UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

For

the month of December 2023

Commission

File Number: 001-38421

BIT

DIGITAL, INC.

(Translation

of registrant’s name into English)

33

Irving Place, New York, NY 10003

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F

Form

20-F ☒ Form 40-F ☐

Exhibit

Index

A

copy of the Bit Digital, Inc. investor presentation at Noble Capital Markets’ 19th Annual Emerging Growth Equity Conference in

Boca Raton, Florida, on December 4, 2023, titled “Bit Digital is a sustainable platform for digital asset production and AI infrastructure”

is being furnished as Exhibit 99.1 with this Report on Form 6-K.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| Date: December 1, 2023 |

Bit Digital, Inc. |

| |

(Registrant) |

| |

|

| |

By: |

/s/ Samir Tabar |

| |

Name: |

Samir Tabar |

| |

Title: |

Chief Executive Officer |

2

Exhibit 99.1

Bit Digital is a sustainable platform for digital asset production and AI infrastructure December 2023

Investing in our securities involves a high degree of risk. Before making an investment decision, you should carefully consider the risks, uncertainties and forward - looking statements described under “Risk Factors” in Item 3.D of our Annual Report on Form 20 - F for the fiscal year ended December 31, 2022. If any material risk was to occur, our business, financial condition or results of operations would likely suffer. In that event, the value of our securities could decline, and you could lose part or all of your investment. The risks and uncertainties we describe are not the only ones facing us. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. In addition, our past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results in the future. Future changes in the network - wide mining difficulty rate or digital asset hash rate may also materially affect the future performance of Bit Digital’s production of digital assets. See “Safe Harbor Statement” below. Safe Harbor Statement: This presentation may contain certain “forward - looking statements” relating to the business of Bit Digital, Inc. (the “Company”), and its subsidiaries. All statements, other than statements of historical fact included herein are “forward - looking statements.” These forward - looking statements are often identified by the use of forward - looking terminology such as “believes,” “expects,” or similar expressions, involving known and unknown risks and uncertainties. Although the Company believes that the expectations reflected in these forward - looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. Investors should not place undue reliance on these forward - looking statements, which speak only as of the date of this presentation. The Company’s actual results could differ materially from those anticipated in these forward - looking statements as a result of a variety of factors, including those discussed in the Company’s periodic reports that are filed with the Securities and Exchange Commission and available on its website at http://www.sec.gov. All forward - looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by these factors. Other than as required under the securities laws, the Company does not assume a duty to update these forward - looking statements. Investor Notice 2

Bit Digital Highlights Bit Digital Inc. (Nasdaq: BTBT) is a sustainability focused generator of digital assets Bit Digital is an institutional scale digital asset miner, with a fleet of more than 45,000 specialized computers, diversified across hosting locations in the U.S., Canada, and Iceland Bit Digital maximizes ROE by focusing investment on mining assets, while leveraging strategic partnerships for access to physical infrastructure and low - cost energy Bit Digital is accelerating its expansion with proprietary channels to access miners (circumventing industry bottlenecks), and pre - negotiated hosting capacity Bit Digital is running approximately 99% of its miners on carbon - free energy Bit Digital AI is a new business line that will provide specialized infrastructure to support generative artificial intelligence (“AI”) workstreams Notes: Miner fleet figures including 3.7 EH/s and 46,852 miners represent bitcoin miners owned or operating (in Iceland) as of 9/30/23. 99% carbon - free power refers to approximate run rate as of 9/30/2023 based on data reported by our hosts, publicly available sources and internal estimates. Not a guarantee of future results. 1 Contract value refers to the aggregate expected revenue generation from 1,504 GPUs contracted over three - years. 3

Balance Sheet Remains a Competitive Advantage Notes: Data as of 9/30/2023. Figures are unaudited. $50.7 million represents fair market value of digital assets as of 9/30/23 Strong liquidity position to weather potential downturns Balance Sheet as September 30, 2023: $73M total liquidity cash ($22.1M) + digital assets ($50.7M) ZERO leverage ZERO unfunded miner purchase obligations ZERO infrastructure capex funding commitments Capital Markets: EFFECTIVE $500 million ATM (Registration Statement effective with SEC) 4

Third Quarter of 2023 Highlights Notes: Data as of 9/30/2023. VS 5 Key Figures Q3 2023 Q2 2023 Q3 2022 Total Revenue: $11.6 Million Bitcoin Mined: 403.1 +27% - 6% +27% +28%

