false

0001742924

0001742924

2023-12-13

2023-12-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of the

Securities Exchange

Act of 1934

Date of Report (Date of earliest event reported):

December 13, 2023

LIVENT CORPORATION

(Exact name of registrant as specified in its

charter)

| Delaware |

001-38694 |

82-4699376 |

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission File Number) |

(I.R.S. Employer

Identification No.)

|

| |

|

|

|

1818 Market Street

Philadelphia, Pennsylvania

|

|

19103 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: 215-299-5900

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

LTHM |

New York Stock Exchange |

Check the appropriate box below if the Form 8-K

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

Certain Litigation Relating to the Transaction

As previously disclosed, on May 10, 2023, Livent Corporation (“Livent”)

entered into the Transaction Agreement, dated as of May 10, 2023, which was subsequently amended by the Amendment to Transaction Agreement,

dated as of August 2, 2023, and the Second Amendment to Transaction Agreement, dated as of November 5, 2023 (and as may be further amended

from time to time, the “Transaction Agreement”), with Allkem Limited, an Australian public company limited by shares

(“Allkem”), Arcadium Lithium plc, a public limited company incorporated under the laws of the Bailiwick of Jersey (originally

incorporated as Lightning-A Limited, a private limited company incorporated under the laws of the Bailiwick of Jersey and f/k/a Allkem

Livent plc) (“Arcadium”), which was subsequently joined by Lightning-A Merger Sub, Inc., a Delaware corporation (“Merger

Sub”), and Arcadium Lithium Intermediate IRL Limited, a private company limited by shares and incorporated and registered in

Ireland, pursuant to which (i) Arcadium will acquire all of the shares of Allkem pursuant to a scheme of arrangement under the Corporations

Act (Cth) 2001 of Australia (the “Scheme”), resulting in Allkem becoming a wholly owned subsidiary of Arcadium, and

(ii) Merger Sub, which will become a wholly owned subsidiary of Arcadium, will merge with and into Livent, with Livent surviving the merger

as a wholly owned subsidiary of Arcadium (the “Merger” and, together with the other transactions contemplated by the

Transaction Agreement, the “Transaction”).

For a more detailed description of the Transaction Agreement and the

Transaction, please see the Definitive Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission (the “SEC”)

by Livent on November 20, 2023 (the “Proxy Statement”).

As of December 12, 2023, three complaints have been filed by purported

Livent stockholders against Livent and members of Livent’s board of directors in connection with the Transaction (the “Complaints”).

The Complaints include allegations, among other matters, of violations of securities laws, negligent misrepresentation and negligence.

In addition to the Complaints, purported stockholders of Livent have sent 12 demand letters alleging similar deficiencies as those asserted

in the Complaints (the “Demands,” and together with the Complaints, the “Matters”). Livent believes

that the claims asserted in the Matters are without merit, and that no further disclosure is required under applicable law. Nonetheless,

to specifically moot plaintiffs’ claims, to avoid the risk that the Matters delay or otherwise adversely affect the Transaction

and to minimize the costs, risks and uncertainties inherent in litigation, Livent is making supplemental disclosures (the “Supplemental

Disclosures”) related to the Transaction, as set forth herein. Nothing in this Current Report on Form 8-K shall be deemed an

admission of the legal necessity or materiality under applicable laws of any of the Supplemental Disclosures.

The Supplemental Disclosures should be read in conjunction with the

Proxy Statement, which is available at www.sec.gov, along with periodic reports and other information Livent files with the SEC. To the

extent that the information set forth herein differs from or updates information contained in the Proxy Statement, the information set

forth herein shall supersede or supplement the information in the Proxy Statement. However, the Supplemental Disclosures contained herein

do not affect the timing of the special meeting of Livent stockholders (the “Livent Special Meeting”), which is scheduled

to be held on December 19, 2023, or the Livent board of directors’ recommendation that Livent stockholders vote in favor of the

Transaction. All page references are to pages in the Proxy Statement, and terms used below, unless otherwise defined, have the meanings

set forth in the Proxy Statement.

