false000126760200012676022023-12-112023-12-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 11, 2023

ALIMERA SCIENCES, INC.

(Exact name of registrant as specified in its charter)

| | | | |

Delaware | | 001-34703 | | 20-0028718 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

6310 Town Square, Suite 400

Alpharetta, Georgia 30005

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (678) 990-5740

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | |

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which

registered |

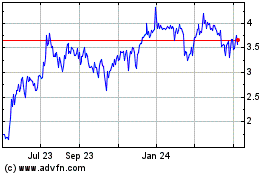

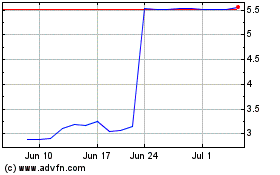

Common stock, par value $0.01 per share | | ALIM | | The NASDAQ Stock Market LLC (Nasdaq Global Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company □

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

A&R Employment Agreement with Richard S. Eiswirth, Jr.

On December 11, 2023 (the “Effective Date”), Alimera Sciences, Inc., a Delaware corporation (the “Company”), entered into an Amended and Restated Employment Agreement with Richard S. Eiswirth, Jr. (the “A&R Employment Agreement”), pursuant to which Mr. Eiswirth will continue to serve as the Company’s President and Chief Executive Officer. The A&R Employment Agreement amends and restates Mr. Eiswirth’s employment agreement with the Company dated January 2, 2019. The Company also awarded Mr. Eiswirth a one-time special cash bonus of $125,000 to be paid in a lump sum in recognition of Mr. Eiswirth’s leadership and significant contributions to the Company, including in connection with the Company’s acquisition of the YUTIQ commercialization rights and the improvement of the Company’s capital structure and balance sheet through the Company’s recent equity and debt financings.

The A&R Employment Agreement provides that Mr. Eiswirth will be entitled to receive an annual base salary of $603,200. In addition, Mr. Eiswirth will continue to be eligible to participate in the Company’s Management Cash Incentive Program, and, beginning with the fiscal year 2024, his target annual bonus amount may not be reduced to an amount below 65% of his then-current base salary. For fiscal year 2023, Mr. Eiswirth’s target bonus shall be $369,460.

Pursuant to the A&R Employment Agreement, Mr. Eiswirth will continue to receive all other benefits generally available to the Company’s executive officers. In addition, the Company will maintain disability insurance for Mr. Eiswirth’s benefit with substantially the same benefits and conditions as provided to him before the Effective Date, but in no event will the Company be obligated to pay an annual aggregate premium in excess of three times the annual aggregate premium paid by the Company for coverage as of immediately before the Effective Date.

The A&R Employment Agreement provides that, in the event of a “change in control” of the Company (as defined in the A&R Employment Agreement), any of Mr. Eiswirth’s performance-based vesting equity grants that are outstanding and unvested as of the effective date of such change in control will fully vest. If the change in control consists of a merger or consolidation of the Company, then all outstanding and unvested equity awards will fully vest unless otherwise provided by the transaction document.

Mr. Eiswirth’s employment with us is “at will.” The A&R Employment Agreement provides certain severance benefits, including cash severance and vesting acceleration upon the occurrence of certain defined events, as described below, in each case, subject to Mr. Eiswirth’s execution and non-revocation of a release of claims.

If the Company terminates Mr. Eiswirth’s employment without “cause” or if Mr. Eiswirth resigns for “good reason” (each as defined in the A&R Employment Agreement), then Mr. Eiswirth will be eligible to receive the following severance payments: (i) a cash severance payment equal to the sum of Mr. Eiswirth’s (A) annual base salary and (B) target annual bonus for the fiscal year of termination, payable in 12 equal monthly installments, (ii) earned bonus for the fiscal year of termination, payable no later than 2½ months after the close of the fiscal year of termination, (iii) one year of continuation coverage premium payments (or, if not permitted under applicable law, reimbursements thereof) under the Consolidated Omnibus Budget Reconciliation Act (“COBRA”), and (iv) 12 months of additional vesting for any time-based vesting equity grants that are outstanding and unvested as of the termination date.

If the Company terminates Mr. Eiswirth’s employment without cause or if Mr. Eiswirth resigns for good reason, in each case, at any time within three months before and 18 months after a change in control of the Company, then Mr. Eiswirth will be eligible to receive the following severance payments and benefits: (i) a cash severance payment equal to 150% of the sum of Mr. Eiswirth’s (A) annual base salary and (B) target annual bonus for the fiscal year of termination, payable in 18 equal monthly installments, (ii) earned bonus for the fiscal year of termination, payable no later than 2½ months after the close of the fiscal year of termination, (iii) 18 months of COBRA continuation coverage premium payments (or, if not permitted under applicable law, reimbursements thereof), and (iv) 100% vesting acceleration of any time-based vesting equity grants that are outstanding and unvested as of the termination date.

If Mr. Eiswirth’s employment is terminated due to a disability or in the event of his death, Mr. Eiswirth (or his estate, as applicable) will be eligible to receive the following payments and benefits: (i) base salary through the end of the month of termination or death (as applicable), (ii) earned bonus for the fiscal year of termination, payable no later than 2½ months after the close of the fiscal year of termination or death (as applicable), (iii) 18 months (12 months for dependents in the case of Mr. Eiswirth’s death) of COBRA continuation coverage premium payments (or, if not permitted under applicable law, reimbursements thereof), and (iv) 100% vesting acceleration of equity grants that are outstanding and unvested as of the termination date or date of death (as applicable).

If Mr. Eiswirth’s employment is terminated for any reason (other than by the Company with cause or by the executive other than for good reason), his outstanding options or other outstanding equity rights shall remain exercisable for the lesser of three years following termination or remaining term of the option or other right.

The description of the A&R Employment Agreement is qualified by reference to the full text of the A&R Employment Agreement, a copy of which is attached as Exhibit 10.1 to this Current Report on Form 8-K, and is incorporated herein by reference.

Employment Agreement with Todd Wood

On December 11, 2023 (the “Effective Date”), the Company entered into an Employment Agreement with Todd Wood (the “Wood Employment Agreement”), pursuant to which Mr. Wood will serve as the Company’s President of U.S. Operations. A copy of the press release announcing Mr. Wood’s appointment is attached hereto as Exhibit 99.1 and incorporated herein by this reference.

The Wood Employment Agreement provides that Mr. Wood will be entitled to receive an annual base salary of $415,000. In addition, beginning with the fiscal year 2024, Mr. Wood will be eligible to participate in the Company’s Management Cash Incentive Program. His initial target annual bonus amount will be up to 45% of his annual base salary and may not be reduced to an amount below 45% of his then-current base salary.

On the Effective Date, pursuant to the Wood Employment Agreement, Mr. Wood was granted a one-time inducement nonstatutory stock option entitling him to purchase up to 125,000 shares of Common Stock (the “Sign-On Option”) pursuant to the terms and conditions of a standalone stock option agreement outside of the Company’s 2023 Equity Incentive Plan and attached hereto as Exhibit 10.3. The exercise price per share subject to the Sign-On Option is equal to closing price per share of the Common Stock on the date of grant.

Subject to the approval of the Compensation Committee, Mr. Wood will receive two additional inducement grants:

A grant of 125,000 restricted stock units representing a notional account equal to a corresponding number of shares of Common Stock (the “RSUs”). The RSUs are subject to the following vesting schedule: 25% of the grant will become vested and exercisable on the first anniversary of the Effective Date, and the remaining portion of the grant will become vested and exercisable, as applicable, in equal monthly installments over the following thirty-six (36) months, subject to Mr. Wood’s continuous employment with the Company on each such vesting date.

