UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

December 15, 2023

Commission File Number 001-37974

VIVOPOWER INTERNATIONAL PLC

(Translation of registrant’s name into English)

The Scalpel, 18th Floor, 52 Lime Street

London EC3M 7AF

United Kingdom

+44-203-667-5158

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F:

Form 20- F ☒ Form 40-F ☐

CONTENTS

On December 12, 2023, VivoPower International PLC, a public limited company organized under the laws of England and Wales (the “Company”), entered into an ordinary share purchase agreement (the “Share Subscription Agreement”) with Abri Advisors Ltd (“Abri Advisors” or the “Investor”), pursuant to which the Company issued and sold 220,000 of its ordinary shares, nominal value $0.12 per share (the “Ordinary Shares”), at a price per share of $1.15, to Abri Advisors Ltd (“Abri Advisors”).

The Share Subscription Agreement contains customary representations and warranties and agreements of the Company and the Investor and customary indemnification rights and obligations of the parties.

The Ordinary Shares were offered by the Company pursuant to a registration statement on Form F-3 (File No. 333-251304) (the “Registration Statement”), previously filed and declared effective by the Securities and Exchange Commission (the “Commission”) on December 23, 2020 and the base prospectus filed as part of the Registration Statement, the prospectus supplement dated December 15, 2023 (the “Prospectus Supplement”). In order for there to be sufficient authority under section 551 of the Companies Act 2006 for the Company to issue the Ordinary Shares pursuant to the Share Subscription Agreement, the Company terminated the proposed issuance of warrants to AWN Holdings Limited (“AWN”) on December 8, 2023 (which it had previously disclosed in its Annual Report on Form 20-F for the year ended June 30, 2023, or were agreed in subsequent board resolutions).

The foregoing summary of the Share Subscription Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Share Subscription Agreement, which is attached as Exhibit 10.1 to this Report on Form 6-K and is incorporated herein by reference.

This Report on Form 6-K does not constitute an offer to sell any securities or a solicitation of an offer to buy any securities, nor shall there be any sale of any securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

A copy of the opinion of Shoosmiths LLP relating to the legality of the issuance and sale of the Ordinary Shares is attached as Exhibit 5.1 hereto.

The information contained in this Report on Form 6-K, including Exhibits 5.1 and 10.1, is hereby incorporated by reference into the Registration Statements.

EXHIBIT INDEX

+ The schedules and exhibits to this agreement have been omitted pursuant to Item 601(a)(5) of Regulation S-K. A copy of any omitted schedule and/or exhibit will be furnished to the SEC upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: December 15, 2023

|

VivoPower International PLC

|

| |

|

| |

/s/ Kevin Chin

|

| |

Kevin Chin

Executive Chairman

|

Exhibit 5.1

|

VivoPower International PLC

The Scalpel

18th Floor

52 Lime Street

London

EC3M 7AF

|

|

|

Our Ref

|

ATP/M-00908237

|

|

Date

|

14 December 2023

|

Dear Sirs

VivoPower International PLC – Proposed Issue of Ordinary Shares

We have acted as counsel to VivoPower International PLC (company number 09978410) (“Company”), a public limited company incorporated in England and Wales, in connection with the matters set forth below.

For the purposes of this Opinion Letter, we have examined and relied upon such documents, records, certificates and other instruments as we, in our professional judgment, have deemed necessary or appropriate as a basis for the opinions and statements below. We have assumed the genuineness of all signatures, the legal capacity of all natural persons, the authenticity of all documents submitted to us as originals, and the conformity to originals of all documents submitted to us as copies.

|

1.1

|

The opinions given in this Opinion Letter (the “Opinions”) are given only with respect to English law as published and applied by the courts of England and Wales at the date of this Opinion Letter.

|

|

1.2

|

We express no opinion on the laws of any other jurisdiction including, for the avoidance of doubt, European Union law, as it affects any jurisdiction other than England and Wales. No opinion is expressed as to any provision of the Documents (as defined below) that refer to specific laws or regulations of any jurisdiction other than England and Wales. To the extent that the laws of the United States of America or any other jurisdiction may be relevant to the subject matter of the Opinions, we have made no independent investigation of them and our opinion is subject to the effect of any such laws. We express no view on the validity of such matters.

|

|

1.3

|

The Opinions are given only with respect to the matters expressly set out in paragraph 3.1 and shall not be construed as opinions as to any other matter. The Opinions do not cover the matters set out in paragraph 5.1.

|

|

1.4

|

The Opinions are given on the basis of the assumptions set out in paragraph 4. We have not taken any steps to investigate whether they are correct except as may be specified in paragraph 4.

|

VivoPower International PLC

|

1.5

|

The Opinions are subject to the qualifications listed in paragraph 5 and to any matters not disclosed to us.

|

|

1.6

|

By providing you with this Opinion Letter, we do not assume any obligation to notify you of future changes in law which may affect the Opinions or to otherwise update this Opinion Letter in any respect.

