UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of DECEMBER 2023

Commission File Number: 001-35563

PEMBINA PIPELINE CORPORATION

(Name of registrant)

(Room #39-095) 4000, 585 8th Avenue S.W.

Calgary, Alberta T2P 1G1

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

☐ Form

20-F ☒ Form 40-F

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

| PEMBINA PIPLELINE CORPORATION |

|

|

| By: |

|

/s/ Cameron Goldade |

|

|

Name: Cameron Goldade |

|

|

Title: Chief Financial Officer |

Date: December 13, 2023

Form 6-K Exhibit Index

Incorporation by Reference

Exhibits 99.1 and 99.2 of this Form 6-K are hereby incorporated by reference as exhibits to the Registration Statement

on Form F-10 (File No. 333-276023) of Pembina Pipeline Corporation.

|

|

|

| PEMBINA PIPELINE CORPORATION |

|

|

| TREASURY OFFERING OF SUBSCRIPTION RECEIPTS |

|

December 13, 2023 |

A final base shelf prospectus of Pembina Pipeline Corporation dated December 13, 2023 (the “final base shelf

prospectus”) containing important information relating to the securities described in this document has been filed with the securities regulatory authorities in each of the provinces of Canada and included in the registration statement on Form F-10 filed with the U.S. Securities and Exchange Commission in the United States. A copy of the final base shelf prospectus, any amendment to the final base shelf prospectus and any applicable shelf prospectus

supplement that has been filed, is required to be delivered with this document.

This document does not provide full disclosure of all material

facts relating to the securities offered. Investors should read the final base shelf prospectus, any amendment thereto and any applicable shelf prospectus supplement for disclosure of those facts, especially risk factors relating to the securities

offered, before making an investment decision.

Investing in the securities offered involves risk. See “Risk Factors” in the final base

shelf prospectus and in any applicable prospectus supplement

|

|

|

| ISSUER: |

|

Pembina Pipeline Corporation (the “Corporation”) |

|

|

| ISSUE: |

|

Treasury offering of 26,000,000 subscription receipts of the Corporation (“Subscription Receipts”) (29,900,000 if the Over-Allotment Option (as defined below) is exercised in full), with each Subscription Receipt entitling

the holder thereof, without payment of any additional consideration or further action on the part of the holder, to receive one common share of the Corporation (a “Common Share”) upon closing of the Acquisition (the

“Offering”). |

|

|

| AMOUNT: |

|

$1,114,100,000 ($1,281,215,000 if the Over-Allotment Option is exercised in full) |

|

|

| ISSUE PRICE: |

|

$42.85 per Subscription Receipt |

|

|

| OVER-ALLOTMENT OPTION: |

|

The Corporation has granted to the underwriters an over-allotment option (the “Over-Allotment Option”), exercisable, in whole or in part, at any time and from time to time until the earlier of: (i) 5:00 p.m. (Calgary time)

on the day that is thirty (30) days following the Offering Closing Date (as defined below); and (ii) the Termination Time (as defined below), to purchase up to an additional 3,900,000 Subscription Receipts on the same terms and conditions

as the Offering, to cover over-allotments, if any, and for market stabilization purposes. |

|

|

| ACQUISITION: |

|

The Corporation has entered into a purchase and sale agreement (as amended, supplemented or otherwise modified from time to time in accordance with the terms thereof, the “Purchase and Sale Agreement”) with Enbridge Inc.

(“Enbridge”) to acquire all of Enbridge’s interests in the Alliance, Aux Sable and NRGreen joint ventures and the related operatorship contracts for an aggregate purchase price of approximately $3.1 billion (subject to certain

adjustments) (the “Purchase Price”), including approximately $327 million of assumed debt, representing Enbridge’s proportionate share of the indebtedness of the Alliance joint venture (the “Acquisition”). The

Acquisition is expected to close in the first half of 2024 (the “Acquisition Closing Date”). |

|

|

| USE OF PROCEEDS: |

|

The net proceeds of the Offering (excluding any Dividend Equivalent Payments (as defined below) and interest and other income that may be earned on the Escrowed Funds (as defined below)) will be used to fund a portion of the

Purchase Price. |

|

|

|

| PEMBINA PIPELINE CORPORATION |

|

|

| TREASURY OFFERING OF SUBSCRIPTION RECEIPTS |

|

December 13, 2023 |

|

|

|

| SUBSCRIPTION RECEIPTS: |

|

Each Subscription Receipt will entitle the holder thereof to receive automatically, without additional consideration or further action on the

part of the holder thereof, one (1) Common Share of the Corporation upon closing of the Acquisition.

If (i) by 5:00 p.m. (Calgary time) on October 1, 2024, (a) the Escrow Release Notice and Direction (as defined below) is not delivered to

Computershare Trust Company of Canada, as subscription receipt agent (the “Subscription Receipt Agent”), prior to such time, or (b) an Escrow Release Notice and Direction has been delivered to the Subscription Receipt Agent prior to

such time, but the Escrowed Funds are subsequently returned to the Subscription Receipt Agent and no further Escrow Release Notice and Direction is delivered to the Subscription Receipt Agent prior to such time; (ii) the Purchase and Sale

Agreement is terminated; (iii) the Corporation gives notice to the Joint Bookrunners, on behalf of the underwriters, that it does not intend to proceed with the Acquisition; or (iv) the Corporation announces to the public that it does not

intend to proceed with the Acquisition (each, a “Termination Event” and the time of the earliest of such Termination Event to occur, the “Termination Time” and the date on which such Termination Time occurs, the “Termination

Date”), the Subscription Receipt Agent will pay to each holder of Subscription Receipts, no earlier than the third business day following the Termination Date, an amount per Subscription Receipt (the “Termination Payment”) equal to

the offering price in respect of such Subscription Receipt, plus (x) if a Dividend Equivalent Payment has been paid or is payable in respect of the Subscription Receipts at any time following the issuance of the Subscription Receipts, any

unpaid Dividend Equivalent Payment owing to such holder, or (y) if no Dividend Equivalent Payment has been paid or is payable in respect of the Subscription Receipts at any time following the issuance of the Subscription Receipts, such

holder’s proportionate share of any interest and other income received or credited on the investment of the Escrowed Funds between the Offering Closing Date and the Termination Date. |

|

|

| DIVIDEND EQUIVALENT PAYMENTS ON SUBSCRIPTION RECEIPTS: |

|

Holders of Subscription Receipts (including Subscription Receipts that may be issued upon the exercise of the Over-Allotment Option) will be

entitled to receive payments per Subscription Receipt equal to the cash dividends per Common Share, if any, paid or payable to holders of Common Shares in respect of all record dates for such dividends occurring from the Offering Closing Date to,

but excluding, the Acquisition Closing Date or to, and including, the Termination Date, as applicable, to be paid to Subscription Receipt holders of record on the record date for the corresponding dividend on the Common Shares on the date on which

such dividend is paid to holders of Common Shares (each, a “Dividend Equivalent Payment”).

