Filed Pursuant to Rule 424(b)(5)

Registration No. 333-275088

The information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities, nor are they soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated December 8, 2023

Preliminary Prospectus Supplement

(To the Prospectus dated October 30, 2023)

MILESTONE SCIENTIFIC INC.

Shares of Common Stock

We are offering shares of our common stock, par value $0.001 per share (“common stock”) pursuant to this prospectus supplement and the accompanying base prospectus in a firm commitment public offering. The purchase price for each share of common stock is $ .

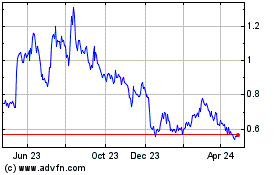

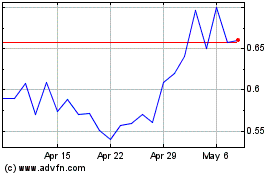

Our common stock is listed on the NYSE American stock exchange under the symbol “MLSS.” On December 7, 2023, the closing price of our common stock on the NYSE American was $0.79 per share.

As of December 8, 2023, the aggregate market value of our outstanding common stock held by non-affiliates, or public float, was approximately $51,916,512 million, based on 71,335,135 shares of our common stock issued and outstanding on December 8, 2023, of which approximately 16,104,803 shares were held by affiliates, and a price of $0.94 per share, which was the closing price at which our common stock was last sold on NYSE American on October 17, 2023. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities registered on this registration statement in a public primary offering with a value exceeding more than one-third of our public float in any 12-month period so long as our public float remains below $75 million. As of December 8, 2023, prior to the consummation of this offering, we have not sold any securities under the foregoing “shelf” registration statement.

Before you invest, you should carefully read this prospectus supplement, the accompanying prospectus and all information incorporated by reference therein. These documents contain information you should consider when making your investment decision.

Investing in these securities involves significant risks. Please read “Risk Factors” on page S-6 of this prospectus supplement, on page 3 of the accompanying prospectus and in the documents incorporated by reference into this prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

| |

|

Per Share

|

|

|

Total

|

|

|

Public offering price

|

|

$ |

|

|

|

$ |

|

|

|

Underwriting discount and commissions (1)

|

|

$ |

|

|

|

$ |

|

|

|

Proceeds, before expenses, to us

|

|

$ |

|

|

|

$ |

|

|

|

(1)

|

In addition to the underwriting discount, we have agreed to reimburse the underwriter for all accountable expenses relating to the offering up to a maximum aggregate amount of $75,000, including, but not limited to, the underwriters’ legal fees, all travel and reasonable out of pocket expenses incurred in this offering. See “Underwriting” for additional information about our compensation arrangements with the underwriter.

|

We have granted the underwriter a 45-day option to purchase up to additional shares of common stock to cover over-allotments, if any. If the underwriter exercises this option in full, the total underwriting discounts and commissions payable will be $ and the total proceeds to us, before expenses, will be $ .

The underwriter expects to deliver the shares on or about December , 2023.

Sole Book Running Manager

Maxim Group LLC

Prospectus Supplement dated December , 2023

TABLE OF CONTENTS

Prospectus Supplement

| |

Page |

| |

|

|

ABOUT THIS PROSPECTUS SUPPLEMENT

|

S-1

|

|

|

|

|

FORWARD LOOKING STATEMENTS

|

S-2

|

| |

|

|

PROSPECTUS SUPPLEMENT SUMMARY

|

S-3

|

| |

|

|

THE OFFERING

|

S-4

|

| |

|

|

RISK FACTORS

|

S-5

|

| |

|

|

USE OF PROCEEDS

|

S-7

|

|

|

|

|

CAPITALIZATION

|

S-8

|

| |

|

|

DILUTION

|

S-9

|

|

|

|

|

DESCRIPTION OF COMMON STOCK

|

S-10

|

| |

|

|

UNDERWRITING

|

S-11

|

| |

|

|

LEGAL MATTERS

|

S-15

|

| |

|

|

EXPERTS

|

S-15

|

| |

|

|

INFORMATION INCORPORATED BY REFERENCE

|

S-15

|

|

|

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

S-16

|

TABLE OF CONTENTS

Prospectus

| |

Page

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

1

|

| |

|

|

FORWARD-LOOKING STATEMENTS

|

2

|

| |

|

|

PROSPECTUS SUMMARY

|

2

|

| |

|

|

RISK FACTORS

|

3

|

| |

|

|

THE BUSINESS

|

3

|

| |

|

|

USE OF PROCEEDS

|

5

|

| |

|

|

DESCRIPTION OF COMMON STOCK WE MAY OFFER

|

5

|

| |

|

|

DESCRIPTION OF PREFERRED STOCK WE MAY OFFER

|

6

|

| |

|

|

DESCRIPTION OF WARRANTS OR SUBSCRIPTION RIGHTS WE MAY OFFER

|

8

|

| |

|

|

DESCRIPTION OF UNITS WE MAY OFFER

|

9

|

| |

|

|

PLAN OF DISTRIBUTION

|

9

|

| |

|

|

LEGAL MATTERS

|

11

|

| |

|

|

EXPERTS

|

12

|

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus form part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. This document contains two parts. The first part consists of this prospectus supplement, which provides you with specific information about this offering. The second part, the accompanying prospectus, provides more general information, some of which may not apply to this offering. Generally, when we refer only to the “prospectus,” we are referring to both parts combined. As of December 8, 2023, prior to the consummation of this offering, we have not sold any securities under the foregoing “shelf” registration statement.

All references in this prospectus supplement to “Milestone,” “us,” “our,” “we,” the Company” or “Milestone Scientific” refer to Milestone Scientific Inc. and its consolidated subsidiaries, Wand Dental, Inc. and Milestone Medical Inc., unless the context otherwise indicates. Milestone Scientific is the owner of the following U.S. registered trademarks: CompuDent®; CompuMed®; CompuFlo®; DPS Dynamic Pressure Sensing technology®; Milestone Scientific®; CathCheck®; the Milestone logo®; SafetyWand®; STA Single Tooth Anesthesia System®; and The Wand®. References to our “common stock” refer to the common stock of Milestone Scientific Inc.

This prospectus supplement, and the information incorporated herein by reference, may add, update or change information in the accompanying prospectus and any free writing prospectuses. You should read both this prospectus supplement, the accompanying prospectus, and any free writing prospectuses together with additional information described under the heading “Where You Can Find More Information.” If there is any inconsistency between the information in this prospectus supplement and the accompanying prospectus, you should rely on the information in this prospectus supplement.

You should rely only on the information contained in or incorporated by reference to this prospectus supplement, the accompanying prospectus, and any free writing prospectuses. We have not authorized any other person to provide information different from that contained in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference herein and therein, and any free writing prospectuses. If anyone provides you with different or inconsistent information, you should not rely on it. You should assume that the information appearing in the accompanying prospectus and this prospectus supplement is accurate as of the dates on their respective covers, regardless of time of delivery of the prospectus and this prospectus supplement or any sale of securities. Our business, financial condition, results of operations, and prospects may have changed since those dates.

