8-K0001365916FALSE00013659162023-12-122023-12-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

____________________

Date of report (Date of earliest event reported): December 12, 2023

Amyris, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-34885 | 55-0856151 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 5885 Hollis Street, Suite 100, | Emeryville, | CA | 94608 |

| (Address of Principal Executive Offices) | (Zip Code) |

| | | | | | | | | | | |

| | (510) | 450-0761 | |

| | (Registrant’s telephone number, including area code) | |

| | | | | | | | |

| | | |

| | (Former name or former address, if changed since last report.) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions (see General Instruction A.2 below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | AMRSQ | N/A* |

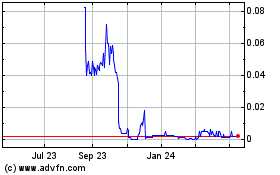

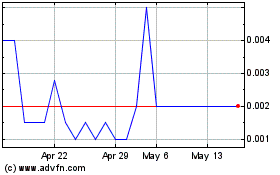

* On September 8, 2023, Nasdaq filed a Form 25 with the Securities and Exchange Commission (the “SEC”) to delist our common stock from the Nasdaq Stock Market LLC. The delisting became effective on September 18, 2023. The deregistration of the shares of common stock under section 12(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) became effective 90 days after the filing date of the Form 25, at which point the shares were deemed registered under Section 12(g) of the Exchange Act. Our common stock currently trades on the OTC Pink Marketplace maintained by the OTC Markets Group, Inc. under the symbol “AMRSQ.”

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

As previously reported, on August 9, 2023, Amyris, Inc. (the “Company”) and certain of its direct and indirect subsidiaries (collectively, the “Company Parties” or the “Debtors”) filed voluntary petitions for relief under Chapter 11 of Title 11 of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”), thereby commencing Chapter 11 cases for the Company Parties (the “Chapter 11 Cases”). The Company Parties continue to operate their business as “debtors in possession” under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code and orders of the Bankruptcy Court.

| | | | | |

Item 1.01 | Entry into a Material Definitive Agreement. |

Amended Plan Support Agreement

On December 12, 2023, the Debtors entered into an amendment to and restatement of that certain Plan Support Agreement, dated October 12, 2023 (together with all exhibits and schedules thereto, the “PSA” and as amended, restated, supplemented or otherwise modified from time to time, the “Amended PSA”), by and among certain of the Debtors’ secured creditors, including Foris Ventures LLC (“Foris”) and Euagore LLC, Anesma Group, LLC, Anjo Ventures, LLC, Perrara Ventures, LLC and Muirisc, LLC, each affiliates of Foris, as well as certain holders of the Company’s outstanding convertible notes, and the Official Committee of Unsecured Creditors (collectively, the “Consenting Parties”). The Amended PSA, together with the amended plan attached as an exhibit to, and incorporated into, the Amended PSA, provide the framework for a plan of reorganization (the “Amended Plan”). Pursuant to the Amended PSA, the parties agreed, among other matters, including those previously agreed to in the PSA, to (i) extend certain milestones, as described below, (ii) provide for certain covenants applicable to the Consenting Convertible Noteholders and the Creditors’ Committee, (iii) include a covenant that the Debtors will not directly or indirectly seek, solicit, encourage, propose, file, support, consent to, or vote for, or enter into or participate in any discussions, agreements, understandings or other arrangements with any Person regarding, or pursue or consummate, any Alternative Restructuring Proposal (as defined in the PSA) and (iv) remove or revise certain termination events.

The Amended PSA further provides that the Debtors will achieve certain additional milestones and extended certain existing milestones, including:

i.By no later than December 12, 2023, the Debtors and the DIP Secured Parties will agree on an amended Approved Budget and corresponding amendments to the DIP Loan Documents;

ii.by no later than December 8, 2023, the Debtors will have commenced the sale and marketing process for the Other Amyris Assets;

iii.by no later than December 20, 2023, the Bankruptcy Court shall have entered the order approving the Other Assets Bidding Procedures;

iv.in the event of a Sale Option under the Amended Plan, an order approving the sale of the Other Amyris Assets in accordance with Other Amyris Assets Bidding Procedures, will have been entered no later than January 25, 2024;

v.by no later than January 25, 2024, the Bankruptcy Court will have entered an order confirming the Amended Plan; and

vi.by no later than February 15, 2024, the effective date of the Amended Plan will have occurred.

The Amended Plan and the PSA require the Debtors to commence a sale process for the Other Assets. The Debtors intend to promptly file a motion with the Bankruptcy Court to approve bidding procedures to govern the sale of the Other Assets. The Plan and the PSA provide that the DIP Secured Parties and the Foris Prepetition Secured Lenders have sole discretion to determine if the Debtors should close a sale of the Other Assets.

A copy of the Amended PSA is attached hereto as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated by reference herein. The foregoing description of the Amended PSA is only a summary, does not purport to be complete, and is qualified in its entirety by reference to the Amended PSA. Capitalized terms used herein that are not otherwise defined herein shall have the meanings given to them in the Amended PSA.

DIP Credit Agreement Amendment

On December 12, 2023, the Company, Amyris Clean Beauty, Inc., and Aprinnova, LLC (collectively, the “Borrowers”), and certain other subsidiaries of the Company (the “Guarantors”) entered into an amendment (the “Amendment No. 5”) to that certain Senior Secured Super Priority Debtor In Possession Loan Agreement (the “DIP Credit Agreement”), dated as of August 9, 2023 (as amended, restated, supplemented or otherwise modified from time to time), by and among the Borrowers, Guarantors, each lender from time to time party to the DIP Credit Agreement and Euagore, LLC, an affiliate of Foris, in its capacity as administrative agent (the “Administrative Agent”). Pursuant to the Amendment No. 5, the parties agreed, among other matters, to extend the approved budget for the Debtors through the potential effective date of February 15, 2024, further extend certain other milestones and waive certain defaults. Capitalized terms used herein that are not otherwise defined herein shall have the meanings given to them in the Amendment No. 5.

The foregoing does not purport to be complete and is qualified in its entirety by reference to the Amendment No. 5 that is filed hereto as Exhibit 10.2 and is incorporated herein by reference.

| | | | | |

Item 7.01 | Regulation FD Disclosure. |

Consumer Brand Sales

On November 30, 2023 and December 1, 2023, the Company conducted auctions for certain of the Debtors’ assets (the “Brand Assets”). At the conclusion of this auction, the Debtors declared THG Beauty USA LLC, Dr. Reddy’s Laboratories, Inc., and Scent Theory Products, LLC (collectively the “Successful Bidders”) as the successful bidders of the Biossance®, MenoLabsTM, and 4U by TiaTM brands, respectively. The sales of those Brand Assets (the “Brand Sales”) to the Successful Bidders was approved by the Bankruptcy Court on December 12, 2023. The aggregate proceeds from these Brand Sales is expected to be approximately $23.6 million. The Debtors’ other brands, including Pipette®, JVNTM, Rose, Inc.TM, and StripesTM are in process of being sold and any such sales will be submitted to the Bankruptcy Court for approval.

Amended Plan and Disclosure Statement

In connection with the Amended PSA, on December 6, 2023 the Debtors filed the Amended Plan and the Disclosure Statement, whereby the parties agreed, among other matters, to: (i) modify the distributions potentially made available to General Unsecured Creditors and other stakeholders, subject to the terms and conditions of the Amended Plan and (ii) include a potential “sale option” for all assets other than the consumer brands. Capitalized terms used herein that are not otherwise defined herein shall have the meanings given to them in the Amended PSA.

Information contained in the Amended Plan and the Disclosure Statement is subject to change, whether as a result of amendments or supplements to the Amended Plan or Disclosure Statement, third-party actions, or otherwise, and should not be relied upon by any party. The documents and other information available via website or elsewhere are not part of this Current Report on Form 8-K and shall not be deemed incorporated herein.

The foregoing does not purport to be complete and is qualified in its entirety by reference to the Notice of Filing of Successful Bidders and Auction Results and to the Amended Plan and Disclosure Statement, as well as other court filings and information about the Chapter 11 Cases, which are available electronically at https://cases.stretto.com/Amyris. Documents and other information available on such website are not part of this Form 8-K and shall not be

deemed incorporated by reference in this Form 8-K. The Company has included the website address in this Form 8-K as an inactive textual reference only.