The sentence under the heading “The Transaction—Recommendation

of the Livent Board; Livent’s Reasons for the Transaction” beginning with “The Livent Board also considered a variety

of risks…” on page 100 of the Proxy Statement is hereby amended and supplemented by replacing the sentence in its entirety

with the following:

The Livent Board also considered a variety of risks and other countervailing

factors, including:

| • | that the fixed exchange ratio implies a premium to Allkem shareholders based on the share prices of the two companies at the time

of announcement and will not adjust upwards to compensate for changes in the price of Livent Shares or Allkem Shares prior to the consummation

of the transaction; |

| • | the restrictions on the conduct of Livent’s business during the pendency of the transaction, which may delay or prevent Livent

from undertaking business opportunities that may arise or may negatively affect Livent’s ability to attract and retain key personnel; |

| • | the terms of the Transaction Agreement that restrict Livent’s ability to solicit alternative transaction proposals and to provide

confidential due diligence information to, or engage in discussions with, a third party interested in pursuing an alternative transaction,

as further discussed under “The Transaction Agreement—No Solicitation of Competing Proposals”; |

| • | the potential for diversion of management and employee attrition and the possible effects of the announcement and pendency of the

transaction on customers and business relationships; |

| • | the amount of time it could take to complete the transaction, including the fact that completion of the transaction depends on factors

outside of Livent’s control, including regulatory approvals, approval of Allkem’s shareholders, and approval of the scheme

by the Court, and that there can be no assurance that the conditions to the transaction will be satisfied even if the transaction is approved

by Livent’s stockholders; |

| • | the fact that Allkem would generally not be required to pay a termination fee if the Transaction Agreement is terminated due to regulatory

impediments, the failure of Allkem shareholders to approve the transaction, the failure of the Independent Expert to conclude that the

scheme is in the best interests of Allkem’s shareholders or the failure of the Court to approve the scheme absent a material breach

of the Transaction Agreement by Allkem; |

| • | the possibility of non-consummation of the transaction and the potential consequences of non-consummation, including the potential

negative impacts on Livent, its business and the trading price of the Livent Shares; |

| • | the risk that the combined company could be treated as a U.S. corporation (and, therefore, a U.S. tax resident) for U.S. federal income

tax purposes following closing pursuant to Section 7874 of the Code, including as a result of a change in applicable law with respect

to Section 7874 of the Code or any other U.S. tax law, or official interpretations thereof, or a change in certain facts (including relative

values); |

| • | the risk that the IRS may assert that the combined company should be treated as a U.S. corporation (and, therefore, a U.S. tax resident)

for U.S. federal income tax purposes pursuant to Section 7874 of the Code; |

| • | the challenges inherent in the combination of two business enterprises of the size and scope of Livent and Allkem and the cross-border

nature of the combined company; |

| • | the fact that Livent and Allkem have incurred and will continue to incur significant transaction costs and expenses in connection

with the transaction, regardless of whether the transaction is consummated, and that these costs may be greater than anticipated; and |

| • | the risks of the type and nature described under the sections entitled “Risk Factors” and “Cautionary Statement

Regarding Forward-Looking Statements.” |

The paragraph under the heading “Illustrative Net Asset Value

Analysis—Livent Standalone Net Asset Value Analysis” beginning with “The discounted cash flows …” on page

104 of the Proxy Statement is hereby amended and supplemented by replacing the paragraph in its entirety with the following:

The discounted cash flows also took into account

Livent’s projected cash expenses, depreciation and amortization, taxes, capital expenditures, working capital, contracted prepayments,

and export duty rebates. Using real discount rates ranging from 10.500% to 11.750%, reflecting estimates of Livent’s weighted average

cost of capital, and a mid-period discounting convention, Gordon Dyal & Co. discounted to present value, as of

December 31, 2023, estimates of such unlevered,

after-tax future cash flows for Livent. Gordon Dyal & Co. then calculated indications of Livent’s illustrative NAV by adding

to the illustrative discounted unlevered, after-tax future cash flows the value of Livent’s net cash balance as of December 31,

2023 of $0.1 billion (which was provided by Livent management). This range of implied NAVs for Livent was then divided by 209,475,051,

the number of fully diluted Livent Shares outstanding as of May 8, 2023, determined using the treasury stock method and taking into account

the impact of outstanding dilutive securities, to arrive at a range of implied NAVs per Livent Share. This analysis implied the following

illustrative ranges of NAVs per Livent Share (rounded to the nearest $0.01 per share):

The paragraph under the heading “Illustrative Net Asset Value

Analysis—Allkem Standalone Net Asset Value Analysis” beginning with “Using each of the cases of Livent’s…”

on page 104 of the Proxy Statement is hereby amended and supplemented by replacing the paragraph in its entirety with the following:

Using each of the cases of Livent’s Adjusted

Allkem Forecasts, Gordon Dyal & Co. performed an illustrative NAV analysis of Allkem by calculating the estimated present value of

the unlevered, after-tax future cash flows that Allkem was projected to generate from operating its assets, including its existing reserves

and estimates of recoverable resources during the calendar year beginning January 1, 2024 through the full calendar year ending December 31,

2067 (and including working capital releases and mine closing costs), as reflected in Livent’s Adjusted Allkem Forecasts as provided

to Gordon Dyal & Co. by Livent. Gordon Dyal & Co. calculated these cash flows based on each of the cases of Livent’s Adjusted

Allkem Forecasts. Gordon Dyal & Co. calculated the estimated present value of these cash flows assuming real lithium product prices

ranging from +20% to -20% of Livent management’s projected real lithium product pricing, which took into account Allkem’s

estimated calendar year 2023 to 2025 contracted volumes, per Allkem management, which pricing and volume assumptions Livent’s management

approved. The discounted cash flows also took into account Allkem’s projected cash expenses, depreciation and amortization, taxes,

capital expenditures, and working capital, which Livent’s management approved. Using real discount rates ranging from 9.250% to

10.500%, reflecting an estimate of Allkem’s weighted average cost of capital and a mid-period discounting convention, Gordon Dyal

& Co. discounted to present value, as of December 31, 2023, estimates of such unlevered, after-tax future cash flows for Allkem.

Gordon Dyal & Co. then calculated a range of indications of Allkem’s illustrative NAVs by adding to the illustrative discounted

unlevered, after-tax future cash flows the value of Allkem’s net cash balance as of December 31, 2023 of $0.8 billion (which

was provided by Allkem management) to arrive at a range of implied NAVs of Allkem. This range of implied NAVs for Allkem was then divided

by 641,487,082, which was the number of fully diluted Allkem Shares outstanding as of May 8, 2023 used by Gordon Dyal & Co. in its

analysis, determined using the treasury stock method and taking into account the impact of outstanding dilutive securities, to arrive

at a range of implied NAVs per Allkem Share. This analysis implied the following illustrative ranges of NAVs for Allkem (rounded to the

nearest $0.1 billion):

The paragraph under the heading “Pro Forma Combined Company

Net Asset Value Analysis” beginning with “Using the Livent projections…” on page 105 of the Proxy Statement is

hereby amended and supplemented by replacing the paragraphs in its entirety with the following:

Using Livent’s Adjusted Allkem Forecasts,

the Livent Forecasts, the Projected Synergies, and Resources Estimates, among other things, Gordon Dyal & Co. performed an illustrative

NAV analysis of the pro forma combined company. The pro forma combined company NAV analysis reflected the standalone NAVs, exclusive of

the impact of the Projected Synergies, derived for (i) Livent, plus (ii) Allkem (for each of the cases of Livent’s Adjusted Allkem

Forecasts), plus (iii) the NAV of the Projected Synergies (including cost, capital and operating model integration benefits) of $1.6 billion.

Gordon Dyal & Co. calculated such NAV value of the Projected Synergies using real discount rates ranging from 9.750% to 11.125%, and

a mid-period discounting convention discounted to present value, as of December 31, 2023. This range of implied NAVs for the pro

forma combined company was then divided by 1,145,484,055, the number of fully diluted shares of the pro forma combined company expected

to be outstanding following the completion of the merger as of May 8, 2023, determined using the treasury stock method and taking into

account the impact of outstanding dilutive securities, to derive a range of illustrative NAVs per NewCo Share. Gordon Dyal & Co. then

multiplied the range of illustrative NAVs per share by the Merger Exchange Ratio to obtain the below illustrative range of NAVs per share

(rounded to the nearest $0.01 per share) of the NewCo Shares to be received by Livent stockholders in the merger:

The paragraph under the heading “Interests of Livent’s

Directors and Executive Officers in the Transaction—Employment Arrangements Following the Transaction” beginning with “Following

the closing of the merger, pursuant to the Transaction Agreement …” on page 118 of the Proxy Statement is hereby amended

and supplemented by replacing the paragraph in its entirety with the following:

Following the closing of the merger, pursuant

to the Transaction Agreement, Livent’s Chief Executive Officer and Chief Financial Officer will become the Chief Executive Officer

and Chief Financial Officer of the combined company, respectively. The parties have also since determined that Livent’s General

Counsel will become the General Counsel of the combined company. As of the date of this proxy statement/prospectus, none of Livent’s

executive officers have entered into any definitive agreements or arrangements regarding employment with NewCo to be effective following

the completion of the transaction (other than entitlement to receive the retention bonuses as described in the section above), nor has

their compensation been determined. However, prior to the effective time, Livent may initiate discussions regarding employment terms

and may enter into definitive agreements regarding employment for certain of Livent’s employees to be effective as of the effective

time, subject to the terms of the Transaction Agreement.

The paragraph under the heading “Interests of Livent’s

Directors and Executive Officers in the Transaction—Combined Company Director Compensation” beginning with “In connection

with the transaction, NewCo intends…” on page 118 of the Proxy Statement is hereby amended and supplemented by replacing

the paragraph in its entirety with the following:

In connection with the transaction, NewCo intends

to adopt a new director compensation program. The purpose of the director compensation program will be to attract and retain a high caliber

of directors and align their interests to NewCo’s shareholders. Messrs. Graves, Marcet, Merkt and Pallash and Ms. Lampe-Önnerud

are expected to receive director compensation partly in cash and partly in equity interests of NewCo, but as of the date of this proxy

statement/prospectus, the amount of such compensation has not yet otherwise been determined.

The paragraph under the heading “The Transaction—Regulatory

Approvals—Australian Court and Allkem Shareholder Approval” beginning with “Under the Australian Corporations Act”

on page 130 of the Proxy Statement is hereby amended and supplemented by replacing the paragraph in its entirety with the following:

Australian Court and Allkem Shareholder Approval

Under the Australian Corporations Act, the scheme

must be approved by both Allkem shareholders and the Court to become effective. At the First Court Hearing, Allkem will seek orders to

convene a meeting of Allkem shareholders to vote on a resolution to approve the scheme. The shareholders’ resolution to approve

the scheme must be passed by: (i) a majority in number of Allkem shareholders that are present and voting at the scheme meeting (either

in person or by proxy, attorney or in the case of a corporation its duly appointed corporate representative); and (ii) 75% or more

of the votes cast on the resolution by Allkem shareholders who are present and voting at the scheme meeting (either in person or by proxy,

attorney or in the case of a corporation its duly appointed corporate representative). If the resolution to approve the scheme is passed

at the scheme meeting and all other conditions to the scheme implementation are satisfied or waived, except for conditions relating to

the approval of the Court or lodgment of the Court order approving the scheme, Allkem will then seek approval of the Court for the scheme

at the Second Court Hearing. The First Court Hearing occurred on November 8, 2023, and the Court made orders to convene the meeting of

Allkem shareholders. The Second Court Hearing is scheduled to occur on December 20, 2023.

The section “The Transaction” of the Proxy Statement

is hereby amended to add a new subsection immediately following the section “The Transaction—Regulatory Approvals” beginning

on page 130 of the Proxy Statement and immediately preceding the section “Accounting Treatment” beginning on page 131 of the

Proxy Statement, as follows:

Independent Expert Report

As a condition to the Transaction Closing, the Independent Expert must issue the IER, which

must conclude that the scheme is in the best interest of Allkem shareholders. The Independent Expert has issued the IER

and has concluded that the scheme is in the best interest of Allkem

shareholders (in the absence of a superior proposal in relation to Allkem), and as of the date of this document the Independent Expert

has not withdrawn or changed that conclusion.

Number of Livent Shares Outstanding on Merger Record Date

The number of shares of Livent common stock, par value $0.001 per share

(the “Livent Shares”) outstanding and entitled to vote as of the close of business on November 14, 2023, the record date for

the Livent Special Meeting, and the number of Livent Shares outstanding as of November 10, 2023, was incorrectly stated as 179,812,100

in the Proxy Statement. The correct number is 179,920,601 Livent Shares in each case.

Important Information and Legal Disclaimer:

Forward-Looking Statements

This communication contains forward-looking statements, including within

the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can often be identified by terms such

as “may,” “will,” “appears,” “should,” “expects,” “plans,” “anticipates,”

“could,” “intends,” “target,” “projects,” “contemplates,” “believes,”

“estimates,” “predicts,” “potential,” or “continue,” or the negative of these words or

other similar terms or expressions that concern expectations, strategy, plans, or intentions. However, the absence of these words or similar

terms does not mean that a statement is not forward-looking. All forward-looking statements are based on information and estimates available

to Allkem or Livent at the time of this announcement and are not guarantees of future performance.