A grant of 125,000 performance stock units representing a notional account equal to a corresponding number of shares of Common Stock (the “PSUs”), the vesting of which will be conditioned on the satisfaction of certain performance metrics as further described in the Wood Employment Agreement.

Pursuant to the Wood Employment Agreement, Mr. Wood will also receive all other benefits generally available to the Company’s executive officers.

Mr. Wood’s employment with us is “at will.” The Wood Employment Agreement provides certain severance benefits, including cash severance and vesting acceleration upon the occurrence of certain defined events, as described below, in each case, subject to Mr. Wood’s execution and non-revocation of a release of claims.

If the Company terminates Mr. Wood’s employment without “cause” or if Mr. Wood resigns for “good reason” (each as defined in the Wood Employment Agreement), then Mr. Wood will be eligible to receive the following severance payments: (i) (A) if termination occurs prior to Mr. Wood’s completion of 6 months of continuous employment with the Company, a cash severance payment equal to Mr. Wood’s earned but unpaid annual base salary, if any, (B) if termination occurs between 6 and 12 months’ completion of continuous employment with the Company, a cash severance payment equal to the sum of Mr. Wood’s (1) earned but unpaid annual base salary, if any, and (2) 50% of Mr. Wood’s then-current annual base salary, payable in 6 equal monthly installments, (C) if termination occurs between 12 and 24 months’ completion of continuous employment with the Company, a cash severance payment equal to the sum of Mr. Wood’s (1) earned but unpaid salary, if any, and (2) 75% of Mr. Wood’s then-current annual base salary payable in 9 equal monthly installments, and (D) if termination occurs at any time after Mr. Wood’s completion of 24 months of continuous employment with the Company, a cash severance payment equal to the sum of Mr. Wood’s (1) earned but unpaid salary, if any, and (2) 100% of Mr. Wood’s then-current annual base salary, payable in 12 equal monthly installments; (ii) earned bonus for the fiscal year of termination, payable no later than 2½ months after the close of the fiscal year of termination; (iii) COBRA continuation coverage premium payments (or, if not permitted under applicable law, reimbursements thereof) for the corresponding 6-, 9- or 12-month periods following the termination, as applicable, or, if earlier, until Mr. Wood is eligible to be covered under another substantially equivalent medical insurance plan by a subsequent employer; and (iv) 12 months of additional vesting for any time-based vesting equity grants that are outstanding and unvested as of the termination date.

If the Company terminates Mr. Wood’s employment without cause or if Mr. Wood resigns for good reason, in each case, at any time within three months before and 12 months after a change in control of the Company, then Mr. Wood will be eligible to receive the following severance payments and benefits: (i) a cash severance payment equal to 100% of the sum of Mr. Wood’s (A) annual base salary and (B) target annual bonus for the fiscal year of termination, payable in 12 equal monthly installments, (ii) annual bonus for the fiscal year of termination, payable no later than 2½ months after the close of the fiscal year of termination, (iii) 18 months of COBRA continuation coverage premium payments (or, if not permitted under applicable law, reimbursements thereof), (iv) 100% vesting acceleration of any time-based vesting equity grants that are outstanding and unvested as of the termination date, and (v) 100% vesting acceleration of any of Mr. Wood’s PSUs that are outstanding and unvested for the measurement year in which the change in control occurs if the trajectory of the revenue for the year is on pace to exceed the revenue target in the year of the change in control as of the date of the change in control (as further described in the Wood Employment Agreement).

If Mr. Wood’s employment is terminated due to a disability or in the event of his death, Mr. Wood (or his estate, as applicable) will be eligible to receive the following payments and benefits: (i) base salary through the end of the month of termination or death (as applicable), (ii) bonus for the fiscal year of termination, payable no later than 2½ months after the close of the fiscal year of termination or death (as applicable), (iii) 12 months of COBRA continuation coverage premium payments (or, if not permitted under applicable law, reimbursements thereof), and (iv) 100% vesting acceleration of equity grants that are outstanding and unvested as of the termination date or date of death (as applicable).

The description of the Wood Employment Agreement is qualified by reference to the full text of the Wood Employment Agreement, a copy of which is attached as Exhibit 10.2 to this Current Report on Form 8-K, and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | |

Exhibit No. | | Description |

10.1 | | Amended and Restated Employment Agreement, dated as of December 11, 2023, by and between Alimera Sciences, Inc. and Richard S. Eiswirth, Jr. |

10.2 | | Employment Agreement, dated as of December 11, 2023, by and between Alimera Sciences, Inc. and Todd Wood |

10.3 | | Inducement Stock Option Agreement, dated as of December 11, 2023, by and between Alimera Sciences, Inc. and Todd Wood (Non-Plan Inducement Award) |

99.1 | | Press Release, dated as of December 12, 2023 |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | |

| ALIMERA SCIENCES, INC. |

| | |

Date: December 12, 2023 | By: | |

| Name: | Russell L. Skibsted |

| Title: | Chief Financial Officer and Senior Vice President |

AMENDED AND RESTATED

EMPLOYMENT AGREEMENT WITH

ALIMERA SCIENCES, INC.

This Amended and Restated Employment Agreement (this “Agreement”) is entered into between Alimera Sciences, Inc., a Delaware corporation (the “Company”), and Richard S. Eiswirth, Jr. (“Executive”), as of December 11, 2023 (the “Effective Date”).

RECITALS:

WHEREAS, the Company is engaged in the business of developing, marketing and selling ophthalmic pharmaceuticals in the United States and throughout the world;

WHEREAS, Company and Executive desire that Executive continue to provide the Company employment services upon the terms and conditions set forth below;

WHEREAS, Executive is serving as the Company as President and Chief Executive Officer pursuant to that certain Amended and Restated Agreement, dated as of January 2, 2019 (the “Prior Agreement”); and

WHEREAS, the Company desires now to continue to retain Executive as President and Chief Executive Officer pursuant to the terms of this Agreement and to implement a competitive compensation and benefit package for Executive commensurate with his role.

NOW, THEREFORE, in consideration of the promises and mutual covenants contained herein, the parties, intending to be legally bound, agree as follows:

AGREEMENT:

|

SECTION 1

EFFECTIVE DATE; TERMINATION OF PRIOR AGREEMENT |

Subject to the terms and conditions set forth in this Agreement, the Company agrees to continue to employ Executive as President and Chief Executive Officer, and Executive agrees to such employment by the Company as of the Effective Date. In connection therewith, upon execution by Executive of this Agreement, the Prior Agreement is terminated in its entirety.

“2023 Plan” means the Alimera Sciences, Inc. 2023 Equity Incentive Plan, as amended and/or restated from time to time.

“Board” means the Board of Directors of the Company.

“Cause” means:

(1)Executive’s gross negligence or willful misconduct with respect to the business and affairs of the Company, including violation of any material policy or rule of the Company that is not cured within 30 days after written notice thereof is given to Executive by the Company;

(2)Executive’s conviction of, or entering a guilty plea or plea of no contest with respect to, a felony or to, a crime involving moral turpitude, deceit, dishonesty or fraud that is likely to inflict or has caused harm to the Company or any affiliate of the Company;

(3)Executive engaging in any material breach of the terms of this Agreement or any agreement between Executive and the Company or failing to fulfill Executive’s duties and responsibilities under this Agreement or assigned or delegated to Executive and such breach or failure, as the case may be, is not cured, or is not capable of being cured, within 30 days after written notice thereof is given to Executive by the Company;

(4)Executive engaging in any intentional act of dishonesty, deceit, fraud, moral turpitude, misconduct, breach of trust or acts intentionally against the financial or business interests of the Company by Executive, or Executive’s use or possession of illegal drugs in the workplace; or

(5) Executive’s failure to cooperate in good faith with a governmental or internal investigation of the Company or its directors, officers or employees, if the Company has requested Executive’s cooperation.