All references in this prospectus supplement to our consolidated financial statements include, unless the context indicates otherwise, the related notes.

The industry and market data and other statistical information contained in this prospectus supplement, the accompanying prospectus, and the documents we incorporate by reference are based on management’s own estimates, independent publications, government publications, reports by market research firms or other published independent sources, and, in each case, management believes are reasonable. Although we believe these sources are reliable, we have not independently verified the information. None of the independent industry publications used in this prospectus supplement, the accompanying prospectus or the documents we incorporate by reference were prepared on our behalf or on behalf of any of our affiliates and none of the sources cited by us consented to the inclusion of any data from its reports, and we have not sought their consent.

We are not making an offer to sell the shares covered by this prospectus supplement in any jurisdiction in which an offer or solicitation is not permitted or in which the person making the offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation.

FORWARD-LOOKING STATEMENTS

Certain statements made in this prospectus supplement are “forward-looking statements” (within the meaning of the Private Securities Litigation Reform Act of 1995) regarding the plans and objectives of management for future operations. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance, or achievements of Milestone Scientific to be materially different from any future results, performance, or achievements expressed or implied by such forward-looking statements. The forward-looking statements included herein are based on current expectations that involve numerous risks and uncertainties. Milestone Scientific’s plans and objectives are based, in part, on assumptions involving the continued expansion of its business. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of Milestone Scientific. Although Milestone Scientific believes that its assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate. Considering the significant uncertainties inherent in the forward-looking statements included herein, our history of operating losses that are expected to continue, requiring additional funding which we may be unable to raise capital when needed (which may force us to delay, curtail or eliminate commercialization efforts of our CompuFlo Epidural Computer Controlled Anesthesia System), the early stage operations of and relative lack of acceptance of our medical products, relying exclusively on two third parties to manufacture our products, changes to our distribution arrangements exposes us to risks of interruption of marketing efforts and building new marketing channels, changes in our informal manufacturing arrangements made by the manufacturer of our products and disruptions at the manufacturing facility of our manufacturers, including shortages of or delays in obtaining chips and other components, exposes us to risks that may harm our business, raising additional funds by issuing securities or through licensing or lending arrangements may cause dilution to our existing stockholders, restrict our operations or require us to relinquish proprietary rights, if physicians do not accept nor use our CompuFlo Epidural Computer Controlled Anesthesia System, our ability to generate revenue from sales will be materially impaired, exposure to the risks inherent in international sales and operations, including China, and developments by competitors may render our products or technologies obsolete or non-competitive, the inclusion of such information should not be regarded as a representation by Milestone Scientific or any other person that the objectives and plans of Milestone Scientific will be achieved. Prospective investors are cautioned that any forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties and the actual results may differ materially from those included within the forward-looking statements as a result of various factors. Milestone Scientific undertakes no obligation to revise or update publicly any forward-looking statements for any reason.

PROSPECTUS SUMMARY

The information below is only a summary of more detailed information included elsewhere in or incorporated by reference in this prospectus supplement and the accompanying prospectus. This summary may not contain all the information that is important to you or that you should consider before making a decision to invest in our common stock. Please read this entire prospectus supplement and the accompanying prospectus, including the risk factors, as well as the information incorporated by reference in this prospectus supplement and the accompanying prospectus, carefully.

About Milestone Scientific

Milestone Scientific is a biomedical technology company that patents, designs, develops and commercializes innovative diagnostic and therapeutic injection technologies and devices for medical and dental use. Since our inception, we have engaged in pioneering proprietary, innovative, computer-controlled injection technologies, and solutions for the medical and dental markets. We believe our technologies are proven and well established.

We have focused our resources on redefining the worldwide standard of care for injection techniques by making the experience more comfortable for the patient by reducing the anxiety and stress of receiving injections from the healthcare provider. Our computer-controlled injection devices make injections precise, efficient, and virtually painless.

Milestone Scientific has developed a proprietary, revolutionary, computer-controlled anesthetic delivery device, our DPS Dynamic Pressure Sensing Technology® System, to meet the needs of various subcutaneous drug delivery injections and fluid aspiration – enabling healthcare practitioners to achieve multiple unique benefits that cannot currently be accomplished with the 160-year-old manual syringe. Our proprietary DPS Dynamic Pressure Sensing technology is our technology platform that advances the development of next-generation devices. It regulates flow rate and monitoring pressure from the tip of the needle, through platform extensions for local anesthesia for subcutaneous drug delivery, used in various dental and medical injections. It has specific medical applications for epidural space identification in regional anesthesia procedures.

Our device, using The Wand®, a single use disposable handpiece, is marketed in dentistry under the trademark CompuDent®, and STA Single Tooth Anesthesia System® and is suitable for all dental procedures that require local anesthetic. The dental devices currently are sold in the United States, Canada and in over 41 other countries. Milestone Scientific also has 510(k) marketing clearance from the U.S. Food and Drug Administration (FDA) on the CompuFlo® Epidural Computer Controlled Anesthesia System in the lumbar, thoracic and cervical thoracic junction of the spine region. In addition, Milestone Scientific has obtained CE mark approval and can be marketed and sold in most European countries.

Our recent receipt of chronology-Specific CPT Code for the Company's technology by the American Medical Association marks an important milestone, that could increase the potential number of anesthesia pain management clinics adopting the CompuFlo instrument. A CPT code expands the potential for reimbursement of epidural procedures in pain management utilizing the CompuFlo Epidural System., which should help accelerate the commercial roll-out of CompuFlo in the U.S.

Milestone Scientific and its subsidiaries currently hold over 245 U.S. and foreign patents, and has many patents pending and patent applications. The Company’s patents and patent applications relate to drug delivery methodologies, Peripheral Nerve Block, drug flow rate measurement, pressure/force computer-controlled drug delivery with exit pressure, dynamic pressure sensing, automated rate control, automated charging, drug profiles, audible and visual pressure/force feedback, tissue identification, identification of a target region drug delivery injection unit, drug drive unit for anesthetic, handpiece, and injection device.

Milestone Scientific remains focused on advancing efforts to achieve the following three primary objectives:

● Establishing Milestone’s DPS Dynamic Pressure Sensing technology platform as the standard-of-care in painless and precise drug delivery, providing for the first time, objective visual and audible in-tissue pressure feedback, and continuing to expand platform applications;

● Following obtaining successful FDA clearance of our first medical device, Milestone Scientific is transitioning from a research and development organization to a commercially focused medical device company; and

● Expanding our global footprint of our CompuFlo Epidural and CathCheck System by utilizing a targeted field sales force and partnering with distribution companies worldwide.

Building on the success of our proprietary, core technology platform for dental injections, and desiring to pursue other growth opportunities, we have recently begun to expand the uses and applications of our proprietary, patented technologies to achieve greater operational efficiencies, enhanced patient safety and therapeutic adherence, patient satisfaction, and improved quality of care across a broad range of medical specialties.