|

|

2

|

EXAMINATION OF DOCUMENTS AND SEARCHES

|

|

2.1

|

For the purpose of giving this Opinion Letter, we have examined the following documents (the “Documents”, each a “Document”):

|

| |

2.1.1

|

copy of the registration statement on Form F-3 (Registration No. 333-251304) filed with the Securities and Exchange Commission under the Securities Act of 1933, as amended;

|

| |

2.1.2

|

the prospectus dated 23 December 2020 (the “Base Prospectus”);

|

| |

2.1.3

|

the prospectus supplement dated 12 November 2021, as supplemented by that certain prospectus supplement dated 29 July 2022;

|

| |

2.1.4

|

the prospectus supplement dated 13 November 2023 related to the issuance of up to 260,000 ordinary shares of nominal value $0.12 to Abri Advisors Ltd (“Abri”);

|

| |

2.1.5

|

copy of the ordinary subscription agreement dated 13 November 2023 made between the Company and Abri Advisors Ltd;

|

| |

2.1.6

|

copy of the ordinary subscription agreement dated 12 December 2023 made between the Company and Abri (the “Abri Agreement”);

|

| |

2.1.7

|

the prospectus supplement related to the Abri Agreement for the issuance of up to 220,000 ordinary shares of nominal value $0.12 to Abri Advisors Ltd in proposed final form;

|

| |

2.1.8

|

copy of the Company’s certificate of incorporation dated 1 February 2016 and copy current articles of association adopted pursuant to a special resolution of the Company’s shareholders passed on 20 August 2018;

|

| |

2.1.9

|

a minute of the general meeting of the Company held on 6 October 2020 at which certain shareholder resolutions were passed, including the resolutions providing a general authority to allot ordinary shares in the Company and disapplying statutory pre-emption rights in respect of such allotment of shares or the grant of rights to subscribe for or convert into ordinary shares up to an aggregate nominal value of $180,000;

|

| |

2.1.10

|

written resolutions of the board of directors of the Company passed on 11 December 2020 which resolved to approve the filing of the Registration Statement with the SEC, and written resolutions of the board of directors passed on 11 December 2020 which resolved to approve the allotment and disapplying statutory pre-emption rights in respect of the allotment of ordinary shares up to a subscription amount of $80,000,000;

|

| |

2.1.11

|

a minute of the general meeting of the Company held on 18 December 2020 at which certain shareholder resolutions were passed, including the resolutions providing a general authority to allot ordinary shares in the Company and disapplying statutory pre-emption rights in respect of such allotment of ordinary shares or the grant of rights to subscribe for or convert into ordinary shares up to an aggregate nominal value of $180,000;

|

VivoPower International PLC

| |

2.1.12

|

written resolutions of the board of directors passed on 9 October 2020 which resolved to approve the allotment of ordinary shares of $0.012 each up to an aggregate subscription amount of $34,500,000;

|

| |

2.1.13

|

written resolutions of the board of directions passed on 14 October 2020 which resolved to approve the allotment of ordinary shares of $0.012 each up to an aggregate offering price of $5,750,000;

|

| |

2.1.14

|

a minute of the general meeting of the Company held on 10 November 2022 at which certain shareholder resolutions were passed, including the resolutions providing a general authority to allot ordinary shares in the Company and disapplying statutory pre-emption rights in respect of such allotment of ordinary shares or the grant of rights to subscribe for or convert into ordinary shares up to an aggregate nominal value of $180,000;

|

| |

2.1.15

|

shareholder resolutions passed on 6 July 2023 providing authority for the directors to consolidate and divide all of the Company’s existing ordinary shares of $0.012 each into such reduced number of ordinary shares of such increased nominal value as the Company’s board may determine at any time prior to 23 October 2023;

|

| |

2.1.16

|

written resolutions of the board of directors passed on 2 October 2023 which resolved to approve the consolidation of the Company’s existing ordinary shares of $0.012 each into 2,578,826 ordinary shares of $0.12 each;

|

| |

2.1.17

|

written resolutions of the board of directors passed on 12 December 2023 which resolved to approve the Abri Agreement and the issue of up to 260,000 ordinary shares of nominal value $0.12 in the capital of the Company pursuant to the Abri Agreement;

|

| |

2.1.18

|

written resolutions of the board of directors passed on 8 December 2023, which resolved to approve the termination of warrants to be issued to AWN Holdings Ltd;

|

| |

2.1.19

|

a certificate of good standing of the Company dated 14 December 2023;

|

| |

2.1.20

|

at 10:41 on 14 December 2023 an online search of the public records on file and available for inspection at Companies House in respect of the Company;

|

| |

2.1.21

|

at 10:51 on 14 December 2023 an online search of the Central Registry of Winding-up Petitions at the Companies Court in London in respect of the Company; and

|

| |

2.1.22

|

a director’s certificate dated 13 December 2023 in which the directors confirmed no resolutions have been passed which render any part of this Opinion Letter untrue or invalid, and that no resolutions of the board or shareholders have been passed to terminate, amend or vary the Abri Agreement, or prevent it being fulfilled in accordance with its terms, and that there are no orders, judgements or other agreements which do the same and that there have been no resolutions of the directors or the shareholders of the Company to revoke any previous authorities provided to the directors to issue shares in the Company free of pre-emption rights.

|

VivoPower International PLC

|

2.2

|

Except as stated above, we have not examined any other documents or corporate or other records and we have not made any other searches, enquiries or investigations for the purpose of giving the Opinions.

