false

0000924383

0000924383

2023-12-07

2023-12-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 7, 2023

Genasys Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

000-24248

|

87-0361799

|

|

(State or Other Jurisdiction of

Incorporation)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification No.)

|

|

16262 West Bernardo Drive

|

|

San Diego, California 92127

|

(Address of Principal Executive Offices)

858-676-1112

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14.a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, $.00001 par value per share

|

GNSS

|

NASDAQ Capital Market

|

|

Item 2.02

|

Results of Operations and Financial Condition.

|

The following information is furnished pursuant to Item 2.02, “Results of Operations and Financial Condition,” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. Such information, including Exhibit 99.1, shall not be incorporated by reference into any filing of Genasys Inc. (the “Company”), whether made before or after the date hereof, regardless of any general incorporation language in such filing.

On December 7, 2023, the Company issued a press release regarding its financial results for the fiscal year ended September 30, 2023. A copy of the press release is furnished as Exhibit 99.1 hereto, and is incorporated by reference herein.

|

Item 9.01

|

Financial Statements and Exhibits

|

(d) Exhibits.

|

Exhibit

Number

|

Description

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: December 7, 2023

|

|

Genasys Inc.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Dennis D. Klahn

|

|

|

|

|

Dennis D. Klahn

|

|

|

|

|

Chief Financial Officer

|

|

Exhibit 99.1

Genasys Inc. Reports Fiscal Fourth Quarter and Fiscal Year 2023 Financial Results

Genasys Protect Software Gaining Momentum

SAN DIEGO – December 7, 2023 – Genasys Inc. (NASDAQ: GNSS), the leader in Protective Communications, today announced financial results for the Company’s fiscal fourth quarter and full year ended September 30, 2023.

Richard S. Danforth, Chief Executive Officer of Genasys, Inc., commented, “As we announced in mid- September, our pipeline of hardware and software business continues to grow rapidly. This week’s announcements include some of the business that we had expected in the September quarter. We expect that we will book each of the forecasted hardware orders that shifted out of our fiscal 2023. In the fourth quarter of fiscal 2023, recurring revenues in our software business were up 43% year over year and 21% sequentially. Based on current contracting activity, the addition of Evertel Technologies, and partnerships with Tablet Command and Ladris, we now expect fiscal 2024 software revenue growth in excess of 100% year over year.”

Mr. Danforth continued, “The steady growth and expansion of our recurring software revenue is gaining momentum. Evertel, now branded Genasys Protect CONNECT, is already delivering strong synergies across our existing customer base. The integration with Tablet Command and added performance and functionality of Ladris expands the use cases and value of the Genasys Protect platform. Combined with our category-defining ACOUSTICS offerings, Genasys is rapidly expanding the differentiation of Protective Communications versus legacy mass notification solutions. The differentiation of Genasys Protect continues to displace incumbents and win the business that is already generating a rapidly growing Annual Recurring Revenue (ARR).”

Fiscal 4Q 2023 Financial Summary

| |

●

|

Revenue of $10.7 million, versus $16.0 million in 4Q 2022

|

| |

●

|

GAAP operating loss of ($2.6) million, versus ($12.8) million in 4Q 2022.

|

| |

●

|

Adjusted EBITDA of ($1.7) million, versus $1.6 million in 4Q 2022.

|

| |

●

|

GAAP net loss of ($10.1) million versus ($13.8) million in 4Q 2022. GAAP net loss per share ($0.27) versus ($0.38) in 4Q 2022.

|

| |

●

|

Adjusted net loss of ($2.7) million vs. ($0.7) million in 4Q 2022. Adjusted net loss per share of ($0.07) vs. ($0.02) per share in 4Q 2022

|

Fiscal 2023 Financial Summary

| |

●

|

Revenue of $46.7 million, versus $54.0 million in fiscal 2022

|

| |

●

|

GAAP operating loss of ($11.0) million, versus ($15.5) million in fiscal 2022.

|

| |

●

|

Adjusted EBITDA of ($6.8) million, versus $2.4 million in fiscal 2022.

|

| |

●

|

GAAP net loss of ($18.4) million versus a ($16.2) million in fiscal 2022. GAAP net loss per share of ($0.50) versus ($0.44) in fiscal 2022.