For purposes of this definition of Cause, no act, or failure to act, will be deemed “willful” or “intentional” if done or omitted to be done by Executive in good faith with a reasonable belief that Executive’s act, or failure to act, was in the best interest of the Company.

“Change in Control” means (i) the consummation of a merger or consolidation of the Company with or into another entity or any other corporate reorganization, if persons who were not stockholders of the Company immediately prior to such merger, consolidation or other reorganization own immediately after such merger, consolidation or other reorganization 50% or more of the voting power of the outstanding securities of each of (A) the continuing or surviving entity and (B) any direct or indirect parent corporation of such continuing or surviving entity or (ii) the sale, transfer or other disposition of all or substantially all of the Company’s assets. A transaction shall not constitute a Change in Control if its sole purpose is to change the state of the Company’s incorporation or to create a holding company that will be owned in substantially the same proportions by the persons who held the Company’s securities immediately before such transaction. Notwithstanding the foregoing, a Change in Control shall not be deemed to occur unless such transaction also qualifies as a “change in control event” as described in Treas. Reg. § 1.409A-3(i)(5).

“Code” means the United States Internal Revenue Code of 1986, as currently and hereafter amended.

“Compensation Committee” means the compensation committee of the Board.

“Competing Business” means any business which develops, sells or markets ophthalmic pharmaceuticals.

“Disability” means a condition which renders Executive unable to engage in any substantial gainful activity as required to regularly perform Executive’s duties hereunder by reason of any medically determinable physical or mental impairment which can be expected to

result in death or to last for a continuous period of not less than six consecutive months with or without reasonable accommodation.

“Earned Bonus” means the bonus, determined based on the actual performance of the Company for the full fiscal year in which Executive’s employment terminates, that Executive would have earned for the year in which his employment terminates had he remained employed for the entire year, prorated based on the ratio of the number of days during such year that Executive was employed to 365. Such Earned Bonus will be determined and paid to Executive no later than 2½ months after the close of the fiscal year in which the Earned Bonus was earned.

“Equity” means (i) all Stock, including restricted stock; (ii) all options and other rights to purchase Stock; (iii) all restricted stock units, performance units or phantom shares whose value is measured by the value of Stock; (iv) all stock appreciation rights whose value is measured by increases in the value of Stock; and (v) any other award under an ISP.

“Good Reason” shall mean, for purposes of Section 4(e), (i) a material diminution of Executive’s authority, duties or responsibilities; (ii) a geographic relocation of the Company’s headquarters, or Executive’s primary business location, to a location that is more than 35 miles from the present location of the Company’s corporate headquarters or Executive’s primary business location, as the case may be; or (iii) any breach by the Company of this Agreement that is material and that is not cured within 30 days after written notice thereof to the Company from Executive.

“Good Reason” shall mean, for purposes of Section 5, that Executive resigns within 12 months after one of the following conditions has come into existence without his consent: (i) a reduction in Executive’s base salary from the amount set forth in Section 4(a) or target bonus opportunity set forth in Section 4(b); (ii) a material adverse change in Executive’s authority, responsibilities or duties; (iii) a geographical relocation of the Company’s corporate headquarters, or Executive’s primary business location, to a location that is more than 35 miles from the present location of the Company’s corporate headquarters or Executive’s primary business location, as the case may be; or (iv) any breach by the Company of this Agreement that is material and that is not cured, or is not capable of being cured, within 30 days after written notice thereof to the Company and the Board from Executive. A condition shall not be considered “Good Reason” unless Executive gives the Company written notice of such condition within 90 days after such condition comes into existence and the Company fails to remedy such condition within 30 days after receiving Executive’s written notice.

“ISP” means the Alimera Sciences, Inc. 2004 Incentive Stock Plan, the Alimera Sciences, Inc. 2005 Incentive Stock Plan, the Alimera Sciences, Inc. 2010 Equity Incentive Stock Plan, the Alimera Sciences, Inc. 2019 Omnibus Incentive Plan, the 2023 Plan and any new equity incentive plan adopted by the Company, in each case as amended from time to time.

“Restricted Period” means the 12-month period beginning on and after Executive’s employment with the Company is terminated pursuant to the terms of this Agreement.

“Separation” means a “separation from service,” as defined in the regulations under Section 409A of the Code.

“Stock” means shares of the Company’s common stock.

|

SECTION 3

TITLE, POWERS AND RESPONSIBILITIES |

|

(a)

Title. Executive shall be President and Chief Executive Officer. |

|

(b)

Powers and Responsibilities. |

|

(1)

Executive in fulfilling Executive’s responsibilities shall have such powers as are normally and customarily associated with a President and Chief Executive Officer in a company of similar size and operating in a similar industry, including the power to hire and fire employees and executives of the Company reporting to Executive and such other powers as are authorized by the Board. |

|

(2)

Executive, as a condition to Executive’s employment under this Agreement; represents and warrants that Executive can assume and fulfill the responsibilities described in Section 3(b)(1) without any risk of violating any non-compete or other restrictive covenant or other agreement to which Executive is a party. |

|

(c)

Reporting Relationship. Executive shall report to the Board. |

|

(d)

Full Time Basis. Executive (1) shall undertake to perform all Executive’s responsibilities and exercise all Executive’s powers in good faith and on a full-time basis, (2) shall not engage in any other employment, consulting or other business activity that would create a conflict of interest with the Company, (3) shall not assist any person or entity in competing with the Company or in preparing to compete with the Company and (4) shall materially comply with the Company’s policies and rules, as they may be in effect from time to time. |

|

(e)

No Conflicting Obligations. Executive represents and warrants to the Company that Executive is under no obligations or commitments, whether contractual or otherwise, that are inconsistent with his obligations under this Agreement provided that the Company acknowledges that Executive may serve on the board of directors or as an advisor for up to two for-profit companies, in addition to the Company’s Board. Executive agrees to attend in person no more than four meetings per year per company and any remaining meetings, if attended, will not require travel. Executive represents and warrants that Executive will not use or disclose, in connection with Executive’s employment with the Company, any trade secrets or other proprietary information or intellectual property in which Executive or any other person has any right, title or interest and that Executive’s employment with the Company will not infringe or violate the rights of any other person.. |

|

SECTION 4

COMPENSATION, BENEFITS, ETC. |

|

(a)

Annual Base Salary. Executive’s base salary shall be $603,200 per year, which amount may be reviewed and adjusted from time to time at the discretion of the Board or the Compensation Committee. Executive’s base salary shall be payable in accordance with the Company’s standard payroll practices and policies for executives and shall be subject to such withholdings as are required by law or as are otherwise permissible under such practices or policies. |

|

(b)

Annual Bonus. The Company shall pay an annual bonus for a fiscal year to Executive no later than 2½ months after the close of such fiscal year, in the amount, and subject to the terms and conditions of the Company’s Management Cash Incentive Program (or any predecessor or successor cash incentive plan thereto), which may be reviewed at the discretion of the Board or the Compensation Committee. For the fiscal year 2023, Executive’s target bonus shall be $369,460. The determinations of the Board or the Compensation Committee with respect to such bonus shall be final and binding; provided, however, that following fiscal 2023, Executive’s target annual bonus amount shall not be reduced to an amount below 65% of Executive’s then-current base salary. |

|

(c)