The information contained in this 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall they be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Cautionary Statements Regarding Trading in the Company’s Securities

The Company’s securityholders are cautioned that trading in the Company’s common stock (the “Common Stock”) during the pendency of the Chapter 11 Cases is highly speculative and poses substantial risks. Trading prices for the Company’s Common Stock may bear little or no relationship to the actual recovery, if any, by holders thereof in the Company’s Chapter 11 Cases. Accordingly, the Company urges extreme caution with respect to existing and future investments in its Common Stock

Cautionary Statements Regarding Forward-Looking Statements

This Current Report on Form 8-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements contained in this Current Report on Form 8-K include, but are not limited to, statements regarding the process and potential outcomes of the Company’s Chapter 11 Cases. These statements are based on management’s current expectations, and actual results and future events may differ materially due to risks and uncertainties, including, without limitation, risks inherent in the bankruptcy process, including the outcome of the Chapter 11 Cases; the Company’s financial projections and cost estimates; the Company’s ability to raise additional funds during the Chapter 11 Cases; the Company’s ability to sell any of its assets; and the effect of the Chapter 11 Cases on the Company’s business prospects, financial results and business operations. The Company may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. These and other factors that may affect the Company’s future business prospects, results and operations are identified and described in more detail in the Company’s filings with the U.S. Securities and Exchange Commission, including the Company’s most recent Annual Report filed on Form 10-K and the subsequently filed Quarterly Report(s) on Form 10-Q. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this Form 8-K. Except as required by applicable law, the Company does not intend to update any of the forward-looking statements to conform these statements to actual results, later events or circumstances or to reflect the occurrence of unanticipated events.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit Number | Description |

| 10.1 | |

| 10.2 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | AMYRIS, INC. | |

| | | | |

| | | | |

| Date: December 13, 2023 | By: | /s/ Han Kieftenbeld | |

| | | Han Kieftenbeld | |

| | Interim Chief Executive Officer and Chief Financial Officer |

THIS AMENDED & RESTATED PLAN SUPPORT AGREEMENT IS NOT AN OFFER, ACCEPTANCE OR SOLICITATION WITH RESPECT TO ANY SECURITIES, LOANS OR OTHER INSTRUMENTS OR A SOLICITATION OF ACCEPTANCES OF A CHAPTER 11 PLAN WITHIN THE MEANING OF SECTION 1125 OF THE BANKRUPTCY CODE. ANY SUCH OFFER, ACCEPTANCE OR SOLICITATION WILL COMPLY WITH ALL APPLICABLE LAW, INCLUDING SECURITIES LAWS AND/OR PROVISIONS OF THE BANKRUPTCY CODE. NOTHING CONTAINED IN THIS AMENDED & RESTATED PLAN SUPPORT AGREEMENT SHALL BE AN ADMISSION OF FACT OR LIABILITY OR, UNTIL THE OCCURRENCE OF THE AGREEMENT EFFECTIVE DATE ON THE TERMS DESCRIBED IN THIS AMENDED & RESTATED PLAN SUPPORT AGREEMENT, DEEMED BINDING ON ANY OF THE PARTIES TO THIS AMENDED & RESTATED PLAN SUPPORT AGREEMENT.

THIS AMENDED & RESTATED PLAN SUPPORT AGREEMENT IS THE PRODUCT OF SETTLEMENT DISCUSSIONS AMONG THE PARTIES HERETO. ACCORDINGLY, THIS AMENDED & RESTATED PLAN SUPPORT AGREEMENT IS PROTECTED BY RULE 408 OF THE FEDERAL RULES OF EVIDENCE AND ANY OTHER APPLICABLE STATUTES OR DOCTRINES PROTECTING THE USE OR DISCLOSURE OF CONFIDENTIAL SETTLEMENT DISCUSSIONS.

THIS AMENDED & RESTATED PLAN SUPPORT AGREEMENT DOES NOT PURPORT TO SUMMARIZE ALL OF THE TERMS, CONDITIONS, REPRESENTATIONS, WARRANTIES, AND OTHER PROVISIONS WITH RESPECT TO THE RESTRUCTURING TRANSACTIONS DESCRIBED HEREIN, WHICH RESTRUCTURING TRANSACTIONS WILL BE SUBJECT TO THE COMPLETION OF DEFINITIVE DOCUMENTS INCORPORATING THE TERMS SET FORTH HEREIN AND THE CLOSING OF ANY RESTRUCTURING TRANSACTIONS SHALL BE SUBJECT TO THE TERMS AND CONDITIONS SET FORTH IN SUCH DEFINITIVE DOCUMENTS AND THE APPROVAL RIGHTS OF THE PARTIES SET FORTH HEREIN AND IN SUCH DEFINITIVE DOCUMENTS.

AMENDED & RESTATED PLAN SUPPORT AGREEMENT

This AMENDED & RESTATED PLAN SUPPORT AGREEMENT (including all exhibits, annexes, and schedules hereto in accordance with Section 14.03 hereof, in each case, as may be amended, supplemented or otherwise modified from time to time in accordance with the terms hereof, this “Agreement”), which amends and restates the Plan Support Agreement dated as of October 12, 2023, is made and entered into as of December 12, 2023 (the “Execution Date”), by and among the following parties (each of the following described in sub-clauses (i) through (iv) of this preamble a “Party” and, collectively, the “Parties”):

i.Amyris, Inc., a company incorporated under the Laws of Delaware (“Amyris”), and each of its affiliates listed on Exhibit A to this Agreement that have executed and delivered counterpart signature pages to this Agreement to counsel to the Consenting Stakeholders (the Entities in this clause (i), collectively, the “Company Parties”);

ii.the undersigned holders of, or investment advisors, sub-advisors, or managers of funds or accounts that hold, Foris Prepetition Claims that have executed and delivered counterpart signature pages to this Agreement to counsel to the Company Parties (the “Consenting Foris Prepetition Secured Lenders”);

iii.the undersigned holders of, or investment advisors, sub-advisors, or managers of funds or accounts that hold the DIP Claims (the “DIP Secured Parties” and, together with the Consenting Foris Prepetition Secured Lenders, the “Consenting Stakeholders”); and

iv.the Consenting Convertible Noteholders, DSM-Firmenich, Givaudan, and the Official Committee of Unsecured Creditors appointed in the Chapter 11 Cases (the “Creditors’ Committee), to the extent each of them sign the Joinder (collectively, the “Other Consenting Stakeholders” and, along with the Consenting Stakeholders, the “Consenting Parties”).

RECITALS

WHEREAS, on August 9, 2023 (the “Initial Petition Date”) and August 21, 2023 (the “Second Petition Date”), as applicable, each of the Debtors commenced voluntary cases (the “Chapter 11 Cases”) under chapter 11 of title 11 of the United States Code, 11 U.S.C. §§ 101–1532, as amended (the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”);

WHEREAS, the Parties have engaged in good faith, arm’s length negotiations regarding the restructuring transactions (the “Restructuring Transactions”) described in and to be implemented through, and to be Materially Consistent with and otherwise in form and substance consistent in all material respects with that Second Amended Joint Chapter 11 Plan of Reorganization of Amyris, Inc. and Its Affiliated Debtors, as Modified attached as Exhibit B hereto (such plan, including all exhibits thereto, the Plan Supplement thereto, and all related and ancillary documents, the “Plan”);

WHEREAS, the Parties have agreed to take certain actions in support of the Plan and the Restructuring Transactions on the terms and conditions set forth in this Agreement and the Plan; and

NOW, THEREFORE, in consideration of the covenants and agreements contained herein, each Party, intending to be legally bound hereby, agrees as follows:

AGREEMENT

Section 1.Definitions and Interpretation.

1.01Definitions. The following terms shall have the following definitions:

“Affiliate” means, with respect to any Entity, all Entities that would fall within the definition assigned to such term in section 101(2) of the Bankruptcy Code if such Entity was a debtor in a case under the Bankruptcy Code.

