UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023

Commission File Number: 001-31528

IAMGOLD Corporation

(Translation of registrant's name into English)

401 Bay Street Suite 3200, PO Box 153

Toronto, Ontario, Canada M5H 2Y4

Tel: (416) 360-4710

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

[ ] Form 20-F [ x ] Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes [ ] No [ x ]

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ________

SUBMITTED HEREWITH

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

IAMGOLD CORPORATION |

| |

(Registrant) |

| |

|

|

| Date: December 18, 2023 |

By: |

/s/ Tim Bradburn |

| |

|

Tim Bradburn |

| |

Title: |

Senior Vice President, General Counsel and Corporate Secretary |

|

|

|

TSX: IMG NYSE: IAG

|

NEWS RELEASE |

IAMGOLD FILES UPDATED TECHNICAL REPORT FOR ESSAKANE GOLD MINE

All monetary amounts are expressed in U.S. dollars, unless otherwise indicated.

Toronto, Ontario, December 18, 2023 - IAMGOLD Corporation (NYSE:IAG, TSX:IMG) ("IAMGOLD" or the "Company") is pleased to announce the filling of a Technical Report (the "Technical Report") for the Company's Essakane Gold Mine ("Essakane"), located in Burkina Faso. The primary objective of the Technical Report is to provide an updated Mineral Resource and Mineral Reserve ("MRMR") estimate and an accompanying updated life of mine ("LOM") plan for Essakane. The Technical Report was prepared in accordance with the disclosure requirements of National Instrument 43-101 ("NI 43-101") and has an effective date of September 30, 2023. The Technical Report is available on SEDAR at www.sedar.com and on the Company's website at www.iamgold.com.

Highlights of updated Technical Report

• Mine life extension to 2028, mining will occur from three remaining pit phases in the Essakane Main Zone ("EMZ") pit, and the Lao and Gourouol satellite pits

• Overall production of 2.4 million ounces of gold ("oz Au") from 2023 to 2028, with an annual average gold production of approximately 400,300 oz Au during this period

• Average estimated operating costs over the LOM (2023-2028) $32.49/t milled net of capitalized waste stripping ("CWS") (excluding CWS and stockpile movements, with CWS being transferred to sustaining capital).

• Capital expenditures over life of mine estimated at $502.7 million (including 2023)

• Mineral Reserve estimate from the open pit increased 21% to 1.9 million ounces at an average grade of 1.32 g/t

• Mineral Resource estimate from the open pit increased 37% to 3.1 million ounces at an average grade of 1.40 g/t

"As one of the top gold producing mines in West Africa, Essakane continues to be an integral part of IAMGOLD," commented Renaud Adams, President and Chief Executive Officer of IAMGOLD. "The filing of the updated Technical Report today demonstrates the successes our teams have had within the fence delineating additional ounces which have increased our mineral resource inventory and more than offset mine production depletion in 2023. As a result, we have been able to extend the mine life of Essakane an additional year, providing visibility for the next five years of operations at the project."

Essakane MRMR Comparison Summary1

|

|

Updated Technical Report2,3

(as of Sep 30, 2023)

|

Dec. 31, 2022 MRMR Estimate2,4

|

|

|

|

|

Tonnage

|

Grade

|

Ounces

|

Tonnage

|

Grade

|

Ounces

|

Au

|

|

|

|

(000 t)

|

(g/t Au)

|

(000 oz)

|

(000 t)

|

(g/t Au)

|

(000 oz)

|

(000 oz)

|

%

|

|

P+P reserves (stockpile)

|

20,089

|

0.64

|

413

|

21,413

|

0.7

|

464

|

-51

|

-11%

|

|

P+P reserves (open pit)

|

45,440

|

1.32

|

1,934

|

31,858

|

1.6

|

1,597

|

337

|

+21%

|

|

Total P+P reserves

|

65,529

|

1.11

|

2,348

|

53,271

|

1.2

|

2,061

|

287

|

+14%

|

|

|

|

|

|

|

|

|

|

|

|

M&I resources2 (stockpile)

