Capital Product Partners L.P. Announces Results of Rights Offering

December 14 2023 - 5:00PM

Capital Product Partners L.P. (the “Partnership”, “CPLP”, or “we”/

“us”) (NASDAQ:CPLP) today announced the final results of its

previously announced rights offering to raise proceeds of up to

$500,000,000 (the “Rights Offering”).

The subscription period for the Rights Offering

expired at 5:00 p.m., New York City time, on December 13, 2023 (the

“Expiration Date”). The Rights Offering resulted in subscriptions

for 445,988 common units representing limited partnership interests

in CPLP (the “Common Units”) offered at an exercise price of $14.25

per Common Unit. The Common Units subscribed for are expected to be

issued to participating unitholders on or about December 22, 2023.

Any excess subscription payments received by Computershare Trust

Company, N.A. will be returned to investors promptly, without

interest or penalty, following the closing of the Rights

Offering.

As previously announced, the Partnership entered

into a Standby Purchase Agreement (the “Standby Purchase

Agreement”) with Capital Maritime & Trading Corp. (“Capital

Maritime”), pursuant to which Capital Maritime agreed to purchase

from CPLP, at $14.25 per Common Unit (which is equal to the

subscription price in the Rights Offering), the number of Common

Units offered pursuant to the Rights Offering that are not issued

pursuant to the Rights Offering. Because the Rights Offering was

not fully subscribed, Capital Maritime will purchase 34,641,731

Common Units pursuant to the Standby Purchase Agreement for an

aggregate amount of $493,644,666.75. Following the closing of the

Rights Offering and the Standby Purchase Agreement, we expect to

have 55,039,143 Common Units outstanding. Capital Maritime will own

39,808,881 Common Units, representing 72.3% of the Common Units

outstanding (40,962,727 Common Units together with the Common Units

owned by Capital Gas Corp., an affiliate of Capital Maritime,

representing 74.4% of the Common Units outstanding) excluding

870,522 treasury units and 348,570 general partner units.

The proceeds to be received by the Partnership

pursuant to the Rights Offering and the Standby Purchase Agreement

are expected to be approximately $500 million. We conducted the

Rights Offering pursuant to the terms of an umbrella agreement,

which we entered into on November 13, 2023 with Capital Maritime

and Capital GP L.L.C. (the “Umbrella Agreement”). The proceeds from

the Rights Offering will be used to finance a portion of the

purchase price for 11 liquefied natural gas carrier (LNG/C) vessels

that we have agreed to purchase from Capital Maritime pursuant to

the Umbrella Agreement, which is expected to close on December 22,

2023.

The Rights Offering is more fully described and

was made pursuant to CPLP’s effective registration statement on

Form F-3 and a prospectus supplement filed with the Securities and

Exchange Commission on November 27, 2023 (together with the base

prospectus included in the registration statement, the

“Prospectus”). Copies of the Prospectus, which contains further

details regarding the Rights Offering, can be accessed through the

SEC’s website at www.sec.gov.

About Capital Product Partners

L.P.

Capital Product Partners L.P. (NASDAQ: CPLP), a

Marshall Islands limited partnership, is an international owner of

ocean-going vessels. CPLP currently owns 22 vessels, including

seven latest generation LNG carrier vessels,

12 Neo-Panamax container vessels and three Panamax

container vessels.

For more information about the Partnership,

please visit: www.capitalpplp.com.

Forward-Looking Statements

This communication includes forward-looking

statements (as such term is defined in Section 21E of the

Securities Exchange Act of 1934, as amended). These statements can

be identified by the fact that they do not relate only to

historical or current facts. In particular, forward-looking

statements include all statements that express forecasts,

expectations, plans, outlook, objectives and projections with

respect to future matters, including, among other things, the

transaction contemplated pursuant to the Umbrella Agreement, our

expected performance following such transactions, our expectations

or objectives regarding future distributions and market and charter

rates expectations. These forward-looking statements involve risks

and uncertainties that could cause the stated or forecasted results

to be materially different from those anticipated, including but

not limited to adverse change in the LNG commodity and shipping

markets in general including container shipping markets, changes in

interest rates and interest rates expectations, changes in the

availability and cost of vessel financing, the ability of our

counterparties to perform under the respective contracts including

charter parties and ship building contracts, material changes in

the operating expenses and maintenance capex of our vessels and

material changes in the regulatory environment for shipping. For a

discussion of some of the factors that could materially affect the

outcome of forward-looking statements and other risks and

uncertainties, see “Risk Factors” in our annual report on Form 20-F

filed with the SEC on April 26, 2023. Unless

required by law, we expressly disclaim any obligation to update or

revise any of these forward-looking statements, whether because of

future events, new information, a change in our views or

expectations, to conform them to actual results or otherwise. We

make no prediction or statement about the performance of our common

units.

Contact Details:

Capital GP L.L.C.Jerry KalogiratosCEOTel. +30

(210) 4584 950E-mail: j.kalogiratos@capitalpplp.com

Capital GP L.L.C.Nikos KalapotharakosCFOTel.

+30 (210) 4584

950E-mail: n.kalapotharakos@capitalmaritime.com

Investor Relations / MediaNicolas

BornozisCapital Link, Inc. (New York)Tel.

+1-212-661-7566E-mail: cplp@capitallink.com

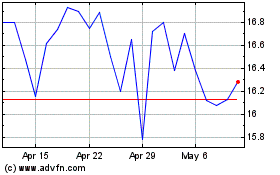

Capital Product Partners (NASDAQ:CPLP)

Historical Stock Chart

From Mar 2024 to Apr 2024

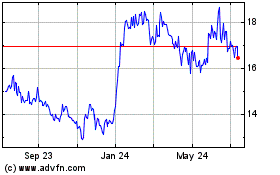

Capital Product Partners (NASDAQ:CPLP)

Historical Stock Chart

From Apr 2023 to Apr 2024