“Agreement” has the meaning set forth in the preamble to this Agreement and, for the avoidance of doubt, includes all the exhibits, annexes, and schedules hereto in accordance with Section 14.03 (including the Plan).

“Agreement Effective Date” means the date on which the conditions set forth in Section 2 have been satisfied or waived by the appropriate Party or Parties in accordance with this Agreement.

“Agreement Effective Period” means, with respect to a Party, the period from the Agreement Effective Date to the Termination Date applicable to that Party.

“Alternative Restructuring Proposal” means any inquiry, proposal, offer, bid, term sheet, discussion, or agreement with respect to an Alternative Transaction.

“Alternative Transaction” means a sale (including, for the avoidance of doubt, a transaction premised on an asset sale under section 363 of the Bankruptcy Code), disposition, new-money investment, restructuring, reorganization, merger, amalgamation, joint venture, partnership, acquisition, consolidation, dissolution, winding up, debt investment, equity investment, liquidation, tender offer, rights offering, recapitalization, plan of reorganization or liquidation, share exchange, business combination, or similar transaction, in each case involving any one or more Company Parties or the debt, equity, or other interests in any one or more Company Party that is inconsistent with this Agreement and the Restructuring Transactions.

“Anesma Loan Agreement” means that certain Loan and Security Agreement dated as of June 5, 2023, by and among Anesma Group, LLC, Amyris and certain Subsidiaries of Amyris, as amended, restated, supplemented or otherwise modified from time to time.

“Anjo Loan Agreement” means that certain Loan and Security Agreement dated as of June 29, 2023, by and among Anjo Ventures, LLC, Amyris and certain Subsidiaries of Amyris, as amended, restated, supplemented or otherwise modified from time to time.

“Approved Budget” has the meaning set forth in the DIP Credit Agreement.

“Bankruptcy Code” has the meaning set forth in the recitals to this Agreement.

“Bankruptcy Court” has the meaning set forth in the recitals to this Agreement.

“Bankruptcy Rules” means the Federal Rules of Bankruptcy Procedure as promulgated by the United States Supreme Court under section 2075 of title 28 of the United States Code, 28 U.S.C. § 2075, as applicable to the Chapter 11 Cases and the general, local, and chambers rules of the Bankruptcy Court, as now in effect or hereafter amended.

“Business Day” means any day other than a Saturday, Sunday, or other day on which commercial banks are authorized to close under the Laws of, or are in fact closed in, the state of California.

“Chapter 11 Cases” has the meaning set forth in the recitals to this Agreement.

“Claim” means any claim, as defined in section 101(5) of the Bankruptcy Code, against any of the Debtors.

“Company Claims/Interests” means any Claim against, or Equity Interest in, a Company Party, and in the case of DSM-Firmenich and Givaudan, includes each of their respective rights, obligations, and remedies under their respective agreements with Amyris.

“Company Parties” has the meaning set forth in the preamble to this Agreement.

“Confidentiality Agreement” means an executed confidentiality agreement, including with respect to the issuance of a “cleansing letter” or other public disclosure of material non-public information agreement, in connection with any proposed Restructuring Transactions.

“Confirmation Date” means the date upon which the Bankruptcy Court enters the Confirmation Order on the docket of the Chapter 11 Cases within the meaning of Bankruptcy Rules 5003 and 9021.

“Confirmation Order” means the order of the Bankruptcy Court confirming the Plan pursuant to section 1129 of the Bankruptcy Code.

“Consenting Convertible Noteholders” means those holders of Convertible Notes holding at least 60% of the outstanding principal amount of the Convertible Notes who have executed a Joinder, and each such holder, a “Consenting Convertible Noteholder.”

“Consenting Stakeholders” has the meaning set forth in the preamble to this Agreement.

“Convertible Notes” means those certain convertible notes issued under that certain Indenture dated as of November 15, 2021 for 1.50% Convertible Senior Notes Due 2026 in an aggregate principal amount outstanding of approximately $690,000,000.

“Debtors” means the Company Parties that are debtors and debtors in possession in the Chapter 11 Cases.

“Definitive Documents” shall have the meaning ascribed to such term in the Plan.

“DIP Agent” has the meaning set forth in the DIP Orders and is defined as the “Administrative Agent” in the preamble to the DIP Credit Agreement.

“DIP Credit Agreement” has the meaning set forth in the DIP Orders.

“DIP Lenders” has the meaning set forth in the DIP Orders and is defined as the “Lenders” in the preamble to the DIP Credit Agreement.

“DIP Loan Documents” has the meaning set forth in the DIP Orders.

“DIP Obligations” has the meaning set forth in the DIP Orders and is defined as the “Secured Obligations” in the preamble to the DIP Credit Agreement.

“DIP Orders” has the meaning set forth in the DIP Credit Agreement.

“DIP Secured Parties” has the meaning set forth in the recitals to this Agreement.

“DIP Claims” means all Claims held by the DIP Secured Parties arising under or relating to the DIP Loan Documents.

“Disclosure Statement” means the related disclosure statement with respect to the Plan, that is prepared and distributed in accordance with, among other things, Sections 1125, 1126(b) and 1145 of the Bankruptcy Code, Rule 3018 of the Bankruptcy Rules, and other applicable Law, including all exhibits and schedules thereto, as may be amended, supplemented, or modified from time to time, to be approved pursuant to the Disclosure Statement Order.

“Disclosure Statement Order” means the order (and all exhibits thereto), entered by the Bankruptcy Court approving the Disclosure Statement and the Solicitation Materials, and allowing solicitation of the Plan to commence (as amended, modified, or supplemented from time to time in accordance with the terms thereof).

“DSM-Firmenich” means DSM-Firmenich AG and its direct and indirect subsidiaries.

“Effective Date” means the date on which (a) all conditions precedent to the occurrence of the consummation of the Plan have been satisfied or waived in accordance with the Plan (including, if necessary, receipt of all Regulatory Approvals and the expiration or early termination of any applicable waiting periods related thereto) and (b) the Plan is declared effective by the Debtors.

“Entity” shall have the meaning set forth in section 101(15) of the Bankruptcy Code.

“Equity Interests” means, collectively, the shares (or any class thereof), common stock, preferred stock, limited liability company interests, and any other equity, ownership, or profits interests of any Debtor, and options, warrants, rights, or other securities or agreements to acquire or subscribe for, or which are convertible into the shares (or any class thereof) of, common stock, preferred stock, limited liability company interests, or other equity, ownership, or profits interests of any Debtor (in each case whether or not arising under or in connection with any employment agreement).

“Estate Claims Settlement Consideration” shall have the meaning set forth in the Plan.

“Execution Date” has the meaning set forth in the preamble to this Agreement.

“First Foris Loan Agreement” means that certain Amended and Restated Loan Agreement dated as of October 28, 2019 by and among Foris Ventures, LLC, Amyris and certain Subsidiaries of Amyris, as, as amended by that certain Omnibus Amendment Agreement, dated as of June 5, 2023, and as further amended, restated, supplemented or otherwise modified from time to time.

“Foris Prepetition Claims” means any Claim on account of the Foris Prepetition Secured Loan Agreements.

“Foris Prepetition Secured Lenders” means each of (a) Foris Ventures, LLC as lender under the First Foris Loan Agreement, (b) Foris Ventures, LLC as lender under the Second Foris Loan Agreement, (c) Perrara Ventures, LLC as lender under the Perrara Loan Agreement, (d) Anesma Group, LLC as lender under the Anesma Loan Agreement, (e) Anjo Ventures, LLC as lender under the Anjo Loan Agreement, and (f) Muirisc, LLC as lender under the Muirisc Loan Agreement.

“Foris Prepetition Obligations” means the Secured Obligations, as defined in the Foris Prepetition Secured Loan Agreements.

“Foris Prepetition Secured Loan Agreements” means the First Foris Loan Agreement, the Second Foris Loan Agreement, the Perrara Loan Agreement, the Anesma Loan Agreement, the Anjo Loan Agreement, the Muirisc Loan Agreement and any other loan agreement made between any Affiliate of a Foris Prepetition Secured Lender, Amyris and any Subsidiary of the Amyris before the Petition Date.