|

20,981

|

0.64

|

429

|

34,282

|

0.6

|

607

|

-178

|

-29%

|

|

M&I resources2 (open pit)

|

68,631

|

1.40

|

3,088

|

52,945

|

1.3

|

2,247

|

841

|

+37%

|

|

Total M&I resources2

|

89,612

|

1.22

|

3,517

|

87,227

|

1.0

|

2,854

|

663

|

+23%

|

|

Inferred resources

|

8,521

|

1.47

|

402

|

2,318

|

1.4

|

107

|

295

|

+276%

|

- Mineral Reserves and Mineral Resources on a 100% basis. IAMGOLD has a 90% project interest and the Government of Burkina Faso has a 10% interest.

- M&I Mineral Resources are inclusive of Mineral Reserves

- Updated Technical Report Mineral Resources are reported assuming a gold price of US$1,700 and Mineral Reserves are reported assuming a gold price of US$1,400/oz.

- December 31, 2022 Mineral Resources are reported assuming a gold price of US$1,500 and Mineral Reserves are reported assuming a gold price of US$1,300/oz.

Mineral Resources

|

Category

|

Tonnage

(000 t)

|

Grade

(g/t Au)

|

Au

(000 oz)

|

|

Measured

|

20,981

|

0.64

|

429

|

|

Indicated

|

68,631

|

1.40

|

3,088

|

|

Total M+I Resources

|

89,612

|

1.22

|

3,517

|

|

Inferred

|

8,521

|

1.47

|

402

|

Notes:

- Measured Mineral Resources are reported in place as stockpiles. Indicated and Inferred Mineral Resources are insitu. All Mineral Resources have an effective date of September 30, 2023. The Qualified Person for the insitu estimate is Mr. Haithem Chattaoui P.Eng, an IAMGOLD employee. The Qualified Person for the stockpile estimate is Mr. Michel Dromacque, C.Eng., an IAMGOLD employee.

- Mineral Resources are reported using the 2014 CIM Definition Standards on a 100% basis. IAMGOLD has a 90% project interest and the Government of Burkina Faso has a 10% interest.

- Mineral Resources are reported inclusive of those Mineral Resources converted to Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Mineral Resources are reported assuming a gold price of US$1,700. Mineral Resources are confined within a conceptual pit shell that uses the following input assumptions: conventional open pit mining methods; process through a carbon-in-leach (CIL) plant; variable metallurgical recoveries based on weathering zones (95% in saprolite, 93% in transition material and an average of 90.07% in fresh rock); variable processing rates based on weathering zones (15 Mt/a in saprolite, 13.09 Mt/a in transition material and 12.29 Mt/a in fresh rock); no allowance for mining dilution; mineralization based costs that vary by weathering zone (US$16.49/t treated in saprolite, US$19.48/t treated in transition material and US$21.71/t treated in fresh rock); allocations for waste rock and incremental bench cost; overall pit slope angles that vary by weathering zone are the same used for operation and a 6.5% royalty. Mineral Resources are reported at variable cut-off grades that vary by weathering zone (0.34 g/t Au for saprolite, 0.41 g/t Au for transition material and 0.48 g/t Au for fresh rock).

- Table numbers have been rounded. Totals may not sum due to rounding.

Mineral Reserves

|

Category

|

Tonnage

(000 t)

|

Grade

(g/t Au)

|

Au

(000 oz)

|

|

Proven Mineral Reserves (open pit)

|

-

|

-

|

-

|

|

Proven Mineral Reserves (stockpile)

|

20,089

|

0.64

|

413

|

|

Probable Mineral Reserves (open pit)

|

45,440

|

1.32

|

1,934

|

|

Total Proven and Probable

|

65,529

|

1.11

|

2,348

|

Notes:

- Mineral Reserves are reported for the Essakane Main Pit, Lao, and Gourouol Satellite areas at the point of delivery to the process plant with an effective date of September 30, 2023. The Qualified Person for the estimate is Mr. Michel Dromacque, C.Eng., an IAMGOLD employee.

- Mineral Reserves are reported using the 2014 CIM Definition Standards on a 100% basis. IAMGOLD has a 90% project interest and the Government of Burkina Faso has a 10% interest.