Examples of forward-looking statements in this announcement (made at

the date of this announcement unless otherwise indicated) include, among others, statements regarding the future performance of the combined

company, the perceived and potential synergies and other benefits of the Transaction, and expectations around the financial impact of

the Transaction on the combined company’s financials. In addition, this announcement contains statements concerning the intentions,

beliefs and expectations, plans, strategies and objectives of the directors and management of Allkem and Livent for Allkem, Livent and

the combined company, the anticipated timing for and outcome and effects of the Transaction (including expected benefits to shareholders

of Allkem and Livent), anticipated production, production capacity or construction or development commencement dates, costs or production

outputs, capital expenditure and future demand for lithium, expectations for the ongoing development and growth potential of the combined

company and the future operation of Allkem, Livent and the combined company.

Forward-looking statements are not statements of historical fact and

actual events and results may differ materially from those contemplated by the forward-looking statements as a result of a variety of

known and unknown risks, uncertainties, and other factors (many of which are outside the control of Allkem, Livent and the combined company),

some of which are described from time to time in Livent’s filings with the SEC and Allkem’s filings with the Australian Securities

Exchange (the “ASX”), including Livent’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022,

and any subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K and Allkem’s Annual Report for the financial year

ended 30 June 2022 (Appendix 4E), Half-Year Report for the half year ended 31 December 2022 (Appendix 4D), and Activities Report for the

quarter ended 30 September 2023, and future filings and reports by either Allkem or Livent.

These statements involve known and unknown risks, uncertainties and

other factors that may cause actual results to be materially different from any results, levels of activity, performance or achievements

expressed or implied by any forward-looking statement and may include statements regarding the expected timing and structure of the proposed

Transaction; the ability of the parties to complete the proposed Transaction considering the various closing conditions; the expected

benefits of the proposed Transaction, such as improved operations, enhanced revenues and cash flow, synergies, growth potential, market

profile, business plans, expanded portfolio and financial strength; the competitive ability and position of Arcadium following completion

of the proposed Transaction; and anticipated growth strategies and anticipated trends in Livent’s, Allkem’s and, following

the completion of the proposed Transaction, Arcadium’s business.

In addition, other factors related to the Transaction between Allkem

and Livent that contribute to the uncertain nature of the forward-looking statements and that could cause actual results and financial

condition to differ materially from those expressed or implied include, but are not limited to: the satisfaction of the conditions precedent

to the consummation of the Transaction, including, without limitation, the receipt of shareholder and regulatory approvals on the terms

desired or anticipated; unanticipated difficulties or expenditures relating to the Transaction, including, without limitation, difficulties

that result in the failure to realize expected synergies, efficiencies and cost savings from the Transaction within the expected time

period (if at all); potential difficulties in Allkem’s and Livent’s ability to retain employees as a result of the announcement

and pendency of the Transaction;

risks relating to the value of Arcadium’s shares to be issued

in the Transaction; disruptions of Allkem’s and Livent’s current plans, operations and relationships with customers caused

by the announcement and pendency of the Transaction; legal proceedings that may be instituted against Allkem and Livent following announcement

of the Transaction; funding requirements; lithium and other commodity prices; exploration, development and operating risks (including

unexpected capital or operating costs); production risks; regulatory restrictions (including environmental regulations and associated

liability, changes in regulatory restrictions or regulatory policy and potential title disputes) and risks associated with general economic

conditions.

Additional factors that could cause actual results, level of activity,

performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied

by the forward-looking statements are detailed in the filings with the SEC, including Livent’s annual report on Form 10-K, periodic

quarterly reports on Form 10-Q, periodic current reports on Form 8-K and other documents filed with the SEC.

There can be no assurance that the Transaction will be implemented

or that plans of the directors and management of Allkem and Livent for the combined company will proceed as currently expected or will

ultimately be successful. Investors are strongly cautioned not to place undue reliance on forward-looking statements, including in respect

of the financial or operating outlook for Allkem, Livent or the combined company (including the realization of any expected synergies).

