UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023

Commission File Number: 001-40010

Pharvaris N.V.

(Translation of registrant’s name into English)

Emmy Noetherweg 2

2333 BK Leiden

The Netherlands

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

PHARVARIS N.V.

On December 6, 2023, Pharvaris N.V. (the “Company”) entered into an underwriting agreement (the “Underwriting Agreement”) with Morgan Stanley & Co. LLC and Leerink Partners LLC, as underwriters (the “Underwriters”), pursuant to which the Company agreed to issue and sell (i) 11,125,000 ordinary shares, par value €0.12 per share (the “Shares”) and (ii) pre-funded warrants (the “Pre-Funded Warrants”) to purchase up to 1,375,000 ordinary shares in an underwritten offering (the “Offering”). The Offering closed on December 8, 2023.

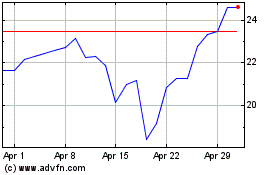

The Shares were sold in the Offering at the public offering price of $24.00 per share. The Pre-Funded Warrants were sold at a public offering price of $23.99 per Pre-Funded Warrant, which represents the per share public offering price for the common stock less the $0.01 per share exercise price for each such Pre-Funded Warrant. Each Pre-Funded Warrant is exercisable as of December 8, 2023 until fully exercised, subject to an ownership limitation relating to the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, as set forth in the form of Pre-Funded Warrant.

The Offering was made pursuant to the Company’s effective registration statement on Form S-3 (Registration No. 333-263198), which was previously filed with the Securities and Exchange Commission under the Securities Act of 1933, as amended (the “Securities Act”), and declared effective on March 10, 2022.

The net proceeds from the Offering, after deducting the underwriting discounts and commissions, are expected to be approximately $282 million. The Company currently intends to use the net proceeds from the offering primarily to fund research and development and product discovery expenses for its clinical and preclinical research and development activities and for working capital and general corporate purposes.

Pursuant to the Underwriting Agreement, the Company’s executive officers and directors entered into agreements in substantially the form included as an exhibit to the Underwriting Agreement, providing for a 90-day “lock-up” period with respect to sales of the Company’s ordinary shares, subject to certain exceptions.

The foregoing is a summary description of the Underwriting Agreement and is qualified in its entirety by the text of the Underwriting Agreement filed as Exhibit 1.1 to this Current Report on Form 6-K and incorporated herein by reference.

The Company intends to grant the investor purchasing Pre-Funded Warrants customary registration rights, including demand registration rights, with respect to the ordinary shares issuable upon exercise of the Pre-Funded Warrants.

The form of Pre-Funded Warrant is filed as Exhibit 4.1 to this report and the foregoing description of the terms of the Pre-Funded Warrants is qualified in its entirety by reference to such exhibit.

A copy of the opinion of NautaDutilh N.V. relating to the validity of the Shares issued in the Offering is filed herewith as Exhibit 5.1. A copy of the opinion of Kirkland & Ellis LLP relating to the validity of the Pre-Funded Warrants issued in the Offering is filed herewith as Exhibit 5.2.

The Company hereby incorporates by reference the information contained in the body of this Report on Form 6-K into the Company’s Registration Statement on Form F-3 (File No. 333-263198), the Company’s Registration Statement on Form F-3 (File No. 333-273757) and the Company’s Registration Statement on Form S-8 (File No. 333-252897). This report on Form 6-K (including the exhibits filed herewith) is incorporated by reference into the Company’s Registration Statement on Form F-3 (File No. 333-263198).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

PHARVARIS N.V. |

|

|

Date: December 8, 2023 |

By: |

/s/ Berndt Modig |

|

Name: |

Berndt Modig |

|

Title: |

Chief Executive Officer |

EXHIB INDEX

Exhibit 1.1

11,125,000 Shares

Pre-Funded Warrants to Purchase 1,375,000 Shares PHARVARIS N.V.

ORDINARY SHARES (NOMINAL VALUE €0.12 PER SHARE)

UNDERWRITING AGREEMENT

December 6, 2023

1

December 6, 2023

Morgan Stanley & Co. LLC Leerink Partners LLC

c/o Morgan Stanley & Co. LLC 1585 Broadway

New York, New York 10036

c/o Leerink Partners LLC

1301 Avenue of the Americas, 12th Floor New York, New York 10019

Ladies and Gentlemen:

Pharvaris N.V., a public company with limited liability (naamloze vennootschap) incorporated and existing under the laws of the Netherlands, with its registered seat in Leiden, the Netherlands, registered under number 64239411, with ordinary shares of €0.12 par value per share (the “Company”), proposes to issue and sell to the several underwriters named in Schedule I hereto (the “Underwriters”) (i) 11,125,000 ordinary shares with a nominal value of €0.12 per share in the capital of the Company (the “Shares”) and (ii) pre- funded warrants to purchase up to 1,375,000 ordinary shares in a form to be mutually agreed upon by the Company and the Underwriters (the “Warrants”). The ordinary shares with a nominal value of €0.12 per share in the capital of the Company to be outstanding after giving effect to the issuance and sales contemplated hereby are hereinafter referred to as the “Ordinary Shares.” The Shares and the Warrants are herein referred to as the “Securities.” The Shares issuable upon exercise of the Warrants are herein referred to as the “Warrant Shares.”

The Company has filed with the Securities and Exchange Commission (the “Commission”) a registration statement on Form F-3 (File No. 333-263198), including a prospectus, relating to the securities (the “Shelf Securities”), including the Securities, to be issued from time to time by the Company. Such registration statement, as amended to the date of this Agreement, including the information (if any) deemed to be part of the registration statement at the time of effectiveness pursuant to Rule 430B under the Securities Act of 1933, as amended (the “Securities Act”), is hereinafter referred to as the “Registration Statement.” The base prospectus filed as part of the Registration Statement and covering the Shelf Securities dated March 15, 2022 in the form first used to confirm sales of the Securities (or in the form first made available to the Underwriters by the Company to meet requests of purchasers pursuant to Rule 173 under the Securities Act), is hereinafter referred to as the “Pricing Prospectus.” The form of the final prospectus relating to the Securities filed with the Commission pursuant to Rule 424(b) under the Securities Act is hereinafter called the “Prospectus.”

1

For purposes of this underwriting agreement (the “Agreement”) “free writing prospectus” has the meaning set forth in Rule 405 under the Securities Act; “Time of Sale Prospectus” means the Pricing Prospectus together with the free writing prospectuses, if any, each identified in Schedule II hereto and the pricing information set forth in Schedule II hereto; and “broadly available road show” means a “bona fide electronic road show” as defined in Rule 433(h)(5) under the Securities Act that has been made available without restriction to any person. As used herein, the terms Registration Statement, Pricing Prospectus, Time of Sale Prospectus and Prospectus shall include the documents, if any, incorporated by reference therein as of the date hereof. The terms “supplement,” “amendment” and “amend” as used herein with respect to (a) the Pricing Prospectus, the Time of Sale Prospectus, or the Prospectus shall include any post-effective amendment to the Registration Statement, any prospectus supplement relating to the Securities filed with the Commission pursuant to Rule 424(b) under the Securities Act and all documents subsequently filed by the Company with the Commission pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are deemed to be incorporated by reference therein, in each case after the date of the Pricing Prospectus or the Prospectus, as the case may be and (b) the Registration Statement shall be deemed to refer to and include any annual report of the Company filed pursuant to Section 13(a) or 15(d) of the Exchange Act after the effective date of the Registration Statement that is incorporated by reference in the Registration Statement.