In the event that the Termination Date occurs after a dividend has been declared on the Common Shares but before the record date for such dividend, holders of

Subscription Receipts will receive, as part of the Termination Payment, a pro rata Dividend Equivalent Payment in respect of such dividend declared on the Common Shares equal to the amount of such dividend multiplied by a fraction equal to:

(i) the number of days from, and including, the date of the prior Dividend Equivalent Payment (or, if |

|

|

|

| PEMBINA PIPELINE CORPORATION |

|

|

| TREASURY OFFERING OF SUBSCRIPTION RECEIPTS |

|

December 13, 2023 |

|

|

|

|

|

none, the date of the Offering Closing Date) to, but excluding, the date of the Termination Event; divided by (ii) the number of days

from, and including, the date of the prior Dividend Equivalent Payment (or, if none, the prior payment date for dividends on the Common Shares) to, but excluding, the date on which such dividend is paid to holders of Common Shares. If the

Termination Date occurs on a record date or following a record date for a dividend on the Common Shares but on or prior to the payment date for such dividend, Subscription Receipt holders of record on the record date will be entitled to receive the

full Dividend Equivalent Payment. The declaration and payment of dividends on the

Common Shares by the Corporation are at the discretion of the Board of Directors of the Corporation. The first Dividend Equivalent Payment that holders of Subscription Receipts are expected to be eligible to receive will be, if so declared by the

Board of Directors of the Corporation, in respect of the dividend payable to holders of Common Shares on or about March 29, 2024, to shareholders of record as of March 15, 2024. |

|

|

| ESCROW CONDITIONS: |

|

The gross proceeds from the sale of the Subscription Receipts, less the Non-Escrowed

Underwriters’ Fee (as defined below) (the “Proceeds”) will, from the Offering Closing Date until the earlier of the delivery of the Escrow Release Notice and Direction and the Termination Time, be held in escrow by the Subscription

Receipt Agent, and deposited or invested, as applicable, pursuant to the terms of a subscription receipt agreement to be dated as of the Offering Closing Date among the Corporation, the Joint Bookrunners, on behalf of the underwriters, and the

Subscription Receipt Agent, provided that Dividend Equivalent Payments may be made from the Proceeds and the interest and other income received or credited thereon from time to time (the “Earned Interest” and, together with the

Proceeds and any interest and other income received or credited on the Earned Interest, the “Escrowed Funds”).

Once the parties to the Purchase and Sale Agreement are able to complete the Acquisition in all material respects in accordance with the terms of the Purchase

and Sale Agreement, without amendment or waiver materially adverse to the Corporation, unless the consent of the Joint Bookrunners is given to such amendment or waiver (such consent not to be unreasonably withheld, conditioned or delayed) but for

the payment of the Purchase Price, and the Corporation has available to it all other funds required to complete the Acquisition (the “Escrow Release Condition”), the Corporation will provide notice (the “Escrow Release Notice and

Direction”) to the Subscription Receipt Agent and the Subscription Receipt Agent will release the Escrowed Funds, less the Escrowed Underwriters’ Fee (as defined below) and any amounts required to satisfy any unpaid Dividend Equivalent

Payments, to or at the direction of the Corporation. The Escrow Release Condition may, if the foregoing conditions are met, at the election of the Corporation, occur up to seven (7) business days prior to the scheduled Acquisition Closing

Date. |

|

|

|

| PEMBINA PIPELINE CORPORATION |

|

|

| TREASURY OFFERING OF SUBSCRIPTION RECEIPTS |

|

December 13, 2023 |

|

|

|

|

|

In the event that Escrowed Funds are released pursuant to an Escrow

Release Notice and Direction and the closing of the Acquisition does not occur within seven (7) business days of such release, the Corporation will cause such Escrowed Funds to be returned to the Subscription Receipt Agent and the Escrowed

Funds will either continue to be held by the Subscription Receipt Agent or returned to the holders of Subscription Receipts, as applicable. |

|

|

| LISTING: |

|

The Corporation has applied to list the Subscription Receipts (including the Subscription Receipts issuable pursuant to the Over-Allotment

Option) on the Toronto Stock Exchange (the “TSX”), and to list the Common Shares issuable pursuant to the Subscription Receipts (including the Subscription Receipts issuable pursuant to the Over-Allotment Option) on both the TSX and the

New York Stock Exchange (the “NYSE”). The Subscription Receipts will not be listed on the NYSE.

The Common Shares are currently listed on the TSX under the symbol “PPL” and the NYSE under the symbol “PBA”. |

|

|

| FORM OF OFFERING: |

|

Public offering in (a) all provinces of Canada pursuant to a prospectus supplement to the Corporation’s base shelf prospectus dated December 13, 2023, and (b) the United States pursuant to prospectus supplements

to the Corporation’s registration statement on Form F-10, including the Corporation’s U.S. base shelf prospectus, filed with the U.S. Securities and Exchange Commission dated December 13,

2023. |

|

|

| FORM OF UNDERWRITING: |

|

Bought deal, subject to a mutually acceptable underwriting agreement between the Corporation and the underwriters containing “disaster out”, “regulatory out” and “material adverse change out” clauses

running to Closing. |

|

|

| ELIGIBILITY FOR INVESTMENT: |

|

The Subscription Receipts and the Common Shares issuable pursuant to the terms thereof will be eligible for RRSPs, RESPs, RRIFs, RDSPs, TFSAs DPSPs and FHSAs. |

|

|

| JOINT BOOKRUNNERS: |

|

TD Securities Inc., RBC Capital Markets and Scotiabank |

|

|

| UNDERWRITING FEE: |

|

4.0% of the gross proceeds of the Offering. Of the total Underwriting Fee, 50% will be payable upon the closing of the Offering (the “Non-Escrowed Underwriters’ Fee”) and the

remaining 50% of the Underwriting Fee will be paid upon the release of the Escrowed Funds as set forth above (the “Escrowed Underwriters’ Fee”). |

|

|

| CLOSING: |

|

December 19, 2023 (the “Offering Closing Date”). |

Pembina has filed a registration statement (including the final base shelf prospectus) on Form F-10 with the U.S. Securities and Exchange Commission (the “SEC”) for the offering to which this document relates. This document does not provide full disclosure of all material facts relating to the

securities offered. Before you invest, you should read the prospectus in that registration statement, the preliminary prospectus supplement and other documents the Corporation has filed with the SEC for more complete information about the issuer and

this offering, especially risk factors relating to the securities offered. You may obtain these documents free of charge by visiting the SEC’s website at www.sec.gov. Alternatively, the Corporation, any underwriter or any dealer participating

in the offering will arrange to send you the prospectus (as supplemented by the prospectus supplement) if you request it. Copies of the final base shelf prospectus, registration statement on Form F-10, and the

applicable prospectus supplements may be obtained upon request in Canada from TD Securities Inc. at 1625 Tech Avenue, Mississauga, Ontario L4W 5P5

|

|

|

| PEMBINA PIPELINE CORPORATION |

|

|

| TREASURY OFFERING OF SUBSCRIPTION RECEIPTS |

|

December 13, 2023 |

Attention: Symcor, NPM, or by telephone at (289) 360-2009 or by email at sdcconfirms@td.com, from RBC Dominion Securities Inc., 180 Wellington Street West,