|

|

3.1

|

Based on and subject to the qualifications, assumptions and limitations set forth herein and subject to any matters not disclosed to us, we are of the opinion that:

|

| |

3.1.1

|

the Company is a public limited company duly incorporated under English law, noting that our searches undertaken on 14 December 2023 revealed no order or resolution for the winding-up of the Company is pending, and no notice of the appointment of a receiver, administrative receiver or administrator in respect of it or any of its assets has been made; and

|

| |

3.1.2

|

the ordinary shares of $0.12 each in the capital of the Company when issued and delivered against payment of the consideration therefor specified in the Abri Agreement, will be validly issued, fully paid and non-assessable.

|

|

3.2

|

The Opinions in paragraph 3.1 are given only for the benefit of the Company and they may not be relied upon by any other person or for any other purpose.

|

|

3.3

|

The Company may not assign this Opinion Letter or any benefit under it to, or hold the benefit of it on trust for, any other person.

|

|

3.4

|

This Opinion Letter and the Opinions may not be disclosed to any person, or quoted in any public document, or otherwise made public in any way, without our prior written consent, except as follows, on a non-reliance basis:

|

| |

3.4.1

|

where disclosure is required or requested by any court of competent jurisdiction or any governmental, banking, taxation or other regulatory authority or similar body, the rules of any relevant stock exchange or pursuant to any applicable law or regulation; or

|

| |

3.4.2

|

where disclosure is required in connection with, and for the purposes of, any litigation, arbitration, administrative or other investigations, proceedings or disputes,

|

| |

3.4.3

|

but only on the condition that: (i) such disclosure is made only to enable any such person to be informed that an opinion has been given and to be made aware of its terms; (ii) we do not assume any duty or liability to any person to whom such disclosure is made; (iii) the recipient is informed of the confidential nature of this opinion; and (iv) the recipient may not disclose this opinion to any other person.

|

|

3.5

|

Our liability under this Opinion Letter is limited to $325,000 for any one claim or series of claims arising out of this Opinion Letter.

|

|

3.6

|

The Opinions are given only by Shoosmiths LLP, an English limited liability partnership, and no partner, member or employee of Shoosmiths LLP shall have any personal responsibility or owe any duty of care in relation to it.

|

VivoPower International PLC

We have assumed:

| |

4.1.1

|

the genuineness of all signatures and seals on the Documents (or on the relevant originals where we have examined copies) and the authenticity and completeness of those Documents;

|

| |

4.1.2

|

the conformity to the original Documents of any Documents submitted to us as certified or uncertified copies or scans of the original Documents; and

|

| |

4.1.3

|

that there have been no variations to any of the Documents provided to us or to the originals thereof and none of the Documents have been superseded or rescinded.

|

|

4.2

|

Other parties and laws

|

In relation to the other parties to the Documents and all laws other than those of England and Wales we have assumed:

| |

4.2.1

|

the capacity, power and authority to execute and the due execution of the Documents by each party to it other than the Company (as a matter of English law);

|

| |

4.2.2

|

that the obligations expressed to be assumed by each party to the Documents other than the Company under the Documents are valid and legally binding upon them (as a matter of English law);

|

| |

4.2.3

|

that all obligations under the Documents are valid, legally binding upon, and enforceable against, the parties thereto as a matter of all relevant laws other than the laws of England and Wales;

|

| |

4.2.4

|

no foreign law would affect any of the conclusions stated in this Opinion Letter;

|

| |

4.2.5

|

due compliance by all relevant parties other than the Company with all matters (including, without limitation, the making of necessary filings, lodgements, registrations and notifications and the payment of stamp duties and other documentary taxes and charges) that govern or relate to the Documents or such parties;

|

| |

4.2.6

|

where any consents, directions, authorisations, approvals or instructions have to be obtained under any law, regulation or practice for the performance of the Documents (other than any corporate authorisations, approvals and company law requirements the subject of this Opinion Letter), they have been obtained or that they will be forthcoming within any relevant period in order to be fully effective for such purpose; and

|

| |

4.2.7

|

other than European Union Law as it affects the laws of England and Wales, there are no laws of any jurisdiction outside England and Wales which would, or might, affect the Opinions.

|

|

4.3

|

Corporate actions and status

|

In relation to the Company, we have assumed:

| |

4.3.1

|

that each resolution of the directors and shareholders of the Company certified as being true and accurate and provided to us in connection with the giving of the Opinions was duly passed by the required majority at a properly convened and quorate meeting of directors (or a duly authorised committee thereof) and of shareholders of the Company or otherwise in accordance with the constitutional documents of the Company and/or the Companies Act 2006;

|

VivoPower International PLC

| |

4.3.2

|

that each person identified as a director or a secretary in any resolution of the directors of the Company was validly appointed as such and was in office at the date of the Documents;

|

| |

4.3.3

|

that any provisions contained in the Companies Act 2006 and/or the articles of association of the Company relating to the declaration of directors’, interests or the power of interested directors to vote were duly observed;

|

| |

4.3.4

|

that any restrictions in the articles of association of the Company on that Company’s and/or on its directors’ authority to guarantee will not be contravened by the entry into and performance by it of the Documents to which it is a party;

|

| |

4.3.5

|

that the execution and delivery of the Documents by the Company and the exercise of its rights and performance of its obligations under the Documents will promote the success of the Company for the benefit of its members as a whole and that any guarantee contained in the Documents was given in good faith by the Company and for the purposes of carrying on its business and the directors of the Company have satisfied themselves, after due deliberation, as to the benefit that the Company will derive from the giving of any guarantee contained in the Documents;

|

| |

4.3.6

|

that no step has been taken to wind up the Company nor to appoint a receiver, administrator or like officer in respect of the Company or any of its assets and that no voluntary arrangement has been proposed in respect of the Company; and

|

| |

4.3.7

|

there are no agreements, letters or other arrangements having contractual effect which modify the terms of, or affect, the Documents or which render the Company incapable of or prohibit it from performing any of its obligations under the Documents and no provision of the Documents have been waived and there are no contractual or similar restrictions contained in any agreement or arrangement (other than the Documents) which are binding on the Company which would prohibit it from performing any of its obligations under the Documents.