|

| |

●

|

Adjusted net loss of ($11.0) million vs. ($3.1) million in fiscal 2022. Adjusted net loss per share of ($0.30) vs. a loss of ($0.08) per share in fiscal 2022

|

Business Highlights

| |

●

|

Fortified the balance sheet with $10.6 Million of cash through follow-on offering of 5.75 million shares of common stock that closed shortly after quarter end

|

| |

●

|

Completed the acquisition of Evertel Technologies, LLC. and subsequently rebranded its offering as Genasys Protect CONNECT

|

| |

●

|

Announced key partnerships with Tablet Command and Ladris, each of which further differentiates Genasys Protect from mass notification solutions

|

| |

●

|

Genasys named a Strong Performer in The Forrester Wave™: Critical Event Management Platforms, Q4 2023 report

|

| |

●

|

Announced a Foreign Military Sales (FMS) order of LRAD equipment for middle eastern military defense force

|

| |

●

|

Won $1M prototype order from US Army for CROWS-AHD development

|

Business Outlook

Software pipeline and bookings continue to see robust growth. Recent competitive wins, the addition of Evertel and newly forged partnerships provide added sales pipeline and market differentiation. While our hardware pipeline continues to grow beyond the delayed orders from last fiscal year, lack of budgetary certainty is again expected to skew hardware revenues significantly toward the second half of our fiscal year. In fiscal 2024, Genasys now expects software revenues to more than double year over year, and hardware revenues to approach fiscal 2022 levels. Adjusted EBITDA for the full fiscal year is expected to improve versus fiscal 2023.

Fiscal 4Q 2023 Financial Review

Fiscal fourth quarter revenue was $10.7 million, a decrease of 33.3% from the record $16.0 million in the prior year's quarter. Software revenue decreased 3.2% and hardware revenue decreased 35.6%, compared with the fiscal 2022 fourth quarter. Within Software, quarterly recurring revenue increased 43.1% year over year. As the company discussed in its September 18th press release, several hardware opportunities that were expected to be booked and recognized for revenue in the period have been delayed until fiscal 2024.

Gross profit margin was 49.6%, compared with 49.5% in the fourth quarter of fiscal 2022.

Operating expenses of $7.9 million increased from $7.5 million in fiscal 4Q 2022, excluding last year’s one-time, non-cash goodwill impairment of $13.2 million. Selling, general and administrative expenses increased 5.8% from $5.8 million in the prior year to $6.2 million in the quarter ended September 30, 2023. Research and development expenses increased 4.4% year-over-year from the addition of 13.3% more engineers over the prior year to increase the features and functionality of our software offerings.

GAAP net loss in the quarter was ($10.1) million, or ($0.27) per share, compared with a GAAP net loss of ($13.8) million, or ($0.38) per share, in the fourth quarter of fiscal 2022. Excluding the $7.4 million deferred tax expense in fiscal 2023 and the $13.2 goodwill impairment in 4Q 2022, 2023 fiscal fourth quarter adjusted net loss was ($2.7) million, or ($0.07) per share, compared with an adjusted net loss of ($0.7) million, or ($0.02) per share in the prior year period. The increase in adjusted net loss was primarily due to lower hardware revenues and increased operating expenses resulting from additional engineering, sales and marketing employees.

Adjusted EBITDA was ($1.7) million for the fourth quarter of fiscal 2023, compared with $1.6 million for the prior fiscal year period.

Fiscal 2023 Financial Review

Revenue for fiscal 2023 was $46.7 million, compared with $54.0 million in the same period last year. Software revenue increased 22.7% and hardware revenue decreased 15.8%, compared with fiscal 2022. As the company discussed in its September 18th press release, several hardware opportunities that were expected to be booked and recognized for revenue in the period have been delayed until fiscal 2024.

Gross profit margin was 46.6%, compared with 50.5% in the prior fiscal year. The decrease in gross profit margin was due primarily to the higher cost of components costs in fiscal 2023 shipments that were booked prior to inflationary component cost increases being realized, and lower overall sales volume.