“Givaudan” means Givaudan SA and its direct and indirect subsidiaries.

“Governmental Authority” means (i) any U.S. federal, state, county, civil, or local legislative, administrative, self-regulatory or regulatory authority, agency court, tribunal, or judicial or arbitral body or other governmental or quasi-governmental entity with competent jurisdiction or (ii) any supranational or non-U.S. authority of similar jurisdiction.

“Initial Petition Date” has the meaning set forth in the recitals to this Agreement.

“Joinder” means the joinder in the form annexed hereto as Exhibit C, pursuant to which an Other Consenting Stakeholder is made a Party to this Agreement by execution and delivery of the same to the other Parties.

“Law” means any federal, state, local, or foreign law (including common law), statute, code, ordinance, rule, regulation, order, ruling, or judgment, in each case, that is validly adopted,

promulgated, issued, or entered by a Governmental Authority of competent jurisdiction (including the Bankruptcy Court).

“Materially Consistent” means, with respect to a Consenting Party, the proposed treatment of such Consenting Parties’ claims against the Debtors (and in the case of the Creditors’ Committee, the claims of holders of unsecured claims against the Debtors other than the claims of the holders of the Convertible Notes) shall be as set forth in Exhibit B.

“Milestones” has the meaning set forth in Section 4.

“Muirisc Loan Agreement” means that certain Loan and Security Agreement dated on or about August 2, 2023, by and among Muirisc, LLC, Amyris and certain Subsidiaries of Amyris as amended, restated, supplemented or otherwise modified from time to time.

“New Board” means the board of directors or the board of managers, as applicable, of Reorganized Amyris which shall be appointed as provided in the Plan. Unless otherwise agreed by the Parties, the identities of the members of the New Board shall be disclosed in the Plan Supplement.

“New Organizational Documents” means the documents providing for corporate governance of Reorganized Amyris, and any subsidiaries thereof, including charters, bylaws, operating agreements, agreements providing indemnification, contribution, or reimbursement to any Person or Entity, other organizational documents, and investment guidelines, as applicable.

“Other Amyris Assets” means all of the assets of the Debtors’ Estates excluding: (i) the Consumer Brands (and the proceeds of the sale thereof); and (ii) the Estate Claims Settlement Consideration, and (iii) the Third-Party Release Settlement Amounts.

“Other Amyris Assets Bidding Procedures” has the meaning set forth in Section 4(e) of this Agreement.

“Other Amyris Assets Bidding Procedures Order” has the meaning set forth in Section 4(e) of this Agreement.

“Other Amyris Assets Sale Order” means the order of the Bankruptcy Court governing the sale of the Other Amyris Assets.

“Other Consenting Stakeholders” has the meaning set forth in the preamble to this Agreement.

“Parties” has the meaning set forth in the preamble to this Agreement.

“Permitted Transferee” means each transferee of any Company Claims/Interests who meets the requirements of Section 9.01.

“Person” has the meaning set forth in section 101(41) of the Bankruptcy Code.

“Perrara Loan Agreement” means that certain Loan and Security Agreement dated as of March 10, 2023, by and among Perrara Ventures, LLC, Amyris and certain Subsidiaries of Amyris, as amended by that certain Omnibus Amendment Agreement, dated as of June 5, 2023, and as further amended, restated, supplemented or otherwise modified from time to time.

“Petition Date” means the Initial Petition Date with respect to the Debtors other than Clean Beauty Collaborative, Inc. and Clean Beauty 4U LLC and the Second Petition Date with respect to Clean Beauty Collaborative, Inc. and Clean Beauty 4U LLC.

“Plan” has the meaning set forth in the recitals to this Agreement.

“Plan Effective Date” means mean the date on which all conditions to the effectiveness of the Plan have been satisfied or waived in accordance with its terms and the Plan has been substantially consummated.

“Plan Supplement” shall have the meaning ascribed to such term in the Plan.

“Qualified Marketmaker” means an entity that (a) holds itself out to the public or the applicable private markets as standing ready in the ordinary course of business to purchase from customers and sell to customers Company Claims/Interests (or enter with customers into long and short positions in Company Claims/Interests), in its capacity as a dealer or market maker in Company Claims/Interests and (b) is, in fact, regularly in the business of making a market in claims against issuers or borrowers (including debt securities or other debt).

“Required Consenting Convertible Noteholders” means those holders of Convertible Notes holding at least 50% of the outstanding principal amount of the Convertible Notes who have executed a Joinder, and each such holder, a “Required Consenting Convertible Noteholder.”

“Regulatory Approvals” means any consents, approvals, or permissions of Governmental Authorities that are necessary to implement and consummate the Restructuring Transactions.

“Reorganized Amyris” means the Debtors from and after the Plan Effective Date.

“Requisite Notice Parties” has the meaning set forth Section 12.06 of this Agreement.

“Restructuring Transactions” has the meaning set forth in the recitals to this Agreement.

“Sale Option” shall have the meaning ascribed to such term in the Plan.

“Second Foris Loan Agreement” means that certain Amended and Restated Loan and Security Agreement dated as of September 27, 2022, by and among Foris Ventures, LLC, Amyris and certain Subsidiaries of Amyris, as amended by that certain Omnibus Amendment Agreement, dated as of June 5, 2023, and as further amended, restated, supplemented or otherwise modified from time to time.

“Second Petition Date” has the meaning set forth in the recitals to this Agreement.

“Securities Act” means the Securities Act of 1933, as amended.

“Solicitation Materials” shall have the meaning ascribed to such term in the Plan.

“Subsidiary” means an entity, whether corporate, partnership, limited liability company, joint venture or otherwise, in which any obligor under the Foris Prepetition Secured Loan Agreements owns or controls 50.1% or more of the outstanding voting securities.

“Termination Date” means the date on which termination of this Agreement as to a Party is effective in accordance with Sections 12.01, 12.02, 12.03, 12.04, and 12.05, as applicable.

“Termination Event” means any event described in Sections 12.01, 12.02, 12.03, 12.04, and 12.05.

“Transfer” means to sell, resell, reallocate, use, pledge, assign, transfer, hypothecate, participate, donate or otherwise encumber or dispose of, directly or indirectly (including through derivatives, options, swaps, pledges, forward sales or other transactions); provided, however that any pledge in favor of a bank or broker dealer at which a Consenting Stakeholder maintains an account, where such bank or broker dealer holds a security interest or other encumbrance over property in the account generally shall not be deemed a “Transfer” for any purposes hereunder.

“Transfer Agreement” means an executed form of the transfer agreement providing, among other things, that a transferee is bound by the terms of this Agreement and substantially in the form attached hereto as Exhibit D.

1.02Interpretation. For purposes of this Agreement:

(a)capitalized terms used but not defined herein shall have the meanings ascribed to them in the Plan;

(b)in the appropriate context, each term, whether stated in the singular or the plural, shall include both the singular and the plural, and pronouns stated in the masculine, feminine, or neuter gender shall include the masculine, feminine, and the neuter gender;

(c)capitalized terms defined only in the plural or singular form shall nonetheless have their defined meanings when used in the opposite form;

(d)unless otherwise specified, any reference herein to an existing document, schedule, or exhibit shall mean such document, schedule, or exhibit, as it may have been or may be amended, restated, supplemented, or otherwise modified from time to time; provided that any capitalized terms herein which are defined with reference to another agreement, are defined with reference to such other agreement as of the date of this Agreement, without giving effect to any termination of such other agreement or amendments to such capitalized terms in any such other agreement following the date hereof;

(e)unless otherwise specified, all references herein to “Sections” are references to Sections of this Agreement;

(f)the words “herein,” “hereof,” and “hereto” refer to this Agreement in its entirety rather than to any particular portion of this Agreement;

(g)captions and headings to Sections are inserted for convenience of reference only and are not intended to be a part of or to affect the interpretation of this Agreement;

(h)references to “shareholders,” “directors,” and/or “officers” shall also include “members” and/or “managers,” as applicable, as such terms are defined under the applicable limited liability company Laws;

(i)whenever the words “include,” “includes” or “including” are used in this Agreement, they will be deemed to be followed by the words “without limitation;”

(j)the words “to the extent” shall mean “the degree by which” and not “if;”

(k)all time periods before which, within which, or following which any act is to be done or step taken pursuant to this Agreement shall be calculated in accordance with Bankruptcy Rule 9006(a);

(l)the word “will” will be construed to have the same meaning and effect as the word “shall.” The words “shall,” “will,” or “agree(s)” are mandatory, and “may” is permissive;

(m)all references to “$” and “dollars” will be deemed to refer to United States currency unless otherwise specifically provided;

(n)all references to a day or days will be deemed to refer to a calendar day or calendar days, as applicable, unless otherwise specifically provided;

(o)any reference to any agreement or contract will be a reference to such agreement or contract, as amended, modified, supplemented or waived, in accordance herewith, if applicable; and

(p)where the context permits, the use of the term “or” will be equivalent to the use of the term “and/or.”