Employee Benefit Plans. Executive shall be eligible to participate, on terms no less favorable to Executive than the terms for participation of any other executive of the Company at the same level within the Company as Executive, in the employee benefit plans, programs and policies maintained by the Company subject to the terms and conditions to participate in such plans, programs and policies as in effect from time to time. During the term of this Agreement, the Company shall maintain disability insurance for the benefit of Executive with substantially the same benefits and conditions as provided to Executive prior to the Effective Date; provided, however, in no event, shall the Company be obligated to pay an annual aggregate premium under such policies in excess of 3X the annual aggregate premium paid by the Company for such policies as of immediately prior to the Effective Date. |

|

(d)

Equity Awards. Executive shall receive Equity awards at the discretion of the Board, subject to the terms and conditions set forth in the applicable ISP and any corresponding notice, agreement or certificate under the ISP. |

|

(e)

Acceleration of Vesting of Equity. The following terms shall apply to all of Executive’s Equity outstanding as of the Effective Date, and to all future grants of Equity, subject to Executive’s execution and non-revocation of the Release provided for in Section 5(a): |

|

(1)

The vested percentage of Executive’s Equity awards subject to time-based vesting shall be determined by adding 12 months to the actual period of service that Executive has completed with the Company if Executive’s employment with the Company is terminated by the Company without Cause or Executive terminates Executive’s employment for Good Reason (i.e., Executive’s vesting shall be accelerated by an additional 12 months). |

|

(2)

Executive shall vest in 100% of Executive’s remaining unvested Equity awards subject to time-based vesting if (i) the Company is subject to a Change in Control and (i) within 3 months prior to a Change in Control, on a Change in Control or in 18 months after the Change in Control, Executive’s employment with the Company is terminated by the Company (or its successor) without Cause or Executive terminates Executive’s employment for Good Reason. |

|

(3)

If the Company is subject to a Change in Control prior to Executive’s termination of employment with the Company, then Executive shall vest in 100% of Executive’s unvested Equity awards subject to performance-based vesting. |

|

(4)

If the Company is a party to a merger or consolidation, all Executive’s outstanding Equity shall vest in full unless the agreement evidencing the merger or consolidation provides for one or more of the following: |

|

(A)

The continuation of such outstanding Equity by the Company (if the Company is the surviving corporation). |

|

(B)

The assumption of such outstanding Equity by the surviving corporation or its parent. |

|

(C)

The substitution by the surviving corporation or its parent of new Equity for such outstanding Equity. |

|

(D)

Full exercisability of outstanding Equity and full vesting of the Stock subject to such Equity, followed by the cancellation of such Equity. The full exercisability of such Equity and full vesting of such Stock, as applicable, may be contingent on the closing of such merger or consolidation. |

|

(E)

The cancellation of outstanding Equity and a payment to Executive equal to the excess of (i) the fair market value of the Stock subject to such Equity (whether or not such Equity is then exercisable or vested, as applicable) as of the closing date of such merger or consolidation over (ii) the exercise price. Such payment shall be made in the form of cash, cash equivalents or securities of the surviving corporation or its parent with a fair market value equal to the required amount. Such payment may be made in installments and may be deferred until the date or dates when such Equity would have become exercisable or such Stock would have vested. Such payment may be subject to vesting based on Executive’s continuing service, provided that the vesting schedule shall not be less favorable to Executive than the schedule under which such Equity would have become exercisable or such Stock would have vested. This provision is mandatory in the event that the Company is acquired by a private company for cash. |

|

(5)

Executive shall vest in 100% of the remaining unvested Equity awards in the event of Disability where a Separation occurs or death. |

|

(6)

In the event that Executive’s employment is terminated, other than by the Company (or its successor) with Cause or by Executive other than for Good Reason, each outstanding option or other outstanding rights to purchase Stock will remain exercisable for the lesser of (a) 3 years following the termination of the Executive’s employment and (b) the then remaining term of the option or other right. |

|

(f)

Rights to Time Off Work. Executive shall be eligible for paid time off in accordance with the Company paid time off policies, as in effect from time to time. |

|

(g)

Expense Reimbursements. Executive shall have the right to expense reimbursements in accordance with the Company’s standard policy on expense reimbursements, as in effect from time to time. Any reimbursement shall (1) be paid promptly but not later than the last day of the calendar year following the year in which the expense was incurred, (2) not be affected by any other expenses that are eligible for reimbursement in any calendar year and (3) not be subject to liquidation or exchange for another benefit. |

|

(h)

Indemnification. The Company shall, to the maximum extent permitted by applicable law and the Company’s governing documents, indemnify Executive and hold Executive harmless from and against any claim, loss or cause of action arising from or out of Executive’s performance as an officer, director, manager or employee of the Company or in any other capacity in which Executive serves at the request of the Board. If any claim is asserted hereunder against Executive, the Company shall pay Executive’s legal expenses (or cause such expenses to be paid) on a quarterly basis, provided that Executive shall reimburse the Company, in a timely manner, for such amounts if Executive shall be found by a final, non-appealable order of a court of competent jurisdiction not to be entitled to indemnification. The indemnification obligations of the Company in this paragraph shall survive any termination of this Agreement and shall be supplemental to any other rights to indemnification from the Company to which Executive is entitled. |

|

(i)

Directors and Officers Liability Insurance. The Company shall maintain directors’ and officers’ liability insurance coverage covering Executive in amounts customary for similarly situated companies in the pharmaceutical industry and with insurers reasonably acceptable to Executive. All policies for such coverage shall provide for insurance on an “occurrence” basis, or if on a “claims-made” basis, with sufficient coverage for claims made after the date on which Executive’s employment with the Company terminates. |

|

(j)

At-Will Employment. Executive’s employment with the Company shall be “at will,” meaning that either Executive or the Company shall be entitled to terminate Executive’s employment at any time and for any or no reason, with or without Cause or Good Reason. Any contrary representations that may have been made to Executive shall be superseded by this Agreement. This Agreement shall constitute the full and complete agreement between Executive and the Company on the “at will” nature of Executive’s employment, which may only be changed in an express written agreement signed by Executive and a duly authorized officer of the Company (other than Executive). |

|

SECTION 5

TERMINATION OF EMPLOYMENT |

|

(a)

General. If the Board terminates Executive’s employment without Cause or Executive resigns for Good Reason and a Separation occurs, then Executive will be entitled to the benefits described in Section 4(e) and this Section 5. However, Executive will not be entitled to any of the benefits described in Section 4(e) or this Section 5 unless Executive has (i) returned all Company property in Executive’s possession, (ii) resigned as a member of the Board (if requested by a majority of the members of the Board then in office) and of the boards of directors of all of the Company’s subsidiaries, to the extent applicable, and (iii) executed a general release of all claims that Executive may have against the Company or persons affiliated with the Company in a form prescribed by the Company (the “Release”), with applicable carve outs for rights to

|

indemnification, enforcement of this Release and to vested Equity. Executive must execute and return the Release on or before the date specified by the Company in the Release (the “Release Deadline”). The Release Deadline will in no event be later than fifty (50) days after Executive’s Separation. If Executive fails to return the executed Release on or before the Release Deadline, or if Executive revokes the Release within seven (7) days after return of the executed Release, then Executive will not be entitled to the benefits described in this Section 5. |

|

(b)