Except as required by applicable law or the ASX Listing Rules, Allkem

and Livent assume no obligation to, and expressly disclaim any duty to, provide any additional or updated information or to update any

forward-looking statements, whether as a result of new information, future events or results, or otherwise. Nothing in this announcement

will, under any circumstances (including by reason of this announcement remaining available and not being superseded or replaced by any

other presentation or publication with respect to Allkem, Livent or the combined company, or the subject matter of this announcement),

create an implication that there has been no change in the affairs of Allkem or Livent since the date of this announcement. The distribution

of this announcement may be subject to legal or regulatory restrictions in certain jurisdictions. Any person who comes into possession

of this announcement must inform himself or herself of and comply with any such restrictions.

No offer or solicitation

This communication is for informational purposes only and is not intended

to be and shall not constitute a solicitation of any vote or approval, or an offer to buy or sell, or the solicitation of an offer to

buy or sell, any securities, or an invitation or recommendation to subscribe for, acquire or buy securities of Allkem, Livent or Arcadium,

or any other financial products or securities, in any place or jurisdiction, nor shall there be any offer, solicitation or sale of securities

in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities

laws of any such jurisdiction. No offer of securities shall be made in the United States absent registration under the U.S. Securities

Act of 1933, as amended, or pursuant to an exemption from, or in a Transaction not subject to, such registration requirements.

Additional information and where to find it

Arcadium has filed with the SEC, and the SEC has declared effective

on November 20, 2023, a registration statement on Form S-4 (File No. 333-273360) that contains a proxy statement/prospectus and other

documents (the “Form S-4”). Livent has mailed the proxy statement/prospectus contained in the Form S-4 to its stockholders.

This communication is not a substitution for any registration statement, proxy statement/prospectus or other documents that are or may

be filed with the SEC in connection with the proposed Transaction.

INVESTORS SHOULD READ THE PROXY STATEMENT/PROSPECTUS AND SUCH OTHER

DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THE PROXY STATEMENT/PROSPECTUS

AND SUCH DOCUMENTS, BEFORE THEY MAKE ANY DECISION WITH RESPECT TO THE PROPOSED TRANSACTION BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT ARCADIUM, LIVENT, ALLKEM, THE TRANSACTION AND RELATED MATTERS. The Form S-4, the proxy

statement/prospectus, any amendments or supplements thereto and all

other documents filed with the SEC in connection with the Transaction is or will be available when filed free of charge on the SEC’s

web site at www.sec.gov. Copies of documents filed with the SEC by Livent will be made available free of charge on Livent’s

investor relations website (at https://ir.livent.com/overview/default.aspx).

Participants in the Solicitation

Livent, Allkem, Arcadium and certain of their respective directors

and executive officers and other members of their respective management and employees may be deemed to be participants in the solicitation

of proxies in connection with the Transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants

in the solicitation of proxies in connection with the Transaction, including a description of their direct or indirect interests in the

Transaction, by security holdings or otherwise, is set forth in the proxy statement/prospectus and other relevant materials filed

with the SEC. Information regarding the directors and executive officers of Livent is contained in Livent’s proxy statement for

its 2023 annual meeting of stockholders, filed with the SEC on March 16, 2023, its Annual Report on Form 10-K for the fiscal year ended

December 31, 2022, which was filed with the SEC on February 24, 2023, subsequent statements of beneficial ownership on file with the SEC

and other filings made from time to time with the SEC. Information about Allkem’s directors and executive officers is set forth

in Allkem’s latest annual report dated 25 August 2022, as updated from time to time via announcements made by Allkem on the ASX.

Additional information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of Livent

security holders in connection with the Transaction, including a description of their direct or indirect interests, by security holdings

or otherwise, is set forth in the proxy statement/prospectus and other relevant materials filed with the SEC. These documents can be obtained

free of charge from the sources indicated above.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

LIVENT CORPORATION |

| |

|

| |

|

| |

By: |

/s/ Gilberto Antoniazzi |

| |

|

Name:

Title:

|

Gilberto Antoniazzi

Vice President and Chief Financial Officer

|

Dated: December 13, 2023

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

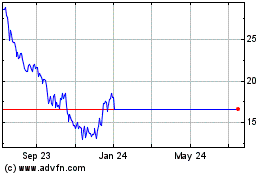

Livent (NYSE:LTHM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Livent (NYSE:LTHM)

Historical Stock Chart

From Apr 2023 to Apr 2024