1.Representations and Warranties. The Company represents and warrants to and agrees with each of the Underwriters that:

(a)The Registration Statement has become effective; no stop order suspending the effectiveness of the Registration Statement is in effect, and no proceedings for such purpose or pursuant to Section 8A under the Securities Act are pending before or, the Company’s knowledge, threatened by the Commission.

(b)(i) Each document, if any, filed or to be filed pursuant to the Exchange Act and incorporated by reference in the Time of Sale Prospectus or the Prospectus complied or will comply when so filed in all material respects with the Exchange Act and the applicable rules and regulations of the Commission thereunder, (ii) the Registration Statement, when it became effective, did not contain and, as amended or supplemented, if applicable, will not contain, as of the date of such amendment or supplement, any untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary to make the statements therein not misleading, (iii) the Registration Statement and the Prospectus comply and, as amended or supplemented, if applicable, will comply, as of the date of such amendment or supplement, in all material respects with the Securities Act and the applicable rules and regulations of the Commission thereunder, (iv) the Time of Sale Prospectus does not, and at the time of each sale of the Securities in connection with the offering when the Prospectus is not yet available to prospective purchasers and at the Closing Date (as defined in Section 4), the Time of Sale Prospectus, as then amended or supplemented by the Company, if applicable, will not, contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements therein, in the light of

2

the circumstances under which they were made, not misleading, (v) each broadly available road show, if any, when considered together with the Time of Sale Prospectus, does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements therein, in the light of the circumstances under which they were made, not misleading and (vi) the Prospectus, as of its date, does not contain and, as amended or supplemented, if applicable, will not contain, as of the date of such amendment or supplement, any untrue statement of a material fact or omit to state a material fact necessary to make the statements therein, in the light of the circumstances under which they were made, not misleading, except that the representations and warranties set forth in this paragraph do not apply to statements or omissions in the Registration Statement, the Time of Sale Prospectus or the Prospectus based upon information relating to any Underwriter furnished to the Company in writing by such Underwriter expressly for use therein.

(c)(i) At the earliest time after the filing of the Registration Statement that the Company or another offering participant made a bona fide offer (within the meaning of Rule 164(h)(2) under the Securities Act) of the Securities and (ii) as of the date hereof, the Company is not an “ineligible issuer” in connection with the offering pursuant to Rules 164, 405 and 433 under the Securities Act. Any free writing prospectus that the Company is required to file pursuant to Rule 433(d) under the Securities Act has been, or will be, filed with the Commission in accordance with the requirements of the Securities Act and the applicable rules and regulations of the Commission thereunder. Each free writing prospectus that the Company has filed, or is required to file, pursuant to Rule 433(d) under the Securities Act or that was prepared by or on behalf of or used or referred to by the Company complies or will comply in all material respects with the requirements of the Securities Act and the applicable rules and regulations of the Commission thereunder. Except for the free writing prospectuses, if any, identified in Schedule II hereto, and electronic road shows, if any, each furnished to the Underwriters before first use, the Company has not prepared, used or referred to, and will not, without the Underwriters’ prior consent, prepare, use or refer to, any free writing prospectus.

(d)The Company has been duly incorporated as a private company with limited liability (besloten vennootschap met beperkte aansprakelijkheid) and is currently validly existing as a public company with limited liability (naamloze vennootschap) under the laws of the Netherlands, has the corporate power and authority to own or lease its property and to conduct its business as described in each of the Registration Statement, the Time of Sale Prospectus and the Prospectus and is duly qualified to transact business in each jurisdiction in which the conduct of its business or its ownership or leasing of property requires such qualification, except to the extent that the failure to be so qualified would not, singly or in the aggregate, have a material adverse effect on the Company and its subsidiaries, taken as a whole.

(e)Each subsidiary of the Company has been duly incorporated, organized or formed, is validly existing as a corporation or other business entity in good

3

standing (to the extent the concept of good standing is applicable in such jurisdiction) under the laws of the jurisdiction of its incorporation, organization or formation, as applicable, has the corporate or other business entity power and authority to own or lease its property and to conduct its business as described in each of the Registration Statement, the Time of Sale Prospectus and the Prospectus and is duly qualified to transact business and is in good standing (to the extent the concept of good standing is applicable in such jurisdiction) in each jurisdiction in which the conduct of its business or its ownership or leasing of property requires such qualification, except to the extent that the failure to be so qualified or be in good standing (to the extent the concept of good standing is applicable in such jurisdiction) would not, singly or in the aggregate, have a material adverse effect on the Company and its subsidiaries, taken as a whole; all of the issued shares of capital stock or other equity interests of each subsidiary of the Company have been duly and validly authorized and issued, are fully paid and non-assessable (to the extent such concepts are applicable under relevant law) and are owned directly or indirectly by the Company, free and clear of all liens, encumbrances, equities or claims.

4

(f)This Agreement has been duly authorized, executed and delivered by the Company.

(g)The authorized, issued and outstanding share capital of the Company conforms in all material respects as to legal matters to the description thereof contained in each of the Registration Statement, the Time of Sale Prospectus and the Prospectus.

(h)The ordinary shares in the capital of the Company outstanding immediately prior to the issuance of the Securities have been duly authorized and are validly issued, fully paid and non-assessable (meaning that the holders of the ordinary shares will not, by reason of merely being such a holder, be subject to assessment or calls by the Company or its creditors for further payment on such ordinary shares).

(i)The Shares have been duly authorized and, when issued, delivered and paid for in accordance with the terms of this Agreement, will be validly issued, fully paid and non-assessable (meaning that the holders of the ordinary shares will not, by reason of merely being such a holder, be subject to assessment or calls by the Company or its creditors for further payment on such ordinary shares), and any preemptive or similar rights with respect to the issuance of the Securities are validly excluded.

(j)The execution and delivery by the Company of, and the performance by the Company of its obligations under, this Agreement and the Warrants will not contravene any provision of (i) applicable law or any judgment, order or decree of any governmental body, agency or court having jurisdiction over the Company or

5

any subsidiary, (ii) the articles of association or by-laws or analogous governing instruments, as applicable) of the Company or (iii) any agreement or other instrument binding upon the Company or any of its subsidiaries that is material to the Company and its subsidiaries, taken as a whole, except in the cases (i) and (iii) for such contraventions that would not, individually or in the aggregate, have a material adverse effect on the Company and its subsidiaries, taken as a whole. No consent, approval, authorization or order of, or qualification with, any governmental body, agency or court is required for the performance by the Company of its obligations under this Agreement, except such as has previously been obtained and such as may be required by the securities or Blue Sky laws of the various states or the rules and regulations of the Financial Industry Regulatory Authority (“FINRA”) in connection with the offer and sale of the Securities.

(k)There has not occurred any material adverse change, or any development involving a prospective material adverse change, in the condition, financial or otherwise, or in the earnings, business or operations of the Company and its subsidiaries, taken as a whole, from that set forth in the Time of Sale Prospectus.

(l)There are no legal or governmental proceedings pending or, to the Company’s knowledge, threatened to which the Company or any of its subsidiaries is a party or to which any of the properties of the Company or any of its subsidiaries is subject (i) other than proceedings accurately described in all material respects in each of the Registration Statement, the Time of Sale Prospectus and the Prospectus and proceedings that would not, singly or in the aggregate, have a material adverse effect on the Company and its subsidiaries, taken as a whole, or a material adverse effect on the power or ability of the Company to perform its obligations under this Agreement or to consummate the transactions contemplated by each of the Registration Statement, the Time of Sale Prospectus and the Prospectus or (ii) that are required to be described in the Registration Statement, the Time of Sale Prospectus or the Prospectus and are not so described in all material respects; and there are no statutes, regulations, contracts or other documents to which the Company or any of its subsidiaries is subject or by which the Company or any of its subsidiaries is bound that are required to be described in the Registration Statement, the Time of Sale Prospectus or the Prospectus or to be filed as exhibits to the Registration Statement that are not described in all material respects or filed as required.