Termination by Board without Cause or by Executive for Good Reason Not in Connection with Change in Control. If the Board terminates Executive’s employment without Cause or Executive resigns for Good Reason and a Separation occurs either more than three months prior to a Change in Control or more than 18 months after a Change in Control, the Company shall pay Executive his earned but unpaid base salary plus 100% of the sum of (i) Executive’s current total annual base salary plus (ii) Executive’s target annual bonus for the then current year (subject to such withholdings as required by law) payable in twelve equal monthly installments (the “Non-Change in Control Severance Payments”). In addition, Executive shall be paid, no later than 2½ months following the close of the fiscal year of termination, Executive’s Earned Bonus for the fiscal year in which the Separation occurs. The Non-Change in Control Severance Payments shall commence within 60 days after Executive’s Separation and, once they commence, shall include any unpaid amounts accrued from the date of Separation. However, if such 60-day period spans two calendar years, then the payments will in any event begin in the second calendar year. In addition, the Company shall make any continuation coverage premium payments (for Executive and Executive’s dependents) for continued health insurance coverage under the Consolidated Omnibus Budget Reconciliation Act (“COBRA”) for the one-year period following the Separation or, if earlier, until Executive is eligible to be covered under another substantially equivalent medical insurance plan by a subsequent employer. Notwithstanding the foregoing, if the Company, in its sole discretion, determines that it cannot provide the foregoing subsidy of COBRA coverage without potentially violating or causing the Company to incur additional expense as a result of noncompliance with applicable law (including Section 2716 of the Public Health Service Act), the Company instead shall provide to Executive a taxable monthly payment in an amount equal to the monthly COBRA premium that Executive would be required to pay to continue the group health coverage in effect on the date of the Separation (which amount shall be based on the premium for the first month of COBRA coverage), which payments (i) shall be made regardless of whether Executive elects COBRA continuation coverage, (ii) shall commence on the later of (A) the first day of the month following the month in which Executive experiences a Separation and (B) the effective date of the Company’s determination of violation of applicable law, and (iii) shall end on the earliest of (x) the effective date on which Executive becomes covered by a medical, dental or vision insurance plan of a subsequent employer, and (y) the last day of the period one year after Separation. Executive shall have no right to an additional gross-up payment to account for the fact that such COBRA premium amounts are paid on an after-tax basis. |

|

(c)

Termination by Board without Cause or by Executive for Good Reason in Connection with Change in Control. If the Board terminates Executive’s employment without Cause or Executive resigns for Good Reason and a Separation occurs either within three months prior to a Change in Control or within 18 months after a Change in Control, the Company shall pay Executive his earned but unpaid base salary plus 150% of the sum of (i) Executive’s current total annual base salary plus (ii) Executive’s target annual bonus for the then current year (subject

|

to such withholdings as required by law) payable in eighteen equal monthly installments (the “Change in Control Severance Payments”). In addition, Executive shall be paid, no later than 2½ months following the close of the fiscal year of termination, Executive’s Earned Bonus for the fiscal year in which the Separation occurs. The Change in Control Severance Payments shall commence within 60 days after Executive’s Separation. However, if such 60-day period spans two calendar years, then the payments will in any event begin in the second calendar year. In addition, the Company shall make any continuation coverage premium payments (for Executive and Executive’s dependents) for continued health insurance coverage under the COBRA for the 18-month period following the Separation or, if earlier, until Executive is eligible to be covered under another substantially equivalent medical insurance plan by a subsequent employer. Notwithstanding the foregoing, if the Company, in its sole discretion, determines that it cannot provide the foregoing subsidy of COBRA coverage without potentially violating or causing the Company to incur additional expense as a result of noncompliance with applicable law (including Section 2716 of the Public Health Service Act), the Company instead shall provide to Executive a taxable monthly payment in an amount equal to the monthly COBRA premium that Executive would be required to pay to continue the group health coverage in effect on the date of the Separation (which amount shall be based on the premium for the first month of COBRA coverage), which payments (i) shall be made regardless of whether Executive elects COBRA continuation coverage, (ii) shall commence on the later of (A) the first day of the month following the month in which Executive experiences a Separation and (B) the effective date of the Company’s determination of violation of applicable law, and (iii) shall end on the earliest of (x) the effective date on which Executive becomes covered by a medical, dental or vision insurance plan of a subsequent employer, and (y) the last day of the period 18 months after Separation. Executive shall have no right to an additional gross-up payment to account for the fact that such COBRA premium amounts are paid on an after-tax basis. |

|

(d)

Termination by the Board for Cause or by Executive without Good Reason. If the Board terminates Executive’s employment for Cause or Executive resigns without Good Reason, the Company’s only obligation to Executive under this Agreement shall be to pay Executive his earned but unpaid base salary, if any, up to the date Executive’s employment terminates, and Executive shall have no right to any Earned Bonus or any unpaid bonus payment whatsoever. The Company shall only be obligated to reimburse any unreimbursed business expenses and to make such payments and provide such benefits under any employee benefit plan, program or policy in which Executive was a participant as are explicitly required to be paid to Executive by the terms of any such benefit plan, program or policy following the date on which Executive’s employment terminates. |

|

(e)

Termination for Disability. The Board shall have the right to terminate Executive’s employment on or after the date Executive has a Disability, and such a termination shall not be treated as a termination without Cause under this Agreement. If Executive’s employment is terminated on account of a Disability and a Separation occurs, the Company shall: |

|

(1)

pay Executive Executive’s base salary through the end of the month in which a Separation occurs as soon as practicable after the Separation, |

|

(2)

pay Executive Executive’s Earned Bonus for the fiscal year in which such Separation occurs; provided that the Earned Bonus shall in no event be paid later than 2½ months after the close of such fiscal year, |

|

(3)

pay or cause the payment of benefits to which Executive is entitled under the terms of the disability plan(s) of the Company covering Executive at the time of such Disability, |

|

(4)

make such payments and provide such benefits as otherwise called for under the terms of the ISP and each other employee benefit plan, program and policy in which Executive was a participant; provided that no payments made under Section 5(e)(l), Section 5(e)(2) or Section 5(e)(3) shall be taken into account in computing any payments or benefits described in this Section 5(e)(4), and |

|

(5)

make any COBRA continuation coverage premium payments (for Executive and for Executive’s dependents), for the 18-month period following the termination of Executive’s employment or, if earlier, until Executive is eligible to be covered under another substantially equivalent medical insurance plan by a subsequent employer. Notwithstanding the foregoing, if the Company, in its sole discretion, determines that it cannot provide the foregoing subsidy of COBRA coverage without potentially violating or causing the Company to incur additional expense as a result of noncompliance with applicable law (including Section 2716 of the Public Health Service Act), the Company instead shall provide to Executive a taxable monthly payment in an amount equal to the monthly COBRA premium that Executive would be required to pay to continue the group health coverage in effect on the date of the Separation (which amount shall be based on the premium for the first month of COBRA coverage), which payments shall be made regardless of whether Executive elects COBRA continuation coverage, shall commence on the later of (i) the first day of the month following the month in which Executive experiences a Separation and (ii) the effective date of the Company’s determination of violation of applicable law, and shall end on the earliest of (x) the effective date on which Executive becomes covered by a medical, dental or vision insurance plan of a subsequent employer, and (y) the last day of the period 18 months after Separation. Executive shall have no right to an additional gross-up payment to account for the fact that such COBRA premium amounts are paid on an after-tax basis. |

|

(f)

