0000785557false2023FY00007855572022-10-012023-09-3000007855572023-03-31iso4217:USD00007855572023-12-04xbrli:shares00007855572021-10-012022-09-30iso4217:USDxbrli:shares0000785557dlhc:GRSIMember2021-10-012022-09-3000007855572023-09-3000007855572022-09-3000007855572021-09-300000785557us-gaap:CommonStockMember2022-09-300000785557us-gaap:AdditionalPaidInCapitalMember2022-09-300000785557us-gaap:RetainedEarningsMember2022-09-300000785557us-gaap:CommonStockMember2022-10-012023-09-300000785557us-gaap:AdditionalPaidInCapitalMember2022-10-012023-09-300000785557us-gaap:RetainedEarningsMember2022-10-012023-09-300000785557us-gaap:CommonStockMember2023-09-300000785557us-gaap:AdditionalPaidInCapitalMember2023-09-300000785557us-gaap:RetainedEarningsMember2023-09-300000785557us-gaap:CommonStockMember2021-09-300000785557us-gaap:AdditionalPaidInCapitalMember2021-09-300000785557us-gaap:RetainedEarningsMember2021-09-300000785557us-gaap:CommonStockMember2021-10-012022-09-300000785557us-gaap:AdditionalPaidInCapitalMember2021-10-012022-09-300000785557us-gaap:RetainedEarningsMember2021-10-012022-09-300000785557srt:MinimumMember2023-09-300000785557srt:MaximumMember2023-09-300000785557dlhc:FacilitiesandEquipmentMembersrt:MinimumMember2023-09-300000785557dlhc:FacilitiesandEquipmentMembersrt:MaximumMember2023-09-300000785557us-gaap:EmployeeStockOptionMember2022-10-012023-09-300000785557dlhc:GRSIMember2022-12-08xbrli:pure0000785557dlhc:GRSIMember2022-12-082022-12-080000785557us-gaap:CommonStockMemberdlhc:GRSIMember2022-12-082022-12-080000785557dlhc:GRSIMember2022-10-012023-09-300000785557us-gaap:CustomerConcentrationRiskMemberdlhc:DepartmentofHealthandHumanServicesMemberus-gaap:RevenueFromContractWithCustomerMember2022-10-012023-09-300000785557us-gaap:CustomerConcentrationRiskMemberdlhc:DepartmentofHealthandHumanServicesMemberus-gaap:RevenueFromContractWithCustomerMember2021-10-012022-09-300000785557us-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberdlhc:DepartmentOfVeteransAffairsMember2022-10-012023-09-300000785557us-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberdlhc:DepartmentOfVeteransAffairsMember2021-10-012022-09-300000785557us-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberdlhc:DepartmentOfDefenseMember2022-10-012023-09-300000785557us-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberdlhc:DepartmentOfDefenseMember2021-10-012022-09-300000785557us-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberdlhc:DepartmentOfHomelandSecurityMember2022-10-012023-09-300000785557us-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberdlhc:DepartmentOfHomelandSecurityMember2021-10-012022-09-300000785557us-gaap:CustomerConcentrationRiskMemberdlhc:OtherCustomersMemberus-gaap:RevenueFromContractWithCustomerMember2022-10-012023-09-300000785557us-gaap:CustomerConcentrationRiskMemberdlhc:OtherCustomersMemberus-gaap:RevenueFromContractWithCustomerMember2021-10-012022-09-300000785557us-gaap:TimeAndMaterialsContractMember2022-10-012023-09-300000785557us-gaap:TimeAndMaterialsContractMember2021-10-012022-09-300000785557dlhc:CostPlusFixedFeeContractMember2022-10-012023-09-300000785557dlhc:CostPlusFixedFeeContractMember2021-10-012022-09-300000785557us-gaap:FixedPriceContractMember2022-10-012023-09-300000785557us-gaap:FixedPriceContractMember2021-10-012022-09-300000785557us-gaap:SalesChannelDirectlyToConsumerMember2022-10-012023-09-300000785557us-gaap:SalesChannelDirectlyToConsumerMember2021-10-012022-09-300000785557us-gaap:SalesChannelThroughIntermediaryMember2022-10-012023-09-300000785557us-gaap:SalesChannelThroughIntermediaryMember2021-10-012022-09-30dlhc:subleasedlhc:sublease_option0000785557us-gaap:CustomerRelationshipsMember2023-09-300000785557us-gaap:CustomerRelationshipsMember2022-09-300000785557dlhc:BacklogMember2023-09-300000785557dlhc:BacklogMember2022-09-300000785557us-gaap:TradeNamesMember2023-09-300000785557us-gaap:TradeNamesMember2022-09-300000785557us-gaap:NoncompeteAgreementsMember2023-09-300000785557us-gaap:NoncompeteAgreementsMember2022-09-300000785557us-gaap:RevolvingCreditFacilityMember2023-09-300000785557us-gaap:RevolvingCreditFacilityMember2022-09-300000785557us-gaap:SecuredDebtMember2023-09-300000785557us-gaap:SecuredDebtMember2022-09-300000785557us-gaap:MediumTermNotesMemberus-gaap:SecuredDebtMember2023-09-300000785557us-gaap:MediumTermNotesMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:SecuredDebtMember2022-10-012023-09-300000785557us-gaap:MediumTermNotesMemberus-gaap:SecuredDebtMember2022-09-300000785557dlhc:LIBOR1Memberus-gaap:MediumTermNotesMemberus-gaap:SecuredDebtMember2021-10-012022-09-300000785557us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredDebtMember2023-09-300000785557us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:SecuredDebtMember2022-10-012023-09-300000785557us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredDebtMember2022-09-300000785557dlhc:LIBOR1Memberus-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredDebtMember2021-10-012022-09-300000785557us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-09-300000785557dlhc:LIBOR1Memberus-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredDebtMember2022-09-300000785557dlhc:MaturityOneMember2023-09-300000785557us-gaap:InterestRateSwapMemberdlhc:MaturityOneMember2023-09-300000785557dlhc:MaturityTwoMember2023-09-300000785557dlhc:MaturityTwoMemberus-gaap:InterestRateSwapMember2023-09-300000785557us-gaap:InterestRateSwapMember2022-10-012023-09-300000785557us-gaap:MediumTermNotesMemberus-gaap:SecuredDebtMember2022-10-012023-09-300000785557us-gaap:MediumTermNotesMemberus-gaap:SecuredDebtMembersrt:MaximumMember2022-10-012023-09-300000785557us-gaap:MediumTermNotesMembersrt:MinimumMemberus-gaap:SecuredDebtMember2022-10-012023-09-300000785557us-gaap:MediumTermNotesMemberus-gaap:SecuredDebtMemberdlhc:ExcessCashFlowsGreaterThanOrEqualto2.50Member2022-10-012023-09-300000785557us-gaap:MediumTermNotesMemberdlhc:ExcessCashFlowsLessThan2.50ButGreaterThan1.50Memberus-gaap:SecuredDebtMember2022-10-012023-09-300000785557us-gaap:MediumTermNotesMemberus-gaap:SecuredDebtMemberdlhc:ExcessCashFlowsLessThan250Member2022-10-012023-09-300000785557us-gaap:MediumTermNotesMemberdlhc:ExcessCashFlowsEqualto1.50Memberus-gaap:SecuredDebtMember2022-10-012023-09-300000785557us-gaap:MediumTermNotesMemberus-gaap:SecuredDebtMemberdlhc:ExcessCashFlowsLessThan1.50Member2022-10-012023-09-300000785557us-gaap:StandbyLettersOfCreditMemberus-gaap:SecuredDebtMember2023-09-300000785557us-gaap:EmployeeStockOptionMemberdlhc:OmnibusEquityIncentivePlan2016Member2022-10-012023-09-300000785557us-gaap:EmployeeStockOptionMember2023-09-300000785557us-gaap:SellingGeneralAndAdministrativeExpensesMemberdlhc:DLHEmployeesMember2022-10-012023-09-300000785557us-gaap:SellingGeneralAndAdministrativeExpensesMemberdlhc:DLHEmployeesMember2021-10-012022-09-300000785557dlhc:NonemployeeDirectorsMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2022-10-012023-09-300000785557dlhc:NonemployeeDirectorsMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2021-10-012022-09-300000785557us-gaap:RestrictedStockUnitsRSUMember2022-10-012023-09-300000785557us-gaap:RestrictedStockUnitsRSUMember2021-10-012022-09-300000785557us-gaap:RestrictedStockUnitsRSUMemberdlhc:NamedExecutiveOfficerMember2022-10-012023-09-300000785557us-gaap:PerformanceSharesMemberdlhc:NamedExecutiveOfficerMember2022-10-012023-09-300000785557dlhc:NamedExecutiveOfficerMemberdlhc:ServiceBasedRestrictedStockUnitsMember2022-10-012023-09-300000785557dlhc:PerformanceBasedRestrictedStockAwardsRevenueMember2022-10-012023-09-300000785557dlhc:PerformanceBasedRestrictedStockAwardsStockPriceMember2022-10-012023-09-300000785557us-gaap:RestrictedStockUnitsRSUMemberdlhc:NonemployeeDirectorsMember2022-10-012023-09-300000785557us-gaap:RestrictedStockUnitsRSUMemberdlhc:NonemployeeDirectorsMember2021-10-012022-09-300000785557dlhc:DLHEmployeesMember2023-09-300000785557dlhc:DLHEmployeesMember2022-09-300000785557dlhc:DLHEmployeesMember2022-10-012023-09-300000785557us-gaap:EmployeeStockOptionMemberdlhc:FairValueAssumptionOneMember2023-01-260000785557us-gaap:EmployeeStockOptionMemberdlhc:FairValueAssumptionOneMember2023-01-262023-01-260000785557dlhc:FairValueAssumptionTwoMemberus-gaap:EmployeeStockOptionMember2022-08-010000785557dlhc:FairValueAssumptionTwoMemberus-gaap:EmployeeStockOptionMember2022-08-012022-08-010000785557us-gaap:EmployeeStockOptionMemberdlhc:FairValueAssumptionThreeMember2022-08-010000785557us-gaap:EmployeeStockOptionMemberdlhc:FairValueAssumptionThreeMember2022-08-012022-08-010000785557dlhc:FacilityLeasesMember2023-09-300000785557dlhc:EquipmentLeasesMember2023-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | | | | | | | |

| (Mark One) | | |

| ☒ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2023 |

| ☐ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission File No. 0-18492

DLH HOLDINGS CORP.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

| New Jersey | | 22-1899798 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.)

|

| 3565 Piedmont Road, | Building 3, | Suite 700 | | | 30305 |

| Atlanta, | Georgia | | | | (Zip code) |

(Address of principal executive offices) | | |

(770) 554-3545

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act

| | | | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

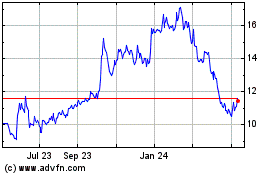

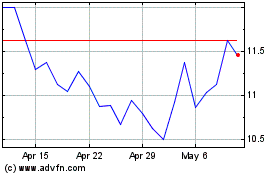

| Common Stock | DLHC | Nasdaq | Capital Market |

Securities registered pursuant to Section 12(g) of the Securities Exchange Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15 (d) of the Securities Exchange Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act. (check one): | | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☒ |

| Non-accelerated filer | ☐ | | Smaller Reporting Company | ☒ |

| | | Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accountant standards provided pursuant to Section 13(a) of the Exchange Act. Yes o No ý

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ý

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ý

The aggregate market value of the voting and non-voting common equity held by non-affiliates, as of the last business day of the registrant's most recently completed second fiscal quarter, March 31, 2023, was $91,396,871.

As of December 4, 2023 there were 14,067,732 shares of the Registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this report incorporates information by reference from the Company's definitive proxy statement, which proxy statement is due to be filed with the Securities and Exchange Commission not later than 120 days after September 30, 2023.

TABLE OF CONTENTS

| | | | | | | | |

| | |

| | | PAGE |

PART I | |

| | |

| | |

Item 1B. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

PART II | |

Item 5. | | |

Item 6. | | |

Item 7. | | |

| | |

Item 8. | | |

Item 9. | | |

| | |

Item 9B. | | |

| | |

PART III | |

Item 10. | | |

Item 11. | | |

Item 12. | | |

Item 13. | | |

Item 14. | | |

PART IV | |

Item 15. | | |

| | |

PART I

FORWARD-LOOKING STATEMENTS

Certain information included or incorporated by reference in this document may not address historical facts and, therefore, could be interpreted to be “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995 and other federal securities laws. All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including projections of financial performance; statements of plans, strategies and objectives of management for future operations; any statement concerning developments, performance or industry rankings relating to products or services; any statements regarding future economic conditions or performance; any statements of assumptions underlying any of the foregoing; and any other statements that address activities, events or developments that DLH Holdings Corp and its subsidiaries (“DLH” or the “Company” and also referred to as “we,” “us” and “our”) intends, expects, projects, believes or anticipates will or may occur in the future. Forward-looking statements may be characterized by terminology such as “believe,” “anticipate,” “expect,” “should,” “intend,” “plan,” “will,” “estimates,” “projects,” “strategy” and similar expressions. These statements are based on assumptions and assessments made by the Company’s management in light of its experience and its perception of historical trends, current conditions, expected future developments and other factors it believes to be appropriate. Any such forward-looking statements are not guarantees of future performance (financial or operating), and actual results, developments and business decisions may differ materially from those envisioned by such forward-looking statements. These forward-looking statements are subject to a number of risks and uncertainties that include but are not limited to the following: the failure to achieve the anticipated benefits of our recent acquisition or any future acquisition (including anticipated future financial operating performance and results); diversion of management’s attention from normal daily operations of the business and the challenges of managing larger and more widespread operations resulting from the acquisition; the inability to retain employees and customers; contract awards in connection with re-competes for present business and/or competition for new business; significant delays or reductions in appropriations for our programs, broader changes in United States ("U.S.") government funding and spending patterns or the inability of the U.S. government to approve new appropriations legislation and avoid a shutdown of its operations; the risks and uncertainties associated with customer interest in and purchases of new services; our ability to manage our increased debt obligations; compliance with new bank financial and other covenants; changes in customer budgetary priorities; government contract procurement (such as bid protest, small business set asides, loss of work due to organizational conflicts of interest, etc.) and termination risks; the ability to successfully integrate the operations of recent and any future acquisitions; regional and national economic conditions in the U.S. and globally, including but not limited to: terrorist activities or war, changes in interest rates, and significant fluctuations in the equity markets; the impact of inflation and higher interest rates; the impact of any epidemic, pandemic or health emergency, including the measures to mitigate its effects, and its impact on the economy and demand for our services; and the other risk factors set forth under Item 1A, Risk Factors, in this Annual Report on Form 10-K and in our other SEC filings. The forward-looking statements included herein apply only as of the date of this Annual Report on Form 10-K. The Company disclaims any duty to update such forward-looking statements, all of which are expressly qualified by the foregoing, except as may be required by law.