8th Floor, Toronto, Ontario M5J 0C2, Attention: Distribution Centre, Phone: (416) 842-5349, Email: Distribution.RBCDS@rbccm.com, or from Scotiabank by mail at 40 Temperance Street, 6th Floor, Toronto, Ontario

M5H 0B4, Attention: Equity Capital Markets, by email at equityprospectus@scotiabank.com or by telephone at (416) 863-7704, or in the United States from TD Securities (USA) LLC, Attention: Equity Capital

Markets, 1 Vanderbilt Avenue, New York, New York 10017, by telephone at (855) 495-9846 or by email at TD.ECM_Prospectus@tdsecurities.com, from RBC Capital Markets, LLC, 200 Vesey Street, 8th Floor, New York,

New York 10281-8098, Attention: Equity Syndicate, Phone: 877-822-4089, Email: equityprospectus@rbccm.com or from Scotia Capital (USA) Inc., 250 Vesey Street, 24th Floor,

New York, New York 10281, Attention: Equity Capital Markets, or by telephone at (212) 255-6854, or by email at us.ecm@scotiabank.com.

Exhibit 99.2 Accretive Consolidation of Alliance and Aux Sable Expanding

Pembina's Premier Natural Gas and NGL Value Chain December 13, 2023 TSX: PPL; NYSE: PBA

Advisories A final base shelf prospectus of Pembina Pipeline Corporation

(“Pembina” or the “Company”) dated December 13, 2023 (the “final base shelf prospectus”) containing important information relating to the securities described in this presentation has been filed with the

securities regulatory authorities in each of the provinces of Canada. A copy of the final base shelf prospectus, any amendment to the final base shelf prospectus and any applicable shelf prospectus supplement that has been filed, is required to be

delivered with this presentation. This presentation does not provide full disclosure of all material facts relating to the securities offered. Investors should read the final base shelf prospectus, any amendment and any applicable shelf prospectus

supplement for disclosure of those facts, especially risk factors relating to the securities offered, before making an investment decision. The Company has filed a registration statement on Form F-10 (including the base shelf prospectus) and a

preliminary prospectus supplement with the United States Securities and Exchange Commission (the SEC ) for the offering to which this document relates. This document does not provide full disclosure of all material facts relating to the securities

offered. Before you invest, you should read the prospectus in that registration statement, the preliminary prospectus supplement and the other documents that the Company has filed with the SEC for more complete information about the issuer and the

offering, especially risk factors relating to the securities offered. You may obtain these documents free of charge by visiting the SEC's website at http://www.sec.gov. Alternatively, the Company, any underwriter, or any dealer participating in the

offering will arrange to send you the prospectus (as supplemented by the prospectus supplement) if you request it. Copies of the base shelf prospectus, registration statement on Form F-10, and the applicable prospectus supplements may be obtained

upon request in Canada by contacting TD Securities Inc. at 1625 Tech Avenue, Mississauga ON L4W 5P5 Attention: Symcor, NPM, or by telephone at (289) 360-2009 or by email at sdcconfirms@td.com, RBC Dominion Securities Inc., 180 Wellington Street

West, 8th Floor, Toronto, ON M5J 0C2, Attention: Distribution Centre, Phone: (416) 842-5349, Email: Distribution.RBCDS@rbccm.com, or Scotiabank by mail at 40 Temperance Street, 6th Floor, Toronto, Ontario M5H 0B4, attn: Equity Capital Markets, by

email at equityprospectus@scotiabank.com or by telephone at (416) 863-7704, or in the United States by contacting TD Securities (USA) LLC, Attention: Equity Capital Markets, 1 Vanderbilt Avenue, New York, NY 10017, by telephone at (855) 495-9846 or

by email at TD.ECM_Prospectus@tdsecurities.com, RBC Capital Markets, LLC, 200 Vesey Street, 8th Floor, New York, NY 10281-8098, Attention: Equity Syndicate, Phone: 877-822-4089, Email: equityprospectus@rbccm.com or Scotia Capital (USA) Inc., 250

Vesey Street, 24th Floor, New York, NY 10281, Attention: Equity Capital Markets, or by telephone at (212) 255-6854, or by email at us.ecm@scotiabank.com. Forward-looking Statements and Information This presentation contains certain forward-looking

statements and forward-looking information (collectively, forward-looking statements ), including forward-looking statements within the meaning of the safe harbor provisions of applicable securities legislation, that are based on Pembina’s

current expectations, estimates, projections and assumptions in light of its experience and its perception of historical trends. In some cases, forward-looking statements can be identified by terminology such as continue , anticipate , schedule ,

will , expects , estimate , potential , future , outlook , strategy , commit , believe and similar expressions suggesting future events or future performance. In particular, this presentation contains forward-looking statements, including certain

financial outlooks, pertaining to, without limitation: Pembina’s acquisition (the “Acquisition”) of Enbridge Inc.’s (“Enbridge”) interests in Alliance, Aux Sable and NRGreen Power (each as defined herein),

including the terms thereof, the expected closing date and the anticipated benefits thereof, including the anticipated synergies and accretive value to Pembina; the Company’s expectations with respect to financing the Acquisition; statements

regarding the effects of the Acquisition on Pembina's financial and operational outlook and performance following completion thereof, including the performance of the Company’s assets, expectations regarding Pembina's operational activities

and service offerings, future credit ratings and financial decisions; expectations about current and future industry activities, development opportunities and market conditions, including their expected impact on Pembina following completion of the