Death. If Executive’s employment terminates because of his death, the Company shall: |

|

(1)

pay to Executive’s estate Executive’s base salary through the end of the month of his death as soon as practicable after his death, |

|

(2)

pay to Executive’s estate Executive’s Earned Bonus, when actually determined, for the year in which Executive’s death occurs, |

|

(3)

make such payments and provide such benefits as otherwise called for under the terms of the ISP and each other employee benefit plan, program and policy in which Executive was a participant; provided that no payments made under Section 5(f)(1) or

|

Section 5(f)(2) shall be taken into account in computing any payments or benefits described in this Section 5(f)(3), and |

|

(4)

make any COBRA continuation coverage premium payments for Executive’s dependents for the one-year period following Executive’s death or, if earlier, until such dependents are eligible to be covered under another substantially equivalent medical insurance plan. Notwithstanding the foregoing, if the Company, in its sole discretion, determines that it cannot provide the foregoing subsidy of COBRA coverage without potentially violating or causing the Company to incur additional expense as a result of noncompliance with applicable law (including Section 2716 of the Public Health Service Act), the Company instead shall provide a taxable monthly payment in an amount equal to the monthly COBRA premium that Executive’s dependents would be required to pay to continue the group health coverage in effect on the date of Executive’s death (which amount shall be based on the premium for the first month of COBRA coverage), which payments shall be made regardless of whether Executive’s dependents elect COBRA continuation coverage, shall commence on the later of (i) the first day of the month following the month in which Executive dies and (ii) the effective date of the Company’s determination of violation of applicable law, and shall end on the earliest of (x) the effective date on which Executive’s dependents become covered under another substantially equivalent medical insurance plan, and (y) the last day of the period one year after Executive’s death. Executive’s dependents shall have no right to an additional gross-up payment to account for the fact that such COBRA premium amounts are paid on an after-tax basis. |

|

SECTION 6

COVENANTS BY EXECUTIVE |

|

(a)

Company Property. Upon the termination of Executive’s employment for any reason, or upon any earlier Company request, Executive shall promptly return all Company Property that had been entrusted or made available to Executive by the Company, where the term “Property” means all Company-related records, files, memoranda, reports, price lists, customer lists, drawings, plans, sketches, keys, codes, computer hardware and software and other property of any kind or description prepared, used or possessed by Executive during Executive’s employment by the Company (and any duplicates of any such Property), together with any and all information, ideas, concepts, discoveries, and inventions and the like conceived, made, developed or acquired at any time by Executive individually or with others during Executive’s employment that relate to the Company or its products or services. |

|

(b)

Trade Secrets. Executive agrees that Executive shall hold in a fiduciary capacity in perpetuity for the sole benefit of the Company and its affiliates and shall not directly or indirectly use or disclose any Trade Secret that Executive may have acquired (whether or not developed or compiled by Executive and whether or not Executive is authorized to have access to such information) during the term of Executive’s employment by the Company or any of its predecessors for so long as such information remains a Trade Secret, where the term “Trade Secret” means information, including technical or non-technical data, a formula, a pattern, a compilation, a program, a device, a method, a technique, a drawing or a process that (1) derives economic value, actual or potential, from not being generally known to, and not being generally readily ascertainable by proper means by, other persons who can obtain economic value from its

|

disclosure or use and (2) is the subject of reasonable efforts by the Company and any of its affiliates to maintain its secrecy. This Section 6(b) is intended to provide rights to the Company and its affiliates which are in addition to, not in lieu of, those rights the Company and its affiliates have under the common law or applicable statutes for the protection of trade secrets. |

|

(c)

Confidential Information. Executive while employed by the Company or its affiliates and for the three-year period thereafter shall hold in a fiduciary capacity for the sole benefit of the Company and its affiliates, and shall not directly or indirectly use or disclose, any Confidential Information that Executive may have acquired (whether or not developed or compiled by Executive and whether or not Executive is authorized to have access to such information) during the term of and in the course of or as a result of Executive’s employment by the Company or its predecessors without the prior written consent of the Board unless and except to the extent that such disclosure is (i) made in the ordinary course of Executive’s performance of his duties under this Agreement or (ii) required by any subpoena or other legal process (in which event Executive will give the Company prompt notice of such subpoena or other legal process in order to permit the Company to seek appropriate protective orders). For the purposes of this Agreement, the term “Confidential Information” means any secret, confidential, or proprietary information possessed by the Company or any of its affiliates, including trade secrets, customer or supplier lists, details of client or consultant contracts, current and anticipated customer requirements, pricing policies, price lists, market studies, business plans, operational methods, marketing plans or strategies, product flaws or development techniques, computer software programs (including object code and source code), data and documentation data, base technologies, systems, structures and architectures, inventions and ideas, past current and planned research and development, compilations, devices, methods, techniques, processes, financial information and data, business acquisition plans, and new personnel acquisition plans (not otherwise included as a Trade Secret under this Agreement) that has not become generally available to the public, and the term “Confidential Information” may include future business plans, licensing strategies, advertising campaigns, information regarding customers or suppliers, executives and independent contractors and the terms and conditions of this Agreement. Notwithstanding the provisions of this Section 6(c) to the contrary, Executive shall be permitted to furnish this Agreement to a subsequent employer or prospective employer. |

|

(d)

Non-solicitation of Customers or Employees. |

|

(1)

Executive (i) while employed by the Company or any of its affiliates shall not, on Executive’s own behalf or on behalf of any person, firm, partnership, association, corporation or business organization, entity or enterprise (other than the Company or one of its affiliates), solicit business for a Competing Business from customers or suppliers of the Company or any of its affiliates and (ii) during the Restricted Period shall not, on Executive’s own behalf or on behalf of any person, firm, partnership, association, corporation or business organization, entity or enterprise, solicit business for a Competing Business from customers or suppliers of the Company or any of its affiliates with whom Executive, in the case of both clauses (i) and (ii) above, had or made material business contact with in the course of Executive’s employment by the Company within the 24-month period immediately preceding the beginning of the Restricted Period. |

|

(2)

Executive (i) while employed by the Company or any of its affiliates shall not, either directly or indirectly, call on, solicit or attempt to induce any other officer, employee or independent contractor of the Company or any of its affiliates to terminate his or her employment with such business and shall not assist any other person or entity in such a solicitation (regardless of whether any such officer, employee or independent contractor would commit a breach of contract by terminating his or her employment), and (ii) during the Restricted Period, shall not, either directly or indirectly, call on, solicit or attempt to induce any other officer, employee or independent contractor of such business with whom Executive had contact, knowledge of, or association in the course of Executive’s employment with the Company or any of its predecessors or affiliates, as the case may be, during the 12-month period immediately preceding the beginning of the Restricted Period, to terminate his or her employment with the Company or any of its affiliates and shall not assist any other person or entity in such a solicitation (regardless of whether any such officer, employee or independent contractor would commit a breach of contract by terminating his or her employment). Notwithstanding the foregoing, nothing shall prohibit any person from contacting Executive about employment or other engagement during the Restricted Period, provided that Executive does not solicit the contact. |

|

(e)

Non-competition Obligation. Without the prior written consent of the Company, Executive, while employed by the Company or any of its affiliates and thereafter until the end of the Restricted Period, will not engage in any of the activities described in Section 3(b)(l) hereof within the geographical area in which the Company or any of its affiliates is actively engaged in developing, marketing and selling ophthalmic pharmaceuticals, for himself or on behalf of any other person, partnership, corporation or other business entity that is a Competing Business for the purpose of competing with the Company. Notwithstanding the preceding sentence, Executive will not be prohibited from owning less than 5% percent of any publicly traded corporation, whether or not such corporation is in a Competing Business. |

|

(f)