(m)[Intentionally omitted].

(n)The Company is not, and after giving effect to the offering and sale of the Securities and the application of the proceeds thereof as described in each of the Registration Statement, the Time of Sale Prospectus and the Prospectus will not be, required to register as an “investment company” as such term is defined in the Investment Company Act of 1940, as amended.

(o)Except as would not singly or in the aggregate have a material adverse effect on the Company and its subsidiaries, taken as a whole, (i) the Company and

6

each of its subsidiaries (w) are in compliance with any and all applicable foreign, federal, state and local laws and rules, regulations, requirements, decisions, orders, decrees, consents and other legally enforceable requirements relating to the protection of the environment, hazardous or toxic substances, wastes, pollutants, chemicals, or contaminants (“Hazardous Materials”) or human health and safety (collectively, “Environmental Laws”),

7

(x) have received all permits, licenses or other approvals required of them under applicable Environmental Laws to conduct their respective businesses, (y) are in compliance with all terms and conditions of any such permit, license or approval, and (z) have not received notice of any actual or potential violation, liability or obligation, and there are no pending or to the Company’s knowledge, threatened complaint, action, suit, proceeding investigation or claim, under or relating to Environmental Laws, and(ii) there are no costs, obligations or liabilities associated with or arising under Environmental Laws of or relating to the Company or its subsidiaries.

(p)There are no costs or liabilities associated with Environmental Laws (including, without limitation, any capital or operating expenditures required for clean-up, closure of properties or compliance with Environmental Laws or any permit, license or approval, any related constraints on operating activities and any potential liabilities to third parties) which would, singly or in the aggregate, reasonably be expected to have a material adverse effect on the Company and its subsidiaries, taken as a whole.

(q)Except as described in each of the Registration Statement, the Prospectus or the Time of Sale Prospectus, there are no contracts, agreements or understandings between the Company and any person granting such person the right to require the Company to file a registration statement under the Securities Act with respect to any securities of the Company or to require the Company to include such securities with the Shares registered pursuant to the Registration Statement.

(r)(i) None of the Company or any of its subsidiaries or controlled affiliates, or any director, officer, or employee thereof, or, to the Company’s knowledge, any agent or representative of the Company or of any of its subsidiaries or controlled affiliates, has taken or will take any action in furtherance of an offer, payment, promise to pay, or authorization or approval of the payment, giving or receipt of money, property, gifts or anything else of value, directly or indirectly, to any government official (including any officer or employee of a government or government-owned or controlled entity or of a public international organization, or any person acting in an official capacity for or on behalf of any of the foregoing, or any political party or party official or candidate for political office) (“Government Official”) in order to influence official action, or to any person in violation of any applicable anti-corruption laws; (ii) the Company and each of its subsidiaries and controlled affiliates have conducted their businesses in compliance with applicable

8

anti-corruption laws and have instituted and maintained and will continue to maintain policies and procedures reasonably designed to promote and achieve compliance with such laws and with the representations and warranties contained herein; and (iii) neither the Company nor any of its subsidiaries will use, directly or indirectly, the proceeds of the offering in furtherance of an offer, payment, promise to pay, or authorization of the payment or giving of money, or anything else of value, to any person in violation of any applicable anti-corruption laws.

(s)The operations of the Company and each of its subsidiaries are and have been conducted at all times in material compliance with all applicable financial recordkeeping and reporting requirements, including those of the Bank Secrecy Act, as amended by Title III of the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (USA PATRIOT Act), and the applicable anti-money laundering statutes of jurisdictions where the Company and each of its subsidiaries conduct business, the rules and regulations thereunder and any related or similar rules, regulations or guidelines, issued, administered or enforced by any governmental agency (collectively, the “Anti-Money Laundering Laws”), and no action, suit or proceeding by or before any court or governmental agency, authority or body or any arbitrator involving the Company or any of its subsidiaries with respect to the Anti-Money Laundering Laws is pending or, to the knowledge of the Company, threatened.

(t)(i) None of the Company, any of its subsidiaries, or any director, officer, or employee thereof, or, to the Company’s knowledge, any agent, affiliate or representative of the Company or any of its subsidiaries, is an individual or entity (“Person”) that is, or is owned or controlled by one or more Persons that are:

(A)the subject of any sanctions administered or enforced by the U.S. Department of the Treasury’s Office of Foreign Assets Control, the United Nations Security Council, the European Union, His Majesty’s Treasury, or other relevant sanctions authority (collectively, “Sanctions”), or

(B)located, organized or resident in a country or territory that is the subject of Sanctions (including, without limitation, the so-called Donetsk People's Republic, the so-called Luhansk People's Republic, Crimea, Cuba, Iran, North Korea and Syria).

(ii)The Company will not, directly or indirectly, use the proceeds of the offering, or lend, contribute or otherwise make available such proceeds to any subsidiary, joint venture partner or other Person:

(A)to fund or facilitate any activities or business of or with any Person or in any country or territory that, at the time of such funding or facilitation, is the subject of Sanctions; or

9

(B)in any other manner that will result in a violation of Sanctions by any Person (including any Person participating in the offering, whether as underwriter, advisor, investor or otherwise).

10

(iii)The Company and each of its subsidiaries have not knowingly engaged in, are not now knowingly engaged in, and will not knowingly engage in, any dealings or transactions with any Person, or in any country or territory, that at the time of the dealing or transaction is or was the subject of Sanctions.

(iv)Any provision of this Section 1(t) shall not apply if and to the extent it is unenforceable as a result of any applicable provision of Council Regulation (EC) No 2271/1996 of 22 November 1996, as amended, recast and/or restated from time to time, (or any law or regulation implementing such Regulation in an EEA member state) or any similar blocking or anti-boycott law, regulation or statute in force from time to time, and, in such case, the enforceability of this Section 1(t) shall not otherwise be affected.

(u)Subsequent to the respective dates as of which information is given in each of the Registration Statement, the Time of Sale Prospectus and the Prospectus, (i) the Company and its subsidiaries, taken as a whole, have not incurred any material liability or obligation, direct or contingent, nor entered into any material transaction; (ii) the Company has not purchased any of its outstanding share capital, nor declared, paid or otherwise made any dividend or distribution of any kind on its share capital other than ordinary and customary dividends; and (iii) there has not been any material change in the share capital, short-term debt or long-term debt of the Company and its subsidiaries, taken as a whole, other than in connection with the exercise or forfeiture of equity awards outstanding on such respective dates as of which information is given in each of the Registration Statement, the Time of Sale Prospectus and the Prospectus.

(v)The Company and each of its subsidiaries have good and marketable title to all real property and good and marketable title to all personal property owned by them which is material to the business of the Company and its subsidiaries, taken as a whole, in each case free and clear of all liens, encumbrances and defects except such as do not have a material adverse effect on the Company and its subsidiaries taken as a whole and except for the bank accounts of the Company to which standard bank conditions apply; and any real property and buildings held under lease by the Company and its subsidiaries are held by them under valid, subsisting and enforceable leases, except as would not have a material adverse effect on the Company and its subsidiaries taken as a whole.