|

|

4.4

|

Reliance on Documents

|

| |

4.4.1

|

All Documents submitted to us as copies or certified copies are true and complete copies of the originals and such originals and all Documents submitted to us as originals are genuine and complete and all signatures (including electronic signatures), stamps and seals on the documents are genuine.

|

| |

4.4.2

|

Each Document accurately records the agreement of the parties to it and has not been amended, varied, waived, superseded, rescinded, breached, revoked or terminated.

|

| |

4.4.3

|

The Documents are in the form produced to the directors of the Company.

|

| |

4.4.4

|

There have been no amendments to the articles of association of the Company since the date referred to in paragraph 2.1.8.

|

| |

4.5.1

|

The Documents have been signed by or on behalf of each party to it by person(s) authorised by the relevant party to (in the presence of a witness where applicable).

|

VivoPower International PLC

| |

4.5.2

|

The making of the signatures on the signature pages to the Documents was made or done in a manner recognised by law as valid and the Documents have remained intact since those signatures were made or affixed (as the case may be).

|

| |

4.5.3

|

The Documents have been dated with the date on which it was signed and duly delivered by the parties to it (where applicable).

|

| |

4.6.1

|

The information disclosed in response to the searches referred to in paragraph 2.1 of this Opinion Letter was accurate, complete and up to date at the time of those searches and those responses did not fail to disclose any matters which they should have disclosed and which were relevant for the purposes of this Opinion Letter. Since the date of those searches and enquiries there has been no alteration in the status of the Company as revealed in those searches.

|

| |

4.6.2

|

No event has occurred in relation to the Company, such as the passing of a resolution for or the presentation of a petition or the taking of any other action for the winding-up of, or the appointment of a liquidator, administrator, administrative receiver or receiver of the Company, in respect of which a filing at the Companies Registry or at the Central Index of the Companies Court was required to be made and has not been made or has been made but has not at the date of the searches appeared on the relevant search result relating to the Company.

|

| |

4.7.1

|

None of the parties to the Documents are or will be seeking to achieve any purpose not apparent from the Documents which might render the Documents illegal or void.

|

| |

4.7.2

|

Where any liability or obligation or right or benefit of a party to the Documents are dependent upon the satisfaction of conditions precedent, those conditions have been or will be duly and properly satisfied.

|

| |

4.7.3

|

There is no other matter or document which would, or might, affect the Opinions and which was not revealed by the Documents.

|

| |

5.1.1

|

We express no opinion as to matters of fact, opinion or intention.

|

| |

5.1.2

|

No opinion is expressed as to any provision of the Documents to the extent it purports to declare or impose a trust, turnover or similar arrangement in relation to any payments or assets received.

|

| |

5.1.3

|

Except to the extent expressly set out in the Opinions, we express no opinion as to any taxation, financial or accountancy matters or any liability to tax which may arise or be suffered as a result of, or in connection with, the Documents or any transaction relating to them.

|

| |

5.1.4

|

We express no opinion as to whether any filings, clearances, notifications or disclosures are required under laws relating to anti-trust, competition, public procurement, state aid or national security.

|

VivoPower International PLC

| |

5.2.1

|

The validity, performance and enforcement of the Documents may be limited by bankruptcy, insolvency, liquidation, reorganisation or prescription or similar laws of general application relating to or affecting the rights of creditors.

|

| |

5.2.2

|

Any provision in the Documents which confers, purports to confer or waives a right of set-off or similar right may be ineffective against a liquidator or creditor.

|

| |

5.2.3

|

A power of attorney may, in limited circumstances, be revoked by the winding-up or dissolution of the donor company.

|

| |

5.2.4

|

The searches and enquiries referred to in paragraph 2 of this Opinion Letter are not conclusively capable of revealing whether insolvency or similar procedures, or steps towards them, have been started against the Company.

|

| |

5.3.1

|

Remedies such as specific performance or the issue of an injunction are available only at the discretion of the courts of England and Wales according to general principles of equity. Specific performance is not usually granted and an injunction is not usually issued where damages would be an adequate alternative.

|

| |

5.3.2

|

The enforcement of any guarantee contained in the Documents may be subject to equitable defences relieving the guarantor from its obligations. The guarantor may be relieved from liability under any guarantee contained in the Documents by (a) the action or the lack of action by or by the conduct of the creditor or debtor in respect of any guaranteed obligations or any guarantee, security or other assurance against financial loss given in respect of such obligations or (b) any bad faith or misrepresentation on the part of such creditor.

|

| |

5.3.3

|

Enforcement of claims arising pursuant to the Documents may become barred under the Limitation Act 1980 or may be subject to a defence of set-off or counterclaim.