Reasonable and Continuing Obligations. Executive agrees that Executive’s obligations under this Section 6 are obligations which will continue beyond the date Executive’s employment terminates and that such obligations are reasonable, fair and equitable in scope, terms and duration, are necessary to protect the Company’s legitimate business interests, and are a material inducement to the Company to enter into this Agreement. |

|

(g)

Remedy for Breach. Executive agrees that the remedies at law of the Company for any actual or threatened breach by Executive of the covenants in this Section 6 would be inadequate and that the Company shall be entitled to specific performance of the covenants in this Section 6, including entry of a temporary restraining order in state or federal court, preliminary and permanent injunctive relief against activities in violation of this Section 6, or both, or other appropriate judicial remedy, writ or order, in addition to any damages and legal expenses which the Company may be legally entitled to recover. The Company agrees, however, to give Executive and, if known, Executive’s attorney reasonable advance notice of any legal proceeding, including any application for a temporary restraining order, relating to an attempt to enforce the covenants in this Section 6 against Executive. Executive acknowledges and agrees that the covenants in this Section 6 shall be construed as agreements independent of any other provision of this Agreement or any other agreement between the Company and Executive, and that the existence of any claim

|

or cause of action by Executive against the Company, whether predicated upon this Agreement or any other agreement, shall not constitute a defense to the enforcement by the Company of such covenants. |

|

(h)

Termination of Restrictive Covenants. In addition to any other right or remedy available to Executive, Executive shall no longer be bound by any of the restrictions set forth in this Section 6 if the Company fails to pay or to provide Executive when due the amounts and benefits due hereunder or under any agreement ancillary hereto, and Executive’s pursuit of such remedy shall not relieve the Company from its obligations to pay and to provide such amounts and benefits to Executive. |

|

(i)

Ownership of Inventions, Discoveries, Improvements, Etc. |

|

(1)

Executive shall promptly disclose and describe to the Company all inventions, improvements, discoveries and technical developments, whether or not patentable, made or conceived by Executive, either alone or with others, during such time as Executive is employed with the Company, and within one year after the date upon such employment terminates, that (i) are based in whole or in part upon Confidential Information or (ii) during such time as Executive is employed with the Company are along the lines of, useful in or related to the business of the Company or (iii) result from or are suggested by any work done by Executive for or on behalf of the Company (“Inventions”). Executive hereby assigns and agrees to assign to the Company Executive’s entire right, title and interest in and to such Inventions (the “Assigned Inventions”), and agrees to cooperate with the Company both during and after such time as Executive is employed with the Company in the procurement and maintenance, at the Company’s expense and at its direction, of patents and copyright registrations and/or other protection of the Company’s rights in such Inventions. Executive shall keep and maintain adequate and current written records of all such Inventions, which shall be and remain the property of the Company. |

|

(2)

If a patent application, trademark registration or copyright registration is filed by Executive or on Executive’s behalf, or a copyright notice indicating Executive’s authorship is used by Executive or on Executive’s behalf, within one year after the date on which Executive’s employment with the Company terminates, that describes or identifies any Invention within the scope of Executive’s work for the Company or that otherwise related to a portion of the Company’s business (or any division thereof) of which Executive had knowledge such time as Executive was employed with the Company, it is to be conclusively presumed that the Invention was conceived by Executive during the such time as Executive was employed with the Company. Executive agrees to notify the Company promptly of any such application or registration and to assign to the Company Executive’s entire right, title and interest in such Invention and in such application or registration. |

|

(3)

If (i) Executive uses or discloses any of Executive’s own or any third party’s confidential information or intellectual property (collectively, “Restricted Materials”) when acting within the scope of Executive’s employment (or otherwise on behalf of the Company) or (ii) any Assigned Invention cannot be fully made, used, reproduced or otherwise exploited without using or violating any Restricted Materials, Executive hereby grants and agrees to grant to the Company a perpetual, irrevocable, worldwide, royalty-

|

free, non-exclusive, sublicensable right and license to exploit and exercise all such Restricted Materials and intellectual property rights therein. Executive will not use or disclose any Restricted Materials for which Executive is not fully authorized to grant the foregoing license. |

|

(4)

To the extent allowed by applicable law, the terms of this Section 6(i) include all rights of paternity, integrity, disclosure and withdrawal and any other rights that may be known as or referred to as moral rights, artist’s rights, droit moral or the like (collectively, “Moral Rights”). To the extent Executive retains any such Moral Rights under applicable law, Executive hereby ratifies and consents to any action that may be taken by or authorized by the Company with respect to such Moral Rights and agrees not to assert any Moral Rights with respect thereto. Executive will confirm any such ratification, consent or agreement from time to time as requested by the Company. |

|

(a)

Notices. Notices and all other communications shall be in writing and shall be deemed to have been duly given when personally delivered or when mailed by United States registered or certified mail. Notices to the Company shall be sent to: |

Alimera Sciences, Inc.

Attention: Chief Financial Officer

6310 Town Square, Suite 400

Alpharetta, Georgia 30005

Notices and communications to Executive shall be sent to the address Executive most recently provided to the Company.

|

(b)

No Waiver. Except for the notice described in Section 7(a), no failure by either the Company or Executive at any time to give notice of any breach by the other of, or to require compliance with, any condition or provision of this Agreement shall be deemed a waiver of any provisions or conditions of this Agreement. |

|

(1)

All payments made under this Agreement shall be subject to reduction to reflect taxes or other charges required to be withheld by law. The Company intends that all payments and benefits provided under this Agreement or otherwise are exempt from, or comply with, with the requirements of Section 409A of the Code (“Section 409A”) so that none of the payments or benefits will be subject to the additional tax imposed under Section 409A, and any ambiguities herein will be interpreted in accordance with such intent. Specifically, to the extent necessary to avoid the imposition of tax on Executive under Section 409A, payments payable upon a termination or separation shall be suspended until the first business day following (i) six (6) months from effective date of termination or separation or (ii) the date of Executive’s death, if, immediately prior to Executive’s termination or separation, Executive is a “specified employee” (within the meaning of Code Section 409A(a)(2)(B)(i)) and Section 409A would require the delay of such payment to avoid any penalties thereunder and any installments that otherwise would have

|

been paid or provided prior to such date will be paid or provided in a lump sum when the severance payments or benefits commence. Each payment hereunder shall be deemed a separate payment for purposes of Section 409A. The parties intend that no payment pursuant to this Agreement shall give rise to any adverse tax consequences to either party pursuant to Section 409A; provided, however, that Executive acknowledges that the Company does not guarantee any particular tax treatment and that Executive is solely responsible for any taxes Executive incurs pursuant to Section 409A, if any, as a result of this Agreement. The Company shall not have a duty to design its compensation policies in a manner that minimizes Executive’s tax liabilities, and Executive agrees not to make any claim against the Company or the Board related to tax liabilities arising from Executive’s compensation. |

|

(2)