We intend to continue to expand the uses and applications of our DPS Dynamic Pressure Sensing technology. We believe that we and our technology solutions are recognized by key opinion leaders (i.e., academics, anesthesiologists and practicing dentists whose opinions are widely respected), industry experts and medical and dental practitioners as a leader in the emerging, computer-controlled injection industry.

Corporate Information

We were organized in August 1989 under the laws of the State of Delaware. Our common stock was initially listed on the NYSE American on June 1, 2015, and trades under the symbol “MLSS”. Our principal executive office is located at 425 Eagle Rock Avenue, Suite 403, Roseland, New Jersey 07068 and our telephone number is (973) 535-2717. Our web address is www.milestonescientific.com. Information contained on or accessed through our website is not part of this prospectus supplement.

| THE OFFERING |

| |

|

|

Issuer:

|

Milestone Scientific Inc.

|

| |

|

|

Securities offered by us:

|

shares of our common stock (or shares of common stock if the underwriter exercises its overallotment option in full).

|

| |

|

|

Public offering price:

|

$ per share of common stock.

|

| |

|

|

Shares of common stock outstanding after the offering (1):

|

shares, (or shares of common stock if the underwriter exercises its overallotment option in full).

|

| |

|

|

Over-allotment option:

|

We have granted the underwriter a 45-day option to purchase up to an additional shares of common stock to cover over-allotments, if any.

|

| |

|

|

Use of proceeds:

|

We expect the net proceeds from our sale of shares of common stock in this offering will be approximately $ (or approximately $ if the underwriter exercises its over-allotment option in full), based on the public offering price of $ per share, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. Any net proceeds we may receive will be used for manufacturing, marketing, sales and distribution of our CompuFlo Epidural System, the development and finalization of the next generation dental instrument, preparation for market readiness once health care insurance providers approve reimbursement payment, working capital and general corporate purposes. See “Use of Proceeds.”

|

| |

|

|

NYSE American listing:

|

Our common stock is listed on the NYSE American under the symbol "MLSS."

|

| |

|

|

Risk factors:

|

Investing in our common stock involves a high degree of risk and purchasers of our common stock may lose their entire investment. See “Risk Factors” and the other information included and incorporated by reference into this prospectus supplement and the accompanying prospectus for a discussion of risk factors you should carefully consider before deciding to invest in our common stock.

|

| |

|

|

Lock-up Agreements

|

We and our officers and directors have agreed, subject to limited exceptions, for a period of 120 days after the closing of this offering, not to offer, sell, contract to sell, pledge, grant any option to purchase, make any short sale or otherwise dispose of, directly or indirectly any shares of common stock or any securities convertible into or exchangeable for our common stock either owned as of the date of the underwriting agreement or thereafter acquired without the prior written consent of the representative. In addition, we have agreed to not issue any securities that are subject to a price reset based on the trading prices of our common stock or upon a specified or contingent event in the future or enter into any agreement to issue securities at a future determined price for a period of 180 days following the closing date of this offering, subject to an exception. The representative may, in its sole discretion and at any time or from time to time before the termination of the lock-up period, without notice, release all or any portion of the securities subject to lock-up agreements.

|

|

(1)

|

The number of shares of our common stock to be outstanding after this offering is based on 70,893,748 shares of common stock issued and 70,860,415 shares of common stock outstanding as of September 30, 2023. The number of shares of common stock outstanding excludes 3,133,652 shares of common stock issuable upon exercise of outstanding stock options, which have a weighted average exercise price of $2.27 per share, and 314,572 shares of common stock issuable upon exercise of outstanding warrants, which have a weighted average exercise price of $0.50 per share, and 463,483 shares of restricted stock issuable upon vesting.

|

RISK FACTORS

Any investment in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below and all of the information contained or incorporated by reference into this prospectus supplement and the accompanying prospectus before deciding whether to purchase our common stock, including the risk factors contained herein and in the accompanying prospectus, as well as those in our periodic reports filed with the Securities and Exchange Commission incorporated by reference in this prospectus supplement and the accompanying prospectus, including those set forth in Item 1A to our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which is incorporated herein by reference. If any of these risks actually occurs, our business, financial condition, liquidity and results of operations would suffer. The risks discussed below also include forward-looking statements and our actual results may differ substantially from those discussed in these forward-looking statements. See the information under the heading “Forward-Looking Statements” in this prospectus supplement.

RISKS RELATING TO THIS OFFERING

As an investor, you may lose all of your investment.

Investing in our common stock involves a high degree of risk. As an investor, you may never recoup all, or even part, of your investment, and you may never realize any return on your investment. You must be prepared to lose all of your investment.

You will experience immediate dilution in the book value per share of the common stock you purchase.

Because the price per share of our common stock being offered is substantially higher than the book value per share of our common stock, you will suffer substantial dilution in the net tangible book value of the common stock you purchase in this offering. Based on the per share purchase price on the cover of this prospectus supplement, you will suffer immediate and substantial dilution of $ per share in the net tangible book value of the common stock, calculated as of September 30, 2023. See “Dilution” on page S-9 for a more detailed discussion of the dilution you will incur if you purchase shares of our common stock in this offering.

Management has broad discretion over the use of the proceeds from this offering. We may use the proceeds of this offering in ways that do not improve our operating results or the market value of our common stock.

We intend to use the net proceeds from the sale of common stock for manufacturing, marketing, sales and distribution of our CompuFlo Epidural System and the development and finalization of the next generation dental instrument, preparation for market readiness once health care insurance providers approve reimbursement payment, working capital and general corporate purposes. However, we will have broad discretion in determining the specific uses of the net proceeds from the sale of the common stock and our allocations may change in response to a variety of unanticipated events, such as differences between our expected and actual revenues from operations or availability of commercial financing opportunities, unexpected expenses or expense overruns or unanticipated opportunities requiring cash expenditures. We will also have significant flexibility as to the timing and use of the net proceeds. As a result, investors will not have the opportunity to evaluate the economic, financial or other information on which we base our decisions on how to use the net proceeds. You will rely on the judgment of our management with only limited information about their specific intentions regarding the use of proceeds. We may spend most of the net proceeds of this offering in ways which you may not agree with. If we fail to apply these funds effectively, our business, results of operations and financial condition may be materially and adversely affected.

The offering price will be set by our Board of Directors and does not necessarily indicate the actual or market value of our common stock.

Our Board of Directors will approve the offering price and other terms of this offering after considering, among other things: the number of shares authorized in our restated certificate of incorporation, as amended (our “certificate of incorporation”); the current market price of our common stock; trading prices of our common stock over time; the volatility of our common stock; our current financial condition and the prospects for our future cash flows; the availability of and likely cost of capital of other potential sources of capital; the characteristics of interested investors and market and economic conditions at the time of the offering. The offering price is not intended to bear any relationship to the book value of our assets or our past operations, cash flows, losses, financial condition, net worth or any other established criteria used to value securities. The offering price may not be indicative of the fair value of the common stock.