|

| |

5.3.4

|

Enforcement may be limited by the provisions of the laws of England and Wales applicable to agreements held to have been frustrated by events happening after execution of a document.

|

| |

5.3.5

|

A party to a contract may be able to avoid its obligations under that contract (and may have other remedies) where it has been induced to enter into that contract by a misrepresentation and the courts of England and Wales will generally not enforce an obligation if there has been fraud.

|

| |

5.3.6

|

In this letter “enforceable” means, in relation to an obligation, that it is of a type which the courts of England and Wales enforce. It does not mean that such obligation will be enforced in all circumstances in accordance with the terms of the relevant Document.

|

| |

5.4.1

|

The courts of England and Wales may stay proceedings if concurrent proceedings are being brought elsewhere.

|

VivoPower International PLC

| |

5.4.2

|

There could be circumstances in which the courts of England and Wales would not treat as conclusive those certificates and determinations which any of the Documents state are to be so treated.

|

| |

5.4.3

|

The question whether or not any provisions of the Documents which may be invalid on account of illegality may be severed from the other provisions thereof in order to save those other provisions would be determined by the courts of England and Wales in their discretion.

|

| |

5.5.1

|

An express choice of the laws of England and Wales will be subject to:

|

| |

a)

|

mandatory provisions of European Community law where all other elements of the situation are located in one or more European Union member states; and

|

| |

b)

|

the discretion of the courts of England and Wales to give effect to the mandatory provisions of law of the country where the obligations arising out of the contract are to be performed insofar as those provisions render performance of the contract unlawful.

|

| |

5.5.2

|

An English court may refuse to accept jurisdiction if proceedings have been commenced in member state of the European Union, a related action is already pending in another member state of the European Union or the courts of another member state of the European Union has exclusive jurisdiction.

|

|

6.1

|

We have not investigated the laws of any country other than England and Wales and the Opinions are given only with respect to the laws of England and Wales as at the date of this letter. In issuing the Opinions we do not assume any obligation to notify or inform you of any developments subsequent to the date of this letter that might render its contents untrue or inaccurate in whole or in part at such later time.

|

|

6.2

|

Where any party to any Document is vested with a discretion or may determine a matter in its opinion, the laws of England and Wales may require that such discretion is exercised reasonably and for a proper purpose and/or that such opinion is formed in good faith based on reasonable grounds.

|

|

6.3

|

Whether any guarantee contained in any Document constitutes a primary obligation of the Company will depend upon its construction. In the absence of a clear statement that the obligations of the Company are of indemnity as well as guarantee the courts of England and Wales may not give effect to provisions seeking to impose primary liability on or to restrict the defences available to the Company in accordance with the terms of the Documents.

|

|

6.4

|

Any provisions excluding liability may be limited by law.

|

|

6.5

|

This Opinion Letter is given on the condition that it will be construed in accordance with English law and that each addressee submits to the jurisdiction of the courts of England and Wales and waives any objection to the exercise of such jurisdiction in relation to any dispute arising out of or in connection with this Opinion Letter.

|

VivoPower International PLC

Yours faithfully

/s/Shoosmiths LLP

SHOOSMITHS LLP

Dated: 14 December 2023

Exhibit 10.1

SUBSCRIPTION AGREEMENT

This SUBSCRIPTION AGREEMENT (this “Agreement”) is dated as of December 12, 2023, between VivoPower International PLC, a public limited company organized under the laws of England and Wales (the “Company”), and the purchaser identified on the signature page hereto (the “Purchaser”).

WHEREAS, the Purchaser desires to subscribe for and purchase from the Company, and the Company desires to issue and sell, ordinary shares, $0.12 par value per share, of the Company (the “Ordinary Shares”), to the Purchaser pursuant to the terms and conditions of this Agreement;

NOW, THEREFORE, upon the execution and delivery of this Agreement, the Company and the Purchaser agree as follows:

1. Subscription. The Purchaser, intending to be legally bound, hereby irrevocably subscribes for and agrees to purchase from the Company the number of Ordinary Shares (the “Shares”) at the per share purchase price, for the aggregate purchase price (the “Purchase Price”) as set forth on the signature page hereto, and the Company, intending to be legally bound, hereby agrees to issue and sell the Shares to the Purchaser, provided, however, that the Company reserves the right to accept or reject this subscription for Shares, in whole or in part. If the Company elects to accept this subscription for Shares in part, it shall promptly notify the Purchaser by delivery to the Purchaser by email of the signature page countersigned by the Company and reflecting the amount of the subscription accepted.

2. Registration of Shares. The offering and sale of the Shares (the “Offering”) are being made pursuant to (a) an effective Registration Statement on Form F-3 (File No. 333-251304) (the “Registration Statement”) filed by the Company with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Securities Act”), including the prospectus contained therein (the “Base Prospectus”), which relates, among other things, to the Shares and the sale thereof from time to time in accordance with Rule 415 under the Securities Act, and (b) a prospectus supplement (the “Prospectus Supplement” and, together with the Base Prospectus, the “Prospectus”) containing certain supplemental information regarding the Shares and terms of the Offering that will be filed by the Company with the Commission and delivered to the Purchaser (or made available to the Purchaser by the filing by the Company of an electronic version thereof with the Commission) no later than the Closing Date (as defined below).