ITEM 1. BUSINESS

Overview and Background

DLH Holdings Corp. ("DLH") delivers improved health and cyber readiness solutions for federal government customers through digital transformation, science research and development, and systems engineering and integration. We bring a unique combination of government sector experience, proven methodology, and unwavering commitment to solve the complex problems faced by civilian and military customers alike, doing so by leveraging multiple capabilities, including cyber technology, artificial intelligence, advanced analytics, cloud-based applications, and telehealth systems.

DLH is a holding company operating through a number of operating subsidiaries. In December 2022, we acquired Grove Resource Solutions, LLC, which provides research and development, systems engineering and integration, and digital transformations solutions to federal agencies, notably the National Institutes of Health ("NIH"), U.S. Navy and U.S. Marine Corps.

Competitive Advantages

We believe we are advantageously positioned within our markets through a number of features including, but not limited to:

•highly credentialed workforce;

•predominantly performing as the prime contractor;

•strong past performance record across our government contracts; and

•strong bipartisan support for our key contracts.

We have invested in leading credentials and capabilities that we expect will deliver value to our customers. These investments include development of secure Information Technology ("IT") platforms; sophisticated data analytic tools and techniques; and implementation process improvement and quality assurance programs and techniques. We are actively pursuing additional credentials that will support our customers' ever evolving missions.

Solutions and Services

We primarily focus on improved deployment of large-scale health and defense initiatives for multiple agencies within the federal government, including the Department of Health and Human Services ("HHS"), the Department of Veterans Affairs ("VA"), Department of Defense ("DoD"), Department of Homeland Security ("DHS"), and many of their sub-agencies.

We deliver services primarily through prime contracts awarded by the federal government through competitive bidding processes. We have a diverse mix of contract vehicles with various agencies of the federal government, which supports our overall corporate growth strategy. Our revenue is distributed to time and materials contracts (56%), firm fixed price contracts (22%), and cost reimbursable contracts (22%).

We provide the following services and solutions, which are aligned with the long-term needs of our customers:

•Digital Transformation and Cyber Security;

•Science Research and Development; and

•Systems Engineering and Integration

Digital Transformation and Cyber Security

We provide critical digital transformation and cyber security solutions across the federal civilian and cyber defense communities, leveraging advanced technology to modernize obsolete systems, protect sensitive information, manage large datasets, and enhance operational efficiency. Our suite of tools includes artificial intelligence and machine learning, cloud enablement, cybersecurity ecosystem, big data analytics, and modeling and simulation.

IT modernization and cyber security maturity are priority initiatives throughout our customer set. Our customers, including numerous institutes and centers within the NIH, the Defense Health Agency ("DHA"), Tele-medicine and Advanced Technology Research Center ("TATRC"), and US Navy Naval Information Warfare Center ("NIWC"), rely on our information technology support to enable their vital missions. We work with these customers to reduce risk and build resilience to cyber and physical threats to the federal government’s infrastructure, providing the full spectrum of cyber capabilities, cryptographic and true cyber engineering, Certified Information Security Officer ("CISO") / Information System Security Officer ("ISSO") support, risk management frameworks, Continuity of Operations ("COOP") / Disaster Recovery, and enterprise infrastructure and cloud governance focused on designing and implementing zero trust architecture.

Science Research and Development

We advance scientific knowledge and understanding through our extensive research portfolio and domain expertise. We primarily provide large-scale data analytics, testing and evaluation, clinical trials research services, and epidemiology studies to support multiple operating divisions within HHS, including NIH and the Center for Disease Control and Prevention ("CDC"), as well as the Military Health System.

Our employees support innovative, cutting-edge research on emerging trends, health informatics analyses, and application of best practices including mobile, social, and interactive media. We leverage evidence-based methods and web technology to drive health equity to our most vulnerable populations through public engagement. Projects often involve highly specialized expertise and transformative R&D support services. Our decades of experience designing, conducting, and analyzing studies for our diverse customer base, and our full-service clinical research solutions are designed for each customer’s specific research development program. Our employees provide expert knowledge and experience that supports our customers’ missions.

System Engineering and Integration

Our employees specialize in delivering engineering solutions that support our customers' evolving needs by rapidly deploying resources, solutions, and services. This includes specialized engineering expertise, encompassing areas of pharmaceutical delivery logistics, fire protection engineering, biomedical equipment, and technology engineering on behalf of the VA, NIWC, HHS and other federal customers.

We utilize automation to accelerate infrastructure innovation and help customers define a lifecycle for automation assets, as well as set standards for version control, testing, and release processes that proved a robust foundation for their customers. DLH delivers IT operational resilience and efficiency in parallel with technology innovation integration, via hybrid and multi-cloud solutions, leveraging integrated services, process automation, advanced tool stacks, and mature quality processes. Our employees engineer, implement, and operate solutions that demonstrate measurable results to satisfy our customer’s management requirements, thus helping customers to confidently deploy secure platforms and technologies that reduce operational costs. We have invested in agile software development credentials for our technical staff, and have achieved Capability Maturity Model Integration ("CMMI") level 3. Our enterprise lifecycle logistics support services encompass military systems deployed worldwide, as well as scientific and IT systems and peripherals for Federal civilian agencies.

Major Customers

Our revenues are from agencies of the U.S. Federal government. A major customer is defined as a customer from whom we derive at least 10% of our revenues. The following table summarizes the revenues by customer for the years ended September 30, 2023 and 2022, respectively (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | 2023 | | 2022 |

| | | | | | Revenue | Percent of total revenue | | Revenue | Percent of total revenue |

| Department of Health and Human Services | | | | | | $ | 161,311 | | 42.9 | % | | $ | 102,201 | | 25.9 | % |

| Department of Veterans Affairs | | | | | | 138,862 | | 37.0 | % | | 126,106 | | 31.9 | % |

| Department of Defense | | | | | | 70,325 | | 18.7 | % | | 33,612 | | 8.5 | % |

| Department of Homeland Security | | | | | | 919 | | 0.2 | % | | 126,576 | | 32.0 | % |

| Customers with less than 10% share of total revenue | | | | | | 4,455 | | 1.2 | % | | 6,678 | | 1.7 | % |

Revenue | | | | | | $ | 375,872 | | 100.0 | % | | $ | 395,173 | | 100.0 | % |

Major Contracts

We operate primarily through prime contracts awarded by the government through competitive bidding processes. We have a diverse mix of contract vehicles with various agencies of the U.S. government, which supports our overall corporate growth strategy. A major contract is defined as a contract or set of contracts from which we derive at least 10% of our revenues.

The revenue attributable to the VA was derived from 16 separate contracts covering the Company's performance of pharmacy and logistics services in support of the VA's Consolidated Mail Outpatient Pharmacy ("CMOP") program.