- Mineral Reserves are reported assuming a gold price of US$1,400/oz. Mineral Reserves are confined within a an open pit shell that uses the following input assumptions: conventional open pit mining methods; process through a carbon-in-leach (CIL) plant; average CIL recovery of 90.26%; process average throughput rate of 12.29 Mt/a; mining dilution of 7-12%; ore loss of 1-4%; inclusion of 5% mining royalty at US$1,400/oz Au; mining cost: US$4.76/t mined, processing cost: US$16.22/t milled (inclusive of power), G&A cost: US$5.71/t milled; bench face slope angles that vary by geotechnical zone (50-85°); and variable cut-off grades ranging from 0.41-0.57 g/t Au.

- Mineral reserves are based on topographic surveyed surfaces at September 30, 2023.

- Numbers have been rounded. Totals may not sum due to rounding.

Life of Mine Plan

The mine life is forecast from 2023 to 2028, averaging 400,300 oz Au/year with a total production of 2.4 Moz Au over the production period. The LOM plan is based on the completion of five different mining phases:

• EMZ: three phases, Phases 5, 6, 7. Represents 87% of the gold to be mined in the LOM plan. Phase 5 is the current north phase of the EMZ pit, and the main source of ore at the Report effective date. Phase 6 is the final push back for the south part of the EMZ pit. Phase 7 is the final push back for the north part of the EMZ pit, and represents an extension of Phase 5 on the eastern wall of the EMZ pit;

• Gourouol: located to the north of the EMZ pit;

• Lao: located to the south of the EMZ pit, and accounts for 12% of the gold to be mined in the LOM plan.

The Essakane processing plant has a process rate limit of 12.19 Mtpa of hard rock equivalent. The 2024 LOM plan assumes a processing throughput capacity of 13.05 Mtpa. This is achieved by ensuring a minimum of 1.1 Mtpa of softer transition and saprolite ore will be fed to the process plant. The updated LOM plan no longer incorporates the investment, construction and operation of a heap leach facility following the successful demonstration of the capability of the plant to process a portion of the stockpiles that were designated for heap leaching through the existing facilities.