3. Purchase and Sale of Shares. The Company agrees to issue and sell to the Purchaser and the Purchaser agrees to purchase the Shares at a closing to take place at the offices of the Company, or such other place as the Purchaser and the Company shall mutually agree, including by way of the exchange of “pdf” copies of signatures (the “Closing”), no later than the second Trading Day (as such term is defined below) following the date hereof (the “Closing Date”). At the Closing, the Company shall deliver instructions to the Company’s transfer agent to issue the Shares as of the Closing Date and deliver via the Depository Trust

Company Deposit Withdrawal Agent Commission System (“DWAC”) the Shares, registered in the name of the Purchaser, against delivery of the Purchase Price, which shall be paid by the Purchaser at the Closing by wire transfer of immediately available funds to the accounts set forth on Schedule I hereto. The term “Trading Day” means a day on which the Nasdaq Stock Market is open for trading.

Prior to Closing, the Purchaser shall direct the broker-dealer at which the account or accounts to be credited with the Shares being purchased by the Purchaser are maintained, which broker/dealer shall be a DTC participant, to set up a DWAC instructing the Company’s transfer agent, to credit such account or accounts with the Shares by means of an electronic book-entry delivery. Simultaneously with the delivery by the Purchaser of the Purchase Price at Closing, the Company shall direct its transfer agent to credit the Purchaser’s account or accounts with the Shares pursuant to the information contained in the DWAC (as specified by the Purchaser on the Investor Questionnaire annexed hereto as Exhibit A).

(a) The obligations of the Company hereunder are subject to the following conditions being met:

(i) the accuracy in all material respects as of the date hereof of the representations and warranties by the Purchaser contained herein; and

(ii) the delivery by the Purchaser of (i) the Purchase Price (net of the Placement Agent Fee) to the Company for the Shares and (ii) the Placement Agent Fee to Chardan for the Shares, in each case as set forth herein, on the Closing Date.

(b) The obligations of the Purchaser hereunder are subject to the following conditions being met:

(i) the accuracy in all material respects as of the date hereof of the representations and warranties by the Company contained herein; and

(ii) the delivery by the Company to the Purchaser of the Prospectus, including the Prospectus Supplement (which may be delivered in accordance with Rule 172 under the Securities Act).

5. Representations and Warranties of the Company. As of the date hereof, the Company hereby represents and warrants to the Purchaser that:

(a) The Company is an entity duly incorporated or otherwise organized, validly existing and in good standing under the laws of the jurisdiction of its incorporation or organization (to the extent the concept of good standing or any functional equivalent is applicable in such jurisdiction) and has the requisite corporate power to own its properties and to carry on its business as presently conducted. The Company is duly qualified as a foreign corporation to do business and is in good standing in each jurisdiction where the nature of the business conducted, or property owned by it, makes such qualification necessary, other than those jurisdictions in which the failure to so qualify would not have a Material Adverse Effect. For purposes of this Agreement, a “Material Adverse Effect” shall mean a material adverse effect on the financial condition, results of operations, prospects, properties or business of the Company.

(b) All issued and outstanding Ordinary Shares of the Company have been duly authorized and validly issued and are fully paid and non-assessable.

(c) This Agreement has been duly authorized, executed and delivered by the Company. The Company has full corporate power and authority necessary to deliver this Agreement and to perform the obligations set forth in this Agreement.

(d) The capitalization of the Company as of the date set forth therein is as set forth in the reports, schedules, forms, statements and other documents required to be filed by the Company under the Securities Act and the Securities Exchange Act of 1934, as amended, including pursuant to Section 13(a) or 15(d) thereof, for the two years preceding the date hereof (or such shorter period as the Company was required by law or regulation to file such material) (the foregoing materials, including the exhibits thereto and documents incorporated by reference therein, together with the Prospectus and the Prospectus Supplement, being collectively referred to herein as the “SEC Reports”) the SEC Reports. Except as set forth in the SEC Reports, there are no outstanding agreements or preemptive or similar rights affecting the Ordinary Shares of the Company and no outstanding rights, warrants or options to acquire, or instruments convertible into or exchangeable for, or agreements or understandings with respect to the sale or issuance of any Ordinary Shares of the Company or other equity interests in the Company except as described on Schedule 5(d) to this Agreement.

(e) No consent, approval, authorization or order of any court, governmental agency, or body or arbitrator having jurisdiction over the Company or the Company's shareholders is required for the sale of the Shares in accordance with this Agreement.

(f) There are no stop orders in effect from the Commission or any state securities commission or any other regulatory authority of any stop order or of any order preventing or suspending any offering of the Ordinary Shares of the Company, or of the suspension of the qualification of the Ordinary Shares of the Company for offering or sale in any jurisdiction or the initiation of any proceeding for any such purpose. If any such stop order is issued, the Company will promptly notify the Purchaser.

6. Representations, Warranties and Covenants of the Purchaser. As of the date hereof, the Purchaser hereby represents and warrants to the Company that:

(a) The Purchaser is an entity duly incorporated or formed, validly existing and in good standing under the laws of the jurisdiction of its incorporation or formation with full right, corporate, partnership, limited liability company or similar power and authority to enter into and to consummate the transactions contemplated by this Agreement and otherwise to carry out its obligations hereunder. The execution and delivery of this Agreement and performance by the Purchaser of the transactions contemplated by this Agreement have been duly authorized by all necessary corporate, partnership, limited liability company or similar action, as applicable, on the part of the Purchaser. This Agreement has been duly executed by the Purchaser, and when delivered by the Purchaser in accordance with the terms hereof, will constitute the valid and legally binding obligation of the Purchaser, enforceable against it in accordance with its terms.