The market price of our common stock may be volatile and may fluctuate in a way that is disproportionate to our operating performance.

Our stock price may experience substantial volatility as a result of a number of factors, including:

● sales or potential sales of substantial amounts of our common stock;

● any delay or failure in initiating our strategy to commercialize our CompuFlo Epidural System and the success of the commercialization strategy;

● announcements about us or about our competitors, including clinical trial results, regulatory approvals or new product introductions that could adversely impact the market acceptance or competitive advantages of our CompuFlo Epidural System;

● developments concerning our licensors or product manufacturers;

● litigation and other developments relating to our patents or other proprietary rights or those of our competitors;

● our ability to successfully develop and commercialize products and services for the healthcare industry;

● conditions in the medical device industry;

● governmental regulation and legislation;

● variations in our anticipated or actual operating results; and

● change in securities analysts’ estimates of our performance, or our failure to meet analysts’ expectations

Many of these factors are beyond our control. The stock markets in general, and the market for small, medical device companies, in particular, have historically experienced extreme price and volume fluctuations. These fluctuations often have been unrelated or disproportionate to the operating performance of these companies. These broad market and industry factors could reduce the market price of our common stock, regardless of our actual operating performance.

Sales of a substantial number of shares of our common stock, or the perception that such sales may occur, may adversely impact the price of our common stock.

Almost all of our outstanding shares of common stock, as well as a substantial number of shares of our common stock underlying outstanding warrants, are available for sale in the public market, either freely or pursuant to Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”). In addition, we have an effective S-3 registration statement on file with the SEC covering the sale by us of up to approximately $45 million of securities (less the dollar amount of securities sold in this offering), including common stock, preferred stock, warrants, subscription rights and units. Sales of a substantial number of shares of our common stock, or the perception that such sales may occur, may adversely impact the price of our common stock.

If we fail to adhere to the strict listing requirements of NYSE American, we may be subject to delisting. As a result, our stock price may decline, and our common stock may be de-listed. If our stock were no longer listed on NYSE American, the liquidity of our securities likely would be impaired.

Our common stock currently trades on the NYSE American under the symbol “MLSS”. If we fail to adhere to NYSE American's strict listing criteria, including with respect to stock price, our market capitalization and stockholders’ equity, our stock may be de-listed. This could potentially impair the liquidity of our securities not only in the number of shares that could be bought and sold at a given price, which may be depressed by the relative illiquidity, but also through delays in the timing of transactions and the potential reduction in media coverage. As a result, you may find it more difficult to dispose of our common stock. Any failure at any time to meet the continuing NYSE American listing requirements could have an adverse impact on the value of and trading activity in our common stock.

USE OF PROCEEDS

We estimate the net proceeds from this offering will be approximately (or approximately $ if the underwriter exercises its over-allotment option in full), based on the public offering price of $ per share, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds from this offering for the manufacturing, marketing, sales and distribution of our CompuFlo Epidural System, the development and finalization of the next generation dental instrument, preparation for market readiness once health care insurance providers approve reimbursement payment, working capital and general corporate purposes.

Our management will have broad discretion to allocate the net proceeds to us from this offering and investors will be relying on the judgment of our management regarding the application of the proceeds from this offering. We reserve the right to change the use of these proceeds as a result of certain contingencies such as competitive developments, the results of our marketing efforts, and other factors. An investor will not have the opportunity to evaluate the economic, financial or other information on which we base our decisions on how to use the proceeds.

CAPITALIZATION

The following table sets forth our cash and cash equivalents and capitalization, as of September 30, 2023:

| |

•

|

on an actual basis; and

|

| |

•

|

on a pro forma basis, after giving effect to the sale of the shares in this offering at a public offering price of $ per share, after underwriting discounts and commissions and estimated offering expenses.

|

The information in this table is illustrative only and our capitalization following the closing of the offering will be adjusted based upon the actual public offering price and other terms of this offering determined at pricing. You should consider this table in conjunction with “Use of Proceeds” above as well as our “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the notes to those financial statements contained within our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, incorporated by reference in this prospectus.

| |

|

As of September 30, 2023

|

|

| |

|

Unaudited,

Actual

|

|

|

Unaudited,

Pro forma

|

|

|

Cash and cash equivalents

|

|

$ |

2,170,593 |

|

|

$ |

|

|

|

Marketable Securities

|

|

|

2,450,470 |

|

|

|

|

|

|

Stockholders’ Equity:

|

|

|

|

|

|

|

|

|

|

Common stock, par value $0.001 per share; 100,000,000 shares authorized, actual, and pro forma; 70,893,748 shares issued actual; 70,860,415 shares outstanding actual; shares issued, pro forma shares outstanding, pro forma

|

|

|

70,894 |

|

|

|

|

|

|

Additional paid-in capital

|

|

|

129,487,592 |

|

|

|

|

|

|

Accumulated deficit

|

|

|

(121,400,682 |

) |

|

|

|

|

|

Treasury stock, at cost, 33,333 shares

|

|

|

(911,516 |

) |

|

|

|

|

|

Noncontrolling interest

|

|

|

(253,263 |

) |

|

|

|

|

|

Total Stockholders’ Equity

|

|

$ |

6,993,025 |

|

|

$ |

|

|

| Capitalization |

|

$ |

6,993,025 |

|

|

$ |

- |

|

The above discussion and table are based on 70,860,415 shares of common stock issued and outstanding as of September 30, 2023. Excluded from the above calculations are the 33,333 shares of treasury stock, the 3,133,652 shares of common stock issuable upon exercise of stock options outstanding as of September 30, 2023, which have a weighted average exercise price of $2.27 per share, and the 314,572 shares of common stock issuable upon exercise of warrants outstanding as of September 30, 2023, which have a weighted average exercise price of $0.50 per share and 463,483 shares of restricted stock issuable upon vesting.

DILUTION

If you purchase securities in this offering, your interest will be immediately and substantially diluted to the extent of the difference between the public offering price per share of our common stock and the as adjusted net tangible book value per share of our common stock after giving effect to this offering.

Our net tangible book value as of September 30, 2023 was approximately $6,804,711, or approximately $0.10 per share. Net tangible book value is determined by subtracting our total liabilities from our total tangible assets, and net tangible book value per share is determined by dividing our net tangible book value by the number of outstanding shares of our common stock. After giving effect to the sale of shares of our common stock in this offering at the public offering price of $ per share, and after deducting the underwriting discount and commissions, and estimated offering expenses payable by us, our adjusted net tangible book value as of September 30, 2023 would have been approximately $ , or approximately $ per share. This represents an immediate increase in net tangible book value of approximately $ per share to our existing stockholders and an immediate dilution in net tangible book value of approximately per share to investors participating in this offering. The following table illustrates this calculation on a per share basis:

|

Public offering price per share of common stock

|

|

$ |

|

|

|

Net tangible book value per share as of September 30, 2023

|

|

$ |

0.10 |

|

|

Increase in net tangible book value per share attributable to this offering

|

|

$ |

|

|

|

Adjusted net tangible book value per share after this offering

|

|

$ |

|

|

|

Amount of dilution in net tangible book value per share to new investors in this offering

|

|

$ |

|

|

The information above assumes that the underwriter does not exercise its over-allotment option. If the underwriter exercised its over-allotment option in full, the as-adjusted net tangible book value will increase to $ per share, representing an immediate increase to existing stockholders of $ per share and an immediate dilution of $ per share to participants in this offering.

