Form 8-K - Current report

December 19 2023 - 4:05PM

Edgar (US Regulatory)

false

0001106644

0001106644

2023-12-15

2023-12-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): December

15, 2023

CHINA PHARMA HOLDINGS, INC.

(Exact name of Registrant as specified in charter)

| Nevada |

|

001-34471 |

|

73-1564807 |

| (State or other jurisdiction |

|

(Commission File No.) |

|

(IRS Employer |

| of Incorporation) |

|

|

|

Identification No.) |

Second Floor, No. 17, Jinpan Road

Haikou, Hainan Province, China 570216

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area

code: +86 898-6681-1730 (China)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17CFR230.425) |

| |

☐ |

Soliciting material pursuant to Rule14a-12 under the Exchange Act (17CFR240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17CFR240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17CFR240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

CPHI |

|

NYSE American |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.07. Submission of Matters to a Vote

of Security Holders.

On December 17, 2023, China

Pharma Holdings, Inc. (the “Company”) held its annual stockholders’ meeting for the fiscal year ended December

31, 2022 (the “Annual Meeting”). Holders of 17,225,997 shares of the Company’s common stock were present in person

or by proxy at the Annual Meeting, representing 54% of the total outstanding shares of common stock and therefore constituting a quorum

of more than one-third of the shares outstanding and entitled to vote at the Annual Meeting as of the record date.

The final voting results

for the matters submitted to a vote of stockholders at the meeting are as follows.

| |

1. |

A proposal to elect three independent director nominees to our Board of Directors: |

| Independent Director’s Name |

|

Votes For |

|

Votes Withheld |

| Gene Michael Bennett |

|

17,174,742 |

|

51,255 |

| Yingwen Zhang |

|

17,165,245 |

|

60,752 |

| Baowen Dong |

|

17,165,232 |

|

60,765 |

Pursuant to the foregoing

votes, Gene Michael Bennett, Yingwen Zhang and Baowen Dong were elected to serve as our independent directors until the next annual meeting

and until their successors are elected and qualified.

| |

2. |

A proposal to adopt the Amendment No.1 to the

Company’s Amended and Restated 2010 Long-Term Incentive Plan: |

| Votes For |

|

Votes Against |

|

Abstentions |

| 17,073,265 |

|

147,382 |

|

5,350 |

Pursuant to the foregoing

votes, the Amendment No.1 to the Company’s Amended and Restated 2010 Long-Term Incentive Plan was approved and adopted.

| 3. | A proposal to amend the Company’s Articles of Incorporation to effect a reverse stock split at a

ratio of up to 1:10, such that every holder of common stock, par value $0.001 per share, of the Company, shall receive one share of Common

Stock for up to every ten shares of Common Stock held: |

| Votes For |

|

Votes Against |

|

Abstentions |

| 17,060,203 |

|

165,541 |

|

253 |

Pursuant to the foregoing

votes, an amendment to the Company’s Articles of Incorporation to effect a reverse stock split at a ratio of up to 1:10, such that

every holder of common stock, par value $0.001 per share, of the Company, shall receive one share of Common Stock for up to every ten

shares of Common Stock held was approved and adopted. Despite of the foregoing, the Board of the Directors has the discretion to decide

if and when to effect the reverse stock split.

Item 8.01. Other Events.

On December 15, 2023, the Company

received a notification from the NYSE American (the “Exchange”) stating that the Company is back in compliance with

the NYSE American continued listing standards. Specifically, the Company has resolved the continued listing deficiency with respect to

Sections 1003(a)(ii) and (iii) of the NYSE American Company Guide (the “Company

Guide”) referenced in the Exchange’s letter dated June 15, 2022 and December 1, 2022, each of which has been disclosed

by the Company in the Current Reports on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on

June 22, 2022 (Initial Equity Notification) and December 2, 2022 (Second Equity Notification).

The Company will be subject to

NYSE Regulation’s normal continued listing monitoring. However, if the Company is again determined to be below any of the continued

listing standards within 12 months from December 15, 2023, the Exchange will examine the relationship between the two incidents of noncompliance

and re-evaluate the Company’s method of financial recovery from the first incident. NYSE Regulation will then take the appropriate

action, which, depending on the circumstances, may include truncating the compliance procedures described Section 1009 of the Company

Guide or immediately initiating delisting proceedings.

Lastly, the below compliance (“.BC”)

indicator will remain on the Company’s ticker as the Company continues to be below compliance with Section

1003(f)(v) of the Company Guide. Specifically, the Company remains subject to the conditions set forth in the letter from the Exchange

dated September 27, 2023 for selling the Company’s securities for a low price per share for a substantial period of time, which

the Company has disclosed in the Current Report on Form 8-K filed with the SEC on October 3, 2023.

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Dated: December 19, 2023

| |

CHINA PHARMA HOLDINGS, INC. |

| |

|

| |

By: |

/s/ Zhilin Li |

| |

|

Name: |

Zhilin Li |

| |

|

Title: |

President and

Chief Executive Officer |

v3.23.4

Cover

|

Dec. 15, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 15, 2023

|

| Entity File Number |

001-34471

|

| Entity Registrant Name |

CHINA PHARMA HOLDINGS, INC.

|

| Entity Central Index Key |

0001106644

|

| Entity Tax Identification Number |

73-1564807

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

Second Floor, No. 17

|

| Entity Address, Address Line Two |

Jinpan Road

|

| Entity Address, Address Line Three |

Haikou

|

| Entity Address, City or Town |

Hainan Province

|

| Entity Address, Country |

CN

|

| Entity Address, Postal Zip Code |

570216

|

| City Area Code |

86

|

| Local Phone Number |

898-6681-1730

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

CPHI

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

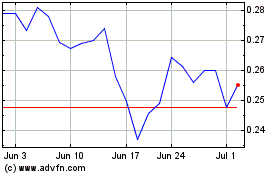

China Pharma (AMEX:CPHI)

Historical Stock Chart

From Mar 2024 to Apr 2024

China Pharma (AMEX:CPHI)

Historical Stock Chart

From Apr 2023 to Apr 2024