•Nine contracts for pharmacy services, which represent approximately $79.6 million and $70.4 million of revenues for the years ended September 30, 2023 and 2022, respectively, are currently operating under a bridge contract through December 31, 2023.

•Seven contracts for logistics services represent approximately $59.2 million and $55.7 million of revenues for the years ended September 30, 2023 and 2022, respectively, are currently operating under a bridge contract through December 31, 2023.

The VA has issued a request for proposal for healthcare logistics and pharmacy services for each CMOP location. The procurements were set-aside for a service-disabled veteran owned small business ("SDVOSB") as the prime contractor. DLH maintains relationships with SDVOSB partners. Should the new contracts for performance of these services be awarded to a partner of DLH, the Company expects to continue to perform a significant amount of the contract’s volume of business as a subcontractor. Should the VA conclude that an award to an SDVOSB prime contractor is not in the best interest of the government, they may reissue a solicitation in an unrestricted competition. DLH believes that its service excellence over many years on the program would provide an advantage in any competition.

Backlog

At September 30, 2023, our backlog was approximately $704.8 million, of which $169.9 million was funded backlog. At September 30, 2022 our backlog was $482.5 million, of which $98.9 million was funded backlog.

We define backlog as our estimate of remaining future revenue from existing signed contracts, assuming the exercise of all options relating to such contracts and including executed task orders issued under Indefinite Quantity/Indefinite Delivery ("IDIQ") contracts or if the contract is a single award IDIQ contract.

We define funded backlog as the portion of backlog for which funding is appropriated and allocated to the contract by the customer and authorized for payment by the customer, once specified work is completed. Funded backlog does not include the full contract value as funding for contracts occurs on a periodic basis.

Circumstances and events may cause changes in the amount of our backlog and funded backlog, including the execution of new contracts, extension of existing contracts, non-renewal or completion of current contracts, early termination, and adjustments to estimates. Changes in funded backlog may be affected by the funding cycles of the government. While no assurances can be given that existing contracts will result in earned revenue in any future period, or at all, our major customers have historically exercised their contractual renewal options.

Backlog value is quantified from management's judgment and assumptions about the volume of services based on past volume trends and current planning developed with customers.

Competitive Landscape

Competitive solicitations and long business development cycles are characteristics of the government and defense industry in which we operate. For major program competition, the business acquisition cycle typically ranges from 18 to 36 months. Companies may pursue work either as prime contractor or partner with other companies in a subcontractor role. Those competing as prime contractors normally expend substantially more resources than those in subcontractor roles. We predominantly are the prime contractor on our contracts with federal government customers and compete with several large and small-business companies in pursuit of acquiring new business. In some cases, we seek to partner with other companies on new business pursuits to improve our competitive positioning with the customer.

Our competitors include operating units within: Deloitte, Booz Allen Hamilton Holding Corp., CACI International, Inc., BAE Systems, ICF International, Inc., Leidos Holdings, Inc., Mantech International Corp., Aglient Technologies Inc., MAXIMUS, Inc., UnitedHealth Group, Inc. operating under Optum, and Westat, Inc.

We compete with these companies by leveraging our differentiating suite of tools and uniquely integrating people and processes and a solid track record of past performance, resulting in highly competitive proposals. We believe that our proprietary tools and processes, including e-PRAT® and SPOT-m®, along with our Infinibyte® cloud-based management system differentiate us from our competitors. We compete for awards through a full and open competition on a best-value basis. We draw heavily from our consistently high-quality past performance ratings, proven and evolving technical differentiators, key personnel credentials and growing market recognition to compete. We believe that our track record, knowledge and processes with respect to government contract bidding represent significant competitive advantages. Further, we believe that the range and depth of educational experience and professional credentials and certifications held by our employees allows us to deploy highly qualified teams to implement solutions to address the needs of our customers. Our recent and future success in this competitive landscape hinges on our ability to continue to uniquely integrate people, processes and technology tools to deliver best value solutions for our targeted customers (both government and industry partners).

Additionally, the Federal government may elect to restrict certain procurement activity, including renewals of our current contracts, to bidders that qualify for certain special statuses such as veteran owned, small, or small disadvantaged businesses. For those efforts, we would be limited to a subcontractor role.

Seasonality

The U.S. government's fiscal year ends on September 30 each year. It is not uncommon for U.S. government agencies to award extra tasks or complete other contract actions within this timeframe leading up to the fiscal year end in order to avoid losses of unexpended fiscal year funds.

Regulation

Our business is affected by numerous laws and regulations relating to the award, administration and performance of U.S. Government contracts. In addition, many federal and state laws materially affect our operations. These laws relate to ethics, labor, tax, and employment matters. As any employer is, we are subject to federal and state statutes and regulations governing their standards of business conduct with the government, including that government contracts typically contain provisions permitting government customers to terminate contracts without cause with limited notice or compensation. The development of additional statutes and regulations and interpretation of existing statutes and regulations with respect to our industry can be expected to evolve over time. Through our corporate membership with the Professional Services Council and other affiliations, we monitor proposed and pending regulations from relevant congressional committees and government agency policies that have potential impact upon our industry and our specific strategically targeted markets. As with any commercial enterprise, we cannot predict with certainty the nature or direction of the development of Federal statutes and regulations that will affect its business operations. See Risk Factors in Part I, Item 1A.

Intellectual Property

Our business involves providing services to government entities, our operations generally are not substantially dependent upon obtaining and/or maintaining copyright or trademark protections, although our operations make use of such protections and benefit from them as discriminators in competition. We claim copyright, trademark and other proprietary rights in a variety of intellectual property, including each of our proprietary computer software and data products and the related documentation. We hold the trademarks, e-PRAT® and SPOT-m®, for our offerings that optimize resource allocation and supply chain management processes in connection with our business process management services, as well as the registered trademark, Infinibyte®, for our cloud-based solution. We maintain a number of trade secrets that contribute to our success and competitive distinction and endeavor to accord such trade secrets adequate protection to ensure their continuing availability.

Human Capital Management and Employee Relations

Our employees are critical to our success and are the reason we continue to execute at a high level. We believe our continued focus on making employee engagement a top priority will help us provide high quality insights and information to our customers.

As of September 30, 2023, we employed approximately 3,200 employees performing throughout the U.S. and one location overseas. Management believes that it has good relations with its employees.

Vision and Values

DLH’s vision is to be the most trusted provider of technology solutions and readiness enhancement services to Federal civilian and military agencies. Through our work, DLH supports Military Service Members, Veterans, children and families, and other at-risk and underserved communities. As a market influencer and emerging leader, DLH strives to shape and enhance the sustainability and readiness posture of those we serve, delivering value to our customers and stakeholders.

DLH stands on strong values including:

•Integrity and Trust - We establish relationships throughout our organization and with customers and partners that are built on a foundation of mutual trust and respect, which exemplifies the way DLH does business. We are committed to the highest standards of ethical conduct during the course of all business.

•Performance Excellence - We are focused on achieving all requirements, with a passion for continuous improvement in the quality of our services and products. We strive to be our customers' "best value" provider and attain the highest measure of customer and shareholder satisfaction.

•Diversity and Inclusion - We create and sustain a corporate culture that fosters inclusion of all employees and values each individual's unique talents and perspectives. We leverage the value of our diversity into every aspect of our business.