Section 2.Effectiveness of this Agreement. This Agreement shall become effective and binding upon:

(a) each of the Parties (other than the Other Consenting Stakeholders) at 12:01 a.m., prevailing Pacific Time, on the Agreement Effective Date, which is the date on which all of the following conditions have been satisfied or waived in accordance with this Agreement:

(i)each of the Company Parties shall have executed this Agreement and delivered counterpart signature pages of this Agreement to counsel to each of the other Parties; and

(ii)the Consenting Stakeholders shall have executed this Agreement and delivered counterpart signature pages of this Agreement to counsel to each of the other Parties,

(b) upon such effectiveness, pursuant to Section 2(a), upon the Other Consenting Stakeholders upon execution of the Joinder.

Section 3.Definitive Documents. The Definitive Documents not executed or in a form attached to this Agreement as of the Execution Date remain subject to negotiation and completion. Upon completion, the Definitive Documents and every other document, deed, agreement, filing, notification, letter or instrument related to the Restructuring Transactions shall contain terms, conditions, representations, warranties, and covenants: (i) Materially Consistent with the terms of this Agreement and the Plan (ii) otherwise in form and substance reasonably acceptable to the Company Parties and the Consenting Parties; and may be modified, amended, or supplemented in accordance with Section 13; provided however, notwithstanding the foregoing, (i) the Plan and the Confirmation Order must be reasonably acceptable to the Company Parties and the Consenting Parties, and (ii) any and all further exhibits, annexes, and schedules to the Plan, the Confirmation Order, and the Plan Supplement, shall be Materially Consistent and otherwise in form and substance acceptable to the Company Parties and the Consenting Parties; and provided, further, however, the rights of the Company Parties and the Consenting Parties with respect to the form and substance of the Plan Administrator Agreement and the Creditor Trust Agreement shall be as set forth in the Plan.

Section 4.Milestones. The following milestones shall apply to this Agreement (collectively, the “Milestones”), which in each case may be waived or extended in writing by the Consenting Stakeholders (electronic mail among counsel is sufficient):

(a)no later than December 12, 2023, the Debtors and the DIP Secured Parties shall agree on an amended Approved Budget and corresponding amendments to the DIP Loan Documents;

(b)by no later than December 13, 2023 the Bankruptcy Court shall have entered the Disclosure Statement Order, which Disclosure Statement Order shall provide that the date upon which votes to accept or reject the Plan must be submitted shall be no later than January 22, 2024;

(c)by no later than December 8, 2023, the Debtors shall have commenced the sale and marketing process for the Other Amyris Assets;

(d)no later than December 20, 2023, the Bankruptcy Court shall have entered the order approving the Other Assets Bidding Procedures (the “Other Assets Bidding Procedures Order”); provided, that the Other Assets Bidding Procedures Order shall be in form and substance acceptable to the DIP Agent, the Creditors’ Committee, and the Ad Hoc Group and shall include, without limitation, (x) the date upon which preliminary bids and qualified bids for the Other Amyris Assets shall be submitted, which shall not be later than January 16, 2024, and the date the sale hearing for the Other Amyris Assets shall occur, which shall not be later than January 24, 2024, the terms and conditions of acceptance of a qualified bid, and (z) the distribution of 100% of the Net Proceeds from the Other Amyris Asset Sale Transaction, which shall, for the avoidance of doubt, be subject in all respects to the Liens and claims of the DIP Lender and the Foris Prepetition Secured Lenders and shall be paid (I) on the Plan Effective Date of the Plan, to fund payment of the Plan Effective Date Funding Amount, (II) to the DIP Lender and/or the Foris Prepetition Secured Lenders in order of priority and applied to the Loans and the Foris Prepetition Obligations as determined by the DIP Lenders and the Foris Prepetition Secured Lenders in their sole discretion, and (III) any remaining balance, if any, shall be retained by the Debtors for distribution to other holders of allowed claims and interests, as applicable; provided, that as set forth in the DIP Orders, the DIP Agent and the Foris Prepetition Secured Lenders shall have the right to credit bid (or assume) up to the full amount of the DIP Secured Obligations and Foris Prepetition Obligations, respectively, in connection with such sale;

(e)in the event of a Sale Option under the Plan, an order approving the sale of the Other Amyris Assets in accordance with Other Amyris Assets Bidding Procedures, shall have been entered no later than January 25, 2024;

(f)by no later than January 25, 2024, the Bankruptcy Court shall have entered the Confirmation Order; and

(g)by no later than February 15, 2024, the Effective Date of the Plan shall have occurred.

Section 5.Commitments of the Consenting Stakeholders and the Company Parties.

5.01General Commitments. During the Agreement Effective Period, the Consenting Parties, severally and not jointly, agree to:

(a)support the Restructuring Transactions and take all steps reasonably necessary and desirable to support, facilitate, implement, consummate or otherwise give effect to the Restructuring Transactions in accordance with this Agreement, including voting and exercising

any powers or rights available to it (including in any board, shareholders’, or creditors’ meeting or in any process requiring voting or approval to which it is legally entitled to participate) in each case in favor of any matter requiring approval to the extent necessary to implement the Restructuring Transactions, and voting, if applicable, in favor of the Plan and supporting and consenting to the releases and exculpation provisions in the Plan;

(b)to the extent any legal or structural impediment arises that would prevent, hinder, or delay the consummation of the Restructuring Transactions contemplated herein, take all steps reasonably necessary and desirable to address any such impediment;

(c)use commercially reasonable efforts to oppose the efforts of any Person seeking to object to, delay, impede, or take any other action to interfere with the acceptance, implementation, or consummation of the Restructuring Transactions; provided, that such commercially reasonable efforts shall not include filing formal objections or pleadings with the Bankruptcy Court;

(d)use commercially reasonable efforts to cooperate with and assist the Company Parties in obtaining additional support for the Restructuring Transactions from their other stakeholders;

(e)use commercially reasonable efforts, and provide such assistance as may be reasonably required by the Company Parties, to obtain any and all third party approvals (including, if necessary, all Regulatory Approvals) for the Restructuring Transactions;

(f)negotiate in good faith and use commercially reasonable efforts to execute and implement the Definitive Documents that are consistent with this Agreement to which it is required to be a party; and

(g)Nothing in this Agreement shall: (a) impair or waive the rights of any Party to assert or raise any objection permitted under this Agreement in connection with the Restructuring Transactions; or (b) prevent any Party from enforcing this Agreement or contesting whether any matter, fact, or thing is a breach of, or is inconsistent with, this Agreement.

5.02Negative Commitments. During the Agreement Effective Period, each Consenting Party agrees, severally and not jointly, that it shall not directly or indirectly:

(a)object to, delay, impede, or take any other action to interfere with acceptance, implementation, or consummation of the Restructuring Transactions;

(b)take any action that is inconsistent in any material respect with, or is intended to frustrate or impede approval, implementation and consummation of the Restructuring Transactions described in this Agreement or the Plan; or

(c)file any motion or pleading with the Bankruptcy Court or any other court (including any modifications or amendments thereof) that, in whole or in part, is not materially consistent with this Agreement or the Plan.