Table 1 - Essakane LOM Plan Summary

|

|

Units

|

20231

|

2024

|

2025

|

2026

|

2027

|

2028

|

Total

|

|

Ore mined

|

000 t

|

9,490

|

10,087

|

9,070

|

8,725

|

8,507

|

5,785

|

51,664

|

|

Grade mined

|

g/t Au

|

1.30

|

1.23

|

1.27

|

1.39

|

1.42

|

1.30

|

1.32

|

|

Waste mined

|

000 t

|

33,848

|

36,743

|

35,724

|

28,625

|

15,750

|

5,628

|

156,318

|

|

Total mined

|

000 t

|

43,338

|

46,830

|

44,794

|

37,350

|

24,257

|

11,414

|

207,983

|

|

Ore milled

|

000 t

|

11,213

|

12,733

|

13,072

|

13,011

|

13,055

|

10,525

|

73,609

|

|

Mill grade

|

g/t Au

|

1.23

|

1.10

|

1.10

|

1.12

|

1.12

|

1.08

|

1.12

|

|

Recovery

|

%

|

90.3

|

90.0

|

90.2

|

90.5

|

90.5

|

90.0

|

90.2

|

|

Gold production

|

000 oz

|

401

|

406

|

417

|

424

|

425

|

329

|

2,402

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING COST

|

|

|

|

|

|

|

|

|

|

Mining Cost (incl CWS+SP)2

|

$M

|

218.3

|

236.9

|

213.4

|

162.3

|

109.2

|

52.2

|

992.3

|

|

Process cost

|

$M

|

207.8

|

224.9

|

208.5

|

199.8

|

191.9

|

161.5

|

1,194.3

|

|

G&A cost

|

$M

|

87.9

|

86.0

|

76.9

|

68.1

|

53.8

|

47.6

|

420.4

|

|

Total

|

$M

|

514.1

|

547.8

|

498.9

|

430.2

|

354.9

|

261.2

|

2607.0

|

|

Unit Cost

|

|

|

|

|

|

|

|

|

|

Mining Cost (incl. CWS+SP)2

|

$/t mined

|

$4.96

|

$5.06

|

$4.76

|

$4.35

|

$4.50

|

$4.57

|

$4.76

|

|

|

|

|

|

|

|

|

|

|

|

Mining Cost (net of CWS+SP)3

|

$/t processed

|

$12.84

|

$12.15

|

$14.99

|

$7.47

|

$6.99

|

$8.95

|

$10.56

|

|

Process cost

|

$/t processed

|

$18.48

|

$17.66

|

$15.95

|

$15.35

|

$14.70

|

$15.34

|

$16.22

|

|

G&A cost

|

$/t processed

|

$7.82

|

$6.76

|

$5.88

|

$5.24

|

$4.12

|

$4.52

|

$5.71

|

|

Total - net of CWS+SP3

|

$/t processed

|

$39.14

|

$36.56

|

$36.83

|

$28.07

|

$25.81

|

$28.81

|

$32.49

|

|

Total - incl. of CWS+SP2

|

$/t processed

|

$45.72

|

$43.02

|

$38.16

|

$33.06

|

$27.18

|

$24.82

|

$35.40

|

|

|

|

|

|

|

|

|

|

|

|

Total SUSTAINING CAPITAL

|

$M

|

123.8

|

150.4

|

76.5

|

82.7

|

19.8

|

0.2

|

453.4

|

|

NON-SUSTAINING CAPITAL

|

$M

|

1.8

|

4

|

12

|

11.5

|

10

|

10

|

49.3

|

|

Total CAPITAL EXPENDITURE

|

$M

|

125.6

|

154.4

|

88.5

|

94.2

|

29.8

|

10.2

|

502.7

|

- 2023 metrics based on actual year to date up to September 30, 2023, with remaining three months of 2023 as forecast in the mine plan.

- Mining Cost (incl. CWS+SP) is the mining cost which includes capitalized waste stripping and stockpile movement costs.

- Mining (net of CWS+SP) is the mining cost excluding capitalized waste stripping and stockpile movements, with capitalized waste stripping being transferred to sustaining capital.

The political and security environment remains volatile in the Sahel region of Burkina Faso, particularly in the area where the mine is located. Terrorist-related incidents continue unabated in the country, the immediate region of the Essakane mine and, more broadly, the Sahel region of West Africa. IAMGOLD continues to take proactive measures to ensure the safety and security of in-country personnel and is constantly adjusting its protocols and the activity levels at the site according to the security environment.

About IAMGOLD

IAMGOLD is an intermediate gold producer and developer based in Canada with operating mines in North America and West Africa. The Company is building the large-scale, long life Côté Gold project in Canada in partnership with Sumitomo Metal Mining Co. Ltd., which is expected to commence production in early 2024. In addition, the Company has an established portfolio of early stage and advanced exploration projects within high potential mining districts in the Americas. IAMGOLD employs approximately 3,300 people and is committed to maintaining its culture of accountable mining through high standards of Environmental, Social and Governance ("ESG") practices, including its commitment to Zero Harm®, in every aspect of its business. IAMGOLD is listed on the New York Stock Exchange (NYSE:IAG) and the Toronto Stock Exchange (TSX:IMG) and is one of the companies on the Jantzi Social Index ("JSI"), a socially screened market capitalization-weighted consisting of companies which pass a set of broadly based environmental, social and governance rating criteria.

IAMGOLD Contact Information

Graeme Jennings, Vice President, Investor Relations

Tel: 416 360 4743 | Mobile: 416 388 6883

Toll-free: 1 888 464 9999

info@iamgold.com

QUALIFIED PERSON AND TECHNICAL INFORMATION

The "Technical Report on the Essakane Gold Mine, Sahel Region, Burkina Faso" that has an effective date of September 30, 2023 was prepared by Mr. Francois J. Sawadogo, MAIG, Mr. Haithem Chattaoui, P.Eng., Mr. Rémi Lapointe, ing, Mr. Michel Dromacque, C.Eng., Mr. Denis Doucet, ing, and Mr. Franck Napon, ing. for IAMGOLD Corporation. These individuals are each a Qualified Person ("QP"), as defined in NI 43-101, and have reviewed and approved the information contained in this news release that is derived from their respective sections of disclosure that is contained in the Technical Report.