(w)(i) Except as would not have a material adverse effect on the Company and its subsidiaries taken as a whole, the Company and its subsidiaries solely and exclusively own or have a valid, enforceable and exclusive license to all

11

patents, inventions, copyrights, know how (including trade secrets and other unpatented and/or unpatentable proprietary or confidential information or procedures), trademarks, service marks, trade names and all other intellectual property and similar proprietary rights (including all registrations and applications for registration of, and all goodwill associated with, any of the foregoing, as applicable) (collectively, “Intellectual Property Rights”) required for the conduct of their businesses as presently conducted or as currently anticipated to be conducted; (ii) except as would not have a material adverse effect on the Company and its subsidiaries taken as a whole, the Intellectual Property Rights owned by the Company or any of its subsidiaries and, to the Company’s knowledge, the Intellectual Property Rights licensed to the Company or any of its subsidiaries, are valid, subsisting and enforceable, and there is no pending or, to the Company’s knowledge, threatened action, suit, proceeding or claim by others challenging the validity, scope or enforceability of any such Intellectual Property Rights; (iii) neither the Company nor any of its subsidiaries has received any written notice alleging any infringement, misappropriation or other violation of Intellectual Property Rights by the Company or any of its subsidiaries which, singly or in the aggregate, if the subject of an unfavorable decision, ruling or finding, would have a material adverse effect on the Company and its subsidiaries, taken as a whole;

(iv) except as would not have a material adverse effect on the Company and its subsidiaries taken as a whole, to the Company’s knowledge, no third party is infringing, misappropriating or otherwise violating, or has infringed, misappropriated or otherwise violated, any Intellectual Property Rights owned or controlled by the Company or any of its subsidiaries; (v) to the Company’s knowledge, neither the Company nor any of its subsidiaries infringes, misappropriates or otherwise violates, or has infringed, misappropriated or otherwise violated, any valid Intellectual Property Rights of any third party; (vi) all employees or contractors engaged in the development of Intellectual Property Rights on behalf of the Company or any subsidiary of the Company have executed an invention assignment agreement whereby such employees or contractors presently assign all of their right, title and interest in and to such Intellectual Property Rights to the Company or any of its subsidiaries, and to the Company’s knowledge no such agreement has been breached or violated; and (vii) the Company and its subsidiaries use, and have used, commercially reasonable efforts to appropriately maintain all information intended to be maintained as a trade secret.

(x)Any statistical and market-related data included in the Registration Statement, the Time of Sale Prospectus or the Prospectus are based on or derived from sources that the Company believes, after reasonable inquiry, to be reliable and accurate in all material respects and, to the extent required, the Company has obtained the written consent to the use of such data from such sources.

(y)Except as would not have a material adverse effect on the Company and its subsidiaries, taken as a whole, (i) to the Company’s knowledge, the Company and each of its subsidiaries have complied and are presently in compliance with all internal and external privacy policies, contractual obligations,

12

industry standards, applicable laws, statutes, judgments, orders, rules and regulations of any court or arbitrator or other governmental or regulatory authority and any other legal obligations, in each case, relating to the collection, use, transfer, import, export, storage, protection, disposal and disclosure by the Company or any of its subsidiaries of personal, personally identifiable, household, sensitive, confidential or regulated data (“Data Security Obligations”, and such data, “Data”); (ii) neither the Company nor any of its subsidiaries has received any notification of or complaint regarding, or is otherwise aware of any other facts that, individually or in the aggregate, would reasonably indicate non-compliance with any Data Security Obligation; and (iii) there is no action, suit, or proceeding by or before any court or governmental agency, authority or body pending or, to the Company’s knowledge, threatened against the Company or any of its subsidiaries alleging non-compliance with any Data Security Obligation.

(z)To the Company’s knowledge, the Company’s and its subsidiaries’ information technology assets and equipment, computers, systems, networks, hardware, software, internet websites, applications and data and databases (including those maintained on behalf of the Company and its subsidiaries by third party vendors) (collectively, “IT Systems”) are adequate for, and operate and perform in all material respects as required in all material respects in connection with, the operation of the business of the Company and its subsidiaries, as it is currently conducted, free and clear of all material bugs, errors, defects, Trojan horses, time bombs, malware and other corruptants. The Company and each of its subsidiaries have taken all commercially reasonable technical and organizational measures reasonably necessary to protect the IT Systems and Data used in connection with the operation of the Company’s and its subsidiaries’ businesses. Without limiting the foregoing, the Company and its subsidiaries have used reasonable efforts to establish and maintain, and have established, maintained, implemented and complied with, reasonable information technology, information security, cyber security, data protection and business continuity/disaster recovery controls, policies and procedures, that are designed to protect against and prevent breach, destruction, loss, unauthorized distribution, use, access, disablement, misappropriation or modification, or other compromise or misuse of or relating to any IT Systems or Data used in connection with the operation of the Company’s and its subsidiaries’ businesses and any other data security incident or data breach as defined by Data Security Obligations (“Breach”). To the Company’s knowledge, there has been no such Breach, and the Company and its subsidiaries have not been notified in writing of and have no knowledge of any event or condition that would reasonably be expected to result in, any such Breach.

(aa) No material labor dispute with the employees of the Company or any of its subsidiaries exists, or, to the knowledge of the Company, is imminent; and the Company is not aware of any existing, threatened or imminent labor disturbance by the employees of any of its principal suppliers, manufacturers or contractors that could, singly or in the aggregate, have a material adverse effect on the Company and its subsidiaries, taken as a whole.

13

(bb) The Company and each of its subsidiaries are insured by insurers of recognized financial responsibility against such losses and risks and in such amounts as the Company believes are prudent and customary in the businesses in which they are engaged, except where the failure to be insured would not, individually or in the aggregate, have a material adverse effect on the Company and its subsidiaries, taken as a whole; neither the Company nor any of its subsidiaries has been refused any insurance coverage sought or applied for; and neither the Company nor any of its subsidiaries has any reason to believe that it will not be able to renew its existing insurance coverage as and when such coverage expires or to obtain similar coverage from similar insurers as may be necessary to continue its business at a cost that would not, singly or in the aggregate, have a material adverse effect on the Company and its subsidiaries, taken as a whole.

(cc) Except as would not have a material adverse effect on the Company and its subsidiaries, taken as a whole, the Company and each of its subsidiaries possess all certificates, authorizations and permits issued by the appropriate federal, state or foreign regulatory authorities necessary to conduct their respective businesses as currently conducted. Neither the Company nor any of its subsidiaries has received any written notice of proceedings relating to the revocation or modification of any such certificate, authorization or permit which, singly or in the aggregate, if the subject of an unfavorable decision, ruling or finding, would have a material adverse effect on the Company and its subsidiaries, taken as a whole.

(dd) The Warrants have been duly authorized and, when executed and delivered by the Company in accordance with this Agreement, will be valid and legally binding agreements of the Company, enforceable against the Company in accordance with their terms except as the enforcement thereof maybe limited by applicable bankruptcy, insolvency, reorganization, moratorium or other similar laws relating to or affecting the rights and remedies of creditors or by general equitable principles. The Warrant Shares to be issued by the Company upon exercise of the Warrants in accordance therewith have been duly authorized and will be reserved for issuance upon exercise of the Warrants in a number sufficient to meet the current exercise requirements. The Warrant Shares, when issued and delivered upon exercise of the Warrants in accordance therewith, will be validly issued, fully paid and non-assessable (meaning that the holders of the ordinary shares will not, by reason of merely being such a holder, be subject to assessment or calls by the Company or its creditors for further payment on such ordinary shares), and the issuance of the Warrant Shares is not subject to any preemptive or similar rights not otherwise validly waived or satisfied.