(b) The Purchaser has received (or otherwise had made available to it by the filing by the Company of an electronic version thereof with the Commission) the Base Prospectus which is a part of the Registration Statement, and the documents incorporated by reference therein (collectively, the “Disclosure Package”), prior to or in connection with the execution of this Agreement. The Purchaser acknowledges that, prior to the delivery of this Agreement to the Company, the Purchaser will receive certain additional information regarding the Offering, including pricing information (the “Offering Information”). Such information may be provided to the Purchaser by any means permitted under the Securities Act, including the Prospectus Supplement, a free writing prospectus and oral communications.

(c) The Purchaser (a) is knowledgeable, sophisticated and experienced in making, and is qualified to make decisions with respect to, investments in shares presenting an investment decision like that involved in the purchase of the Shares, including investments in securities issued by the Company and investments in comparable companies and has reviewed such information and made such inquiries regarding the Company and the purchase of the Shares as the Purchaser has deemed appropriate and (b) in connection with its decision to purchase the Shares, has received (or had full access to) and is relying only upon the Disclosure Package and the documents incorporated by reference therein. The Purchaser is able to bear the economic risk of an investment in the Shares and, at the present time, is able to afford a complete loss of such investment.

(d) The Purchaser understands that nothing in this Agreement, the Disclosure Package or any other materials presented to the Purchaser in connection with the purchase and sale of the Shares constitutes legal, tax or investment advice. The Purchaser has consulted such legal, tax and investment advisors and made such investigations as the Purchaser, in its sole discretion, has deemed necessary or appropriate in connection with its purchase of the Shares.

(e) Except for a placement agent fee of 7% per share (the “Placement Agent Fee”) to be paid to Chardan Capital Markets LLC (“Chardan”), no person or entity acting on behalf of, or under the authority of, the Purchaser is or will be entitled to any broker’s, finder’s, or similar fees or commission payable by the Company. The Company requests, and Purchaser agrees, to pay the Placement Agent Fee directly to Chardan, at the account set forth on Schedule I hereto, which Placement Agent Fee will be deducted from the total Purchase Price to be paid to the Company at the Closing.

(f) The Purchaser has not disclosed any information regarding the Offering to any third parties (other than its legal, accounting and other advisors) and has not engaged in any purchases or sales of the securities of the Company (including, without limitation, any Short Sales (as defined herein) involving the Company’s securities). The Purchaser agrees that it will not use any of the Shares acquired pursuant to this Agreement to cover any short position in the Ordinary Shares. For purposes hereof, “Short Sales” include, without limitation, all “short sales” as defined in Rule 200 promulgated under Regulation SHO under the Exchange Act, whether or not against the box, and all types of direct and indirect stock pledges, forward sales contracts, options, puts, calls, short sales, swaps, “put equivalent positions” (as defined in Rule 16a-1(h) under the Exchange Act) and similar arrangements (including on a total return basis), and sales and other transactions through non-U.S. broker dealers or foreign regulated brokers.

(g) No offer by the Purchaser to buy the Shares will be accepted and no part of the Purchase Price will be delivered to the Company until the Purchaser has received the Offering Information and the Company has accepted such offer by countersigning a copy of this Agreement, and any such offer may be withdrawn or revoked, without obligation or commitment of any kind, at any time prior to the Company sending (orally, in writing or by electronic mail) notice of its acceptance of such offer. An indication of interest will involve no obligation or commitment of any kind until the Purchaser has been delivered the Offering Information and this Agreement is accepted and countersigned by or on behalf of the Company. The Purchaser understands and agrees that the Company, in its sole discretion, reserves the right to accept or reject this subscription for Shares, in whole or in part.

(h) The Purchaser is acquiring the Shares as principal for its own account and has no direct or indirect arrangement or understandings with any other persons to distribute or regarding the distribution of such Shares (this representation and warranty not limiting the Purchaser’s right to sell the Shares in compliance with applicable federal and state securities laws). The Purchaser is acquiring the Shares hereunder in the ordinary course of its business. The Purchaser understands that it is acquiring such Shares as principal for its own account and not with a view to or for distributing or reselling such Shares or any part thereof in violation of the Securities Act or any applicable securities law, has no present intention of distributing any of such Shares in violation of the Securities Act or any applicable securities law and has no direct or indirect arrangement or understandings with any other persons to distribute or regarding the distribution of such Shares in violation of the Securities Act or any applicable securities law (this representation and warranty not limiting the Purchaser’s right to sell such Shares in compliance with applicable federal and state securities laws).

(i) At the time the Purchaser was offered the Shares, it was, and as of the date hereof it is, either (i) an “accredited investor” as defined in Rule 501(a)(1), (a)(2), (a)(3), (a)(7), (a)(8), (a)(9), (a)(12), or (a)(13) under the Securities Act or (ii) a “qualified institutional buyer” as defined in Rule 144A(a) under the Securities Act.