Excluding last year’s one-time, non-cash Goodwill Impairment of $13.2 million, fiscal 2022 operating expenses of $29.6 million increased to $32.7 million in fiscal year 2023. Selling, general and administrative expenses increased 8.8% from $22.6 million in the prior year to $24.6 million in fiscal 2023. Research and development expenses increased 15.9% year-over-year due to intentional investment to increase the features and functionality of our software offerings.

GAAP net loss for the fiscal year was ($18.4) million, or ($0.50) per share, compared with a GAAP net loss of ($16.2) million, or ($0.44) per share, in fiscal 2022. Excluding the $7.4 million deferred tax expense in fiscal 2023 and the $13.2 million goodwill impairment in fiscal 2022, 2023 fiscal year adjusted net loss was ($11.0) million, or ($0.30) per share, compared with an adjusted net loss of ($3.1) million, or ($0.08) per share in the prior year period. The increase in adjusted net loss was primarily due to lower hardware revenues and increased operating expenses resulting from additional engineering, sales and marketing employees.

Adjusted EBITDA was ($6.8) million in fiscal 2023, compared with $2.4 million in fiscal 2022.

Cash, cash equivalents and marketable securities totaled $10.1 million as of September 30, 2023, compared with $19.9 million as of September 30, 2022. Accounts receivable at quarter end totaled $6.0 million versus $6.7 million as of September 30, 2022. Since the quarter end, the Company completed the acquisition of Evertel Technologies LLC as well as a follow-on offering of 5.75 million shares of common stock. Combined the two actions resulted in the addition of approximately $9.6 million in net proceeds to the balance sheet.

We include in this press release Non-GAAP operational metrics of adjusted EBITDA, adjusted net loss, and adjusted net loss per share, which we believe provide helpful information to investors with respect to evaluating the Company’s performance. Adjusted EBITDA represents our net income before other income, net, income tax expense (benefit), depreciation and amortization expense and stock-based compensation. We do not consider these items to be indicative of our core operating performance. The items that are non-cash include depreciation and amortization expense and stock-based compensation. Adjusted EBITDA is a measure used by management to understand and evaluate our core operating performance and trends and to generate future operating plans, make strategic decisions regarding allocation of capital and invest in initiatives that are focused on cultivating new markets for our solutions. In particular, the exclusion of certain expenses in calculating adjusted EBITDA facilitates comparisons of our operating performance on a period-to-period basis.

Webcast and Conference Call Details

Management will host a conference call to discuss the financial results for the fourth quarter of fiscal year 2023 this afternoon at 4:30 p.m. Eastern Time / 1:30 p.m. Pacific Time. To access the conference call, dial toll-free (888) 390-3967, or international at (862) 298-0702. A webcast will also be available at the following link: https://www.webcaster4.com/Webcast/Page/1375/49520

Questions to management may be submitted before the call by emailing them to: ir@genasys.com. A replay of the webcast will be available approximately four hours after the presentation on the page of the Company’s website.

About Genasys Inc.

Genasys Inc. (NASDAQ: GNSS) is the global leader in Protective Communications Solutions and Systems, designed around one premise: ensuring organizations and public safety agencies are “Ready when it matters™”. The company provides the Genasys Protect platform, the most comprehensive portfolio of preparedness, response, and analytics software and systems, as well as Genasys Long Range Acoustic Devices (LRAD®) that deliver directed, audible voice messages with exceptional vocal clarity from close range to 5,500 meters. Genasys serves state and local governmental agencies, and education (SLED); enterprise organizations in critical sectors such as oil and gas, utilities, manufacturing, and automotive; and federal governments and the military. Genasys Protective Communications Solutions have diverse applications, including emergency warning and mass notification for public safety, critical event management for enterprise companies, de-escalation for defense and law enforcement, and automated detection of real-time threats like active shooters and severe weather. Today, Genasys protects over 70 million people globally and is used in more than 100 countries, including more than 500 cities, counties, and states in the U.S. For more information, visit genasys.com.