(ee) The Company and its subsidiaries have operated at all times and are currently in compliance in all material respects with all applicable Health Care Laws (as defined herein), including all statutes, rules, regulations and policies administered by the U.S. Food and Drug Administration (the “FDA”) and comparable foreign regulatory authorities, including the European Medicines Agency and the UK Medicines & Healthcare products Regulatory Agency (collectively, the “Regulatory Authorities”) and all other local, state, federal,

14

national, supranational and foreign laws, relating to the regulation of the Company or its subsidiaries and the ownership, testing, development, manufacture, packaging, processing, use, distribution, marketing, labeling, promotion, sale, offer for sale, storage, import, export or disposal of any product under development, manufactured or distributed by the Company (“Health Care Laws”).

(ff) Except as would not have a material adverse effect on the Company and its subsidiaries, taken as a whole, (i) the studies, tests and preclinical and clinical trials conducted by or on behalf of or sponsored by the Company or its subsidiaries or in which the Company or its subsidiaries have participated, that are described in the Registration Statement, the Time of Sale Prospectus and the Prospectus, or the results of which are referred to in the Registration Statement, the Time of Sale Prospectus and the Prospectus, as applicable, were, and if still pending are, being conducted in accordance with standard medical and experimental protocols, procedures and controls pursuant to accepted professional scientific research standards and procedures, and all applicable Health Care Laws, the rules and regulations of the Regulatory Authorities and applicable good clinical practices and good laboratory practices; (ii) the descriptions of the results of such studies and trials contained in the Registration Statement, the Time of Sale Prospectus or the Prospectus are accurate and complete in all material respects and fairly present the data derived from such trials and studies; (iii) the Company has no knowledge of any other studies or trials not described in the Registration Statement, the Time of Sale Prospectus and the Prospectus, the results of which are inconsistent with or call into question the results described or referred to in the Registration Statement, the Time of Sale Prospectus and the Prospectus; (iv) the Company has provided the Underwriters with all substantive written notices and correspondence provided to the Company or its subsidiaries from the Regulatory Authorities; and (v) neither the Company nor any of its subsidiaries have received any written notices, correspondence or other communications from the Regulatory Authorities requiring or threatening the termination, modification or suspension of any pre- clinical studies or clinical trials that are described in the Registration Statement, the Time of Sale Prospectus and the Prospectus or the results of which are referred to in the Registration Statement, the Time of Sale Prospectus and the Prospectus, other than ordinary course communications with respect to modifications in connection with the design and implementation of such studies or trials, and, to the Company’s knowledge, there are no reasonable grounds for the same.

(gg) (i) Neither the Company nor any of its subsidiaries have received written notice of any claim, action, suit, proceeding, hearing, enforcement, investigation, arbitration or other action from any court or arbitrator or Regulatory Authority, other governmental entity or third party alleging that any Company or product operation or activity is in violation of any Health Care Laws, including, without limitation, any FDA Form 483, notice of adverse finding, warning letter, untitled letter or other correspondence or notice from the FDA or any comparable communication from any other Regulatory Authority or governmental entity, nor, to the Company’s knowledge, is any such claim, action, suit, proceeding, hearing, enforcement, investigation, arbitration or other action threatened; (ii) neither the

15

Company nor any of its subsidiaries are a party to any corporate integrity agreements, monitoring agreements, consent decrees, settlement orders, or similar agreements with or imposed by any Regulatory Authority or other governmental entity; and (iv) neither the Company, its subsidiaries nor any of their respective employees, officers or directors has been excluded, suspended or debarred from participation in any U.S. federal health care program or human clinical research or, to the knowledge of the Company, is subject to an inquiry, investigation, proceeding or other similar action by a Regulatory Authority or other governmental entity that could reasonably be expected to result in debarment, suspension, or exclusion.

(hh) The financial statements included in each of the Registration Statement, the Time of Sale Prospectus and the Prospectus, together with the related schedules and notes thereto, comply as to form in all material respects with the applicable accounting requirements of the Securities Act and present fairly in all material respects the consolidated financial position of the Company and its subsidiaries as of the dates shown and its results of operations and cash flows for the periods shown, and such financial statements have been prepared in conformity with international financial reporting standards (“IFRS”) applied on a consistent basis throughout the periods covered thereby except for any normal year-end adjustments in the Company’s quarterly financial statements. The other financial information included in each of the Registration Statement, the Time of Sale Prospectus and the Prospectus has been derived from the accounting records of the Company and its consolidated subsidiaries and presents fairly in all material respects the information shown thereby.

(ii) PricewaterhouseCoopers Accountants N.V., who have certified certain financial statements of the Company and its subsidiaries and delivered its report with respect to the audited consolidated financial statements filed with the Commission as part of the Registration Statement and included in each of the Registration Statement, the Time of Sale Prospectus and the Prospectus, is an independent registered public accounting firm with respect to the Company within the meaning of the Securities Act and the applicable rules and regulations thereunder adopted by the Commission and the Public Company Accounting Oversight Board (United States).

(jj) The Company and its subsidiaries on a consolidated basis maintain a system of internal accounting controls sufficient to provide reasonable assurance that (i) transactions are executed in accordance with management’s general or specific authorizations; (ii) transactions are recorded as necessary to permit preparation of financial statements in conformity with IFRS, as issued by the International Accounting Standard Board (“IASB”) and to maintain asset accountability; (iii) access to assets is permitted only in accordance with management’s general or specific authorization; and (iv) the recorded accountability for assets is compared with the existing assets at reasonable intervals and appropriate action is taken with respect to any differences. Since the end of the Company’s most recent audited fiscal year, except as disclosed in the Registration

16

Statement, the Time of Sale Prospectus and Prospectus, there has been (i) no material weakness in the Company’s internal control over financial reporting (whether or not remediated) and (ii) no change in the Company’s internal control over financial reporting that has materially and adversely affected, or is reasonably likely to materially and adversely affect, the Company’s internal control over financial reporting.

(kk) Except as described in each of the Registration Statement, the Pricing Prospectus, the Time of Sale Prospectus and the Prospectus, the Company has not sold, issued or distributed any Ordinary Shares during the six-month period preceding the date hereof, including any sales pursuant to Rule 144A under, or Regulation D or S of, the Securities Act, shares issued pursuant to employee benefit plans, qualified stock option plans or other employee compensation plans or pursuant to outstanding options, rights, or warrants.

(ll) The Company and each of its subsidiaries have filed all federal, state, local and foreign tax returns required to be filed through the date of this Agreement or have requested extensions thereof (except where the failure to file would not, singly or in the aggregate, have a material adverse effect on the Company and its subsidiaries, taken as a whole) and have paid all taxes required to be paid thereon (except for cases in which the failure to pay would not, singly or in the aggregate, have a material adverse effect on the Company and its subsidiaries, taken as a whole, or, except as currently being contested in good faith and for which reserves required by IFRS (as issued by IASB) have been created in the financial statements of the Company), and no tax deficiency has been determined adversely to the Company or any of its subsidiaries which, singly or in the aggregate, has had (nor has the Company nor any of its subsidiaries received any written notice of any unpaid tax deficiency which could reasonably be expected to be determined adversely to the Company or its subsidiaries and which could reasonably be expected to have) a material adverse effect on the Company and its subsidiaries, taken as a whole.