•Agility - As we grow, we continue to evolve in a manner that maintains our flexibility and agility. This allows us to anticipate and respond to ever-changing government service requirements while delivering maximum value to customers and shareholders.

Talent Acquisition, Development, and Retention

Our success depends in large part on our ability to attract talent to meet the needs of our customers. To ensure we have the talent to meet the needs of our customers, we employ broad recruiting and outreach efforts to enable us to attract an inclusive pool of highly qualified candidates. As demand for talent is highly competitive, we continue to invest in our employees through a variety of benefits and overall program enhancements. We continually review and adapt our recruiting, hiring, and training efforts to respond to market imperatives and the needs of our customers.

We seek to attract and cultivate high performing talent by providing opportunities for career growth, skills development, and recognition for their contributions as they work to serve our customers. We provide competitive compensation programs to compete and reward our talented employees. In addition to base compensation, additional compensatory benefits may include bonus programs and participation in a 401(k) Plan. We have used targeted equity-based grants with performance and service based vesting conditions to facilitate attracting and retaining key personnel. We also invest in talent development initiatives including industry-leading learning management solutions, professional credentialing, and licensures. These benefits will further enhance our talented employee base and augment our efforts to infuse proven best practices into our operations through world-class talent acquisition and talent management tools.

Employee Safety and Health

We are committed to the health, safety and wellness of our employees. We provide our employees and their families with flexible and convenient health and wellness programs, including competitive benefits arrangements to address healthcare needs, including health insurance benefits, health savings and flexible spending accounts, paid time off, family leave, and family care resources.

Company Website and Information

Our corporate headquarters are located at 3565 Piedmont Road NE, Building 3 Suite 700, Atlanta, Georgia 30305. Our telephone number is (770) 554-3545. Our website is www.dlhcorp.com. The website contains information about our company and operations. Links to the Investor Relations section of our website, copies of our filings with the U.S. Securities and Exchange Commission ("SEC") on Forms 10-K, 10-Q, 8-K, and all amendments to those reports, can be viewed and downloaded free of charge as soon as reasonably practicable after the reports and amendments are electronically filed with or furnished to the SEC. In addition, the SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including DLH. The information on our website is not incorporated by reference into and is not part of this Annual Report on Form 10-K.

ITEM 1A. RISK FACTORS

As provided for under the Private Securities Litigation Reform Act of 1995 ("1995 Reform Act"), we wish to caution shareholders and investors that the following important factors, among others discussed throughout this Annual Report on Form 10-K for the fiscal year ended September 30, 2023, have affected, and in some cases could affect, our actual results of operations and cause our results to differ materially from those anticipated in forward looking statements made herein. Our business, results of operations, cash flows and financial condition may be materially and adversely affected due to any of the following risks. The risks described below are not the only ones we face. Additional risks we are not presently aware of or that we currently believe are immaterial may also impair our business operations. The trading price of our common stock could decline due to any of these risks. In assessing these risks, you should also refer to the other information contained or incorporated by reference in this Annual Report on Form 10-K, including our consolidated financial statements and related notes.

Risks Relating to Our Business and the Industry in which we Compete

We depend on contracts with the Federal government for virtually all of our revenue and our business could be seriously harmed if the Federal government decreased or ceased doing business with us.

At present, we derive 99% of our revenue from agencies of the Federal government, primarily as a prime contractor but also as a subcontractor to other Federal prime contractors. In addition, substantially all accounts receivable, including unbilled accounts receivable, are from agencies of the U.S. Government as of September 30, 2023 and 2022. We expect that Federal government contracts will continue to be our primary source of revenue for the foreseeable future. We believe that the credit risk associated with our receivables is limited due to the creditworthiness of these customers. In general, if we were suspended or debarred from contracting with the federal government or if the government otherwise ceased doing business with us or significantly decreased the amount of business it does with us, our business, financial condition and operating results would be materially and adversely affected.

A significant portion of our revenue is concentrated in a small number of contracts, and we could be seriously harmed if we were unable to continue providing services under, or unsuccessful in our recompete efforts on, these contracts.

We are dependent upon the continuation of our relationships with the VA and HHS as a significant portion of our revenue is concentrated in contracts with these customers. There can be no assurance as to the actual amount of services that we will ultimately provide to VA and HHS under our current contracts, or that we will be successful in recompete efforts. As described in greater detail above in "Item 1 - Business - Major Contracts", our contracts with the VA for the provision of services to its CMOP operations are expected to be subject to renewal solicitations. We believe that our strong working relationships and effective service delivery support ongoing performance for the terms of the contracts and recompete efforts as a prime or subcontractor. Our results of operations, cash flows and financial condition would be materially adversely affected if we were unable to continue our relationship with either of these customers, if we were to lose any of our material current contracts, or if the amount of services we provide to them is materially reduced.

The U.S. government may prefer veteran-owned, minority-owned, women-owned and small disadvantaged businesses; therefore, we may have fewer opportunities to bid for or could lose a portion of our existing work to small businesses.

As a result of the Small Business Administration ("SBA") set-aside program, the U.S. government may decide to restrict certain procurement activity only to bidders that qualify as veteran owned, minority-owned, small, or small disadvantaged businesses. In such cases, we would not be eligible to perform as a prime contractor on those programs and would be limited to work as a subcontractor on those programs. As previously reported, various agencies within the federal government have policies that support small business goals, including the adoption of the “Rule of Two” by the VA, which provides that the agency shall award contracts by restricting competition for the contract to service-disabled or other veteran owned businesses. To restrict competition pursuant to this rule, the contracting officer must reasonably expect that at least two of these businesses, which are capable of delivering the services, will submit offers and that the award can be made at a fair and reasonable price that offers the best value to the U.S. The effect of these set-aside provisions may limit our ability to compete for prime contractor positions on programs that we have targeted for growth and to maintain our prime contractor position as current contracts are subject to renewal.

Loss of our GSA schedule contracts or other contracting vehicles could impair our ability to win new business and perform under existing contracts.

We currently hold multiple GSA schedule contracts, including a Federal supply schedule contract for professional and allied healthcare services and the logistics worldwide services contract. If we were to lose one or more of these contracts or other contracting vehicles, we could lose a significant revenue source and our operating results and financial condition could be materially and adversely affected.

Future legislative or government budgetary and spending changes could negatively impact our business.

U.S. Government programs are subject to annual congressional budget authorization and appropriation processes. For many programs, Congress appropriates funds on a fiscal year basis even though the program performance period may extend over several years. Consequently, programs are often partially funded initially and additional funds are committed only as Congress makes further appropriations. In recent years, we have seen frequent debates regarding the scope of funding of our customers, thereby leading to budgetary uncertainty for our Federal customers. Changes in federal government budgetary priorities or actions taken to address government budget deficits, the national debt, and/or prevailing economic conditions, could directly affect our financial performance. Further, congressional seats may change during election years, and the balance of spending priorities may change along with them.

A significant decline in government expenditures, a shift of expenditures away from programs that we support or a change in federal government contracting policies could cause federal government agencies to reduce their purchases under contracts, to exercise their right to terminate contracts at any time without penalty or not to exercise options to renew contracts. In the event the budgets or budgetary priorities of the U.S. Government entities with which we do business are delayed, decreased or underfunded, our consolidated revenues and results of operations could be materially and adversely affected.