Forward-Looking Statements

Except for historical information contained herein, the matters discussed are forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. You should not place undue reliance on these statements. We base these statements on particular assumptions that we have made in light of our industry experience, the stage of product and market development as well as our perception of historical trends, current market conditions, current economic data, expected future developments and other factors that we believe are appropriate under the circumstances. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those suggested in any forward-looking statement. The risks and uncertainties in these forward-looking statements include without limitation the business impact of geopolitical conflict, epidemics or pandemics, and other causes that may affect our supply chain, and other risks and uncertainties, many of which involve factors or circumstances that are beyond the Company's control. Risks and uncertainties are identified and discussed in our filings with the Securities and Exchange Commission. These forward-looking statements are based on information and management's expectations as of the date hereof. Future results may differ materially from our current expectations. For more information regarding other potential risks and uncertainties, see the "Risk Factors" section of the Company's Form 10-K for the fiscal year ended September 30, 2023. Genasys Inc. disclaims any intent or obligation to publicly update or revise forward-looking statements, except as otherwise specifically stated.

Investor Relations Contacts

Brian Alger, CFA

SVP, IR and Corporate Development

ir@genasys.com

(858) 676-0582

|

Genasys Inc.

|

|

|

Condensed Consolidated Balance Sheets

|

|

|

(Unaudited - in thousands)

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

8,665 |

|

|

$ |

12,736 |

|

|

Short-term marketable securities

|

|

|

1,481 |

|

|

|

6,397 |

|

|

Restricted cash

|

|

|

758 |

|

|

|

100 |

|

|

Accounts receivable, net

|

|

|

5,952 |

|

|

|

6,744 |

|

|

Inventories, net

|

|

|

6,501 |

|

|

|

6,008 |

|

|

Prepaid expenses and other

|

|

|

1,851 |

|

|

|

3,577 |

|

|

Total current assets

|

|

|

25,208 |

|

|

|

35,562 |

|

|

Long-term marketable securities

|

|

|

- |

|

|

|

781 |

|

|

Long-term restricted cash

|

|

|

96 |

|

|

|

823 |

|

|

Deferred tax assets, net

|

|

|

- |

|

|

|

7,373 |

|

|

Property and equipment, net

|

|

|

1,551 |

|

|

|

1,757 |

|

|

Goodwill

|

|

|

10,282 |

|

|

|

10,118 |

|

|

Intangible assets, net

|

|

|

8,427 |

|

|

|

10,505 |

|

|

Operating lease right of use asset

|

|

|

3,886 |

|

|

|

4,541 |

|

|

Prepaid expenses and other - noncurrent

|

|

|

455 |

|

|

|

394 |

|

|

Total assets

|

|

$ |

49,905 |

|

|

$ |

71,854 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

2,785 |

|

|

$ |

2,334 |

|

|

Accrued liabilities

|

|

|

7,466 |

|

|

|

12,083 |

|

|

Operating lease liabilities, current portion

|

|

|

1,008 |

|

|

|

948 |

|

|

Total current liabilities

|

|

|

11,259 |

|

|

|

15,365 |

|

| |

|

|

|

|

|

|

|

|

|

Other liabilities, noncurrent

|

|

|

551 |

|

|

|

907 |

|

|

Operating lease liabilities, noncurrent

|

|

|

4,283 |

|

|

|

5,189 |

|

|

Total liabilities

|

|

|

16,093 |

|

|

|

21,461 |

|

| |

|

|

|

|

|

|

|

|

|

Total stockholders' equity

|

|

|

33,812 |

|

|

|

50,393 |

|

|

Total liabilities and stockholders' equity

|

|

$ |

49,905 |

|

|

$ |

71,854 |

|

|

Genasys Inc.

|

|

|

Condensed Consolidated Statements of Operations

|

|

|

(Unaudited - in thousands, except per share amounts)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended

|

|

|

Years ended

|

|

| |

|

September 30,

|

|

|

September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

(unaudited)