The above discussion and table are based on 70,893,748 shares of common stock issued and 70,860,415 shares of common stock outstanding as of September 30, 2023. The number of shares of common stock outstanding excludes 3,133,652 shares of common stock issuable upon exercise of outstanding stock options, which have a weighted average exercise price of $2.27 per share, and 314,572 shares of common stock issuable upon exercise of outstanding warrants, which have a weighted average exercise price of $0.50 per share, and 463,483 shares of restricted stock issuable upon vesting.

DESCRIPTION OF COMMON STOCK

The following description of our common stock is only a summary. This description is subject to, and qualified in its entirety by reference to, our certificate of incorporation and amended and restated bylaws (the “bylaws”), each of which has previously been filed with the SEC, and the Delaware General Corporation Law (“DGCL”).

Common Stock

Our authorized capital stock includes 100,000,000 shares of common stock, par value $0.001 per share. As of September 30, 2023, there were 70,893,748 shares of common stock issued, 70,860,415 shares outstanding and 33,333 shares of common stock held in the treasury. The following description of the rights of the common stock do not apply to the treasury shares.

Subject to preferences that may apply to preferred shares outstanding at the time, the holders of outstanding common stock are entitled to receive dividends out of assets legally available therefor at such times and in such amounts as the Board of Directors may from time to time determine. Each stockholder is entitled to one vote for each share of common stock held on all matters submitted to a vote of stockholders. Directors are elected by plurality vote. Therefore, the holders of a majority of the common stock votes can elect all of the directors then standing for election. The common stock is not entitled to preemptive rights and are not subject to conversion. If we are liquidated or dissolved or our business is otherwise wound up, the holders of common stock would be entitled to share ratably in the distribution of all of our assets remaining available for distribution after satisfaction of all our liabilities and the payment of the liquidation preference of any outstanding preferred shares. Each outstanding share of common stock is, and all shares of common stock to be outstanding upon completion of this offering, will be, fully paid and non-assessable.

Authorized but Unissued Common Stock

The DGCL does not require stockholder approval for any issuance of authorized shares, except in certain limited circumstances. However, the listing requirements of the NYSE American, which would apply for so long as our common stock is listed on the NYSE American, require stockholder approval of certain issuances (other than a public offering) equal to or exceeding 20% of the then outstanding voting power or then outstanding number of shares of common stock, as well as for certain issuances of stock in compensatory transactions. These additional shares may be used for a variety of corporate purposes, including future public offerings, to raise additional capital or to facilitate acquisitions. One of the effects of the existence of unissued and unreserved shares of common stock may be to enable our Board of Directors to sell shares to persons friendly to current management, for such consideration, in form and amount, as is acceptable to the Board, which issuance could render more difficult or discourage an attempt to obtain control of us by means of a merger, tender offer, proxy contest or otherwise, and thereby protect the continuity of our management and possibly deprive stockholders of opportunities to sell their common stock at prices higher than prevailing market prices.

Dividends

We have not declared or paid any cash dividends on our common stock, and we do not anticipate declaring or paying cash dividends for the foreseeable future. We are not subject to any legal restrictions respecting the payment of dividends, except that we may not pay dividends if the payment would render us insolvent. Any future determination as to the payment of cash dividends on our common stock will be at our Board of Directors’ discretion and will depend on our financial condition, operating results, capital requirements and other factors that our Board of Directors considers to be relevant. Currently, the Board of Directors does not intend to pay any cash dividends, but retain all funds for working capital.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Continental Stock Transfer & Trust Company, 1 State Street, 30th Floor, New York, NY 10004.

UNDERWRITING

We are offering the shares of common stock described in this prospectus supplement and the accompanying prospectus through the underwriters listed below. Maxim Group LLC is acting as the sole book-running manager of this offering and representative of each of the underwriters named below, if any. The underwriters named below have agreed to buy, subject to the terms of the underwriting agreement, the number of securities listed opposite its name below. The underwriters are committed to purchase and pay for all of the securities if any are purchased, other than those securities covered by the over-allotment option described below.

|

Underwriter

|

|

|

Number of shares of Common Stock

|

|

|

Maxim Group LLC

|

|

|

|

|

|

Total

|

|

|

|

|

The underwriters have advised us that they propose to offer shares of common stock to the public at a price of $ per share. The underwriters propose to offer the shares of common stock to certain dealers at the same price less a concession of not more than $ per share. After the offering, these figures may be changed by the underwriters.

Over-allotment Option

We have granted the underwriters an option exercisable not later than 45 days after the date of this prospectus supplement to purchase up to an additional shares of common stock. The underwriters may exercise the option solely to cover over-allotments, if any, made in connection with this offering. To the extent the underwriters exercise the option, the underwriters will become obligated, subject to certain conditions, to purchase the shares of common stock for which they exercise the option.

Underwriting Discounts and Expenses

The following table summarizes the underwriting discount and commission to be paid to the underwriters by us. These amounts are shown assuming both no exercise and full exercise of the over-allotment option.

| |

|

Per Share

|

|

|

Total Without Over-

Allotment

|

|

|

Total With

Over-Allotment

|

|

|

Public offering price

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Underwriting discount and commissions (1)

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Proceeds, before expenses, to us

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

(1)

|

In addition to the underwriting discount, we have agreed to reimburse the representative for all accountable expenses relating to the offering up to a maximum aggregate amount of $75,000, including, but not limited to, the underwriters’ legal fees, all travel and reasonable out of pocket expenses incurred in this offering. We estimate that the total expenses of this offering, excluding underwriting discounts, will be $190,000. These expenses are payable by us.

|

Indemnification

We have agreed to indemnify the underwriters against certain liabilities, including liabilities under the Securities Act, and to contribute to payments that the underwriters may be required to make in respect of those liabilities.

Lock-up Agreements

We and our officers and directors have agreed, subject to limited exceptions, for a period of 120 days after the closing of this offering, not to offer, sell, contract to sell, pledge, grant any option to purchase, make any short sale or otherwise dispose of, directly or indirectly any shares of common stock or any securities convertible into or exchangeable for our common stock either owned as of the date of the underwriting agreement or thereafter acquired without the prior written consent of the representative. In addition, we have agreed to not issue any securities that are subject to a price reset based on the trading prices of our common stock or upon a specified or contingent event in the future or enter into any agreement to issue securities at a future determined price for a period of 180 days following the closing date of this offering, subject to an exception. The representative may, in its sole discretion and at any time or from time to time before the termination of the lock-up period, without notice, release all or any portion of the securities subject to lock-up agreements.