Lisa Ragsdale, P.Geo (Director, Mining Geology, IAMGOLD Corporation), is the QP responsible for the review and approval of the mineral resource estimates contained herein, as at December 31, 2022. Guy Bourque, Eng. (Director, Mining, IAMGOLD Corporation), is the QP responsible for the review and approval of mineral reserve estimates contained herein, as at December 31, 2022.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

All information included in this news release, including any information as to the Company's future financial or operating performance and other statements that express management's expectations or estimates of future performance, including statements in respect of the prospects and/or development of the Company's projects, other than statements of historical fact, constitutes forward-looking information or forward-looking statements within the meaning of applicable securities laws (collectively referred to herein as "forward-looking statements") and such forward-looking statements are based on expectations, estimates and projections as of the date of this news release. Forward-looking statements are generally identifiable by the use of words such as "may", "will", "should", "continue", "expect", "budget", "aim", "can", "focus", "forecast", "anticipate", "estimate", "believe", "intend", "plan", "schedule", "guidance", "outlook", "potential", "seek", "targets", "cover", "strategy", "during", "ongoing", "subject to", "future", "objectives", "opportunities", "committed", "prospective", or "project" or the negative of these words or other variations on these words or comparable terminology. For example, forward-looking statements in this news release include, without limitation, those under the headings "Outlook", "Quarterly Updates", "Exploration", "Liquidity and Capital Resources" and "Market Trends" and include, but are not limited to, statements with respect to: the estimation of mineral reserves and mineral resources and the realization of such estimates; operational and financial performance including the Company's guidance for and actual results of production, costs and capital and other expenditures such as exploration and including depreciation expense and effective tax rate; the expected costs and schedule to complete construction of the Côté Gold project; the updated life-of-mine plan, ramp up assumptions and other project metrics including operating costs in respect to the Côté Gold project; expected benefits from the operational improvements and de-risking strategies implemented or to be implemented by the Company; mine development activities; the Company's capital allocation; the composition of the Company's portfolio of assets including its operating mines, development and exploration projects; the completion of the sale of the Bambouk assets; permitting timelines and the expected receipt of permits; inflation and inflationary pressures; global supply chain constraints; the ability to secure alternative sources of consumables of comparable quality and on reasonable terms; workforce and contractor availability, labour costs and other labour impacts; the impacts of weather; the future price of gold and other commodities; foreign exchange rates and currency fluctuations; impairment assessments and assets carrying values estimates; safety and security concerns in the jurisdictions in which the Company operates and the impact thereof on the Company's operational and financial performance and financial condition; and government regulation of mining operations.

The Company cautions the reader that forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, financial, operational and other risks, uncertainties, contingencies and other factors, including those described below, which could cause actual results, performance or achievements of the Company to be materially different from results, performance or achievements expressed or implied by such forward-looking statements and, as such, undue reliance must not be placed on them. Forward-looking statements are also based on numerous material factors and assumptions, including as described in this news release, including with respect to: the Company's present and future business strategies; operations performance within expected ranges; anticipated future production and cash flows; local and global economic conditions and the environment in which the Company will operate in the future; the price of precious metals, other minerals and key commodities; projected mineral grades; international exchanges rates; anticipated capital and operating costs; the availability and timing of required governmental and other approvals for the construction of the Company's projects.