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

$ |

10,700 |

|

|

$ |

16,038 |

|

|

$ |

46,663 |

|

|

$ |

54,035 |

|

|

Cost of revenues

|

|

|

5,391 |

|

|

|

8,105 |

|

|

|

24,901 |

|

|

|

26,759 |

|

|

Gross profit

|

|

|

5,309 |

|

|

|

7,933 |

|

|

|

21,762 |

|

|

|

27,276 |

|

| |

|

|

49.6 |

% |

|

|

49.5 |

% |

|

|

46.6 |

% |

|

|

50.5 |

% |

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative

|

|

|

6,178 |

|

|

|

5,841 |

|

|

|

24,621 |

|

|

|

22,635 |

|

|

Impairment of goodwill

|

|

|

- |

|

|

|

13,162 |

|

|

|

- |

|

|

|

13,162 |

|

|

Research and development

|

|

|

1,770 |

|

|

|

1,696 |

|

|

|

8,127 |

|

|

|

7,010 |

|

|

Total operating expenses

|

|

|

7,948 |

|

|

|

20,699 |

|

|

|

32,748 |

|

|

|

42,807 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) income from operations

|

|

|

(2,639 |

) |

|

|

(12,766 |

) |

|

|

(10,986 |

) |

|

|

(15,531 |

) |

|

Other income and expense, net

|

|

|

(6 |

) |

|

|

48 |

|

|

|

(10 |

) |

|

|

60 |

|

|

(Loss) income before income taxes

|

|

|

(2,645 |

) |

|

|

(12,718 |

) |

|

|

(10,996 |

) |

|

|

(15,471 |

) |

|

Income tax (benefit) expense

|

|

|

7,417 |

|

|

|

1,108 |

|

|

|

7,400 |

|

|

|

741 |

|

|

Net (loss) income

|

|

$ |

(10,062 |

) |

|

$ |

(13,826 |

) |

|

$ |

(18,396 |

) |

|

$ |

(16,212 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income per common share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

(0.27 |

) |

|

$ |

(0.38 |

) |

|

$ |

(0.50 |

) |

|

$ |

(0.44 |

) |

|

Diluted

|

|

$ |

(0.27 |

) |

|

$ |

(0.38 |

) |

|

$ |

(0.50 |

) |

|

$ |

(0.44 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

37,190 |

|

|

|

36,599 |

|

|

|

36,939 |

|

|

|

36,495 |

|

|

Diluted

|

|

|

37,190 |

|

|

|

36,599 |

|

|

|

36,939 |

|

|

|

36,495 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of GAAP measures to non-GAAP measures

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income

|

|

$ |

(10,062 |

) |

|

$ |

(13,826 |

) |

|

$ |

(18,396 |

) |

|

$ |

(16,212 |

) |

|

Other income and expense, net

|

|

|

6 |

|

|

|

(48 |

) |

|

|

10 |

|

|

|

(60 |

) |

|

Income tax (benefit) expense

|

|

|

7,417 |

|

|

|

1,108 |

|

|

|

7,400 |

|

|

|

741 |

|

|

Impairment of goodwill

|

|

|

- |

|

|

|

13,162 |

|

|

|

- |

|

|

|

13,162 |

|

|

Depreciation and amortization

|

|

|

640 |

|

|

|

636 |

|

|

|

2,558 |

|

|

|

2,556 |

|

|

Stock based compensation

|

|

|

313 |

|

|

|

577 |

|

|

|

1,642 |

|

|

|

2,227 |

|

|

Adjusted EBITDA

|

|

$ |

(1,686 |

) |

|

$ |

1,609 |

|

|

$ |

(6,786 |

) |

|

$ |

2,414 |

|

v3.23.3

Document And Entity Information

|

Dec. 07, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Genasys Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Dec. 07, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

000-24248

|

| Entity, Tax Identification Number |

87-0361799

|

| Entity, Address, Address Line One |

16262 West Bernardo Drive

|

| Entity, Address, City or Town |

San Diego

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

92127

|

| City Area Code |

858

|

| Local Phone Number |

676-1112

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common stock

|

| Trading Symbol |

GNSS

|

| Security Exchange Name |

NASDAQ

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000924383

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

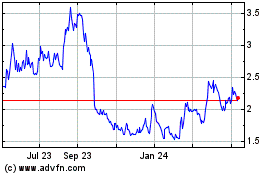

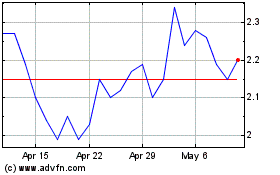

Genasys (NASDAQ:GNSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Genasys (NASDAQ:GNSS)

Historical Stock Chart

From Apr 2023 to Apr 2024