulating a 99.8% decline in 2023.

Plug Power (NASDAQ:PLUG) – Plug Power considers

the new U.S. rules for qualifying hydrogen projects for tax credits

to be “disappointing” but expects the regulations to become more

flexible after public comments. The rules require strict clean

energy usage and hourly matching to qualify for tax credits of up

to $3 per kilogram.

Chevron (NYSE:CVX) – Chevron faces profit

estimate reductions by Wall Street analysts and potential job cuts

due to operational setbacks in 2023. The company’s shares have

fallen 15% this year, while profit estimates for 2024 have

decreased by an average of 10.3%. Investors are questioning the

company’s operational targets, and 2024 is seen as a growth hiatus

year. Chevron also faces delays in the acquisition of

Hess (NYSE:HES) and challenges in its operations

in the Permian Basin and Kazakhstan.

ConocoPhillips (NYSE:COP) – ConocoPhillips has

financially approved its $8 billion Willow oil and gas project in

Alaska. The project aims to produce up to 180,000 barrels of oil

per day and is seen as a move to offset declining oil production in

the region, although it has faced opposition from environmental and

indigenous groups.

Goldman Sachs (NYSE:GS) – According to

Bloomberg, Goldman Sachs has learned two lessons when betting on

the post-pandemic reopening boom in China in 2023. First, that

emerging markets and ex-China emerging markets should be treated

differently due to the lack of correlation of Chinese assets with

other emerging assets. Second, that the resilience of emerging

markets, excluding China, is remarkable, thanks to proactive

policies by central banks in these countries.

Mastercard (NYSE:MA) – Retail sales in the

United States increased by 3.1% between November 1st and December

24th, below Mastercard’s expectations of 3.7%.

Amazon (NASDAQ:AMZN) and Walmart

(NYSE:WMT) increased promotions but not as deeply as in the

previous year when there was excess inventory due to the pandemic.

Online sales grew by 6.3%, slower than last year. Clothing and

restaurant sales increased, while electronics sales decreased by

0.4%.

Volcon (NASDAQ:VLCN) – Volcon’s shares are down

over 6% in pre-market trading on Wednesday, after rising 88.9% and

achieving a record daily gain on Tuesday, with a record turnover of

93.3 million shares. The electric off-road vehicle company had

previous supply chain issues but has now announced that remaining

components are in order, and shipments will commence in the first

quarter of 2024. The shares are still down 96.3% for the year.

Bristol Myers Squibb (NYSE:BMY), RayzeBio

(RYZB), Karuna Therapeutics (KRTX) – Bristol Myers Squibb will

acquire RayzeBio for approximately $4.1 billion to strengthen its

cancer drug portfolio. This is BMS’s second major deal in a week,

following the purchase of Karuna Therapeutics for $14 billion. The

deal aims to enhance BMS’s presence in the cancer treatment market,

especially with RayzeBio’s radiotherapeutic therapy RYZ101.

RayzeBio’s shares have increased by 27% since its market debut in

September.

AstraZeneca (NASDAQ:AZN), Gracell

Biotechnologies – AstraZeneca has announced the acquisition of

Gracell Biotechnologies, a Chinese biotechnology company focused on

cancer treatments, in a deal worth up to $1.2 billion. The

acquisition aims to boost AstraZeneca’s ambitions in cell therapy.

Gracell’s shareholders will receive $2 in common stock and an

additional contingent value right of 30 cents per share. The

transaction is expected to be completed in the first quarter of

2024, subject to regulatory approvals and Gracell’s shareholders.

American depositary receipts of Gracell surged 59% on Tuesday in

response to the news.

Emergent BioSolutions (NYSE:EBS) – Emergent

BioSolutions’ shares fell on Tuesday after rising more than 11% in

the two previous sessions. The recent surge was driven by the Biden

administration’s announcement of the availability of overdose

reversal drugs at federal facilities and public locations, but the

shares have still fallen 26.3% in the last three months.

Coherus BioSciences (NASDAQ:CHRS) – Coherus

BioSciences has received FDA approval for its Udenyca on-body

injector, resulting in a 33% increase in the company’s shares in

pre-market trading on Wednesday. Udenyca Onbody is a new

presentation of Coherus’ cancer drug, and it is expected to be

commercially available in the first quarter of 2024. The company’s

shares have fallen by 72% over the year.

Manchester United (NYSE:MANU) – Manchester

United’s shares closed higher on Tuesday after British billionaire

Jim Ratcliffe acquired a minority stake of 25% in the club. The

deal values the club at $5.4 billion. Ratcliffe will provide an

additional $300 million for future investments at Old Trafford

stadium and will assume responsibility for the club’s football

operations. The team faces pressure to improve its sporting

performance, and the Glazers are exploring options to sell the

club.

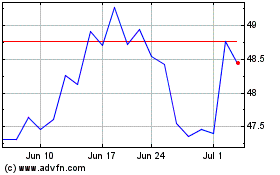

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

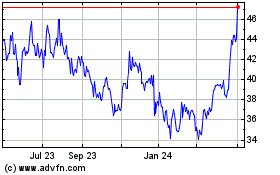

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Apr 2023 to Apr 2024