Bitcoin and altcoins await the Fed’s decision

Bitcoin (COIN:BTCUSD) and other cryptocurrencies have stabilized

after a recent drop that took prices to their lowest level in 20

months. Investors and analysts are closely watching the U.S.

Federal Reserve, anticipating potential interest rate cuts and

awaiting approval of the first Bitcoin ETF. Bitget analyst Fernando

Pereira is monitoring the market’s technical levels. “I find it

unlikely that we will see any significant price movement in BTC

until Wednesday when we will know the new U.S. interest rate. We

will probably have a quiet day with the price trading near $41k,”

Pereira indicated.

Small investor selling pattern drives 70% increase in Cardano

Santiment, an on-chain analysis company, identified a pattern in

Cardano (COIN:ADAUSD) that may have triggered a 71% increase in

ADA’s price in the last month. The study revealed a significant

reduction in the number of small wallets, with a drop of nearly

35,000 addresses on November 17th. Surprisingly, 98.1% of these

sales came from small holders, suggesting that large investors may

have taken the opportunity to buy. Since then, Cardano has recorded

a notable recovery, standing out from other cryptocurrencies with a

6% increase in the last 24 hours.

Cantor Fitzgerald CEO Howard Lutnick praises bitcoin and

stablecoins

Howard Lutnick, CEO of Cantor Fitzgerald, expressed admiration

for Bitcoin (COIN:BTCUSD), highlighting its halving cycle and

decentralization as factors contributing to its popularity. In an

interview on CNBC’s Money Mover podcast, Lutnick discussed

inflation, the Fed’s response to interest rate cuts, and the

dynamics of the cryptocurrency market. He highlighted the pattern

of Bitcoin’s price increase after each halving and praised the

decentralized nature of the asset. Additionally, he praised Tether

(COIN:USDTUSD), mentioning the stability provided by its treasury

bonds.

S&P Global rates Tether as ‘restricted’ with a score of 4

S&P Global (NYSE:SPGI), an American credit rating company,

has released stability ratings for various stablecoins. Tether

(COIN:USDTUSD) received a ‘restricted’ rating of 4 concerning its

ability to maintain parity with the U.S. dollar. The rating, which

ranges from 1 (strong) to 5 (weak), highlights the lack of

transparency in information about USDT’s custodians and

counterparties. Despite a significant portion of Tether’s reserves

consisting of U.S. Treasury bonds, there are concerns about

exposure to high-risk assets. S&P suggests that increased

disclosure and regulation could improve USDT’s rating. Circle’s

USDC (COIN:USDCUSD) was highlighted as one of the strongest

stablecoins, initially receiving the highest score of 1 but

adjusted to 2 due to uncertainty regarding bankruptcy

protection.

Nasdaq shifts focus to cryptocurrency technology in emerging

markets

Nasdaq (NASDAQ:NDAQ) plans to expand its cryptocurrency

technology developed for emerging markets, including the carbon

sector. After abandoning its digital asset custody project in the

U.S. due to regulatory challenges, the company aims to capitalize

on its technology to attract customers interested in new assets.

Tal Cohen, co-president of Nasdaq, stated that they will launch the

technology as a service, targeting the potential of digital and

carbon markets.

ARK Invest continues to sell Coinbase shares in a bullish market

ARK Invest, led by Cathie Wood, has continued to sell Coinbase

(NASDAQ:COIN) shares for the third day, totaling 82,255 shares,

equivalent to approximately $11.5 million, at the close of Tuesday.

The sales occurred despite the stability of Coinbase’s shares,

staying within 5% of the annual peak. Coinbase shares have risen in

parallel with the increase in Bitcoin (COIN:BTCUSD), which has

surged about 150% this year. ARK Invest’s policy is to maintain the

maximum weight of any company in its ETFs at 10%.