Strategic Priorities for 2023 Maintain a best - in - class balance sheet Continued focus on prudent balance sheet management through 2023 and beyond Strategically deploy capital Opportunistic credit investments Prudent miner fleet growth: target to expand operating fleet to approximately 3.5 EH/s by Q1 2024 Expand into Proof - of - Stake (PoS) Target to stake approximately half of our total digital asset position Exploring incubating additional PoS related businesses Enhance treasury management solutions Strategic partnerships that can activate structured solutions that may enhance yield on treasury assets and provide downside protection Continued focus on sustainability Progress towards goal of becoming entirely carbon - free 6

Geographically Diversified Hosting Facilities 99% Carbon Free As of Q3 2023 Iceland Canada United States 7

Bit Digital is Infrastructure - light Hosting strategy designed to maximize shareholder returns and operational resiliency We partner with leading data center operators, allowing us to specialize in mining Our hosting contracts provide more than enough to power our current fleet, providing substantial room for growth Strong pipeline of new potential hosting partners and locations We aim to optimize and diversify our hosting portfolio to reduce counterparty risk, regulatory risk, and site - specific risk Our goal is to secure hosting capacity that is both cost effective and powered by sustainable energy sources 8

ESG: We are a Leader in Digital Asset Sustainability Our fleet was running on 99% carbon free energy as of September 30, 2023, without using carbon credits or offsets Inspired by the Paris Climate Agreement, the CCA is a private sector - led initiative for the entire crypto community, focused on decarbonizing the cryptocurrency and blockchain industry. BMC is a voluntary and open forum of Bitcoin miners committed to the network and its core principles. BMC promotes transparency, shares best practices, and educates the public on benefits of bitcoin and mining. We became the first listed miner we are aware of to engage an independent ESG consultancy to provide ongoing ESG reviews for greater transparency. Bit Digital covets hosting facilities that draw power from sustainable energy sources. Our mining operations are primarily powered by hydroelectric, geothermal, wind, and solar energy sources. Our long - term goal is for our mining operations to become entirely carbon - free. Recognized thought leadership 9

The Bit Digital Flywheel Earn rewards by sustainably mining Bitcoin Exchange Bitcoin mining rewards for Ethereum Stake Ethereum to earn yield and accumulate rewards Use Ethereum yield to reinvest into Bitcoin miners Repeat, creating a perpetual flywheel 10

Introducing Bit Digital AI 11

Bit Digital AI Overview Bit Digital AI is a new business line that provides specialized infrastructure to support generative artificial intelligence (“AI”) workstreams. Bit Digital has procured a fleet of state - of - the - art NVIDIA H100 GPUs that will be deployed at a Tier - 3 datacenter We will provide the GPU computing resources to power our clients’ AI workstreams. Bit Digital AI positioned as a foundational layer in the AI supply chain. Long - term Goal: To become the market leading provider of AI infrastructure - as - a - service to the EMEA 1 region 1 Notes:(1) EMEA refers to Europe, the Middle East, and Asia 12

Generative AI Poised for Robust Growth Generative AI's ability to learn from data and produce original outputs is not just streamlining workflows but also pioneering new forms of creativity and problem - solving . With its robust adaptability and escalating advancements, generative AI is set to become a cornerstone of the digital economy, driving a new era of growth that is as creative as it is computational . McKinsey estimates that generative AI features stand to add up to $4.4 trillion annually to the global economy Bloomberg Intelligence forecast generative AI becoming a $1.3 trillion market by 2032, representing a ~42% growth CAGR from 2020. According to Forrester’s new forecast, generative AI will have an average annual growth rate of 36% up to 2030, capturing 55% of the AI software market. 13

Anchor Customer Secured Finalized contract to provide GPU resources to a customer for an initial three - year period Customer is focused on developing AI applications, including their own proprietary large - language model (LLM), and is well - capitalized following a 2023 funding round Bit Digital will provide its customer with computational power from 1,504 GPUs for three years, representing more than $35M of annualized revenue to Bit Digital Initial order of 1,504 H100 GPUs to power the first phase of the contract; delivery expected by January 2024 Contract revenue to commence in January at significantly higher margins than the Company’s existing business operations 14