5.03Provisions Regarding the Consenting Convertible Noteholders and Creditors’ Committee Commitments. Each Consenting Convertible Noteholder, severally and not jointly, and the Creditors’ Committee agrees that it shall:

(a)use commercially reasonable efforts to oppose and object to the efforts of any Person seeking to object to, delay, impede, or take any other action to interfere with the acceptance, implementation, or consummation of the Restructuring Transactions, including, but

not limited to, timely filing a formal objection to any motion filed with the Bankruptcy Court by any Person or Entity seeking the entry of an order (i) directing the appointment of a trustee or examiner; (ii) converting any of the Chapter 11 Cases to cases under chapter 7 of the Bankruptcy Code; (iii) seeking relief from the automatic stay with respect to any material asset or assets of the Debtors; (iv) dismissing any of the Chapter 11 Cases; (v) providing for the Bankruptcy Court to abstain from hearing any of the Chapter 11 Cases; (vi) modifying or terminating any Debtor’s exclusive right to file and solicit acceptances of a plan of reorganization; or (vii) for relief that (A) is materially inconsistent with this Agreement in any respect or (B) would, or would reasonably be expected to, frustrate the purposes of this Agreement, including by preventing the consummation of the Restructuring Transactions;

(b)timely join a formal objection filed by the Company Parties or Consenting Stakeholders to any motion filed with the Bankruptcy Court by a third party challenging the validity, enforceability, perfection, or priority of, or seeking avoidance, disallowance or subordination of, or otherwise challenging, attacking or disputing, any portion of the Foris Prepetition Claims, or the liens securing such Claims (as applicable);

(c)use commercially reasonable efforts to support the Consenting Stakeholders and/or the Company Parties in any litigation against Lavvan Inc.;

(d)support approval of the Other Amyris Assets Bidding Procedures;

(e)in the event of a Sale Option under the Plan, support approval of the sale of the Other Amyris Assets under the Plan;

(f)[reserved];

(g)in the event that Class 7 (Convertible Note Claims) and/or Class 8 (General Unsecured Claims) votes to reject the Plan, the Other Consenting Stakeholders (and each of their underlying members, as applicable), shall continue to support confirmation of the Plan and shall oppose any motion, litigation, appeal or adversary proceeding initiated by a third party seeking to reverse, stay, vacate, reconsider, modify or amend the order confirming the Plan;

(h)immediately stop all discovery and investigations, and not commence any litigation, related to the Consenting Stakeholders and their respective affiliates and related parties, and the Company Parties, and their respective affiliates and related parties (including current and former directors, officers and employees (other than Excluded Parties);

(i)consent and not object to, delay, impede, or take any other action to interfere with implementation or consummation of the Amendment No. 5 to Senior Secured Super Priority Debtor in Possession Loan Agreement in form and substance as attached hereto as Exhibit E; and

(j)not seek or support an application or motion seeking compensation and expense reimbursement for each of their respective legal and financial professionals inconsistent with amounts identified in the Plan.

Section 6.Additional Provisions Regarding the Consenting Parties’ Commitments. Notwithstanding anything contained in this Agreement, nothing in this Agreement shall:

(a)affect the ability of any Consenting Party to consult with any other Consenting Party, the Company Parties, or any other party in interest in the Chapter 11 Cases (including any official committee and the United States Trustee);

(b)impair or waive the rights of any Consenting Party to assert or raise any objection permitted under this Agreement in connection with the Restructuring Transactions;

(c)be construed to prohibit any Consenting Party from appearing as a party-in-interest in a Chapter 11 Case, so long as such appearance and any positions advocated in connection therewith are not inconsistent with this Agreement; or

(d)be construed to prohibit any Consenting Party from asserting, whether any matter, factor, or thing is a breach of, or is materially inconsistent with, this Agreement.

Section 7.Commitments of the Company Parties.

7.01Affirmative Commitments. Subject in all cases to Section 8, during the Agreement Effective Period, the Company Parties agree to:

(a)support and take all steps reasonably necessary and desirable to support, facilitate, implement, consummate or otherwise give effect to the Restructuring Transactions in accordance with this Agreement;

(b)to the extent any legal or structural impediment arises that would prevent, hinder, or delay the consummation of the Restructuring Transactions contemplated herein, take all steps reasonably necessary and desirable, or reasonably requested by the Creditors’ Committee or the Ad Hoc Group, to address any such impediment;

(c)consider in good faith all reasonable actions necessary or reasonably requested by the Consenting Stakeholders or the Other Consenting Stakeholders to facilitate the solicitation, confirmation (if applicable), and consummation of the Restructuring Transactions;

(d)use commercially reasonable efforts to oppose and object to the efforts of any Person seeking to object to, delay, impede, or take any other action to interfere with the acceptance, implementation, or consummation of the Restructuring Transactions, including, but not limited to, timely filing a formal objection to any motion filed with the Bankruptcy Court by any Person or Entity seeking the entry of an order (i) directing the appointment of a trustee or examiner (with expanded powers beyond those set forth in sections 1106(a)(3) and (4) of the Bankruptcy Code); (ii) converting any of the Chapter 11 Cases to cases under chapter 7 of the Bankruptcy Code; (iii) seeking relief from the automatic stay with respect to any material asset or assets of the Debtors; (iv) dismissing any of the Chapter 11 Cases; (v) providing for the Bankruptcy Court to abstain from hearing any of the Chapter 11 Cases; (vi) modifying or terminating any Debtor’s exclusive right to file and solicit acceptances of a plan of reorganization; or (vii) for relief that (A) is materially inconsistent with this Agreement in any respect or (B) would, or would reasonably be expected to, frustrate the purposes of this Agreement, including by preventing the consummation of the Restructuring Transactions;

(e)timely file a formal objection to any motion filed with the Bankruptcy Court by a third party challenging the validity, enforceability, perfection, or priority of, or seeking avoidance, disallowance or subordination of, any portion of the Foris Prepetition Claims, or the liens securing such Claims (as applicable);

(f)use commercially reasonable efforts, and provide such assistance as may be reasonably required by the Consenting Stakeholders or the Other Consenting Stakeholders, to obtain any and all third party approvals (including, if necessary, all Regulatory Approvals) for the Restructuring Transactions;

(g)negotiate in good faith and use commercially reasonable efforts to execute and deliver the Definitive Documents and any other required agreements to effectuate and consummate the Restructuring Transactions as contemplated by this Agreement;

(h)use commercially reasonable efforts to seek additional support for the Restructuring Transactions from their other material stakeholders to the extent reasonably prudent;

(i)provide counsel to Consenting Parties with Definitive Documents that the Debtors intend to file with the Bankruptcy Court in a timely manner but in no event less than (3) Business Days in advance of the filing thereof, or if not reasonably practicable, as soon as reasonably practicable but in any event no less than twenty-four (24) hours in advance of filing thereof;

(j)inform counsel to the Consenting Parties as soon as reasonably practicable and in any event within two (2) Business Days after the applicable Company Party (i) becomes aware of receipt of any notice or other correspondence from a third party asserting its consent is required to implement the Restructuring Transactions and (ii) makes any definitive determination (by the applicable Company Party or, as applicable, its board of directors, board of managers, or similar governing body), after consulting with counsel, (a) that taking any action, or refraining from taking any action, with respect to the Restructuring Transactions would be inconsistent with applicable Law or its fiduciary obligations under applicable Law or, (b) in the exercise of its fiduciary duties, to pursue an Alternative Restructuring Proposal, in accordance with Section 8; and

(k)if any Company Party receives an Alternative Restructuring Proposal, (i) within two (2) Business Days after the receipt of such Alternative Restructuring Proposal, notify counsel to the Consenting Stakeholders and the Other Consenting Stakeholders of the receipt thereof, with such notice to include the material terms thereof (including the identity of the Person(s) involved), and thereafter promptly provide counsel to the Consenting Stakeholders and the Other Consenting Stakeholders with any amendments, supplements or modifications to such Alternative Restructuring Proposal that are received by any Company Party, and (ii) consult with counsel to the Consenting Stakeholders and the Other Consenting Stakeholders with respect to such Alternative Restructuring Proposal (or any amendments, supplements or modifications thereto) upon the reasonable request of such counsel.