DWS Group, Flow Traders, and Galaxy Digital create company to

launch Euro stablecoin

Deutsche Bank’s DWS Group (NYSE:DB), Flow Traders, and Galaxy

Digital Holdings (TSX:GLXY) are joining forces to form AllUnity, a

company focused on issuing a stablecoin denominated in euros,

headquartered in Frankfurt. Alexander Höptner, former CEO of

BitMEX, will lead the initiative, which seeks an electronic money

license from the German BaFin, aiming to launch the stablecoin in

the next 18 months. The partnership aims to serve institutions,

businesses, and private users in the stablecoin market.

Blockstream launches Series 2 after the success of BASIC note

Blockstream, a Bitcoin infrastructure company, exceeded its goal

of $5 million with Series 1 of the “BASIC” program, focused on

profiting from the Bitcoin mining market’s recovery. With $5,075

million raised, the company will allocate most of it to purchase

Antminer S19k Pro ASIC machines. Now, it will launch Series 2,

aiming to capitalize on low hardware prices before Bitcoin’s

halving in 2024. The strategy includes acquiring and storing ASICs

for strategic sales over the next two years.

Worldcoin expands digital identity platform with World ID 2.0

Cryptocurrency startup Worldcoin (COIN:WLDUSD), co-founded by

Sam Altman, announced the expansion of World ID, its

ocular-scanning-based identity system. With integration on major

platforms like Shopify (NYSE:SHOP) and Reddit, World ID 2.0 offers

a new multi-level verification system. In addition to the standard

level, there will be a basic level without retina scans and a

stricter level, Orb Plus. Worldcoin emphasizes that it does not

store biometric data, aiming to preserve users’ privacy.

Rainbow introduces points program to attract users and reward

loyalty

Rainbow, a cryptocurrency wallet accessible via mobile and web,

has introduced a points program to reward existing users and

attract new ones. Using an Ethereum activity snapshot, Rainbow

allocated points to Ethereum (COIN:ETHUSD) users and offered

bonuses to MetaMask users. This reward scheme, which the company

calls “fox hunting,” could lead to future Rainbow token airdrops

(COIN:RNRWUST).

Cryptocurrency and fintech adoption growing rapidly in Latin

America

Fintech companies in Latin America are rapidly adopting digital

solutions, driven by the increasing acceptance of cryptocurrencies

in the region. A report from Circle highlighted that Latin

Americans received $562 billion in digital currency between 2021

and 2022, with stablecoins playing a crucial role. The region

presents a high market demand, political support, and widespread

use of the U.S. dollar, favoring the adoption of stablecoins for

daily transactions.

Nubank expands cryptocurrency services to include withdrawals and

USDC

Brazilian neobank Nubank (NYSE:NU) plans to allow cryptocurrency

withdrawals on its platform, responding to demands from the

country’s Bitcoin (COIN:BTCUSD) community. Starting next year,

users will be able to withdraw crypto assets directly from the

banking app. Additionally, Nubank will integrate the stablecoin

USDC (COIN:USDCUSD) following an agreement with Circle. This

initiative is part of an expansion that includes the addition of 11

altcoins in 2023 and the appointment of David Marcus, former head

of blockchain at Meta (NASDAQ:META), to the company’s board.

OKX DEX Aggregator compromised in security breach

OKX DEX Aggregator suffered a security breach due to an outdated

smart contract, resulting in the loss of approximately $370,000.

OKX reacted by revoking permissions and promising to reimburse

affected users. The breach involved the theft of notable tokens,

including USDC (COIN:USDCUSD) and SHIBA INU (COIN:SHIBUSD). The

company is conducting a comprehensive review and working with

authorities to track the stolen funds, with potential total losses

reaching $1.1 million.

Binance and former CEO contest SEC intervention in DOJ agreement

Binance Holdings and its former CEO, Changpeng Zhao, are

contesting the SEC’s attempt to incorporate details of Binance’s

$4.3 billion agreement with the U.S. Department of Justice (DOJ)

into its legal proceedings. The company considers the SEC’s action

to be procedurally inadequate and inadmissible. Since June 2023,

Binance has faced SEC charges for alleged securities law

violations, including mishandling customer assets. Binance’s

response highlights the lack of relevance and procedural flaws in

the SEC’s approach.