Acquisition; expectations about future demand for Pembina's infrastructure and services; financial guidance and short-, medium- and long-term outlooks following completion of the Acquisition, including the Company’s expectations regarding

adjusted earnings before interest, taxes, deprecation and amortization (“EBITDA”), rating agency funds from operations-to-debt, fee-based contribution to adjusted EBITDA, proportionately consolidated debt-to-adjusted EBITDA and cash flow

from operating activities; Pembina's future common share dividends; and expectations regarding Pembina's commercial agreements and development opportunities, including the expected timing and benefit thereof. These forward-looking statements are not

guarantees of future performance and are based upon expectations, factors and assumptions that Pembina believes are reasonable as of the date hereof, although there can be no assurance that these expectations, factors and assumptions will prove to

be correct. These forward-looking statements are also subject to a number of known and unknown risks and uncertainties that could cause actual events or results to differ materially, including, but not limited to: the ability of Pembina and Enbridge

to receive all necessary regulatory approvals and satisfy all other necessary conditions to closing of the Acquisition on a timely basis or at all; the failure to realize the anticipated benefits and synergies of the Acquisition following completion

thereof due to integration or other issues; an inability to complete the necessary financings in respect of the Acquisition in accordance with management’s current expectations or at all; reliance on third parties to successfully operate and

maintain certain assets; labour and material shortages; reliance on key relationships and agreements and the outcome of stakeholder engagement; the strength and operations of the oil and natural gas production industry and related commodity prices;

expectations and assumptions concerning, among other things, customer demand for Pembina’s assets and services; non-performance or default by counterparties to agreements which Pembina or one or more of its subsidiaries has entered into in

respect of its business; actions by joint venture partners or other partners which hold interests in certain of Pembina's assets; actions by governmental or regulatory authorities, including changes in tax laws and treatment, changes in royalty

rates, changes in regulatory processes or increased environmental regulation; the ability of Pembina to acquire or develop the necessary infrastructure in respect of future development projects; fluctuations in operating results; adverse general

economic and market conditions, including potential recessions in Canada, North America and worldwide resulting in changes, or prolonged weaknesses, as applicable, in interest rates, foreign currency exchange rates, inflation rates, commodity

prices, supply/demand trends and overall industry activity levels; constraints on, or the unavailability of, adequate infrastructure; the political environment in North America and elsewhere, and public opinion; the ability to access various sources

of debt and equity capital; changes in credit ratings; counterparty credit risk; technology and security risks including cyber-security risks; natural catastrophes; the conflict between Ukraine and Russia and the potential impacts thereof. This list

of risk factors should not be construed as exhaustive. 1

Advisories Forward-looking Statements and Information (Continued) For

additional information relating to the assumptions made, and the risks and uncertainties, which could impact the forward-looking statements herein and cause results to differ materially from those predicted, forecasted or projected by such

forward-looking statements, see Pembina's annual information form and management's discussion and analysis, each dated February 23, 2023, for the year ended December 31, 2022, and Pembina's other public disclosure documents available at

www.sedarplus.ca, www.sec.gov and through Pembina's website at www.pembina.com. The estimates of adjusted EBITDA, fee-based contribution to adjusted EBITDA, payout of fee-based distributable cash flow, cash flow from operating activities, rating

agency funds from operations-to-debt and proportionately consolidated debt- to-adjusted EBITDA contained in this presentation may be considered to be financial outlooks for the purposes of applicable Canadian securities laws. The financial outlooks

contained in this presentation are based on assumptions about future events, including economic conditions and proposed courses of action, based on management's assessment of the relevant information currently available, and which may become

available in the future. These projections constitute forward- looking statements and are based on a number of the material factors and assumptions, including those set out above. Actual results may differ significantly from the projections

presented herein. See above for a discussion of the risks that could cause actual results to vary. The financial outlooks contained in this presentation have been approved by management as of the date hereof. The purpose of the financial outlooks

contained in this presentation is to assist readers in understanding the Company’s expected outlook and results following completion of the Acquisition and prospective investors are cautioned that any financial outlooks contained herein should

not be used for other purposes. Pembina and its management believe that the financial outlooks contained in this presentation have been prepared based on assumptions that are reasonable in the circumstances, reflecting management's best estimates

and judgments, and represents, to the best of management's knowledge and opinion, expected and targeted financial results. However, because this information is highly subjective, it should not be relied on as necessarily indicative of future

results. The forward-looking statements contained in this presentation speak only as of the date of this presentation. Pembina does not undertake any obligation to publicly update or revise any forward-looking statements or information contained

herein, except as required by applicable laws. The forward-looking statements contained in this presentation are expressly qualified by this cautionary statement. Abbreviations In this presentation, the following abbreviated terms have the indicated

meanings: AECO Alberta Energy Company benchmark price for natural gas bcf/d billions of cubic feet per day bpd barrels per day km kilometer mbpd thousands of barrels per day MMcf/d millions of cubic feet per day LNG Liquefied natural gas NGL Natural

gas liquids U.S. United States WCSB Western Canadian Sedimentary Basin 2 In this presentation, all dollar amounts are expressed in Canadian dollars unless stated otherwise.

Acquisition Summary (1) • Pembina to purchase Enbridge’s 50%

interest in the Alliance Pipeline and 42.7% interest in Aux Sable (2) (3) • Acquisition value of ~$3.1 billion , which includes the assumption of ~$327 million of debt › Funded through a combination of (i) the net proceeds of a ~$1.114

billion bought deal offering of subscription receipts; and (ii) amounts drawn under Pembina’s existing credit facilities and cash on hand • Acquisition expected to close in the first half of 2024, subject to the satisfaction or waiver of

customary conditions, including the receipt of required regulatory approvals (1) Current Ownership Pro Forma Ownership 50% 100% 42.7% 85.4% 14.6% 14.6% (1) As part of the Acquisition Pembina is also acquiring Enbridge’s interest in NRGreen

Power Limited Partnership. For a full description of the assets being acquired see the Appendix. (2) Subject to certain adjustments. (3) Represents Enbridge’s proportionate share of the indebtedness of Alliance. 3 An opportunistic

consolidation of a high-quality asset at an attractive price

Acquisition Highlights ~$225 – $250 Leverage million Neutral

expected and consistent with incremental cash Pembina’s Financial Business profile flow from operating Guardrails On Strategy †(1) unchanged activities Increases Further ~85 – 90% exposure to high- Bolsters the fee-based quality,

highly Immediately with high-degree of Pembina Store ~$40 – $65 strategic Accretive take-or-pay infrastructure million to adjusted cash commitments annual synergies flow from operating expected by 2025; activities per share, with mid-single

digit long-term ~9x 2023 and accretion expected opportunities to 2024 Adjusted to be achieved in the reduce Acquisition †(2) EBITDA forecast* first full year of multiple ownership ~8x 2023 and 2024 Adjusted †(2) EBITDA forecast*

inclusive of synergies expected by 2025 (1) Expected 2025 including synergies. (2) Implied Acquisition multiple. 4 * Adjusted EBITDA is a non-GAAP measure. The Acquisition multiples shown here are non-GAAP ratios. See “Non-GAAP and Other

Financial Measures” herein. † See Forward-Looking Statements and Information under Advisories .