7.02Negative Commitments. Subject in all cases to Section 8, during the Agreement Effective Period, each of the Company Parties shall not directly or indirectly:

(a)object to, delay, impede, or take any other action to interfere with confirmation of the Plan or acceptance, implementation, or consummation of the Restructuring Transactions;

(b)take any action that is inconsistent in any material respect with, or is intended to frustrate or impede approval, implementation, or consummation of the Restructuring Transactions described in this Agreement or the Plan;

(c)modify the Plan or any of the Definitive Documents, in whole or in part, in a manner that is not consistent with this Agreement in all material respects;

(d)withdraw or revoke the Plan, as applicable, or publicly announce its intention not to pursue the Restructuring Transactions;

(e)commence, support, or join any litigation or adversary proceeding against the Consenting Stakeholders other than in connection with the interpretation or enforcement of the Company Parties’ rights under this Agreement;

(f)file any motion, pleading, or Definitive Documents with the Bankruptcy Court or any other court (including any modifications or amendments thereof) that, in whole or in part, is not materially consistent with this Agreement (including in violation of the consent rights of any Party as to the form and substance of such motion, pleading, or Definitive Document) or the Plan; or

(g)(i) seek, solicit, encourage; or (ii) prior to the exercise of a Permitted Fiduciary-Out Action, propose, file, support, consent to, or vote for, or enter into or participate in any discussions, agreements, understandings or other arrangements, in each case with any Person regarding, or with respect to pursuing or consummating, any Alternative Restructuring Proposal.

Section 8.Additional Provisions Regarding the Company Parties’ and Creditors’ Committee’s Commitments.

8.01Notwithstanding anything to the contrary in this Agreement, nothing in this Agreement shall require a Company Party or the Creditors’ Committee, or the board of directors, board of managers, or similar governing body of a Company Party, after consulting with counsel to the Company Parties or the Creditors’ Committee, as applicable, to take any action or to refrain from taking any action with respect to the Restructuring Transactions to the extent taking or failing to take such action would, based on the advice of counsel to the Company Parties or the Creditors’ Committee, as applicable, be inconsistent with its fiduciary obligations under applicable Law, and any such action or inaction pursuant to this Section 8.01 (collectively, “Permitted Fiduciary-Out Actions”) shall not be deemed to constitute a breach of this Agreement; provided, however, a Company Party or the Creditors’ Committee shall provide prompt notice to the Consenting Parties of such Permitted Fiduciary-Out Actions. Notwithstanding the foregoing, each of the Company Parties or the Creditors’ Committee acknowledges its entry into this Agreement and the Restructuring Transactions is consistent with applicable Law and its fiduciary duties as of the Agreement Effective Date.

8.02Notwithstanding anything to the contrary in this Agreement, each Company Party and the Creditors’ Committee, and their respective directors, officers, employees, investment bankers, attorneys, accountants, consultants, and other advisors or representatives shall have the rights to: (a) consider, respond to, and facilitate Alternative Restructuring Proposals and/or Alternative Transactions; (b) provide access to non-public information concerning any Company Party to any Entity or enter into Confidentiality Agreements or nondisclosure agreements with any Entity; (c) maintain or continue discussions or negotiations with respect to Alternative Restructuring Proposals and/or Alternative Transactions; (d) otherwise cooperate with, assist, participate in, or facilitate any inquiries, proposals, discussions, or negotiation of Alternative Restructuring Proposals and/or Alternative Transactions; and (e) enter into or continue discussions or negotiations with holders of Claims against or Equity Interests in a Debtor, any other party in interest in the Chapter 11 Cases (including any official committee and the U.S. Trustee), or any other Entity regarding the Restructuring Transactions, Alternative Restructuring Proposals, and/or Alternative Transactions; provided, that a Company Party and the Creditors’ Committee, as applicable, shall provide notice to the Consenting Parties within two (2) Business Days of any definitive decision by the applicable Company Party or its board of directors, board of managers, or similar governing body, or Creditors’ Committee, as applicable, after consulting with counsel in good faith, and consistent with its fiduciary duties, to pursue an Alternative Restructuring Proposal and/or Alternative Transaction.

8.03The Company Parties and the Creditors’ Committee shall (x) provide to counsel to the Consenting Parties (i) notice of any expression of interest regarding any Alternative Restructuring Proposals and/or Alternative Transactions, with such notice to include the material terms thereof, including the identity of the person or group of persons involved (unless prohibited by separate agreement) and (ii) a copy of any written offer or proposal (or a

description of the terms of any oral offer or proposal) for any Alternative Restructuring Proposals and/or Alternative Transaction, in each case within two (2) Business Days of the Company Parties’ or the Creditors’ Committee’s, as applicable, receipt of such indication of interest, offer, or proposal; (y) provide such information to counsel to the Consenting Parties regarding such discussions (including copies of any material provided to the Company Parties, the Creditors’ Committee or their advisors) as necessary to keep the Consenting Parties reasonably contemporaneously informed as to the status and substance of such discussions, including with respect to any material changes to such indications of interest, offers, or proposals; and (z) promptly respond to information requests or questions from counsel to the Consenting Parties related to any such indications of interest, offers, or proposals.

8.04In the event that either a Company Party or the Creditors’ Committee elects to pursue an Alternative Transaction, the increases to the Carve-Out with respect to all Professionals as provided for in Section 7.15(c) of the Loan Agreement by operation of Amendment No. 5 To Senior Secured Super Priority Debtor In Possession Loan Agreement (“Amendment No. 5”) shall be void ab initio and shall have no force and effect and Section 7.15(c) of the Loan Agreement shall be deemed not to be amended by Amendment No 5. For the avoidance of doubt, in the event that either a Company Party or the Creditors’ Committee elects to pursue an Alternative Transaction, Section 7.15(c) of the Loan Agreement shall be operative and apply as it was in effect prior to the Effective Date of Amendment No. 5 (as Effective Date is defined in Amendment No. 5).

Section 9.Transfer of Interests and Securities.

9.01During the Agreement Effective Period, no Party shall Transfer any ownership (including any beneficial ownership as defined in the Rule 13d-3 under the Securities Exchange Act of 1934, as amended) in any Company Claims/Interests to any affiliated or unaffiliated party, including any party in which it may hold a direct or indirect beneficial interest, unless:

(a)the authorized transferee is either (i) a qualified institutional buyer as defined in Rule 144A of the Securities Act, (ii) a non-U.S. person in an offshore transaction as defined under Regulation S under the Securities Act, (iii) an accredited investor (as defined in the Rules), or (iv) a Consenting Party;

(b)either (i) the transferee executes and delivers to counsel to the Company Parties, at or before the time of the proposed Transfer, a Transfer Agreement or (ii) the transferee is a Party or an Affiliate thereof bound by the terms of this Agreement and the transferee provides notice of such Transfer (including the amount and type of Company Claim/Interest Transferred) to counsel to the Company Parties by the close of business on the second Business Day following such Transfer; and

(c)in the case of a Transfer by a DIP Lender, such transfer is made pursuant to the terms of the DIP Credit Agreement.

9.02Upon compliance with the requirements of Section 9.01, the transferee shall be deemed a Party under this Agreement, and the transferor shall be deemed to relinquish its rights (and be released from its obligations) under this Agreement to the extent of the rights and obligations in respect of such transferred Company Claims/Interests.

9.03 This Agreement shall in no way be construed to preclude the Consenting Stakeholders or any Other Consenting Stakeholder from acquiring additional Company Claims/Interests; provided, however, that (a) such additional Company Claims/Interests shall automatically and immediately upon acquisition by a Party be deemed subject to the terms of this Agreement (regardless of when or whether notice of such acquisition is given to counsel to the

Company Parties) and (b) such Party must provide notice of such acquisition (including the amount and type of Company Claim/Interest acquired) to counsel to the Company Parties within five (5) Business Days of such acquisition.

9.04This Section 9 shall not impose any obligation on any Company Party to issue any “cleansing letter” or otherwise publicly disclose information for the purpose of enabling a Party to Transfer any of its Company Claims/Interests. Notwithstanding anything to the contrary herein, to the extent a Company Party and another Party have entered into a Confidentiality Agreement, the terms of such Confidentiality Agreement shall continue to apply and remain in full force and effect according to its terms, and this Agreement does not supersede any rights or obligations otherwise arising under such Confidentiality Agreements.