Justin Sun assures asset security in HTX and Poloniex after hack

Cryptocurrency magnate Justin Sun has assured that assets in HTX

and Poloniex are “100% safe” after a hack resulting in the theft of

over $200 million. Both exchanges have partially resumed

withdrawals, primarily for Bitcoin (COIN:BTCUSD) and Tron

(COIN:TRXUSD), while some altcoins remain locked. Sun stated that

most of the assets have already been recovered, and all losses have

been covered, ensuring the safety of customer assets.

Insomniac Games targeted in cyberattack with bitcoin ransom demand

Game studio Insomniac Games, known for titles like Spider-Man 2

and Ratchet & Clank, fell victim to a cyberattack by the

Rhysida group, according to CyberDaily. Hackers are demanding a

ransom of 50 Bitcoin (COIN:BTCUSD), valued at over $2 million. Sony

(NYSE:SONY), the owner of Insomniac, is investigating the incident.

The attack resulted in access to sensitive data, including personal

information of employees and screenshots of the upcoming Wolverine

game. Insomniac faces a one-week deadline to meet the hackers’

demands, who have already started auctioning off the stolen

data.

IRS-CI highlights cryptocurrency criminal cases in its top 10 for

2023

The IRS Criminal Investigation Division (IRS-CI) has revealed

its list of the top 10 criminal cases for 2023, with a focus on

crimes involving cryptocurrencies. Four of the most notable cases

include the seizure of Bitcoin from the Silk Road, the conviction

of Karl Sebastian Greenwood in the OneCoin fraud scheme, the arrest

of Amir Elmaani for tax evasion, and the conviction of Ian Freeman

for money laundering with Bitcoin. Jim Lee, division head,

emphasized the team’s ability to track complex financial

transactions and dismantle fraudulent schemes.

3AC’s Su Zhu to be released after good behavior in prison

Su Zhu, co-founder of cryptocurrency hedge fund Three Arrows

Capital (3AC), will be released after serving four months in prison

for lack of cooperation in the company’s liquidation. Bloomberg

reported that his good behavior in custody contributed to his

release. Simultaneously, Zhu faces questioning about the collapse

of 3AC and the location of its assets. Teneo, the liquidator of

3AC, seeks to recover $1.3 billion from the co-founders, while

Singapore authorities are also investigating them. 3AC, which

managed around $18 billion, collapsed due to risk mismanagement and

reckless transactions.

SBF’s lawyer criticizes his performance in trial

David Mills, lawyer for Sam Bankman-Fried (SBF), co-founder of

FTX, described him as the “worst person” he has ever seen in an

interrogation. In an interview with Bloomberg, Mills highlighted

that SBF deviated from the prepared legal strategy and handled

questions from prosecutors poorly. Mills believes that although

better performance would not change the verdict, the trial was not

fair, maintaining the opinion that SBF is innocent because he had

no intention of wrongdoing.

Donald Trump launches NFTs based on his recent arrest

Former U.S. President Donald Trump has unveiled a new series of

non-fungible tokens (NFTs) inspired by his arrest, according to an

announcement on X, formerly known as Twitter. Trump was arrested in

August 2023 on conspiracy charges related to the 2020 elections.

The collection of 47 NFTs includes a photo of his arrest, with each

item priced at $99. Collectors who acquire all of them will receive

exclusive rewards, including dinners at Mar-a-Lago and fragments of

Trump’s suit worn during his arrest.

LINE NEXT raises $140 million to expand global web3 platform

LINE NEXT, the NFT subsidiary of South Korean-based LINE

Corporation, has raised $140 million to strengthen its Web3

ecosystem. Led by Crescendo Equity Partners, the investment is

considered the largest in the Asian blockchain Web3 sector this

year. With this capital, LINE NEXT will launch its global NFT

platform, DOSI, in January 2024, aiming to popularize Web3 usage

and give brands ownership of digital products.

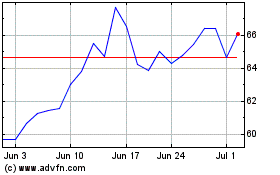

Shopify (NYSE:SHOP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Shopify (NYSE:SHOP)

Historical Stock Chart

From Apr 2023 to Apr 2024