(j) The Purchaser acknowledges that it has had the opportunity to review the SEC Reports and has been afforded, (i) the opportunity to ask such questions as it has deemed necessary of, and to receive answers from, representatives of the Company concerning the terms and conditions of the offering of the Shares and the merits and risks of investing in the Shares; (ii) access to information about the Company and its financial condition, results of operations, business, properties, management and prospects sufficient to enable it to evaluate its investment; and (iii) the opportunity to obtain such additional information that the Company possesses or can acquire without unreasonable effort or expense that is necessary to make an informed investment decision with respect to the investment.

(k) The Purchaser is not purchasing the Shares as a result of any advertisement, article, notice or other communication regarding the Shares published in any newspaper, magazine or similar media or broadcast over television or radio or presented at any seminar or, to the knowledge of the Purchaser, any other general solicitation or general advertisement.

7. Governing Law. All questions concerning the construction, validity, enforcement and interpretation of this Agreement shall be governed by and construed and enforced in accordance with the laws of the State of New York, without regard to the principles of conflicts of law thereof. Each party agrees that all legal proceedings concerning the interpretations, enforcement and defense of the transactions contemplated by this Agreement (whether brought against a party hereto or its respective affiliates, directors, officers, shareholders, partners, members, employees or agents) shall be commenced exclusively in the state and federal courts sitting in the City of New York. Each party hereby irrevocably submits to the exclusive jurisdiction of the state and federal courts sitting in the City of New York, Borough of Manhattan for the adjudication of any dispute hereunder or in connection herewith or with any transaction contemplated hereby or discussed herein, and hereby irrevocably waives, and agrees not to assert in any action or proceeding, any claim that it is not personally subject to the jurisdiction of any such court, that such action or proceeding is improper or is an inconvenient venue for such proceeding. Each party hereby irrevocably waives personal service of process and consents to process being served in any such action or proceeding by mailing a copy thereof via registered or certified mail or overnight delivery (with evidence of delivery) to such party at the address in effect for notices to it under this Agreement and agrees that such service shall constitute good and sufficient service of process and notice thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any other manner permitted by law. If any party shall commence an action or proceeding to enforce any provisions of this Agreement, the prevailing party in such action or proceeding shall be reimbursed by the non-prevailing party for its reasonable attorneys’ fees and other costs and expenses incurred with the investigation, preparation and prosecution of such action or proceeding.

8. Entire Agreement. This Agreement constitutes the entire agreement between the Company and the Purchaser with respect to the matters covered hereby and supersedes all prior agreements and understanding with respect to such matters between the Company and the Purchaser.

9. Severability. In case any provision contained in this Agreement should be invalid, illegal or unenforceable in any respect, the validity, legality and enforceability of the remaining provisions contained herein will not in any way be affected or impaired thereby.

10. Counterparts; Facsimile or “pdf” Copies. This Agreement may be executed in counterparts, each of which, when executed, shall be deemed an original but all of which, taken together, shall constitute one and the same Agreement. Delivery of an executed copy of a signature page to this Agreement by facsimile or “pdf” transmission shall be as effective as delivery of a manually executed copy of this Agreement and shall be as effective and enforceable as the original.

11. Notices. All notices, demands, requests, consents, approvals, and other communications required or permitted hereunder shall be in writing and, unless otherwise specified herein, shall be (a) personally served, (b) delivered by reputable air courier service with charges prepaid next business day delivery, or (c) transmitted by hand delivery, or email as a PDF, addressed as set forth below or to such other address as such party shall have specified most recently by written notice given in accordance herewith. Any notice or other communication required or permitted to be given hereunder shall be deemed effective upon hand delivery or delivery by email at the address designated below (if delivered on a business day during normal business hours where such notice is to be received), or the first business day following such delivery (if delivered other than on a business day during normal business hours where such notice is to be received). The address for notice to a party is as shown on the signature page of this Agreement, or such other address as any party shall have given by written notice to the other party as provided above.

[SIGNATURES FOLLOW ON NEXT PAGE]

IN WITNESS WHEREOF, the undersigned has caused this Agreement to be duly executed by its authorized signatory as of the date first indicated above.

| |

PURCHASER:

|

| |

By:

Name:

|

/s/Jeffrey Tirman

Jeffrey Tirman

|

| |

|

|

| |

Title: President, Abri Advisors, Ltd

Address for Notice:

|

| |

|

| |

|

| |

Telephone: |

| |

E-mail: |

| |

Attention: |

Subscription Amount: $253,000

Purchase Price per Share: $1.15

No. of Shares: 220,000

|

Agreed and Accepted this:

|

|

| |

COMPANY:

By: /s/Kevin Chin

Name: Kevin Chin

Title: Chief Executive Officer, VivoPower

International PLC

|

| |

|

|

Subscription Amount

Accepted: $253,000

No. of Shares Accepted: 220,000

|

Address for Notice:

Telephone:

E-mail:

Attention: VivoPower International PLC

|

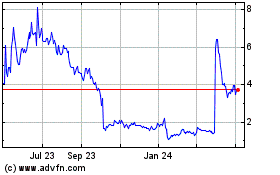

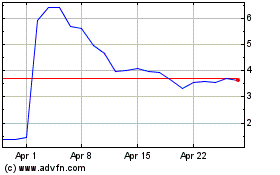

VivoPower (NASDAQ:VVPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

VivoPower (NASDAQ:VVPR)

Historical Stock Chart

From Apr 2023 to Apr 2024