Price Stabilization, Short Positions and Penalty Bids

In connection with this offering, the underwriters may engage in activities that stabilize, maintain or otherwise affect the price of our securities during and after this offering, including: stabilizing transactions; short sales; purchases to cover positions created by short sales; imposition of penalty bids; and syndicate covering transactions.

Stabilizing transactions consist of bids or purchases made for the purpose of preventing or retarding a decline in the market price of our shares of common stock while this offering is in progress. Stabilization transactions permit bids to purchase the underlying security so long as the stabilizing bids do not exceed a specified maximum. These transactions may also include making short sales of our shares of common stock, which involve the sale by the underwriters of a greater number of shares of common stock than they are required to purchase in this offering and purchasing shares of common stock on the open market to cover short positions created by short sales. Short sales may be “covered short sales,” which are short positions in an amount not greater than the underwriters’ option to purchase additional shares referred to above, or may be “naked short sales,” which are short positions in excess of that amount.

The underwriters may close out any covered short position by either exercising their option, in whole or in part, or by purchasing shares in the open market. In making this determination, the underwriters will consider, among other things, the price of shares available for purchase in the open market as compared to the price at which they may purchase shares through the over-allotment option.

Naked short sales are short sales made in excess of the over-allotment option. The underwriters must close out any naked short position by purchasing shares in the open market. A naked short position is more likely to be created if the underwriters are concerned that there may be downward pressure on the price of the shares of common stock in the open market that could adversely affect investors who purchased in this offering.

The underwriters also may impose a penalty bid. This occurs when a particular underwriter repays to the underwriters a portion of the underwriting discount received by it because Maxim has repurchased shares sold by or for the account of that underwriter in stabilizing or short covering transactions.

These stabilizing transactions, short sales, purchases to cover positions created by short sales, the imposition of penalty bids and syndicate covering transactions may have the effect of raising or maintaining the market price of our common stock or preventing or retarding a decline in the market price of our common stock. As a result of these activities, the price of our common stock may be higher than the price that otherwise might exist in the open market. The underwriters may carry out these transactions on the NYSE American, in the over-the-counter market or otherwise. Neither we nor the underwriters make any representation or prediction as to the effect that the transactions described above may have on the price of the shares. Neither we, nor any of the underwriters make any representation that the underwriters will engage in these stabilization transactions or that any transaction, once commenced, will not be discontinued without notice.

Electronic Distribution

This prospectus supplement in electronic format may be made available on websites or through other online services maintained by the underwriters, or by their affiliates. Other than this prospectus supplement in electronic format, the information on the underwriters’ websites and any information contained in any other websites maintained by the underwriters is not part of this prospectus or the registration statement of which this prospectus forms a part, has not been approved and/or endorsed by us or the underwriters in their capacity as underwriters, and should not be relied upon by investors.

Right of First Refusal

We have agreed that upon the closing of this offering, subject to certain conditions, for a period of six (6) months from such closing, we will grant Maxim the right of first refusal to act as sole managing underwriter and sole book runner, sole placement agent, or sole sales agent for any and all future public or private equity, equity-linked or debt (excluding commercial bank debt) offerings during such period of the Company, or any successor to or any subsidiary of the Company.

Other

From time to time, the underwriters may in the future provide, various investment banking and other financial services for us and, may in the future receive, customary fees. Except for the services provided in connection with this offering, the underwriters have not provided any investment banking or other financial services during the 180-day period preceding the date of this prospectus supplement.

Selling Restrictions

European Economic Area

Notice to prospective investors in the European Economic Area

In relation to each Member State of the European Economic Area (each a “Relevant Member State”), no shares have been offered or will be offered pursuant to the offering to the public in that Relevant Member State prior to the publication of a prospectus in relation to the shares which has been approved by the competent authority in that Relevant Member State or, where appropriate, approved in another Relevant Member State and notified to the competent authority in that Relevant Member State, all in accordance with the Prospectus Regulation, except that it may make an offer to the public in that Relevant Member State of any shares at any time under the following exemptions under the Prospectus Regulation:

a) to any legal entity which is a qualified investor as defined under the Prospectus Regulation;

b) to fewer than 150 natural or legal persons (other than qualified investors as defined under the Prospectus Regulation), subject to obtaining the prior consent of the representatives; or

c) in any other circumstances falling within Article 1(4) of the Prospectus Regulation,

provided that no such offer of the shares shall require the issuer or any underwriter to publish a prospectus pursuant to Article 3 of the Prospectus Regulation or supplement a prospectus pursuant to Article 23 of the Prospectus Regulation.

For the purposes of this provision, the expression an “offer to the public” in relation to the shares in any Relevant Member State means the communication in any form and by any means of sufficient information on the terms of the offer and any shares to be offered so as to enable an investor to decide to purchase or subscribe for any shares, and the expression “Prospectus Regulation” means Regulation (EU) 2017/1129.

United Kingdom

Notice to prospective investors in United Kingdom

In relation to the United Kingdom, no shares have been offered or will be offered pursuant to the offering to the public in the United Kingdom prior to the publication of a prospectus in relation to the shares that has been approved by the Financial Conduct Authority, except that offers of shares may be made to the public in the United Kingdom at any time under the following exemptions under the UK Prospectus Regulation:

| |

a)

|

to any legal entity which is a qualified investor as defined under Article 2 of the UK Prospectus Regulation;

|

| |

b)

|

to fewer than 150 natural or legal persons (other than qualified investors as defined under Article 2 of the UK Prospectus Regulation), subject to obtaining the prior consent of the representatives; or

|

| |

c)

|

in any other circumstances falling within Section 86 of the Financial Services and Markets Act 2000 (the “FSMA”),

|

provided that no such offer of shares shall require the issuer or any underwriter to publish a prospectus pursuant to Section 85 of the FSMA or supplement a prospectus pursuant to Article 23 of the UK Prospectus Regulation.

For the purposes of this provision, the expression an “offer to the public” in relation to the shares in the United Kingdom means the communication in any form and by any means of sufficient information on the terms of the offer and any shares to be offered so as to enable an investor to decide to purchase or subscribe for any shares and the expression “UK Prospectus Regulation” means Regulation (EU) 2017/1129 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018.

In addition, this prospectus is only being distributed to, and is only directed at, and any investment or investment activity to which this prospectus relates is available only to, and will be engaged in only with, persons who are outside the United Kingdom or persons in the United Kingdom (i) having professional experience in matters relating to investments who fall within the definition of “investment professionals” in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”); or (ii) who are high net worth entities falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”). Persons who are not relevant persons should not take any action on the basis of this prospectus and should not act or rely on it.