Compelling Strategic Rationale ✓ Critical and highly

differentiated North American energy infrastructure • Highly reliable and highly utilized cross-border pipeline, unique ability to transport liquids-rich gas (“2 pipes in 1”) Opportunistic ✓ Pembina uniquely positioned, with

existing operational know-how and minimal integration risk Consolidation of Highly Strategic • Alliance commercially managed by Pembina, and Aux Sable already operated by Pembina today Infrastructure • Near-term, low risk integration and

synergy benefits expected to unlock incremental value • Simplifies corporate reporting structure ✓ Macro support for WCSB liquids-rich gas export to Chicago Backed by Strong Fundamentals • WSCB/Canadian LNG + Bakken volume growth

and U.S. Gulf Coast LNG growth ✓ Low risk cash flow underpinned by long-term contracts with high-quality counterparties ✓ Upside provided by widening AECO-Chicago gas price differentials and frac spreads Drives Resilient ✓

Increases exposure to lighter hydrocarbons (natural gas & NGL) Growth ✓ Enhances service offering of the Pembina Store; existing strong customer relationships; unlocks new growth opportunities ✓ Expands U.S. presence and leverages

Pembina’s brand name in the U.S. NGL market Platform for the ✓ Opportunity to grow marketing portfolio by ~100,000 bpd over the long-term (2030+) Future ✓ Incremental commercial integration opportunities, further bolstering the

Pembina Store 5 Complements Pembina's strategy of providing world-class WCSB resources with access to premium end markets

Favorable Macro North American Natural Gas Dynamics (1) Western Canadian

Natural Gas Flows Projected Production / Capacity Expansions Over Next 5 Years Alliance has strategic value within the North WCSB American natural gas and liquids market Gas West Coast Station 2 LNG Export +2.0 • Supplies premium U.S. Midwest

market and U.S. +2.8 Bcf/d Gulf Coast export Bcf/d • Unique ability to carry liquids-rich natural gas AECO Empress WCSB production growth expected to continue Sumas Kingsgate Bakken • New volume growth expected to largely supply Gas

Emerson Bakken West Coast LNG export +2.1 (2) Bcf/d • Tepid WCSB intra-basin demand drives increased Marcellus Dawn need for egress Chicago • World-class Montney has lowest supply costs and longest Tier 1 inventory in North America DJ

Significant U.S. Gulf Coast LNG export growth (3) Tier 1 Inventory Years Remaining expected over the next five years SCOOP / STACK Montney 18 • Demand pull supports AECO-Chicago Delaware 15 differentials, drawing WCSB volumes south Midland 10

Midland Eagle Ford 9 Delaware • U.S. domestic gas plays lack long-term scale and DJ 7 USGC LNG economics of the Montney SCOOP|S… 4 Eagle Export Ford Bakken 3 +13.0 (1) Source: S&P Global Commodity Insights Marcellus 1 (2) Source:

North Dakota Industrial Commission and North Dakota Pipeline Authority Bcf/d 6 (3) Source: Enverus

NGL The Pembina Store Natural Gas Value Chain + + Gas Consumers NGL

(pre-FID LNG Export Terminal) Mainline Extraction Alliance rd 3 Party and Fractionation Pembina Gas Infrastructure Pipeline & Palermo Pipelines (Younger, Empress, Gathering, Processing, Conditioning Plant Aux Sable) Field Extraction Industrial

Users NGL Value Chain C2 C2 + + C3 C3 C2+ mix rd C4 3 Party C3+ mix Pipelines & C5 Facilities NGL Prince Rupert Terminal C5+ Redwater NGL Redwater & Marketing & Producers Storage (LPG Export) Pipelines Aux Sable Distribution

Fractionation Oil & Condensate (LVP) Heavy Oil Producers Oil Edmonton Terminals and Vancouver Terminals C5 Pipelines Refining Pipelines Canadian Diluent Hub Wharves (& Upgrading) 7 Strengthening the integrated service offering

Premier Cross-Border Natural Gas and NGL Value Chain Alliance Pipeline

3,849 km integrated Canadian & U.S. natural gas transmission Highly strategic pipeline, with 60 receipt points, delivering ~1.7 bcf/d of liquids-rich Overview cross border natural gas from the WCSB & North Dakota to markets in the Chicago,

Illinois area pipeline and fractionation facility Fee-based, underpinned by predominantly long-term, take-or-pay Revenue Type with expected contracts immediate Volume weighted average remaining take-or-pay contract life integration benefits

Contracts greater than seven years and long-term Chicago natural gas demand remains sufficiently elevated and marketing and Drivers WCSB supply remains cost competitive vs. alternatives growth Adjusted opportunities 2023 Forecast: ~C$550 million

(100% W.I.) *† EBITDA Aux Sable Fractionation complex is capable of extracting and fractionating up to 131,000 bbls/day of spec NGL products (C2, C3, NC4, IC4 and C5+) by processing up to 2.1 bcf/d; Aux Sable has the exclusive Overview right

to extract NGL from the rich natural gas shipped on Alliance pipeline Aux Sable’s primary asset, the Channahon Facility, is predominantly Revenue Type commodity exposed Natural gas/NGL supply derived from a cost advantaged basin, with Drivers

egress constraints Adjusted 2023 Forecast: ~C$150 million (100% W.I.) * Adjusted EBITDA is a non-GAAP measure. See “Non-GAAP and Other Financial Measures” herein. *† EBITDA † See Forward-Looking Statements and Information

under Advisories . 8 Acquisition expands Pembina's capability to deliver WCSB natural gas and NGL into premium markets

Acquisition Consistent With Financial Guardrails Pro Forma Acquisition

† 2024 Forecast Maintain target of 80% fee-based contribution to 1 ~85% - 90%* adjusted EBITDA Predominantly fee-based contracts Target <100% payout of fee-based distributable ~70% - 75% 2 cash flow Primarily Target 75% credit exposure from

investment 3 investment grade ~80% - 85% grade and secured counterparties counterparties Leverage neutral, ~19 - 22% consistent with 4 Maintain strong BBB credit rating Rating Agency FFO- Pembina’s strong to- Debt* BBB credit rating * Adjusted

EBITDA and Rating Agency FFO-to-Debt are non-GAAP measures or non-GAAP ratios. See “Non-GAAP and Other Financial Measures” herein. † See Forward-Looking Statements and Information under Advisories . 9 Transac Acquisit tion demon

ion demon strates stra Pembina’ tes Pembina’ s contin s commitme ued commitme nt to nt execut to ex e ecut strae tegy stra within tegy within its fina the ncia fina l gu ncar ial drail guar sdrails