(mm) From the time of the initial filing of the Registration Statement to the Commission through the date hereof, the Company has been and is an “emerging growth company,” as defined in Section 2(a) of the Securities Act (an “Emerging Growth Company”).

(nn) The Company (i) has not alone engaged in any Testing-the-Waters Communication with any person other than Testing-the-Waters Communications with the consent of the Underwriters with entities that are reasonably believed to be qualified institutional buyers within the meaning of Rule 144A under the Securities Act or institutions that are reasonably believed to be accredited investors within the meaning of Rule 501 under the Securities Act and (ii) has not authorized anyone other than the Underwriters to engage in Testing-the-Waters Communications. The Company reconfirms that the Underwriters have been authorized to act on its behalf in undertaking Testing-the-Waters Communications. The Company has not distributed any Testing-the-Waters Communication that is a

17

written communication within the meaning of Rule 405 under the Securities Act other than those listed on Schedule III hereto. “Testing-the-Waters Communication” means any communication with potential investors undertaken in reliance on Section 5(d) or Rule 163B of the Securities Act.

(oo) Neither the Company nor any of its subsidiaries has any securities rated by any “nationally recognized statistical rating organization,” as such term is defined in Section 3(a)(62) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

(pp) As of the time of each sale of the Securities in connection with the offering when the Prospectus is not yet available to prospective purchasers, none of (A) the Time of Sale Prospectus, (B) any free writing prospectus, when considered together with the Time of Sale Prospectus, and (C) any individual Testing-the-Waters Communication, when considered together with the Time of Sale Prospectus, included, includes or will include an untrue statement of a material fact or omitted, omits or will omit to state a material fact necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading, except that the representations and warranties set forth in this paragraph do not apply to statements or omissions in the Time of Sale Prospectus and any free writing prospectus based upon information relating to any Underwriter furnished to the Company in writing by such Underwriter expressly for use therein.

(qq) No stamp, issuance, registration, transfer, or other similar documentary taxes or duties are payable by or on behalf of the Underwriters, the Company or any of its subsidiaries in the Netherlands or to any taxing authority thereof or therein having power to tax in connection with (i) the execution, delivery or consummation of this Agreement, (ii) the creation, allotment and issuance of the Securities, (iii) the issuance, sale and delivery of the Securities to the Underwriters or purchasers procured by the Underwriters, or (iv) the resale and delivery of the Securities by the Underwriters, each in the manner contemplated herein.

(rr) All payments of commissions, costs and expenses to be made by the Company to the Underwriters under this Agreement may be made free and clear of, and without withholding or deduction for, or on account of any taxes, duties, assessments or governmental charges by or on behalf of the Netherlands or any political subdivision or authority thereof or therein having power to tax.

(ss) The Company does not believe that it was a “passive foreign investment company” (“PFIC”) for U.S. federal income tax purposes in 2022 and, subject to the assumptions and qualifications set forth in the Registration Statement, the Time of Sale Prospectus and the Prospectus, it does not expect to be a PFIC for its current taxable year or in the foreseeable future.

(tt) It is not necessary under the laws of the Netherlands (i) to enable the Underwriters to enforce their rights under this Agreement provided that they are

18

not otherwise engaged in regulated business in the Netherlands, or (ii) solely by reason of the execution, delivery or consummation of this Agreement, for any of the Underwriters to be qualified or entitled to carry out business in the Netherlands except that any Underwriter offering Securities or investment services or performing investment activities in or from the Netherlands, should be licensed, excepted or exempted under or pursuant to the Dutch Financial Supervision Act (Wet op het financieel toezicht) (“DFSA”).

(uu) This Agreement is in proper form under the laws of the Netherlands for the enforcement thereof against the Company, and to ensure the legality, validity, enforceability or admissibility into evidence in Netherlands of this Agreement.

(vv) The Company is a “foreign private issuer” as defined in Rule 405 of the Securities Act.

(ww) No action has been taken or is contemplated to dissolve or liquidate the Company or any of its subsidiaries, and, to the knowledge of the Company no insolvency proceedings have been proposed, commenced or threatened against the Company or any of its subsidiaries and no judgment has been made or is pending declaring the Company or any of its subsidiaries insolvent. No voluntary arrangement has been prosed between the Company or a subsidiary and its creditors and no compromise or arrangement with creditors has been proposed, agreed or sanctioned in respect of the Company or its subsidiaries. Neither the Company nor any of its subsidiaries has, by reason of actual or anticipated financial difficulties, commenced discussions with any third party including any governmental agency to obtain stand-by or emergency funding or has commenced negotiations with its creditors or any class of its creditors with a view to rescheduling any of its indebtedness.

(xx) Neither the Company nor any of its subsidiaries nor any of its or their properties or assets has any immunity from the jurisdiction of any court or from any legal process (whether through service or notice, attachment prior to judgment, attachment in aid of execution or otherwise) under the laws of the Netherlands. The irrevocable and unconditional waiver and agreement of the Company contained in Section 17(a) not to plead or claim any such immunity in any legal action, suit or proceeding based on this Agreement is valid and binding under the laws of the Netherlands, provided that such waiver may not be effective in relation to assets located in the Netherlands that are destined for the public service (goederen bestemd voor de openbare dienst).

(yy) The choice of law of the State of New York as the governing law of this Agreement is a valid choice of law under the laws of the Netherlands and will be recognized by the courts of the Netherlands. The Company has the power to submit, and pursuant to Section 17(a) has, to the extent permitted by law, legally, validly, effectively and irrevocably submitted, to the jurisdiction of the Specified Courts (as defined in Section 17(a)), and has the power to designate, appoint and

19

empower, and pursuant to Section 17(b), has legally, validly and effectively designated, appointed and empowered an agent for service of process in any suit or proceeding based on or arising under this Agreement in any of the Specified Courts.

(zz) The interactive data in eXtensible Business Reporting Language, if any, included or incorporated by reference in the Registration Statement, the Time of Sale Prospectus and the Prospectus fairly presents the information called for in all material respects and has been prepared in accordance with the Commission’s rules and guidelines applicable thereto to the extent required.

2.Agreements to Sell and Purchase. The Company hereby agrees to issue and sell to the several Underwriters, and each Underwriter, upon the basis of the representations and warranties herein contained, but subject to the terms and conditions hereinafter stated, agrees, severally and not jointly, to purchase from the Company the respective (i) numbers of Shares set forth in Schedule I hereto opposite its name at $22.56 per Share (the “Purchase Price”) and (ii) the respective number of Warrants set forth in Schedule I hereto opposite its name at $22.5506 per Warrant (the “Warrant Purchase Price”).

3.Terms of Public Offering. The Company is advised by the Underwriters that they propose to make a public offering of their respective portions of the Shares as soon after the Registration Statement and this Agreement have become effective as in the Underwriters’ judgment is advisable. The Company is further advised by the Underwriters that the Shares are to be offered to the public initially at $24.00 a share (the “Public Offering Price”) and to certain dealers selected by the Underwriters at a price that represents a concession not in excess of $0.864 a share under the Public Offering Price.

4.Payment and Delivery. Payment for the Securities shall be made to the Company in Federal or other funds immediately available in New York City against delivery of such Securities for the respective accounts of the several Underwriters at 10:00 a.m., New York City time, on December 8, 2023, or at such other time on the same or such other date, not later than December 15, 2023 as shall be designated in writing by the Underwriters. The time and date of such payment are hereinafter referred to as the “Closing Date.”