If any payment or benefit that Executive would receive in connection with an acquisition of ownership or effective control of the Company or ownership of a substantial portion of the Company’s assets (within the meaning of section 280G of the Code and the regulations thereunder) (the “Payment”) would (i) constitute a “parachute payment” within the meaning of Section 280G of the Code, and (ii) but for this sentence, be subject to the excise tax imposed by Section 4999 of the Code (the “Excise Tax”), then such Payment shall be equal to the Reduced Amount. The “Reduced Amount” shall be either (x) the largest portion of the Payment that would result in no portion of the Payment being subject to the Excise Tax, or (y) the largest portion, up to and including the total, of the Payment, whichever amount, after taking into account all applicable federal, state and local employment taxes, income taxes, and the Excise Tax (all computed at the highest applicable marginal rate), results in Executive’s receipt of the greatest economic benefit notwithstanding that all or some portion of the Payment may be subject to the Excise Tax. If a reduction in payments or benefits constituting “parachute payments” is necessary so that the Payment equals the Reduced Amount, any reduction shall be applied first, on a pro rata basis, to amounts that constitute deferred compensation within the meaning of Section 409A of the Code, and, in the event that the reductions pursuant to this Section 7(c)(2) exceed payments that are subject to Section 409A of the Code, the remaining reductions shall be applied, on a pro rata basis, to any other remaining payments, first with respect to amounts payable in cash before being made in respect to any payments to be provided in the form of benefits or Equity award acceleration, and in the form of benefits before being made with respect to Equity award acceleration. The Company’s determinations hereunder shall be final, binding and conclusive on all interested parties. |

|

(3)

Georgia Law. This Agreement shall be governed by the laws of the state of Georgia without regard to its provisions regarding choice of law or conflicts of law. Any litigation that may be brought by either the Company or Executive involving the enforcement of this Agreement or any rights, duties, or obligations under this Agreement, shall be brought exclusively in a Georgia state court or United States District Court in Georgia. |

|

(4)

Assignment. This Agreement shall be binding upon and inure to the benefit of the Company and any successor in interest to the Company. The Company may assign

|

this Agreement to any affiliate or successor that acquires all or substantially all of the assets and business of the Company or a majority of the voting interests of the Company, and no such assignment shall be treated as a termination of Executive’s employment under this Agreement. Executive’s rights and obligations under this Agreement are personal and shall not be assigned or transferred. |

|

(5)

Other Agreements. This Agreement replaces and merges any and all previous agreements and understandings regarding all the terms and conditions of Executive’s employment relationship with the Company, including the Prior Agreement, and this Agreement constitutes the entire agreement between the Company and Executive with respect to such terms and conditions. |

|

(6)

Amendment. No amendment to this Agreement shall be effective unless it is in writing and signed by an authorized officer of the Company (other than Executive) and Executive. |

|

(7)

Invalidity. If any part of this Agreement becomes or is deemed invalid or otherwise unenforceable by a court of competent jurisdiction, the remaining part shall be unaffected and shall continue in full force and effect, and the invalid or otherwise unenforceable part shall be deemed not to be part of this Agreement. |

|

(8)

Litigation. If either party to this Agreement institutes litigation against the other party to enforce his or its respective rights under this Agreement, each party shall pay its own costs and expenses incurred in connection with such litigation. |

|

(9)

Interpretation. The recitals to this Agreement shall be taken into account in the construction or interpretation of this Agreement. The words “include,” “includes” and “including” are deemed to be followed by the phrase “without limitation.” The captions or headings of the Sections and other subdivisions of this Agreement are inserted only as a matter of convenience or reference and have no effect on the meaning of the provisions of those Sections or subdivisions. If the provisions of this Agreement require judicial interpretation, the parties agree that the judicial body interpreting or construing the Agreement may not apply the assumption that the terms must be more strictly construed against one party by reason of the rule of construction that an instrument is to be construed more strictly against the party that itself or through its agents prepared the instrument. |

|

(10)

Survival. The respective indemnities, representations, warranties, agreements and covenants of the Company and Executive contained in this Agreement shall survive the termination of this Agreement and shall remain in full force and effect. |

|

(11)

Counterparts. This Agreement may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. |

[The remainder of this page intentionally left blank]

IN WITNESS WHEREOF, the Company and Executive have executed this Agreement in multiple originals as of the Effective Date.

ALIMERA SCIENCES, INC. EXECUTIVE

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Adam Morgan

|

|

By:

|

/s/ Richard S. Eiswirth, Jr.

|

|

|

Adam Morgan,

Chairman of the Board

|

|

|

Richard S. Eiswirth, Jr.

|

|

|

|

|

|

|

|

Date:

|

December 11, 2023

|

|

Date:

|

December 11, 2023

|

|

|

|

|

|

|

Signature Page to Amended and Restated Agreement between

Richard S. Eiswirth, Jr. and Alimera Sciences, Inc.

EMPLOYMENT AGREEMENT WITH

ALIMERA SCIENCES, INC.

This Employment Agreement (this “Agreement”) is entered into between Alimera Sciences, Inc., a Delaware corporation (the “Company”), and Todd Wood (“Executive”), as of December 11, 2023.

RECITALS:

WHEREAS, the Company is engaged in the business of developing, marketing and selling ophthalmic pharmaceuticals in the United States and throughout the world; and

WHEREAS, the Company and Executive desire that Executive provide employment services to the Company upon the terms and conditions set forth below; and

WHEREAS, the Company desires now to retain Executive as its President, U.S. Operations, effective as of December 11, 2023 (the “Effective Date”), pursuant to the terms and conditions of this Agreement, and to implement a competitive compensation and benefit package for Executive commensurate with his role, as provided herein.

NOW, THEREFORE, in consideration of the promises and mutual covenants contained herein, the parties, intending to be legally bound, agree as follows:

AGREEMENT:

Subject to the terms and conditions set forth in this Agreement, the Company agrees to employ Executive as President, U.S. Operations, and Executive agrees to such employment by the Company effective as of the Effective Date.

“2023 Plan” means the Alimera Sciences, Inc. 2023 Equity Incentive Plan, as amended and/or restated from time to time.

“Board” means the Board of Directors of the Company.

“Bonus” means the bonus, determined based on the actual performance of the Company for the full fiscal year in which Executive’s employment terminates, that Executive would have earned for the year in which his employment terminates had he remained employed for the entire year, prorated based on the ratio of the number of days during such year that Executive was employed to 365. Subject to the conditions set forth in Section 5(a), such Bonus will be determined and paid to Executive no later than 2½ months after the close of the fiscal year in which Executive’s employment terminates.

“Cause” means:

(1)Executive’s gross negligence or willful misconduct with respect to the business and affairs of the Company, including violation of any material policy or rule of the Company that is not cured within 30 days after written notice thereof is given to Executive by the Company;

(2)Executive’s conviction of, or entering a guilty plea or plea of no contest with respect to a felony or to a crime involving moral turpitude, deceit, dishonesty or fraud;

(3)Executive’s material breach of the terms of this Agreement or any agreement between Executive and the Company of material violation of any of the Company’s written employment policies;

(4) Executive’s failure to fulfill Executive’s duties and responsibilities under this Agreement, or such other duties and responsibilities as may be assigned or delegated to Executive, and such breach or failure, as the case may be, if capable of being cured, is not cured within 30 days after written notice thereof is given to Executive by the Company;

(5)Executive’s engaging in any intentional act of dishonesty, deceit, fraud, moral turpitude, misconduct, breach of trust or acting intentionally against the financial or business interests of the Company, or Executive’s use or possession of illegal drugs in the workplace; or

(6) Executive’s failure to cooperate in good faith with a governmental or internal investigation of the Company or its directors, officers or employees, if the Company has requested Executive’s cooperation.

For purposes of this definition of Cause, no act, or failure to act, will be deemed “willful” or “intentional” if done or omitted to be done by Executive in good faith with a reasonable belief that Executive’s act, or failure to act, was in the best interest of the Company.