Risks, uncertainties, contingencies and other factors that could cause actual results, performance or achievements of the Company to be materially different from results, performance or achievements expressed or implied by such forward-looking statements include, without limitation: the ability of the Company to successfully complete the construction of Côté Gold and commence commercial production from the mine; the ability of the Company to complete the sales of the remaining Bambouk assets; the Company's business strategies and its ability to execute thereon; security risks, including civil unrest, war or terrorism and disruptions to the Company's supply chain as a result of such security risks, particularly in Burkina Faso and the Sahel region surrounding the Company's Essakane mine; the ongoing impacts of COVID-19 (and its variants) on the Company and its workforce; the availability of labour and qualified contractors; the availability of key inputs for the Company's operations and disruptions in global supply chains; the volatility of the Company's securities; litigation; contests over title to properties, particularly title to undeveloped properties; mine closure and rehabilitation risks; management of certain of the Company's assets by other companies or joint venture partners; the lack of availability of insurance covering all of the risks associated with a mining company's operations; unexpected geological conditions; competition and consolidation in the mining sector; the profitability of the Company being highly dependent on the condition and results of the mining industry as a whole, and the gold mining industry in particular; changes in the global prices for gold, and commodities used in the operation of the Company's business (such as diesel and electricity); legal, litigation, legislative, political or economic risks and new developments in the jurisdictions in which the Company carries on business; changes in taxes, including mining tax regimes; the failure to obtain in a timely manner from authorities key permits, authorizations or approvals necessary for exploration, development or operation, operating or technical difficulties in connection with mining or development activities, including geotechnical difficulties and major equipment failure; the inability of the Company to participate in any gold price increase above the cap in any collar transaction entered into in conjunction with certain gold sale prepayment arrangements; the availability of capital; the level of liquidity and capital resources; access to capital markets and financing; the Company's level of indebtedness; the Company's ability to satisfy covenants under its credit facilities; changes in interest rates; adverse changes in the Company's credit rating; the Company's choices in capital allocation; effectiveness of the Company's ongoing cost containment efforts; the Company's ability to execute on de-risking activities and measures to improve operations; availability of specific assets to meet contractual obligations; risks related to third-party contractors, including reduced control over aspects of the Company's operations and/or the failure and/or the effectiveness of contractors to perform; risks arising from holding derivative instruments; changes in U.S. dollar and other currency exchange rates or gold lease rates; capital and currency controls in foreign jurisdictions; assessment of carrying values for the Company's assets, including the ongoing potential for material impairment and/or write-downs of such assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; the fact that reserves and resources, expected metallurgical recoveries, capital and operating costs are estimates which may require revision; the presence of unfavourable content in ore deposits, including clay and coarse gold; inaccuracies in life of mine plans; failure to meet operational targets; equipment malfunctions; information systems security threats and cybersecurity; laws and regulations governing the protection of the environment; employee relations and labour disputes; the maintenance of tailings storage facilities and the potential for a major spill or failure of the tailings facilities due to uncontrollable events, lack of reliable infrastructure, including access to roads, bridges, power sources and water supplies; physical and regulatory risks related to climate change; unpredictable weather patterns and challenging weather conditions at mine sites; disruptions from weather related events resulting in limited or no productivity such as forest fires, flooding, heavy snowfall, poor air quality, and extreme heat or cold; attraction and retention of key employees and other qualified personnel; availability and increasing costs associated with mining inputs and labour, negotiations with respect to new, reasonable collective labour agreements may not be agreed to; the ability of contractors to timely complete projects on acceptable terms; the relationship with the communities surrounding the Company's operations and projects; indigenous rights or claims; illegal mining; the potential direct or indirect operational impacts resulting from external factors, including infectious diseases, pandemics, or other public health emergencies; and the inherent risks involved in the exploration, development and mining business generally. Please see the Company's AIF or Form 40-F available on www.sedar.com or www.sec.gov/edgar.shtml for a comprehensive discussion of the risks faced by the Company and which may cause actual results, performance or achievements of the Company to be materially different from results, performance or achievements expressed or implied by forward-looking statements.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as required by applicable law.

All material information on IAMGOLD can be found at www.sedar.com or at www.sec.gov.

Si vous désirez obtenir la version française de ce communiqué, veuillez consulter le www.iamgold.com/French/accueil/default.aspx.

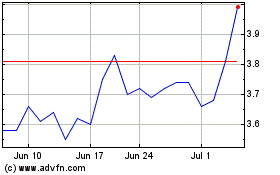

Iamgold (NYSE:IAG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Iamgold (NYSE:IAG)

Historical Stock Chart

From Apr 2023 to Apr 2024