Bit Digital AI to drive long - term value creation Integral part of the AI supply chain Unique procurement capabilities for servers and datacenter capacity Minimal customer acquisition costs – strong pipeline of potential customers Value Creation Stable revenue generation to smooth out core mining business Highly scalable with requisite capital Robust margins and forecastable cash flow Core Features 15

Leadership Team SAM V. TABAR Chief Executive Officer Mr . Tabar served as Chief Strategy Officer of Bit Digital from 2021 to 2023 . He served as the Co - Founder and Chief Strategy Officer of Fluidity from April 2017 to June 2020 . Prior to this, he held the title of Partner at FullCycle Fund which he served from December 2015 to April 2017 . Prior thereto, he served as Director and Head of Capital Strategy (Asia Pacific Region) for Bank of America Merrill Lynch from February 2010 to April 2011 . Prior to this, he was Co - Head of Marketing at Sparx Group from January 2004 to 2010 . Prior thereto, he was an associate at Skadden, Arps, Meagher, Flom LLP & Affiliates from September 2001 to January 2004 . Mr . Tabar received his Bachelor of Arts from Oxford University in 2000 , and received his Master of Law (LL . M . ) from Columbia University School of Law in 2001 . He was associate editor of the Columbia Law Business Law Journal in 2000 and is a current member of the New York State Bar Association . He holds Series 79 and 63 licenses . ERKE HUANG Chief Financial Officer & Director Mr . Huang has served as Chief Financial Officer of Bit Digital since October 18 , 2019 . Prior to that, Mr . Huang had served as a Co - Founder and advisor of Long Soar Technology Limited from August 2019 , and also served as the Founder and CEO of Bitotem Investment Limited from May 2018 to October 2019 , as well as being an Investment Manager of Guojin Capital from June 2016 to May 2018 . He had also previously worked as an Engineering Analyst of Crowncastle International from March 2013 to November 2014 , bringing a wealth of experience to his current role . Mr . Huang received a Master’s degree in Civil & Environmental Engineering from Carnegie Mellon University, and received his Bachelor’s degree in Environmental Engineering from Southwest Jiaotong University . 16

Leadership Team BRYAN BULLETT Senior Advisor Mr . Bullett served as Chief Executive Officer of Bit Digital from 2021 to 2023 . From August 2016 to June 2019 , Mr . Bullett served as Executive Vice President for US affiliates of the company now known as E&P Financial Group . From August 2012 to July 2016 , Mr . Bullett served as a Senior Vice President at FBR & Co . During 2011 and 2012 , Mr . Bullett served as a Vice President at Keefe, Bruyette & Woods . During the years 2006 through 2010 , Mr . Bullett served as a Vice President and as an Associate at Bank of America Merrill Lynch (formerly Banc of America Securities) . During the years 2004 through 2006 , Mr . Bullett served as an Associate at Deutsche Bank Securities . Prior thereto, Mr . Bullett served as an early or founding employee of several technology and/or media - related startup companies . Mr . Bullett received a bachelor’s degree from Brown University and an MBA from Columbia Business School and holds Series 7 and Series 63 licenses . BROCK PIERCE Director Mr . Pierce has served as Chairman of the Board for Bitcoin Foundation and Integro Foundation since June 2014 and December 2017 , respectively, and has served on the board for SRAX since 2021 . He is a Founder and has served as a Managing Member of Percival Services since 2019 . He is the Co - founder of EOS Alliance, Block . one, Blockchain Capital, and Tether . He has served as Advisor to Open Data Exchange, Paybook, The Element Group, Blog Inc . , Metronome Token, Shyft Network, BLOCKv, and AirSwap . Pierce has been involved in Bitcoin mining since its genesis days, acquiring a significant portion of the first batch of Avalons and managed KNC’s China operation, one of the world’s first large - scale mining operations . He was also a seed investor in BitFury through Blockchain Capital and established the largest Bitcoin mining operation in Washington State . Pierce was on the first - ever Forbes List of “Richest People in Cryptocurrency” and was an Independent Party candidate for President of the United States . 17

33 Irving Place New York, NY 10003 United States +1 212 463 5121 IR@bit - digital.com

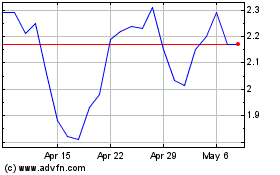

Bit Digital (NASDAQ:BTBT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bit Digital (NASDAQ:BTBT)

Historical Stock Chart

From Apr 2023 to Apr 2024