De-Risked Acquisition Synergies to Unlock Value Creation ~9x Adjusted

EBITDA* ~8x multiple Adjusted EBITDA* <8x multiple Adjusted EBITDA* multiple Expected Annual Expected Annual Synergies Synergies of of >$100 million $40-$65 million †(1) 2023 and 2024 Forecast Illustrative 2023 and 2024 Longer-Term

Forecast † Forecast Including near-term Synergies • Opportunity to grow Marketing • Increased Marketing activities portfolio • Bakken growth (1) Latter part of the decade. • Various capital project developments •

Efficiencies through single entity * Adjusted EBITDA is a non-GAAP measure. See “Non-GAAP and Other Financial Measures” herein. ownership † See Forward-Looking Statements and Information under Advisories . 10 Immediate synergy

value and longer-term targets to reduce Acquisition multiple

Pembina’s Investment Highlights ✓ Alliance / Aux Sable

acquisition is a rare opportunity to consolidate critical energy infrastructure at an attractive valuation with immediate cash flow accretion and significant synergy potential ✓ WCSB momentum enhancing utilization of Pembina’s assets

and providing significant growth opportunities ✓ Unequalled connectivity to Montney and Duvernay growth ✓ Integrated, difficult-to-replicate assets provide an enduring competitive advantage and unequaled market access for customers

✓ Low risk business model delivers resilient and growing cash flow ✓ Strong BBB credit rating and commitment to financial guardrails ✓ Developing ‘in-strategy’ energy transition growth opportunities 11 Pembina is a

leading North American energy infrastructure company with a track record of per share growth

Appendix TSX: PPL; NYSE: PBA

Asset Description Aux Sable Alliance Aux Sable Canada Alliance Canada

• Includes Aux Sable Canada LP and Aux Sable Canada Ltd. • Includes Alliance Pipeline Limited Partnership, Alliance Canada Marketing Ltd. • Heartland Offgas Plant - 20 MMcf/d extraction plant located in Fort Saskatchewan, and

Alliance Canada Marketing L.P. Description Description Alberta. • Canadian portion of the Alliance Pipeline which consists of a 1,561 km natural gas and Primary and Primary • The Septimus Pipeline - located in northeastern British

Columbia and transports mainline pipeline and 732 km of related lateral pipelines connected to natural gas Assets sweet, liquids rich gas from the Septimus and Wilder gas plants to the Alliance Assets receipt locations, primarily at gas processing

facilities in northwestern Alberta and Pipeline, for downstream processing at Aux Sable U.S.'s Channahon Facility. northeastern British Columbia, and related infrastructure. • Current: Jointly owned by Pembina (50 percent) and indirectly by

Enbridge (50 • Current: Jointly owned by Pembina (50 percent) and indirectly by Enbridge (50 Ownership percent) percent) Ownership • Pro Forma: Pembina (100 percent) • Pro Forma: Pembina (100 percent) Aux Sable U.S. Alliance U.S.

• Includes Alliance Pipeline Ltd., Alliance Pipeline Inc. and Alliance Pipeline L.P. Description • U.S. portion of the Alliance Pipeline consists of 1,556 km of infrastructure • Includes Aux Sable Liquids Products Inc., Aux Sable

Liquid Products L.P., and Aux and Primary including the 129 km Tioga lateral in North Dakota. Alliance U.S., an affiliate of Sable Midstream LLC Assets Alliance Canada, owns the U.S. portion of the Alliance Pipeline system. • The Channahon

Facility - capable of processing 2.1 bcf/d of natural gas and can produce approximately 131 mbpd of specification NGL products. All of the natural • Current: Jointly owned by Pembina (50 percent) and indirectly by Enbridge (50 gas delivered

via the Alliance Pipeline is processed at the Channahon Facility. percent) Ownership Description • The Palermo Conditioning Plant - 80 MMcf/d plant, which receives gas from • Pro Forma: Pembina (100 percent) and Primary gathering systems

servicing nearby Bakken shale oil and gas production areas and Assets removes the heavier hydrocarbon compounds while leaving the majority of the natural gas liquids in the rich gas prior to shipping on the Alliance Pipeline via NRGreen delivery on

the Prairie Rose Pipeline. • The Prairie Rose Pipeline - 120 MMcf/d pipeline connecting the Palermo NRGreen Power Conditioning Plant to the Alliance Pipeline. • Includes NRGreen Power Ltd. and NRGreen Power Limited Partnership

Description • Four waste heat recovery units with the capacity to generate 20 MW of electricity, and Primary along the Alliance Pipeline in Saskatchewan, and a 14 MW waste heat recovery • Current: Pembina (42.7 percent), indirectly by

Enbridge (42.7 percent) and Assets unit at Alliance Pipeline’s Windfall compressor station near Whitecourt, Alberta. indirectly by Williams Partners (14.6 percent). Ownership • Pro Forma: Pembina (85.4 percent) and indirectly by Williams

Partners (14.6 • Current: Jointly owned by Pembina (50 percent) and indirectly by Enbridge (50 percent). Ownership percent) 13 • Pro Forma: Pembina (100 percent)

Non-GAAP and Other Financial Measures Throughout this presentation,

Pembina has disclosed certain financial measures and ratios that are not specified, defined or determined in accordance with GAAP and which are not disclosed in Pembina's financial statements. Non-GAAP financial measures either exclude an amount

that is included in, or include an amount that is excluded from, the composition of the most directly comparable financial measure specified, defined and determined in accordance with GAAP. Non-GAAP ratios are financial measures that are in the form

of a ratio, fraction, percentage or similar representation that has a non-GAAP financial measure as one or more of its components. These non-GAAP financial measures and ratios, together with financial measures and ratios specified, defined and

determined in accordance with GAAP, are used by management to evaluate the performance and cash flows of Pembina and its businesses and to provide additional useful information respecting Pembina's financial performance and cash flows to investors

and analysts. The non-GAAP financial measures and ratios disclosed in this presentation do not have any standardized meaning under International Financial Reporting Standards ( IFRS ) and may not be comparable to similar financial measures or ratios

disclosed by other issuers. The measures and ratios should not, therefore, be considered in isolation or as a substitute for, or superior to, measures and ratios of Pembina's financial performance, or cash flows specified, defined or determined in

accordance with IFRS, including earnings, earnings before income tax, earnings per share, cash flow from operating activities and cash flow from operating activities per share. Except as otherwise described herein, these non-GAAP financial measures

and non-GAAP ratios are calculated on a consistent basis from period to period. Specific reconciling items may only be relevant in certain periods. Below is a description of each non-GAAP financial measure and non-GAAP ratio disclosed in this

presentation, together with, as applicable, disclosure of the most directly comparable financial measure that is specified, defined and determined in accordance with GAAP to which each non-GAAP financial measure relates and a quantitative

reconciliation of each non-GAAP financial measure to such directly comparable GAAP financial measure. 14