Canada

The securities may be sold in Canada only to purchasers purchasing, or deemed to be purchasing, as principal that are accredited investors, as defined in National Instrument 45-106 Prospectus Exemptions or subsection 73.3(1) of the Securities Act (Ontario), and are permitted clients, as defined in National Instrument 31 103 Registration Requirements, Exemptions and Ongoing Registrant Obligations. Any resale of the securities must be made in accordance with an exemption from, or in a transaction not subject to, the prospectus requirements of applicable securities laws.

Securities legislation in certain provinces or territories of Canada may provide a purchaser with remedies for rescission or damages if this prospectus supplement (including any amendment thereto) contains a misrepresentation, provided that the remedies for rescission or damages are exercised by the purchaser within the time limit prescribed by the securities legislation of the purchaser’s province or territory. The purchaser should refer to any applicable provisions of the securities legislation of the purchaser’s province or territory for particulars of these rights or consult with a legal advisor.

Pursuant to section 3A.3 of National Instrument 33 105 Underwriting Conflicts (NI 33 105), the placement agent is not required to comply with the disclosure requirements of NI 33-105 regarding conflicts of interest in connection with this offering.

Israel

Notice to prospective investors in Israel

In the State of Israel this prospectus shall not be regarded as an offer to the public to purchase shares under the Israeli Securities Law, 5728—1968, which requires a prospectus to be published and authorized by the Israel Securities Authority, if it complies with certain provisions of Section 15 of the Israeli Securities Law, 5728–1968, including, inter alia, if: (i) the offer is made, distributed or directed to not more than 35 investors, subject to certain conditions (the “Addressed Investors”) or (ii) the offer is made, distributed or directed to certain qualified investors defined in the First Addendum of the Israeli Securities Law, 5728—1968, subject to certain conditions (the “Qualified Investors”). The Qualified Investors shall not be taken into account in the count of the Addressed Investors and may be offered to purchase securities in addition to the 35 Addressed Investors. The issuer has not and will not take any action that would require it to publish a prospectus in accordance with and subject to the Israeli Securities Law, 5728—1968. We have not and will not distribute this prospectus or make, distribute or direct an offer to subscribe for our shares to any person within the State of Israel, other than to Qualified Investors and up to 35 Addressed Investors.

Qualified Investors may have to submit written evidence that they meet the definitions set out in of the First Addendum to the Israeli Securities Law, 5728—1968. In particular, we may request, as a condition to be offered shares, that each Qualified Investor will represent, warrant and certify to us and/or to anyone acting on our behalf: (i) that it is an investor falling within one of the categories listed in the First Addendum to the Israeli Securities Law, 5728—1968; (ii) which of the categories listed in the First Addendum to the Israeli Securities Law, 5728—1968 regarding Qualified Investors is applicable to it; (iii) that it will abide by all provisions set forth in the Israeli Securities Law, 5728—1968 and the regulations promulgated thereunder in connection with the offer to be issued shares; (iv) that the shares that it will be issued are, subject to exemptions available under the Israeli Securities Law, 5728—1968: (a) for its own account; (b) for investment purposes only; and (c) not issued with a view to resale within the State of Israel, other than in accordance with the provisions of the Israeli Securities Law, 5728—1968; and (v) that it is willing to provide further evidence of its Qualified Investor status. Addressed Investors may have to submit written evidence in respect of their identity and may have to sign and submit a declaration containing, inter alia, the Addressed Investor’s name, address and passport number or Israeli identification number.

NYSE American Listing

Our common stock is listed on the NYSE American under the symbol “MLSS.”

LEGAL MATTERS

The validity of the securities offered by this prospectus supplement will be passed upon for us by Golenbock Eiseman Assor Bell & Peskoe LLP, New York, New York. Sullivan & Worcester LLP, New York, New York is acting as counsel for the underwriter in connection with this offering.

EXPERTS

The financial statements as of and for the year ended December 31, 2022 incorporated by reference in this registration statement have been audited by Marcum LLP, an independent registered public accounting firm, as stated in their report. Such financial statements are incorporated by reference in reliance upon the report of such firm given upon their authority as experts in accounting and auditing.

The financial statements as of and for the year ended December 31, 2021 incorporated by reference in this registration statement have been audited by Friedman LLP, an independent registered public accounting firm, as stated in their report. Such financial statements are incorporated by reference in reliance upon the report of such firm given upon their authority as experts in accounting and auditing.

INFORMATION INCORPORATED BY REFERENCE

This prospectus supplement “incorporates by reference” certain information that we have filed with the SEC under the Exchange Act. This means we are disclosing important information to you by referring you to those documents. We incorporate by reference the documents listed below and any future filings made by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act until the offering is terminated:

| |

●

|

Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed on March 30, 2023, including the Definitive Proxy Statement of Schedule14A, filed on May 1, 2023;

|

| |

● |

Quarterly Reports on Form 10-Q for the fiscal quarter ended March 31, 2023, filed on May 10, 2023, for the fiscal quarter ended June 30, 2023, filed on August 14, 2023, and for the fiscal quarter ended September 30, 2023, filed on November 14, 2023;

|

| |

●

|

Current Reports on Form 8-K, filed on January 5, 2023, February 6, 2023, June 30, 2023, July 13, 2023, August 24, 2023 and September 12, 2023; and

|

| |

● |

The description of Milestone’s Common Stock contained in Exhibit 4.6 to its Annual Report on Form 10-K filed with the SEC on March 31, 2022, including any further amendment or report filed hereafter for the purpose of updating such description.

|

You should rely only on the information incorporated by reference or provided in this prospectus. We have not authorized anyone to provide you with different information. You should not assume that the information in this prospectus supplement is accurate as of any date other than the date on the front of this document. All documents that we file pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus supplement or after the date of the registration statement of which this prospectus supplement forms a part and prior to the termination of the offering will be deemed to be incorporated in this prospectus supplement by reference and will be a part of this prospectus supplement from the date of the filing of the document. Any statement contained in a document incorporated or deemed to be incorporated by reference in this prospectus supplement, except in case the information contained in such document to the extent “furnished” and not “filed” will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus supplement or in any other subsequently filed document which also is or is deemed to be incorporated by reference in this prospectus supplement modifies or supersedes that statement. Any statement that is modified or superseded will not constitute a part of this prospectus supplement, except as modified or superseded.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement under the Securities Act that registers the securities offered hereby. The registration statement, including the exhibits and schedules attached thereto and the information incorporated by reference therein, contains additional relevant information about the securities and our Company, which we are allowed to omit from this prospectus supplement pursuant to the rules and regulations of the SEC. In addition, we file annual, quarterly and current reports and proxy statements and other information with the SEC. Our SEC filings are also available on the SEC’s website at www.sec.gov. Copies of certain information filed by us with the SEC are also available on our website at www.milestonescientific.com. We have not incorporated by reference into this prospectus supplement the information on our website and it is not a part of this document.

PROSPECTUS

$45,000,000

MILESTONE SCIENTIFIC INC.