9.05Notwithstanding Section 9.01, a Qualified Marketmaker that acquires any Company Claims/Interests with the purpose and intent of acting as a Qualified Marketmaker for such Company Claims/Interests shall not be required to execute and deliver a Transfer Agreement in respect of such Company Claims/Interests if (a) such Qualified Marketmaker subsequently transfers such Company Claims/Interests (by purchase, sale assignment, participation, or otherwise) within five (5) Business Days of its acquisition to a transferee that is an entity that is not an affiliate, affiliated fund, or affiliated entity with a common investment advisor; (b) the transferee otherwise is a Permitted Transferee under Section 9.01; and (c) the Transfer otherwise is a permitted Transfer under Section 9.01. To the extent that a Consenting Party is acting in its capacity as a Qualified Marketmaker, it may Transfer (by purchase, sale, assignment, participation, or otherwise) any right, title or interests in Company Claims/Interests that the Qualified Marketmaker acquires from a holder of the Company Claims/Interests who is not a Consenting Party without the requirement that the transferee be a Permitted Transferee. For the avoidance of doubt, if a Qualified Marketmaker acquires any Company Claims/Interests from a Consenting Party and is unable to transfer such Company Claims/Interests within the five (5) Business Day-period referred to above, the Qualified Marketmaker shall execute and deliver a Transfer Agreement in respect of such Company Claims/Interests.

9.06Notwithstanding anything to the contrary in this Section 9, the restrictions on Transfer set forth in this Section 9 shall not apply to the grant of any liens or encumbrances on any claims and interests in favor of a bank or broker-dealer holding custody of such claims and interests in the ordinary course of business and which lien or encumbrance is released upon the Transfer of such claims and interests.

Section 10.Representations and Warranties of the Consenting Parties. Each Consenting Party other than the Creditors’ Committee severally, and not jointly, represents and warrants that, as of the date such Consenting Party executes and delivers this Agreement or a Joinder to this Agreement:

(a)it has the full power and authority to tender, act on behalf of, vote and consent to matters concerning, such Company Claims/Interests;

(b)such Company Claims/Interests are free and clear of any pledge, lien, security interest, charge, claim, equity, option, proxy, voting restriction, right of first refusal, or other limitation on disposition, transfer, or encumbrances of any kind, that would materially and adversely affect in any way such Consenting Parties’ ability to perform any of its obligations under this Agreement at the time such obligations are required to be performed;

(c)it has the full power to vote, tender, approve changes to, and transfer all of its Company Claims/Interests as contemplated by this Agreement subject to applicable Law; and

(d)solely with respect to holders of Company Claims/Interests, (i) it is either (A) a qualified institutional buyer as defined in Rule 144A of the Securities Act, (B) not a U.S. person (as defined in Regulation S of the Securities Act), or (C) an accredited investor (as defined in the Rules), and (ii) any securities acquired by the Consenting Stakeholder in connection with the Restructuring Transactions will have been acquired for investment and not with a view to distribution or resale in violation of the Securities Act.

Section 11.Mutual Representations and Warranties. Each of the Parties, severally and not jointly, represents and warrants to each other Party that, as of the date such Party executes this Agreement or a Joinder, as applicable:

(a)it is validly existing and in good standing under the Laws of the jurisdiction of its incorporation or organization, and has all requisite corporate, partnership, limited liability company or similar authority to enter into this Agreement and carry out the transactions contemplated hereby and perform its obligations contemplated hereunder, and the execution and delivery of this Agreement and the performance of such Party’s obligations hereunder have been duly authorized by all necessary corporate, partnership, limited liability company, or other similar action;

(b)this Agreement is a legal, valid, and binding obligation of such Party, enforceable against it in accordance with its terms, except as enforcement may be limited by applicable Laws relating to or limiting creditors’ rights generally or by equitable principles relating to enforceability;

(c)except as expressly provided in this Agreement, the Plan, and the Bankruptcy Code, if applicable, no consent or approval is required by any other Person or Entity in order for it to effectuate the Restructuring Transactions contemplated by, and perform its respective obligations under, this Agreement;

(d)the execution, delivery, and performance of such Party of this Agreement do not, and will not (i) violate (A) any provision of any Law or regulations applicable to it or (B) its articles of association, memorandum of association, charter, bylaws, or other governing documents or (ii) conflict with or constitute a breach of or default (without notice or lapse of time, or both) under, or give rise to a right of termination, modification, or cancellation of any obligation under any material contractual obligation to which it is a party, except in the case of clause (i)(A) and (ii)(Y) with respect to Company Parties, as would not reasonably be expected to have a material adverse effect on Company Parties, taken as a whole, and (Z) with respect to any other Party, as would not reasonably be expected to prevent or materially impair, alter, or delay the ability of such Party to consummate the transactions contemplated hereby;

(e)to its knowledge, no facts or circumstances, including with respect to any pending or threatened legal actions, exist that would be reasonably expected to impair or delay the ability of such Party to consummate the Restructuring Transactions; and

(f)except as expressly provided by this Agreement, it is not party to any restructuring or similar agreements or arrangements with the other Parties to this Agreement that have not been disclosed to all Parties to this Agreement.

Section 12.Termination Events.

12.01Consenting Stakeholder Termination Events. This Agreement may be terminated by the DIP Secured Parties or the Consenting Foris Prepetition Secured Lenders as to all Parties by the delivery to all Parties of a written notice in accordance with Section 14.12 hereof upon the occurrence of any one of the following events:

(a)the breach in any material respect by a Company Party or any Other Consenting Stakeholder of any of the representations, warranties, or covenants of the Company Parties or the Other Consenting Stakeholders set forth in this Agreement that remains uncured (to the extent curable) for seven (7) Business Days after such terminating Consenting Stakeholders transmit a written notice in accordance with Section 14.12 hereof detailing any such breach;

(b)any of the Milestones set forth in Section 4 (as may have been extended with the approval of the DIP Secured Parties and Consenting Foris Prepetition Secured Lenders) is not achieved, except where such Milestone has been waived or extended by the applicable Consenting Stakeholders;

(c)the delivery of a notice by the Company Parties in accordance with Section 8.01;

(d)this Agreement or any Definitive Document is amended, waived or modified in any manner not consistent in any material respect with the terms of this Agreement;

(e)the issuance by any Governmental Authority, including any regulatory authority or court of competent jurisdiction, of any final, non-appealable ruling or order that (i) would reasonably be expected to prevent the consummation of a material portion of the Restructuring Transactions and (ii) remains in effect for fifteen (15) Business Days after such terminating Consenting Stakeholders transmit a written notice in accordance with Section 14.12 hereof detailing any such issuance; provided, that this termination right may not be exercised by any Party that sought or requested such ruling or order in contravention of any obligation set out in this Agreement;

(f)the entry of an order by the Bankruptcy Court, or the filing of a motion or application by any Company Party or any Other Consenting Stakeholder seeking an order (without the prior written consent of the Consenting Stakeholders, not to be unreasonably withheld), (i) dismissing any of the Chapter 11 Cases, (ii) converting one or more of the Chapter 11 Cases of a Company Party to a case under chapter 7 of the Bankruptcy Code, (iii) appointing an examiner with expanded powers beyond those set forth in sections 1106(a)(3) and (4) of the Bankruptcy Code or a trustee in one or more of the Chapter 11 Cases of a Company Party, or (iv) rejecting this Agreement;

(g)any Company Party or Other Consenting Stakeholder (i) files, amends or modifies, or files a pleading seeking approval of any Definitive Document or authority to amend or modify any Definitive Document in a manner that is inconsistent with or not permitted by this Agreement (including with respect to the consent rights afforded the Consenting Stakeholders under this Agreement) without the prior written consent of the Consenting Stakeholders, (ii) revokes the Restructuring Transactions without the prior consent of the Consenting Stakeholders, including the withdrawal of the Plan or support therefor, or (iii) publicly announces its intention to take any such acts listed in the foregoing clauses (i) or (ii) or is otherwise inconsistent in any material respect with the consent rights afforded such Parties under this Agreement;