VA programs, which accounted for approximately 36.9% and 31.9% of Company revenue for the years ended September 30, 2023 and 2022, respectively, were exempt from the spending caps established under Federal government sequestration targets enacted in 2013.

Because we depend on U.S. government contracts, a delay in the completion of the U.S. government's budget and appropriations process could delay procurement of the services we provide and adversely affect our future revenues.

The funding of U.S. government programs is subject to an annual congressional budget authorization and appropriations process. In years when the U.S. government does not complete its appropriations before the beginning of the new fiscal year on October 1, government operations are typically funded pursuant to a "continuing resolution," which allows federal government agencies to operate at spending levels approved in the previous appropriations cycle but does not authorize new spending initiatives. Currently, the government is currently operating under a continuing resolution (CR) which expires on January 19, 2024 for certain departments and February 2, 2024 for others. When the U.S. government operates under a CR, delays can occur in the procurement of the services and solutions that we provide and may result in new initiatives being canceled. When a CR expires, unless appropriations bills have been passed by Congress and signed by the President, or a new CR is passed and signed into law, the government must cease operations, or shutdown, except in certain emergency situations or when the law authorizes continued activity. We continuously review our operations in an attempt to identify programs potentially at risk from CRs so that we can consider appropriate contingency plans. A federal government shutdown could, however, result in our incurrence of substantial labor or other costs without reimbursement under customer contracts, the delay or cancellation of programs or the delay of contract payments, which could have a negative effect on our cash flows and adversely affect our future results of operations.

The markets in which we operate are highly competitive, and many of the companies we compete against have substantial resources. Further, the U.S. Government contract bid process is highly competitive, complex and sometimes lengthy, and is subject to protest and implementation delays.

The markets in which we operate are highly competitive. Further, many of our contracts and task orders with the Federal government are awarded through a competitive bidding process, which is complex and sometimes lengthy. We expect that many of the opportunities we will seek in the foreseeable future will be awarded through competitive bidding. Furthermore, budgetary pressures and developments in the procurement process have caused many government customers to increasingly purchase goods and services through IDIQ contracts, GSA schedule contracts and other government-wide acquisition contracts. These contracts, some of which are awarded to multiple contractors, have increased competition and pricing pressure, requiring that we make sustained post-award efforts to realize revenue under each such contract. Many of our competitors are larger and have greater resources than we do, larger customer bases and greater brand recognition. Our competitors, individually or through relationships with third parties, may be able to provide customers with different or greater capabilities or benefits than we can provide. If we are unsuccessful in competing with these other companies, our revenues and margins may materially decline.

Overall, the competitive bidding process presents a number of risks, including the following: (i) we expend substantial cost and managerial time and effort to prepare bids and proposals for contracts that we may not win, and to defend those bids through any protest process; (ii) we may be unable to estimate accurately the resources and cost structure that will be required to service any contract we win; and (iii) we may encounter expenses and delays if our competitors protest or challenge awards of contracts to us in competitive bidding, and any such protest or challenge could result in the resubmission of bids on modified specifications, or in the termination, reduction or modification of the awarded contract. If we are unable to win particular contracts, we may be prevented from providing the services that are purchased under those contracts for a number of years. If we are unable to consistently win new contract awards over any extended period, our business and prospects will be adversely affected and that could cause our actual results to differ materially and adversely from those anticipated. In addition, upon the expiration of a contract, if the customer requires further services of the type provided by the contract, there is frequently a competitive rebidding process. There can be no assurance that we will win any particular bid, or that we will be able to replace business lost upon expiration or completion of a contract, and the termination or non-renewal of any of our significant contracts could cause our actual results to differ materially and adversely from those anticipated.

If a bid is won and a contract awarded, there still is the possibility of a bid protest or other delays in implementation. Our business could be adversely affected by delays caused by our competitors protesting major contract awards received by us, resulting in the delay of the initiation of work. It can take many months to resolve protests by one or more of our competitors of contract awards we receive. The resulting delay in the startup and funding of the work under these contracts may cause our actual results to differ materially and adversely from those anticipated, and there can be no assurance that such protest process or implementation delays will not have a material adverse effect on our financial condition or results of operations in the future.

Our business may suffer if we or our employees are unable to obtain and maintain the necessary security clearances or other qualifications required to perform services for our customers.

Many federal government contracts require us to have security clearances and employ personnel with specified levels of education, work experience and security clearances. Depending on the level of clearance, security clearances can be difficult and time-consuming to obtain. If we or our employees lose or are unable to obtain necessary security clearances, we may not be able to win new business and our existing customers could terminate their contracts with us or decide not to renew them. To the extent we cannot obtain or maintain the required security clearances for our employees working on a particular contract, we may not derive the revenue anticipated from the contract, which could cause our results to differ materially and adversely from those anticipated.

Our business is regulated by complex federal procurement and contracting laws and regulations, and we are subject to periodic compliance reviews by governmental agencies.

We must comply with complex laws and regulations relating to the formation, administration, and performance of federal government contracts, including the Federal Acquisition Regulation, which, among other things, requires us to certify and disclose cost and pricing data and to divest work in the event of certain organizational conflicts of interest. These laws and regulations create compliance risk and affect how we do business with our federal agency customers and may impose added costs on our business. The government may in the future reform its procurement practices or adopt new contracting rules and regulations, including cost accounting standards, that could be costly to satisfy or that could impair our ability to obtain new contracts or change the basis upon which it reimburses our compensation and other expenses or otherwise limit such reimbursements. These changes could impair our ability to obtain new contracts or win re-competed contracts or adversely affect our future profit margin. Additionally, the government may face restrictions from new legislation, regulations or government union pressures, on the nature and amount of services the government may obtain from private contractors. Any reduction in the government’s use of private contractors to provide federal services could cause our actual results to differ materially and adversely from those anticipated.

Our performance on our U.S. Government contracts and our compliance with applicable laws and regulations, including submission of invoices to our customers, are subject to audit by the government. The scope of any such audits could span multiple fiscal years. These agencies review our performance on contracts, pricing practices, cost structure and compliance with applicable laws, regulations and standards. They also evaluate the adequacy of internal controls over our business systems, including our purchasing, accounting, estimating, earned value management, and government property systems. Any costs found to be improperly allocated or assigned to contracts will not be reimbursed, and any such costs already reimbursed must be refunded and certain penalties may be imposed. Moreover, if any of the administrative processes and systems are found not to comply with requirements, we may be subjected to increased government scrutiny and approval that could delay or otherwise adversely affect our ability to compete for or perform contracts or collect our revenues in a timely manner. Therefore, an unfavorable outcome of an audit could cause actual results to differ materially and adversely from those anticipated. If a government review or investigation uncovers illegal activities or activities not in compliance with a particular contract's terms or conditions, we may be subject to civil and criminal penalties and administrative sanctions, including termination of contracts, forfeiture of profits, harm to our reputation, suspension of payments, fines, and suspension or debarment from doing business with Federal government agencies. Any of these events could lead to a material reduction in our revenues, cash flows and operating results. Further, as the reputation and relationships that we have established and currently maintain with government personnel and agencies are important to our ability to maintain existing business and secure new business, damage to our reputation or relationships could have a material adverse effect on our revenue and operating results.