Non-GAAP and Other Financial Measures Adjusted Earnings Before

Interest, Taxes, Depreciation and Amortization ( adjusted EBITDA ) and adjusted EBITDA per Common Share Year Ended ($ millions, except as noted) Notes Adjusted EBITDA is a non-GAAP financial measure and is calculated as earnings before net finance

costs, income December 31, 2022 taxes, depreciation and amortization (included in operations and general and administrative expense) and Earnings (loss) before income tax 3,219 unrealized gains or losses on commodity-related derivative financial

instruments. The exclusion of unrealized gains or losses on commodity-related derivative financial instruments eliminates the non-cash impact of such Adjustments to share of profit from equity (1) 468 gains or losses. accounted investees and other

Adjusted EBITDA also includes adjustments to earnings for losses (gains) on disposal of assets, transaction costs Net finance costs 486 incurred in respect of acquisitions, dispositions and restructuring, impairment charges or reversals in respect

of goodwill, intangible assets, investments in equity accounted investees and property, plant and equipment, certain Depreciation and amortization 683 non-cash provisions and other amounts not reflective of ongoing operations. In addition, Pembina's

proportionate share of results from investments in equity accounted investees with a preferred interest is presented in adjusted Unrealized (gain) loss on commodity-related (133) EBITDA as a 50 percent common interest. These additional adjustments

are made to exclude various non-cash derivative financial instruments and other items that are not reflective of ongoing operations. Canadian Emergency Wage Subsidy -- The most directly comparable GAAP measure is earnings (loss) before income tax.

Transformation and restructuring costs 5 Management believes that adjusted EBITDA provides useful information to investors as it is an important indicator of an issuer's ability to generate liquidity through cash flow from operating activities and

equity accounted Transaction costs incurred in respect of acquisitions (1) investees. Management also believes that adjusted EBITDA provides an indicator of operating income generated from capital invested, which includes operational finance income

from lessor lease arrangements. Adjusted Arrangement Termination Payment -- EBITDA is also used by investors and analysts for assessing financial performance and for the purpose of valuing an issuer, including calculating financial and leverage

ratios. Management utilizes adjusted EBITDA to set Gain on Pembina Gas Infrastructure transaction (1,110) objectives and as a key performance indicator of the Company's success. Pembina presents adjusted EBITDA as management believes it is a measure

frequently used by analysts, investors and other stakeholders in evaluating Impairment charges and non-cash provisions 129 the Company's financial performance. Adjusted EBITDA 3,746 (1) See reconciliation table on slide 16. 15

Non-GAAP and Other Financial Measures Adjusted EBITDA From Equity

Accounted Investees In accordance with IFRS, Pembina's jointly controlled investments are accounted for using equity accounting. Under equity accounting, the assets and liabilities of the investment are presented net in a single line item in the

Consolidated Statement of Financial Position, Investments in Equity Accounted Investees . Net earnings from investments in equity accounted investees are recognized in a single line item in the Consolidated Statement of Earnings and Comprehensive

Income Share of Profit from Equity Accounted Investees . The adjustments made to earnings, in adjusted EBITDA above, are also made to share of profit from investments in equity accounted investees. Cash contributions and distributions from

investments in equity accounted investees represent Pembina's share paid and received in the period to and from the investments in equity accounted investees. To assist in understanding and evaluating the performance of these investments, Pembina is

supplementing the IFRS disclosure with non-GAAP proportionate consolidation of Pembina's interest in the investments in equity accounted investees. The most directly comparable GAAP measure is share of profit (loss) from equity accounted investees

– operations. Pembina's proportionate interest in equity accounted investees has been included in adjusted EBITDA, described above. Pembina’s current ownership interests in Alliance Pipeline and Aux Sable are treated as equity accounted

investees and reported in the Pipelines Division and Marketing & New Ventures Division, respectively. Year Ended December 31, 2022 ($ millions, except as noted) Notes Marketing and Pipelines Facilities Total New Ventures Share of profit (loss)

from equity accounted 171 108 82 361 investees - operations Adjustments to share of profit (loss) from equity accounted investees: Net finance costs 21 79 -- 100 Income tax expense -- 14 -- 14 Depreciation and amortization 149 138 25 312 Unrealized

loss on commodity-related -- 27 -- 27 derivative financial instruments Transaction costs incurred in respect of -- 13 -- 13 acquisitions Share of earnings (loss) in excess of equity (1) 2 -- -- 2 interest Total adjustments to share of profit from

172 271 25 468 equity accounted investees Impairment charges and non-cash provisions -- -- -- -- Adjusted EBITDA from equity accounted 343 379 107 829 investees (1) Pembina's proportionate share of results from investments in equity accounted

investees with a preferred interest is presented in adjusted EBITDA as a 50 percent common interest. 16

Non-GAAP and Other Financial Measures Acquisition Multiple This

presentation refers to Acquisition multiples, which are non-GAAP ratios calculated by dividing the Acquisition purchase price by the adjusted EBITDA for the acquired assets. The presentation refers to these multiples inclusive and exclusive of

synergies expected in relation to the Acquisition. Management believes that these multiples are commonly used by investors and analysts as useful indicators of value. Year Ended December 31, 2023 Forecast Year Ended December 31, 2024 Forecast ($

millions, except as noted) Notes Alliance Pipeline Aux Sable Total Alliance Pipeline Aux Sable Total Adjusted EBITDA (100%) 550 150 700 552 148 700 Adjusted EBITDA (from interests being acquired - 50% Alliance, 42.7% Aux Sable) A 275 64 339 276 63

339 Acquisition Purchase Price B 3,100 3,100 Near-term expected synergies (mid-point of $40 million to $65 million) C 53 53 Acquisition Multiple, excluding synergies =B/A 9x 9x Acquisition Multiple, including synergies =B/(A+C) 8x 8x 17

