false

0001288855

0001288855

2023-12-08

2023-12-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported) December 8, 2023

OPTIMUMBANK

HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Florida |

|

000-50755 |

|

55-0865043 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

file

number) |

|

(IRS

employer

identification

no.) |

| 2929

East Commercial Boulevard |

|

|

|

33308 |

| Ft.

Lauderdale, Florida |

|

|

|

(Zip

Code) |

| (Address

of principal executive offices) |

|

|

|

|

(954)

776-2332

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

Registered pursuant to Section 12(b) of the Act:

| Title

of each class registered |

|

Trading

Symbol(s) |

|

Name

of exchange on which registered |

| Common

Stock |

|

OPHC |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1933 (§240.12b-2 of this chapter)

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

December 8, 2023, OptimumBank Holdings, Inc. issued a press release describing aspects of its results of operations for the month ended

October 31, 2023.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

The

information in this report (including the exhibits) shall not be deemed to be “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not

be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or

the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| OPTIMUMBANK

HOLDINGS, INC. |

|

| |

|

|

| Date: |

December

8, 2023 |

|

| |

|

|

| By: |

/s/

Moishe Gubin |

|

| |

Moishe

Gubin |

|

| |

Chairman

of the Board of Directors |

|

Exhibit 99.1

OptimumBank Holdings,

Inc. (OPHC-NASDAQ)

Chairman Gubin’s

comments pertaining to the Board’s

Strategic Planning

- “A successful roadmap for growing our Bank”

OptimumBank Holdings, Inc., a (the “Company”)

ended the month of October 2023 with assets exceeding $755.7 million, an increase of $43 million as compared to $712.7 million in the

prior month. The net change in total assets was partially driven by a $26 million increase in net loans. Since the Company announced entry

into Accounts Receivable Financing to Skilled Nursing Facilities at the end of last year, our SNF portfolio has grown to over $28MM. Additionally,

since the Company announced seeking entry into the Small Business Administration (SBA) National Lending Program to provide loans to small

and middle market companies, the Company is now approved for SBA Lending and has closed it first SBA Loan for $300,000 and has a pipeline

of $15MM in various stages of loan underwriting and processing. Additionally, the Company intends to close in the area of $50MM of SBA

loans in 2024. Core earnings are a non-GAPP financial measure used by management as an earnings measure to ascertain the profitability

of the underlying business of the Company for the month of October 2023 has increased over the past ten months to $1,410,900 as compared

to $963,215 reported for the month ended December 31, 2022.1

Chairman

Gubin commends the Board and Management for the promising implementation of a well-designed strategic plan to grow the size and profitability

of the Company and developing strong and lasting customer relationships along the way.

Growing the asset size of the Company

for the remainder of 2023 and into 2024 is facilitating our goal to provide greater shareholder returns. Growth in our earning as the

Company grows has been and will continue to be our main focus. The Board and Management are working hard to improve on our results and

truly succeed in bringing returns to all of our shareholders.

As

the Company grows, the Board and Management stays focused on maintaining our well capitalized status under regulatory guidelines,

enhancing our reputation for consistent and stellar customer service,

and performing better than many of our peers in a number of banking metrics.

OptimumBank’s strategic plan also

encompasses expanding lending capabilities, increasing the Company’s core deposit base primarily with fee-based income businesses

and by evaluating M&A opportunities. The Board and Management remains focused on increasing

the Loan-to-Deposit ratio by maintaining competitive pricing of the Company’s products to improve the Net Interest Margin (NIM)

to reach its maximum potential. The Company continues to focus on the customer on its path to grow larger and stronger while still achieving

community banking at its best, where each customer is a name, not a number.

1

The following table reconciles core earnings to net income, a GAAP financial measure:

| | |

| |

Consolidated | |

| | |

| |

Month

End | |

| | |

| |

10/31/2023 | | |

12/31/2022 | |

| | |

Net

Income | |

$ | 749,888 | | |

$ | 540,836 | |

| Add | |

Taxes | |

| 255,142 | | |

| 184,351 | |

| Add | |

Provision

for Credit Losses | |

| 405,870 | | |

| 238,028 | |

| | |

| |

$ | 1,410,900 | | |

$ | 963,215 | |

About OptimumBank Holdings, Inc.

OptimumBank Holdings, Inc. operates as

the bank holding company for OptimumBank that provides a range of consumer and commercial banking services to individuals and businesses.

The company accepts demand interest-bearing and noninterest-bearing, savings, money market,

NOW, and time deposit accounts, as well

as certificates of deposit; and offers residential and commercial real estate, commercial, and consumer loans, as well as lending lines

for working capital needs. It also provides debit and ATM cards; investment, cash management, and notary and night depository services;

and direct deposits, money orders, cashier’s checks, domestic collections, drive-in tellers, and banking by mail, as well as Internet

banking services. In addition, the company engages in holding, managing, and disposing foreclosed real estate. It operates through banking

offices located in Broward County, Florida. OptimumBank Holdings, Inc. was founded in 2000 and is based in Fort Lauderdale, Florida.

Safe Harbor Statement:

This press release contains forward-looking

statements that can be identified by terminology such as “believes,” “expects,” “potential,” “plans,”

“suggests,” “may,” “should,” “could,” “intends,” or similar expressions. Many

forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results to be materially

different from any future results or implied by such statements. These factors include, but are not limited to, our limited operating

history, managing our expected growth, risks associated with integration of acquired websites, possible inadvertent infringement of third-party

intellectual property rights, our ability to effectively compete, our acquisition strategy, and a limited public market for our common

stock, among other risks. OptimumBank Holdings, Inc.’s future results may also be impacted by other risk factors listed from time-to-time

in its SEC filings. Many factors are difficult to predict accurately and are generally beyond the company’s control. Forward looking

statements speak only as to the date they are made and OptimumBank Holdings, Inc. does not undertake to update forward-looking statements

to reflect circumstances or events that occur after the date the forward-looking statements are made.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

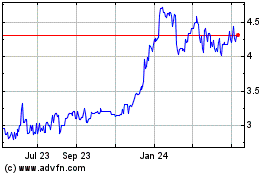

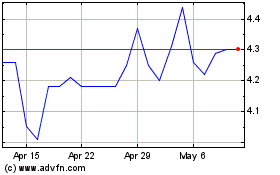

OptimumBank (NASDAQ:OPHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

OptimumBank (NASDAQ:OPHC)

Historical Stock Chart

From Apr 2023 to Apr 2024