Federal government contracts may be terminated at will and may contain other provisions that may be unfavorable to us.

Many of the U.S. Government programs in which we participate as a contractor or subcontractor may extend for several years. The U.S. Government may modify, curtail or terminate its contracts and subcontracts for convenience and to the extent that a contract award contemplates one or more option years, the Government may decline to exercise such option periods. Accordingly, the maximum contract value specified under a government contract or task order awarded to us is not necessarily indicative of the revenue that we will realize under that contract. Due to our dependence on these programs, the modification, curtailment or termination of our major programs or contracts may have a material adverse effect on our results of operations and financial condition. In addition, federal government contracts contain provisions and are subject to laws and regulations that give the government rights and remedies, some of which are not typically found in commercial contracts, including allowing the government to (i) cancel multi-year contracts and related orders if funds for contract performance for an subsequent year become unavailable; (ii) claim rights in systems and software developed by us; (iii) suspend or debar us from doing business with the federal government or with a governmental agency; and (iv) impose fines and penalties and subject us to criminal prosecution. If the government terminates a contract for convenience, we may recover only our incurred or committed costs, settlement expenses and profit on work completed prior to the termination. If the government terminates a contract for default, we may be unable to recover even those amounts and instead may be liable for excess costs incurred by the government in procuring undelivered items and services from another source. Depending on the value of a contract, such termination could cause our actual results to differ materially and adversely from those anticipated.

Certain contracts also contain organizational conflict of interest (OCI) clauses that limit our ability to compete for or perform certain other contracts. OCIs arise any time we engage in activities that (i) make us unable or potentially unable to render impartial assistance or advice to the government; (ii) impair or might impair our objectivity in performing contract work; or (iii) provide us with an unfair competitive advantage. For example, when we work on the design of a particular system, we may be precluded from competing for the contract to develop and install that system. Depending upon the value of the matters affected, an OCI issue that precludes our participation in or performance of a program or contract could cause our actual results to differ materially and adversely from those anticipated.

We may not receive the full amounts authorized under the contracts included in our backlog, which could reduce our revenue in future periods below the levels anticipated.

Our total backlog consists of funded and unfunded amounts and may include estimates and assumptions about matters that cannot be determined with certainty at the time the backlog is calculated. Funded backlog represents contract value that has been appropriated by a customer and is expected to be recognized into revenue. Unfunded backlog represents the sum of the unappropriated contract value on executed contracts and unexercised option years that is expected to be recognized into revenue. The maximum contract value specified under a government contract or task order awarded to us is not necessarily indicative of the revenue that we will realize under that contract. For example, we generate revenue from IDIQ contracts, which do not require the government to purchase a pre-determined amount of goods or services under the contract. Action by the government to obtain support from other contractors or failure of the government to order the quantity of work anticipated could cause our actual results to differ materially and adversely from those anticipated. Additionally, many of our multi-year contracts may only be partially-funded at any point during their term with the unfunded portion subject to future appropriations by Congress. As a result of a lack of appropriated funds or efforts to reduce federal government spending, our backlog may not result in revenue. Accordingly, our backlog may not result in actual revenue in any particular period, or at all, which could cause our actual results to differ materially and adversely from those anticipated.

Our business growth and profitable operations require that we develop and maintain strong relationships with other contractors with whom we partner or otherwise depend on.

We may enter into future teaming ventures with other companies, which carry risk in regard to maintaining strong, trusted working relationships in order to successfully fulfill contract obligations. Teaming arrangements may include being engaged as a subcontractor to a prime contractor, engaging a subcontractor on a contract for which we are the prime contractor, or entering into a joint venture with another company. We may lack control over fulfillment of such contracts, and poor performance on the contract could impact our customer relationship, even if we perform as required. We expect to depend on relationships with other contractors for a portion of our revenue in the foreseeable future. Our revenue and operating results could differ materially and adversely from those anticipated if any such prime contractor or teammate chooses to offer directly to the customer services of the type that we provide or if they team with other companies to provide those services.

Restrictions on or other changes to the federal government’s use of service contracts may harm our operating results.

We derive virtually all of our revenue from service contracts with the federal government. The government may face restrictions from new legislation, regulations or government union pressures on the nature and amount of services the government may obtain from private contractors (i.e., insourcing versus outsourcing). Any reduction in the government’s use of private contractors to provide federal services could cause our actual results to differ materially and adversely from those anticipated.

Our earnings and margins may vary based on the mix of our contracts and programs.

At September 30, 2023, our backlog includes cost reimbursable, time-and-materials, and firm-fixed-price contracts. Our earnings and margins may vary depending on the relative mix of contract types, the costs incurred in their performance, the achievement of other performance objectives and the stage of performance at which the right to receive fees, particularly under incentive and award fee contracts, is finally determined.

Our employees, or those of our teaming partners, may engage in misconduct or other improper activities which could harm our business.

We are exposed to risk from misconduct or fraud by our employees, or employees of our teaming partners. Such violations could include intentional disregard for Federal government procurement regulations, engaging in unauthorized activities, seeking reimbursement for improper expenses, or falsifying time records. Employee misconduct could also involve the improper use of our customers' sensitive or classified information and result in a serious harm to our reputation. While we have appropriate policies in effect to deter illegal activities and promote proper conduct, it is not always possible to deter employee misconduct. Precautions to prevent and detect this activity may not be effective in controlling such risks or losses. As a result of employee misconduct, we could face fines and penalties, loss of security clearance and suspension or debarment from contracting with the federal government, which could materially and adversely affect our business, results of operations, financial condition, cash flows, and liquidity.

If we are unable to attract qualified personnel, our business may be negatively affected.

We rely heavily on our ability to attract and retain qualified employees and other personnel who possess the skills, experience, and licenses necessary in order to provide our solutions for our assignments. Our business is materially dependent upon the continued availability of such qualified personnel. Our inability to secure qualified personnel would have a material adverse effect on our business. Competition for qualified employees is intense and the cost of attracting qualified personnel and providing them with attractive benefits packages may be higher than we anticipate and, as a result, if we are unable to pass these costs on to our customers, our profitability could decline. Moreover, if we are unable to attract and retain qualified personnel, the quality of our services may decline and, as a result, we could lose customers.

If our subcontractors do not perform their contractual obligations, our performance as a prime contractor and our ability to obtain future business could be materially and adversely impacted and our actual results could differ materially and adversely from those anticipated.

Our performance of government contracts may involve the issuance of subcontracts to other companies upon which we rely to perform all or a portion of the work we are obligated to deliver to our customers. Unsatisfactory performance by one or more of our subcontractors to deliver on a timely basis the agreed-upon supplies, perform the agreed-upon services, or appropriately manage their vendors may materially and adversely impact our ability to perform our obligations as a prime contractor. A subcontractor’s performance deficiency could result in the government terminating our contract for default. A default termination could expose us to liability for excess costs of reprocurement by the government and have a material adverse effect on our ability to compete for future contracts and task orders. Depending upon the level of problem experienced, such problems with subcontractors could cause our actual results to differ materially and adversely from those anticipated.

The federal government’s appropriation process and other factors may delay the collection of our receivables, and our business may be adversely affected if we cannot collect our receivables in a timely manner.