Non-GAAP and Other Financial Measures Adjusted Cash Flow From Operating

Activities and Adjusted Cash Flow From Operating Activities per Year Ended ($ millions, except as noted) Notes Common Share December 31, 2022 Cash flow from operating activities 2,929 Adjusted cash flow from operating activities is a non-GAAP

measure which is defined as cash flow from operating activities adjusting for the change in non-cash operating working capital, adjusting for current Change in non-cash operating working capital (177) tax and share-based compensation payment, and

deducting preferred share dividends paid. Adjusted cash flow from operating activities deducts preferred share dividends paid because they are not Current tax expense (227) attributable to common shareholders. The calculation has been modified to

include current tax and share-based compensation payment as it allows management to better assess the obligations discussed Taxes paid, net of foreign exchange 334 below. Accrued share-based payment expense (117) The most directly comparable GAAP

measure is cash flow from operating activities. Share-based compensation payment 45 Management believes that adjusted cash flow from operating activities provides comparable information to investors for assessing financial performance during each

reporting period. Management Preferred share dividends paid (126) utilizes adjusted cash flow from operating activities to set objectives and as a key performance indicator Adjusted cash flow from operating activities A 2,661 of the Company's

ability to meet interest obligations, dividend payments and other commitments. Weighted Average Shares (Basic) (million) B 553 Adjusted cash flow from operating activities per common share is a non-GAAP ratio which is calculated by dividing adjusted

cash flow from operating activities by the weighted average number of common Adjusted cash flow from operating activities per =A/B 4.82 common share – basic (dollars) ($) shares outstanding. Payout of Fee-Based Distributable Cash Flow Year

Ended ($ millions, except as noted) Notes Payout of Fee-Based Distributable Cash Flow is a non-GAAP ratio calculated as the ratio of December 31, 2022 common dividends paid to fee-based distributable cash flow, as described above. Dividends paid

– common A 1,525 Management believes Payout of Fee-Based Distributable Cash Flow is useful to investors and Fee-based distributable cash flow B 1,900 other users of Pembina’s financial information in the evaluation of the Company’s

ability to pay dividends on its common shares using cash generated from its non-commodity exposed Payout of fee-based distributable cash flow (%) =A/B 80% businesses. 18

Non-GAAP and Other Financial Measures Fee-Based Contribution to

Adjusted EBITDA Year Ended ($ millions, except as noted) Notes December 31, 2022 Fee-based contribution to adjusted EBITDA is a non-GAAP measure defined as the portion of Adjusted EBITDA (1) 3,746 adjusted EBITDA derived from the fee-based, non

commodity exposed, parts of Pembina’s business and excludes adjusted EBITDA attributable to the Corporate segment and the Adjusted EBITDA – Corporate segment 239 Marketing & New Ventures Division. The most directly comparable GAAP

measure is earnings Adjusted EBITDA excluding Corporate segment A 3,985 (loss) before income tax. Adjusted EBITDA – Marketing & New Ventures (721) When expressed as a percentage, fee-based contribution to adjusted EBITDA is a non-GAAP

ratio. Fee-Based Contribution to Adjusted EBITDA B 3,264 Fee-Based Contribution to Adjusted EBITDA (%) =B/A 82% Management believe this metric is useful to investors and other users of Pembina’s financial information is assessing the earnings

generated from Pembina’s non-commodity exposed Adjusted EBITDA from Equity Accounted Investees - Pipelines (2) (343) businesses. Adjusted EBITDA from Equity Accounted Investees - Facilities (2) (379) Fee-Based Distributable Cash Flow

Distributions from Equity Accounted Investees 673 Fee-based distributable cash flow is a non-GAAP measure defined as the cash generated from the fee-based, non-commodity exposed, parts of Pembina’s business that is available for distribution

to less: distributions from Equity Accounted Investees - Marketing (134) common shareholders. The most directly comparable GAAP measure is earnings (loss) before General & administrative – Corporate segment (246) income tax. Net Finance

Costs - loans and borrowings and hybrid (414) Fee-based distributable cash flow is comprised of fee-based adjusted EBITDA from Pembina’s wholly-owned assets within the Pipelines and Facilities divisions, plus the fee-based portion of Net

Finance Costs - leases (32) distributions from equity accounted investees, less preferred share dividends, net finance costs related to loans and borrowings and leases, and illustrative current tax expense. Subtotal 2,389 Management believes this

metric is useful to investors and other users of Pembina’s financial Illustrative current tax expense @ 15% (363) information is assessing the amount of cash generated from Pembina’s non-commodity exposed Preferred Dividends Paid (126)

businesses. Fee-Based Distributable Cash Flow 1,900 Fee-based distributable cash flow is used in the calculation of payout of fee-based distributable cash flow, described below. (1) For reconciliation of adjusted EBITDA to earnings (loss) before

income tax, see slide 15. (2) See reconciliation table on slide 16. 19

Non-GAAP and Other Financial Measures Rating Agency FFO-to-Debt Year

Ended ($ millions, except as noted) Notes December 31, 2022 Rating Agency FFO-to-Debt is a non-GAAP ratio defined and used by Pembina to Cash flow from operating activities 2,929 replicate one of the Company’s rating agency methodologies, in

the evaluation of the Company's creditworthiness. The component parts in the calculation are Rating Share-based compensation payment 45 Agency Funds From Operations and Rating Agency Debt, both of which are non-GAAP Other (1) 5 financial measures.

The most directly comparable GAAP measure to Rating Agency FFO Change in non-cash working capital (177) is cash from operating activities. The most directly comparable GAAP measure to Rating Agency Debt is loans and borrowings. Interest paid during

construction (21) 50% of preferred dividends paid (63) 50% of subordinated hybrid interest paid 15 Rating Agency Funds From Operations (FFO) A 2,733 Loans and borrowings (current) 600 Loans and borrowings (non-current) 9,405 Cash and cash

equivalents (94) 50% of Preferred Shares 1,104 50% of Hybrid Notes 298 Post-retirement benefit obligations/(asset) (after tax) (2) (5) Decommissioning provision (after tax) (3) 198 Lease liabilities (current + non-current) 675 Rating Agency Debt B

12,181 Rating Agency FFO-to-Debt (%) =A/B 22% (1) Other is found in Pembina’s 2022 Annual Report on page 84. (2) Canadian statutory tax rate of 23.6% applied as per Note 11. $(6)MM * (1 – 0.236) = $(5)MM. (3) Canadian statutory tax rate

of 23.6% applied as per Note 11. $259MM * (1 – 0.236) = $198MM. 20

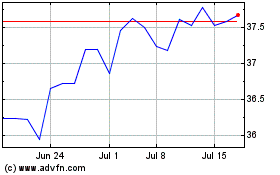

Pembina Pipeline (NYSE:PBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

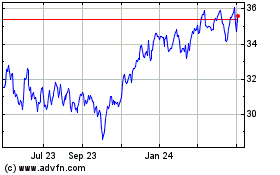

Pembina Pipeline (NYSE:PBA)

Historical Stock Chart

From Apr 2023 to Apr 2024