The Shares and the Warrants shall be registered in such names and in such denominations as the Underwriters shall request in writing not later than one full business day prior to the Closing Date. The Securities shall be delivered to the Underwriters on the Closing Date for the respective accounts of the several Underwriters, with any transfer taxes payable in connection with the transfer of the Shares to the Underwriters duly paid, against payment of the Purchase Price or Warrant Purchase Price, as applicable, therefor.

Notwithstanding the foregoing, the Company and the Underwriters shall instruct the purchaser of the Warrants in the offering to make payment for the Warrants on the Closing Date to the Company by wire transfer in immediately available funds to the account specified by the Company of the Warrant Purchase Price, in lieu of payment by the Underwriters for such amount, and the Company shall deliver such Warrants to such purchaser on the Closing Date in definitive form against such payment, in lieu of the

20

Company’s obligation to deliver such Warrants to the Underwriters; provided that, the underwriting discounts and commissions in respect of the Warrants, as calculated by subtracting the Warrant Purchase Price from the Offering Price of Warrants set forth on Schedule II hereto, shall be deducted and withheld from the amount otherwise payable by the Underwriters to the Company for the Shares as set forth in Section 2.

In the event that the purchasers of the Warrants in the public offering fail to make payment to the Company for all or part of the Warrants on the Closing Date, the Underwriters may elect, by written notice to the Company, to receive Ordinary Shares in lieu of all or a portion of such Warrants to be delivered to the Underwriters under this Agreement.

5.Conditions to the Underwriters’ Obligations. The obligations of the Company to sell the Securities to the Underwriters and the several obligations of the Underwriters to purchase and pay for the Securities on the Closing Date are subject to the following conditions:

(a)Subsequent to the execution and delivery of this Agreement and prior to the Closing Date:

(i)no order suspending the effectiveness of the Registration Statement shall be in effect, and no proceeding for such purpose or pursuant to Section 8A under the Securities Act shall be pending before or threatened by the Commission; and

(ii)there shall not have occurred any change, or any development involving a prospective change, in the condition, financial or otherwise, or in the earnings, business or operations of the Company and its subsidiaries, taken as a whole, from that set forth in the Time of Sale Prospectus that, in the Underwriters’ judgment, is material and adverse and that makes it, in the Underwriters’ judgment, impracticable to market the Securities on the terms and in the manner contemplated in the Time of Sale Prospectus.

(b)The Underwriters shall have received on the Closing Date a certificate, dated the Closing Date and signed by an executive officer of the Company, to the effect set forth in Sections 5(a)(i) and 5(a)(ii) above and to the effect that the representations and warranties of the Company contained in this Agreement are true and correct as of the Closing Date and that the Company has complied with all of the agreements and satisfied all of the conditions on its part to be performed or satisfied hereunder on or before the Closing Date.

The officer signing and delivering such certificate may rely upon the best of his or her knowledge as to proceedings threatened.

(c)The Underwriters shall have received on the Closing Date (i) an opinion and (ii) a negative assurance letter of Kirkland & Ellis LLP, United States

21

counsel to the Company, dated the Closing Date, in form and substance reasonably satisfactory to the Underwriters.

(d)The Underwriters shall have received on the Closing Date an opinion of NautaDutilh N.V., Dutch counsel to the Company, dated the Closing Date, in form and substance reasonably satisfactory to the Underwriters.

(e)The Underwriters shall have received on the Closing Date an opinion of Paustian & Partner, intellectual property counsel for the Company, dated the Closing Date, in form and substance reasonably satisfactory to the Underwriters.

(f)The Underwriters shall have received on the Closing Date an opinion and negative assurance letter of Sidley Austin LLP, counsel for the Underwriters, dated the Closing Date, in form and substance reasonably satisfactory to the Underwriters.

(g)The Underwriters shall have received on the Closing Date an opinion of Loyens & Loeff N.V., Dutch counsel for the Underwriters, dated the Closing Date, in form and substance reasonably satisfactory to the Underwriters.

With respect to Sections 5(c) and 5(f) above, Kirkland & Ellis LLP and Sidley Austin LLP may state that their opinions and beliefs are based upon their participation in the preparation of the Registration Statement, the Pricing Prospectus, the Time of Sale Prospectus and the Prospectus and any amendments or supplements thereto and review and discussion of the contents thereof, but are without independent check or verification, except as specified therein.

(h)The Underwriters shall have received, on each of the date hereof and the Closing Date, a certificate dated the date hereof or the Closing Date, as the case may be, in form and substance reasonably satisfactory to the Underwriters, from the Chief Executive Officer of the Company as to the accuracy of certain financial and other information included in the Registration Statement, the Time of Sale Prospectus and the Prospectus.

(i)The Underwriters shall have received, on each of the date hereof and the Closing Date, a letter dated the date hereof or the Closing Date, as the case may be, in form and substance satisfactory to the Underwriters, from PricewaterhouseCoopers Accountants N.V., independent public accountants, containing statements and information of the type ordinarily included in accountants’ “comfort letters” to underwriters with respect to the financial statements and certain financial information contained in the Registration Statement, the Time of Sale Prospectus and the Prospectus; provided that the letter delivered on the Closing Date shall use a “cut-off date” not earlier than the date hereof.

(j)The “lock-up” agreements, each substantially in the form of Exhibit A hereto, between the Underwriters and certain shareholders, officers and directors

22

of the Company relating to sales and certain other dispositions of Ordinary Shares or certain other securities, delivered to the Underwriters on or before the date hereof, shall be in full force and effect on the Closing Date.

(k)The Underwriters shall have received a form of Warrant in form and substance reasonably acceptable to the Underwriters.

6.Covenants of the Company. The Company covenants with each Underwriter as follows:

(a)To furnish to the Underwriters, without charge, conformed copies of the Registration Statement (including exhibits thereto and documents incorporated by reference) and for delivery to each other Underwriter a conformed copy of the Registration Statement (without exhibits thereto but including documents incorporated by reference) and to furnish to the Underwriters in New York City, without charge, prior to 10:00 a.m. New York City time on the business day next succeeding the date of this Agreement and during the period mentioned in Section 6(e) or 6(f) below, as many copies of the Pricing Prospectus, the Time of Sale Prospectus, the Prospectus, any documents incorporated by reference therein, and any supplements and amendments thereto or to the Registration Statement as the Underwriters may reasonably request.

(b)Before amending or supplementing the Registration Statement, the Pricing Prospectus, the Time of Sale Prospectus or the Prospectus, to furnish to the Underwriters a copy of each such proposed amendment or supplement and not to file any such proposed amendment or supplement to which the Underwriters reasonably object, and to file with the Commission within the applicable period specified in Rule 424(b) under the Securities Act any prospectus required to be filed pursuant to such Rule.

(c)To furnish to the Underwriters a copy of each proposed free writing prospectus to be prepared by or on behalf of, used by, or referred to by the Company and not to use or refer to any proposed free writing prospectus to which the Underwriters reasonably object.

(d)Not to take any action that would result in an Underwriter or the Company being required to file with the Commission pursuant to Rule 433(d) under the Securities Act a free writing prospectus prepared by or on behalf of the Underwriter that the Underwriter otherwise would not have been required to file thereunder.