We depend on the collection of our receivables to generate cash flow, provide working capital, pay debt and continue our business operations. If the federal government or any prime contractor for whom we are a subcontractor fails to pay or delays the payment of their outstanding invoices for any reason, our business and financial condition may be materially and adversely affected. The government may fail to pay outstanding invoices for a number of reasons, including lack of appropriated funds or lack of an approved budget. Contracting officers have the authority to impose contractual withholdings, which can also adversely affect our ability to collect timely. If we experience difficulties collecting receivables, it could cause our actual results to differ materially and adversely from those anticipated. In addition, from time to time, when we are awarded a contract, we incur significant expenses before we receive any contract payments. These expenses include leasing and outfitting office space, purchasing office equipment, and hiring personnel. In other situations, contract terms provide for billing upon achievement of specified project milestones. In these situations, we are required to expend significant sums of money before receiving related contract payments. In addition, payments due to us from government agencies may be delayed due to billing cycles or as a result of failures by the government to approve governmental budgets in a timely manner. In addition to these factors, poor execution on project startups could impact us by increasing our use of cash. In certain circumstances, we may defer recognition of costs incurred at the inception of a contract. Such action assumes that we will be able to recover these costs over the life of the contract. To the extent that a project does not perform as anticipated, these deferred costs may not be considered recoverable resulting in an impairment charge.

Risks Relating to Our Information Technology Systems and Intellectual Property

We are highly dependent on the proper functioning of our information systems.

We are highly dependent on the proper functioning of our information systems in operating our business. Critical information systems used in daily operations match employee resources and customer assignments and track regulatory credentialing. They also perform payroll, billing and accounts receivable functions. While we have multiple back up plans for these types of contingencies, our information systems are vulnerable to fire, storms, flood, power loss, telecommunication outages, physical break-ins, cyber-attack, ransomware, and similar events. If our information systems become inoperable, or are otherwise unavailable, these functions would have to be accomplished manually, which in turn could impact our financial viability, due to the increased cost associated with performing these functions manually.

Our systems and networks may be subject to cybersecurity breaches.

Many of our operations rely heavily upon technology systems and networks to receive, input, maintain and communicate participant and customer data pertaining to the programs we manage. Any systems failures, whether caused by us, a third-party service provider, or unauthorized intruders and hackers, or due to situations such as computer viruses, natural disasters, or power shortages, could cause loss of data or interruptions or delays in our business or that of our customers. If our systems or networks were compromised by a security breach, we could be adversely affected by losing confidential or protected information of program participants and customers, and we could suffer reputational damage and a loss of confidence from prospective and existing customers. Similarly, if our internal networks were compromised, we could be adversely affected by the loss of proprietary, trade secret or confidential technical and financial data. The loss, theft or improper disclosure of that information could subject the Company to sanctions under the relevant laws, lawsuits from affected individuals, negative press articles and a loss of confidence from our government customers, all of which could adversely affect our existing business, future opportunities and financial condition. Further, our property and cyber insurance may be inadequate to compensate us for all losses that may occur as a result of any system or operational failure or disruption and, as a result, our actual results could differ materially and adversely from those anticipated. In addition, in order to provide services to our customers, we often depend upon or use customer systems that are supported by the customer or third parties. Any security breach or system failure in such systems could result in an interruption of our customer’s operations which could cause us to experience significant delays under a contract, and a material adverse effect on our results of operations.

Additionally, a number of projects require us to receive, maintain and transmit protected health information or other types of confidential personal information. That information may be regulated by the Health Insurance Portability and Accountability Act (HIPAA), the Health Information Technology for Economic and Clinical Health Act of 2009, Internal Revenue Service regulations and other laws. The loss, theft or improper disclosure of that information could subject us to sanctions under these laws, breach of contract claims, lawsuits from affected individuals, negative press articles and a loss of confidence from our government customers, all of which could adversely affect our existing business, future opportunities and financial condition.

Failure to adequately protect, maintain, or enforce our rights in our intellectual property may adversely limit our competitive position.

We rely upon a combination of nondisclosure agreements and other contractual arrangements, as well as copyright, trademark, and trade secret laws to protect our proprietary information. We also enter into proprietary information and intellectual property agreements with employees, which require them to disclose any inventions created during employment, to convey such rights to inventions to us, and to restrict any disclosure of proprietary information. Trade secrets are generally difficult to protect. Although our employees are subject to confidentiality obligations, this protection may be inadequate to deter or prevent misappropriation of our confidential information and/or the infringement of our trademarks and copyrights. Further, we may be unable to detect unauthorized use of our intellectual property or otherwise take appropriate steps to enforce our rights. Failure to adequately protect, maintain, or enforce our intellectual property rights may adversely limit our competitive position.

We may face from time to time, allegations that we or a supplier or customer have violated the intellectual property rights of third parties. If, with respect to any claim against us for violation of third-party intellectual property rights, we are unable to prevail in the litigation or retain or obtain sufficient rights or develop non-infringing intellectual property or otherwise alter our business practices on a timely or cost-efficient basis, our business and competitive position may be adversely affected.

Any infringement, misappropriation or related claims, whether or not meritorious, are time consuming, divert technical and management personnel, and are costly to resolve. As a result of any such dispute, we may have to develop non-infringing intellectual property, pay damages, enter into royalty or licensing agreements, cease utilizing certain products or services, or take other actions to resolve the claims. These actions, if required, may be costly or unavailable on terms acceptable to us.

Risks Relating to Acquisitions

In connection with acquisitions, we may be required to take write-downs or write-offs, restructuring and impairment, or other charges that could negatively affect our business, assets, liabilities, prospects, outlook, financial condition, and results of operations.

Although we conduct extensive due diligence in connection with an acquisition, we cannot assure that this diligence revealed all material issues that may be present, that it would be possible to uncover all material issues through customary due diligence, or that factors outside of our control will not later arise. We have also purchased representations and warranties insurance in connection with the acquisition, but there is no assurance that those policies will cover any losses we might experience from breaches of the sellers’ representations and warranties or otherwise arising from the acquisition. Even if our due diligence successfully identifies certain risks, unexpected risks may arise and previously known risks may materialize in a manner not consistent with our preliminary risk analysis. Further, as a result of the acquisition, purchase accounting, and the operation of the combined company after closing, we may be required to take write-offs or write-downs, restructuring and impairment or other charges that could negatively affect business, assets, liabilities, prospects, outlook, financial condition and results of operations.

We may have difficulty identifying and executing other acquisitions on favorable terms and therefore may grow at slower than anticipated rates.

One of our potential paths to growth is to selectively pursue acquisitions. Through acquisitions, we may be able to expand our base of customers, increase the range of solutions we offer to our customers and deepen our penetration of existing markets and customers. We may not identify and execute suitable acquisitions. To the extent that management is involved in identifying acquisition opportunities or integrating new acquisitions into our business, our management may be diverted from operating our core business. Without acquisitions, we may not grow as rapidly otherwise, which could cause our actual results to differ materially and adversely from those anticipated.

We may encounter other risks in regard to making acquisitions, including:

•increased competition for acquisitions may increase the costs of our acquisitions;

•non-discovery or non-disclosure of material liabilities during the due diligence process, including omissions by prior owners of any acquired businesses or their employees in complying with applicable laws or regulations, or their inability to fulfill their contractual obligations to the federal government or other customers; and

•acquisition financing may not be available on reasonable terms or at all.