Common Stock

Preferred Stock

Warrants

Subscription Rights

Units

This prospectus relates to common stock, preferred stock, warrants, subscription rights and units that we may sell from time to time in one or more offerings up to a total public offering price of $45,000,000 on terms to be determined at the time of sale. We will provide specific terms of these securities in supplements to this prospectus. You should read this prospectus and any supplement carefully before you invest. This prospectus may not be used to offer and sell securities unless accompanied by a prospectus supplement for those securities.

Our common stock is listed on the NYSE American under the symbol “MLSS”. On October 18, 2023, the closing price of our common stock on the NYSE American was $0.90 per share.

These securities may be sold directly by us, through dealers or agents designated from time to time, to or through underwriters or through a combination of these methods. See “Plan of Distribution” in this prospectus. We may also describe the plan of distribution for any particular offering of these securities in any applicable prospectus supplement. If any agents, underwriters or dealers are involved in the sale of any securities in respect of which this prospectus is being delivered, we will disclose their names and the nature of our arrangements with them in a prospectus supplement. The net proceeds we expect to receive from any such sale will also be included in a prospectus supplement.

Investing in our securities involves certain risks. See “Risk Factors” beginning on page 3 of this prospectus and in any prospectus supplement before you make your investment decision.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is October 30, 2023.

Table of Contents

| |

Page

|

| |

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

1

|

| |

|

|

FORWARD-LOOKING STATEMENTS

|

2

|

| |

|

|

PROSPECTUS SUMMARY

|

2

|

| |

|

|

RISK FACTORS

|

3

|

| |

|

|

THE BUSINESS

|

3

|

| |

|

|

USE OF PROCEEDS

|

5

|

| |

|

|

DESCRIPTION OF COMMON STOCK WE MAY OFFER

|

5

|

| |

|

|

DESCRIPTION OF PREFERRED STOCK WE MAY OFFER

|

6

|

| |

|

|

DESCRIPTION OF WARRANTS OR SUBSCRIPTION RIGHTS WE MAY OFFER

|

8

|

| |

|

|

DESCRIPTION OF UNITS WE MAY OFFER

|

9

|

| |

|

|

PLAN OF DISTRIBUTION

|

9

|

| |

|

|

LEGAL MATTERS

|

11

|

| |

|

|

EXPERTS

|

12

|

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and special reports, proxy statements and other information with the Securities and Exchange Commission (the “SEC”). You can inspect and copy these reports, proxy statement and other information at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D. C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room. The SEC also maintains a web site that contains reports, proxy and information statements and other information regarding issuers, such as Milestone Scientific Inc. (www.sec.gov). Our web site is located at www.milestonescientific.com. The information contained on our web site is not part of this prospectus.

This prospectus “incorporates by reference” certain information that we have filed with the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). This means we are disclosing important information to you by referring you to those documents. We incorporate by reference the documents listed below and any future filings made by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act until the offering is terminated:

| |

●

|

Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed on March 30, 2023, including the Definitive Proxy Statement of Schedule14A, filed on May 1, 2023;

|

| |

●

|

Quarterly Reports on Form 10-Q for the fiscal quarter ended March 31, 2023, filed on May 10, 2023, and for the fiscal quarter ended June 30, 2023, filed on August 14, 2023;

|

| |

●

|

Current Reports on Form 8-K, filed on January 5, 2023, February 6, 2023, June 30, 2023, July 13, 2023, August 24, 2023 and September 12, 2023; and

|

| |

●

|

The description of Milestone’s Common Stock contained in Exhibit 4.6 to its Annual Report on Form 10-K filed with the SEC on March 31, 2022, including any further amendment or report filed hereafter for the purpose of updating such description.

|

You should rely only on the information incorporated by reference or provided in this prospectus. We have authorized no one to provide you with different information. You should not assume that the information in this prospectus is accurate as of any date other than the date on the front of this document. All documents that we file pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus or after the date of the registration statement of which this prospectus forms a part and prior to the termination of the offering will be deemed to be incorporated in this prospectus by reference and will be a part of this prospectus from the date of the filing of the document. Any statement contained in a document incorporated or deemed to be incorporated by reference in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or in any other subsequently filed document which also is or is deemed to be incorporated by reference in this prospectus modifies or supersedes that statement. Any statement that is modified or superseded will not constitute a part of this prospectus, except as modified or superseded.

We will provide, upon written or oral request, without charge to you, including any beneficial owner to whom this prospectus is delivered, a copy of any or all of the documents incorporated herein by reference other than the exhibits to those documents, unless the exhibits are specifically incorporated by reference into the information that this prospectus incorporates. You should direct a request for copies to us at Attention: Controller, Keisha Harcum, Milestone Scientific Inc., 425 Eagle Rock Avenue, Suite 403, Roseland, New Jersey 07068, or you may call us at (973) 535-2717.

FORWARD-LOOKING STATEMENTS

Certain information set forth in this prospectus or incorporated by reference in this prospectus are “forward-looking statements” (within the meaning of the Private Securities Litigation Reform Act of 1995) regarding the plans and objectives of management for future operations. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance, or achievements of Milestone Scientific to be materially different from any future results, performance, or achievements expressed or implied by such forward-looking statements. The forward-looking statements included herein are based on current expectations that involve numerous risks and uncertainties. Milestone Scientific’s plans and objectives are based, in part, on assumptions involving the continued expansion of its business. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of Milestone Scientific. Although Milestone Scientific believes that its assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate. Considering the significant uncertainties inherent in the forward-looking statements included herein, our history of operating losses that are expected to continue, requiring additional funding which we may be unable to raise capital when needed (which may force us to delay, curtail or eliminate commercialization efforts of our CompuFlo Epidural Computer Controlled Anesthesia System), the early stage operations of and relatively lack of acceptance of our medical products, relying exclusively on two third parties to manufacture our products, changes to our distribution arrangements exposes us to risks of interruption of marketing efforts and building new marketing channels, changes in our informal manufacturing arrangements made by the manufacturer of our products and disruptions at the manufacturing facility of our manufacturers, including shortages of or delays in obtaining chips and other components, exposes us to risks that may harm our business, raising additional funds by issuing securities or through licensing or lending arrangements may cause dilution to our existing stockholders, restrict our operations or require us to relinquish proprietary rights, if physicians do not accept nor use our CompuFlo Epidural Computer Controlled Anesthesia System, our ability to generate revenue from sales will be materially impaired, exposure to the risks inherent in international sales and operations, including China, and developments by competitors may render our products or technologies obsolete or non-competitive, the inclusion of such information should not be regarded as a representation by Milestone Scientific or any other person that the objectives and plans of Milestone Scientific will be achieved. Prospective investors are cautioned that any forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties and the actual results may differ materially from those included within the forward-looking statements as a result of various factors. Milestone Scientific undertakes no obligation to revise or update publicly any forward-looking statements for any reason.

PROSPECTUS SUMMARY