(e)If the Time of Sale Prospectus is being used to solicit offers to buy the Securities at a time when the Prospectus is not yet available to prospective purchasers and any event shall occur or condition exist as a result of which it is necessary to amend or supplement the Time of Sale Prospectus in order to make the statements therein, in the light of the circumstances under which they were made, not misleading, or if any event shall occur or condition exist as a result of

23

which the Time of Sale Prospectus conflicts with the information contained in the Registration Statement then on file, or if, in the reasonable opinion of counsel for the Underwriters, it is necessary to amend or supplement the Time of Sale Prospectus to comply with applicable law, forthwith to prepare, file with the Commission and furnish, at its own expense, to the Underwriters and to any dealer upon request, either amendments or supplements to the Time of Sale Prospectus so that the statements in the Time of Sale Prospectus as so amended or supplemented will not, in the light of the circumstances when the Time of Sale Prospectus is delivered to a prospective purchaser, be misleading or so that the Time of Sale Prospectus, as amended or supplemented, will no longer conflict with the Registration Statement, or so that the Time of Sale Prospectus, as amended or supplemented, will comply with applicable law.

(f)If, during such period after the first date of the public offering of the Securities as in the reasonable opinion of counsel for the Underwriters the Prospectus (or in lieu thereof the notice referred to in Rule 173(a) of the Securities Act) is required by law to be delivered in connection with sales by an Underwriter or dealer, any event shall occur or condition exist as a result of which it is necessary to amend or supplement the Prospectus in order to make the statements therein, in the light of the circumstances when the Prospectus (or in lieu thereof the notice referred to in Rule 173(a) of the Securities Act) is delivered to a purchaser, not misleading, or if, in the reasonable opinion of counsel for the Underwriters, it is necessary to amend or supplement the Prospectus to comply with applicable law, forthwith to prepare, file with the Commission and furnish, at its own expense, to the Underwriters and to the dealers (whose names and addresses the Underwriters will furnish to the Company) to which Securities may have been sold by the Underwriters and to any other dealers upon request, either amendments or supplements to the Prospectus so that the statements in the Prospectus as so amended or supplemented will not, in the light of the circumstances when the Prospectus (or in lieu thereof the notice referred to in Rule 173(a) of the Securities Act) is delivered to a purchaser, be misleading or so that the Prospectus, as amended or supplemented, will comply with applicable law.

(g)To endeavor to qualify the Securities for offer and sale under the securities or Blue Sky laws of such jurisdictions as the Underwriters shall reasonably request; provided that in no event shall the Company be obligated to qualify to do business in any jurisdiction where it is not now so qualified or to take any action that would subject it to service of process in suits, other than those arising out of the offering or sale of the Securities, or taxation in any jurisdiction where it is not now so subject.

(h)To make generally available to the Company’s security holders and to the Underwriters as soon as practicable an earnings statement (which may satisfied by the Company filing its Annual Report on Form 20-F with the Commission) covering a period of at least twelve months beginning with the first fiscal quarter of the Company occurring after the date of this Agreement which

24

shall satisfy the provisions of Section 11(a) of the Securities Act and the rules and regulations of the Commission thereunder.

(i)Whether or not the transactions contemplated in this Agreement are consummated or this Agreement is terminated, to pay or cause to be paid all expenses incident to the performance of its obligations under this Agreement, including: (i) the fees, disbursements and expenses of the Company’s counsel and the Company’s accountants in connection with the registration and delivery of the Securities under the Securities Act and all other fees or expenses in connection with the preparation and filing of the Registration Statement, the Pricing Prospectus, the Time of Sale Prospectus, the Prospectus, any free writing prospectus prepared by or on behalf of, used by, or referred to by the Company and amendments and supplements to any of the foregoing, including all printing costs associated therewith, and the mailing and delivering of copies thereof to the Underwriters and dealers, in the quantities hereinabove specified, (ii) all costs and expenses related to the transfer and delivery of the Securities to the Underwriters as contemplated by this Agreement, including any transfer or other similar documentary taxes payable thereon, (iii) the reasonable and documented cost of printing or producing any Blue Sky or Legal Investment memorandum in connection with the offer and sale of the Securities under state securities laws and all expenses in connection with the qualification of the Securities for offer and sale under state securities laws as provided in Section 6(g) hereof, including filing fees and the reasonable fees and disbursements of counsel for the Underwriters in connection with such qualification and in connection with the Blue Sky or Legal Investment memorandum, (iv) all filing fees and the reasonable and documented fees and disbursements of counsel to the Underwriters incurred in connection with the review and qualification of the offering of the Securities by FINRA (provided that the amount payable by the Company with respect to the fees and disbursements of counsel for the Underwriters incurred pursuant to subsections (iii) and (iv) of this Section 6(i) shall not exceed $15,000 in the aggregate, (v) all costs and expenses incident to listing the Shares on the NASDAQ Global Market, (vi) the costs and charges of any transfer agent, registrar or depositary, (vii) the costs and expenses of the Company relating to investor presentations on any “road show” undertaken in connection with the marketing of the offering of the Securities, including, without limitation, expenses associated with the preparation or dissemination of any electronic road show, expenses associated with the production of road show slides and graphics, fees and expenses of any consultants engaged in connection with the road show presentations with the prior approval of the Company, travel and lodging expenses of the Underwriters and officers of the Company and any such consultants (provided that 50% of the cost of any aircraft chartered in connection with the road show shall be paid by the Underwriters and 50% of the cost of any aircraft chartered in connection with the road show shall be paid by the Company), (viii) the document production charges and expenses associated with printing this Agreement, (ix) the costs of reproducing and distributing each of the Warrants and

(x) all other costs and expenses incident to the performance of the obligations of the Company hereunder for which provision is not otherwise made in this Section. It is understood, however, that except as provided in this Section, Section 8 entitled

25

“Indemnity and Contribution” and the last paragraph of Section 10 below, the Underwriters will pay all of their costs and expenses, including fees and disbursements of their counsel, stock transfer taxes payable on resale of any of the Securities by them and any advertising expenses connected with any offers they may make.

(j)The Company will promptly notify the Underwriters if the Company ceases to be an Emerging Growth Company at any time prior to the later of (i) completion of the distribution of the Securities within the meaning of the Securities Act and (ii) completion of the Restricted Period (as defined in this Section 6).

(k)If at any time following the distribution of any Testing-the-Waters Communication that is a written communication within the meaning of Rule 405 under the Securities Act there occurred or occurs an event or development as a result of which such Testing-the-Waters Communication included or would include an untrue statement of a material fact or omitted or would omit to state a material fact necessary in order to make the statements therein, in the light of the circumstances existing at that subsequent time, not misleading, the Company will promptly notify the Underwriters and will promptly amend or supplement, at its own expense, such Testing-the-Waters Communication to eliminate or correct such untrue statement or omission.

(m)The Company shall pay, and shall indemnify and hold the Underwriters harmless against, any stamp, issue, registration, transfer, or other similar documentary taxes or duties (other than taxes or duties imposed on the net income of the Underwriters) imposed under the laws of the Netherlands or any political sub-division or taxing authority thereof or therein having the power to tax that is payable in connection with (i) the execution, delivery, consummation or enforcement of this Agreement, (ii) the creation, allotment and issuance of the Securities, (iii) the sale and delivery of the Securities to the Underwriters or purchasers procured by the Underwriters, or (iv) the resale and delivery of the Securities by the Underwriters, in each case in the manner contemplated herein.

(n)All sums of commissions, costs and expenses payable by the Company to the Underwriters under this Agreement shall be paid free and clear of and without deductions or withholdings of any present or future taxes or duties, unless the deduction or withholding is required by law, in which case the Company shall pay such additional amount as will result in the receipt by each Underwriter of the full amount that would have been received had no deduction or withholding been made.

(o)All sums payable to an Underwriter shall be considered exclusive of any value added or similar taxes unless otherwise provided in this Agreement. Where the Company is obliged to pay value added or similar tax on any amount payable hereunder to an Underwriter, the Company shall in addition to the sum

26